Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Chapter 9 Corporate Finance Value of Bond and Common Stocks Copyright © 2006 by

Содержание

- 1. Chapter 9 Corporate Finance Value of Bond and Common Stocks Copyright © 2006 by

- 2. Key Concepts and SkillsKnow the important bond

- 3. Chapter Outline9.1 Definitions and Example of a Bond9.2 How

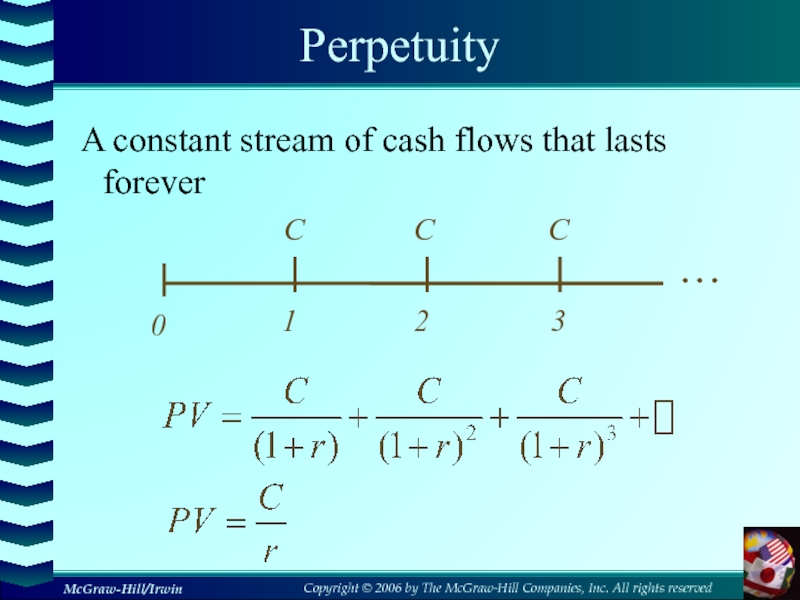

- 4. Slide Overview – business valuationsMaximisation of shareholder wealthInvestment decisionAvoid over-payingfor acquisitions

- 5. Review :Time Value1 Valuation: The One-Period Case2

- 6. 1 The One-Period CaseIf you were to

- 7. Future ValueIn the one-period case, the formula

- 8. Present ValueIf you were to be promised

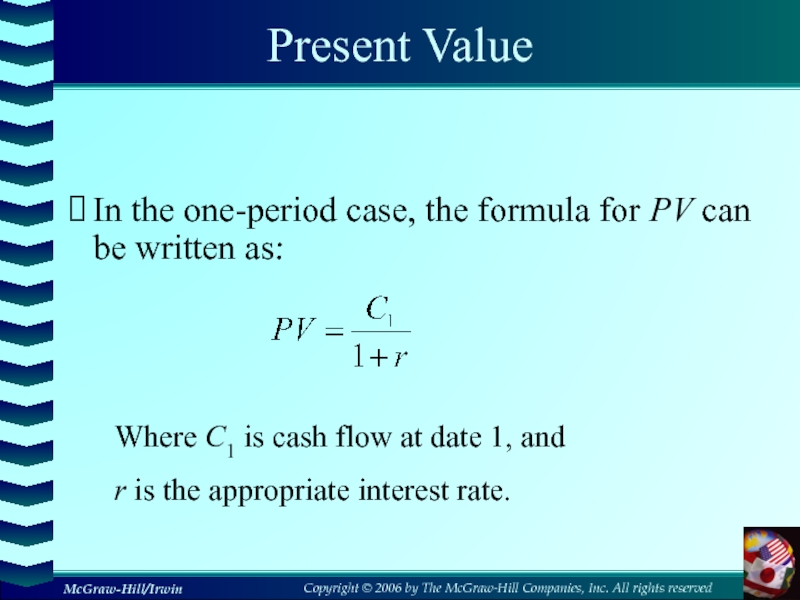

- 9. Present ValueIn the one-period case, the formula

- 10. Net Present ValueThe Net Present Value (NPV)

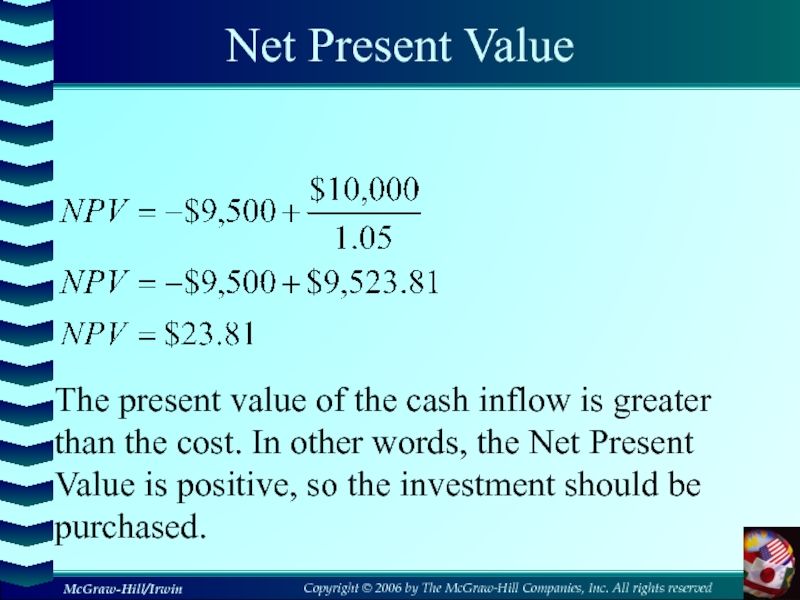

- 11. Net Present ValueThe present value of the

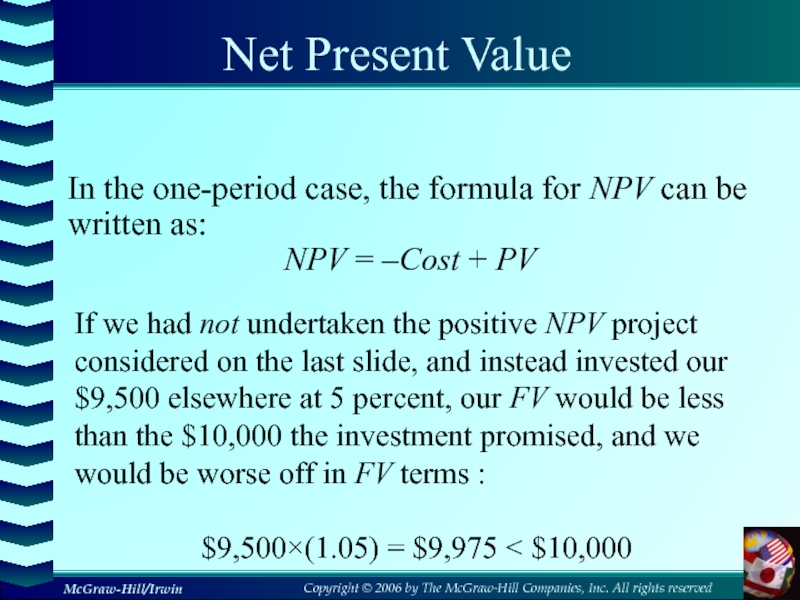

- 12. Net Present ValueIn the one-period case, the

- 13. 4.2 The Multiperiod CaseThe general formula for

- 14. Future ValueSuppose a stock currently pays a

- 15. Future Value and CompoundingNotice that the dividend

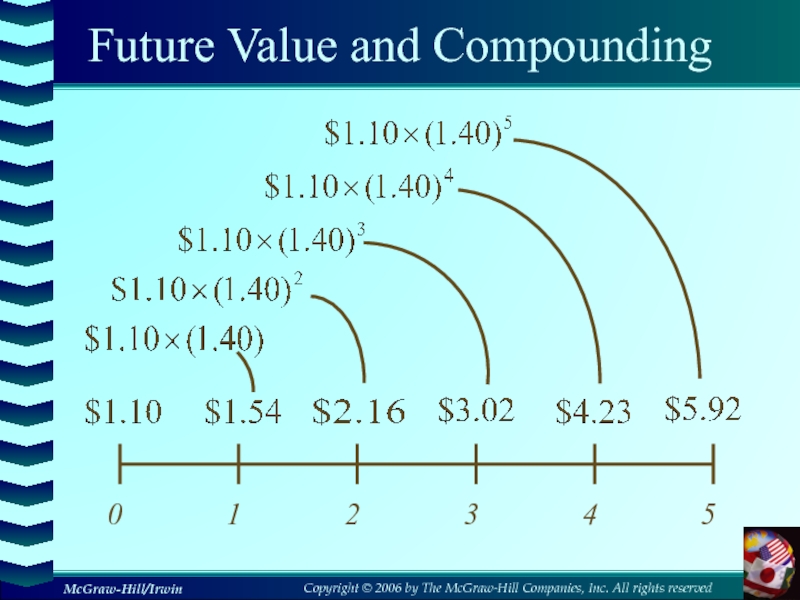

- 16. Future Value and Compounding

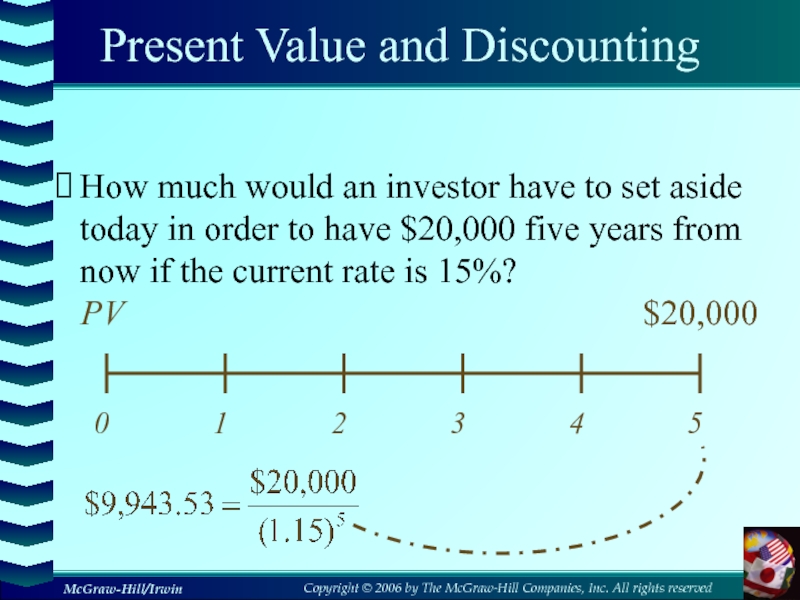

- 17. Present Value and DiscountingHow much would an

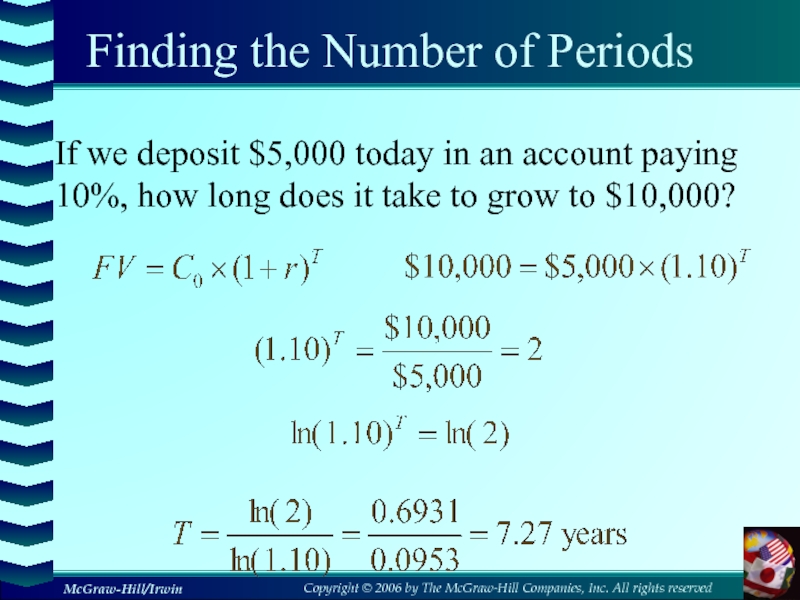

- 18. Finding the Number of PeriodsIf we deposit

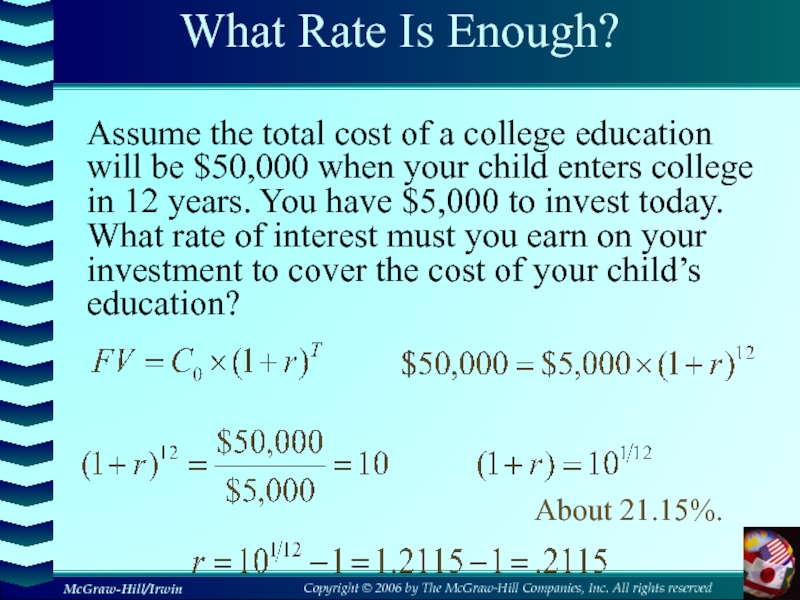

- 19. What Rate Is Enough?Assume the total cost

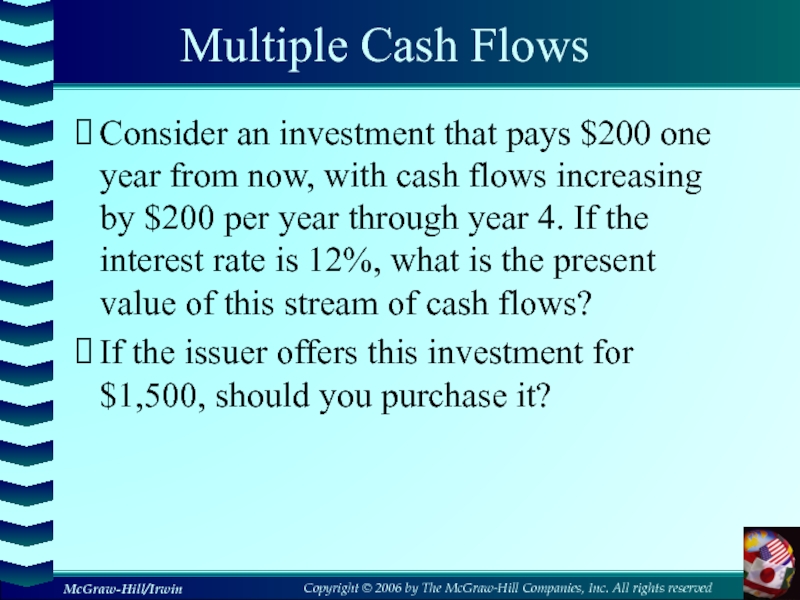

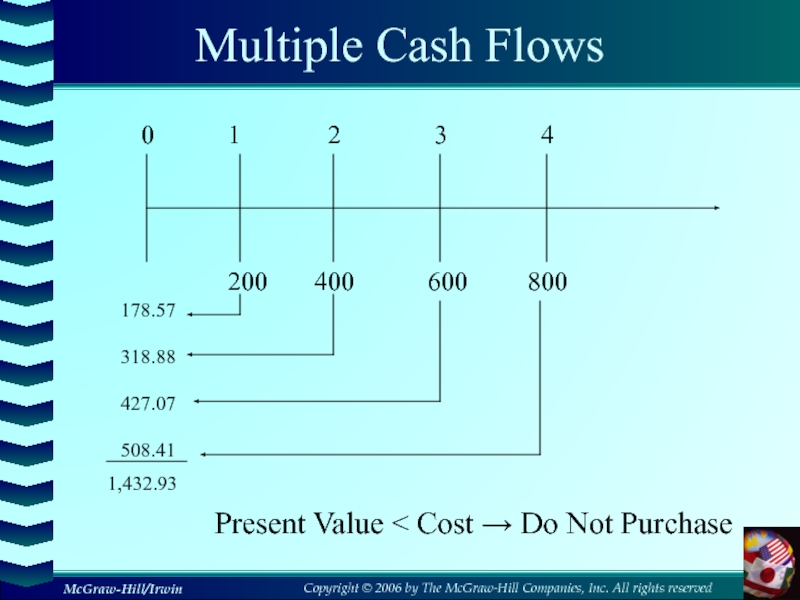

- 20. Multiple Cash Flows Consider an investment that pays

- 21. Multiple Cash FlowsPresent Value < Cost → Do Not Purchase

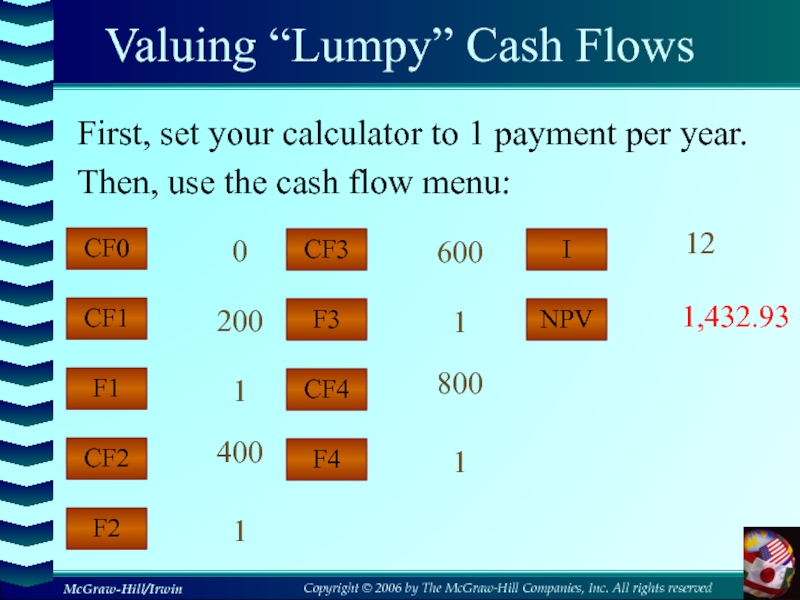

- 22. Valuing “Lumpy” Cash FlowsFirst, set your calculator

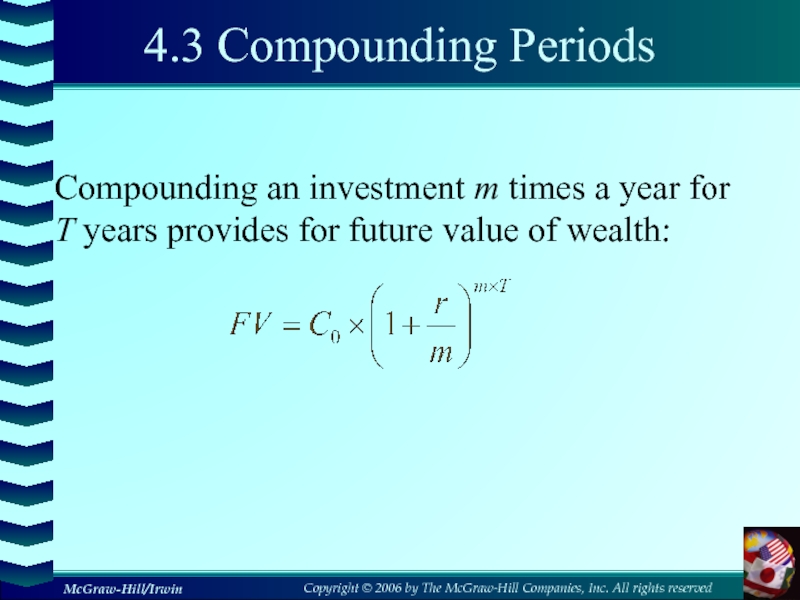

- 23. 4.3 Compounding PeriodsCompounding an investment m times

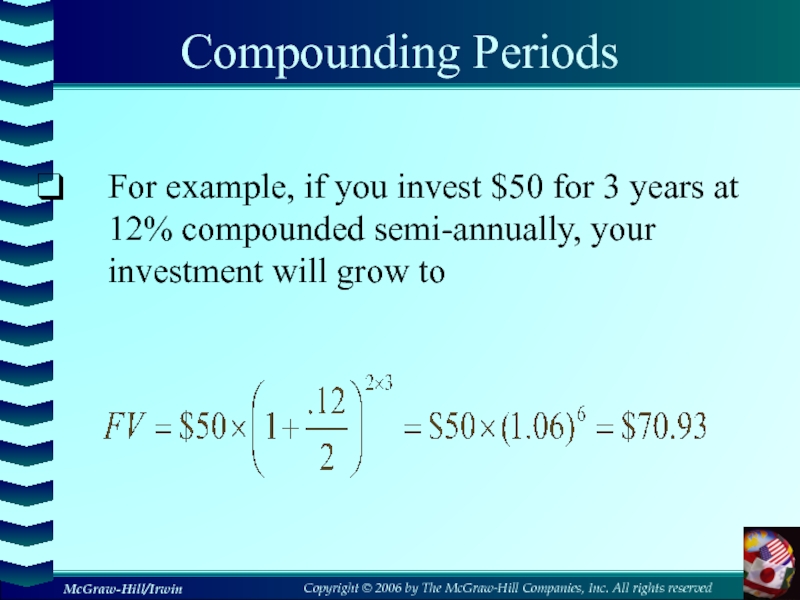

- 24. Compounding PeriodsFor example, if you invest $50

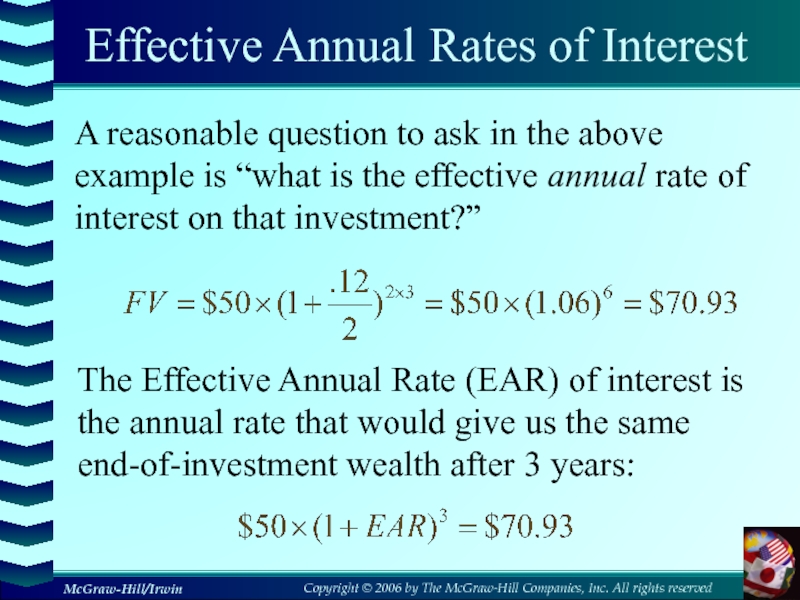

- 25. Effective Annual Rates of InterestA reasonable question

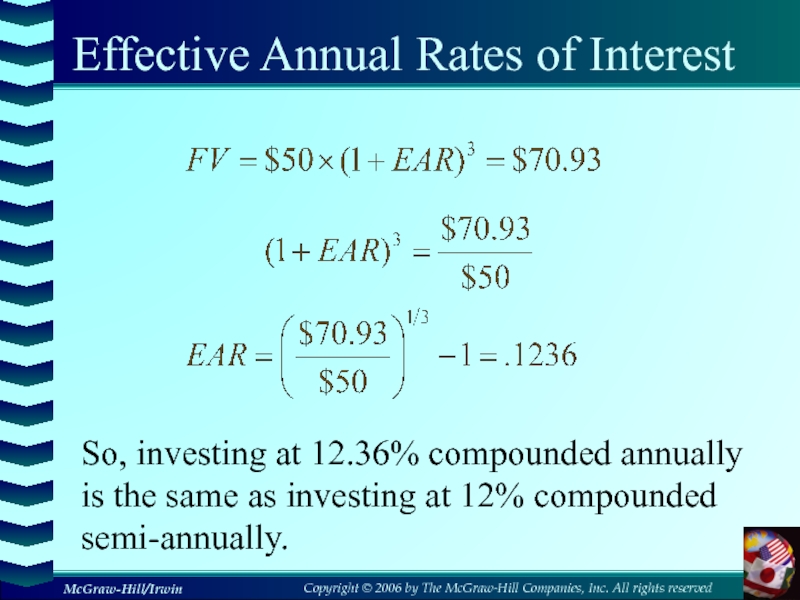

- 26. Effective Annual Rates of InterestSo, investing at

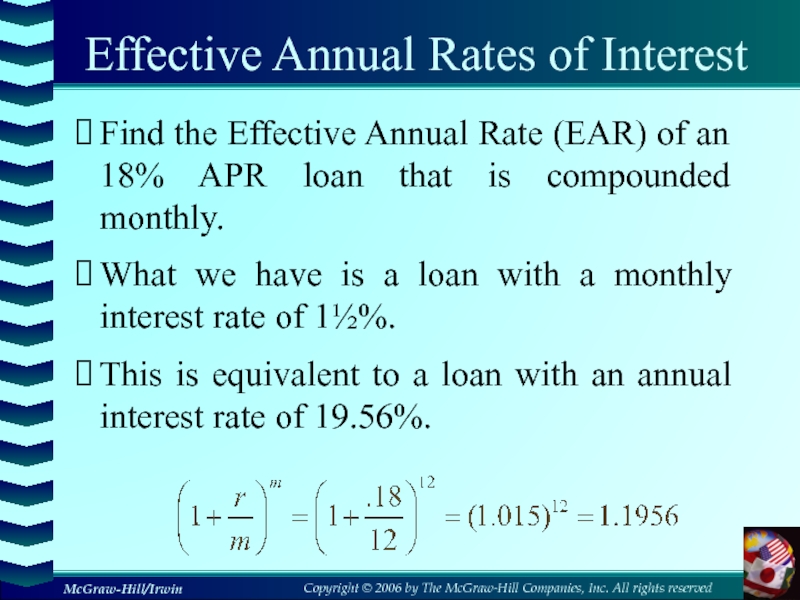

- 27. Effective Annual Rates of InterestFind

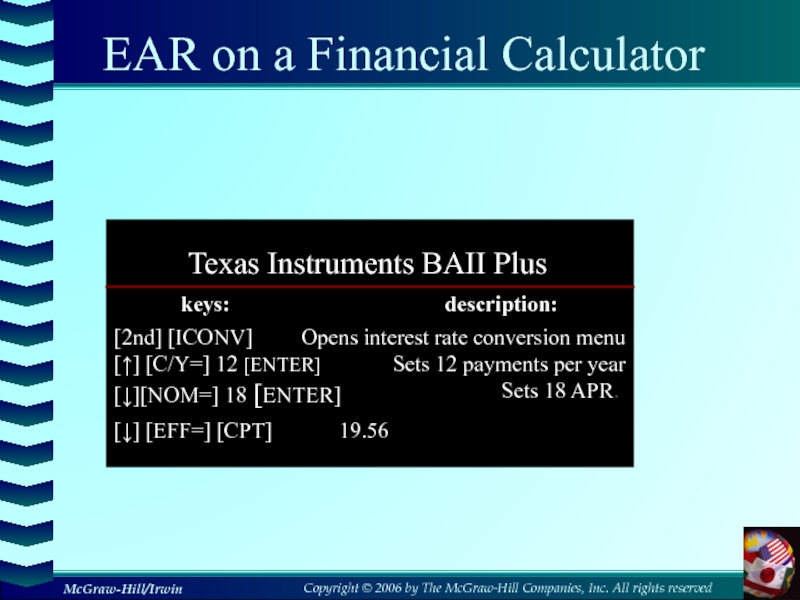

- 28. EAR on a Financial CalculatorTexas Instruments BAII Plus

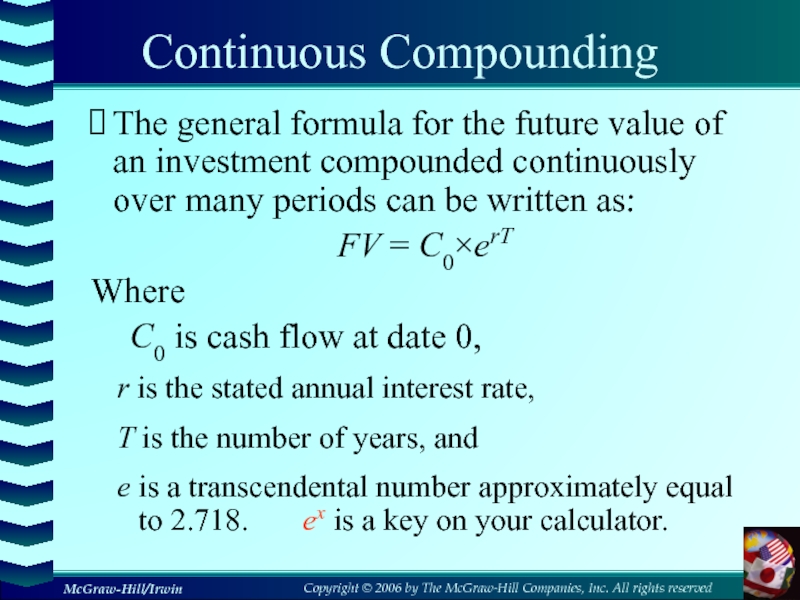

- 29. Continuous CompoundingThe general formula for the future

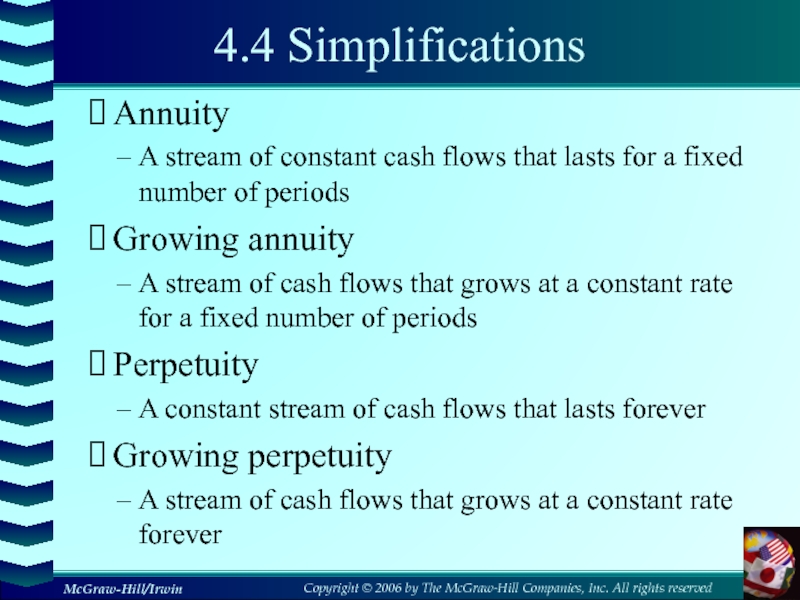

- 30. 4.4 SimplificationsAnnuityA stream of constant cash flows

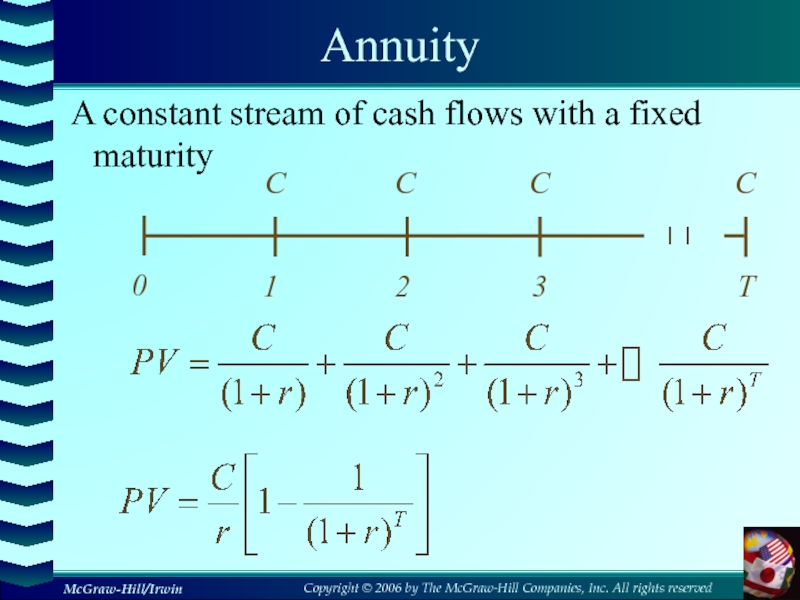

- 31. AnnuityA constant stream of cash flows with a fixed maturity

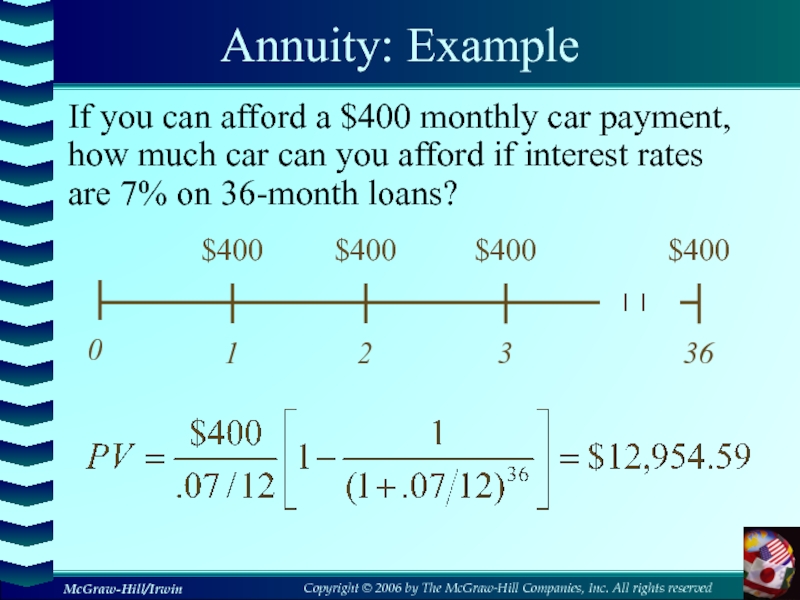

- 32. Annuity: ExampleIf you can afford a $400

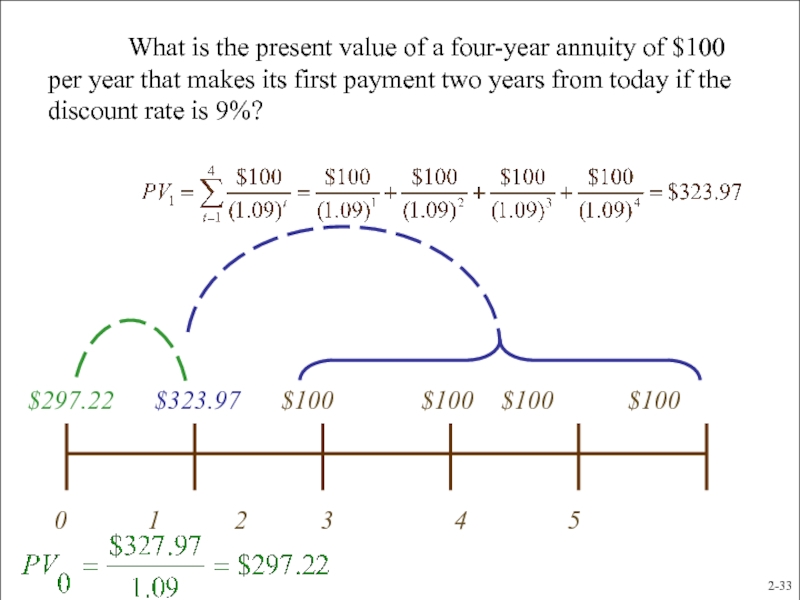

- 33. What is the present

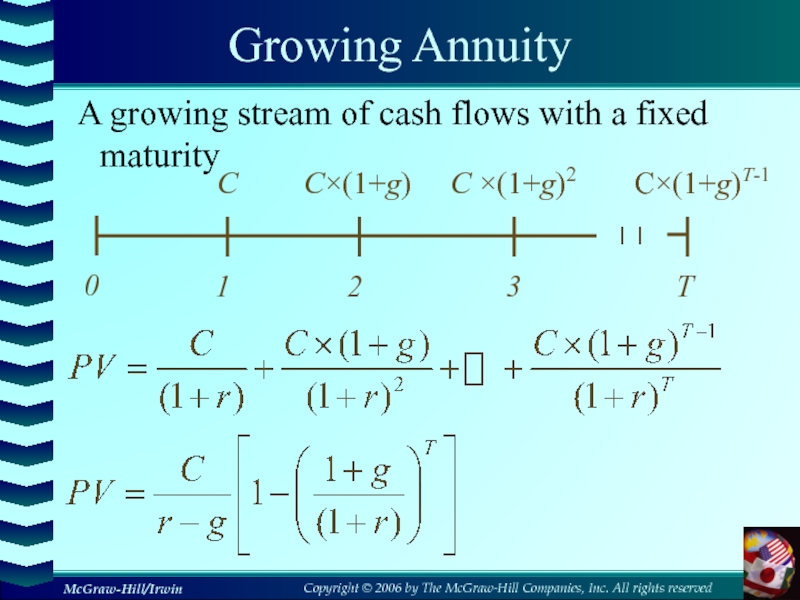

- 34. Growing AnnuityA growing stream of cash flows with a fixed maturity

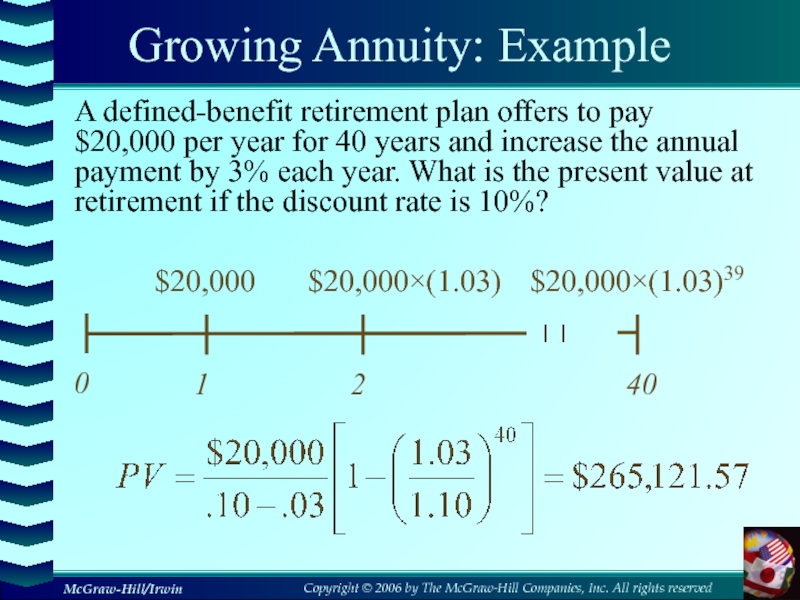

- 35. Growing Annuity: ExampleA defined-benefit retirement plan offers

- 36. PerpetuityA constant stream of cash flows that lasts forever…

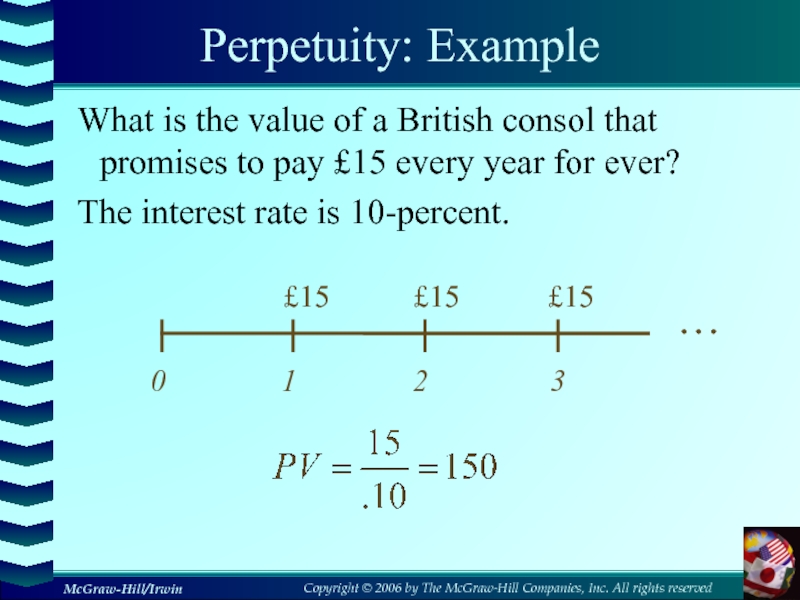

- 37. Perpetuity: ExampleWhat is the value of a

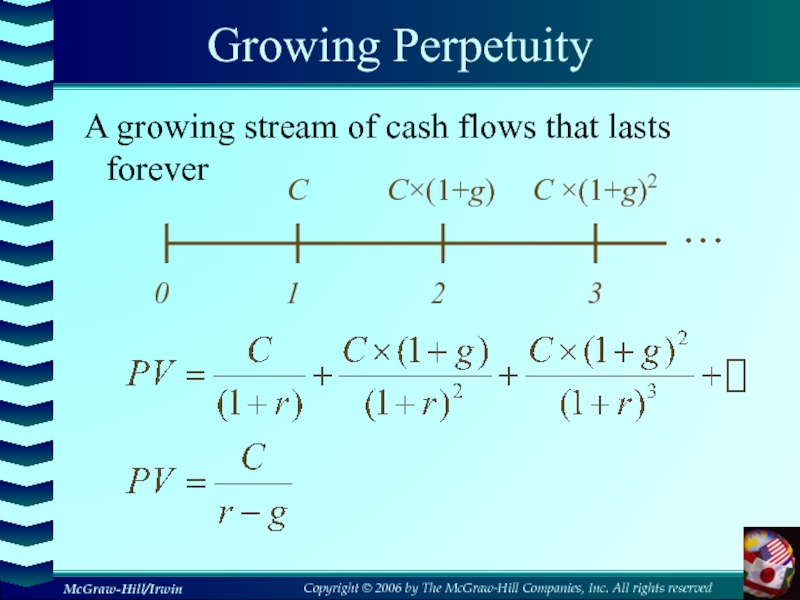

- 38. Growing PerpetuityA growing stream of cash flows that lasts forever…

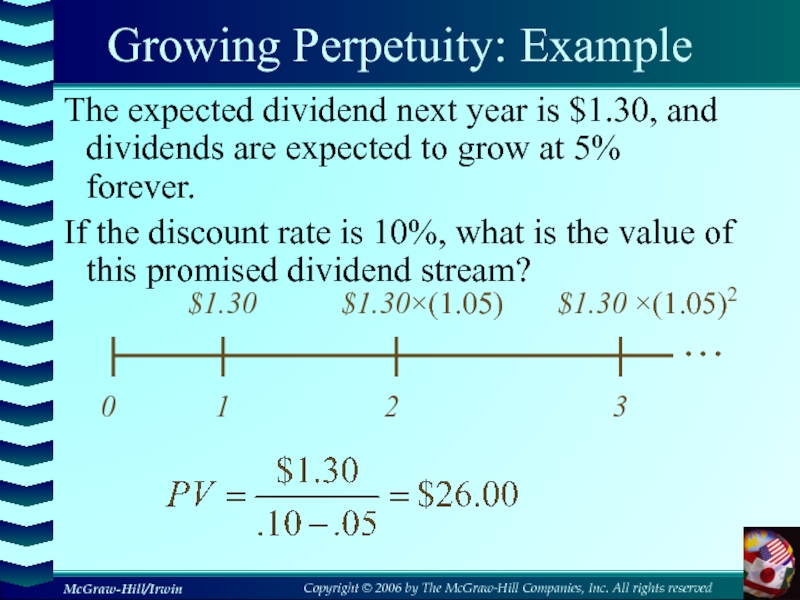

- 39. Growing Perpetuity: ExampleThe expected dividend next year

- 40. Valuation of Bond and StockAfter reviewing the

- 41. 9.1 Definition of a BondA bond is

- 42. 9.2 How to Value Bonds Primary Principle:Value

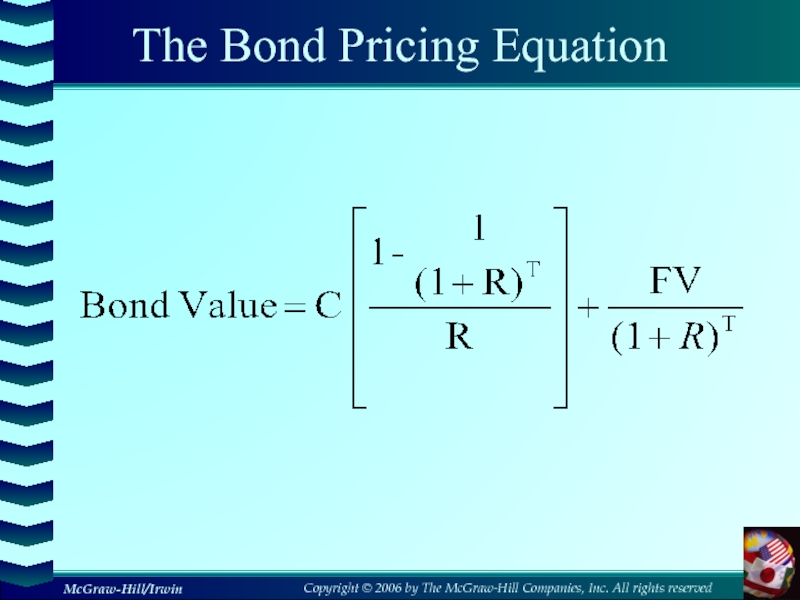

- 43. The Bond Pricing Equation

- 44. Pure Discount BondsMake no periodic interest payments

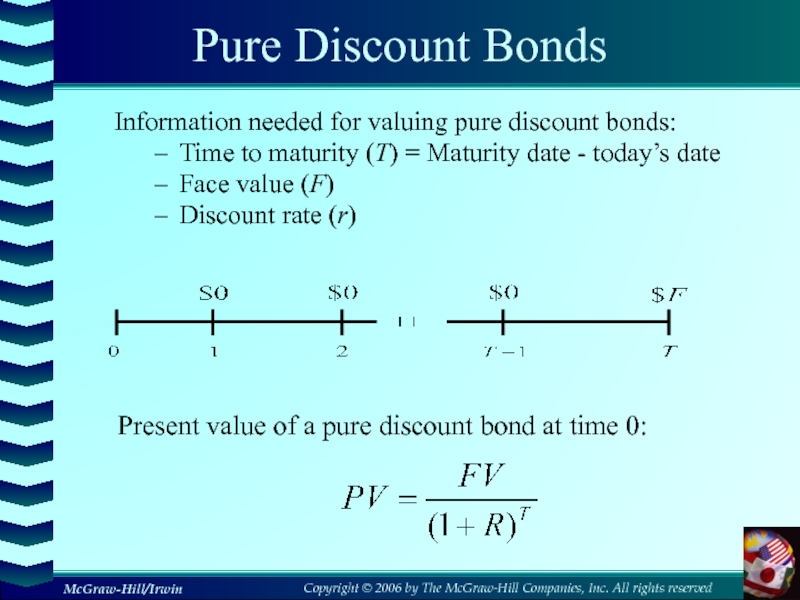

- 45. Pure Discount BondsInformation needed for valuing pure

- 46. Pure Discount Bond: ExampleFind the value of

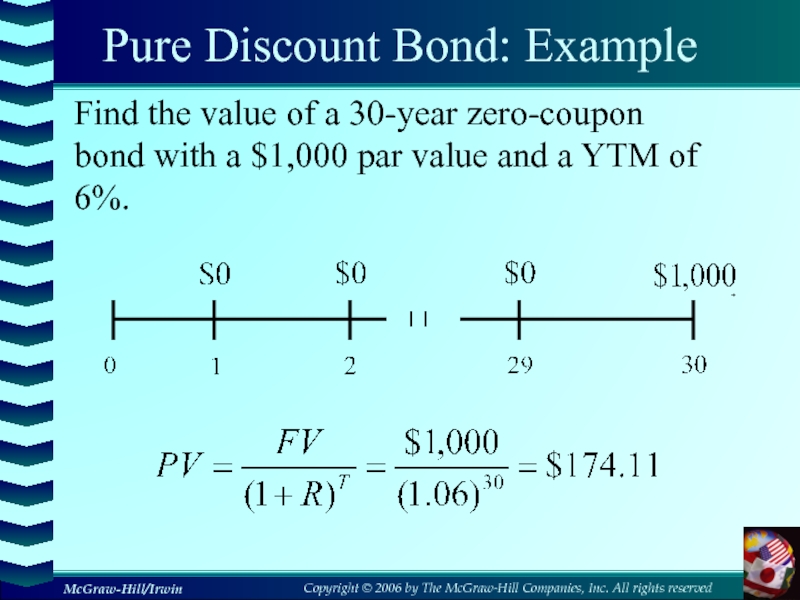

- 47. Level Coupon BondsMake periodic coupon payments in

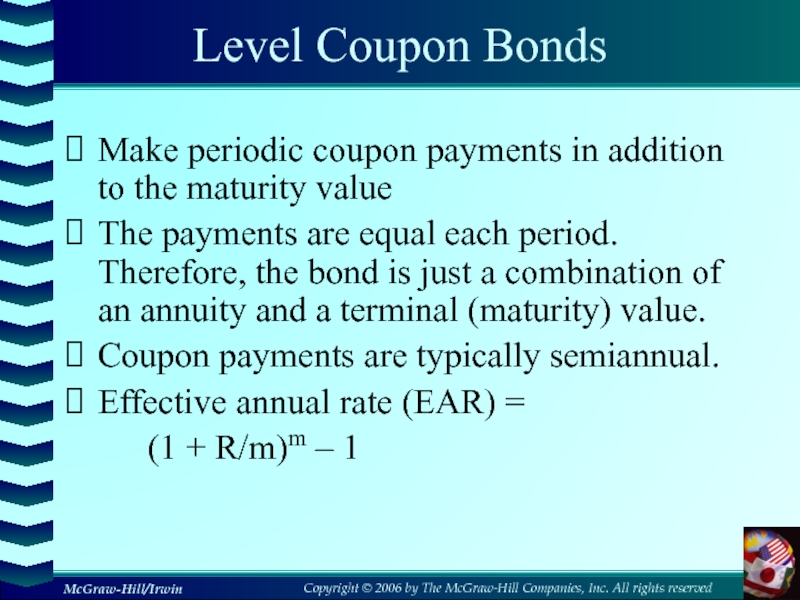

- 48. Level Coupon Bond: ExampleConsider a U.S. government

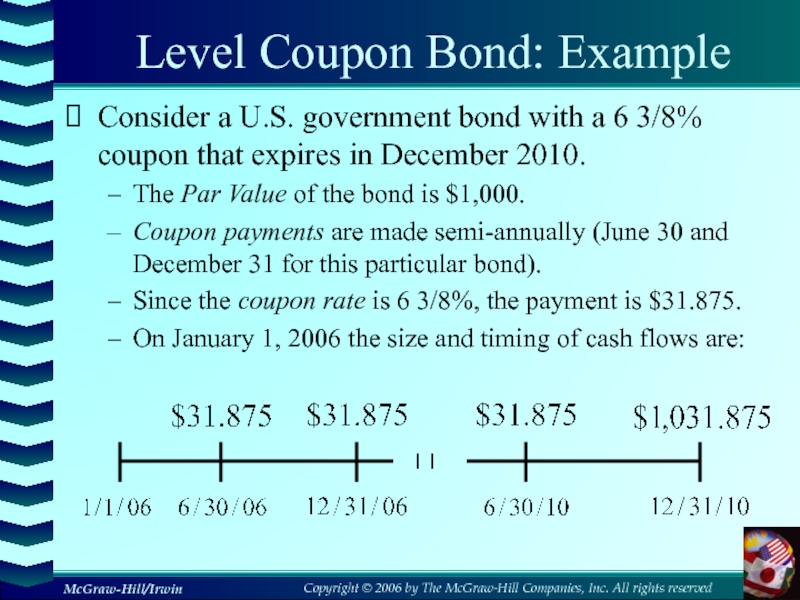

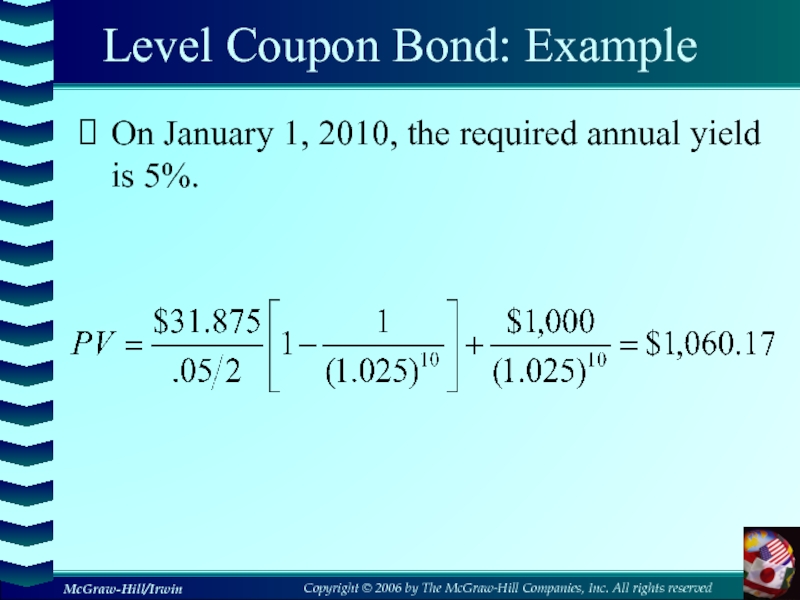

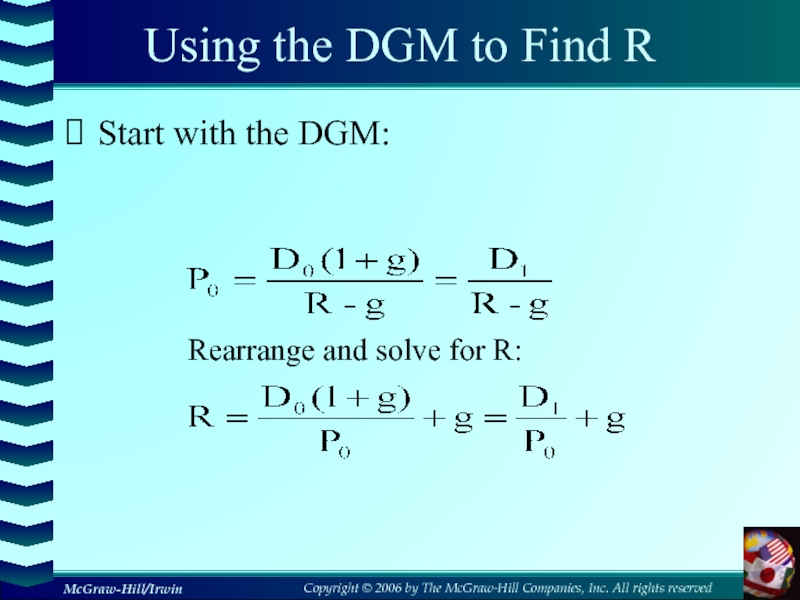

- 49. Level Coupon Bond: ExampleOn January 1, 2010, the required annual yield is 5%.

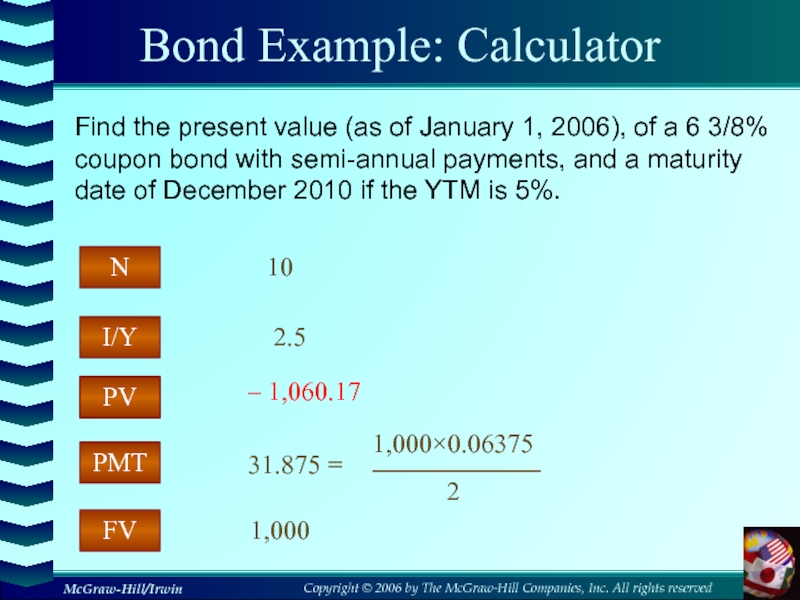

- 50. Bond Example: CalculatorPMTI/YFVPVNPV31.875 =2.51,000– 1,060.1710Find the present

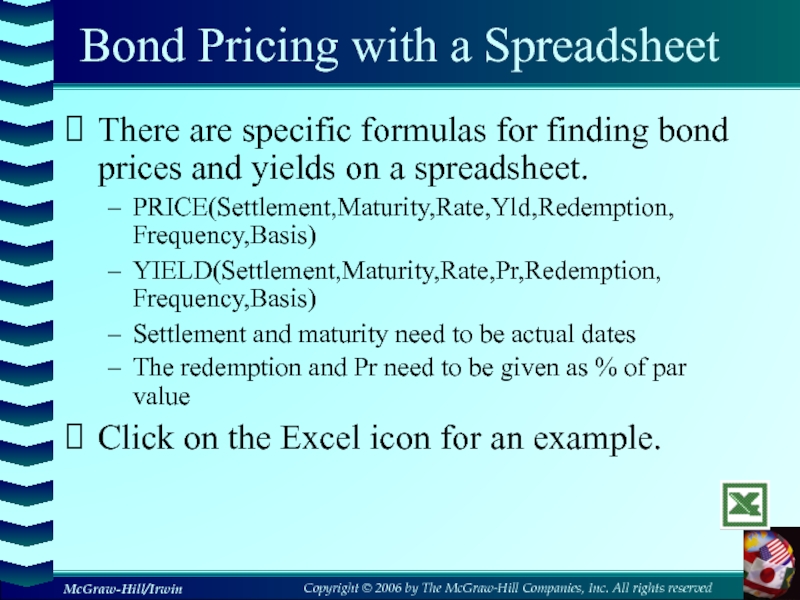

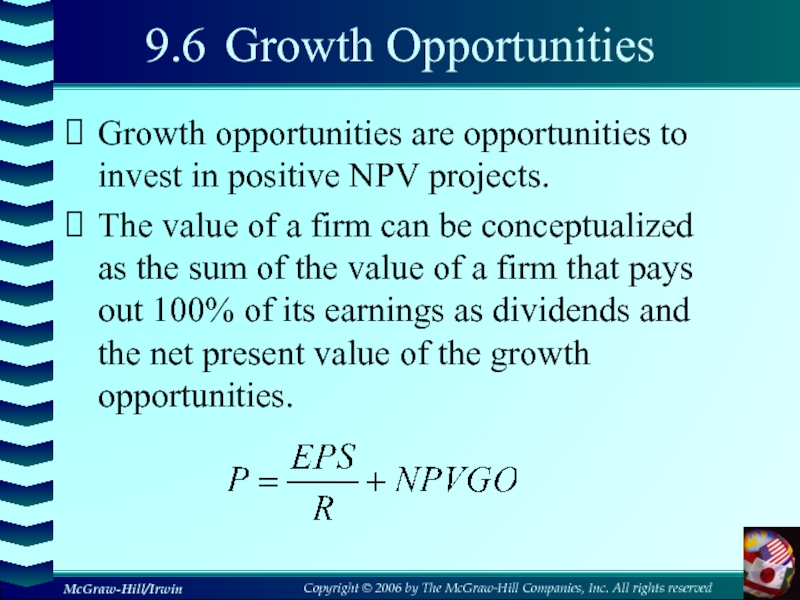

- 51. Bond Pricing with a SpreadsheetThere are specific

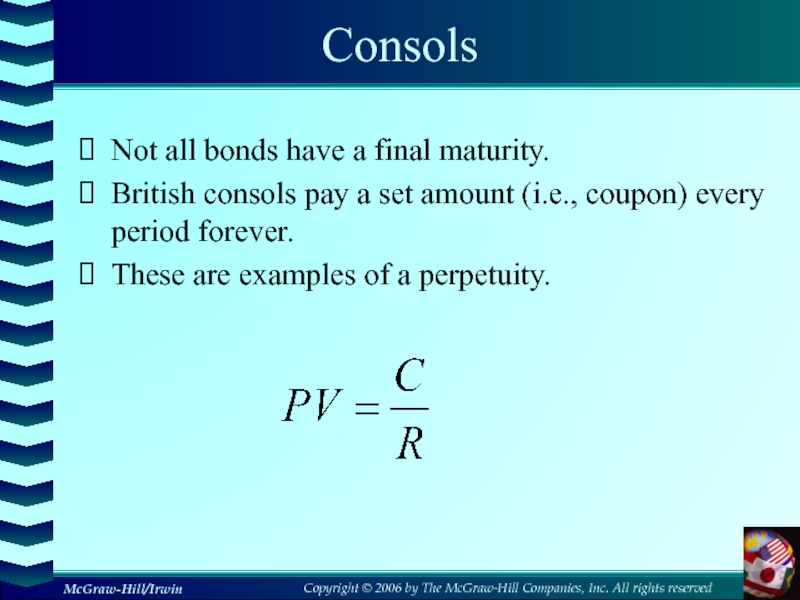

- 52. ConsolsNot all bonds have a final maturity.British

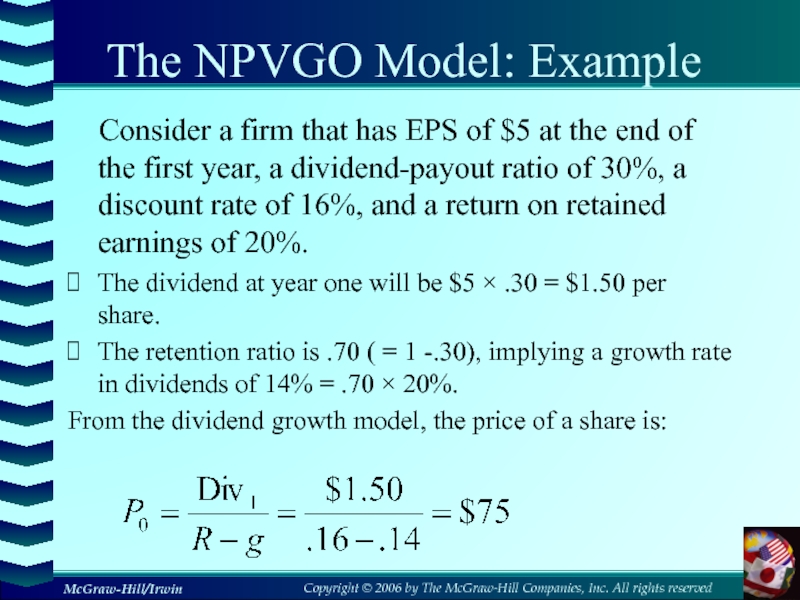

- 53. 9.3 Bond ConceptsBond prices and market interest

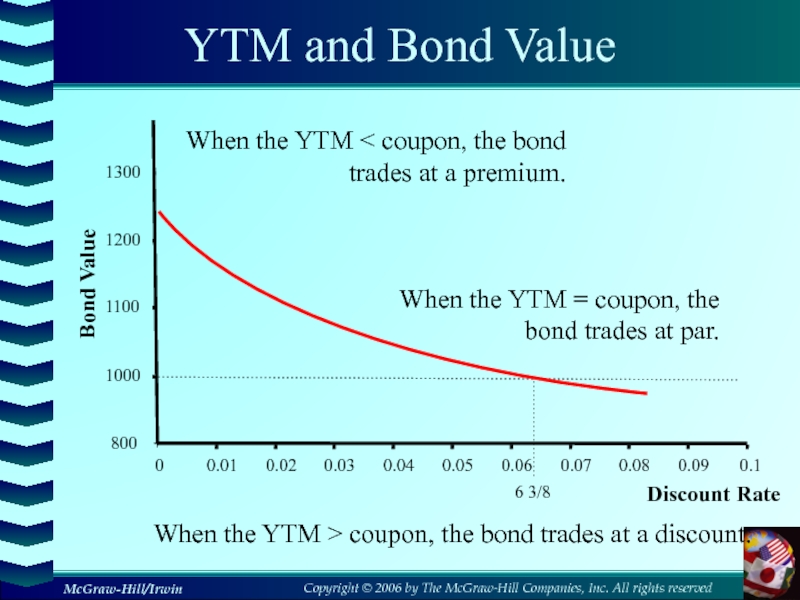

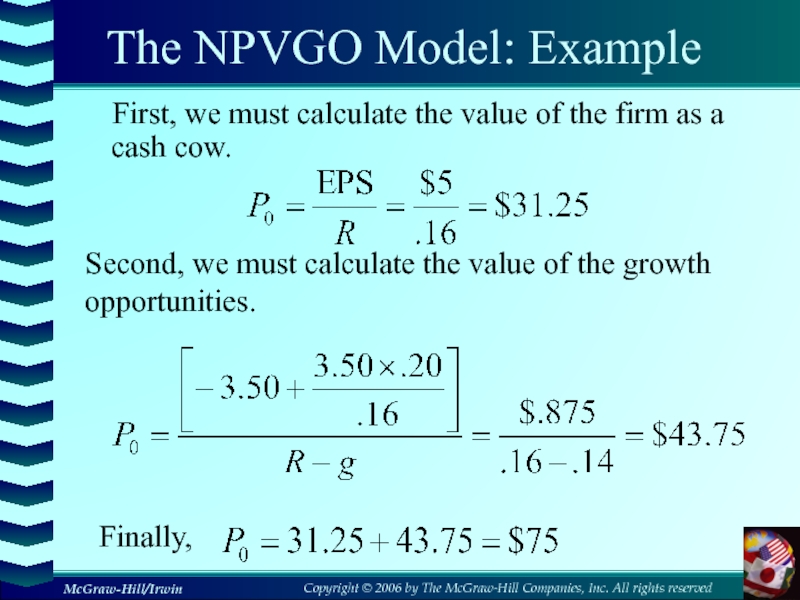

- 54. YTM and Bond Value800100011001200130000.010.020.030.040.050.060.070.080.090.1Discount RateBond ValueWhen the

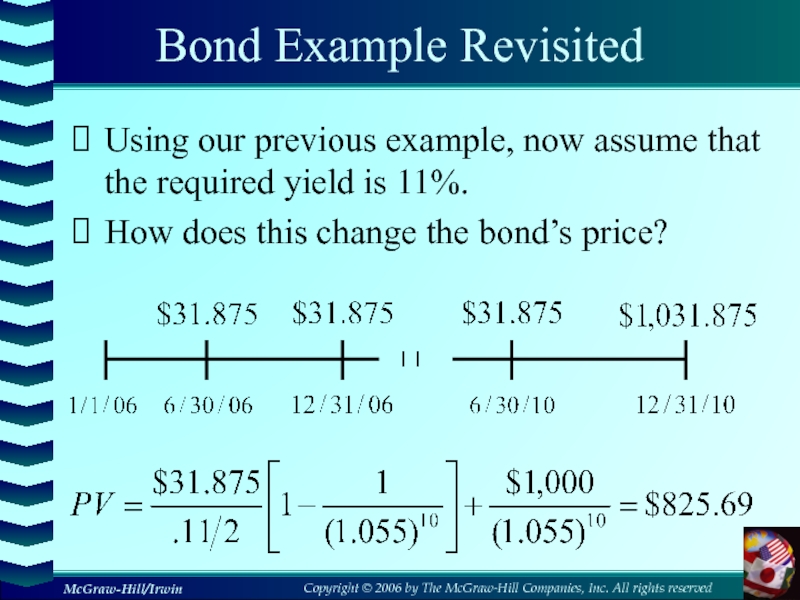

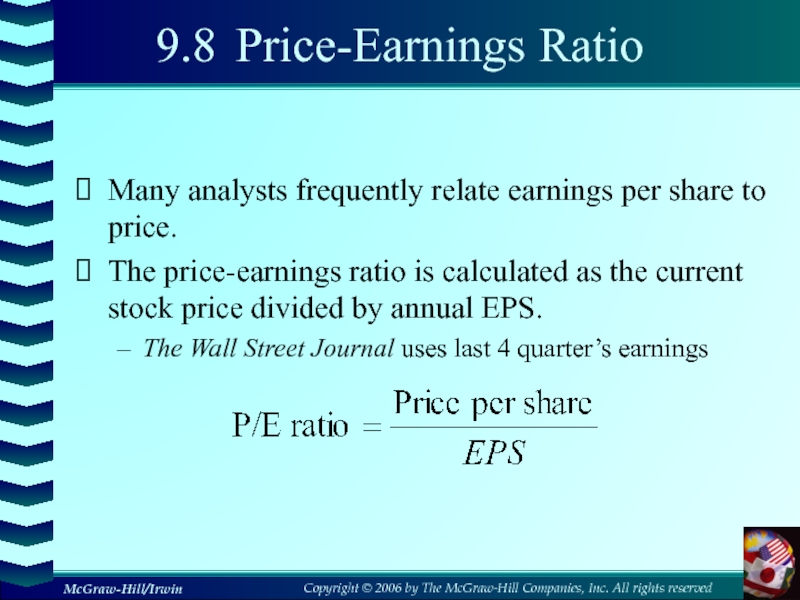

- 55. Bond Example RevisitedUsing our previous example, now

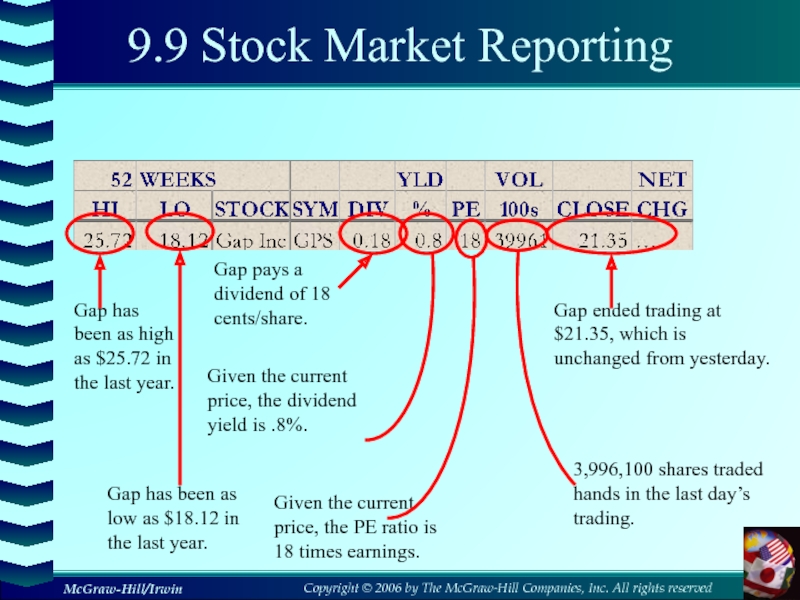

- 56. Computing Yield to MaturityYield to maturity is

- 57. YTM with Annual CouponsConsider a bond with

- 58. YTM with Semiannual CouponsSuppose a bond with

- 59. Bond Market ReportingPrimarily over-the-counter transactions with dealers

- 60. Treasury Quotations8 Nov 21 132:23 132:24 -12 5.14What is the

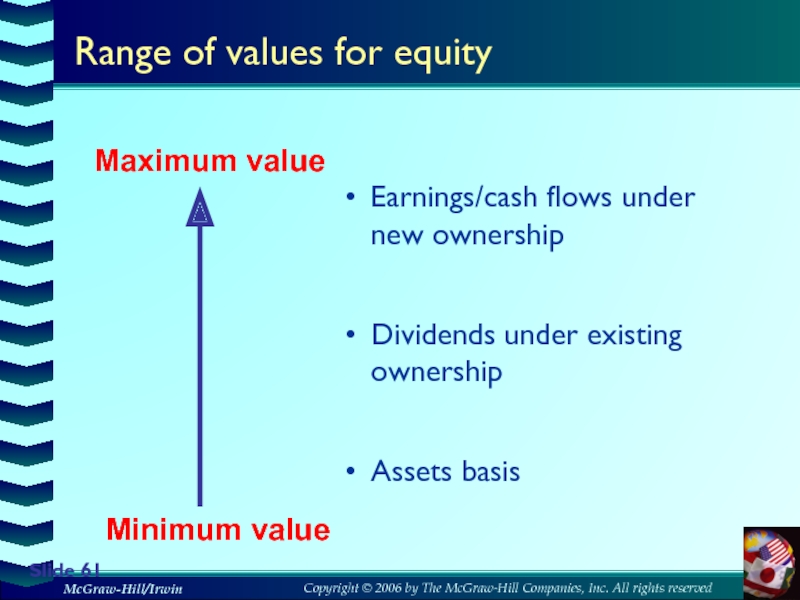

- 61. Slide Range of values for equityEarnings/cash flows under new ownershipDividends under existing ownershipAssets basisMaximum valueMinimum value

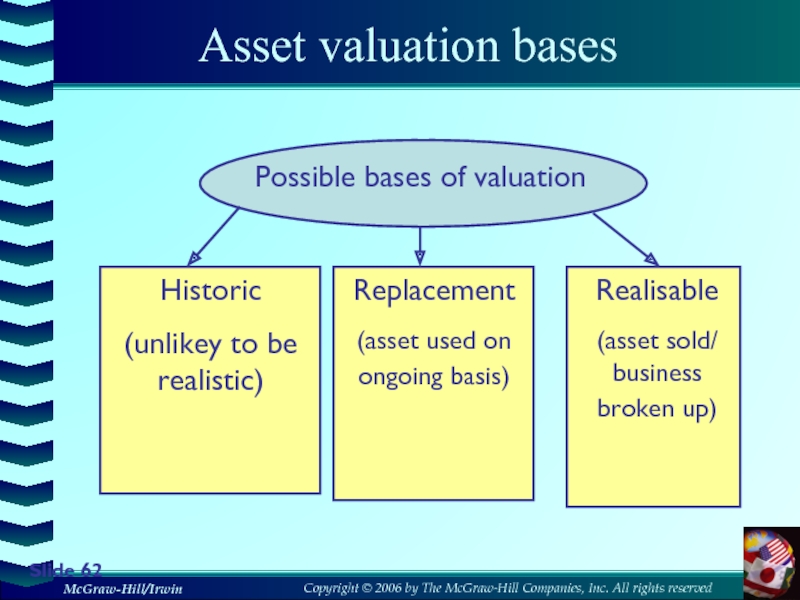

- 62. Slide Asset valuation basesPossible bases of valuationHistoric(unlikey

- 63. Assets basis If a business is

- 64. 9.4 The Present Value of Common StocksThe

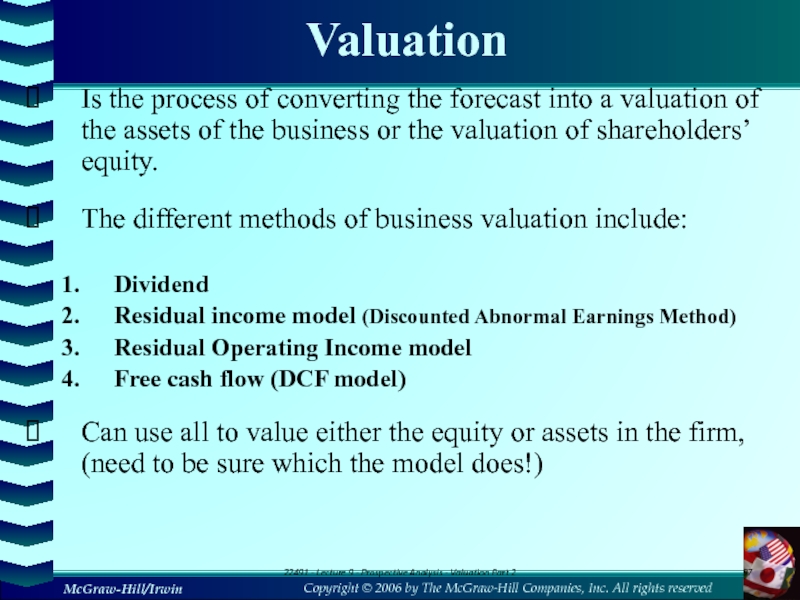

- 65. Dividend basisSlide MaxMinValue the dividends under the existing management

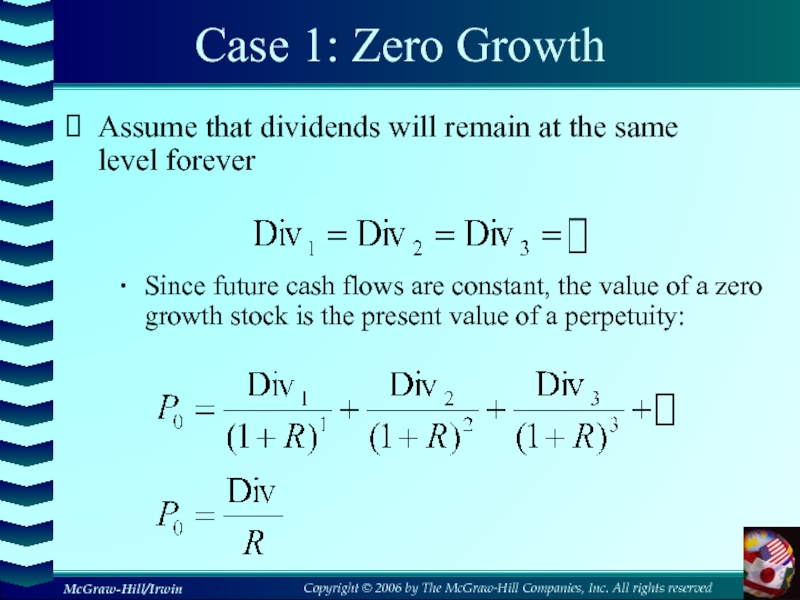

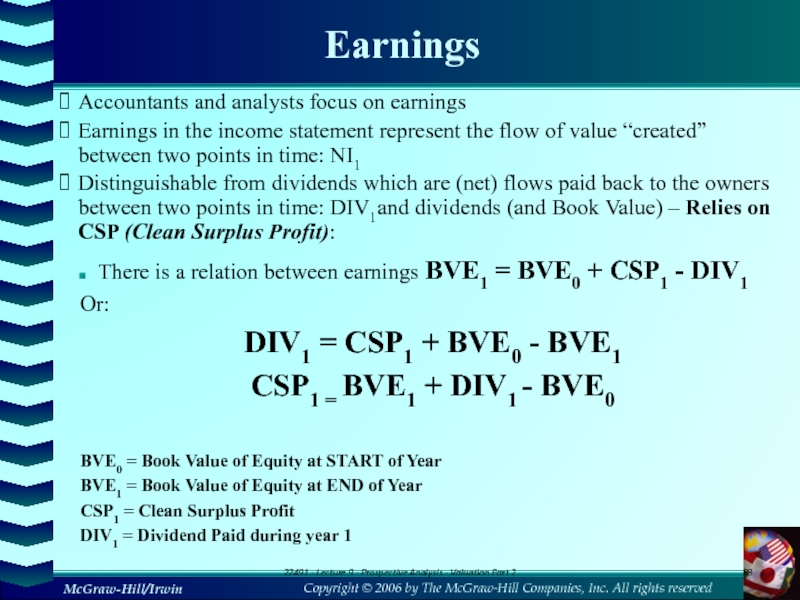

- 66. Case 1: Zero GrowthAssume that dividends will

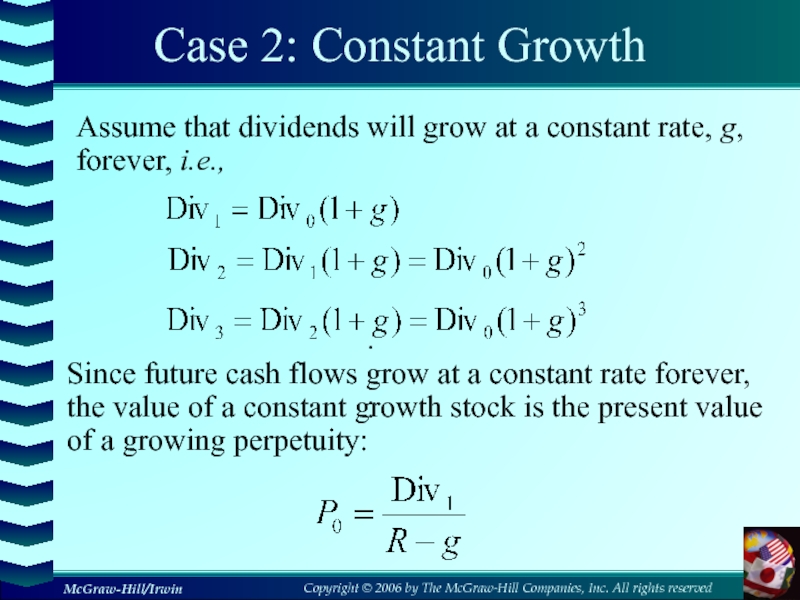

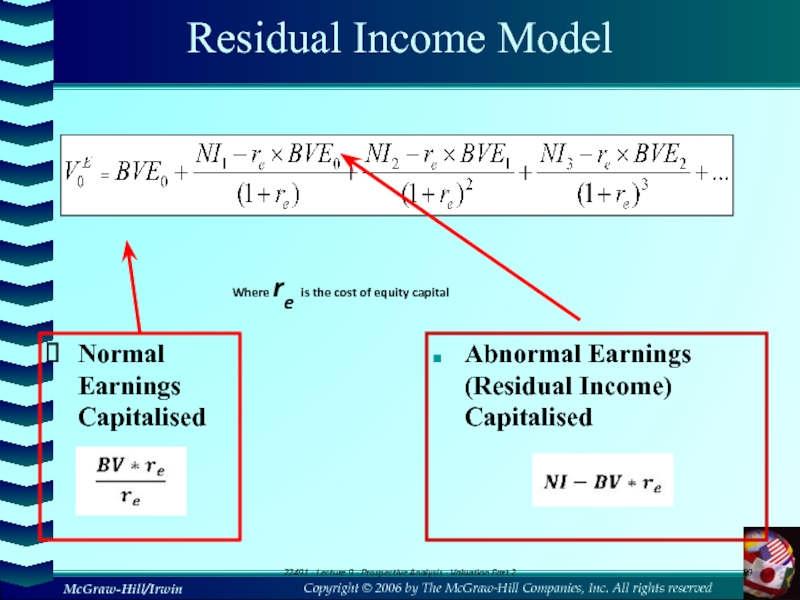

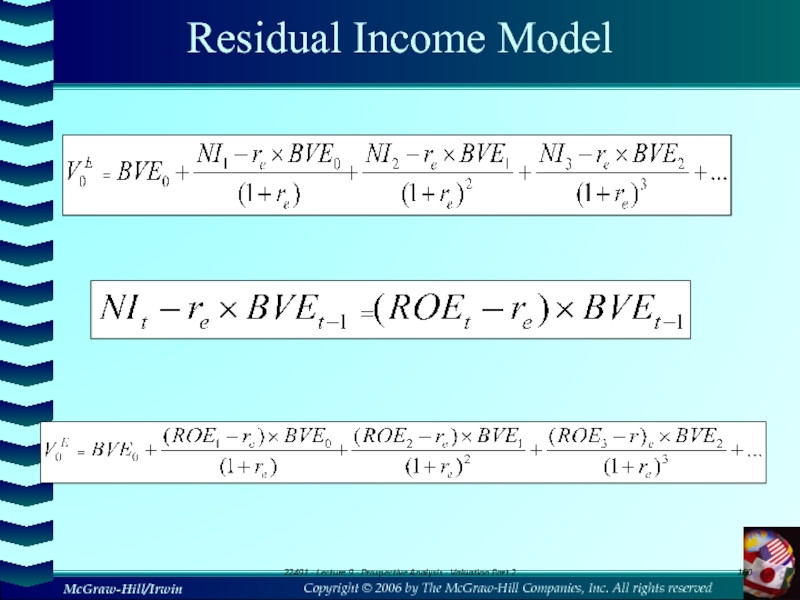

- 67. Case 2: Constant GrowthSince future cash flows

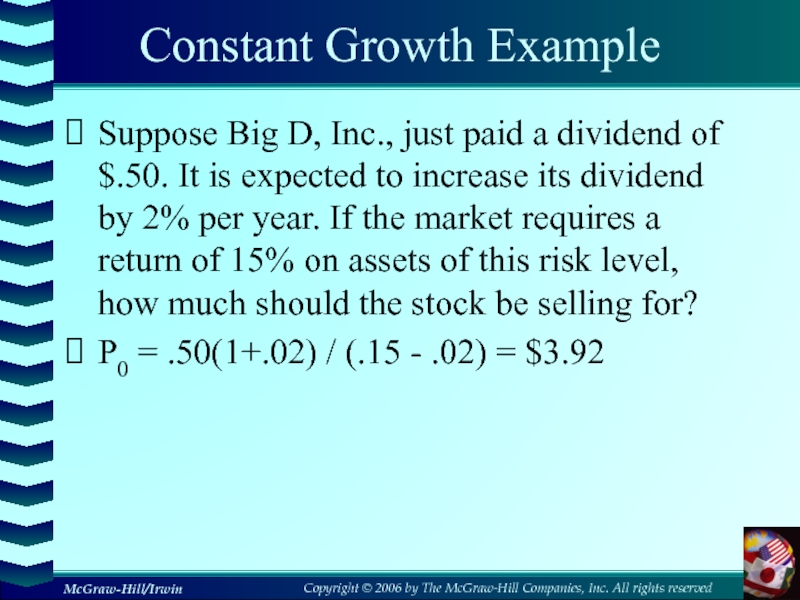

- 68. Constant Growth ExampleSuppose Big D, Inc., just

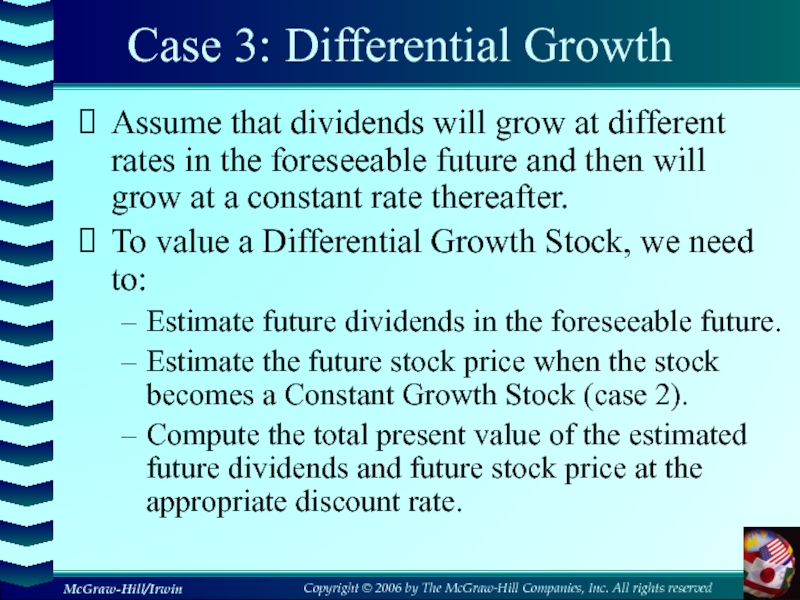

- 69. Case 3: Differential GrowthAssume that dividends will

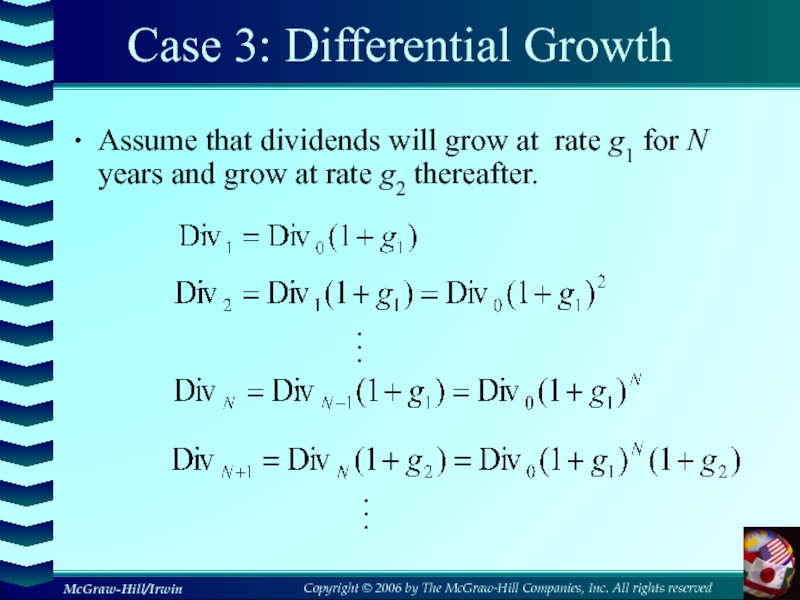

- 70. Case 3: Differential GrowthAssume that dividends will

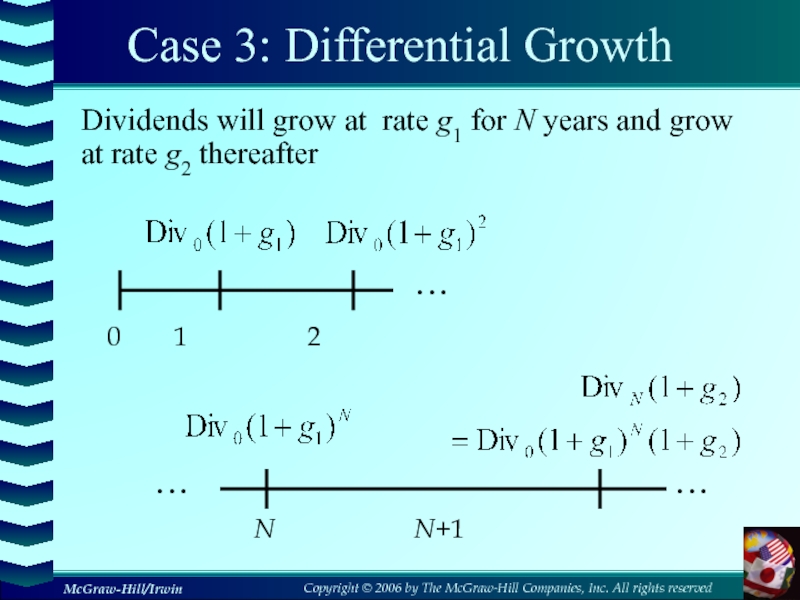

- 71. Case 3: Differential GrowthDividends will grow at

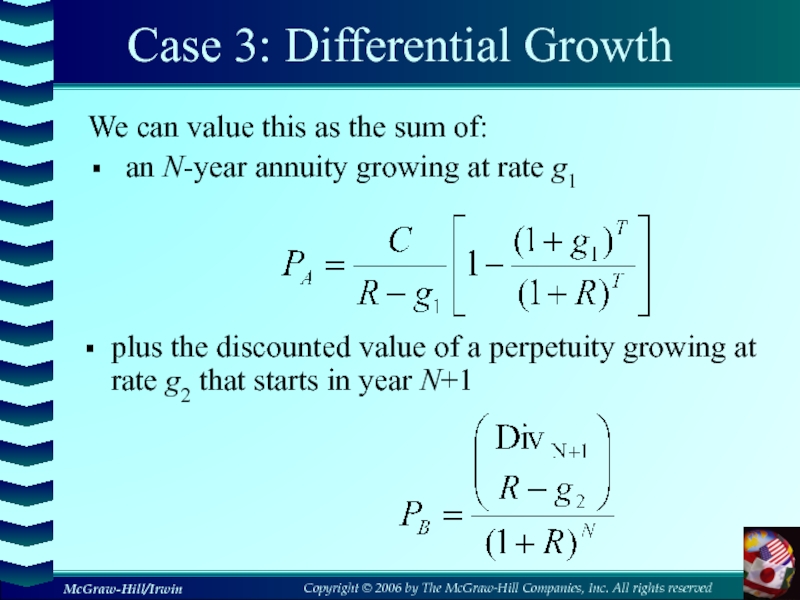

- 72. Case 3: Differential GrowthWe can value this

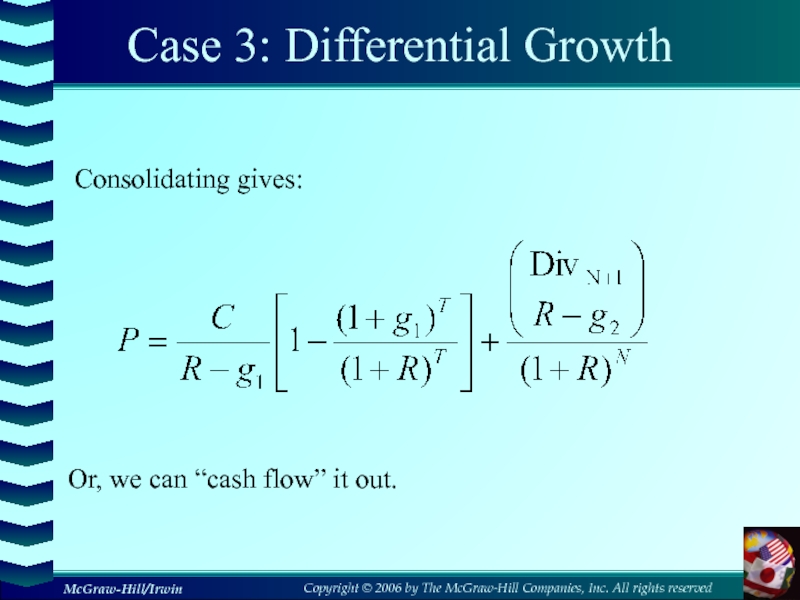

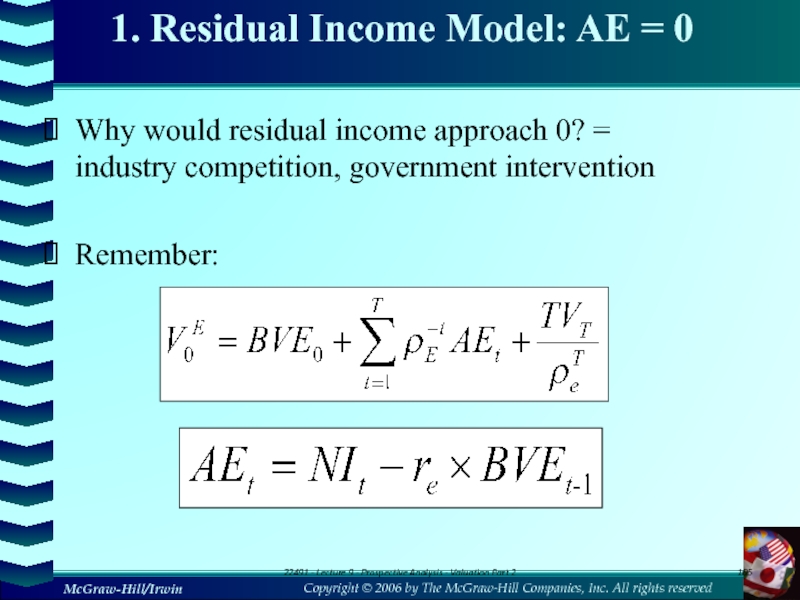

- 73. Case 3: Differential GrowthConsolidating gives:Or, we can “cash flow” it out.

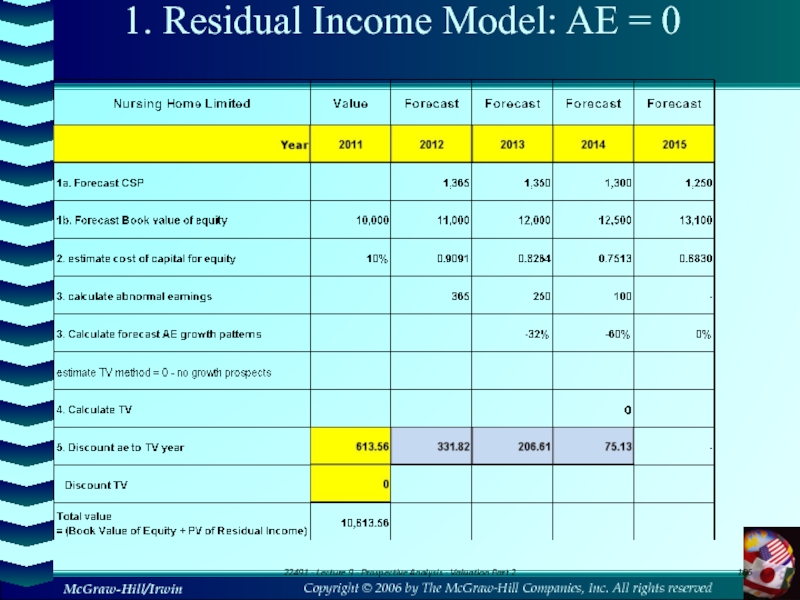

- 74. A Differential Growth ExampleA common stock just

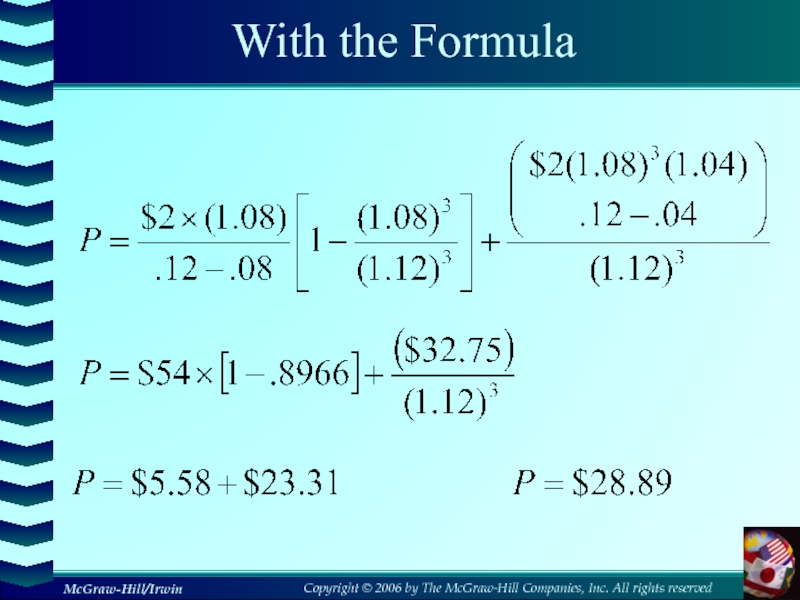

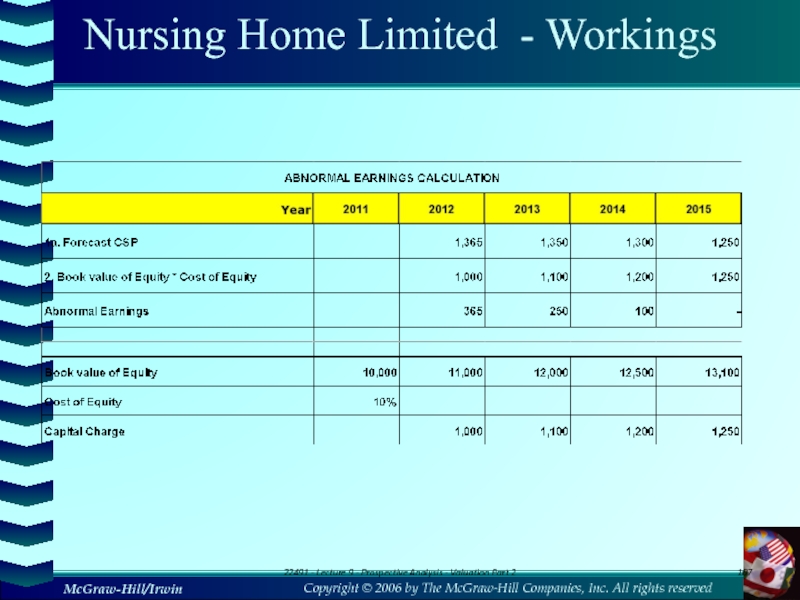

- 75. With the Formula

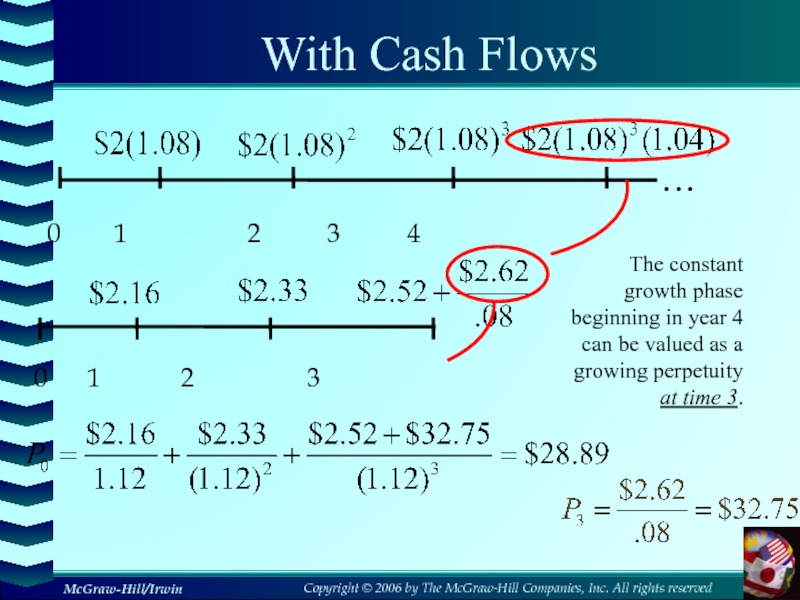

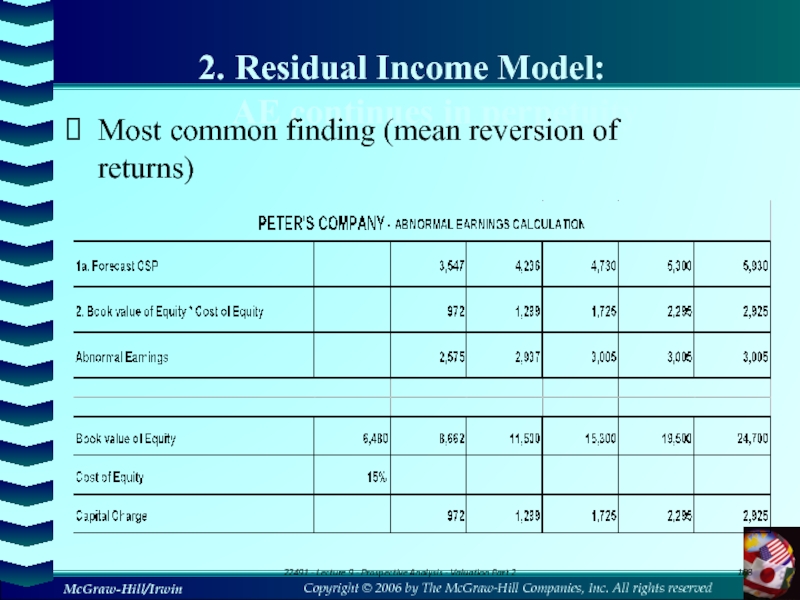

- 76. With Cash Flows…0 1

- 77. DisadvantagesSlide It is difficult to estimating future

- 78. The Red Bud Co. just paid a

- 79. 9.5 Estimates of ParametersThe value of a

- 80. Where does R come from?The discount rate

- 81. Using the DGM to Find RStart with the DGM:Rearrange and solve for R:

- 82. what should be paid for Overland common

- 83. 9.6 Growth OpportunitiesGrowth opportunities are opportunities to invest

- 84. 9.7 The Dividend Growth Model and the NPVGO

- 85. The NPVGO Model: Example Consider a

- 86. The NPVGO Model: Example First, we

- 87. 9.8 Price-Earnings RatioMany analysts frequently relate earnings per

- 88. 9.9 Stock Market Reporting

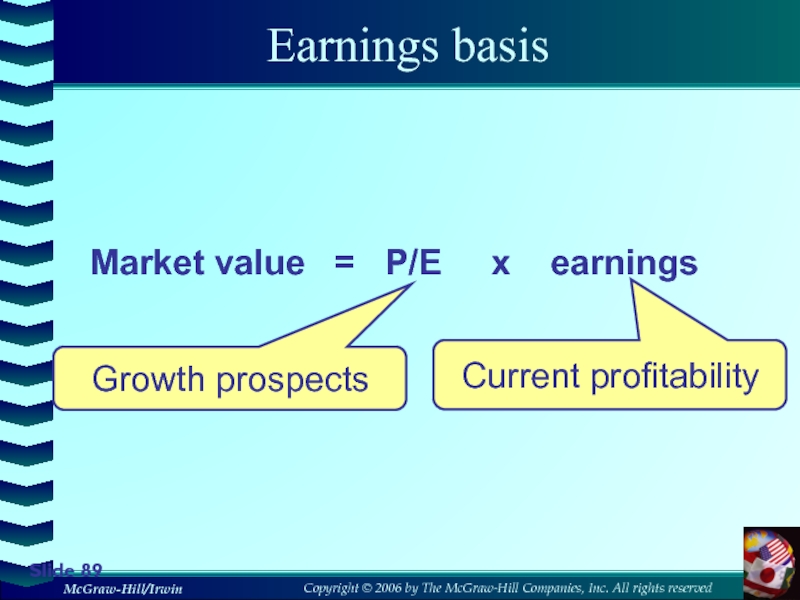

- 89. Slide Earnings basisMarket value = P/E x earningsGrowth prospectsCurrent profitability

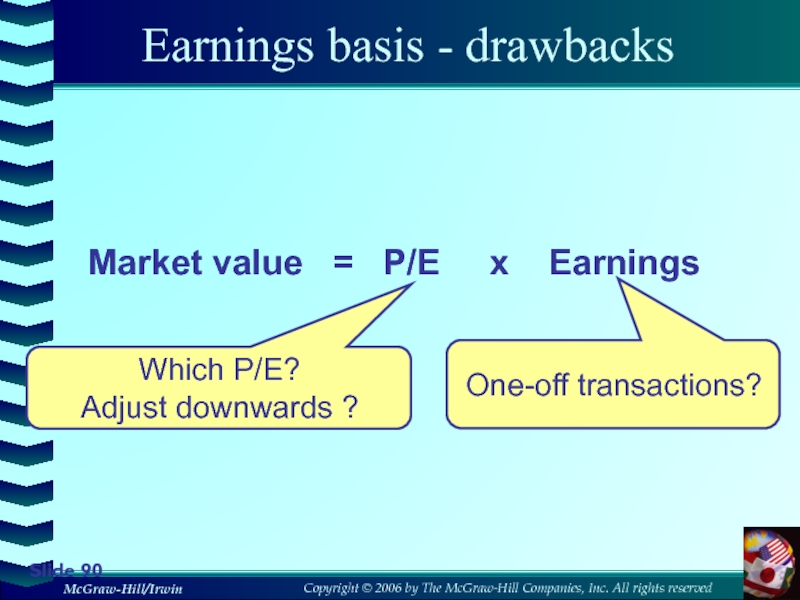

- 90. Slide Earnings basis - drawbacksMarket value

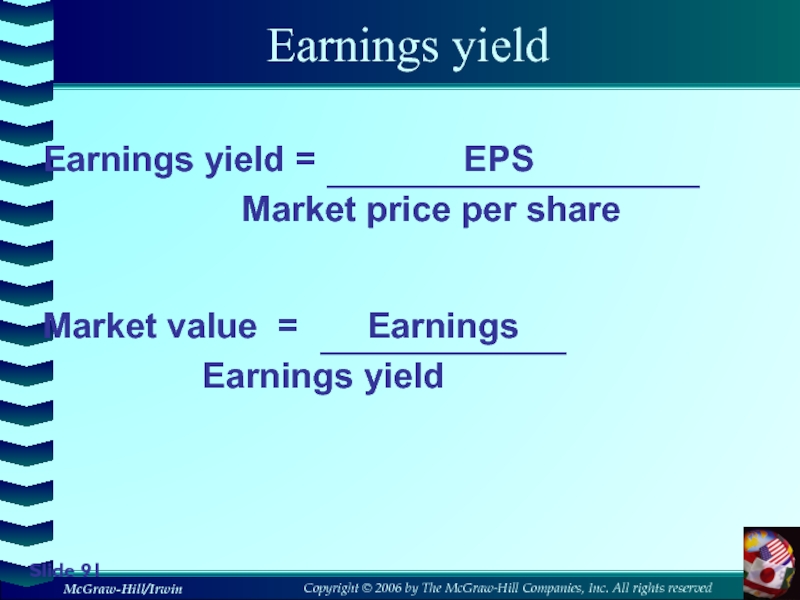

- 91. Slide Earnings yieldMarket value =

- 92. Valuation of other securitiesDiscounted cash flow techniques

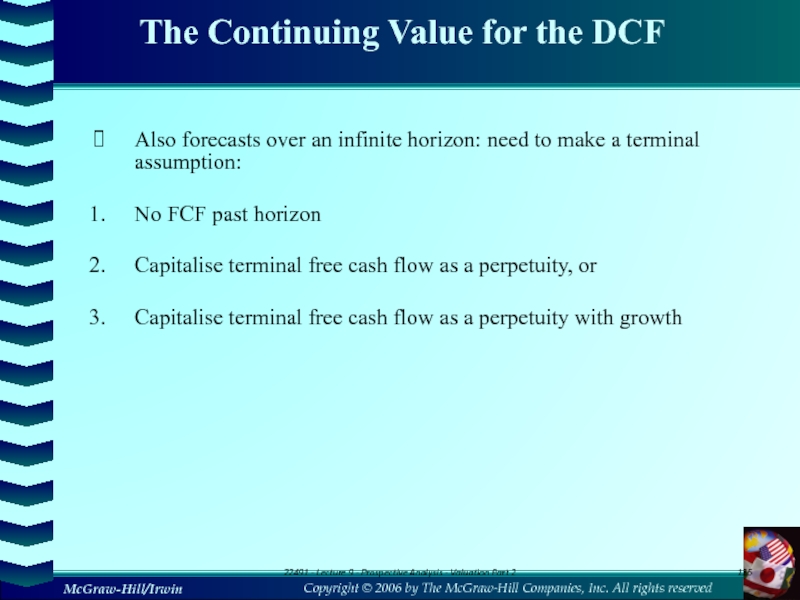

- 93. Quick QuizHow do you find the value

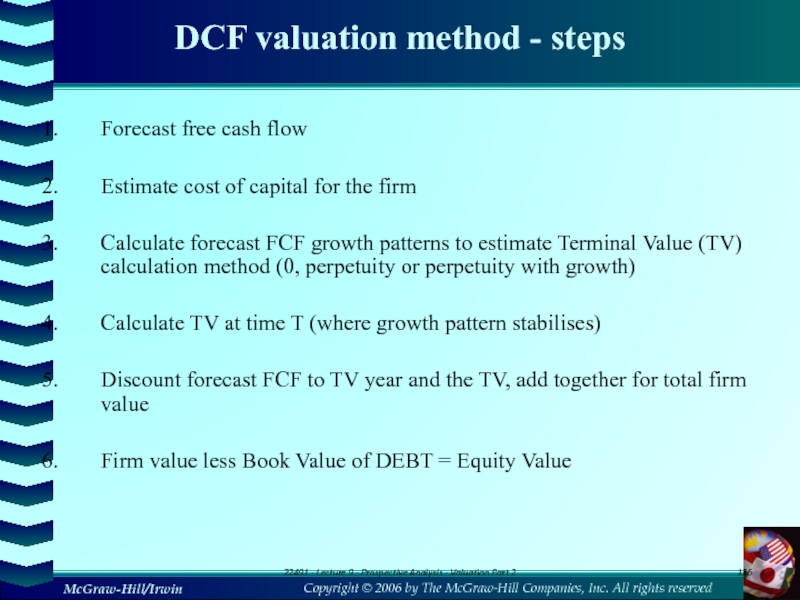

- 94. Lecture 9Prospective Analysis – Valuation theory and

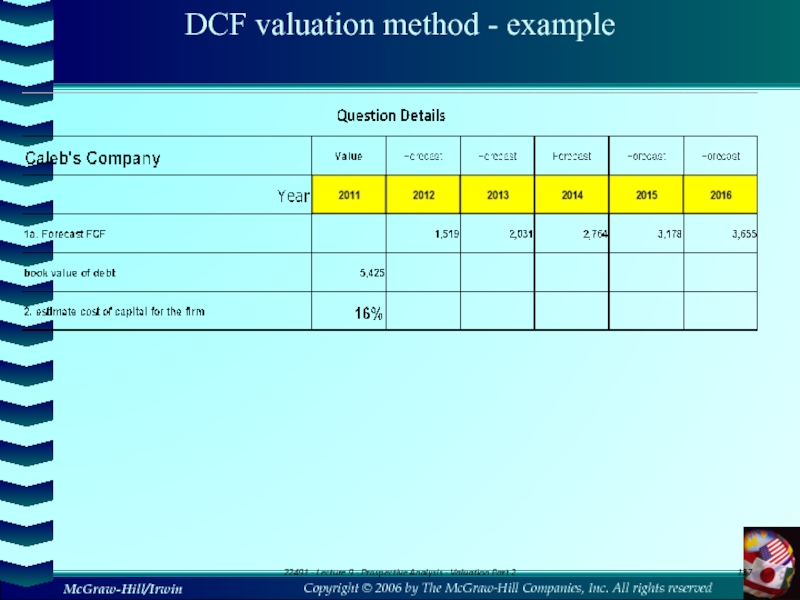

- 95. The steps involved in Business AnalysisStep 1

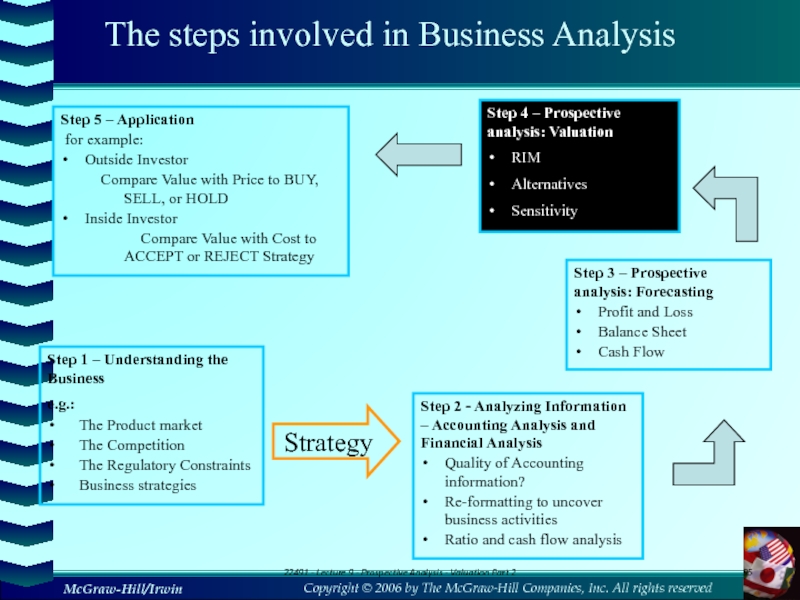

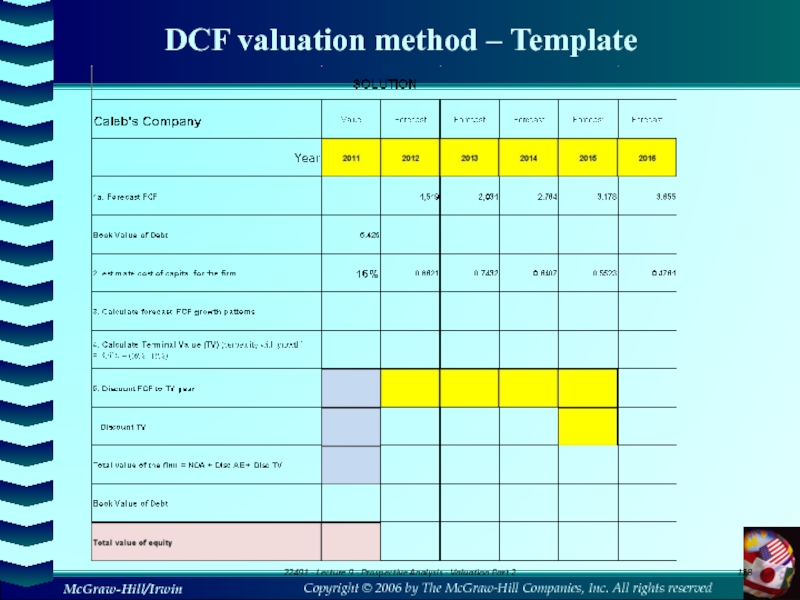

- 96. Learning ObjectivesAt the conclusion of this lecture

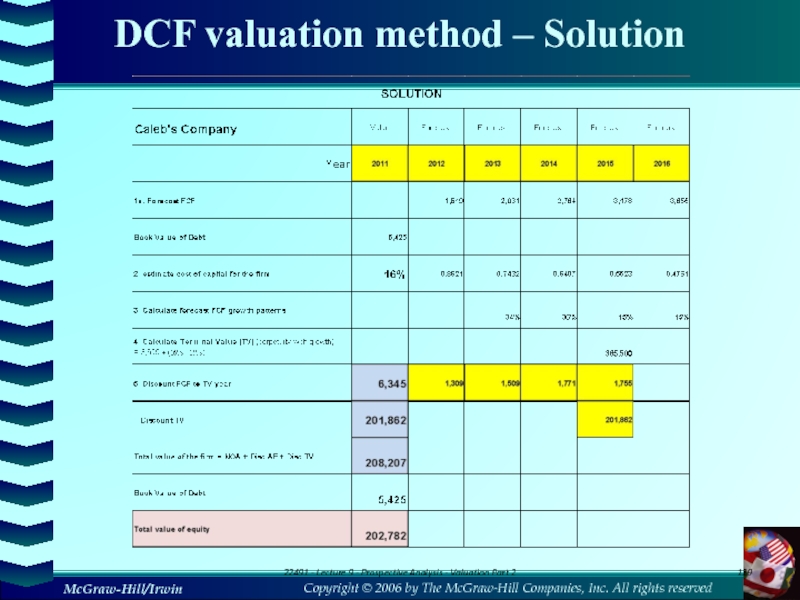

- 97. ValuationIs the process of converting the forecast

- 98. EarningsAccountants and analysts focus on earningsEarnings in

- 99. Residual Income ModelNormal Earnings Capitalised Abnormal Earnings (Residual

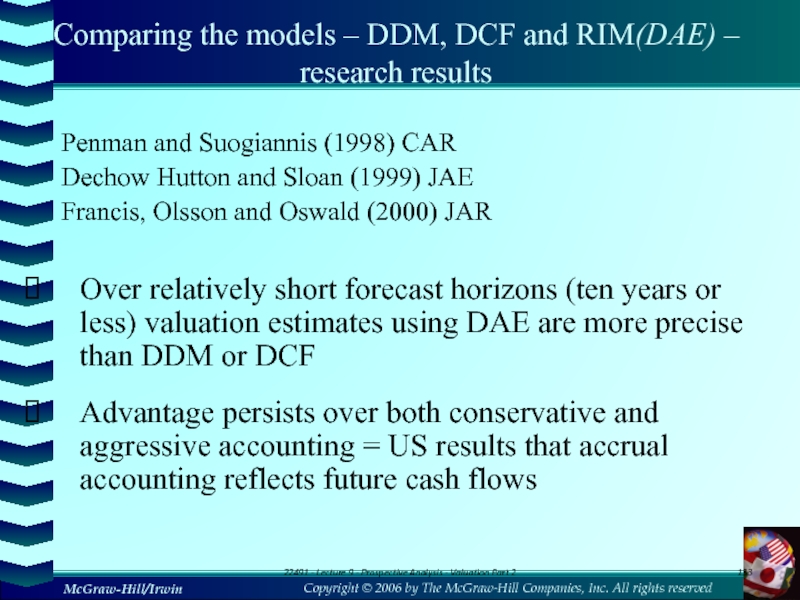

- 100. Residual Income Model22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

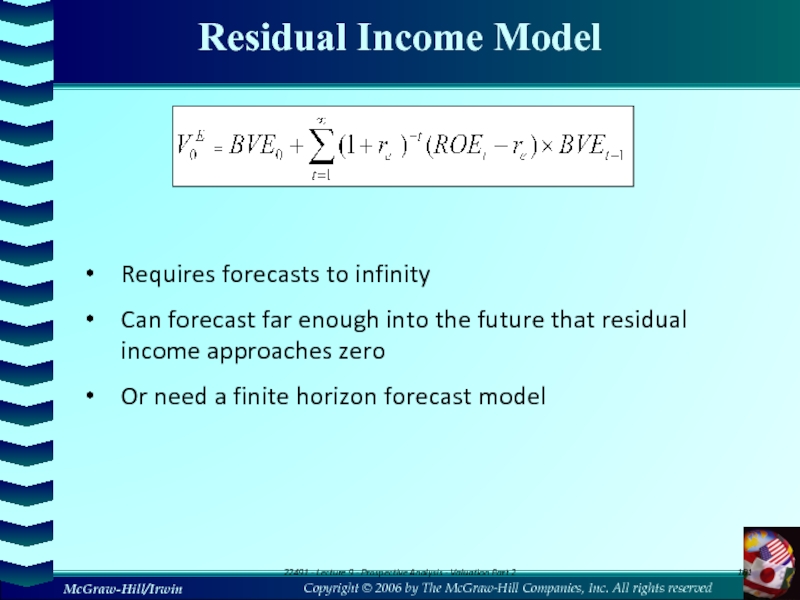

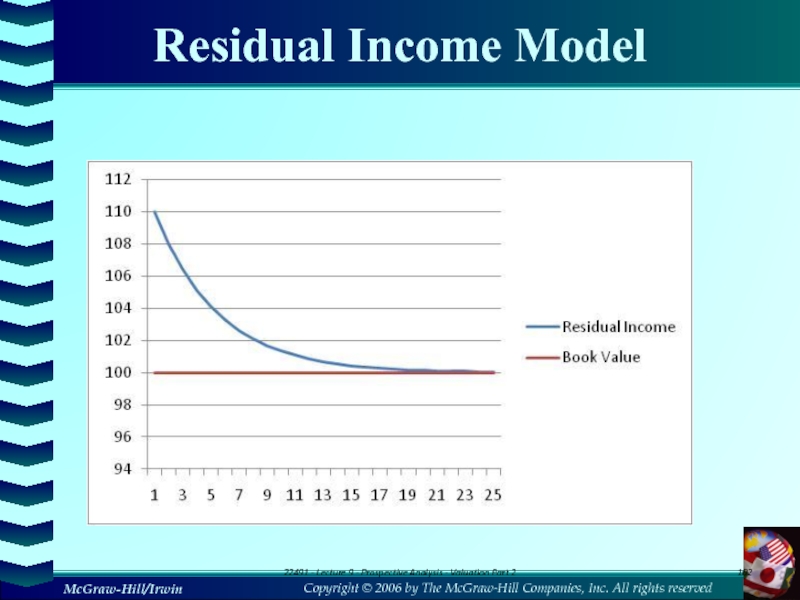

- 101. Residual Income ModelRequires forecasts to infinityCan forecast

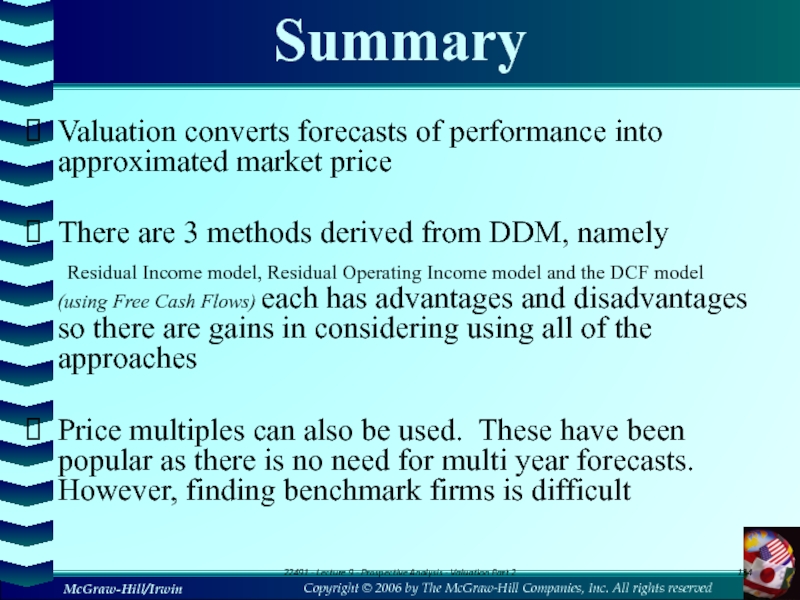

- 102. Residual Income Model22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

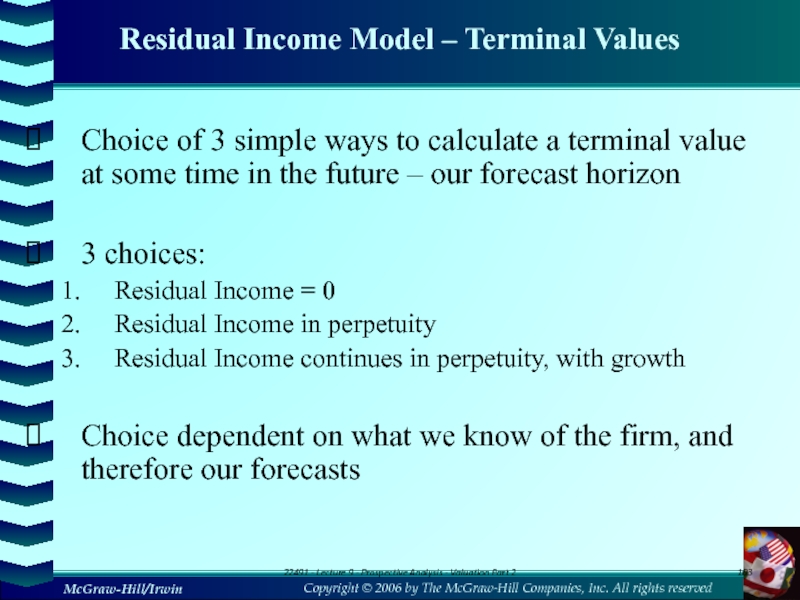

- 103. Residual Income Model – Terminal ValuesChoice of

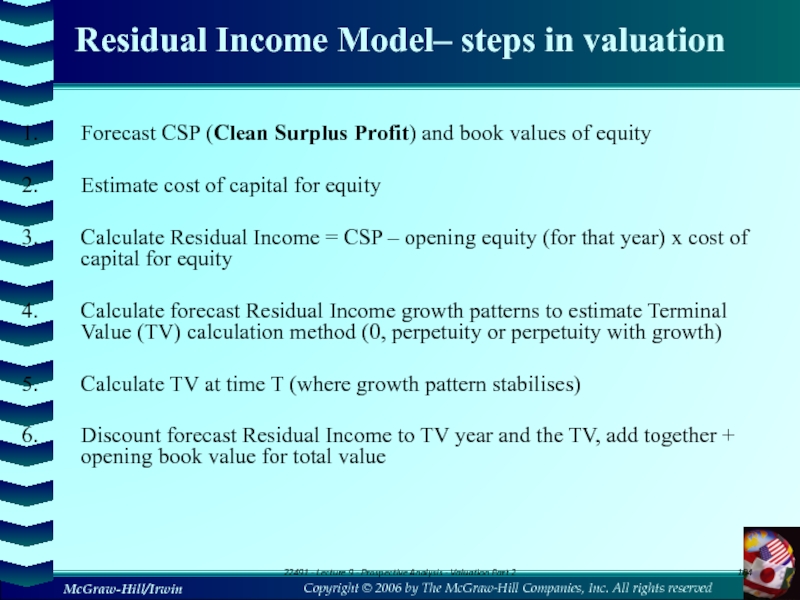

- 104. Residual Income Model– steps in valuationForecast CSP

- 105. 1. Residual Income Model: AE = 0Why

- 106. 1. Residual Income Model: AE = 022491

- 107. Nursing Home Limited - Workings22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

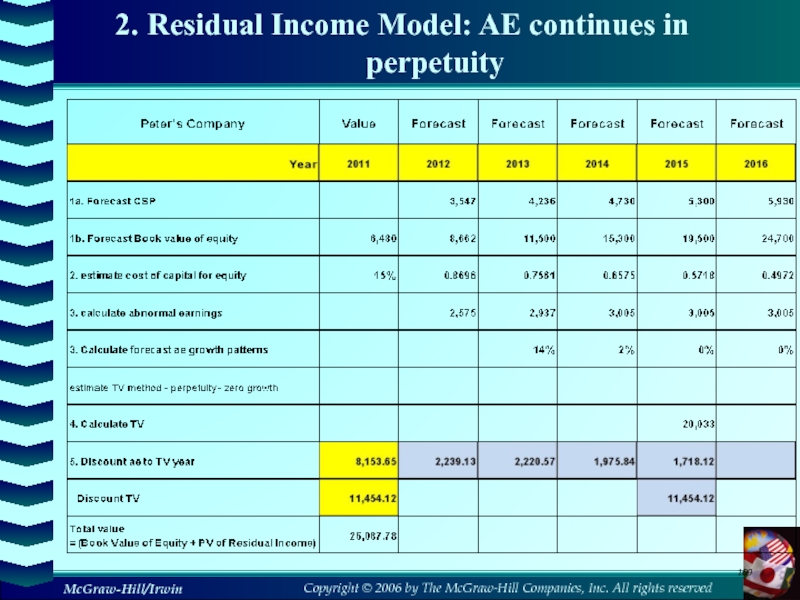

- 108. 2. Residual Income Model: AE continues

- 109. 2. Residual Income Model: AE continues in perpetuity

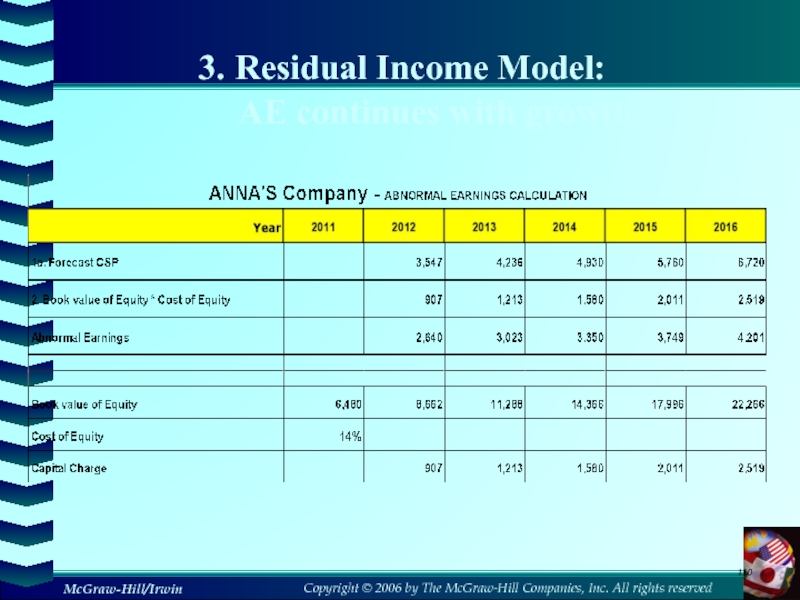

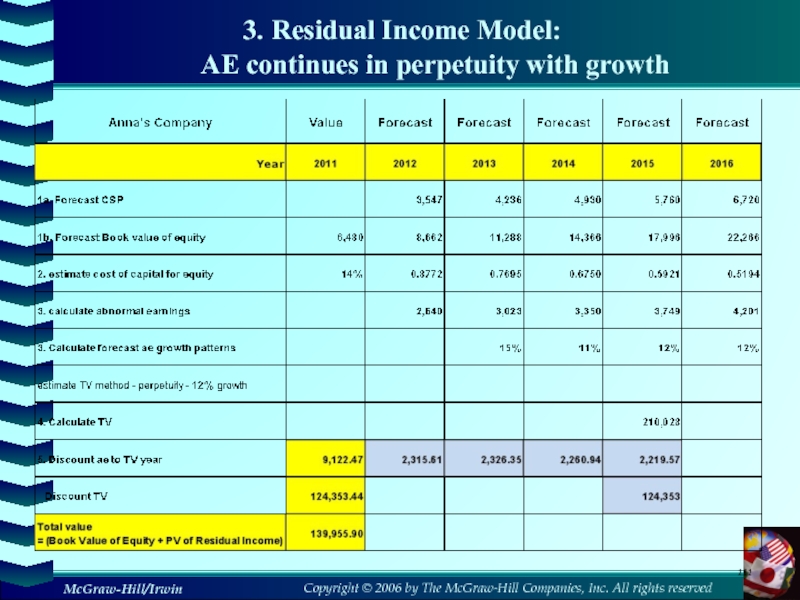

- 110. 3. Residual Income Model: AE continues with growth

- 111. 3. Residual Income Model: AE continues in perpetuity with growth

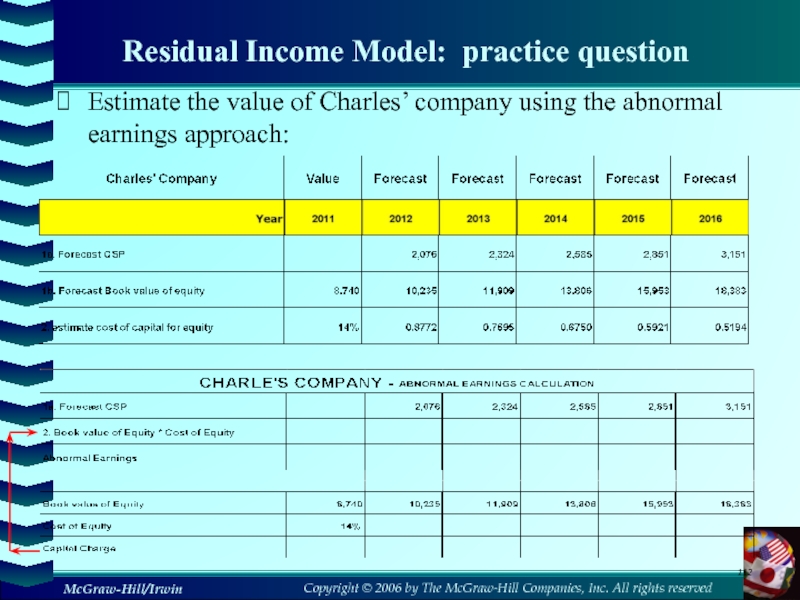

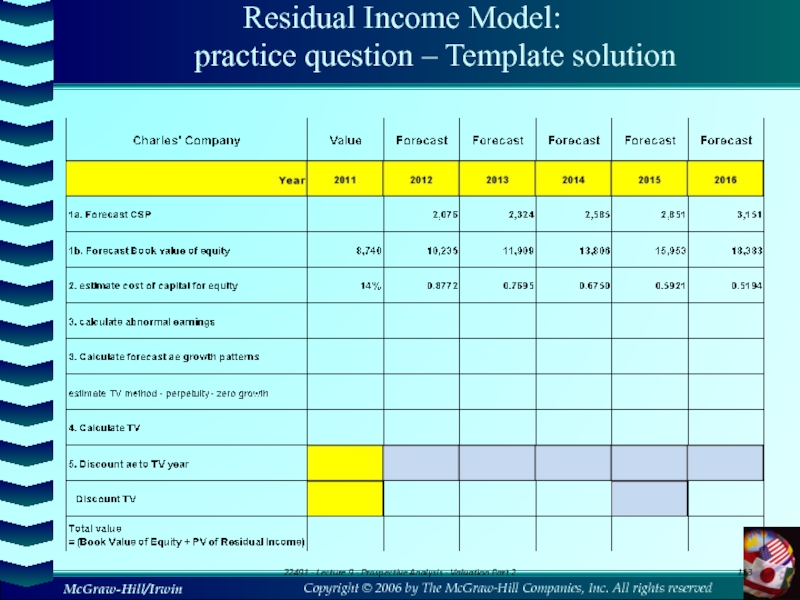

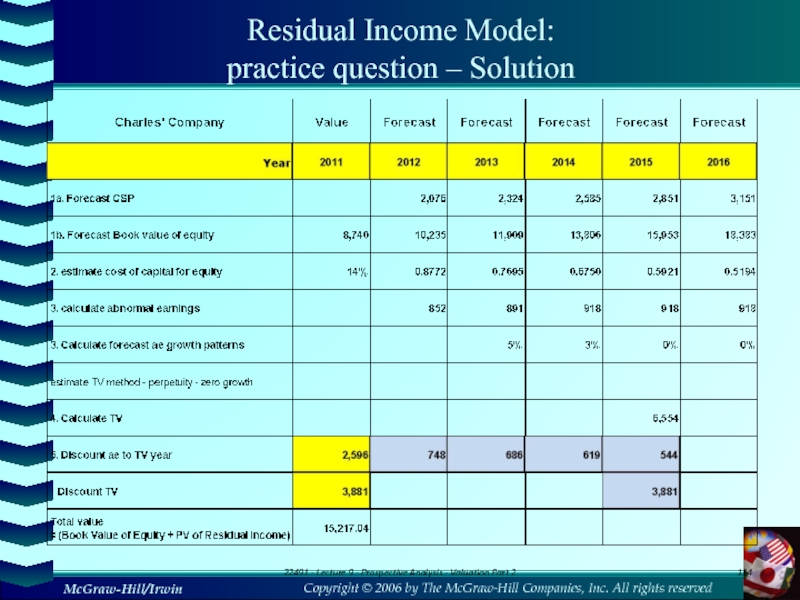

- 112. Residual Income Model: practice questionEstimate the value of Charles’ company using the abnormal earnings approach:

- 113. Residual Income Model: practice question –

- 114. Residual Income Model: practice question –

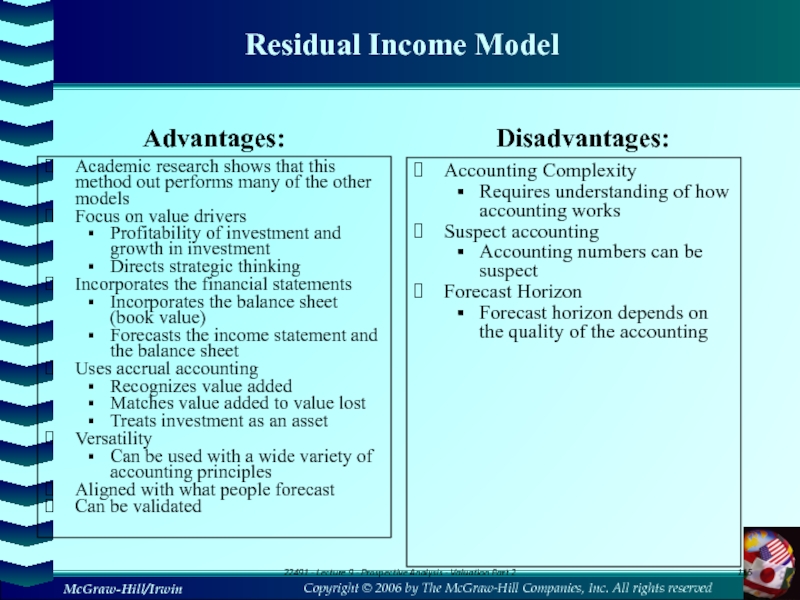

- 115. Residual Income ModelAdvantages:Academic research shows that this

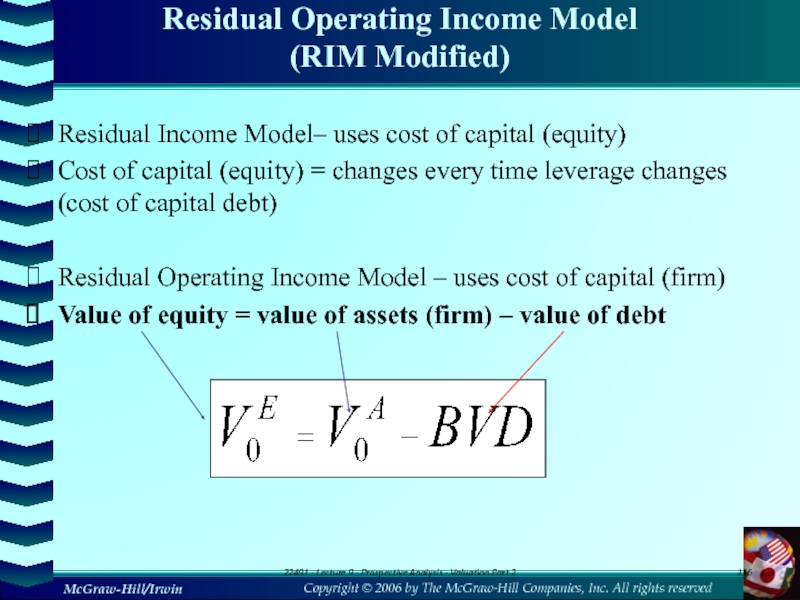

- 116. Residual Operating Income Model (RIM Modified)Residual

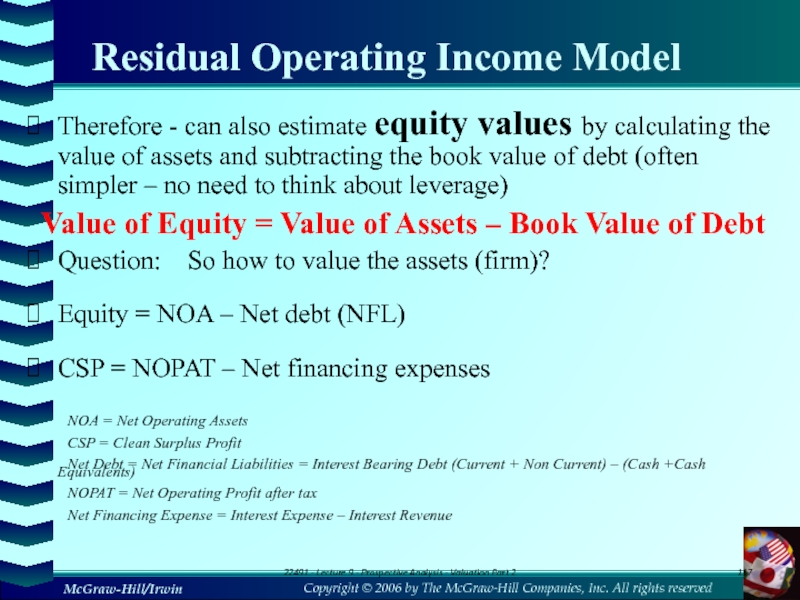

- 117. Residual Operating Income ModelTherefore - can also

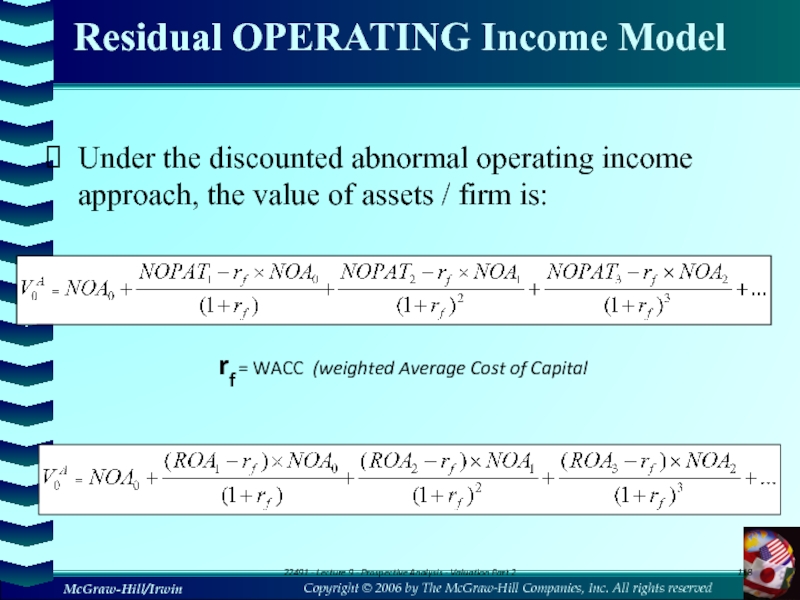

- 118. Residual OPERATING Income ModelUnder the discounted abnormal

- 119. Residual Operating Income ModelGives the same result

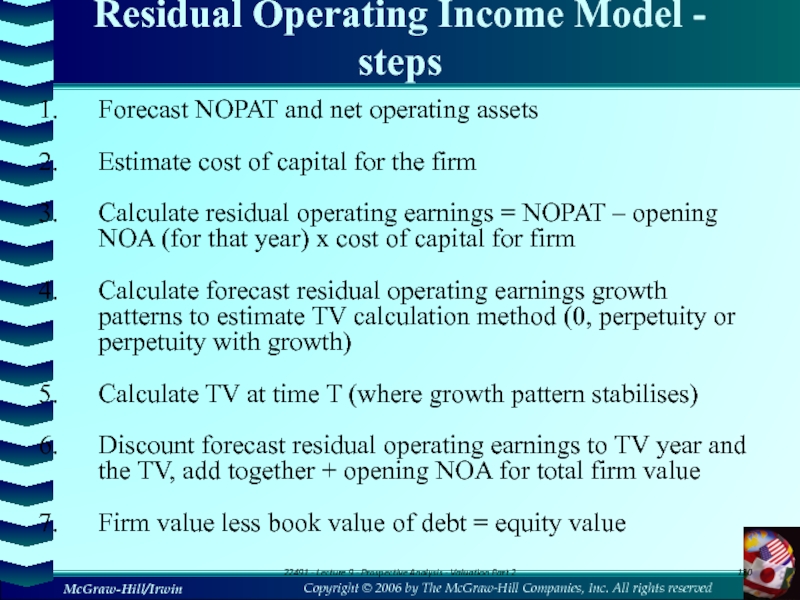

- 120. Residual Operating Income Model - stepsForecast NOPAT

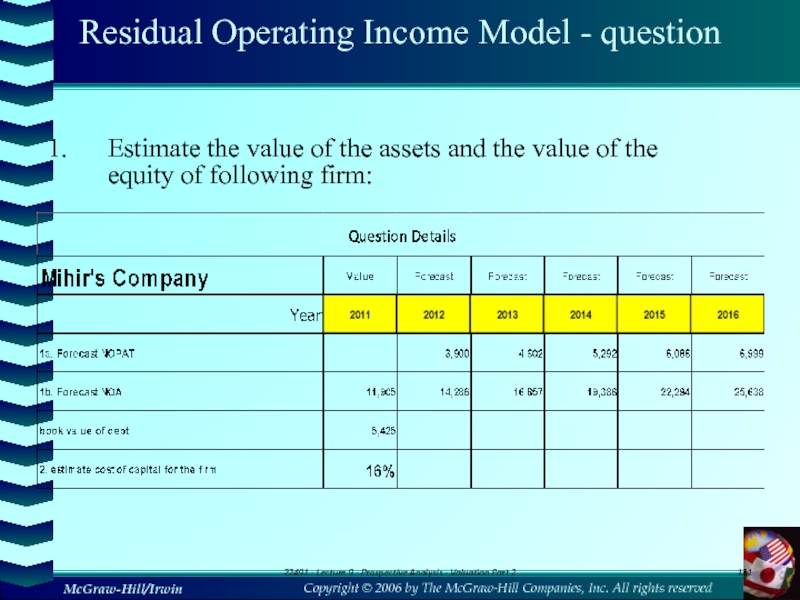

- 121. Residual Operating Income Model - questionEstimate the

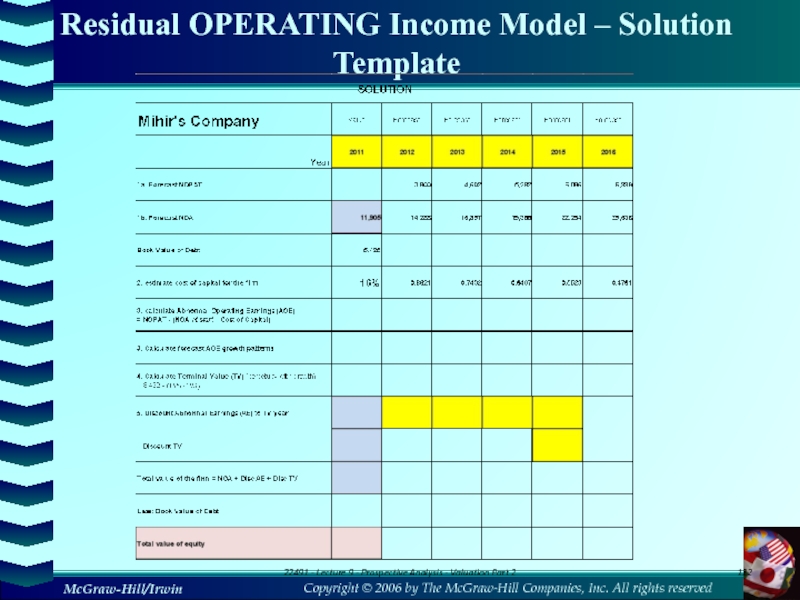

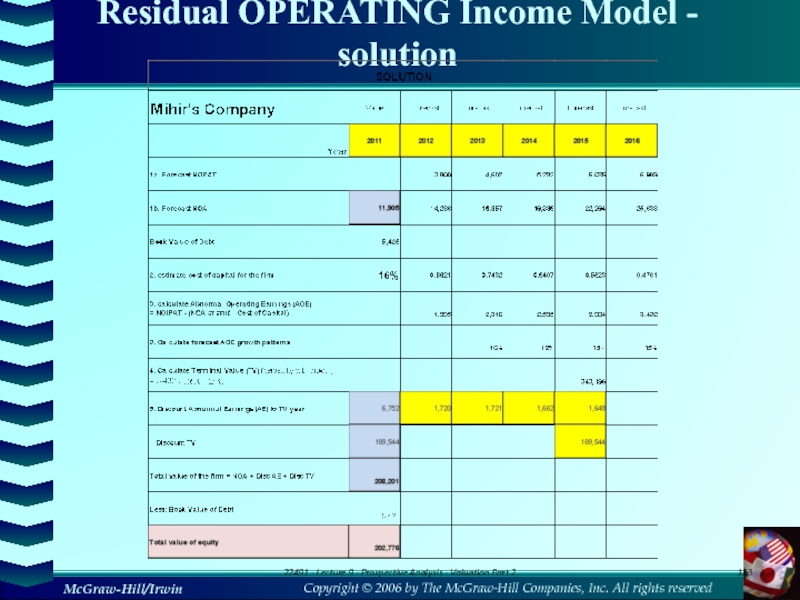

- 122. Residual OPERATING Income Model – Solution Template22491

- 123. Residual OPERATING Income Model - solution22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

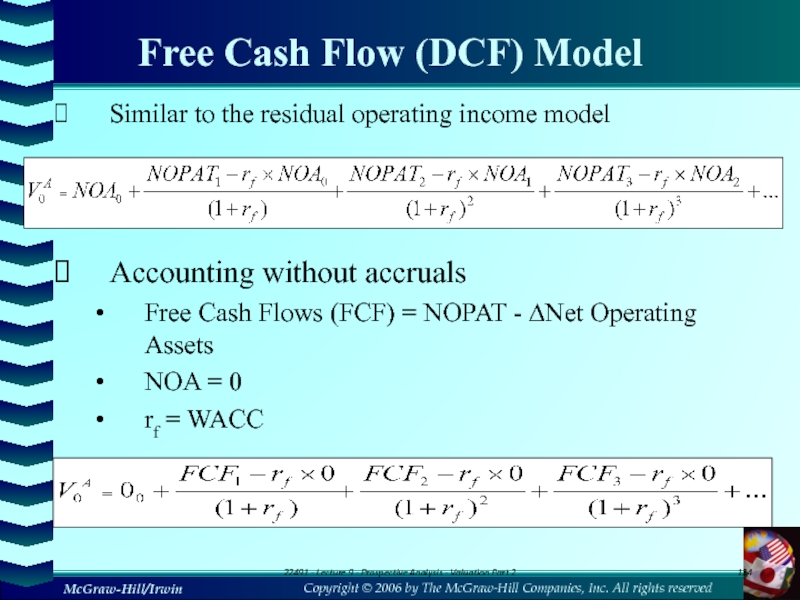

- 124. Free Cash Flow (DCF) ModelSimilar to the

- 125. Also forecasts over an infinite horizon: need

- 126. DCF valuation method - stepsForecast free cash

- 127. DCF valuation method - example22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

- 128. DCF valuation method – Template22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

- 129. DCF valuation method – Solution22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

- 130. What are the problems with DCF?Cash flow

- 131. DCF AnalysisAdvantagesEasy concept: cash flows are “real” and

- 132. Comparing the models – DDM, DCF and

- 133. Comparing the models – DDM, DCF and

- 134. SummaryValuation converts forecasts of performance into approximated

- 135. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1Chapter 9

Corporate Finance

Value of Bond and Common Stocks

Copyright © 2006

by The McGraw-Hill Companies, Inc. All rights reserved

Слайд 2Key Concepts and Skills

Know the important bond features and bond

types

Understand bond values and why they fluctuate

Understand how stock prices

depend on future dividends and dividend growthBe able to compute stock prices using the dividend growth model

Understand how growth opportunities affect stock values

Слайд 3Chapter Outline

9.1 Definitions and Example of a Bond

9.2 How to Value Bonds

9.3 Bond

Concepts

9.4 The Present Value of Common Stocks

9.5 Estimates of Parameters in the

Dividend- Discount Model9.6 Growth Opportunities

9.7 The Dividend Growth Model and the NPVGO Model

9.8 Price-Earnings Ratio

9.9 Stock Market Reporting

Слайд 4Slide

Overview – business valuations

Maximisation of

shareholder wealth

Investment decision

Avoid over-paying

for

acquisitions

Слайд 5Review :Time Value

1 Valuation: The One-Period Case

2 The Multiperiod Case

3

Compounding Periods

4 Simplifications

6 What Is a Firm Worth?

Слайд 61 The One-Period Case

If you were to invest $10,000 at

5-percent interest for one year, your investment would grow to

$10,500.$500 would be interest ($10,000 × .05)

$10,000 is the principal repayment ($10,000 × 1)

$10,500 is the total due. It can be calculated as:

$10,500 = $10,000×(1.05)

The total amount due at the end of the investment is call the Future Value (FV).

Слайд 7Future Value

In the one-period case, the formula for FV can

be written as:

FV = C0×(1 + r)

Where C0 is cash

flow today (time zero), and r is the appropriate interest rate.

Слайд 8Present Value

If you were to be promised $10,000 due in

one year when interest rates are 5-percent, your investment would

be worth $9,523.81 in today’s dollars.The amount that a borrower would need to set aside today to be able to meet the promised payment of $10,000 in one year is called the Present Value (PV).

Note that $10,000 = $9,523.81×(1.05).

Слайд 9Present Value

In the one-period case, the formula for PV can

be written as:

Where C1 is cash flow at date 1,

and r is the appropriate interest rate.

Слайд 10Net Present Value

The Net Present Value (NPV) of an investment

is the present value of the expected cash flows, less

the cost of the investment.Suppose an investment that promises to pay $10,000 in one year is offered for sale for $9,500. Your interest rate is 5%. Should you buy?

Слайд 11Net Present Value

The present value of the cash inflow is

greater

than the cost. In other words, the Net Present

Value is

positive, so the investment should be purchased.

Слайд 12Net Present Value

In the one-period case, the formula for NPV

can be written as:

NPV = –Cost + PV

If we had

not undertaken the positive NPV project considered on the last slide, and instead invested our $9,500 elsewhere at 5 percent, our FV would be less than the $10,000 the investment promised, and we would be worse off in FV terms :$9,500×(1.05) = $9,975 < $10,000

Слайд 134.2 The Multiperiod Case

The general formula for the future value

of an investment over many periods can be written as:

FV

= C0×(1 + r)TWhere

C0 is cash flow at date 0,

r is the appropriate interest rate, and

T is the number of periods over which the cash is invested.

Слайд 14Future Value

Suppose a stock currently pays a dividend of $1.10,

which is expected to grow at 40% per year for

the next five years.What will the dividend be in five years?

FV = C0×(1 + r)T

$5.92 = $1.10×(1.40)5

Слайд 15Future Value and Compounding

Notice that the dividend in year five,

$5.92, is considerably higher than the sum of the original

dividend plus five increases of 40-percent on the original $1.10 dividend:$5.92 > $1.10 + 5×[$1.10×.40] = $3.30

This is due to compounding.

Слайд 17Present Value and Discounting

How much would an investor have to

set aside today in order to have $20,000 five years

from now if the current rate is 15%?$20,000

PV

Слайд 18Finding the Number of Periods

If we deposit $5,000 today in

an account paying 10%, how long does it take to

grow to $10,000?Слайд 19What Rate Is Enough?

Assume the total cost of a college

education will be $50,000 when your child enters college in

12 years. You have $5,000 to invest today. What rate of interest must you earn on your investment to cover the cost of your child’s education?About 21.15%.

Слайд 20Multiple Cash Flows

Consider an investment that pays $200 one year

from now, with cash flows increasing by $200 per year

through year 4. If the interest rate is 12%, what is the present value of this stream of cash flows?If the issuer offers this investment for $1,500, should you purchase it?

Слайд 22Valuing “Lumpy” Cash Flows

First, set your calculator to 1 payment

per year.

Then, use the cash flow menu:

CF2

CF1

F2

F1

CF0

1

200

1

1,432.93

0

400

I

NPV

12

CF4

CF3

F4

F3

1

600

1

800

Слайд 234.3 Compounding Periods

Compounding an investment m times a year for

T years provides for future value of wealth:

Слайд 24Compounding Periods

For example, if you invest $50 for 3 years

at 12% compounded semi-annually, your investment will grow to

Слайд 25Effective Annual Rates of Interest

A reasonable question to ask in

the above example is “what is the effective annual rate

of interest on that investment?”The Effective Annual Rate (EAR) of interest is the annual rate that would give us the same end-of-investment wealth after 3 years:

Слайд 26Effective Annual Rates of Interest

So, investing at 12.36% compounded annually

is the same as investing at 12% compounded semi-annually.

Слайд 27 Effective Annual Rates of Interest

Find the Effective Annual

Rate (EAR) of an 18% APR loan that is compounded

monthly.What we have is a loan with a monthly interest rate of 1½%.

This is equivalent to a loan with an annual interest rate of 19.56%.

Слайд 29Continuous Compounding

The general formula for the future value of an

investment compounded continuously over many periods can be written as:

FV

= C0×erTWhere

C0 is cash flow at date 0,

r is the stated annual interest rate,

T is the number of years, and

e is a transcendental number approximately equal to 2.718. ex is a key on your calculator.

Слайд 304.4 Simplifications

Annuity

A stream of constant cash flows that lasts for

a fixed number of periods

Growing annuity

A stream of cash flows

that grows at a constant rate for a fixed number of periodsPerpetuity

A constant stream of cash flows that lasts forever

Growing perpetuity

A stream of cash flows that grows at a constant rate forever

Слайд 32Annuity: Example

If you can afford a $400 monthly car payment,

how much car can you afford if interest rates are

7% on 36-month loans?Слайд 33 What is the present value of a

four-year annuity of $100 per year that makes its first

payment two years from today if the discount rate is 9%?0 1 2 3 4 5

$100 $100 $100 $100

$323.97

$297.22

2-

Слайд 35Growing Annuity: Example

A defined-benefit retirement plan offers to pay $20,000

per year for 40 years and increase the annual payment

by 3% each year. What is the present value at retirement if the discount rate is 10%?Слайд 37Perpetuity: Example

What is the value of a British consol that

promises to pay £15 every year for ever?

The interest

rate is 10-percent.…

Слайд 39Growing Perpetuity: Example

The expected dividend next year is $1.30, and

dividends are expected to grow at 5% forever.

If the

discount rate is 10%, what is the value of this promised dividend stream?…

Слайд 40Valuation of Bond and Stock

After reviewing the Time Value, then

we go to the main body of this chapter……

Слайд 419.1 Definition of a Bond

A bond is a legally binding

agreement between a borrower and a lender that specifies the:

Par

(face) valueCoupon rate

Coupon payment

Maturity Date

The yield to maturity is the required market interest rate on the bond.

Слайд 429.2 How to Value Bonds

Primary Principle:

Value of financial securities

= PV of expected future cash flows

Bond value is,

therefore, determined by the present value of the coupon payments and par value.Interest rates are inversely related to present (i.e., bond) values.

Слайд 44Pure Discount Bonds

Make no periodic interest payments (coupon rate =

0%)

The entire yield to maturity comes from the difference between

the purchase price and the par value.Cannot sell for more than par value

Sometimes called zeroes, deep discount bonds, or original issue discount bonds (OIDs)

Treasury Bills and principal-only Treasury strips are good examples of zeroes.

Слайд 45Pure Discount Bonds

Information needed for valuing pure discount bonds:

Time to

maturity (T) = Maturity date - today’s date

Face value (F)

Discount

rate (r)Present value of a pure discount bond at time 0:

Слайд 46Pure Discount Bond: Example

Find the value of a 30-year zero-coupon

bond with a $1,000 par value and a YTM of

6%.Слайд 47Level Coupon Bonds

Make periodic coupon payments in addition to the

maturity value

The payments are equal each period. Therefore, the bond

is just a combination of an annuity and a terminal (maturity) value.Coupon payments are typically semiannual.

Effective annual rate (EAR) =

(1 + R/m)m – 1

Слайд 48Level Coupon Bond: Example

Consider a U.S. government bond with a

6 3/8% coupon that expires in December 2010.

The Par Value

of the bond is $1,000.Coupon payments are made semi-annually (June 30 and December 31 for this particular bond).

Since the coupon rate is 6 3/8%, the payment is $31.875.

On January 1, 2006 the size and timing of cash flows are:

Слайд 50Bond Example: Calculator

PMT

I/Y

FV

PV

N

PV

31.875 =

2.5

1,000

– 1,060.17

10

Find the present value (as of

January 1, 2006), of a 6 3/8% coupon bond with

semi-annual payments, and a maturity date of December 2010 if the YTM is 5%.Слайд 51Bond Pricing with a Spreadsheet

There are specific formulas for finding

bond prices and yields on a spreadsheet.

PRICE(Settlement,Maturity,Rate,Yld,Redemption, Frequency,Basis)

YIELD(Settlement,Maturity,Rate,Pr,Redemption, Frequency,Basis)

Settlement and

maturity need to be actual datesThe redemption and Pr need to be given as % of par value

Click on the Excel icon for an example.

Слайд 52Consols

Not all bonds have a final maturity.

British consols pay a

set amount (i.e., coupon) every period forever.

These are examples of

a perpetuity.Слайд 539.3 Bond Concepts

Bond prices and market interest rates move in

opposite directions.

When coupon rate = YTM, price = par value

When

coupon rate > YTM, price > par value (premium bond)When coupon rate < YTM, price < par value (discount bond)

Слайд 54YTM and Bond Value

800

1000

1100

1200

1300

0

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

0.09

0.1

Discount Rate

Bond Value

When the YTM < coupon,

the bond trades at a premium.

When the YTM = coupon,

the bond trades at par.When the YTM > coupon, the bond trades at a discount.

Слайд 55Bond Example Revisited

Using our previous example, now assume that the

required yield is 11%.

How does this change the bond’s

price?Слайд 56Computing Yield to Maturity

Yield to maturity is the rate implied

by the current bond price.

Finding the YTM requires trial and

error if you do not have a financial calculator and is similar to the process for finding R with an annuity.If you have a financial calculator, enter N, PV, PMT, and FV, remembering the sign convention (PMT and FV need to have the same sign, PV the opposite sign).

Слайд 57YTM with Annual Coupons

Consider a bond with a 10% annual

coupon rate, 15 years to maturity, and a par value

of $1,000. The current price is $928.09.Will the yield be more or less than 10%?

N = 15; PV = -928.09; FV = 1,000; PMT = 100

CPT I/Y = 11%

Слайд 58YTM with Semiannual Coupons

Suppose a bond with a 10% coupon

rate and semiannual coupons has a face value of $1,000,

20 years to maturity, and is selling for $1,197.93.Is the YTM more or less than 10%?

What is the semiannual coupon payment?

How many periods are there?

N = 40; PV = -1,197.93; PMT = 50; FV = 1,000; CPT I/Y = 4% (Is this the YTM?)

YTM = 4%*2 = 8%

Слайд 59Bond Market Reporting

Primarily over-the-counter transactions with dealers connected electronically

Extremely large

number of bond issues, but generally low daily volume in

single issuesMakes getting up-to-date prices difficult, particularly on a small company or municipal issues

Treasury securities are an exception

Слайд 60Treasury Quotations

8 Nov 21 132:23 132:24 -12 5.14

What is the coupon rate on

the bond?

When does the bond mature?

What is the bid price?

What does this mean?What is the ask price? What does this mean?

How much did the price change from the previous day?

What is the yield based on the ask price?

Слайд 61Slide

Range of values for equity

Earnings/cash flows under new ownership

Dividends

under existing ownership

Assets basis

Maximum value

Minimum value

Слайд 62Slide

Asset valuation bases

Possible bases of valuation

Historic

(unlikey to be realistic)

Replacement

(asset used on ongoing basis)

Realisable

(asset sold/ business broken up)

Слайд 63Assets basis

If a business is difficult to sell,

its owners may be prepared to accept a minimum bid

that matched the value that they get from a liquidation. There are 2 ways of assessing this:Balance sheet value - but the book value of assets will differ from their market value

Realisable value - better, but harder to calculate.

Slide

Слайд 649.4 The Present Value of Common Stocks

The value of any

asset is the present value of its expected future cash

flows.Stock ownership produces cash flows from:

Dividends

Capital Gains

Valuation of Different Types of Stocks

Zero Growth

Constant Growth

Differential Growth

Слайд 66Case 1: Zero Growth

Assume that dividends will remain at the

same level forever

Since future cash flows are constant, the value

of a zero growth stock is the present value of a perpetuity:Слайд 67Case 2: Constant Growth

Since future cash flows grow at a

constant rate forever, the value of a constant growth stock

is the present value of a growing perpetuity:Assume that dividends will grow at a constant rate, g, forever, i.e.,

.

.

.

Слайд 68Constant Growth Example

Suppose Big D, Inc., just paid a dividend

of $.50. It is expected to increase its dividend by

2% per year. If the market requires a return of 15% on assets of this risk level, how much should the stock be selling for?P0 = .50(1+.02) / (.15 - .02) = $3.92

Слайд 69Case 3: Differential Growth

Assume that dividends will grow at different

rates in the foreseeable future and then will grow at

a constant rate thereafter.To value a Differential Growth Stock, we need to:

Estimate future dividends in the foreseeable future.

Estimate the future stock price when the stock becomes a Constant Growth Stock (case 2).

Compute the total present value of the estimated future dividends and future stock price at the appropriate discount rate.

Слайд 70Case 3: Differential Growth

Assume that dividends will grow at rate

g1 for N years and grow at rate g2 thereafter.

.

.

.

.

.

.

Слайд 71Case 3: Differential Growth

Dividends will grow at rate g1 for

N years and grow at rate g2 thereafter

…

0

1 2 …

N N+1

…

Слайд 72Case 3: Differential Growth

We can value this as the sum

of:

an N-year annuity growing at rate g1

plus the discounted

value of a perpetuity growing at rate g2 that starts in year N+1Слайд 74A Differential Growth Example

A common stock just paid a dividend

of $2. The dividend is expected to grow at 8%

for 3 years, then it will grow at 4% in perpetuity.What is the stock worth? The discount rate is 12%.

Слайд 76With Cash Flows

…

0 1 2 3 4

0 1

2

3The constant growth phase beginning in year 4 can be valued as a growing perpetuity at time 3.

Слайд 77Disadvantages

Slide

It is difficult to estimating future dividend growth

It

is inaccurate to assume that growth will be constant

It

creates zero values for zero dividend companies. It creates negative values for high growth companies, if g > Ke

Слайд 78The Red Bud Co. just paid a dividend of $1.20

a share. The company announced today that it will continue

to pay this constant dividend for the next 3 years after which time it will discontinue paying dividends permanently. What is one share of this stock worth today if the required rate of return is 7%?a. $2.94

b. $3.15

c. $3.23

d. $3.44

e. $3.60

Слайд 799.5 Estimates of Parameters

The value of a firm depends upon

its growth rate, g, and its discount rate, R.

Where

does g come from?g = Retention ratio × Return on retained earnings

Слайд 80Where does R come from?

The discount rate can be broken

into two parts.

The dividend yield

The growth rate (in

dividends)In practice, there is a great deal of estimation error involved in estimating R.

Слайд 82what should be paid for Overland common stock? Overland has

just paid a dividend of $2.25. These dividends are expected

to grow at a rate of 5% in the foreseeable future. The required rate of return is 11%.Слайд 839.6 Growth Opportunities

Growth opportunities are opportunities to invest in positive NPV

projects.

The value of a firm can be conceptualized as the

sum of the value of a firm that pays out 100% of its earnings as dividends and the net present value of the growth opportunities.Слайд 849.7 The Dividend Growth Model and the NPVGO Model

We have

two ways to value a stock:

The dividend discount model

The sum

of its price as a “cash cow” plus the per share value of its growth opportunitiesСлайд 85The NPVGO Model: Example

Consider a firm that has

EPS of $5 at the end of the first year,

a dividend-payout ratio of 30%, a discount rate of 16%, and a return on retained earnings of 20%.The dividend at year one will be $5 × .30 = $1.50 per share.

The retention ratio is .70 ( = 1 -.30), implying a growth rate in dividends of 14% = .70 × 20%.

From the dividend growth model, the price of a share is:

Слайд 86The NPVGO Model: Example

First, we must calculate the

value of the firm as a cash cow.

Second,

we must calculate the value of the growth opportunities. Finally,

Слайд 879.8 Price-Earnings Ratio

Many analysts frequently relate earnings per share to price.

The

price-earnings ratio is calculated as the current stock price divided

by annual EPS.The Wall Street Journal uses last 4 quarter’s earnings

Слайд 90Slide

Earnings basis - drawbacks

Market value = P/E

x Earnings

Which P/E?

Adjust downwards ?

One-off transactions?

Слайд 91Slide

Earnings yield

Market value = Earnings

Earnings yield

Earnings yield =

EPSMarket price per share

Слайд 92Valuation of other securities

Discounted cash flow techniques can be used

to value irredeemable debt, redeemable debt, convertible debt and preference

shares.Slide

Слайд 93Quick Quiz

How do you find the value of a bond,

and why do bond prices change?

What is a bond indenture,

and what are some of the important features?What determines the price of a share of stock?

What determines g and R in the DGM?

Decompose a stock’s price into constant growth and NPVGO values.

Discuss the importance of the PE ratio.

Слайд 94Lecture 9

Prospective Analysis – Valuation theory and concepts (part 2)

Chapter

7 – Palepu, Healy & Peek IFRS Edition

Слайд 95The steps involved in Business Analysis

Step 1 – Understanding the

Business

e.g.:

The Product market

The Competition

The Regulatory Constraints

Business strategies

Step 2 - Analyzing

Information – Accounting Analysis and Financial AnalysisQuality of Accounting information?

Re-formatting to uncover business activities

Ratio and cash flow analysis

Step 3 – Prospective analysis: Forecasting

Profit and Loss

Balance Sheet

Cash Flow

Step 4 – Prospective analysis: Valuation

RIM

Alternatives

Sensitivity

Step 5 – Application

for example:

Outside Investor

Compare Value with Price to BUY, SELL, or HOLD

Inside Investor

Compare Value with Cost to ACCEPT or REJECT Strategy

Strategy

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 96Learning Objectives

At the conclusion of this lecture you should understand:

How to value a firm using the following methods:

Residual income

(Abnormal Earnings)Residual operating income

Discounted cash flow

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 97Valuation

Is the process of converting the forecast into a valuation

of the assets of the business or the valuation of

shareholders’ equity.The different methods of business valuation include:

Dividend

Residual income model (Discounted Abnormal Earnings Method)

Residual Operating Income model

Free cash flow (DCF model)

Can use all to value either the equity or assets in the firm, (need to be sure which the model does!)

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 98Earnings

Accountants and analysts focus on earnings

Earnings in the income statement

represent the flow of value “created” between two points in

time: NI1Distinguishable from dividends which are (net) flows paid back to the owners between two points in time: DIV1and dividends (and Book Value) – Relies on CSP (Clean Surplus Profit):

There is a relation between earnings BVE1 = BVE0 + CSP1 - DIV1

Or:

DIV1 = CSP1 + BVE0 - BVE1

CSP1 = BVE1 + DIV1 - BVE0

BVE0 = Book Value of Equity at START of Year

BVE1 = Book Value of Equity at END of Year

CSP1 = Clean Surplus Profit

DIV1 = Dividend Paid during year 1

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 99Residual Income Model

Normal Earnings Capitalised

Abnormal Earnings (Residual Income) Capitalised

22491 -

Lecture 9 - Prospective Analysis - Valuation Part 2

Where re

is the cost of equity capitalСлайд 101Residual Income Model

Requires forecasts to infinity

Can forecast far enough into

the future that residual income approaches zero

Or need a finite

horizon forecast model22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 103Residual Income Model – Terminal Values

Choice of 3 simple ways

to calculate a terminal value at some time in the

future – our forecast horizon3 choices:

Residual Income = 0

Residual Income in perpetuity

Residual Income continues in perpetuity, with growth

Choice dependent on what we know of the firm, and therefore our forecasts

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 104Residual Income Model– steps in valuation

Forecast CSP (Clean Surplus Profit)

and book values of equity

Estimate cost of capital for equity

Calculate

Residual Income = CSP – opening equity (for that year) x cost of capital for equityCalculate forecast Residual Income growth patterns to estimate Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth)

Calculate TV at time T (where growth pattern stabilises)

Discount forecast Residual Income to TV year and the TV, add together + opening book value for total value

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 1051. Residual Income Model: AE = 0

Why would residual income

approach 0? = industry competition, government intervention

Remember:

22491 - Lecture 9

- Prospective Analysis - Valuation Part 2Слайд 1061. Residual Income Model: AE = 0

22491 - Lecture 9

- Prospective Analysis - Valuation Part 2

Слайд 1082. Residual Income Model:

AE continues in perpetuity

Most common finding

(mean reversion of returns)

22491 - Lecture 9 - Prospective Analysis

- Valuation Part 2Слайд 112Residual Income Model: practice question

Estimate the value of Charles’ company

using the abnormal earnings approach:

Слайд 113Residual Income Model:

practice question – Template solution

22491 - Lecture

9 - Prospective Analysis - Valuation Part 2

Слайд 114Residual Income Model:

practice question – Solution

22491 - Lecture 9

- Prospective Analysis - Valuation Part 2

Слайд 115Residual Income Model

Advantages:

Academic research shows that this method out performs

many of the other models

Focus on value drivers

Profitability of investment

and growth in investmentDirects strategic thinking

Incorporates the financial statements

Incorporates the balance sheet (book value)

Forecasts the income statement and the balance sheet

Uses accrual accounting

Recognizes value added

Matches value added to value lost

Treats investment as an asset

Versatility

Can be used with a wide variety of accounting principles

Aligned with what people forecast

Can be validated

Disadvantages:

Accounting Complexity

Requires understanding of how accounting works

Suspect accounting

Accounting numbers can be suspect

Forecast Horizon

Forecast horizon depends on the quality of the accounting

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 116Residual Operating Income Model

(RIM Modified)

Residual Income Model– uses cost

of capital (equity)

Cost of capital (equity) = changes every time

leverage changes (cost of capital debt)Residual Operating Income Model – uses cost of capital (firm)

Value of equity = value of assets (firm) – value of debt

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 117Residual Operating Income Model

Therefore - can also estimate equity values

by calculating the value of assets and subtracting the book

value of debt (often simpler – no need to think about leverage)Value of Equity = Value of Assets – Book Value of Debt

Question: So how to value the assets (firm)?

Equity = NOA – Net debt (NFL)

CSP = NOPAT – Net financing expenses

NOA = Net Operating Assets

CSP = Clean Surplus Profit

Net Debt = Net Financial Liabilities = Interest Bearing Debt (Current + Non Current) – (Cash +Cash Equivalents)

NOPAT = Net Operating Profit after tax

Net Financing Expense = Interest Expense – Interest Revenue

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 118Residual OPERATING Income Model

Under the discounted abnormal operating income approach,

the value of assets / firm is:

22491 - Lecture 9

- Prospective Analysis - Valuation Part 2rf = WACC (weighted Average Cost of Capital

Слайд 119Residual Operating Income Model

Gives the same result as abnormal earnings

valuation (as long as cost of capital for equity is

adjusted each time leverage changes)22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 120Residual Operating Income Model - steps

Forecast NOPAT and net operating

assets

Estimate cost of capital for the firm

Calculate residual operating earnings

= NOPAT – opening NOA (for that year) x cost of capital for firmCalculate forecast residual operating earnings growth patterns to estimate TV calculation method (0, perpetuity or perpetuity with growth)

Calculate TV at time T (where growth pattern stabilises)

Discount forecast residual operating earnings to TV year and the TV, add together + opening NOA for total firm value

Firm value less book value of debt = equity value

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 121Residual Operating Income Model - question

Estimate the value of the

assets and the value of the equity of following firm:

22491

- Lecture 9 - Prospective Analysis - Valuation Part 2Слайд 122Residual OPERATING Income Model – Solution Template

22491 - Lecture 9

- Prospective Analysis - Valuation Part 2

Слайд 123Residual OPERATING Income Model - solution

22491 - Lecture 9 -

Prospective Analysis - Valuation Part 2

Слайд 124Free Cash Flow (DCF) Model

Similar to the residual operating income

model

Accounting without accruals

Free Cash Flows (FCF) = NOPAT - ∆Net

Operating AssetsNOA = 0

rf = WACC

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 125Also forecasts over an infinite horizon: need to make a

terminal assumption:

No FCF past horizon

Capitalise terminal free cash flow as

a perpetuity, orCapitalise terminal free cash flow as a perpetuity with growth

The Continuing Value for the DCF

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 126DCF valuation method - steps

Forecast free cash flow

Estimate cost of

capital for the firm

Calculate forecast FCF growth patterns to estimate

Terminal Value (TV) calculation method (0, perpetuity or perpetuity with growth)Calculate TV at time T (where growth pattern stabilises)

Discount forecast FCF to TV year and the TV, add together for total firm value

Firm value less Book Value of DEBT = Equity Value

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 130What are the problems with DCF?

Cash flow from operations (value

added) is reduced by investments (which also add value): investments

are treated as value lossesValue received is not matched against value surrendered to generate value - except for long forecast horizons

Note: analysts forecast earnings, not cash flows

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 131DCF Analysis

Advantages

Easy concept: cash flows are “real” and easy to think

about; they are not

affected by accounting rules

Familiarity:

is a straight application of familiar net present valuetechniques

Disadvantages

Suspect concept: → free cash flow does not measure value added in the

short run; value gained is not matched with value given up

→ free cash flow fails to recognize value generated that

does not involve cash flows

→ investment is treated as a loss of value

→ free cash flow is partly a liquidation concept; firms

increase free cash flow by cutting back on investments

Forecast horizons: can require long forecast horizons to recognize cash

inflows from investments, particularly when investments

are growing

Validation: it is hard to validate free cash flow forecasts

Not aligned with

what people

forecast: analysts forecast earnings, not free cash flow; adjusting

earnings forecasts to free cash forecasts requires further

forecasting of accruals

When It Works Best

When the investment pattern is such as to produce constant free cash flow or free cash flow growing at a constant rate

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 132Comparing the models – DDM, DCF and RIM

All derive from

the dividend discount model

Differences:

Focus on different issues

Require different levels of

structureHave different implications for terminal values

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 133Comparing the models – DDM, DCF and RIM(DAE) – research

results

Penman and Suogiannis (1998) CAR

Dechow Hutton and Sloan (1999) JAE

Francis,

Olsson and Oswald (2000) JAROver relatively short forecast horizons (ten years or less) valuation estimates using DAE are more precise than DDM or DCF

Advantage persists over both conservative and aggressive accounting = US results that accrual accounting reflects future cash flows

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2

Слайд 134Summary

Valuation converts forecasts of performance into approximated market price

There are

3 methods derived from DDM, namely

Residual Income model, Residual

Operating Income model and the DCF model (using Free Cash Flows) each has advantages and disadvantages so there are gains in considering using all of the approachesPrice multiples can also be used. These have been popular as there is no need for multi year forecasts. However, finding benchmark firms is difficult

22491 - Lecture 9 - Prospective Analysis - Valuation Part 2