Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

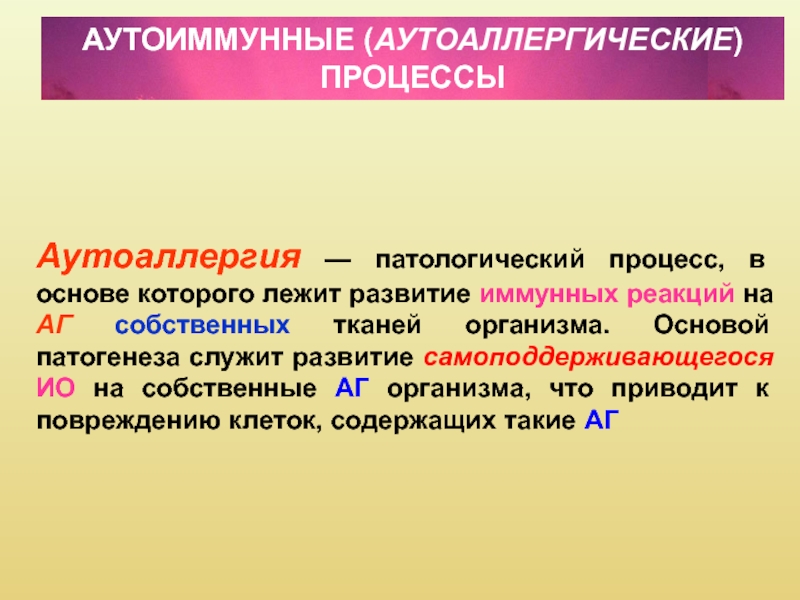

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Financial Management in Foreign Companies

Содержание

- 1. Financial Management in Foreign Companies

- 2. TABLE OF CONTENTSI. Purpose of financial management. II. FM

- 3. I- Purpose of financial management 1.1- Accounting:

- 4. I- Purpose of financial management 1.2- What

- 5. II- FM and underlying business Can FM

- 6. II- FM and underlying business 2.1- The swine industry value-added chain

- 7. II- FM and underlying business 2.2- “5 forces diagram” - TEMPLATE

- 8. II- FM and underlying business 2.2- “5 forces

- 9. II- FM and underlying business 2.2- “5 forces

- 10. II- FM and underlying business 2.2- “5 forces diagram” applied to Hog production

- 11. II- FM and underlying business 2.2- “5 forces

- 12. II- FM and underlying business 2.2- “5 forces diagram” applied to Hog production

- 13. II- FM and underlying business 2.2- “5 forces diagram” applied to “Multiplication”

- 14. II- FM and underlying business 2.2- “5 forces

- 15. II- FM and underlying business 2.2- “5 forces diagram” applied to “Multiplication”

- 16. II- FM and underlying business 2.2- “5 forces diagram” applied to “Multiplication”

- 17. II- FM and underlying business 2.2- “5 forces diagram” applied to “Multiplication”

- 18. II- FM and underlying business 2.2- “Hog production”

- 19. II- FM and underlying business 2.3- Supply and

- 20. II- FM and underlying business 2.3- Supply and Demand of Carcasses

- 21. II- FM and underlying business 2.3- Supply and

- 22. III- Aim of a Company 3.1- Contribution vs. Output

- 23. III- Aim of a Company 3.2- Who runs

- 24. IV- What accounts to produce? 4.1- 3 different

- 25. IV- What accounts to produce? 4.2- Always go for the full set

- 26. IV- What accounts to produce? 4.3- IFRS vs. Russian GAAP

- 27. Скачать презентанцию

TABLE OF CONTENTSI. Purpose of financial management. II. FM and underlying business.III. Aim of a company.IV. Which accounts to produce?

Слайды и текст этой презентации

Слайд 2TABLE OF CONTENTS

I. Purpose of financial management.

II. FM and underlying business.

III. Aim

of a company.

Слайд 3I- Purpose of financial management

1.1- Accounting: the basement of FM

What

is accounting?

A LANGUAGE!!!

It translates economic and financial realities into figures

so as to make them understandable and handable by anybody who “speaks” the language.Double-entry (modern) accounting is a system in which data are entered in 2 different accounts (credit and debit) which enables it to prevent most of basic mistakes: “accounts need to balance”.

Who invented “modern” accounting?

Officially, Fra Luca Bartolomeo de Pacioli, an Italian mathematician, Franciscan friar and collaborator with Leonardo da Vinci in order to help Venetian merchants to control their business during the 15th century.

In reality, most probably the antique Egyptians (3 700 years ago). The scribes precisely accounted basically every economic activity for tax collection purposes.

Слайд 4I- Purpose of financial management

1.2- What is FM use for?

All

processes based on financial documents that enable managers to:

Run the

business (i.e. like a road map, or GPS):Define clear cut short, mid and long-term goals;

Assess performances;

Provide forecast views;

Support decision making process (what if?);

Reduce risk.

Communicate with:

Shareholders;

Banks;

Administration;

Business community;

As well as internally.

Report to authorities:

Taxes;

Statistics.

Слайд 5II- FM and underlying business

Can FM be independent from understanding

underlying business?

NO, NO and NO!!!

Only in mathematics do number exist

per se. In FM (or in physics) they represent something. So you absolutely need to understand that something. Doing proper FM management requires understanding:

The company and its operations;

Its business and the industry it is a part of;

Its economic, legal and financial environment.

Focus is put here on industry and economic environment understanding.

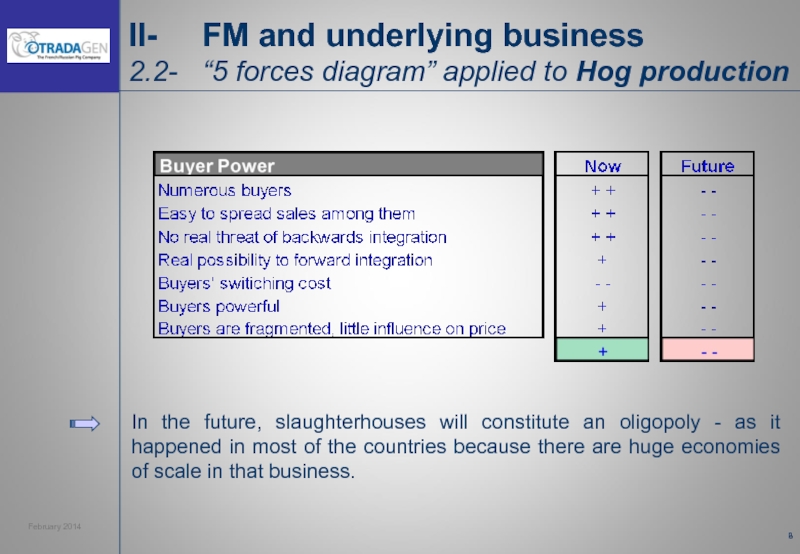

Слайд 8II- FM and underlying business 2.2- “5 forces diagram” applied to Hog

production

In the future, slaughterhouses will constitute an oligopoly - as

it happened in most of the countries because there are huge economies of scale in that business.Слайд 9II- FM and underlying business 2.2- “5 forces diagram” applied to Hog

production

Vertical integration into feed production is an absolute must.

Слайд 11II- FM and underlying business 2.2- “5 forces diagram” applied to Hog

production

Competing in the hog industry requires:

Cost efficiency thru improvement of

technical performances shall be the day-to-day concern of management.Product differentiation thru “European type hogs” (low fat content and stable carcass weight).

Branding of animals and meat, potentially thru creation of own retail network.

Слайд 14II- FM and underlying business

2.2- “5 forces diagram” applied to “Multiplication”

Vertical

integration into feed production is an absolute must.

Establishing a long

term relationship with the genetic R & D supplier is a key success factor in business.Слайд 18II- FM and underlying business

2.2- “Hog production” vs. “Multiplication”

Otradagen:

is focusing on

multiplication;

has got its own feed-mill;

has got the strongest brand-name for

genetics in the market (Danavl);has a long lasting contractual relationship with genetic R&D supplier;

is the most efficient swine company in Russia from a technical performance point of view (source NSS);

differentiates thru use innovative technology and animal welfare focus.

Слайд 19II- FM and underlying business

2.3- Supply and Demand of Carcasses

Russia is

still heavily relying on imports for supplying pork meat to

its citizens.The domestic swine and meat market is not a “free” market because, among others, quotas and import duties have been implemented.

In order to run a pig company in Russia it is mandatory to understand:

how these market distortions influence “Supply” and “Demand” and the resulting market price;

why the state authorities have decided to do that.

For purpose of simplification, we will consider the “carcass” market and make the assumption that only carcasses are imported (vs. livestock and cuts in reality) and that quotas and duties apply only to that good.

In a second stage, we will qualitatively try to understand how the things are running at the “hog” market level.

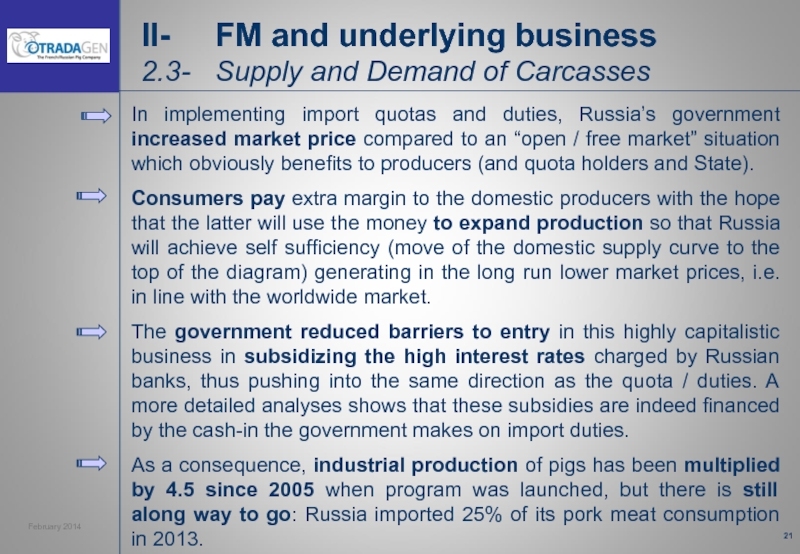

Слайд 21II- FM and underlying business

2.3- Supply and Demand of Carcasses

In implementing

import quotas and duties, Russia’s government increased market price compared

to an “open / free market” situation which obviously benefits to producers (and quota holders and State).Consumers pay extra margin to the domestic producers with the hope that the latter will use the money to expand production so that Russia will achieve self sufficiency (move of the domestic supply curve to the top of the diagram) generating in the long run lower market prices, i.e. in line with the worldwide market.

The government reduced barriers to entry in this highly capitalistic business in subsidizing the high interest rates charged by Russian banks, thus pushing into the same direction as the quota / duties. A more detailed analyses shows that these subsidies are indeed financed by the cash-in the government makes on import duties.

As a consequence, industrial production of pigs has been multiplied by 4.5 since 2005 when program was launched, but there is still along way to go: Russia imported 25% of its pork meat consumption in 2013.

Слайд 23III- Aim of a Company

3.2- Who runs the show?

The contributions of

the different business partners allow the company to create “Value

Added” = Sales - Purchases.Value Added is shared among the company (asset base) and rewards the different business partners (wages, taxes, interests and profits) compensating for their respective resource contribution (labor, infrastructure, loan, capital).

Bot the initiative of creating the company and the highest risk level go to the shareholders which make them standing in the position of the “conductor” of the orchestra.

Provided that the other business partners get their reward according to business contracts (wages, interests) or law provisions (taxes), the shareholders can manage the company in short and long term so as to maximize their interest, i.e. ROE.

In a capitalistic economy, the shareholders run the show!

Слайд 24IV- What accounts to produce?

4.1- 3 different statements

The Balance sheet is

a “picture” at a given point in time outlining the

Assets, Debts and Equity of the company.The Profit & Loss Statement outlines the revenues, costs and profits generated by the company during a given period of time.

The Cash Flow Statement outlines the in and out flows of money during a given period of time.

All 3 statements provide valuable information about the company which cannot be fully understood with only 1 or 2 of these statements. As a consequence: Always go for the full set.