Слайд 1Economics of Integration

Lecture 5: EU budget

Слайд 2Introduction

To conduct its policies and fulfill its goals as specified

in the Treaties, the EU needs financial resources;

The EU adopts

Multiannual Financial Framework (MFF) and annual budgets;

The EU budget is equivalent to just 1% of combined EU GDP, while national budgets (total public sector finances) of indicidual Member States are 40-45% of their GDP;

EU budgetary procedures are described in detail in TFEU;

Слайд 3MFF (Art. 312 TFEU)

The multiannual financial framework shall ensure that

Union expenditure develops in an orderly manner and within the

limits of its own resources.

It shall be established for a period of at least five years.

The annual budget of the Union shall comply with the multiannual financial framework.

The financial framework shall determine the amounts of the annual ceilings on commitment appropriations by category of expenditure and of the annual ceiling on payment appropriations. The categories of expenditure, limited in number, shall correspond to the Union's major sectors of activity.

The financial framework shall lay down any other provisions required for the annual budgetary procedure to run smoothly.

The current MFF covers 2007-2013;

Слайд 4Budgetary procedure (I)

Draft budget prepared by the European Commission, approved

by the EU Council, and adopted by European Parliament;

EP can

make changes in the draft budget, it can also reject the draft „for important reasons” with 2/3 majority;

EP approves the execution of the budget and gives a discharge to the Commission;

This makes the budget procedure very democratic;

Слайд 5Budgetary procedure (II)

The annual budgetary procedure as established by the

Treaty of Lisbon lasts from 1 September to 31 December.

All EU institutions and bodies draw up their estimates for the draft budget according to their internal procedures before 1 July.

Commission’s draft budget: The Commission consolidates these estimates and establishes the annual 'draft budget', which is submitted to the Council and the European Parliament by 1 September. In practice, the Commission endeavours to present the draft budget before the end of April/beginning of May.

Council's reading: The Council adopts its position on the draft budget including amendments, if any, and passes it to the European Parliament before 1 October. The Council informs the European Parliament of the reasons which led it to adopt its position.

Parliament’s reading: The Parliament has then 42 days to either adopt the budget at its first reading in October or hand its amendments back to the Council. The Council may accept the amendments within 10 days and adopt the draft budget.

Detailed description of the annual budget procedure: TFEU, Article 310.

Слайд 6Conciliation procedure

Conciliation procedure: If the Council does not accept the

Parliament's amendments, a Conciliation Committee is set up, composed of

the members of the Council or their representatives and an equal number of members representing the European Parliament. The Conciliation Committee is assigned to come up with a joint text within 21 days. If the conciliatory procedure fails, the Commission has to come up with a new draft budget. Once a joint text is agreed upon by the Conciliation Committee in early November, the Council and the Parliament have 14 days to approve or reject it. The Parliament may adopt the budget even if the Council rejects the joint text. In case the Council and the Parliament both reject the joint draft or fail to decide, the budget is rejected and the Commission has to submit a new draft budget.

If, at the beginning of a financial year, the budget has not yet been definitively adopted, a sum equivalent to not more than 1/12 of the budget appropriations for the preceding financial year may be spent each month.

Слайд 7Key budgetary principles

All revenues and expenditures are included in one

document.

Budget is adopted annually for one calendar year;

Budget must be

balanced, i.e. all expenditures must be covered by own resources, and borrowing is not allowed;

Transparency, good practice, universality, in euro;

Слайд 8Own resources

The overall amount of own resources needed to finance

the budget is determined by total expenditure less other revenue.

The total amount of own resources cannot exceed 1.23 % of the gross national income (GNI) of the EU. Own resources can be divided into the following categories (the figures below refer to the 2011 budget):

Traditional own resources (TOR) consist of customs duties and sugar levies. These own resources are levied on economic operators and collected by Member States on behalf of the EU. However, Member States keep 25 % as a compensation for their collection costs. Customs duties are levied on imports of products coming from third countries, at rates based on the Common Customs Tariff. Sugar levies are paid by sugar producers to finance the export refunds for sugar. These levies only amount to around 1 % of total TOR. TOR account for around 13 % of total EU revenue.

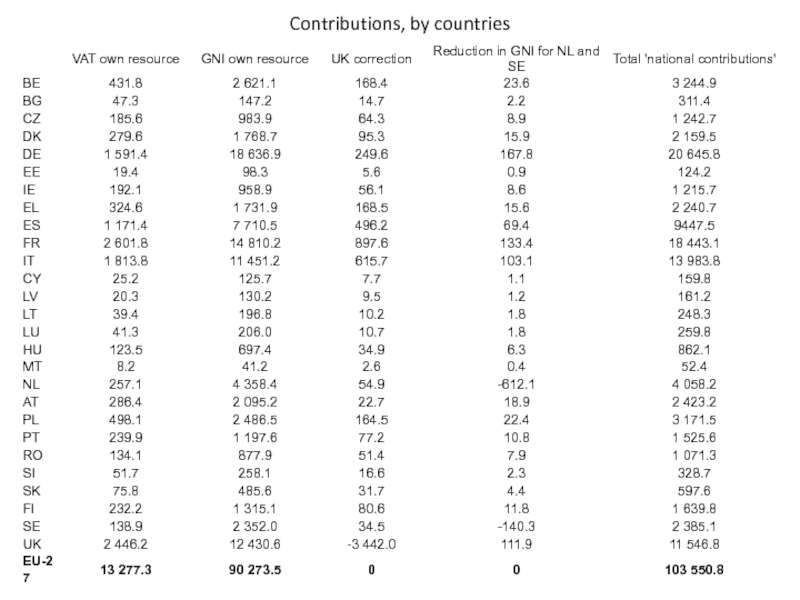

The own resource based on value added tax (VAT) is levied on Member States' VAT bases, which are harmonised for this purpose in accordance with Community rules. The same percentage (0.30%) is levied on the harmonised base of each Member State. This rate is for the period 2007-2013 reduced for 4 Member States (Austria 0.225%, Germany 0.15%, the Netherlands and Sweden 0.10%). However, the VAT base to take into account is capped at 50 % of each Member State’s GNI. This rule is intended to avoid that the less prosperous Member States pay out of proportion to their contributive capacity, since consumption and hence VAT tend to account for a higher percentage of a country's national income at relatively lower levels of prosperity. The VAT-based resource accounts for around 11 % of total EU revenue.

The resource based on gross national income (GNI) is used to balance budget revenue and expenditure, i.e. to finance the part of the budget not covered by any other sources of revenue. The same percentage rate is levied on each Member States' GNI, which is established in accordance with Community rules. For the period 2007-2013 Sweden and the Netherlands are granted gross reductions in their annual GNI payments. The reductions are EUR 605 million for the Netherlands and EUR 150 million for Sweden in 2004 prices. These amounts are financed by all Member States including those two benefiting from them. The GNI-based resource accounts for around 75 % of total EU revenue.

Слайд 9The UK rebate

A specific mechanism for correcting the budgetary imbalance

of the United Kingdom (the UK correction or UK rebate)

is also part of the own resources system.

The current UK correction mechanism was introduced in 1985 to correct the imbalance between the United Kingdom's share in payments to the Community budget and its share in Community expenditure allocated to the Member States. The basic principles remain the same since then.

This imbalance is calculated as the difference between the percentage share of the UK in EU expenditure paid in the Member States ("allocated expenditure") and the UK share in total VAT-based and GNI-based own resources payments. The difference in percentage points is multiplied by the total amount of EU expenditure allocated to the Member States. The UK is reimbursed by 66 % of this budgetary imbalance. Total allocated expenditure is gradually adjusted downward by deducting certain elements of expenditure in countries that joined the EU after 2003.

The cost of the correction is borne by the other 26 Member States. The distribution of the financing is first calculated on the basis of each country's share in total EU GNI. The financing share of Germany, the Netherlands, Austria and Sweden is, however, restricted to one fourth of its normal value. This cost is redistributed across the remaining 22 Member States.

The UK correction in the 2010 budget amounts to around EUR 4.0 billion.

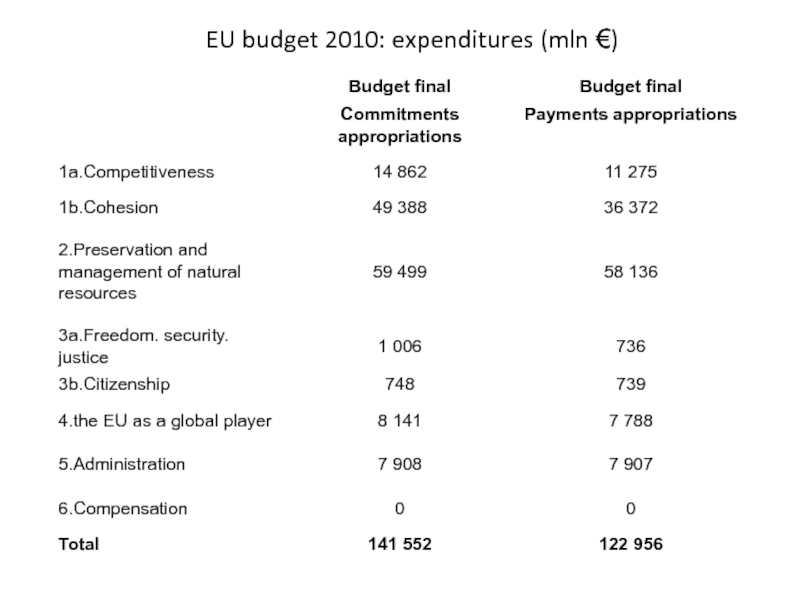

Слайд 10EU budget 2010: expenditures (mln €)

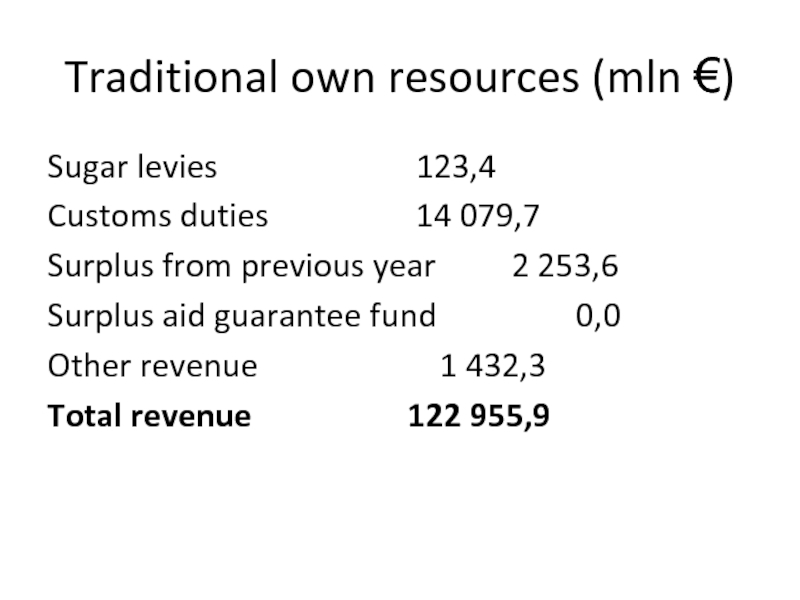

Слайд 12Traditional own resources (mln €)

Sugar levies

123,4

Customs duties 14 079,7

Surplus from previous year

2 253,6

Surplus aid guarantee fund 0,0

Other revenue 1 432,3

Total revenue 122 955,9