Слайд 1

Portfolio Construction

Mikhail Kamrotov

Data Analysis in Economics and Finance

Слайд 2Satisfying vs optimal

Simple rules are often far more robust than

complicated ”optimal” alternatives

Rules of thumb work surprisingly well in a

variety of fields (Haldane, 2012)

Reasons:

“collecting and processing the information necessary for complex decision-making is costly”

“fully defining future states of the world, and probability‑weighting them, is beyond anyone’s cognitive limits”

Oversimplifying things is obviously bad as well

Слайд 3Simplicity in portfolio theory

“One should always divide his wealth into

three parts: a third in land, a third in merchandise,

and a third ready to hand.”

Source: Rabbi Isaac bar Aha, Babylonian Talmud: Tractate Baba Mezi’a, folio 42a, 4th century

Empirically valid statement

Naïve, equal-weight portfolio frequently delivers better results than “optimal” allocation strategies (DeMiguel, 2005)

Let’s test this simple allocation strategy!

Слайд 4Steps of strategy evaluation

Formally define rules for decision-making

Collect data and

clean it

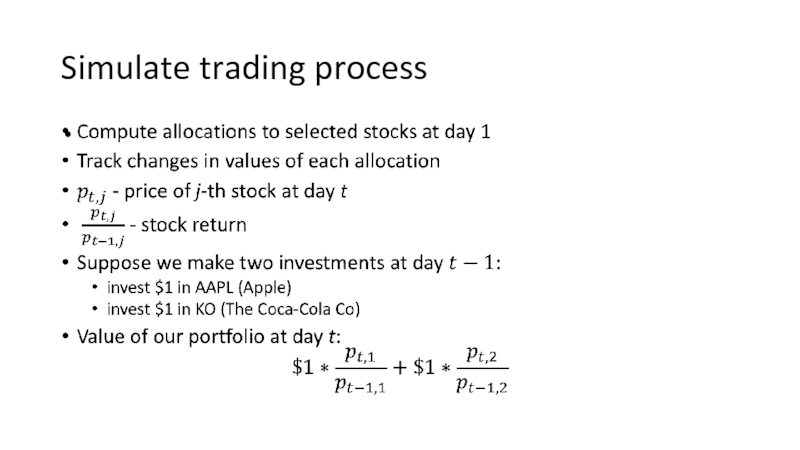

Simulate trading process

Compare the results to the benchmark

Compute performance

metrics

Слайд 5Decision-making rules

Distribute the initial capital equally between N stocks

Example:

Initial capital:

$1000

10 stocks

You invest $100 in each stock and stay away

from the market for a while

Looks simple!

Слайд 6Not so simple in fact

How to choose N stocks (assets)

to invest in?

Infinite possible solutions:

All US stocks

All stocks in the

world

All stocks, bonds, currencies, real estate – everything

Only stocks that satisfy specific conditions (most liquid stocks, stocks of the largest companies, stocks with low P/E ratio, etc.)

Result crucially depends on the answer

Universe of securities is a set of stocks (assets) you’re focusing on

Слайд 7Universe of securities

We will look at largest US companies by

market capitalization

Capitalization = Number of shares * Price of one

share

Components of Russell 1000

Pay attention to the methodology of index (sections 6.1.1 and 6.10.1 in Russell_methodology.pdf)

Russell 1000 defines universe of ~1000 largest US companies

They account for ~90% of total market capitalization

You can try S&P 500 and DJIA as well, or apply any custom filter: dividends, P/E, most volatile stocks, etc.

Слайд 8Data collection

We need daily close prices for all Russell 1000

components

Yahoo! Finance is one of the options

Yahoo! close prices are

now split adjusted

Split example:

In June 2014 Apple shares were at ~$700 per share

A 7-to-1 split was implemented by Apple in June

Each stock you owned turned into 7 stocks and the price went down to ~$100

Split adjusted prices mean that all prices before the split are divided by 7

Слайд 10Compare result with the benchmark

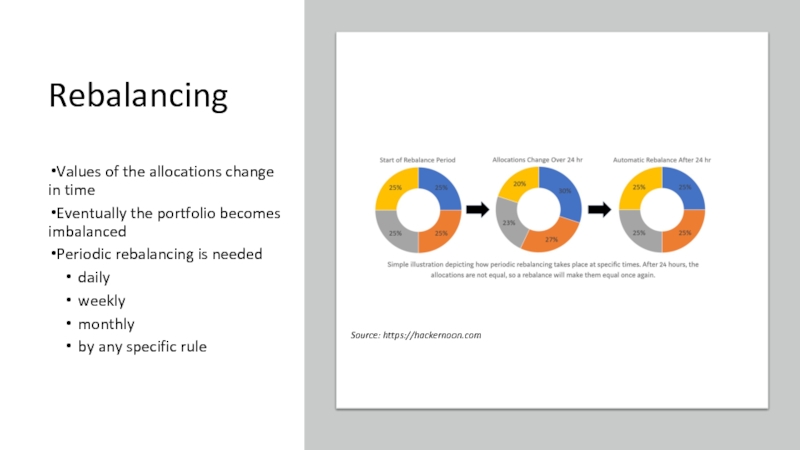

Слайд 11Rebalancing

Values of the allocations change in time

Eventually the portfolio becomes

imbalanced

Periodic rebalancing is needed

daily

weekly

monthly

by any specific rule

Source: https://hackernoon.com

Слайд 12Backtest pitfalls

Survivorship bias

we picked only companies that didn’t go bankrupt

moreover,

they were eventually included in Russell 1000 – we picked

the best ones

No trading costs

Trading on close prices is impossible

Stocks are not sold in fractions

See “A Practitioner’s Guide to Assessing Strategies and Avoiding Pitfalls” and chapter 3 of “Successful Algorithmic Trading” (M. Halls-Moore, 2015) for advanced details

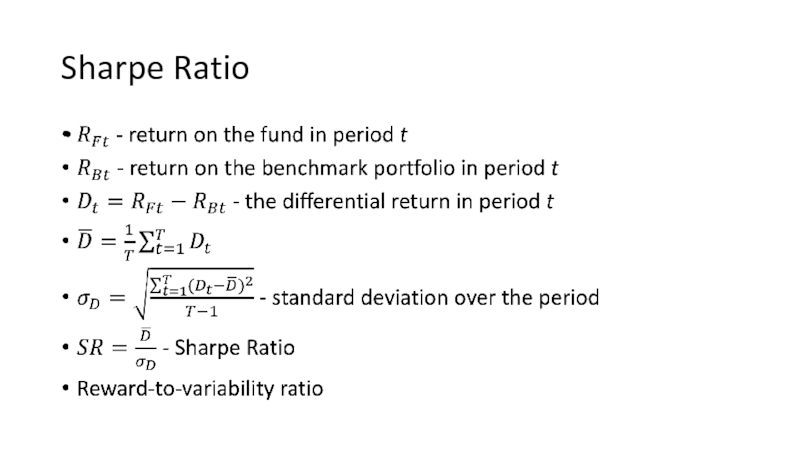

Слайд 13Measures of risk and return

Mean

Variance

Standard deviation

Covariance

Correlation

Слайд 15Covariance and correlation

Diversification implies distributing investments between different assets

“Don’t put

all your eggs in one basket”

Investing in 1000 similar stocks

does not spread your risks

Covariance and correlation measure relationship between variables (assets)

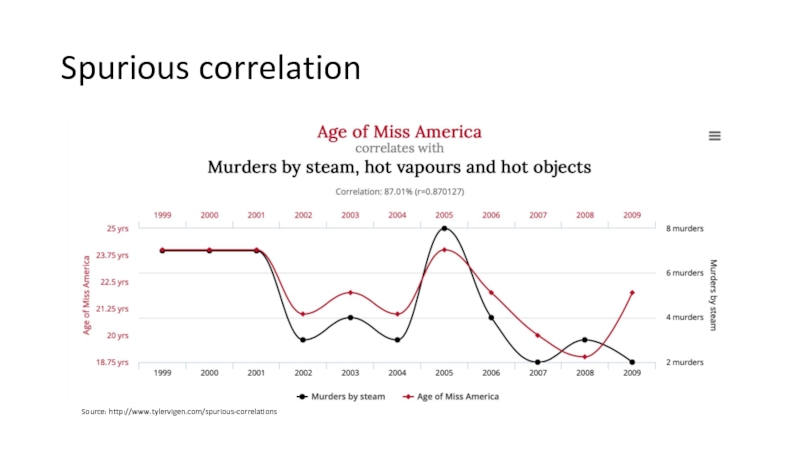

Слайд 18Spurious correlation

Source: http://www.tylervigen.com/spurious-correlations

Слайд 19Covariance matrix

Is used to construct a diversified portfolio

Shows covariances for

all possible pairs of assets

Covariance matrix is symmetric

The diagonal elements

contain the variances

R automatically computes covariance matrix, when cov() is applied to a matrix or a data frame