Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Merchandising Operations Horngren’s Accounting Lecture Twelve Lisa, Li 1

Содержание

- 1. Merchandising Operations Horngren’s Accounting Lecture Twelve Lisa, Li 1

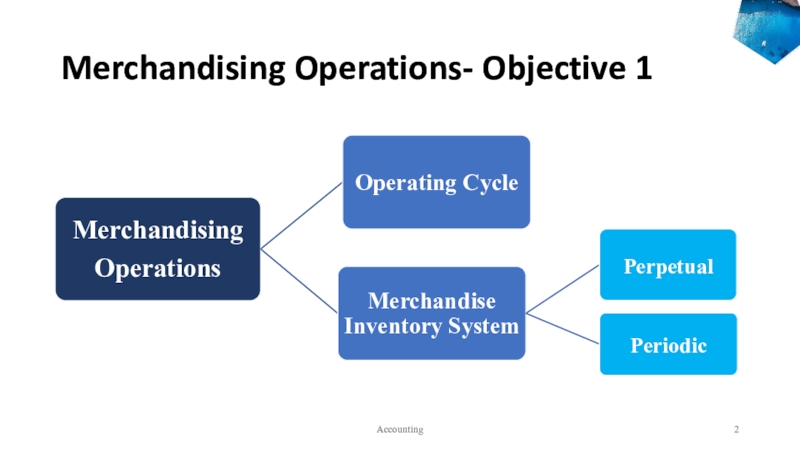

- 2. Merchandising Operations- Objective 1Accounting

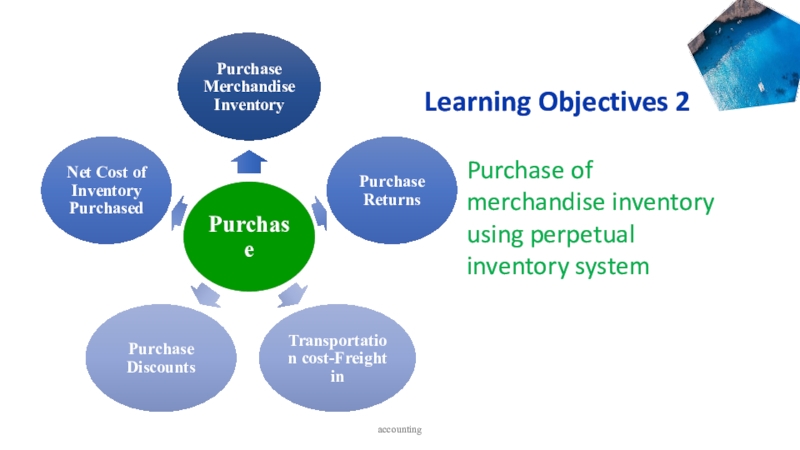

- 3. accounting Learning Objectives 2Purchase of merchandise inventory using perpetual inventory system

- 4. accounting Learning Objectives 3 Account

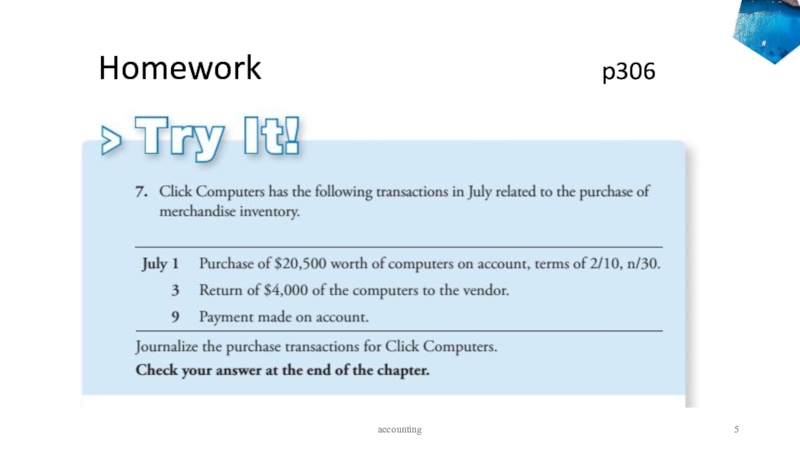

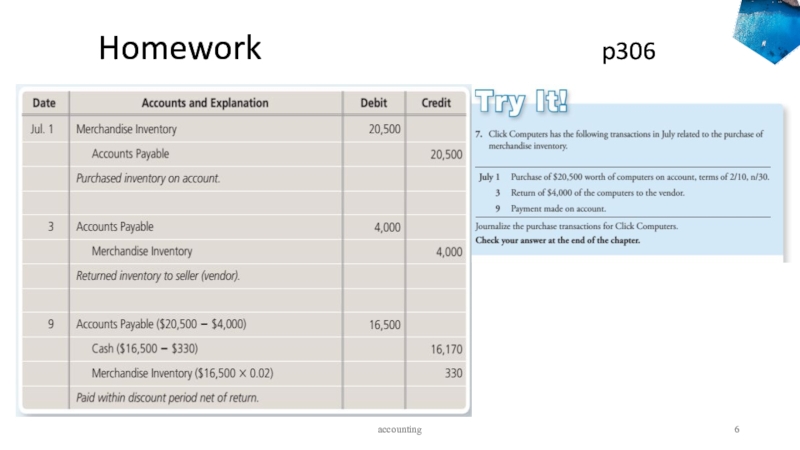

- 5. Homework

- 6. Homework

- 7. Homework

- 8. Homework

- 9. Learning Objectives –

- 10. Learning Objectives –

- 11. accounting Learning Objectives 3 Account

- 12. 4. Transportation Cost - Freight OutThe freight

- 13. 5. Net Sales RevenueFor the year, Smart

- 14. 5. Net Sales RevenueFor the year, Smart

- 15. 6. Gross ProfitThe difference between Net Sales

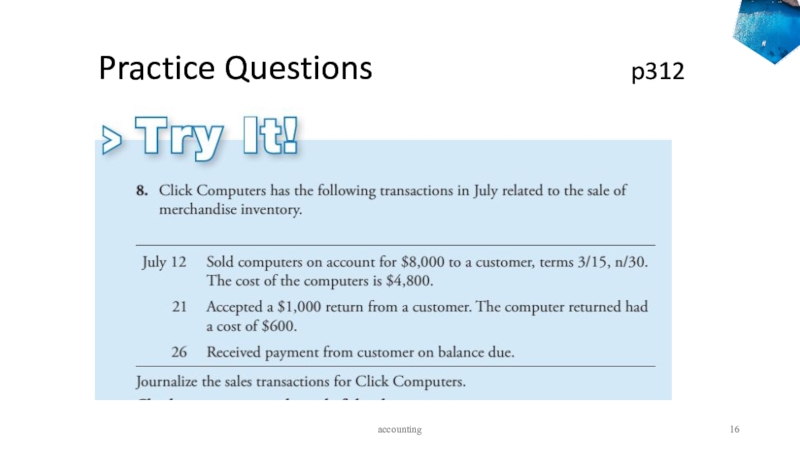

- 16. Practice Questions

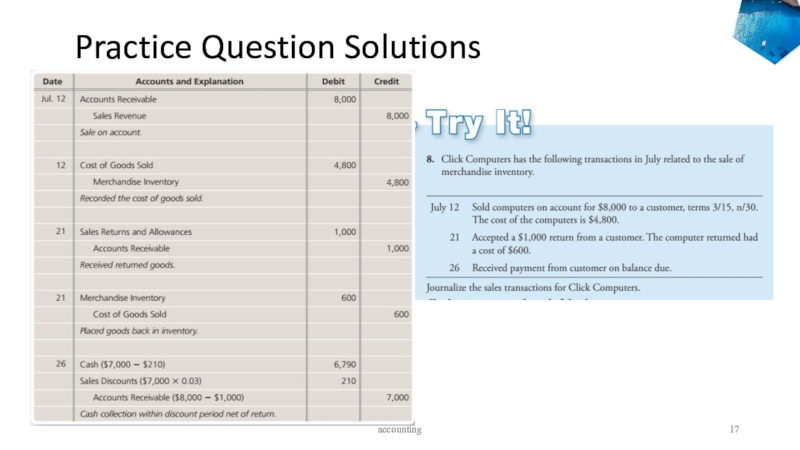

- 17. Practice Question Solutionsaccounting

- 18. Learning Objectives 4 Adjust and close the accounts of a merchandising businessAccounting

- 19. Adjusting Merchandise InventoryAt the end of

- 20. Adjusting Merchandise InventorySmart Touch Learning’s Merchandise

- 21. Closing the Accounts of a MerchandiserClose R

- 22. 5-accounting Closing in a Merchandiser

- 23. Closing the Accounts of a MerchandiserAt this

- 24. Learning Objectives 5 Prepare a merchandiser’s financial statementsAccounting

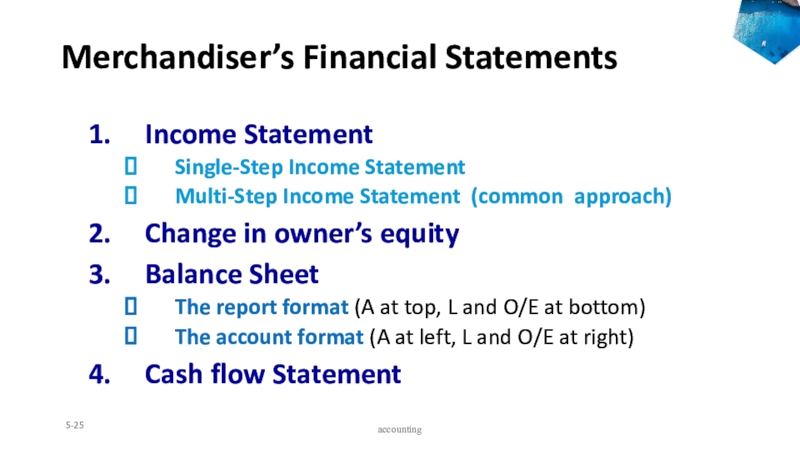

- 25. Merchandiser’s Financial StatementsIncome StatementSingle-Step Income StatementMulti-Step Income

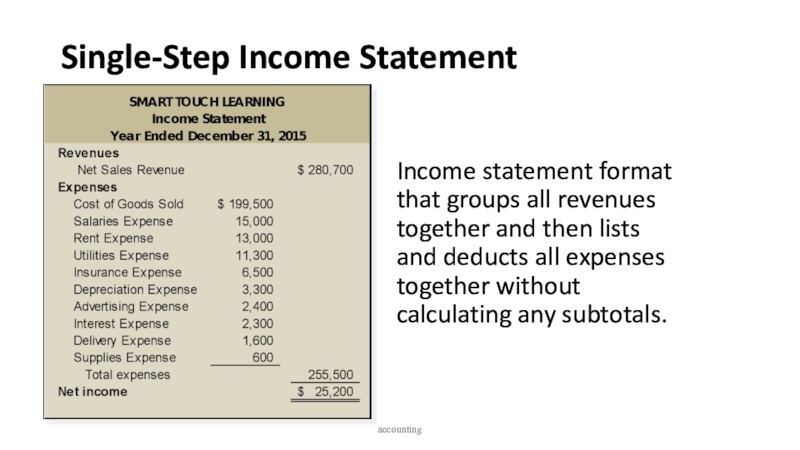

- 26. Single-Step Income StatementIncome statement format that groups

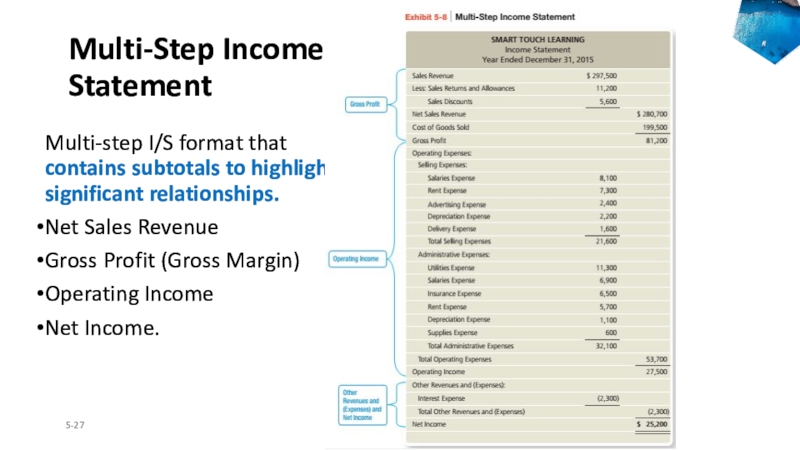

- 27. Multi-Step Income StatementMulti-step I/S format that

- 28. Multi-Step Income StatementCOGS: is also called

- 29. Operating Expenses: Expenses (other than COGS) that

- 30. Other revenues and expenses: Revenues or expenses

- 31. Statement of Owner’s Equity and the B/SA

- 32. Learning Objectives 6 Use the gross profit percentage to evaluate business performanceAccounting

- 33. Gross Profit PercentageMeasures the profitability of each

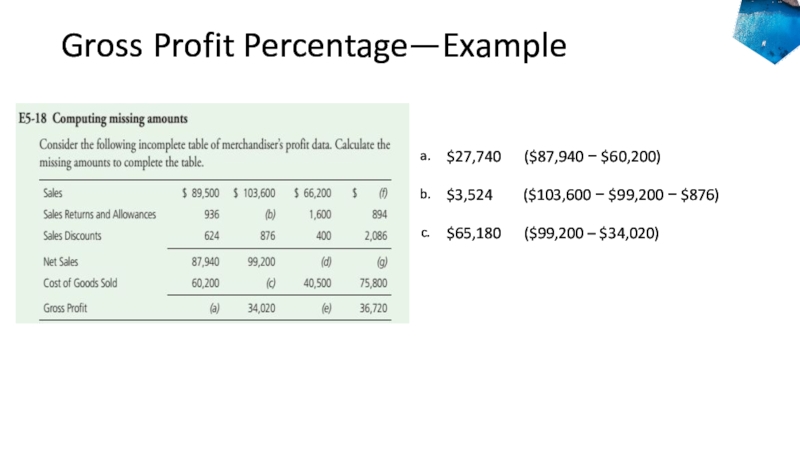

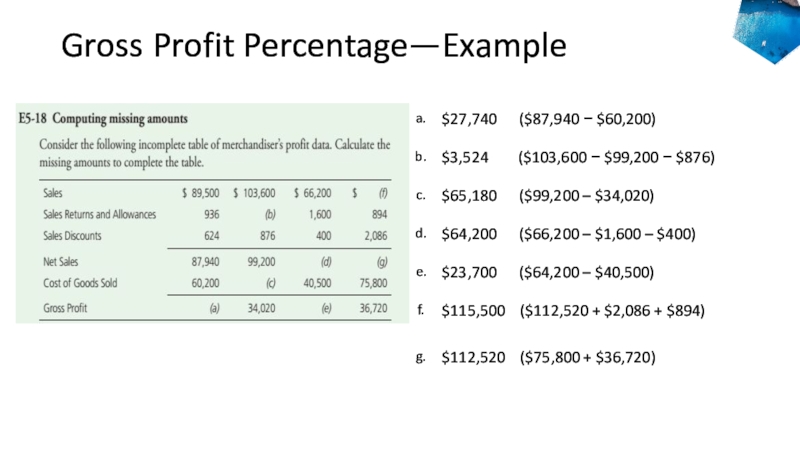

- 34. Gross Profit Percentage—Example

- 35. Gross Profit Percentage—Example

- 36. Gross Profit Percentage—Example

- 37. Gross Profit Percentage—Example

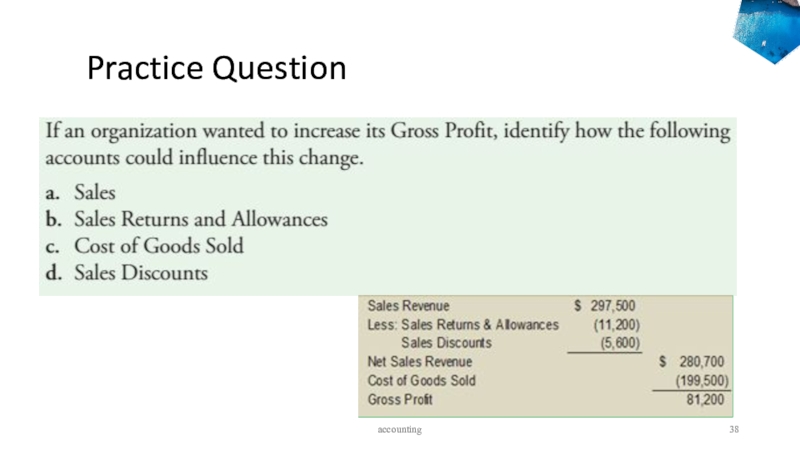

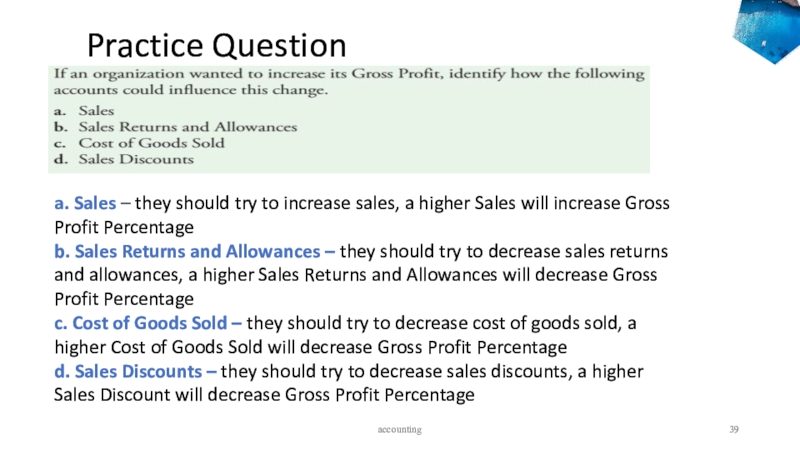

- 38. Practice Question accounting

- 39. Practice Question accounting a. Sales

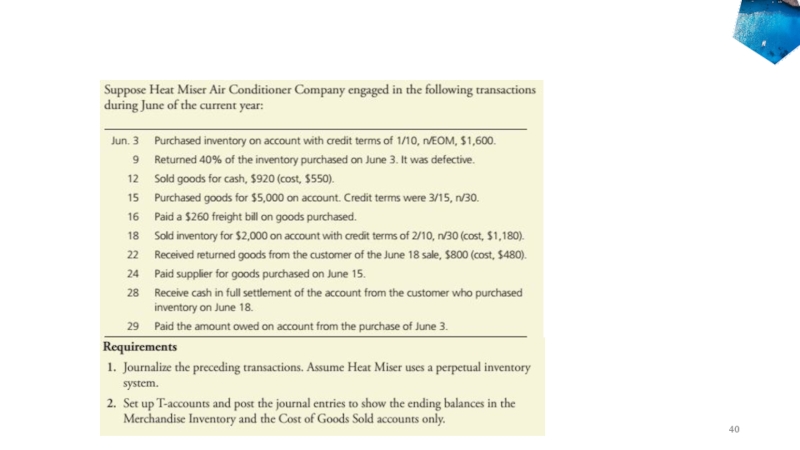

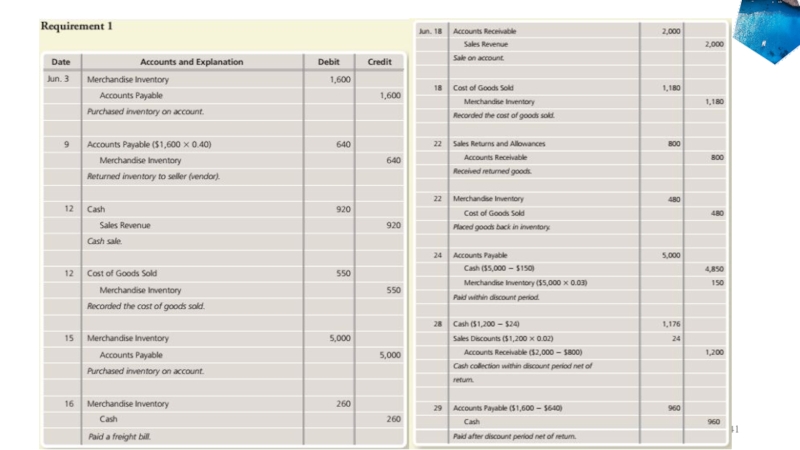

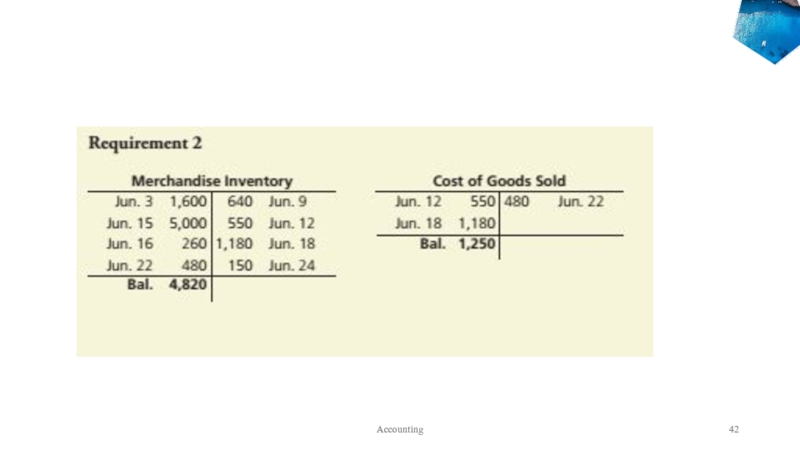

- 40. Example – Summary Problem 5-1Accounting

- 41. Accounting

- 42. Summary Problem 5-1Accounting

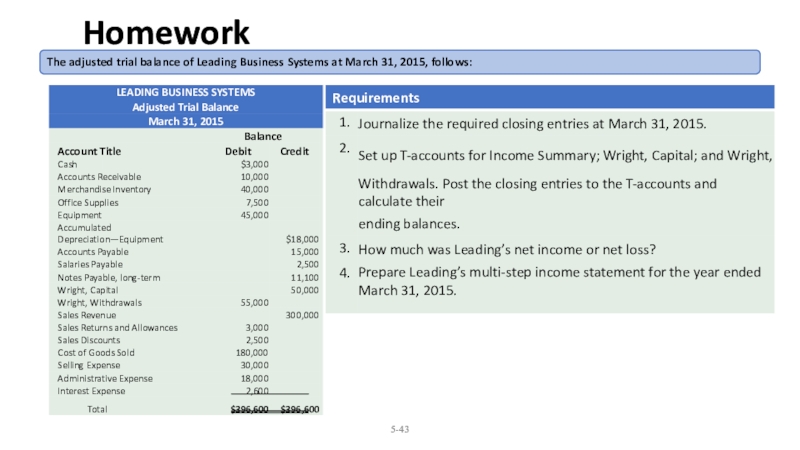

- 43. 5-The adjusted trial balance of Leading Business Systems at March 31, 2015, follows:Homework

- 44. The End of Chapter 5

- 45. Скачать презентанцию

Слайды и текст этой презентации

Слайд 3accounting

Learning Objectives 2

Purchase of merchandise inventory using perpetual inventory

system

Слайд 4accounting

Learning Objectives 3

Account for the sale

of merchandise inventory using a perpetual inventory system

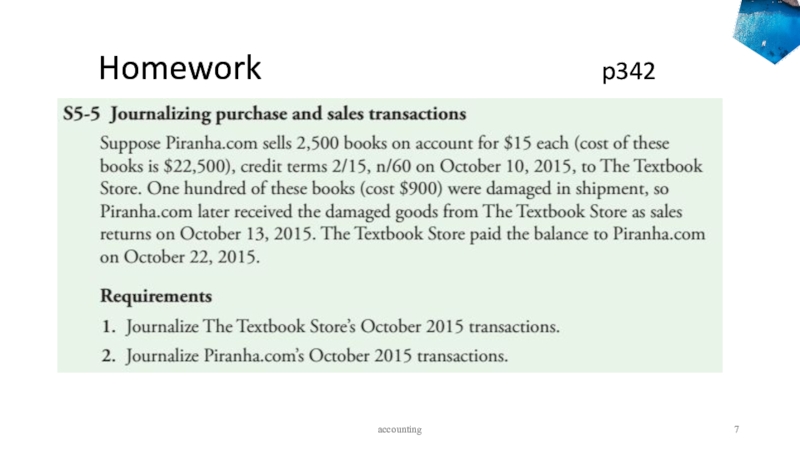

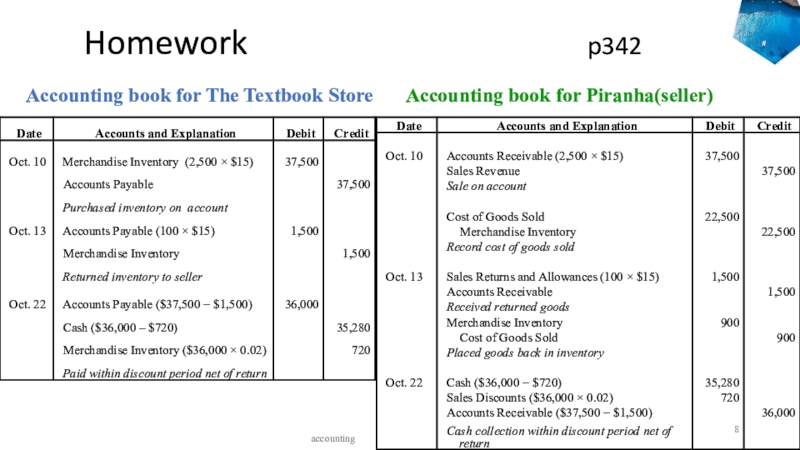

Слайд 8 Homework

p342

accounting

Accounting book for The Textbook Store

Accounting book for Piranha(seller)

Слайд 9Learning Objectives

– Chapter 5

Describe merchandising operations

and the two types of merchandise inventory systems

Account for the

purchase of merchandise inventory using a perpetual inventory systemAccount for the sale of merchandise inventory using a perpetual inventory system

Accounting

Слайд 10Learning Objectives

– Chapter 5

Adjust and close

the accounts of a merchandising business

Prepare a merchandiser’s financial statements

Use

the gross profit percentage to evaluate business performanceAccounting

Слайд 11accounting

Learning Objectives 3

Account for the sale

of merchandise inventory using a perpetual inventory system

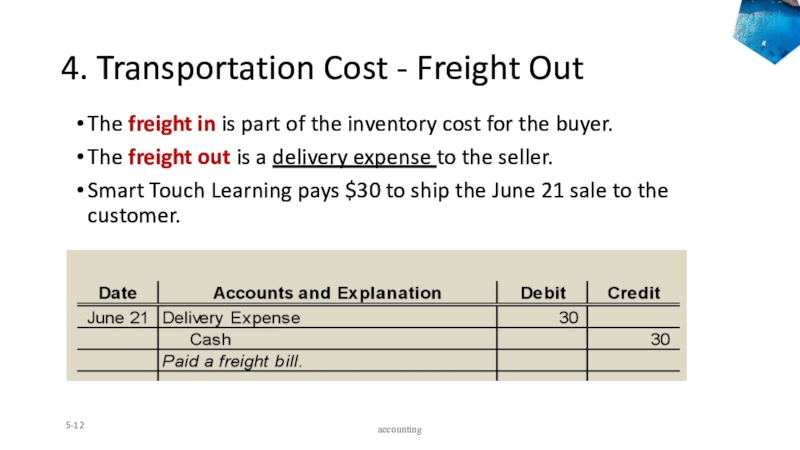

Слайд 124. Transportation Cost - Freight Out

The freight in is part

of the inventory cost for the buyer.

The freight out is

a delivery expense to the seller.Smart Touch Learning pays $30 to ship the June 21 sale to the customer.

5-

accounting

Слайд 135. Net Sales Revenue

For the year, Smart Touch Learning sells

$297,500 of merchandise inventory. They process $11,200 of sales returns

and allowances, and they award $5,600 of sales discounts.What is Net Sales Revenue for the year?

5-

accounting

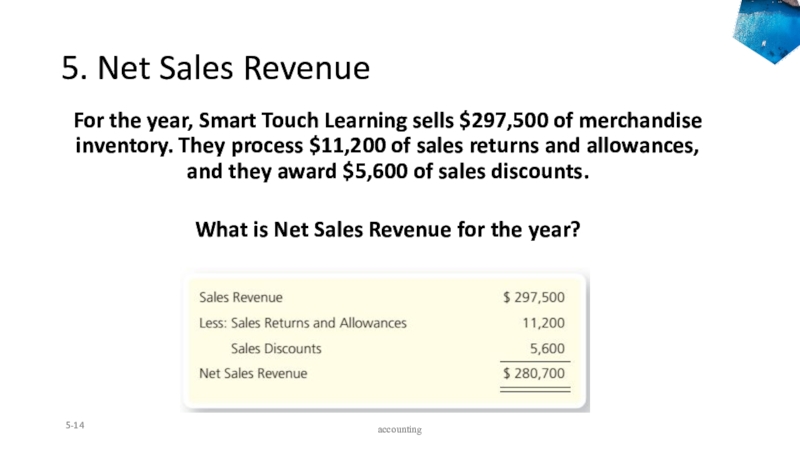

Слайд 145. Net Sales Revenue

For the year, Smart Touch Learning sells

$297,500 of merchandise inventory. They process $11,200 of sales returns

and allowances, and they award $5,600 of sales discounts.What is Net Sales Revenue for the year?

5-

accounting

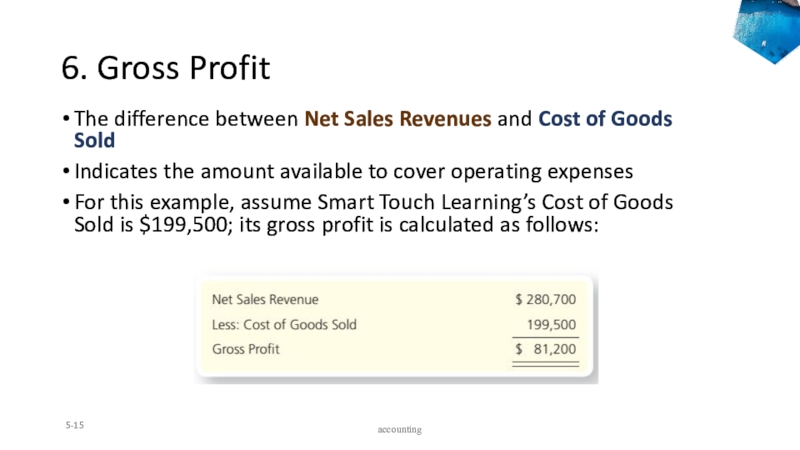

Слайд 156. Gross Profit

The difference between Net Sales Revenues and Cost

of Goods Sold

Indicates the amount available to cover operating expenses

For

this example, assume Smart Touch Learning’s Cost of Goods Sold is $199,500; its gross profit is calculated as follows:5-

accounting

Слайд 19 Adjusting Merchandise Inventory

At the end of the period, actual

inventory on hand may differ from the accounting records in

perpetual inventory system.This difference can occur because of:

Theft

Damage

Errors

‘Merchandise Inventory’ account must be adjusted at the end of the period

accounting

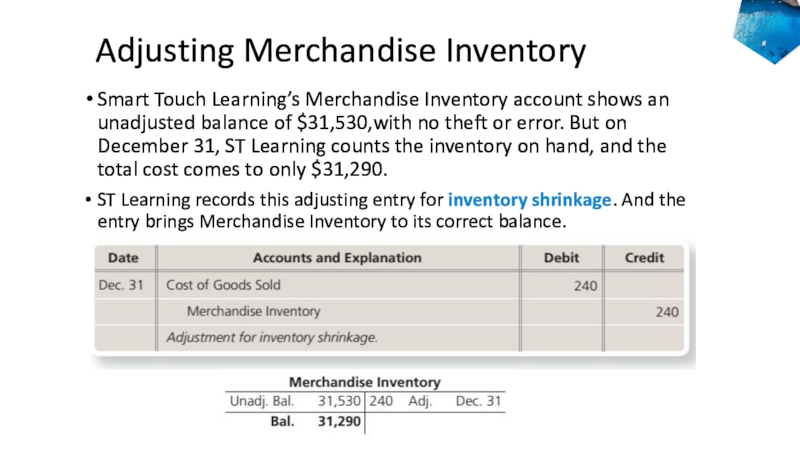

Слайд 20 Adjusting Merchandise Inventory

Smart Touch Learning’s Merchandise Inventory account shows

an unadjusted balance of $31,530,with no theft or error. But

on December 31, ST Learning counts the inventory on hand, and the total cost comes to only $31,290.ST Learning records this adjusting entry for inventory shrinkage. And the entry brings Merchandise Inventory to its correct balance.

accounting

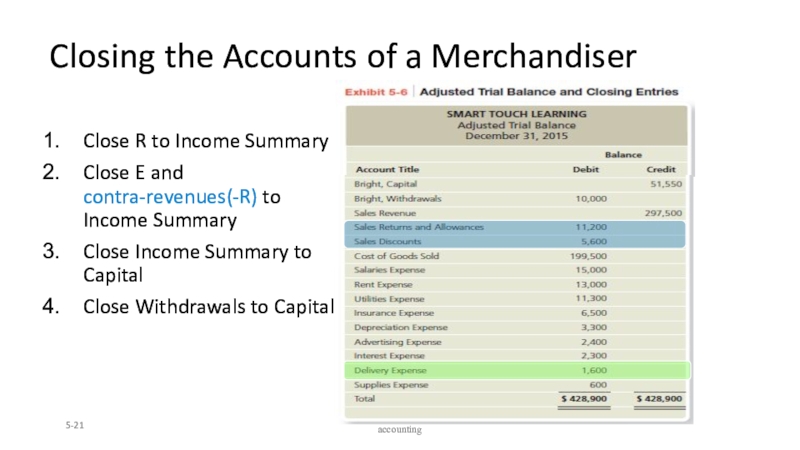

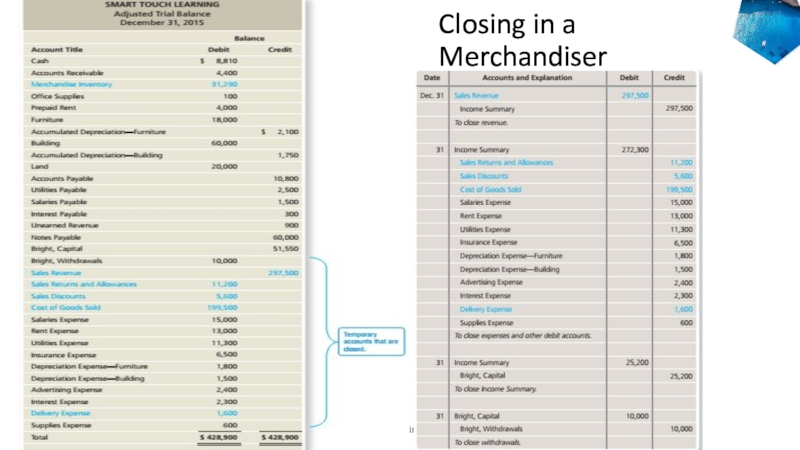

Слайд 21Closing the Accounts of a Merchandiser

Close R to Income Summary

Close

E and contra-revenues(-R) to Income Summary

Close Income Summary to Capital

Close

Withdrawals to Capital5-

accounting

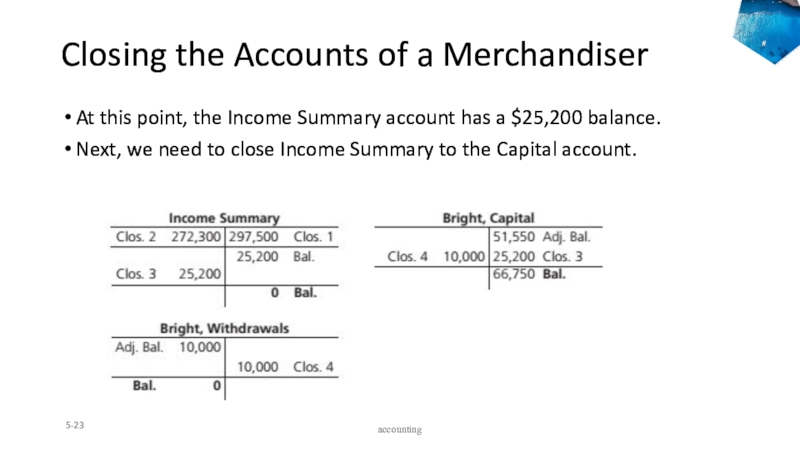

Слайд 23Closing the Accounts of a Merchandiser

At this point, the Income

Summary account has a $25,200 balance.

Next, we need to close

Income Summary to the Capital account.5-

accounting

Слайд 25Merchandiser’s Financial Statements

Income Statement

Single-Step Income Statement

Multi-Step Income Statement (common approach)

Change

in owner’s equity

Balance Sheet

The report format (A at top, L

and O/E at bottom)The account format (A at left, L and O/E at right)

Cash flow Statement

5-

accounting

Слайд 26Single-Step Income Statement

Income statement format that groups all revenues together

and then lists and deducts all expenses together without calculating

any subtotals.accounting

Слайд 27Multi-Step Income

Statement

Multi-step I/S format that contains subtotals to highlight

significant relationships.

Net Sales Revenue

Gross Profit (Gross Margin)

Operating Income

Net Income.

5-

accounting

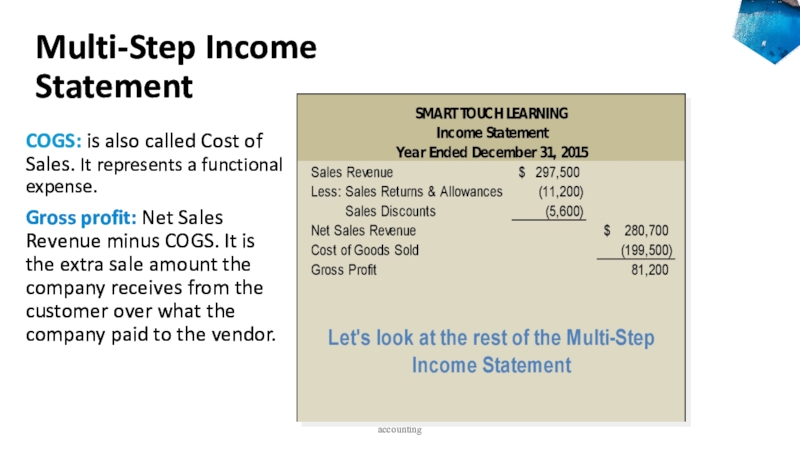

Слайд 28Multi-Step Income

Statement

COGS: is also called Cost of Sales. It

represents a functional expense.

Gross profit: Net Sales Revenue minus COGS.

It is the extra sale amount the company receives from the customer over what the company paid to the vendor. accounting

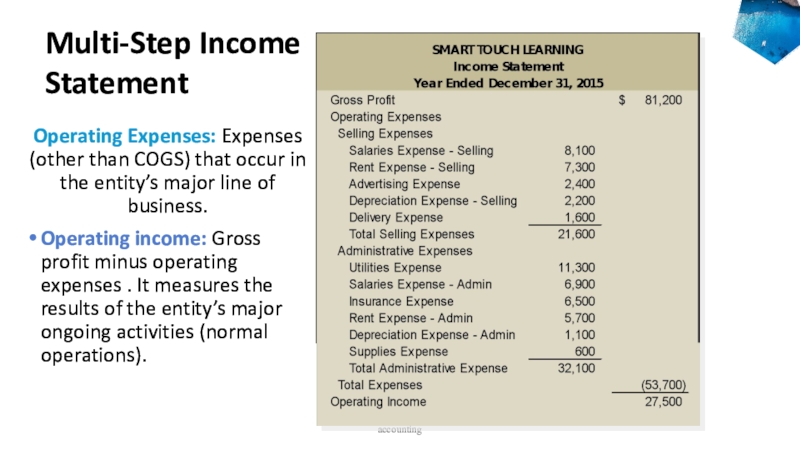

Слайд 29Operating Expenses: Expenses (other than COGS) that occur in the

entity’s major line of business.

Operating income: Gross profit minus operating

expenses . It measures the results of the entity’s major ongoing activities (normal operations).accounting

Multi-Step Income Statement

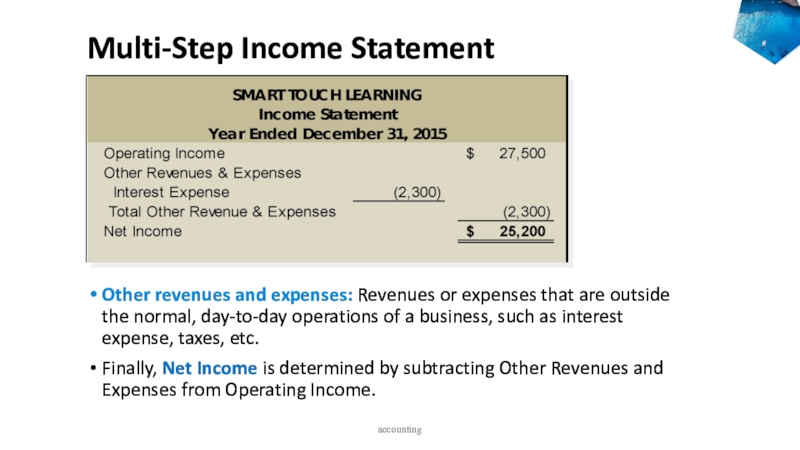

Слайд 30Other revenues and expenses: Revenues or expenses that are outside

the normal, day-to-day operations of a business, such as interest

expense, taxes, etc.Finally, Net Income is determined by subtracting Other Revenues and Expenses from Operating Income.

accounting

Multi-Step Income Statement

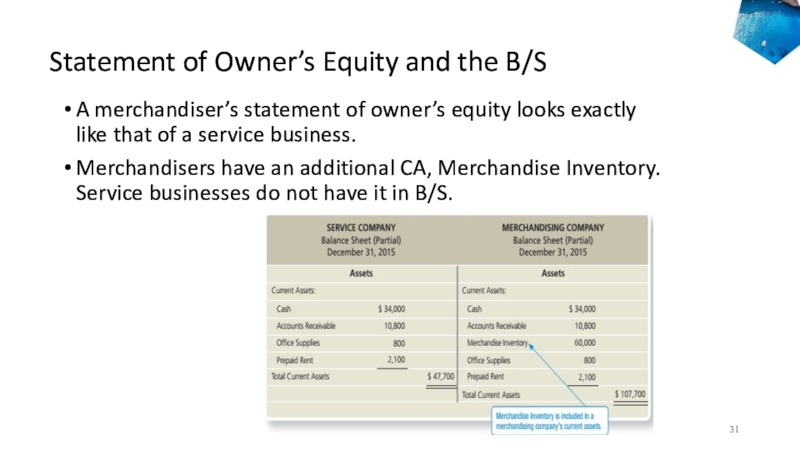

Слайд 31Statement of Owner’s Equity and the B/S

A merchandiser’s statement of

owner’s equity looks exactly like that of a service business.

Merchandisers have an additional CA, Merchandise Inventory. Service businesses do not have it in B/S.

Accounting

Слайд 32Learning Objectives 6

Use the gross profit percentage

to evaluate business performance

Accounting

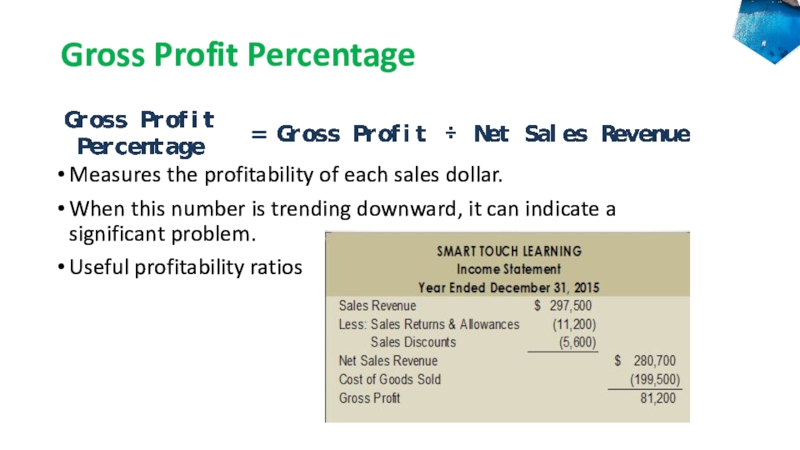

Слайд 33Gross Profit Percentage

Measures the profitability of each sales dollar.

When this

number is trending downward, it can indicate a significant problem.

Useful

profitability ratiosСлайд 39 Practice Question

accounting

a. Sales – they should

try to increase sales, a higher Sales will increase Gross

Profit Percentageb. Sales Returns and Allowances – they should try to decrease sales returns and allowances, a higher Sales Returns and Allowances will decrease Gross Profit Percentage

c. Cost of Goods Sold – they should try to decrease cost of goods sold, a higher Cost of Goods Sold will decrease Gross Profit Percentage

d. Sales Discounts – they should try to decrease sales discounts, a higher Sales Discount will decrease Gross Profit Percentage