Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Global Economic Crisis and Belarus

Содержание

- 1. Global Economic Crisis and Belarus

- 2. CONTENTSIntroductionMacroeconomic and market situationCrisis’s consequences a) Devaluation of Belarusian ruble b) Social issuesWays off

- 3. INTRODUCTION At first glance, it seems that Belarus’

- 4. Macroeconomic and market situation The rapid decrease of

- 5. Exports of major products

- 6. Macroeconomic and market situation Taking into account the

- 7. Main indicators of foreign trade

- 8. CRISIS’S CONSEQUENCES. DEVALUATION OF BELARUSIAN RUBLE Growing

- 9. CRISIS’S CONSEQUENCES. DEVALUATION OF BELARUSIAN RUBLE Thus

- 10. Crisis’s consequences and Social issues The potential increase

- 11. Ways offLoans and solutionReforms as a remedy

- 12. Ways offLoans and solution. Belarus was among

- 13. Ways offReforms as a remedy

- 14. Thanks for attention!

- 15. Скачать презентанцию

CONTENTSIntroductionMacroeconomic and market situationCrisis’s consequences a) Devaluation of Belarusian ruble b) Social issuesWays off

Слайды и текст этой презентации

Слайд 2CONTENTS

Introduction

Macroeconomic and market situation

Crisis’s consequences

a) Devaluation of Belarusian ruble

b) Social

issues

Слайд 3INTRODUCTION

At first glance, it seems that Belarus’ recent economic performance

surprised most outside observers. According to official statistics, economic growth

in Belarus between January and June 2009 amounted to a 0.3% increase year-on-year, while Russia’s economy – a major market for Belarusian industrial exports – dropped by 10.1% year-by-year. Comparison of the country’s previous economic performance illustrates the negative impact of the crisis. A decrease of external demand hit Belarusian industry and increased external imbalances, while the fall of energy prices and deterioration of enterprises deteriorated government revenues. All of these factors unveiled structural problems that required appropriate action. Instead, the government has chosen to delay “radical” reforms by borrowing abroad.Слайд 4Macroeconomic

and market situation

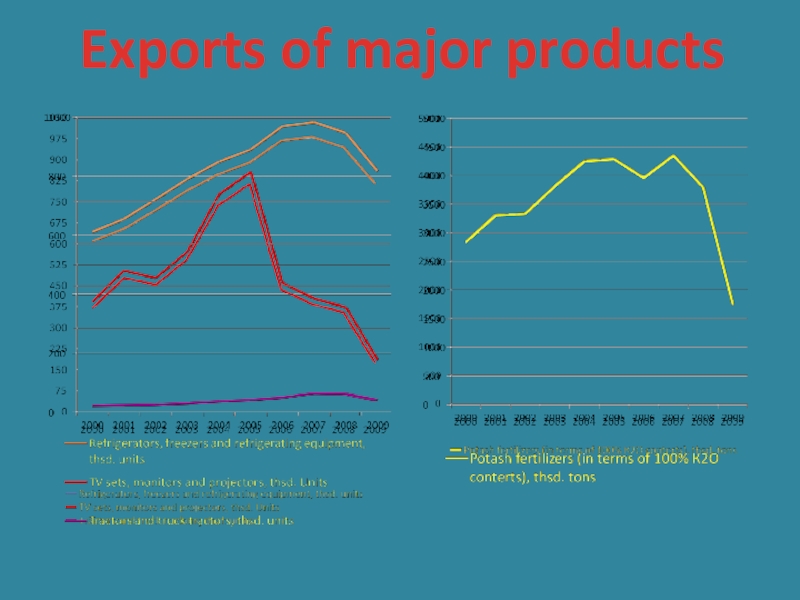

The rapid decrease of external demand in Belarus

is a major consequence of the global economic crisis. The

decline in industrial demand resulted in increased inventories (finished good and stock). As a result, between January and May of 2009, Belarusian merchandise exports dropped by 48% year-on-year.Слайд 6Macroeconomic

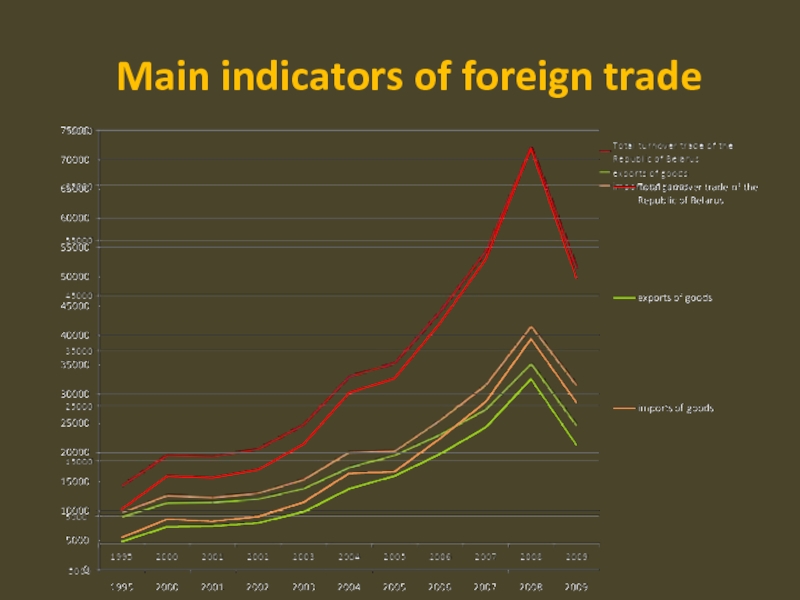

and market situation

Taking into account the existing relationship between export

and import volumes (1% to 0.64%), the contraction of Belarusian

exports should result in a growing trade deficit (see diagram).Слайд 8CRISIS’S CONSEQUENCES.

DEVALUATION OF BELARUSIAN RUBLE

Growing external imbalances forced the

government to revise exchange rate policy. The devaluation was required

by the IMF. Despite the measure, this devaluation has not been followed by a restriction in domestic demand,Слайд 9CRISIS’S CONSEQUENCES.

DEVALUATION OF BELARUSIAN RUBLE

Thus the current account deficit

persists. The main reason for exchange rate instability – the

current account deficit. Here you can see the basic measures accepted by the Belarus authorities. They are:Слайд 10Crisis’s consequences and

Social issues

The potential increase of poverty creates challenges

for social policy, due to a drastic of government revenues

and poor identification of vulnerable groups, especially unemployed and low-paid workers. The main “social” choice for the government is between hidden and open unemployment. Efficient privatization is another possible solution, although it would require firing excess labor. It would create new work places and generate revenues for social support.Слайд 12Ways off

Loans and solution.

Belarus was among the first transition economies

to ask for an International Monetary Fund (IMF) stand-by loan.

As a great part of the loan agreement the Fund expects the Belarusian government to promote father liberalization efforts which includes preparing the economy for privatization, as well as implementing some structural changes deemed “essential to improve prospects for long-run growth and external stability”.Слайд 13Ways off

Reforms as a remedy

At the moment, the

shape of this “revised” economic program is not clear. However,

the previous version, approved at the end of 2008, included several measures which can be viewed as improving liberalization efforts – including prices, wages, and doing business. After recent discussions with the IMF and World Bank it seems that Belarusian authorities are ready to launch large scale all of for privatization efforts. Evidently, these measures are good for growth in the medium to long- term, but the question remains:will they solve the country’s short-term economic problems?

Теги