Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Lecture

Содержание

Eugene FamaBorn in 1939, an American economist, known for his work on portfolio theory and asset pricing, both theoretical and empirical. Currently he is a professor of finance at the University

Слайды и текст этой презентации

Слайд 2Eugene Fama

Born in 1939, an American economist, known for his

work on portfolio theory and asset pricing, both theoretical and

empirical.Currently he is a professor of finance at the University of Chicago Booth School of Business. MBA, PhD.

Слайд 3Eugene Fama

E. Fama is most often thought of as the

father of efficient market hypothesis (EMH), beginning with his Ph.D.

thesis.In a ground-breaking article in the May, 1970 issue of the Journal of Finance, entitled "Efficient Capital Markets: A Review of Theory and Empirical Work," E. Fama proposed three types of efficiency:

strong-form;

semi-strong form; and

weak efficiency.

He was a co-founder of Fama–French three-factor model (1993).

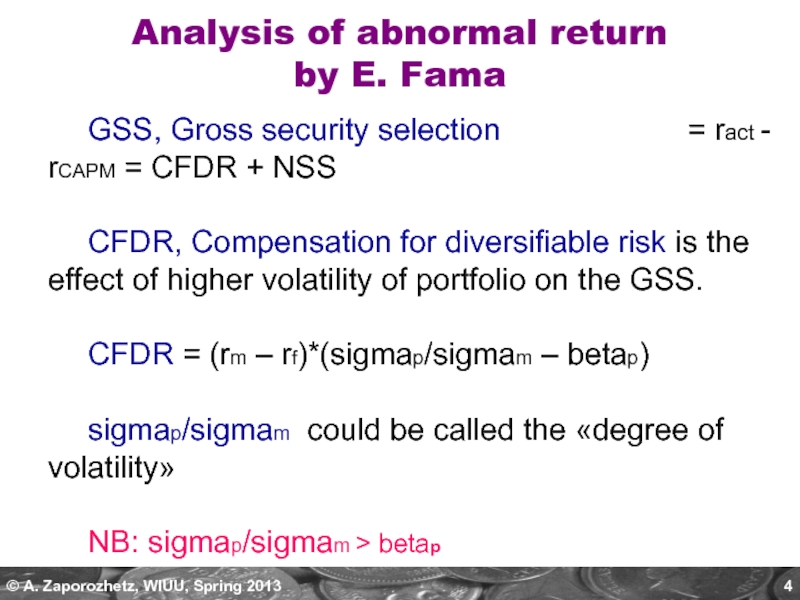

Слайд 4 GSS, Gross security selection = ract - rCAPM = CFDR

+ NSS

CFDR, Compensation for diversifiable risk is the effect of

higher volatility of portfolio on the GSS. CFDR = (rm – rf)*(sigmap/sigmam – betap)

sigmap/sigmam could be called the «degree of volatility»

NB: sigmap/sigmam > betap

Analysis of abnormal return

by E. Fama

Слайд 5 NSS, Net security selection = GSS – CFDR

NSS is the

effect of “smart” selection of securities for a portfolio, and

effective & efficient trading (opening/closing positions).

Слайд 6

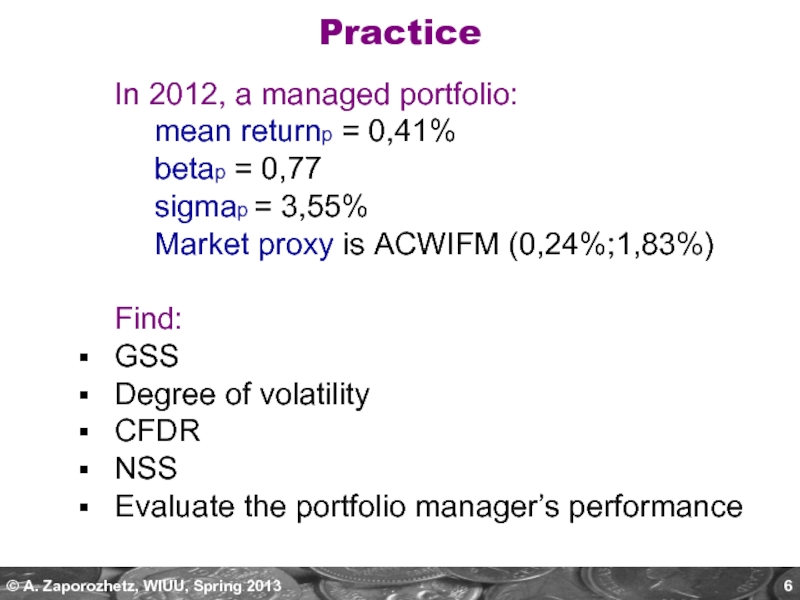

In 2012, a managed portfolio:

mean returnp = 0,41%

betap

= 0,77

sigmap = 3,55%

Market proxy is ACWIFM (0,24%;1,83%)

Find:

GSS

Degree

of volatilityCFDR

NSS

Evaluate the portfolio manager’s performance

Practice

Слайд 7Analysis of abnormal return

by E. Fama

If NSS > 0,

the portfolio manager was effective: he/she “added up” to the

portfolio return.If NSS < 0, the portfolio manager was not effective: he/she “ate up” some return.