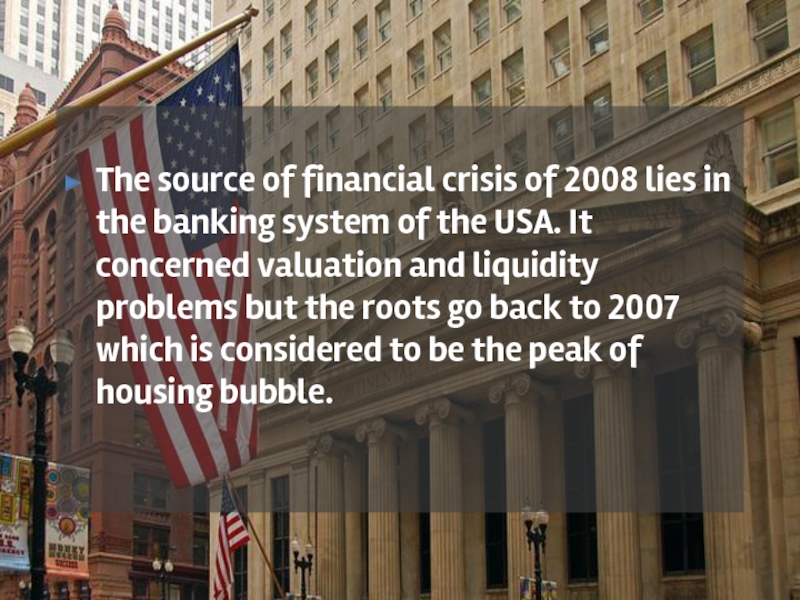

who instead spoke of the Great Moderation. A number of

economists predicted the crisis, with varying arguments.

A cover story in BusinessWeek magazine claims that economists mostly failed to predict the worst international economic crisis since the Great Depression of 1930s.

Within mainstream financial economics, most believe that financial crises are simply unpredictable.

Lebanese-American trader and financial risk engineer Nassim Nicholas Taleb warned against the breakdown of the banking system in particular and the economy in general owing to their use of bad risk models and reliance on forecasting and framed the problem as part of "robustness and fragility".

Role of economic forecasting