Разделы презентаций

- Разное

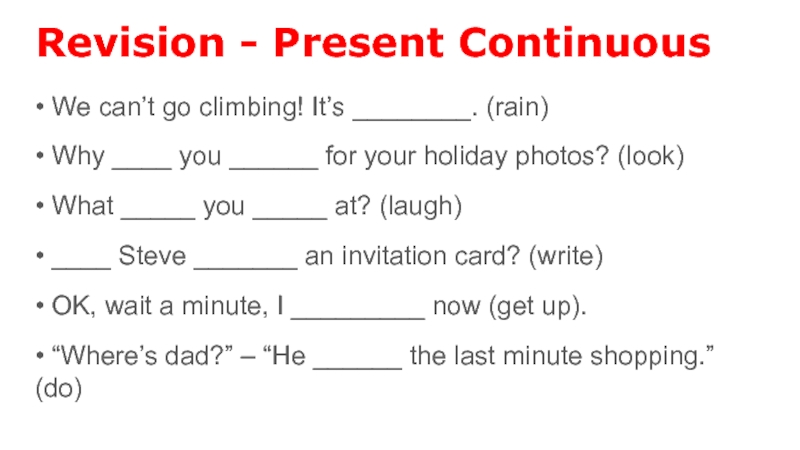

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Taxes in the USA

Содержание

- 1. Taxes in the USA

- 2. To tax is to impose a financial

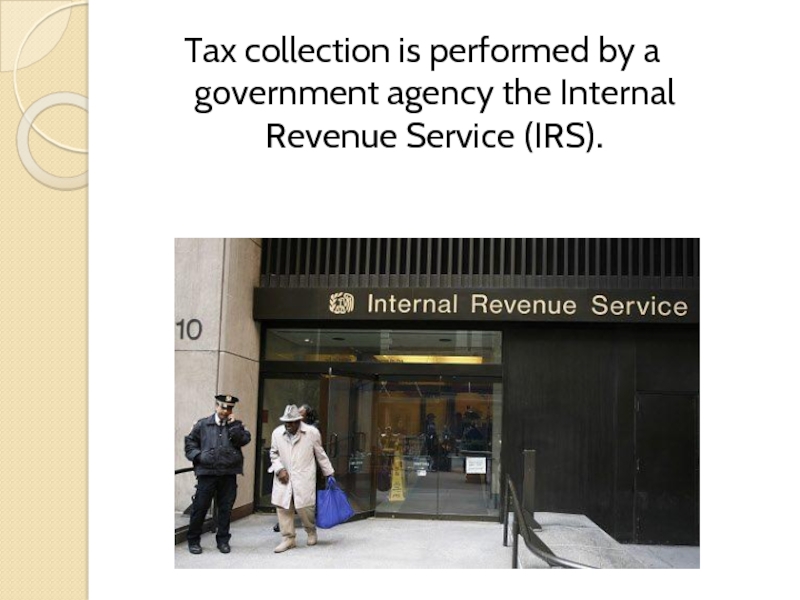

- 3. Tax collection is performed by a government agency the Internal Revenue Service (IRS).

- 4. PurposesMoney provided by taxation has been used

- 5. Levels and types of taxationThe United States

- 6. Income taxes are imposed at the federal

- 7. TaxpayersTaxes may be imposed onindividuals (natural persons) business entitiesestatestrustsother forms of organization

- 8. Income taxTaxes based on income are imposed

- 9. Income tax rates differ at the federal

- 10. Federal and state income tax is calculated,

- 11. Payroll taxesPayroll taxes are assessed by the

- 12. Property taxesProperty tax is based on fair

- 13. PenaltiesFailure to timely and properly pay federal

- 14. In some situations public can influence on

- 15. Скачать презентанцию

To tax is to impose a financial charge upon a taxpayer by state.Failure to pay is punishable by law.Taxes consist of direct tax (income tax) or indirect tax (sales tax), and

Слайды и текст этой презентации

Слайд 2To tax is to impose a financial charge upon a

taxpayer by state.

of direct tax (income tax) or indirect tax (sales tax), and may be paid in money or as its labor equivalent.Слайд 4Purposes

Money provided by taxation has been used by states to

carry out many functions. Some of these include expenditures on

war, the enforcement of law and public order, protection of property, economic infrastructure (roads, legal tender, enforcement of contracts, etc.), public works, social engineering, and the operation of government itself.Governments also use taxes to fund public services. These services can include education systems, health care systems, pensions for the elderly, unemployment benefits, and public transportation.

Слайд 5Levels and types of taxation

The United States has an assortment

of federal, state, local, and special purpose governmental jurisdictions.

Each

imposes taxes to fully or partly fund its operations. These taxes may be imposed on the same income, property or activity.

The types of tax imposed at each level of government vary.

Слайд 6Income taxes are imposed at the federal and most state

levels.

Taxes on property are typically imposed only at the local

level.Excise taxes are imposed by the federal and some state governments.

Sales taxes are imposed by most states and many local governments.

Слайд 7Taxpayers

Taxes may be imposed on

individuals (natural persons)

business entities

estates

trusts

other forms

of organization

Слайд 8Income tax

Taxes based on income are imposed at the federal,

most state, and some local levels within the United States.

The

U.S. income tax system imposes a tax based on income on individuals, corporations, estates, and trusts.Слайд 9Income tax rates differ at the federal and state levels

for corporations and individuals.

Individuals are subject to federal graduated tax

rates from 10% to 35%.Corporations are subject to federal graduated rates of tax from 15% to 35%.

State income tax rates vary from 1% to 16%, including local income tax.

Слайд 10Federal and state income tax is calculated, and returns filed,

for each taxpayer.

Two married individuals may calculate tax and

file returns jointly or separately.Some people hire an accountant for tax calculations.

Слайд 11Payroll taxes

Payroll taxes are assessed by the federal government, all

fifty states, the District of Columbia, and numerous cities.

These

taxes are imposed on employers and employees and on various compensation bases. They are collected and paid to the taxing jurisdiction by the employers.

Слайд 12Property taxes

Property tax is based on fair market value of

the subject property.

Most jurisdictions impose a tax on interests in

real property (land, buildings, and permanent improvements).Слайд 13Penalties

Failure to timely and properly pay federal payroll taxes results

in an automatic penalty of 2% to 10%.

State and local

penalties vary by jurisdiction.Слайд 14In some situations public can influence on taxes.

For example, if

one school district wants more money people vote whether they

pay more taxes for it or not.

Теги