Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Социальная физика. Обзор основных направлений

Содержание

- 1. Социальная физика. Обзор основных направлений

- 2. Социальная физика. Предыстория

- 3. Социальная физикаКоллективное поведение живых организмов

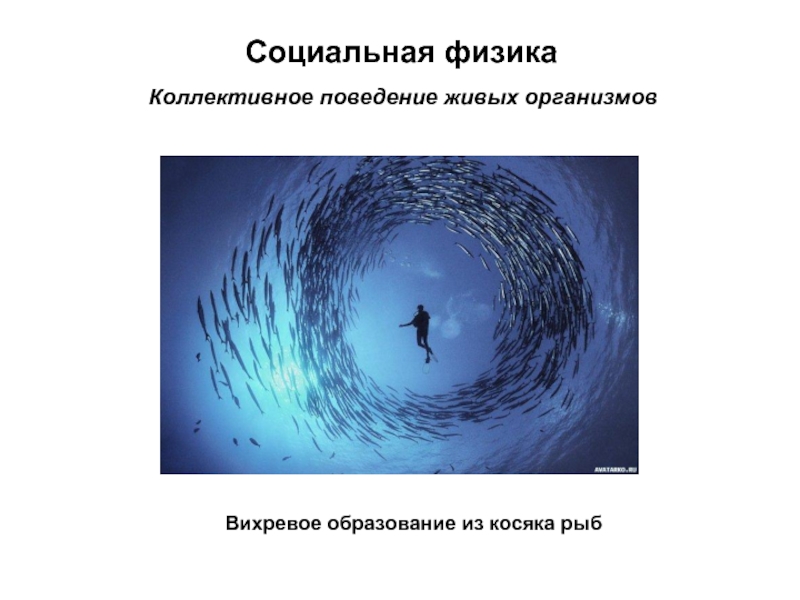

- 4. Социальная физикаКоллективное поведение живых организмовВихревое образование из косяка рыб

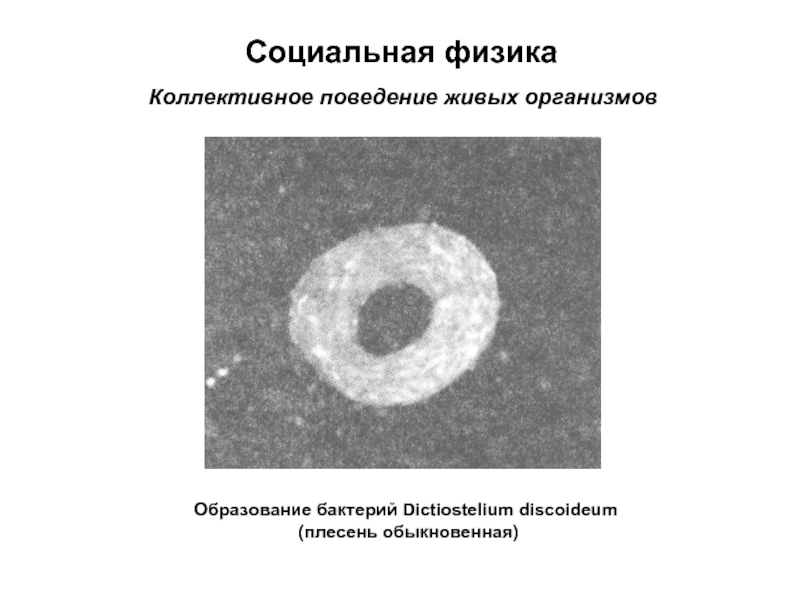

- 5. Социальная физикаКоллективное поведение живых организмовОбразование бактерий Dictiostelium discoideum (плесень обыкновенная)

- 6. Социальная физикаКоллективное поведение живых организмовDictiostelium discoideum вблизи

- 7. Социальная физикаКоллективное поведение живых организмовМодель Boids (K.

- 8. Социальная физикаМодели поведения толпы

- 9. Социальная физикаМодели поведения толпыМодель пешеходного движения (D.

- 10. Социальная физикаМодели поведения толпыМодель пешеходного движения (D. Helbing, P. Molnar, 80-е гг. 20 в)

- 11. Социальная физикаМодели поведения толпыМодель неконтролируемого поведения (D.

- 12. Социальная физикаМодели дорожного движения

- 13. Социальная физикаМодели дорожного движенияПервая модель (James Lighthill

- 14. Социальная физикаМодели дорожного движенияМодель потока с дополнительными

- 15. Социальная физикаМодели социальных сетей

- 16. Социальная физикаМодели социальных сетейМонография "Contacts and Influences"(Ithiel

- 17. Социальная физикаМодели социальных сетейМодель малых миров (Duncan

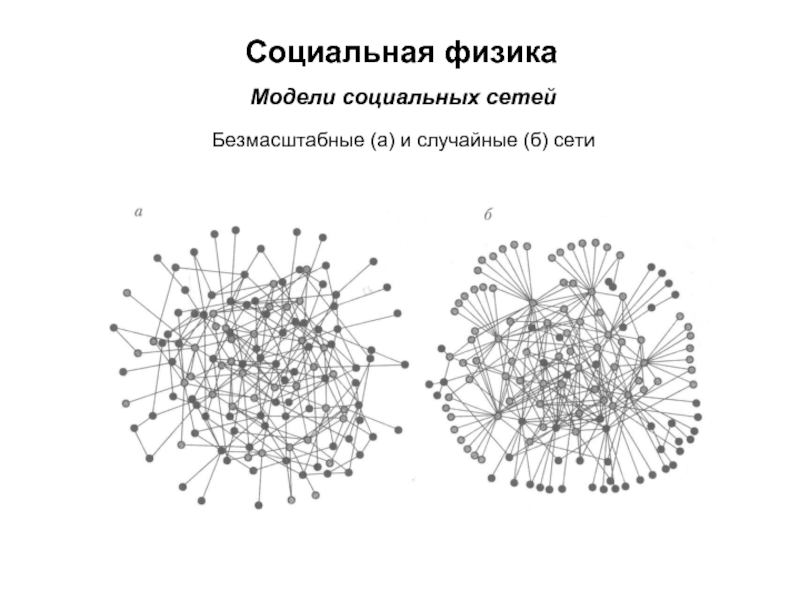

- 18. Социальная физикаМодели социальных сетейБезмасштабные сети (A.-L. Barabási,

- 19. Социальная физикаМодели социальных сетейБезмасштабные (а) и случайные (б) сети

- 20. Социальная физикаМодели взаимодействующих агентов в экономике. Эконофизика

- 21. Социальная физикаМодели взаимодействующих агентов в экономике. ЭконофизикаАгентно-ориентированные

- 22. Социальная физикаДругие направления и модели Модели разрастания

- 23. Социальная физикаМодель возникновения общественного мненияJoshua Epstein, Learning

- 24. Социальная физикаМодель возникновения общественного мненияJoshua Epstein, Learning

- 25. Социальная физикаОсновные выводыОсобый упор социальная физика делает

- 26. Литература:Z.-F. Huang, S. Solomon, Finite market size

- 27. Спасибо за внимание

- 28. Скачать презентанцию

Социальная физика. Предыстория

Слайды и текст этой презентации

Слайд 1Социальная физика.

Обзор основных направлений

Дубовиков Михаил Михайлович

Директор по стратегии

Байкальская Школа

- 2011

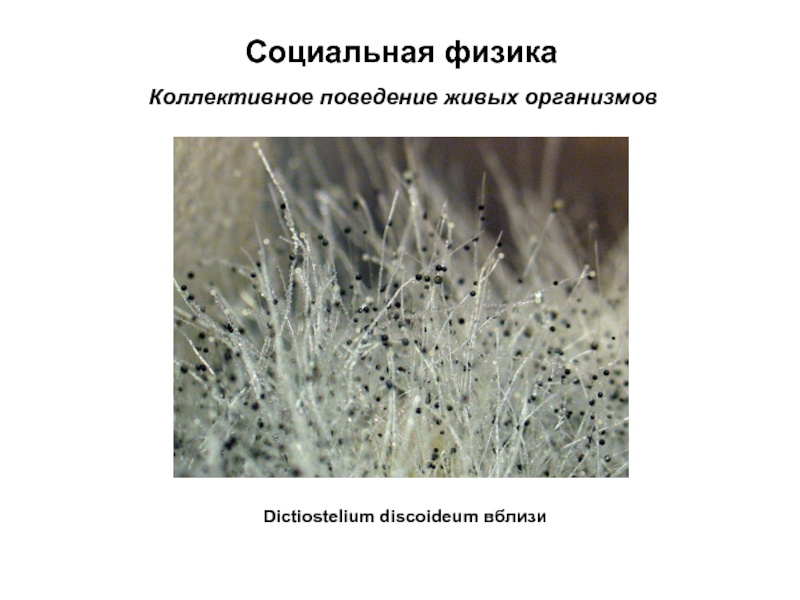

Слайд 5Социальная физика

Коллективное поведение живых организмов

Образование бактерий Dictiostelium discoideum

(плесень обыкновенная)

Слайд 7Социальная физика

Коллективное поведение живых организмов

Модель Boids (K. Reinolds, 1987). Клеточные

автоматы

(boid = bird + droid)

Craig W. Reynolds, Flocks, Herds,

and Schools: A Distributed Behavioral Model, Published in Computer Graphics, 21(4) (SIGGRAPH 87 Conference Proceedings) p. 25-34 (1987), http://www.red.com/cwr/boids.htmМодель Dictiostelium discoideum (T. Vicsek, A. Czirók, 1994)

E. Ben-Jacob, O. Shochet, A. Tenenbaum, I. Cohen, A. Czirok and T. Vicsek, Generic modelling of cooperative growth patterns in bacterial colonies, Nature, v. 368, p. 46 (1994)

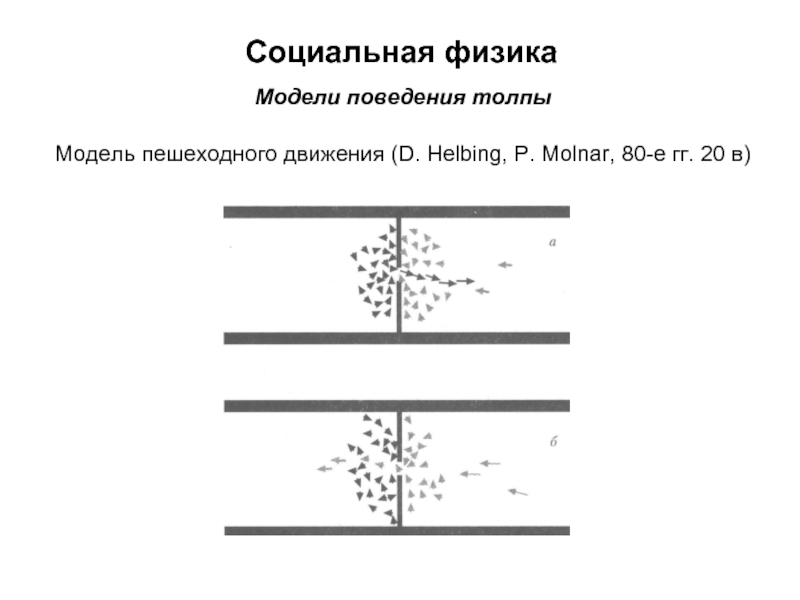

Слайд 9Социальная физика

Модели поведения толпы

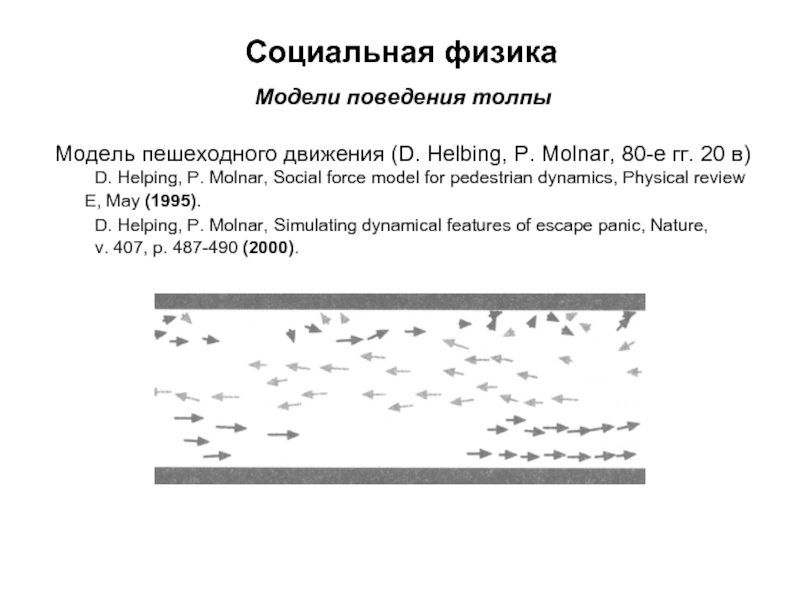

Модель пешеходного движения (D. Helbing, P. Molnar,

80-е гг. 20 в)

D. Helping, P. Molnar, Social force model

for pedestrian dynamics, Physical review E, May (1995).D. Helping, P. Molnar, Simulating dynamical features of escape panic, Nature,

v. 407, p. 487-490 (2000).

Слайд 10Социальная физика

Модели поведения толпы

Модель пешеходного движения (D. Helbing, P. Molnar,

80-е гг. 20 в)

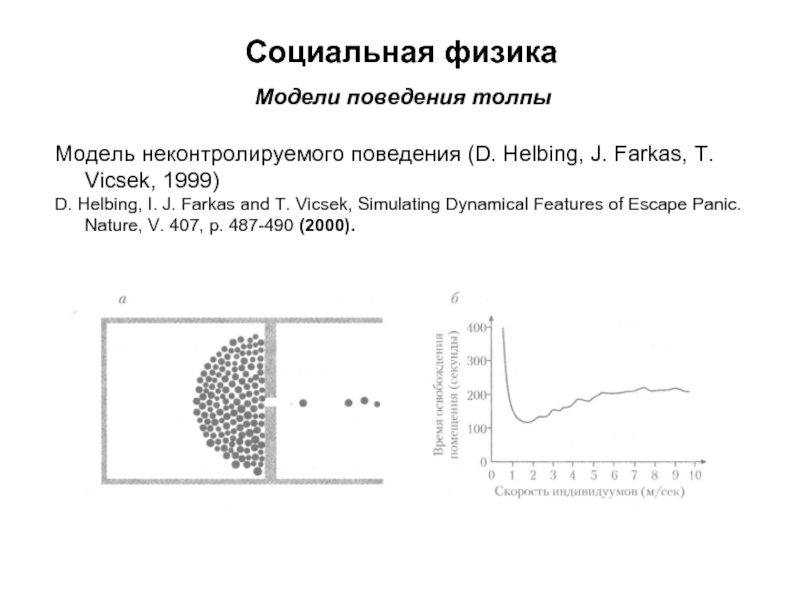

Слайд 11Социальная физика

Модели поведения толпы

Модель неконтролируемого поведения (D. Helbing, J. Farkas,

T. Vicsek, 1999)

D. Helbing, I. J. Farkas and T.

Vicsek, Simulating Dynamical Features of Escape Panic. Nature, V. 407, p. 487-490 (2000). Слайд 13Социальная физика

Модели дорожного движения

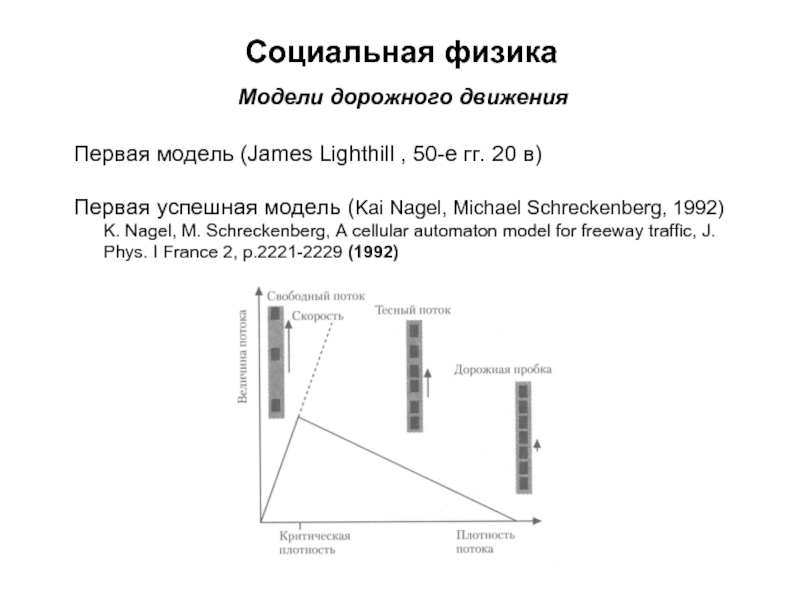

Первая модель (James Lighthill , 50-е гг.

20 в)

Первая успешная модель (Kai Nagel, Michael Schreckenberg, 1992) K.

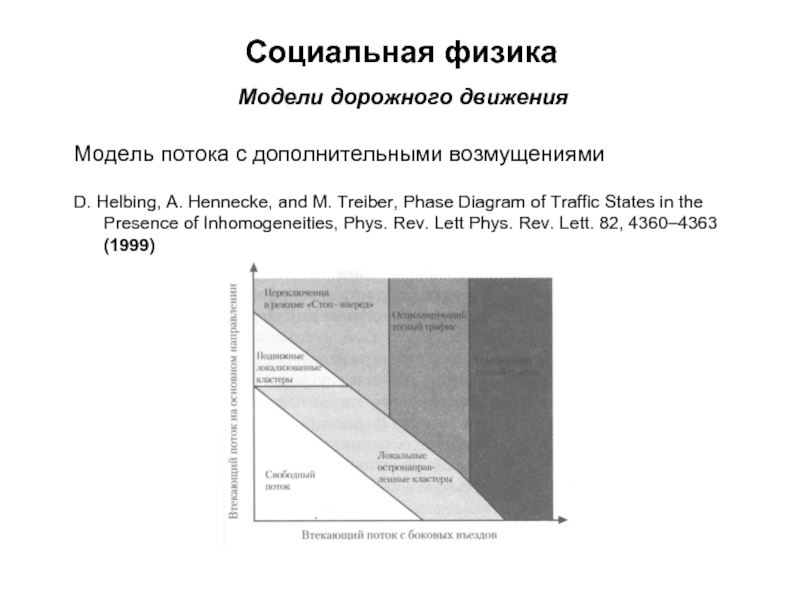

Nagel, M. Schreckenberg, A cellular automaton model for freeway traffic, J. Phys. I France 2, p.2221-2229 (1992)Слайд 14Социальная физика

Модели дорожного движения

Модель потока с дополнительными возмущениями

D. Helbing, A.

Hennecke, and M. Treiber, Phase Diagram of Traffic States in

the Presence of Inhomogeneities, Phys. Rev. Lett Phys. Rev. Lett. 82, 4360–4363 (1999)Слайд 16Социальная физика

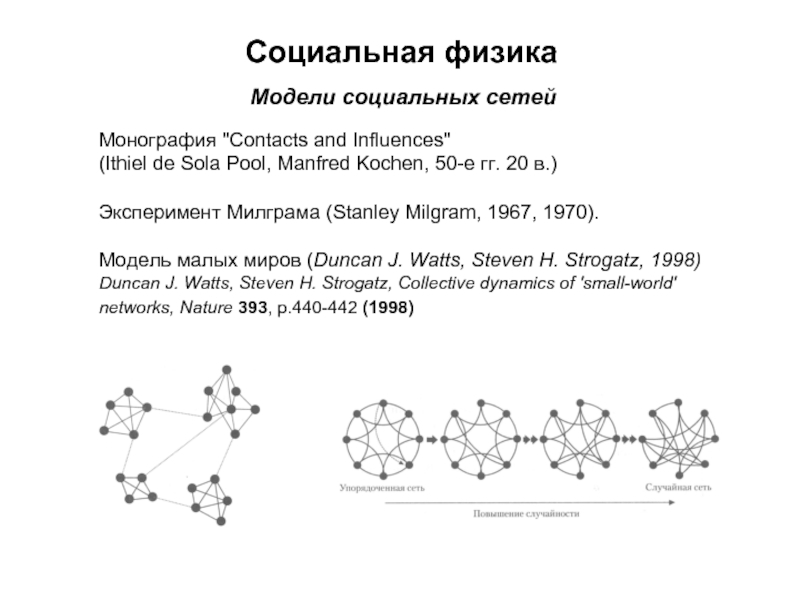

Модели социальных сетей

Монография "Contacts and Influences"

(Ithiel de Sola Pool,

Manfred Kochen, 50-е гг. 20 в.)

Эксперимент Милграма (Stanley Milgram,

1967, 1970).

Модель малых миров (Duncan J. Watts, Steven H. Strogatz, 1998)Duncan J. Watts, Steven H. Strogatz, Collective dynamics of 'small-world' networks, Nature 393, р.440-442 (1998)

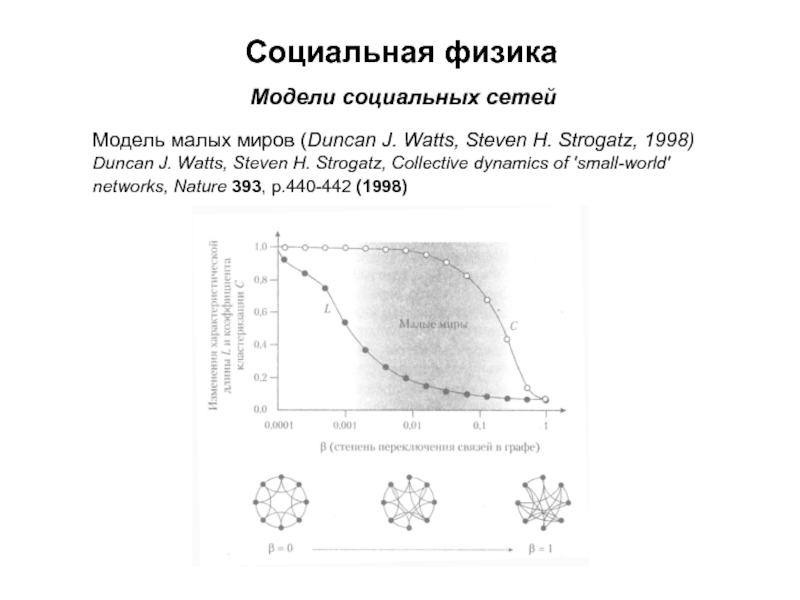

Слайд 17Социальная физика

Модели социальных сетей

Модель малых миров (Duncan J. Watts, Steven

H. Strogatz, 1998)

Duncan J. Watts, Steven H. Strogatz, Collective dynamics

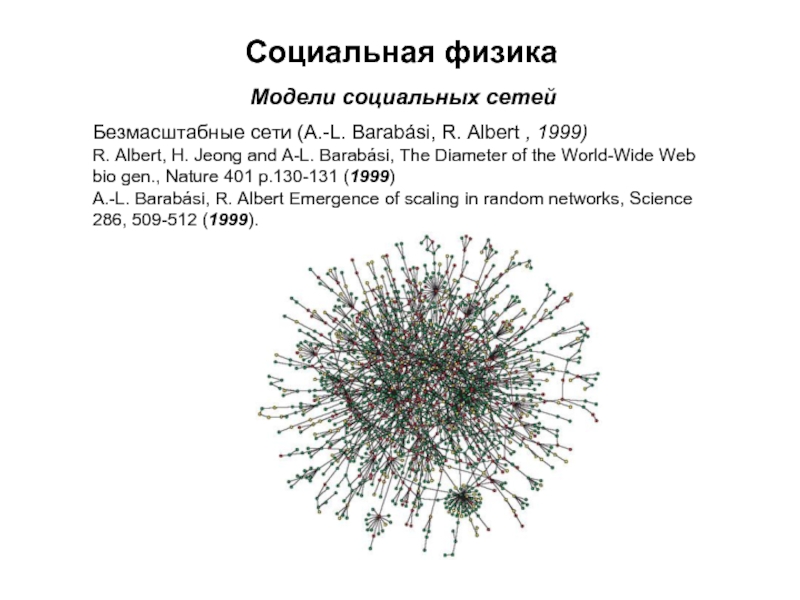

of 'small-world' networks, Nature 393, р.440-442 (1998) Слайд 18Социальная физика

Модели социальных сетей

Безмасштабные сети (A.-L. Barabási, R. Albert ,

1999)

R. Albert, H. Jeong and A-L. Barabási, The Diameter of

the World-Wide Web bio gen., Nature 401 p.130-131 (1999) A.-L. Barabási, R. Albert Emergence of scaling in random networks, Science 286, 509-512 (1999).

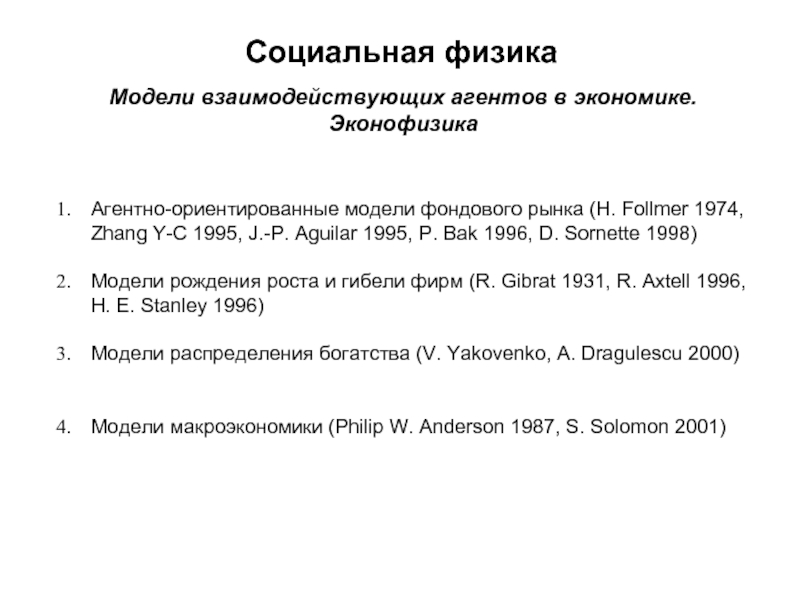

Слайд 21Социальная физика

Модели взаимодействующих агентов в экономике. Эконофизика

Агентно-ориентированные модели фондового рынка

(H. Follmer 1974, Zhang Y-C 1995, J.-P. Aguilar 1995, P.

Bak 1996, D. Sornette 1998)Модели рождения роста и гибели фирм (R. Gibrat 1931, R. Axtell 1996, H. E. Stanley 1996)

Модели распределения богатства (V. Yakovenko, A. Dragulescu 2000)

Модели макроэкономики (Philip W. Anderson 1987, S. Solomon 2001)

Слайд 22Социальная физика

Другие направления и модели

Модели разрастания городов (M. Batty,

P. Longley 1994,

H. Makse, S. Havlin,

H. E. Stanley 1996, L. Carvalho, A. Penn, 2004)Модель расовой сегрегации (T. C. Schelling, 1973)

Модель взаимoдействия культур и обычаев (R. Axelrod, 1986)

Модель образования коалиций в корпоративных войнах

(R. Axelrod, 1997)

Модели возникновения и разрушения коллективного сотрудничества

(M. Novak, K. Sigmund 1992)

Модели поведения электората при голосовании (A.T. Bernardes, 2002)

Модели роста преступности (P. Ormerod, M.Campbell, 1997)

Модели изменения количества брачных союзов

(P. Ormerod, M.Campbell, 1998)

Модель Sugarscape (Joshua M. Epstein, Robert Axtell 1996)

Слайд 23Социальная физика

Модель возникновения общественного мнения

Joshua Epstein, Learning to be thoughtless:

sosial norms and individual computation, Computation Economics 18 (1), p.

9-24 (2001)Слайд 24Социальная физика

Модель возникновения общественного мнения

Joshua Epstein, Learning to be thoughtless:

sosial norms and individual computation, Computation Economics 18 (1), p.

9-24 (2001)Слайд 25Социальная физика

Основные выводы

Особый упор социальная физика делает на анализе эмпирических

данных или вычислительном эксперименте

Сохраняя за агентами свободу индивидуального выбора, социальная

физика ставит своей целью определение условий этого выбора. Поэтому она исследует не те структуры, которые появляются в результате сознательного выбора агентов, а те, которые возникают самопроизвольно в результате повторяющихся действий агентов, совершаемых ими скорее бессознательно в силу принятых норм поведенияПоскольку такие структуры возникают в результате фазового перехода, то в отличие, например от математической экономики (где базовые модели – это модели равновесия), в социальной физике базовыми моделями являются модели фазовых переходов

Слайд 26Литература:

Z.-F. Huang, S. Solomon, Finite market size es a sourse

of extreme wealth inequality and market instability, Physica A 294,

p. 503-13 (2001)Y. Louzoun, S. Solomon, J.Goldenberg & D. Mazursky, The risk at being unfair: world-size global markets lead to economic instability, Preprint (2002)

Ph. Ball, The physical modelling of society: a historical perspective, Physica A 314, p. 1-14 (2002)

Ph. Ball, Critical mass. Farrar, Straus and Giroux, New York (2004)

M. Campbell, P. Ormerod, Social interaction and the dynamics of crime, Preprint (2000)

P. Ormerod, M. Campbell, The evolution of family structures in a social context, Preprint, May (2000)

AT Bernardes, D. Stauffer, and J. Kertesz, Election results and the Sznajd model on Barabasi network, Eur. Phys. J. B 25, 123 (2002)

J. M. Epstein and R. Axtell, Growing Artificial Societies, p. 136, MIT Press, Cambridge, Mass. 480 (1996)

Дидье Сорнетте, Как предсказывать крахи финансовых рынков. Критические события в комплексных финансовых системах. М.: Интернет-Трейдинг (2003)

J.-P. Bouchaud, M. Potters, Theory of Financial Risks: From Statistical Physics to Risk Management. Cambridge, New York, Cambridge University Press (2000)

Per Bak, M. Paczuski, M. Shubik, Price Variations in a Stock Market with Many Agents, Working paper 96-05-078, Santa Fe Institute Economics Research Pro-gramm (1996)

М.М. Дубовиков, Н.В. Старченко, Эконофизика и фрактальный анализ финансовых временных рядов, УФН 181, стр. 779–786 (2011) http://ufn.ru/ru/articles/2011/7/k/

Теги