Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

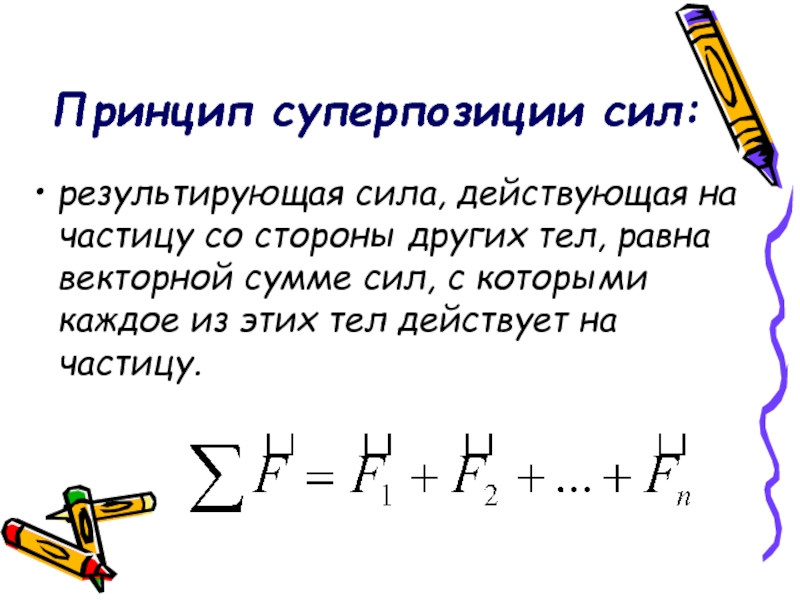

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Daimler AG

Содержание

- 1. Daimler AG

- 2. Table of Content:LiquidityOutstanding BondsChange in Yield to MaturityHighest amount outstanding/shortest/longestCAPM-ModelGordon Constant Growth

- 3. Liquidity2007 achieved an appropriate level of liquidity

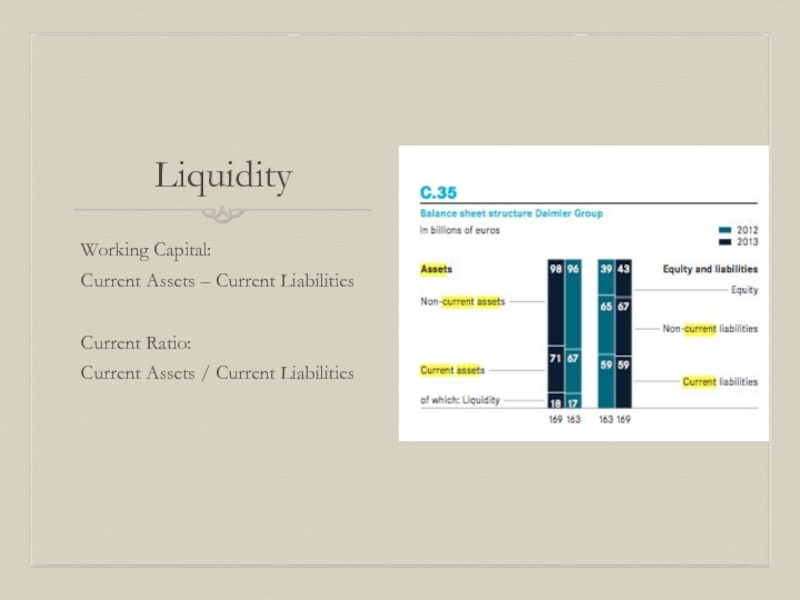

- 4. LiquidityWorking Capital: Current Assets – Current LiabilitiesCurrent Ratio: Current Assets / Current Liabilities

- 5. Outstanding Bonds:2013Jan – Aug $ 6 billion

- 6. Change in YTM:

- 7. Highest amount outstanding/shortest/longest Highest Amount Outstanding:1. Daimler

- 8. Highest amount outstanding/shortest/longest Current Bond Price: $100.6Bond

- 9. Replacing Data for 2016Daimler Fin North Amer

- 10. Holding PeriodDaimler Fin North Amer 1.3% /

- 11. Funds:Wealth Fund:Daimlerchrysler Co 0.6816% yield to maturity:

- 12. CAPM ModelBeta of Stock: 1.93Risk Free Rate: 4.87%Market Required Rate: 4%Required Rate of Return: 3.1909%

- 13. Gordon Constant Growth ModelConstant Growth Rate =(85.07

- 14. Thank youFor your attention.

- 15. Скачать презентанцию

Слайды и текст этой презентации

Слайд 2Table of Content:

Liquidity

Outstanding Bonds

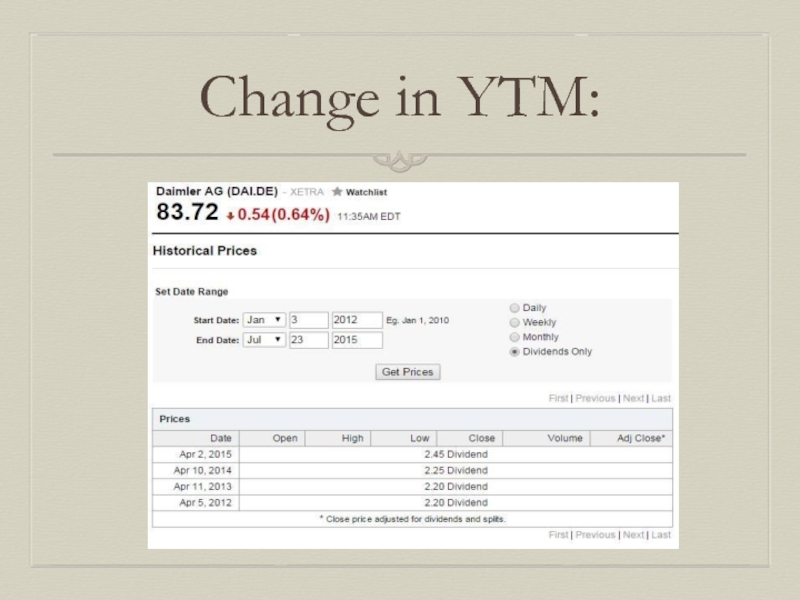

Change in Yield to Maturity

Highest amount outstanding/shortest/longest

CAPM-Model

Gordon

Constant Growth

Слайд 3Liquidity

2007 achieved an appropriate level of liquidity

Daimler liquidity moderately

increased over the last 3 years

Increase was caused by positive

free cash flow Defined as cash and cash equivalents and other marketable securities

Their liquidity situation of the international capital markets and their creditworthiness lead Daimler to continue with a good refinancing conditions in 2014.

Daimler aims to have a liquidity available in a volume appropriate to the general risk situation financial markets and their risk profile.

Слайд 4Liquidity

Working Capital:

Current Assets – Current Liabilities

Current Ratio:

Current Assets

/ Current Liabilities

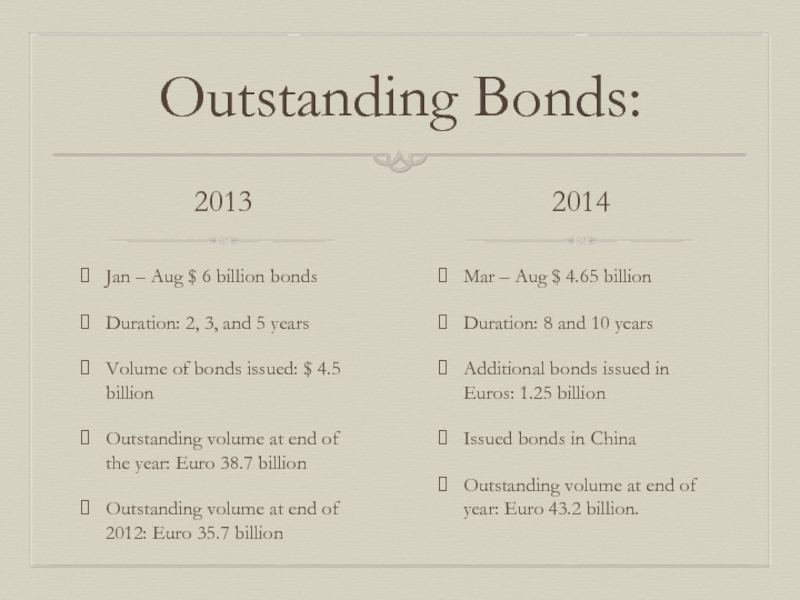

Слайд 5Outstanding Bonds:

2013

Jan – Aug $ 6 billion bonds

Duration: 2, 3,

and 5 years

Volume of bonds issued: $ 4.5 billion

Outstanding volume

at end of the year: Euro 38.7 billionOutstanding volume at end of 2012: Euro 35.7 billion

2014

Mar – Aug $ 4.65 billion

Duration: 8 and 10 years

Additional bonds issued in Euros: 1.25 billion

Issued bonds in China

Outstanding volume at end of year: Euro 43.2 billion.

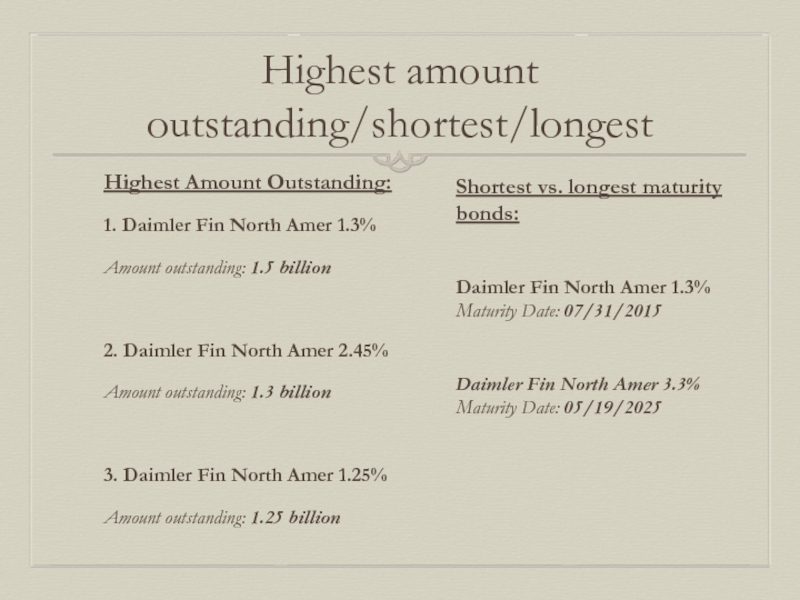

Слайд 7Highest amount outstanding/shortest/longest

Highest Amount Outstanding:

1. Daimler Fin North Amer 1.3%

Amount outstanding: 1.5 billion

2. Daimler Fin North Amer 2.45%

Amount outstanding:

1.3 billion3. Daimler Fin North Amer 1.25%

Amount outstanding: 1.25 billion

Shortest vs. longest maturity bonds:

Daimler Fin North Amer 1.3%

Maturity Date: 07/31/2015

Daimler Fin North Amer 3.3%

Maturity Date: 05/19/2025

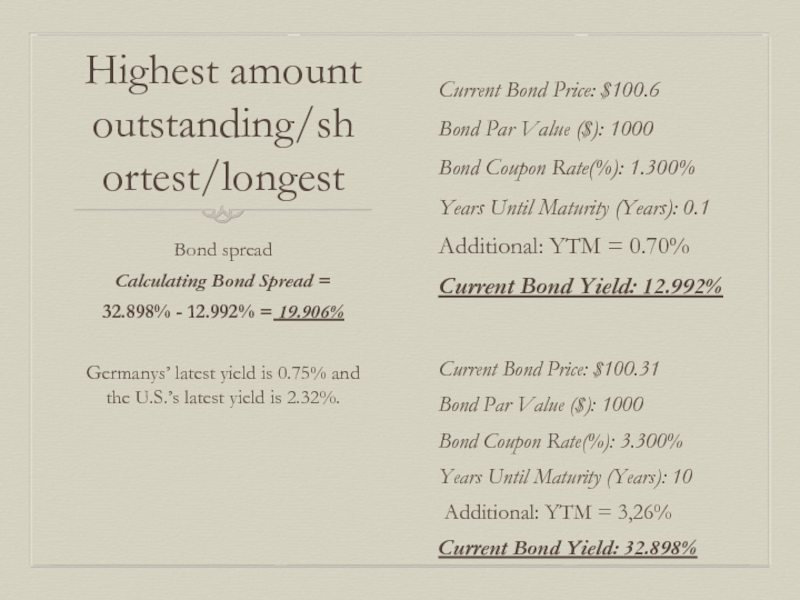

Слайд 8Highest amount outstanding/shortest/longest

Current Bond Price: $100.6

Bond Par Value ($): 1000

Bond

Coupon Rate(%): 1.300%

Years Until Maturity (Years): 0.1

Additional: YTM = 0.70%

Current

Bond Yield: 12.992%Bond spread

Calculating Bond Spread =

32.898% - 12.992% = 19.906%

Germanys’ latest yield is 0.75% and the U.S.’s latest yield is 2.32%.

Current Bond Price: $100.31

Bond Par Value ($): 1000

Bond Coupon Rate(%): 3.300%

Years Until Maturity (Years): 10

Additional: YTM = 3,26%

Current Bond Yield: 32.898%

Слайд 9Replacing Data for 2016

Daimler Fin North Amer 1.3%

Amount outstanding: 1.5

billion

Current Bond Price: $100.90

Bond Par Value ($): 1000

Bond Coupon Rate(%):

1.885%Years Until Maturity (Years): 0.1

Daimler Fin North Amer 2.45%

Amount outstanding: 1.3 billion

Current Bond Price: $100.50

Bond Par Value ($): 1000

Bond Coupon Rate(%): 2.250%

Years Until Maturity (Years): 4

Additional: YTM = 2,36%

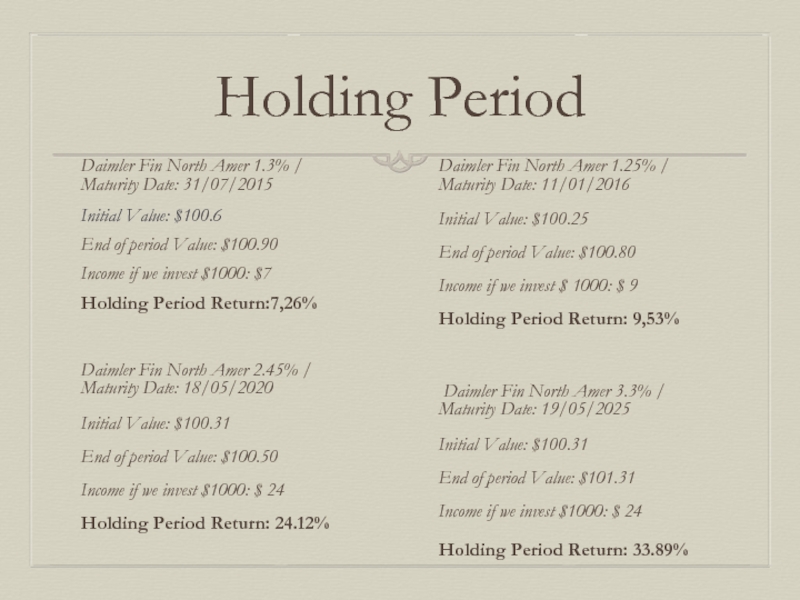

Слайд 10Holding Period

Daimler Fin North Amer 1.3% / Maturity Date: 31/07/2015

Initial

Value: $100.6

End of period Value: $100.90

Income if we invest $1000:

$7 Holding Period Return:7,26%

Daimler Fin North Amer 2.45% / Maturity Date: 18/05/2020

Initial Value: $100.31

End of period Value: $100.50

Income if we invest $1000: $ 24

Holding Period Return: 24.12%

Daimler Fin North Amer 1.25% / Maturity Date: 11/01/2016

Initial Value: $100.25

End of period Value: $100.80

Income if we invest $ 1000: $ 9

Holding Period Return: 9,53%

Daimler Fin North Amer 3.3% / Maturity Date: 19/05/2025

Initial Value: $100.31

End of period Value: $101.31

Income if we invest $1000: $ 24

Holding Period Return: 33.89%

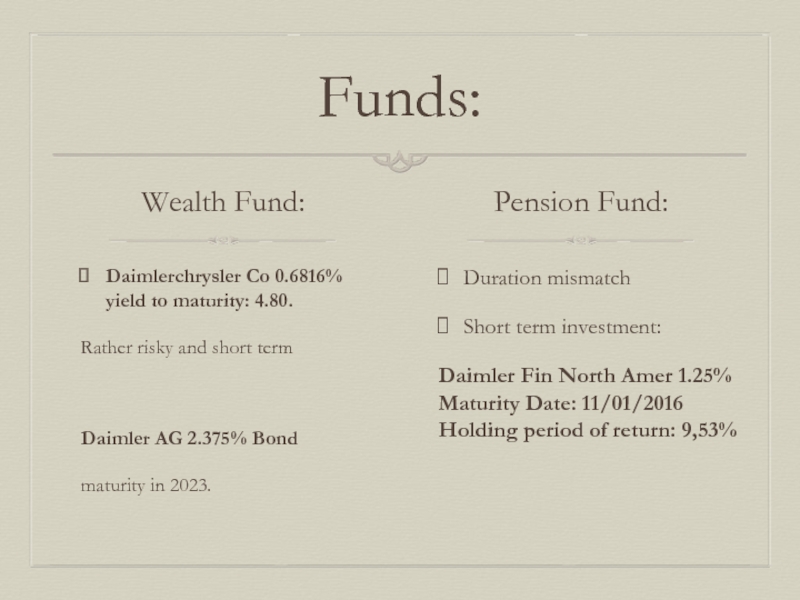

Слайд 11Funds:

Wealth Fund:

Daimlerchrysler Co 0.6816% yield to maturity: 4.80.

Rather risky and

short term

Daimler AG 2.375% Bond

maturity in 2023.

Pension Fund:

Duration mismatch

Short

term investment: Daimler Fin North Amer 1.25% Maturity Date: 11/01/2016 Holding period of return: 9,53%

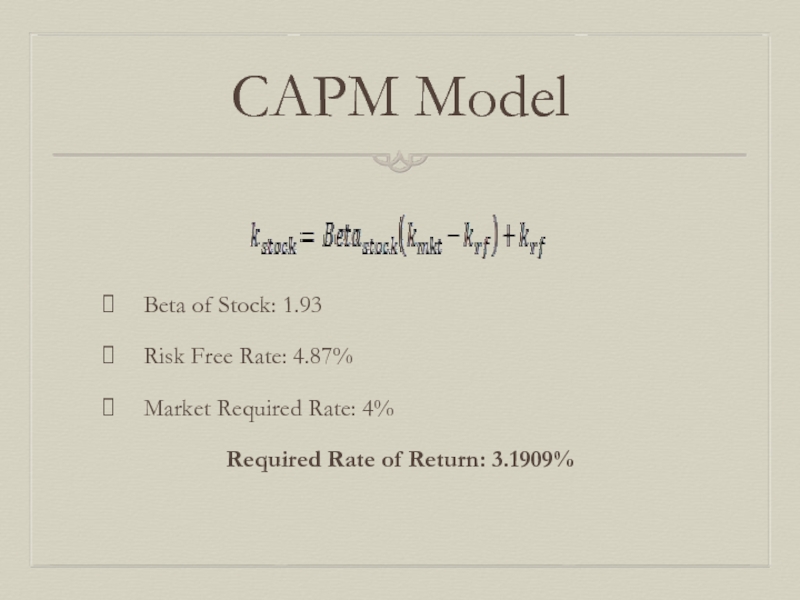

Слайд 12CAPM Model

Beta of Stock: 1.93

Risk Free Rate: 4.87%

Market Required Rate:

4%

Required Rate of Return: 3.1909%

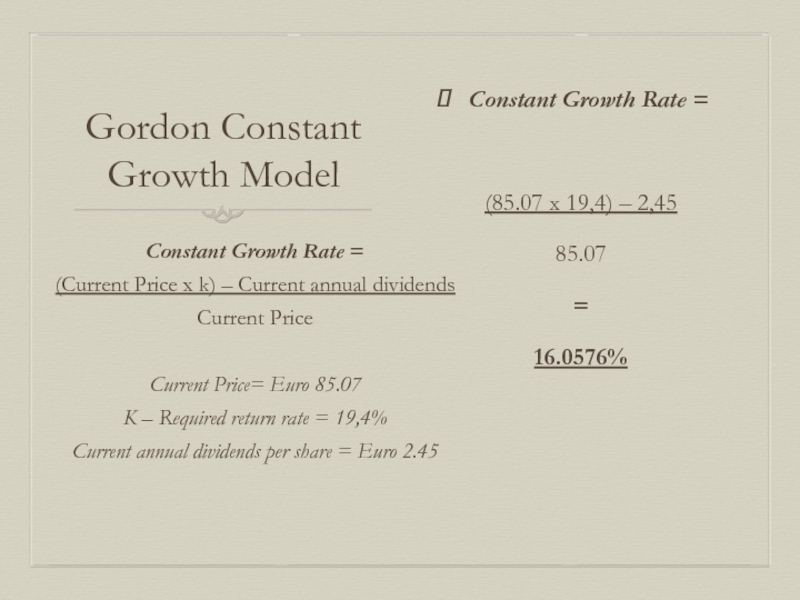

Слайд 13Gordon Constant Growth Model

Constant Growth Rate =

(85.07 x 19,4) –

2,45

85.07

=

16.0576%

Constant Growth Rate =

(Current Price x k) – Current

annual dividendsCurrent Price

Current Price= Euro 85.07

K – Required return rate = 19,4%

Current annual dividends per share = Euro 2.45