Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

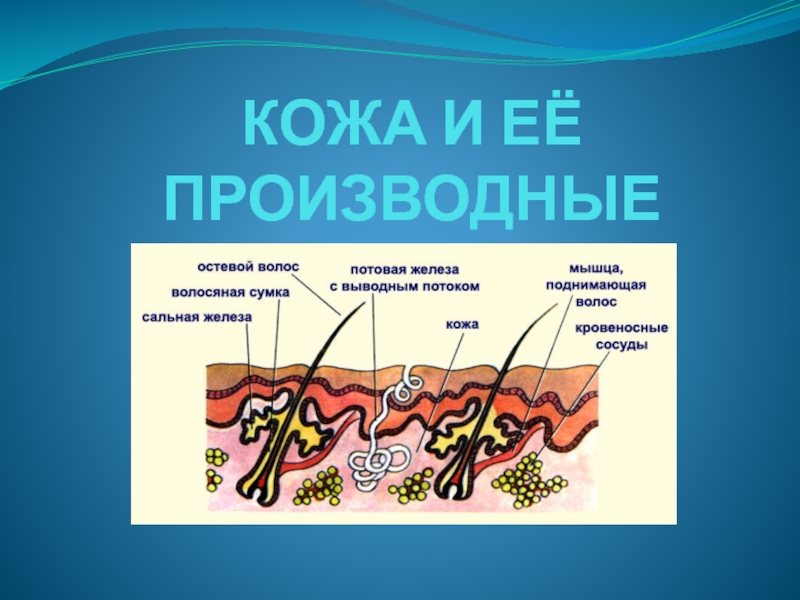

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

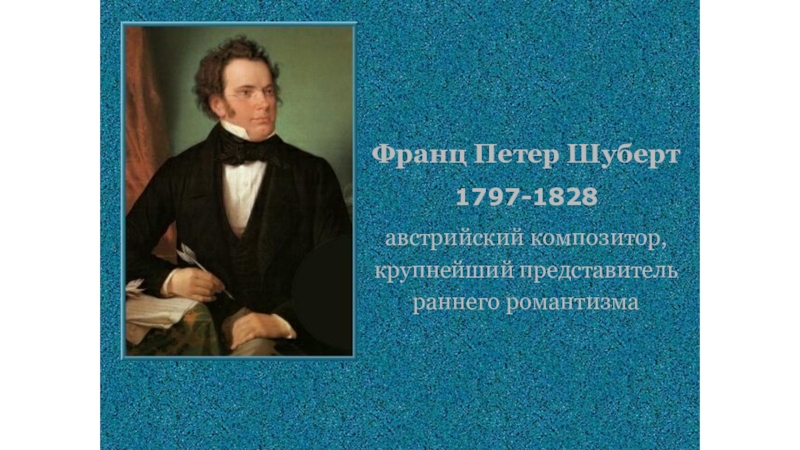

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Benefits and Process of Company Registration in Malaysia

Содержание

- 1. Benefits and Process of Company Registration in Malaysia

- 2. OVERVIEW The investment bank – a division

- 3. Слайд 3

- 4. What are the permitted activities of the

- 5. Transaction banking – The business of providingcredit

- 6. Securities trading – The business of undertakingdifferent

- 7. Why should you choose Labuan for investment

- 8. How to get a Labuan investment bank

- 9. For More Information Contact hereCONTACT US :-

- 10. Слайд 10

- 11. Скачать презентанцию

OVERVIEW The investment bank – a division of a bank or financial institution – provides capital raising and M&A (mergers and acquisitions) advisory services. Labuan investment banking mainly serves governments, corporations,

Слайды и текст этой презентации

Слайд 4What are the permitted activities of the investment bank business?

Labuan

investment bank is permitted to conduct all business activities of

commercial banks, except receiving individual/corporate account deposits. Here are some authorized activities of the investment banking business in Labuan.Transaction banking

Corporate finance

Securities trading

Asset & wealth management

Слайд 5Transaction banking – The business of providing

credit facilities includes activities

like:

• Principle investing

• Trade funding

• Project/asset financing

• Syndication/loan arrangement

Corporate finance

– The business of providingconsultancy and advisory services for corporate

developments like:

• Mergers and acquisitions

• Initial public offerings

• Capital rearrangement

• Debt issuance

Слайд 6Securities trading – The business of undertaking

different types of risk

management activities including:

• Derivatives (interest rate swaps, cross-currency swaps)

• Hedging

(interest rates, LIBOR, etc.)• FOREX (foreign exchange)

• Treasury/government bonds

• Proprietary trading

• Issuance of financial products for sale

Asset & wealth management – The business

of providing consultancy and advisory services relating to

investment matters:

• Private banking

• Wealth management and succession planning process for high net worth individuals

Слайд 7Why should you choose Labuan for investment business?

Labuan brings various

financial benefits together with

improved working conditions including privacy

legislation toprotect to

company assets and details. Formaximum profit, saved money can be invested back into your

firm or elsewhere. Let’s take a look at a few key reasons for

choosing Labuan for the investment banking business.

No tax for non-trading companies

A tax rate of 3 % for trading companies

No capital gains tax

A highly developed legal infrastructure

Strategic location and optimal time zone

A strong economy and low operating costs

Flexibility for Labuan Banks to conduct business in designated areas of Malaysia

Слайд 8How to get a Labuan investment bank license?

There are many

criteria for Labuan investment

banking license. Make sure you follow one

ofthem to be eligible for this license. Criteria include:

An investment bank should be licensed by the regulatory authority in the country of origin; or

An established financial institution or an experienced bankshould be supervised by a competent regulatory authority; or

The bank should have at least three years’ experience in the financial industry with a good track record