Слайд 1

Marx In High Technology Era: Globalisation, Capital And Class

Evolution of

the Marx’s Surplus Value Concept in the conditions of the

Transformation of Technological Generation

Elena Tkachenko

Saint Petersburg State University of Economics (St. Petersburg, Russia)

27th of October, 2018 Jesus College , Webb Library, Cambridge, United Kingdom

New Industrial Development Institute (NIDI)

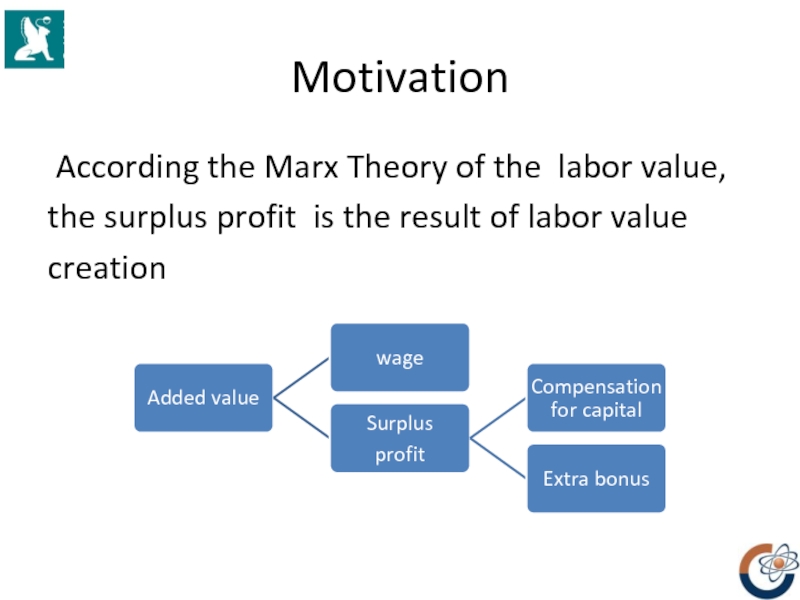

Слайд 2Motivation

According the Marx Theory of the labor value, the

surplus profit is the result of labor value creation

Слайд 3Motivation

The intellectual capital of an enterprise is a very complicated

and dynamic system consisting of interdependent and interpenetrating elements. The

cost of these elements changes under the influence of both internal and external factors of diverse nature and controverse dynamics. Roos, G. Pike, S. and Fernstrom, L. (2005), Dumay (2009) and Bratianu (2018).

Слайд 4Research Methodology

Our research is based on the methods of observation,

data collection, analysis and synthesis, mathematical modeling in economics and

financial modeling.

In addition, polling methods (questioning) and personal interviews have been used in this research.

Слайд 5Dispute of two Cambridge on the capital nature

Piero Sraffa, Joan

Robinson, Luigi Pasinetti, Pierandzhelo Garenyany as representatives of the English

school, Paul Samuelson, Robert Solow, Frank Khan and Christopher Bliss — the American (neoclassical) school.

Dispute essence:

role and, as a result, measurement of the capital in industrial capitalist societies

economic processes don't result in balance, and therefore the analysis of balance can't be considered the adequate tool for a research of processes of growth and accumulation of the capital.

Polemic value of ideological representations in a situation when conclusions from simple models are unstable

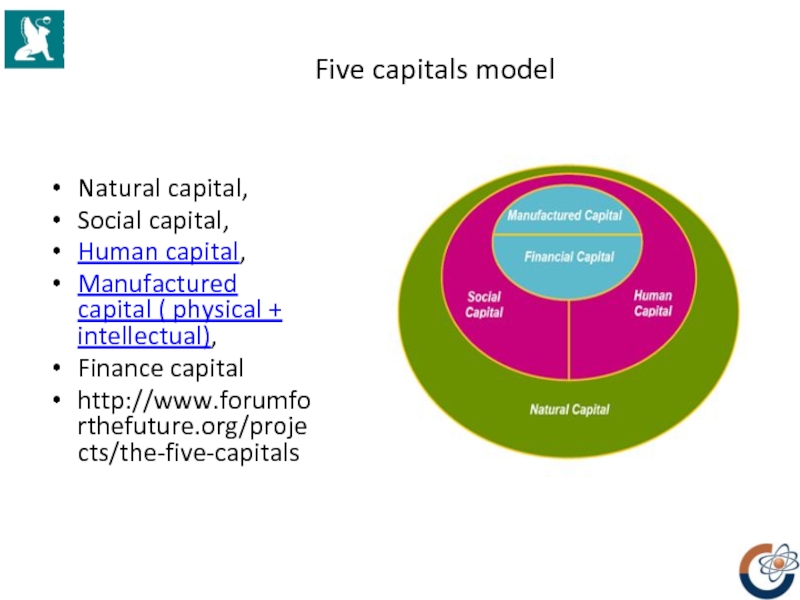

Слайд 6Five capitals model

Natural capital,

Social capital,

Human capital,

Manufactured capital

( physical + intellectual),

Finance capital

http://www.forumforthefuture.org/projects/the-five-capitals

Слайд 7Surplus profit method (capitalization of goodwill) is separately identified among

them as a method which the most correctly meets the

conditions of the cost approach to business. It is connected with one more classification of non-material resources of the enterprise which allows to possess:

business goodwill (undivided intangible assets);

personal goodwill;

identifiable intangible assets

Слайд 8To reveal the relationship between intellectual capital investments and companies’

financial performance, we carried out a survey of top managers

of enterprises in St. Petersburg and Leningrad Region from January to May 2018. We selected sectors of shipbuilding industry with high level of innovation activities because these are the sectors where enterprises generally invest in intangibles, including technologies, research and development, human capital, brands etc.

Regression analysis

Слайд 9

Regression analysis

Also we considered whether an intellectual capital management system

or, at least, its elements exist within a company. The

primary sample contained top managers of 87 companies.

At the first stage it revealed that from 87 companies that formed the sample, only 40 private companies approved their interest in IC management and answered negatively at the question on implication of intellectual capital management methods in their practice. We included them at the sample for the second stage of the study.

Слайд 10Regression analysis

Respondents were asked to state how they would estimate

the investments in the following items of intellectual capital for

the previous three years:

1 – investments in technologies

2 – investments in human capital

3 – investments in brands.

The suggested answers were converted into points from 0 to 3, as illustrated in Table 3.

Слайд 12Regression analysis

To estimate financial performance, we asked respondents to express

their opinion on the financial stability of their enterprises and

proposed the following answers:

0 points – financial stability decreased

1 point – financial stability remained unchanged

2 points – financial stability increased. .

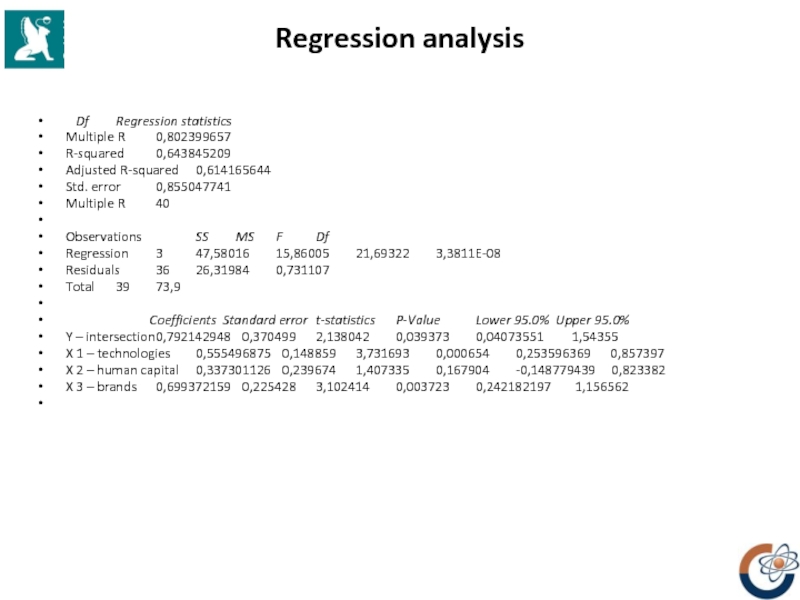

Слайд 13Regression analysis

Df Regression statistics

Multiple R 0,802399657

R-squared 0,643845209

Adjusted R-squared 0,614165644

Std. error 0,855047741

Multiple R 40

Observations SS MS F Df

Regression 3 47,58016 15,86005 21,69322 3,3811E-08

Residuals 36 26,31984 0,731107

Total 39 73,9

Coefficients Standard

error t-statistics P-Value Lower 95.0% Upper 95.0%

Y – intersection 0,792142948 0,370499 2,138042 0,039373 0,04073551 1,54355

X 1 – technologies 0,555496875 0,148859 3,731693 0,000654 0,253596369 0,857397

X 2 – human capital 0,337301126 0,239674 1,407335 0,167904 -0,148779439 0,823382

X 3 – brands 0,699372159 0,225428 3,102414 0,003723 0,242182197 1,156562

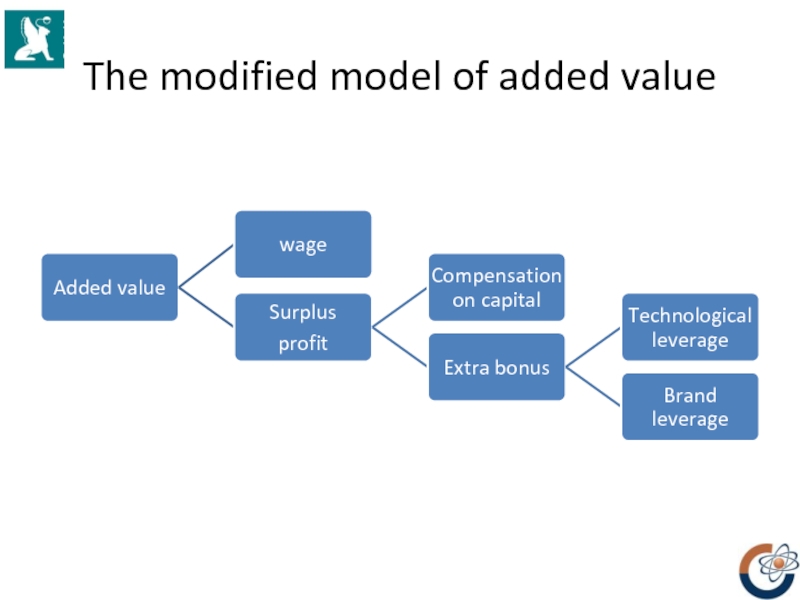

Слайд 14The modified model of added value

Слайд 15

Conclusion

The dispute on the capital nature in modern conditions can

be resolved by account on the different parties of balance

the financial capital and the production capital including the physical capital, the natural capital and the intellectual capital

The new essence of the surplus value is that intellectual capital becomes her source.

In ideal model of fair strategic development the financial capital must invest the surplus income in development of technologies and respectively has to limit consumption

The value of the intellectual capital can be estimated on the bases of surplus profit creation

Слайд 16Thank you for your attention

Your questions?