Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Chapter 12

Содержание

- 1. Chapter 12

- 2. Learning ObjectivesIdentify and describe the primary and

- 3. Securities MarketsA place where you buy and

- 4. Primary Markets Place where new securities are

- 5. Primary MarketsPrimary market activities require the help

- 6. Primary MarketsTombstone ads are placed in newspapers

- 7. Secondary Markets - StocksPreviously-issued securities trade in

- 8. Secondary Markets - StocksThere are 9 organized

- 9. Secondary Markets - StocksNew York Stock Exchange

- 10. Secondary Markets - StocksMembers of the NYSE

- 11. Secondary Markets - StocksThe American Stock Exchange

- 12. Secondary Markets - StocksThe Regional Stock Exchanges

- 13. Secondary Markets - StocksThe over-the-counter (OTC) market

- 14. Secondary Markets - StocksIn 1971, the National

- 15. Secondary Markets - BondsWhile some bonds trade

- 16. International MarketsBabylonians introduced debt financing as far

- 17. International MarketsHow can you buy international stocks?Some

- 18. International MarketsInternational stocks can be traded through

- 19. Regulation of the Securities MarketsAim is to

- 20. Regulation of the Securities MarketsSecurities Act of

- 21. Regulation of the Securities MarketsSelf-Regulation – much

- 22. The Role of the SpecialistMaintains a fair

- 23. Order CharacteristicsOrder SizeOdd lots1-99 sharesRound lots100 sharesTime

- 24. Types of Orders Market Orders – buy

- 25. Short Selling Short selling – the more

- 26. Short Selling Most trading involves buying a

- 27. Types of BrokersFull-Service Brokers – paid commissions

- 28. Types of BrokersDeep Discount Brokers – in

- 29. Cash Versus Margin AccountsCash AccountsInvestor pays in

- 30. Registration: Street Name or Your NameSecurities can

- 31. Joint AccountsJoint Tenancy with Right of Survivorship

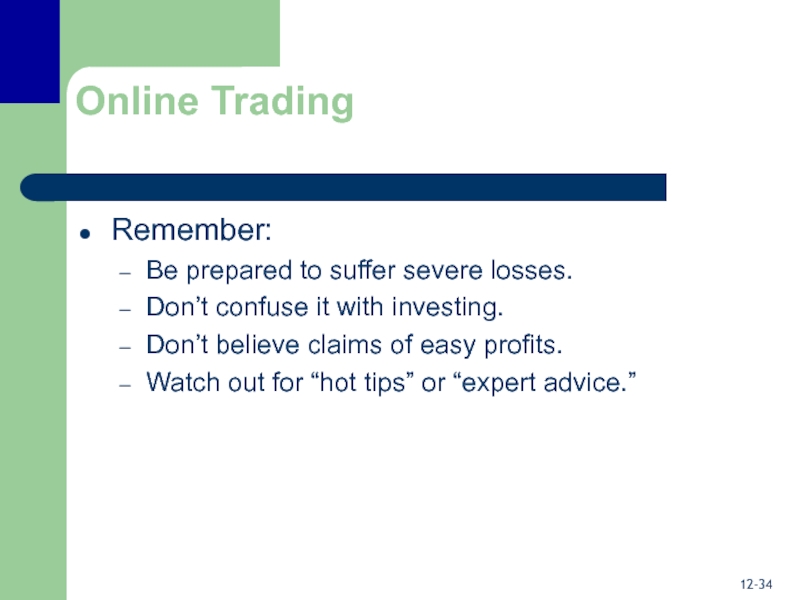

- 32. Tips for Online InvestingChecklist 12.3Online trading is

- 33. Online TradingDay traders trade with a very

- 34. Online TradingRemember:Be prepared to suffer severe losses.Don’t

- 35. Sources of Investment InformationCorporate Sources – annual

- 36. Скачать презентанцию

Learning ObjectivesIdentify and describe the primary and secondary securities markets.Trade securities using a broker.Locate and use several different sources of investment information to trade securities.

Слайды и текст этой презентации

Слайд 2Learning Objectives

Identify and describe the primary and secondary securities markets.

Trade

securities using a broker.

investment information to trade securities.Слайд 3Securities Markets

A place where you buy and sell securities.

Includes stocks

and bonds.

Securities are issued by corporations to raise money.

After the

initial issue, securities are traded among investors. Слайд 4Primary Markets

Place where new securities are traded.

2 types of

primary market offerings:

Initial public offering (IPO) - the first time

a company’s stock is traded publicly.Seasoned new issues - stock offerings by companies that already have stock trading in the marketplace.

Слайд 5Primary Markets

Primary market activities require the help of an investment

banker to serve as the underwriter.

The underwriter is a middleman

who buys the entire issue from the company, then resells it to the public.

The managing investment banker will form a syndicate of other investment banking companies to underwrite the security.

Слайд 6Primary Markets

Tombstone ads are placed in newspapers to announce the

offering and provide details.

A prospectus describes the issue and the

issuing company’s financial prospects.Слайд 7Secondary Markets - Stocks

Previously-issued securities trade in the secondary markets.

Secondary

markets can be either:

Organized exchange – a physical location where

stocks trade.Over-the-counter market – transactions conducted over phone or computer.

Слайд 8Secondary Markets - Stocks

There are 9 organized exchanges in the

U.S.

National Exchanges:

New York Stock Exchange (NYSE)

American Stock Exchange (AMEX)

Regional

Exchanges:Pacific Stock Exchange

Chicago Stock Exchange

Philadelphia Stock Exchange

Cincinnati Stock Exchange

Intermountain Stock Exchange

Spokane Stock Exchange

Boston Stock Exchange

Слайд 9Secondary Markets - Stocks

New York Stock Exchange (NYSE) – also

known as the “Big Board”

The oldest of the U.S.

exchanges.In 1792, 24 traders signed the “Buttonwood Agreement,” giving preference to each other when trading securities.

Слайд 10Secondary Markets - Stocks

Members of the NYSE occupy “seats” with

the number fixed at 1366.

On December 1, 2005, a seat

sold for a record $4 million.2800 companies are listed on the NYSE.

Слайд 11Secondary Markets - Stocks

The American Stock Exchange (AMEX) is the

second largest organized U.S. exchange, in terms of the number

of listed companies.1000 companies are listed on the AMEX.

It has 660 “seats” and operates like the NYSE.

The daily dollar value of trading is less than some regional exchanges.

Слайд 12Secondary Markets - Stocks

The Regional Stock Exchanges trade securities of

local and regional firms.

Have more relaxed listing requirements.

Many regional exchanges

also list stocks found on the NYSE and AMEX.Слайд 13Secondary Markets - Stocks

The over-the-counter (OTC) market links dealers, has

no listing requirements.

The OTC is highly automated, providing quotes on

35,000 securities.Information on infrequently-traded stocks is disseminated daily through “pink sheets” mailed to dealers.

More frequently traded stocks are handled by the NASDAQ.

Слайд 14Secondary Markets - Stocks

In 1971, the National Association of Securities

Dealers Automated Quotations system (NASDAQ) was created, allowing dealers to

post bid and ask prices for OTC stocks via computers.Bid price – price at which an individual is willing to purchase a security.

Ask price – price at which an individual is willing to sell a security.

Слайд 15Secondary Markets - Bonds

While some bonds trade at the NYSE,

most trading is done through bond dealers.

Bond dealers deal directly

with large financial institutions. Smaller investors use a broker.Limited interest in the secondary market for corporate debt.

Tremendous interest in the secondary market for government bonds, totaling billions of dollars monthly.

Слайд 16International Markets

Babylonians introduced debt financing as far back as 2000

B.C.

The world bond market is valued at over $25 trillion,

dominated by the U.S. market. Japan, Germany, France, and the United Kingdom are major players.

Слайд 17International Markets

How can you buy international stocks?

Some foreign shares trade

on U.S. exchanges.

Go online and invest directly in international stocks.

Visit www.intltrader.com

Слайд 18International Markets

International stocks can be traded through American Depository Receipts

(ADRs).

The foreign stock is held on deposit in the

foreign country’s bank. The foreign bank issues an ADR, representing direct ownership of those shares. ADR then trades like a stock.Слайд 19Regulation of the

Securities Markets

Aim is to protect investors so that

all have a fair chance of making money.

2 types of

regulation:General regulation by the Securities and Exchange Commission (SEC)

Self-regulation directly by the exchanges

Слайд 20Regulation of the

Securities Markets

Securities Act of 1933

Disclosure of relevant

information on IPO’s and registration with the Federal Trade Commission.

Securities

Exchange

Act of 1934 Focus on the secondary market.

Created the SEC to enforce trading laws.

Required annual reports for shareholders.

Слайд 21Regulation of the

Securities Markets

Self-Regulation – much day-to-day market regulation, left

to the securities industry, is performed by exchanges and the

NASD.Self-regulation is preferred over government regulation.

After the October 1987 crash, the NYSE imposed “circuit breakers” to stop or slow future crashes.

Слайд 22The Role of the Specialist

Maintains a fair and orderly market.

Assigned

to a stock, acts as both a broker and dealer.

Acts as a facilitator, keeping track of all buy and sell orders, matching them when appropriate.

Maintains an inventory to buy and sell stock and affect the price when necessary.

Слайд 23Order Characteristics

Order Size

Odd lots

1-99 shares

Round lots

100 shares

Time Periods

Day orders expire

at end of day.

Good-till-cancelled (GTC) orders remain in effect until

filled or cancelled.Слайд 24Types of Orders

Market Orders – buy or sell immediately

at the best price available.

Limit Orders – trade is to

be made only if at a certain price or better.Stop Orders – order to sell if the price drops below a specified level or to buy if the price climbs above a specified level.

Слайд 25Short Selling

Short selling – the more the price drops,

the more money your make.

Borrow stock from the broker and

then sell it, in anticipation of the price falling. Profit by buying back stock at a lower price and returning it to the broker.

If price increases, you buy back for more than the sold price, and lose money.

Слайд 26Short Selling

Most trading involves buying a stock low and

selling it high – making money as the price appreciates.

Short

selling involves selling high and then buying back later at a low price – making money as the stock declines.Short seller must put up collateral – margin requirement.

Слайд 27Types of Brokers

Full-Service Brokers – paid commissions based on sales

volume. Broker gives advice to client and executes trades.

Discount Brokers

– execute trades but do not provide advice. Commissions are 50-70% less than full-service brokers.Слайд 28Types of Brokers

Deep Discount Brokers – in 1994, they began

executing trades for up to 90% less than full service

brokers.Charles Schwab and Fidelity are examples.

Online Brokers – either discount or deep discount brokers trading electronically.

Costs are extremely low, some at $5.

Some research is provided.

Слайд 29Cash Versus Margin Accounts

Cash Accounts

Investor pays in full.

Payment due in

3 business days.

Margin Accounts

Investors borrow a portion of the purchase

price.Initial margin is 50%.

Maintenance margin is the minimum you must maintain.

Слайд 30Registration: Street Name

or Your Name

Securities can be registered in your

name or “street name.”

Street Name – registered securities remain in

the broker’s custody and are a computer entry in your name. More convenient to sell.

May have maintenance fee for inactivity.

Слайд 31Joint Accounts

Joint Tenancy with Right of Survivorship – when one

owner dies, the other receives full ownership of assets in

the account.Asset by-pass probate but may be subject to taxes.

Tenancy-in-Common – the deceased’s portion of the account goes to the heirs of the diseased, not the surviving account holder.

Слайд 32Tips for Online Investing

Checklist 12.3

Online trading is quick, but online

investing takes time.

Set price limits.

If you cancel, make sure

it worked before placing another trade.No regulations regarding the time to execute a trade.

Слайд 33Online Trading

Day traders trade with a very short-term time horizon.

Goal is to ride momentum.

It is speculating – not investing.

Слайд 34Online Trading

Remember:

Be prepared to suffer severe losses.

Don’t confuse it with

investing.

Don’t believe claims of easy profits.

Watch out for “hot tips”

or “expert advice.”Слайд 35Sources of Investment Information

Corporate Sources – annual reports

Brokerage Firm Reports

– research reports by security analysts

The Press – Wall Street

Journal, Forbes, etc.Investment Advisory Services – Moody’s, S&P, Value Line

Internet Sources – www.edgar-online.com

Investment Clubs – provide social, educational, and investment value.