Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Classical Theories of International Trade

Содержание

- 1. Classical Theories of International Trade

- 2. Lecture 4Evolution of Trade

- 3. Comparative AdvantageIn economics, the law of comparative advantage refers

- 4. Absolute Advantage versus Comparative AdvantageA country enjoys

- 5. Absolute Advantage versus Comparative AdvantageA country enjoys

- 6. Comparative AdvantageDavid Ricardo: Principles of Political

- 7. Ricardo's Assumptions

- 8. Ricardo's AssumptionsLabour is homogeneous i.e. identical in

- 9. Gains from Comparative AdvantageEven if a country

- 10. Gains from Comparative AdvantageWhen countries specialize in

- 11. Why would trade occur if one country

- 12. India - Opportunity Costs1 Machine =

- 13. The U.S. has a greater absolute advantage

- 14. Even though U.S. has an absolute advantage

- 15. Since we are dealing with Opp. Costs,

- 16. Change in World Output Resulting from Specialization According to Comparative AdvantageTRADE BASED ON COMPARATIVE ADVANTAGE

- 17. Trade in the Ricardian Model (cont.)A country

- 18. Static Gains from trade are gains in

- 19. Assumptions and limitationsDriven only

- 20. The Sources of Comparative AdvantageFactor endowments refer

- 21. The Heckscher-Ohlin TheoremThe Heckscher-Ohlin theorem is a

- 22. Слайд 22

- 23. Слайд 23

- 24. Comparative Advantage TheoryWhat determines comparative advantage?Comparative advantage

- 25. Comparative Advantage TheoryFor a country, the following

- 26. Comparative Advantage TheoryLong-term rates of inflation compared to

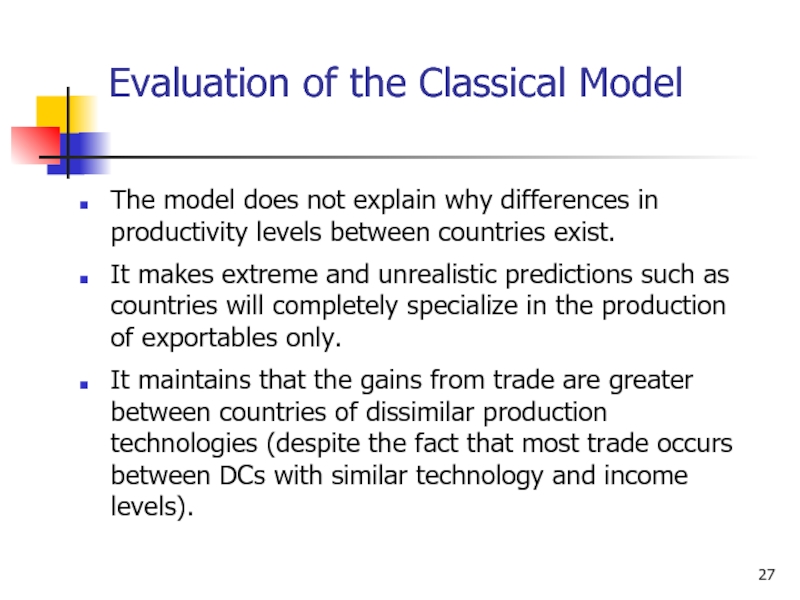

- 27. Evaluation of the Classical ModelThe model does

- 28. Evaluation (cont.)The classical model is a useful

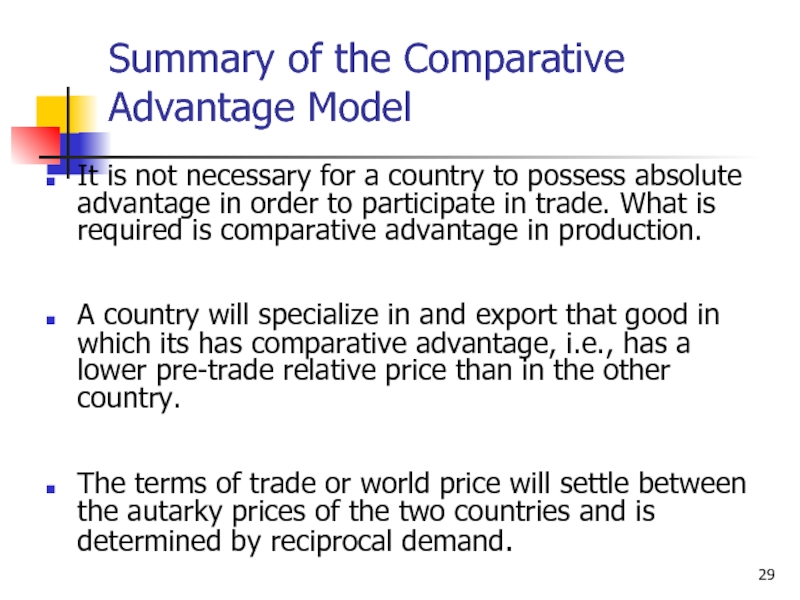

- 29. Summary of the Comparative Advantage ModelIt is

- 30. Скачать презентанцию

Слайды и текст этой презентации

Слайд 2

Lecture 4

Evolution of Trade Theories

Mercantilism

Absolute Advantage

Comparative Advantage

Factor

proportion Trade

Слайд 3

Comparative Advantage

In economics, the law of comparative advantage refers to the ability of

a person or a country to produce a particular good

or service at a lower marginal and opportunity cost over another. Even if one country is more efficient in the production of all goods (absolute advantage in all goods) than the other, both countries will still gain by trading with each other, as long as they have different relative efficiencies.Opportunity cost is the cost of any activity measured in terms of the value of the next best alternative forgone (that is not chosen). It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices

Слайд 4Absolute Advantage

versus Comparative Advantage

A country enjoys an absolute advantage over

another country in the production of a product when it

uses fewer resources to produce that product than the other country does.Слайд 5Absolute Advantage

versus Comparative Advantage

A country enjoys a comparative advantage in

the production of a good when that good can be

produced at a lower cost in terms of other goods.Слайд 6

Comparative Advantage

David Ricardo: Principles of Political Economy (1817)

Extended free trade

argument

Should import even if the country is more efficient in

the product’s production than country from which it is buying.Look to see how much more efficient. If only comparatively efficient, then import.

Слайд 7

Ricardo's Assumptions

Ricardo explains his theory with the help of following

assumptions :

There are two countries and two commodities.

There is a perfect

competition both in commodity and factor market.Cost of production is expressed in terms of labour i.e. value of a commodity is measured in terms of labour hours/days required to produce it. Commodities are also exchanged on the basis of labour content of each good.

Labour is the only factor of production other than natural resources.

Слайд 8Ricardo's Assumptions

Labour is homogeneous i.e. identical in efficiency, in a

particular country.

Labour is perfectly mobile within a country but perfectly

immobile between countries.There is free trade i.e. the movement of goods between countries is not hindered by any restrictions.

Production is subject to constant returns to scale.

There is no technological change.

Trade between two countries takes place on barter system.

Full employment exists in both countries.

There is no transport cost.

Слайд 9Gains from Comparative Advantage

Even if a country had a considerable

absolute advantage in the production of both goods, Ricardo would

argue that specialization and trade are still mutually beneficial.Слайд 10Gains from Comparative Advantage

When countries specialize in producing the goods

in which they have a comparative advantage, they maximize their

combined output and allocate their resources more efficiently.Слайд 11

Why would trade occur if one country had an absolute

advantage in both goods?

Comparative Advantage is the ability of a

country to produce a good at a lower opportunity cost than another countryWe compare the degree of absolute advantage or disadvantage in the production of goods

TRADE BASED ON

COMPARATIVE ADVANTAGE

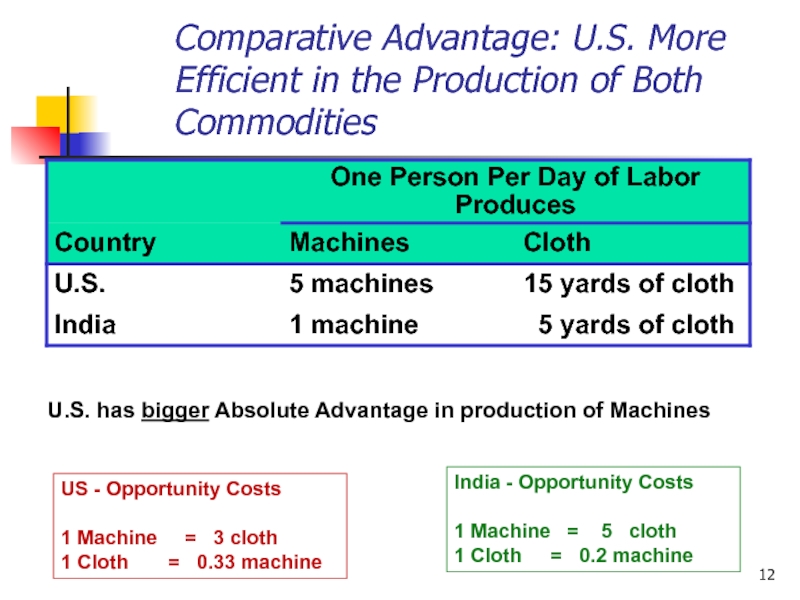

Слайд 12India - Opportunity Costs

1 Machine = 5

cloth

1 Cloth = 0.2 machine

US -

Opportunity Costs1 Machine = 3 cloth

1 Cloth = 0.33 machine

Comparative Advantage: U.S. More Efficient in the Production of Both Commodities

U.S. has bigger Absolute Advantage in production of Machines

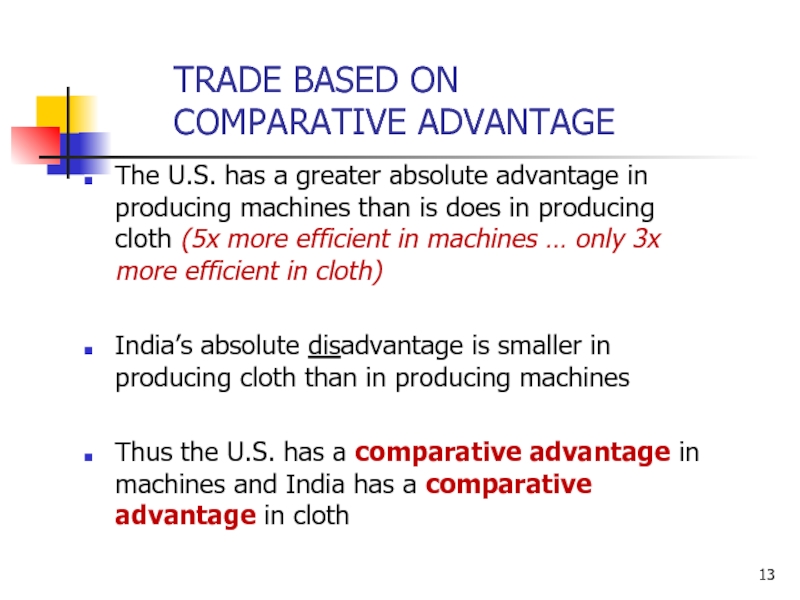

Слайд 13The U.S. has a greater absolute advantage in producing machines

than is does in producing cloth (5x more efficient in

machines … only 3x more efficient in cloth)India’s absolute disadvantage is smaller in producing cloth than in producing machines

Thus the U.S. has a comparative advantage in machines and India has a comparative advantage in cloth

TRADE BASED ON

COMPARATIVE ADVANTAGE

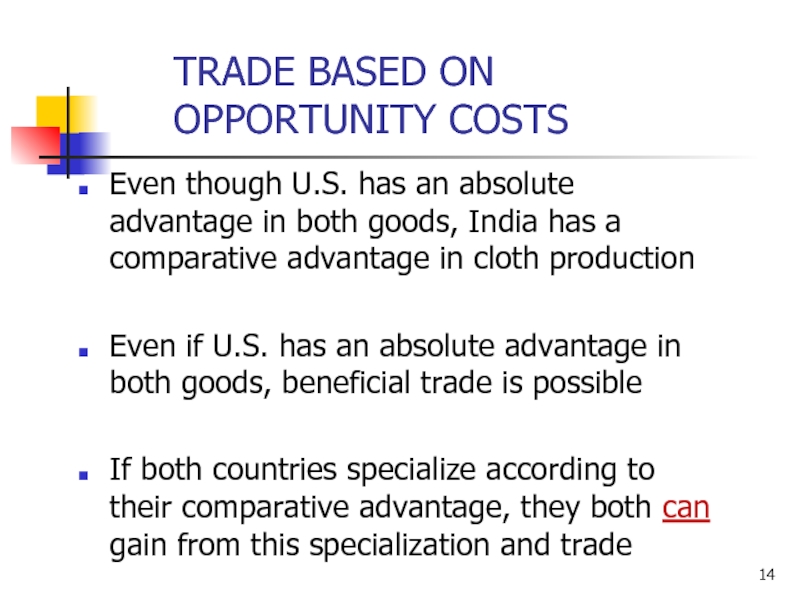

Слайд 14Even though U.S. has an absolute advantage in both goods,

India has a comparative advantage in cloth production

Even if U.S.

has an absolute advantage in both goods, beneficial trade is possibleIf both countries specialize according to their comparative advantage, they both can gain from this specialization and trade

TRADE BASED ON

OPPORTUNITY COSTS

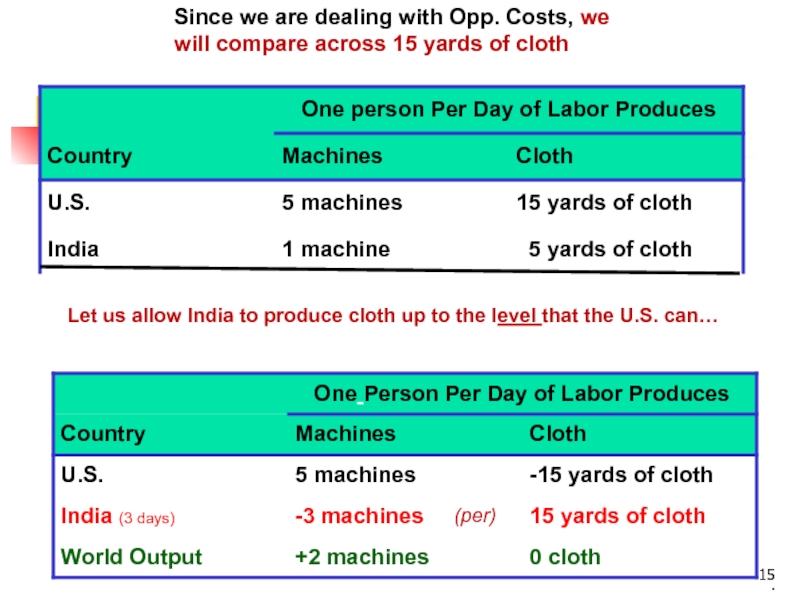

Слайд 15Since we are dealing with Opp. Costs, we

will compare

across 15 yards of cloth

.

(per)

Let us allow India to produce

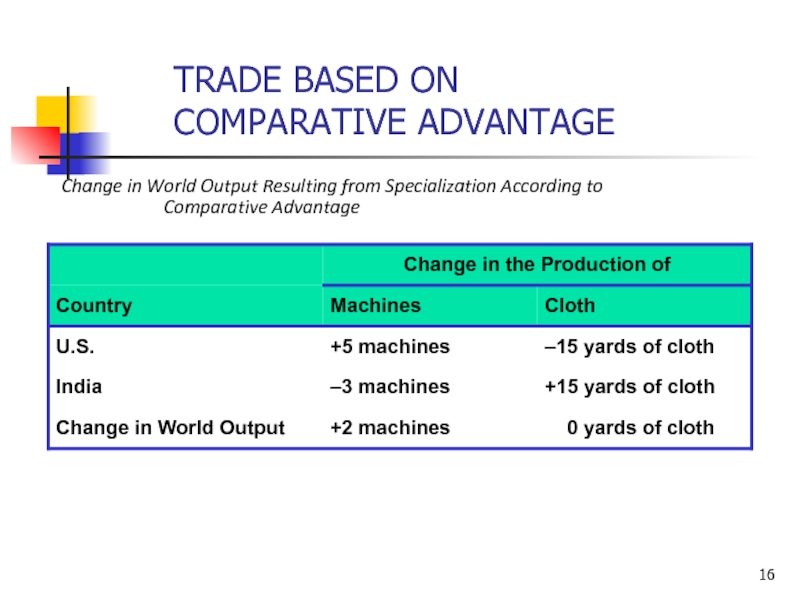

cloth up to the level that the U.S. can…Слайд 16Change in World Output Resulting from Specialization According to Comparative

Advantage

TRADE BASED ON

COMPARATIVE ADVANTAGE

Слайд 17Trade in the Ricardian Model (cont.)

A country can be more

efficient in producing both goods, but it will have a

comparative advantage in only one good.Even if a country is the most (or least) efficient producer of all goods, it still can benefit from trade.

Слайд 18Static Gains from trade are gains in word output that

result from specialization and trade

Dynamic gains from trade are gains

from trade over time that occur because trade induces greater efficiency in the use of existing resourcesDYNAMIC GAINS FROM TRADE

Слайд 19

Assumptions and limitations

Driven only by maximization of production

and consumption

Only 2 countries engaged in production and consumption of

just 2 goods?What about the transportation costs?

Only resource – labor (that too, non-transferable)

No consideration for ‘learning theory’

Слайд 20The Sources of

Comparative Advantage

Factor endowments refer to the quantity and

quality of labor, land, and natural resources of a country.

Factor

endowments seem to explain a significant portion of actual world trade patterns.Слайд 21The Heckscher-Ohlin Theorem

The Heckscher-Ohlin theorem is a theory that explains

the existence of a country’s comparative advantage by its factor

endowments.According to the theorem, a country has a comparative advantage in the production of a product if that country is relatively well endowed with inputs used intensively in the production of that product.

Слайд 24Comparative Advantage Theory

What determines comparative advantage?

Comparative advantage is a dynamic concept.

It can and does change over time. Some businesses find

they have enjoyed a comparative advantage in one product for several years only to face increasing competition as rival producers from other countries enter their markets.Слайд 25Comparative Advantage Theory

For a country, the following factors are important

in determining the relative costs of production:

The quantity and quality of

factors of production available (e.g. the size and efficiency of the available labour force and the productivity of the existing stock of capital inputs). If an economy can improve the quality of its labour force and increase the stock of capital available it can expand the productive potential in industries in which it has an advantage.Investment in research & development (important in industries where patents give some firms significant market advantage)

Movements in the exchange rate. An appreciation of the exchange rate can cause exports from a country to increase in price. This makes them less competitive in international markets.

Слайд 26Comparative Advantage Theory

Long-term rates of inflation compared to other countries. For

example if average inflation in Country X is 4% whilst

in Country B it is 8% over a number of years, the goods and services produced by Country X will become relatively more expensive over time. This worsens their competitiveness and causes a switch in comparative advantage.Import controls such as tariffs and quotas that can be used to create an artificial comparative advantage for a country's domestic producers- although most countries agree to abide by international trade agreements.

Non-price competitiveness of producers (e.g. product design, reliability, quality of after-sales support)

Слайд 27Evaluation of the Classical Model

The model does not explain why

differences in productivity levels between countries exist.

It makes extreme and

unrealistic predictions such as countries will completely specialize in the production of exportables only.It maintains that the gains from trade are greater between countries of dissimilar production technologies (despite the fact that most trade occurs between DCs with similar technology and income levels).

Слайд 28Evaluation (cont.)

The classical model is a useful tool because:

It provides

a motive for trade between developed and developing countries

It explains

why high-wage countries may still benefit from trade even when faced with low-wage competing countries Слайд 29Summary of the Comparative Advantage Model

It is not necessary for

a country to possess absolute advantage in order to participate

in trade. What is required is comparative advantage in production.A country will specialize in and export that good in which its has comparative advantage, i.e., has a lower pre-trade relative price than in the other country.

The terms of trade or world price will settle between the autarky prices of the two countries and is determined by reciprocal demand.