Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Ekaterina Zhilkina Ilya Nikiforov Kirill Komarov Nikita Kurilenko IB CLUB MSU,

Содержание

- 1. Ekaterina Zhilkina Ilya Nikiforov Kirill Komarov Nikita Kurilenko IB CLUB MSU,

- 2. Unilever Group &OJSC Kalina Merger ModelTable of

- 3. Our Position.Buy sideResearchClearly define the Company's business

- 4. Unilever Group. Overview.The world's third-largest consumer goods

- 5. Since 2008 the company has focused on

- 6. OJSC Kalina. Business description.COGS, 2010Sector stock performance 1q 2011.Revenue,2010Income statement, mln €

- 7. Cosmetic Market in Russia is one of

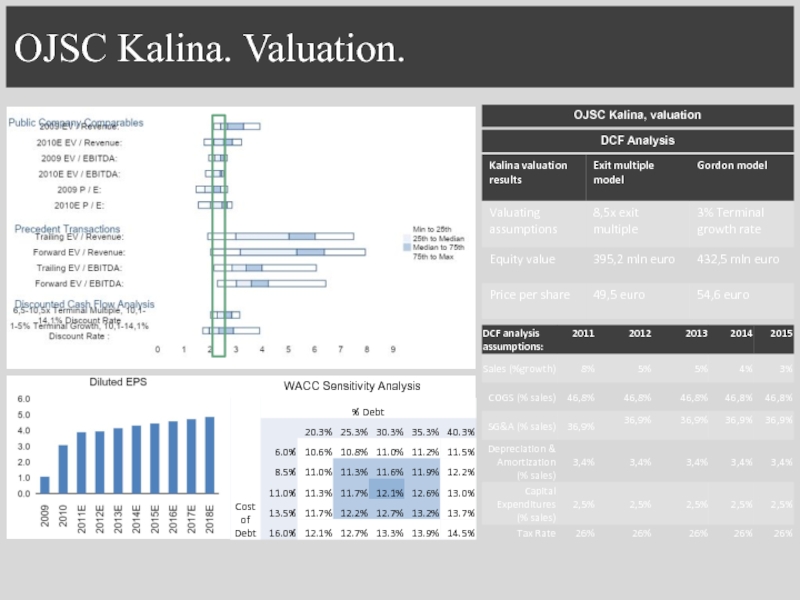

- 8. OJSC Kalina. Valuation.WACC Sensitivity AnalysisOJSC Kalina, valuationDCF Analysis

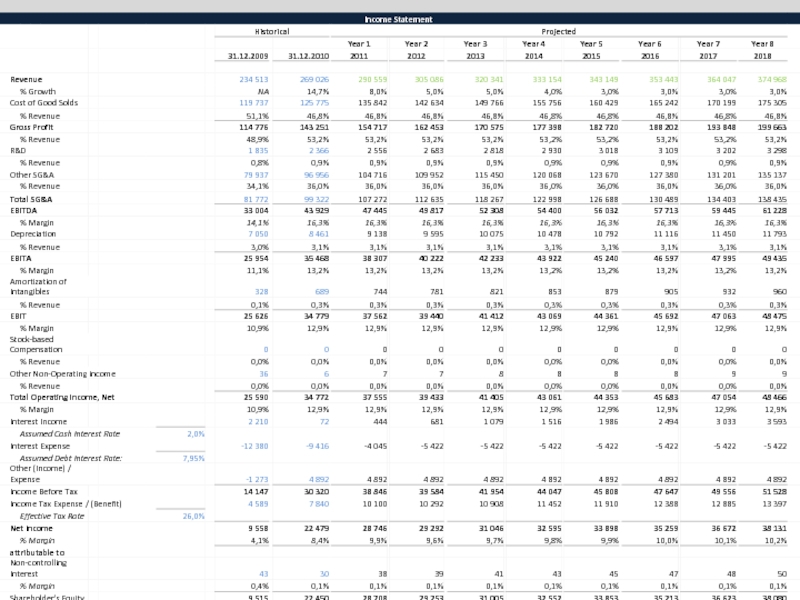

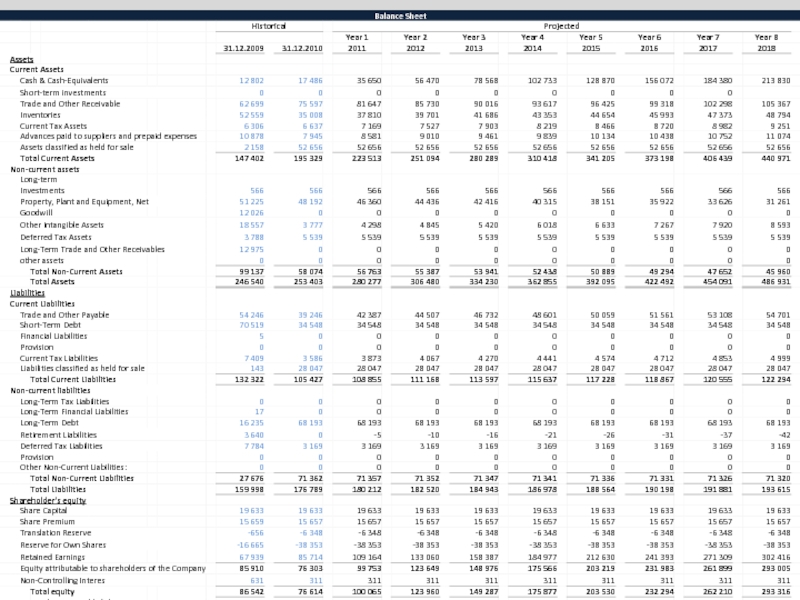

- 9. Key Outputs of M&A Model Unilever experience

- 10. Risks and Mitigations.

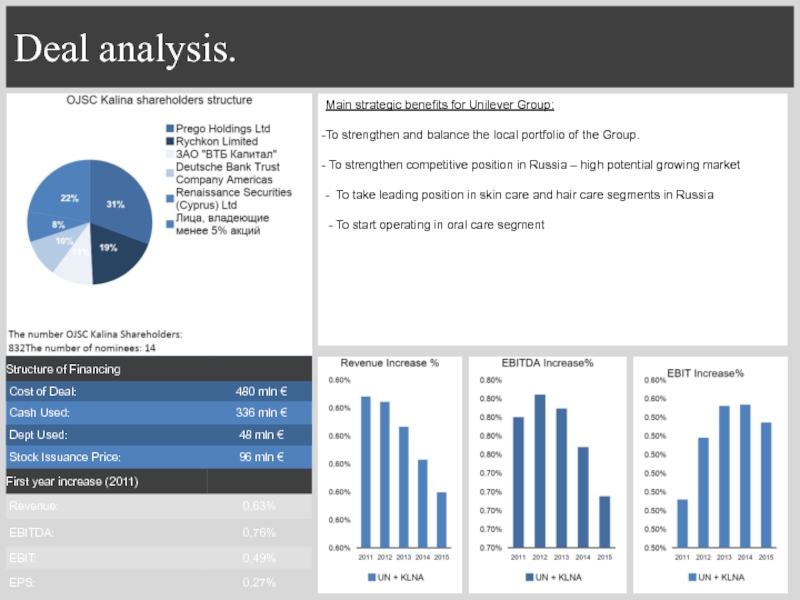

- 11. Deal analysis.Main strategic benefits for Unilever Group:To

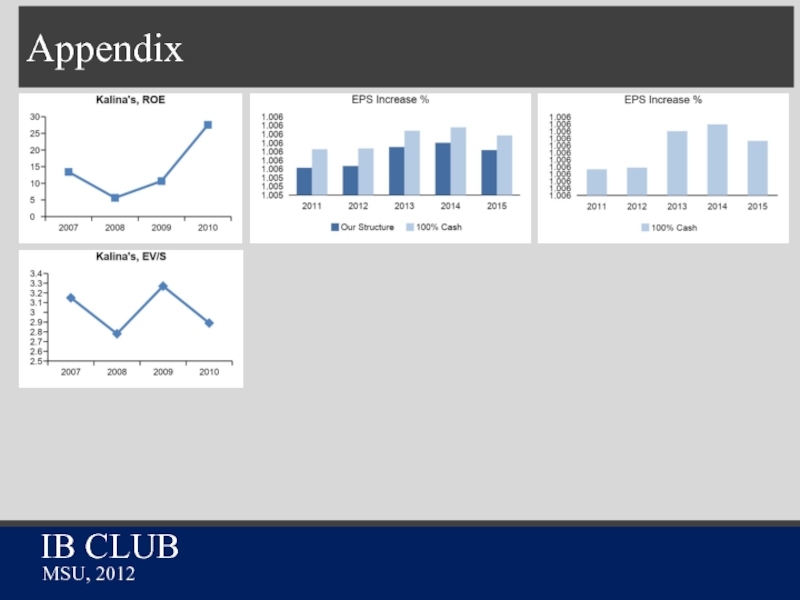

- 12. IB CLUBMSU, 2012 Appendix

- 13. Слайд 13

- 14. Слайд 14

- 15. Слайд 15

- 16. Слайд 16

- 17. Слайд 17

- 18. Слайд 18

- 19. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1 Ekaterina Zhilkina

Ilya Nikiforov

Kirill Komarov

Nikita Kurilenko

IB CLUB

MSU, 2012

Unilever

Group &

Слайд 2Unilever Group &

OJSC Kalina Merger Model

Table of contents

Unilever Group. Overview.

Acquisition

policy and assets in Russia.

OJSC Kalina. Business description.

OJSC Kalina.

Market Position.OJSC Kalina. Valuation.

Key Outputs of M&A Model

2

4

3

5

6

7

Our position

1

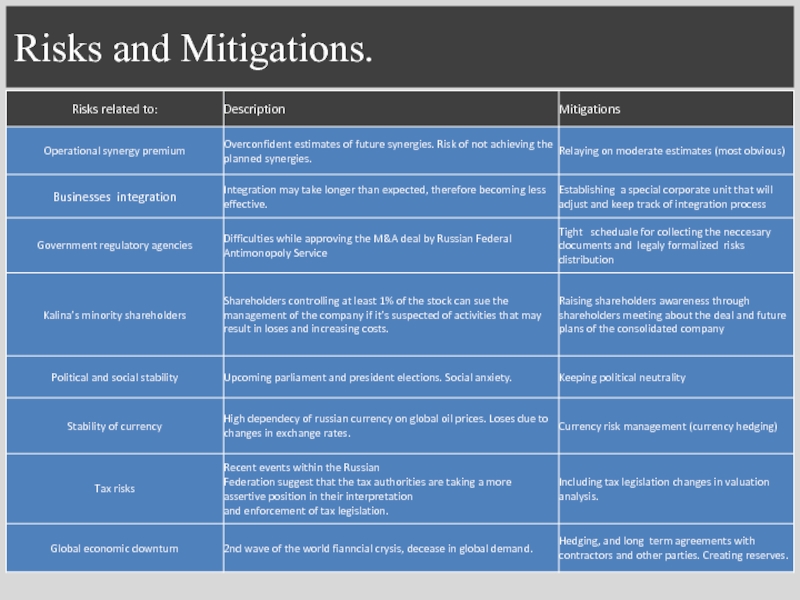

Risks and Mitigations.

8

Deal analysis.

9

Appendix.

10

Слайд 3Our Position.

Buy side

Research

Clearly define the Company's business objectives and develop

an appropriate strategy.

Determine the segments of the market to target

in terms of offering, size, and geography.Assemble a team with bandwidth to actively work the process.

Identify

Identify acquisition opportunities in all market segments of interest.

Develop "communication" plan.

Initial contact and screening for interest.

Negotiate

Determine key issues and quickly identify any potential "deal breakers".

Design optimal deal structure.

Negotiate price, terms and conditions.

Strategic, operational, financial and legal due diligence.

Purchase agreements and related documents.

Valuation date: 30.09.2011

All calculations are done using the consolidated financial statements of Unilever Group due to informational accessibility and in accordance with learning purposes.

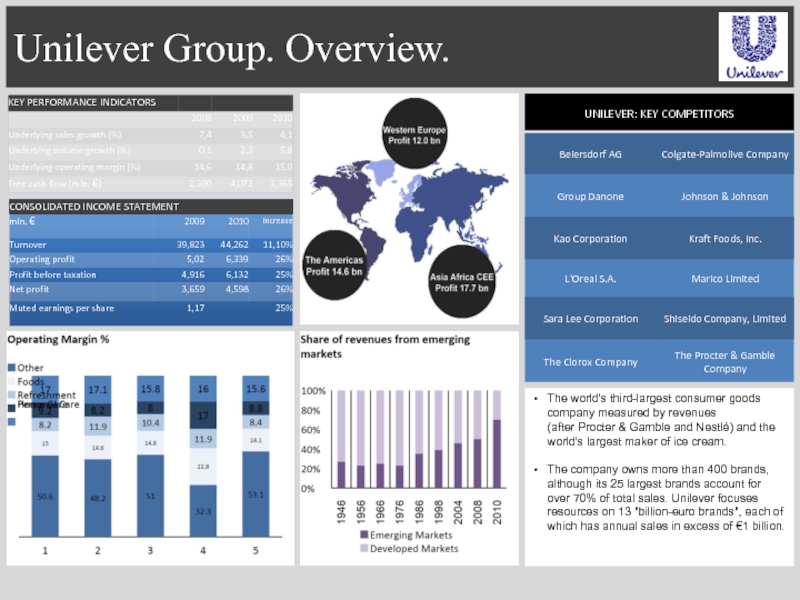

Слайд 4Unilever Group. Overview.

The world's third-largest consumer goods company measured by

revenues (after Procter & Gamble and Nestlé) and the world's largest maker of

ice cream.The company owns more than 400 brands, although its 25 largest brands account for over 70% of total sales. Unilever focuses resources on 13 "billion-euro brands", each of which has annual sales in excess of €1 billion.

Слайд 5

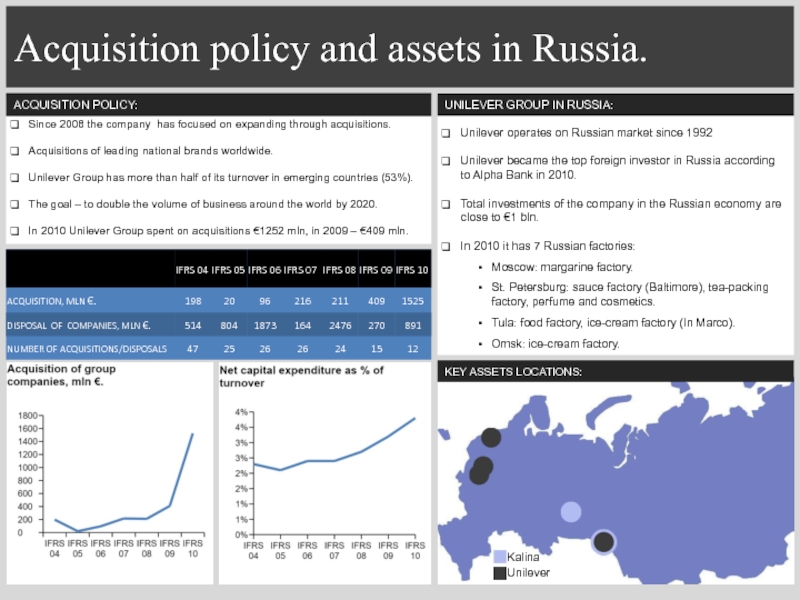

Since 2008 the company has focused on expanding through acquisitions.

Acquisitions of leading national brands worldwide.

Unilever Group has more than

half of its turnover in emerging countries (53%).The goal – to double the volume of business around the world by 2020.

In 2010 Unilever Group spent on acquisitions €1252 mln, in 2009 – €409 mln.

Acquisition policy and assets in Russia.

Unilever operates on Russian market since 1992

Unilever became the top foreign investor in Russia according to Alpha Bank in 2010.

Total investments of the company in the Russian economy are close to €1 bln.

In 2010 it has 7 Russian factories:

Moscow: margarine factory.

St. Petersburg: sauce factory (Baltimore), tea-packing factory, perfume and cosmetics.

Tula: food factory, ice-cream factory (In Marco).

Omsk: ice-cream factory.

Kalina

Unilever

Key assets locations:

Unilever Group in Russia:

Acquisition policy:

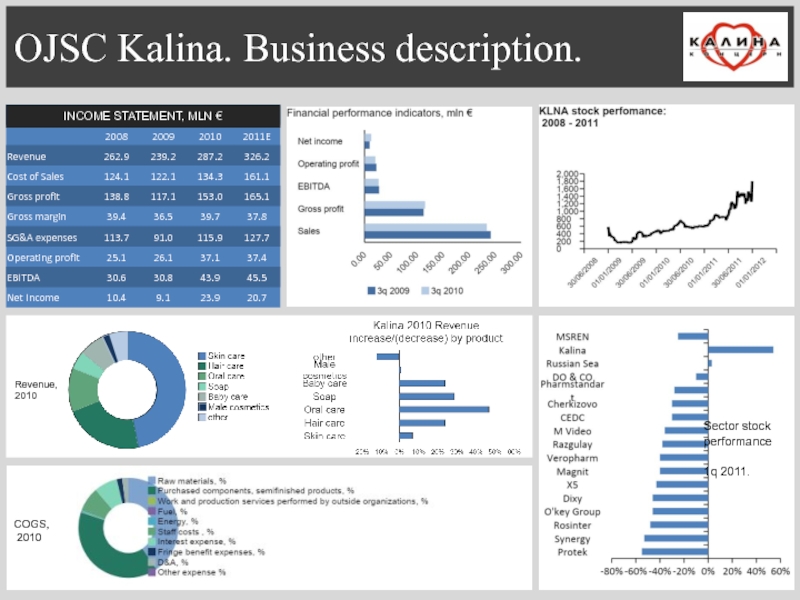

Слайд 6OJSC Kalina. Business description.

COGS,

2010

Sector stock performance

1q 2011.

Revenue,

2010

Income statement,

mln €

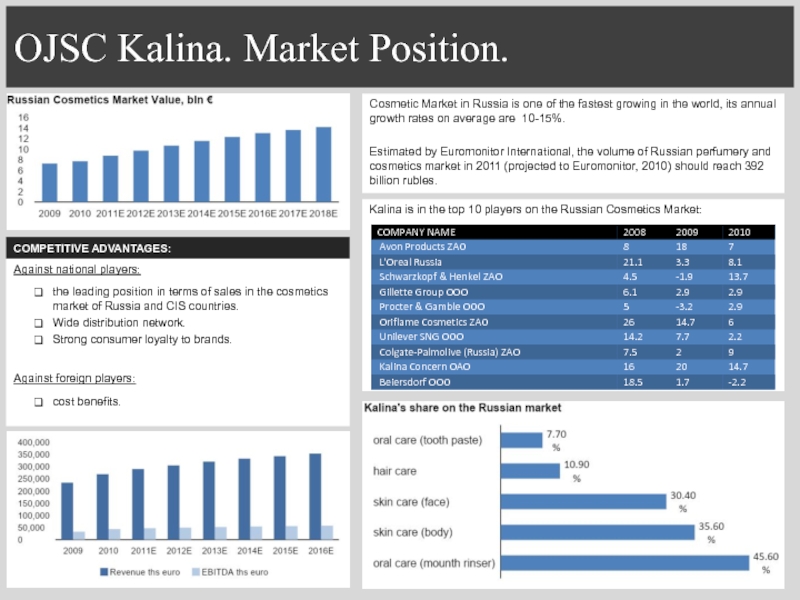

Слайд 7Cosmetic Market in Russia is one of the fastest growing

in the world, its annual growth rates on average are

10-15%.Estimated by Euromonitor International, the volume of Russian perfumery and cosmetics market in 2011 (projected to Euromonitor, 2010) should reach 392 billion rubles.

Against national players:

the leading position in terms of sales in the cosmetics market of Russia and CIS countries.

Wide distribution network.

Strong consumer loyalty to brands.

Against foreign players:

cost benefits.

OJSC Kalina. Market Position.

Kalina is in the top 10 players on the Russian Cosmetics Market:

Competitive advantages:

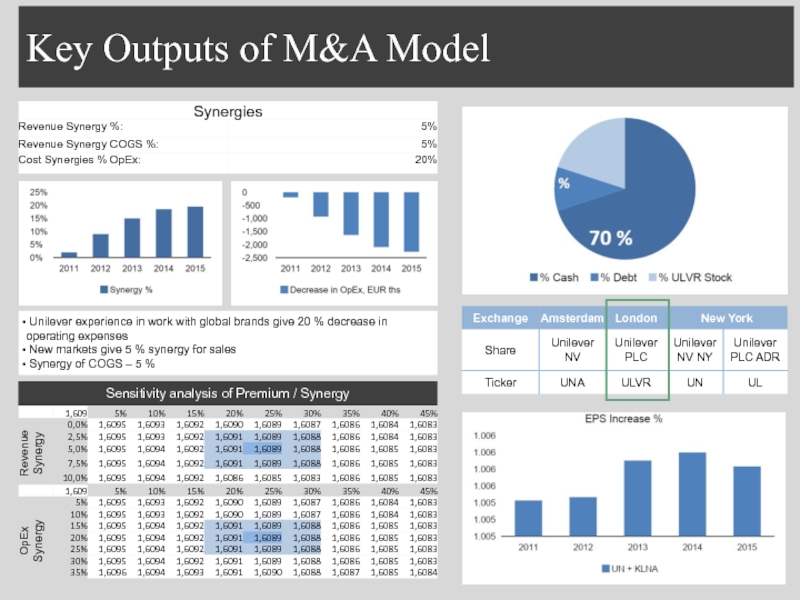

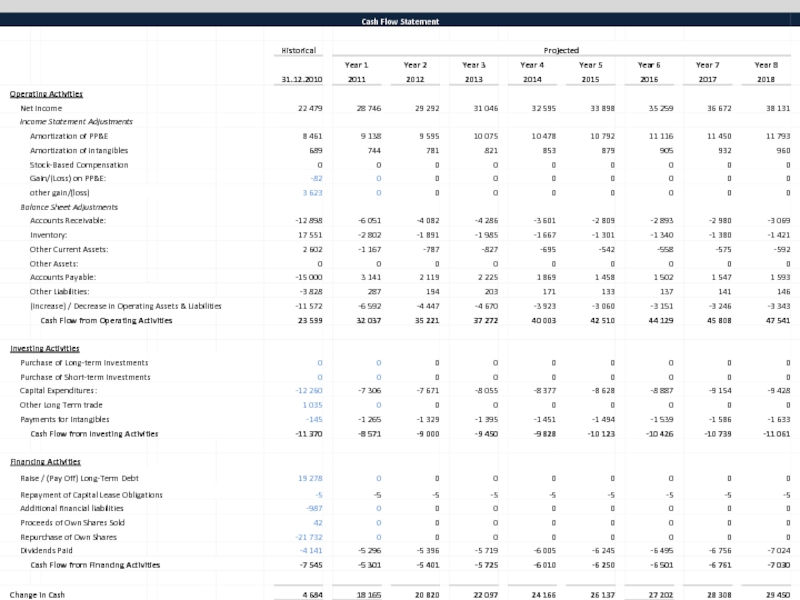

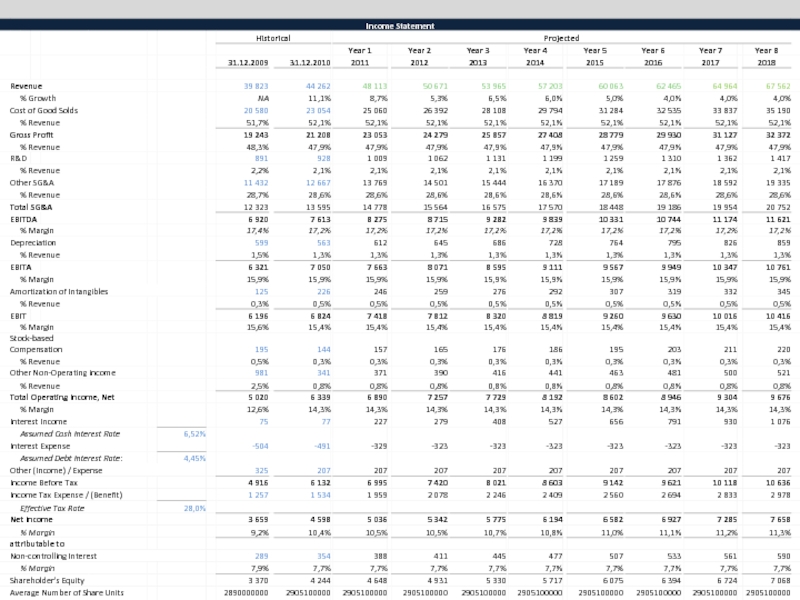

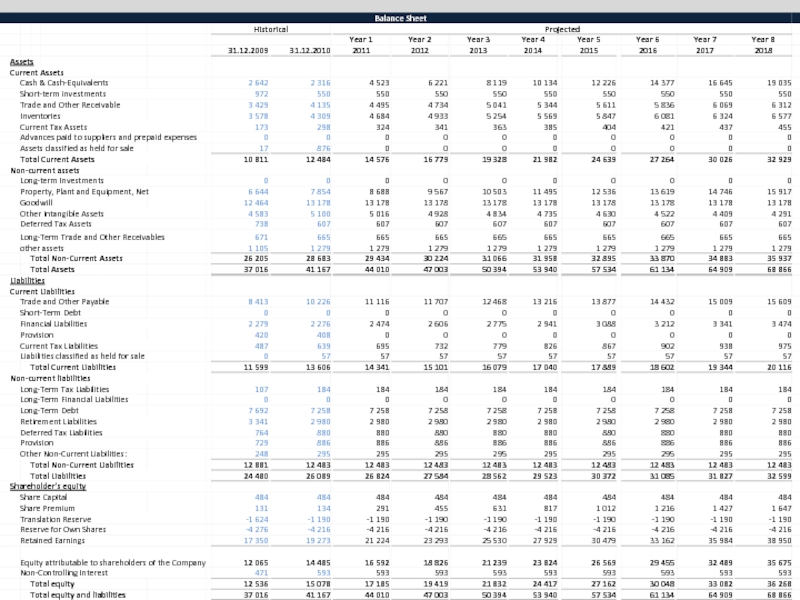

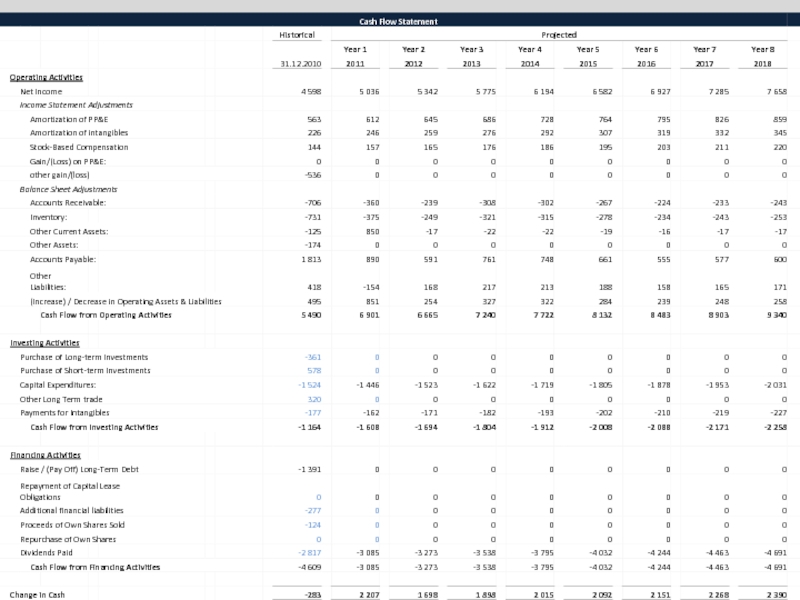

Слайд 9Key Outputs of M&A Model

Unilever experience in work with

global brands give 20 % decrease in operating expenses

New

markets give 5 % synergy for salesSynergy of COGS – 5 %

Sensitivity analysis of Premium / Synergy

Revenue

Synergy

OpEx

Synergy

Слайд 11Deal analysis.

Main strategic benefits for Unilever Group:

To strengthen and balance

the local portfolio of the Group.

To strengthen competitive position

in Russia – high potential growing market- To take leading position in skin care and hair care segments in Russia

- To start operating in oral care segment