Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

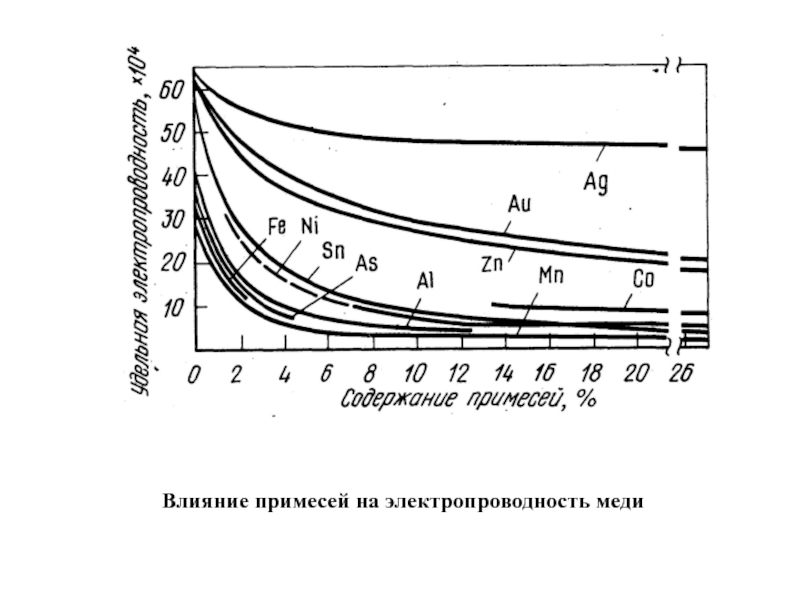

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The future of bank branches. Evstratov Alexander AM2-1

Содержание

- 1. The future of bank branches. Evstratov Alexander AM2-1

- 2. IntroductionBranch bank transformation is motivated by customer

- 3. SpeedSpeedEaseConvenience

- 4. reliabilityAlthough digitally savvy, many consumers still see

- 5. How are people banking?“Expectations & Experiences: Household

- 6. Not unexpectedly, seniors (63%) and boomers

- 7. Many banks already are shifting how they

- 8. The number of braches in America is

- 9. ConclusionBanks must adapt to the reality that

- 10. Conclusion

- 11. Скачать презентанцию

IntroductionBranch bank transformation is motivated by customer demand for “convenience and the ability to do business anytime and everywhere”.

Слайды и текст этой презентации

Слайд 2Introduction

Branch bank transformation is motivated by customer demand for “convenience

and the ability to do business anytime and everywhere”.

Слайд 4reliability

Although digitally savvy, many consumers still see the physical branch

as highly relevant and a vital component of their financial

lives.Слайд 5How are people banking?

“Expectations & Experiences: Household Finances” survey

More consumers

(39 %) prefer in-person interaction to online contact (36 %)

as their primary avenue when they engage with a financial institution.Слайд 6 Not unexpectedly, seniors (63%) and boomers (45%) are most

likely to visit a branch.

But a significant number of early

(25%) and late (24%) millennials also prefer in-person experiences.Branches boast Solid roots

Слайд 7Many banks already are shifting how they do business to

meet this “anytime, anywhere” mindset, with services such as instant

card issuance more readily available.More than half of consumers say that access to convenient services such as immediate card issuance would influence where they bank.

Fulfilling the need for full speed

Слайд 8The number of braches in America is decreasing.

In 2017,

the number of bank branches in the US declined from

91,900 to 89,900, a 2,2% decrease.Total branch deposits increased to $11.9 trillion in 2017(5.3% increase)

More business in fewer branches

Слайд 9Conclusion

Banks must adapt to the reality that customers are moving

to digital but still value the branch.

In response, leading banks

will craft a seamless customer experience across physical and digital channels.This is the future of bank branch strategy.