Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

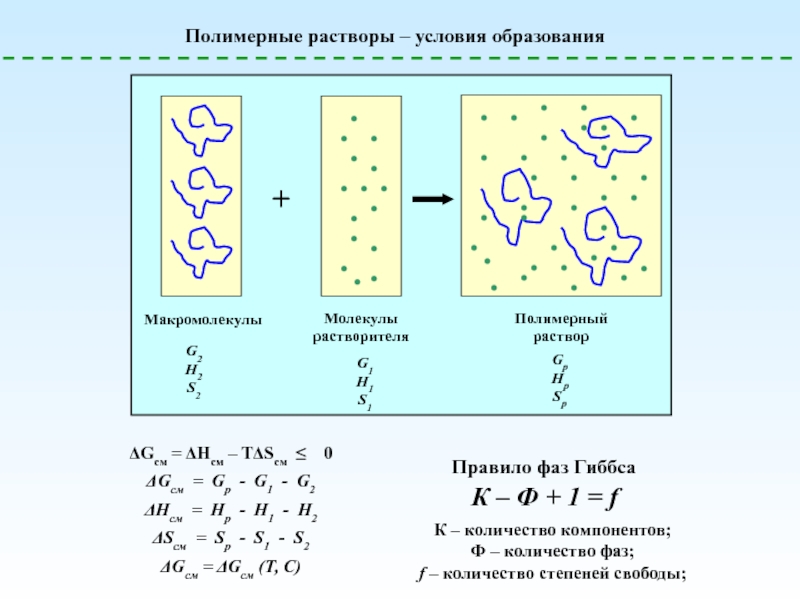

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Individual income tax in Germany Zhuraeva G. Fin 231

Содержание

An essential part of the deductions from income taxes are not as social transfers . This medical insurance , contributions to unemployment insurance, from helplessness , as well as the pension

Слайды и текст этой презентации

Слайд 3

Income tax on individuals. This tax is the main source

of government revenue. The object of taxation on it is

the personal income received by them from various sources. In contrast to the Kazakhstan income tax is progressive in Germany . Its minimum rate - 19% , maximum - 53%. The maximum tax rate applicable to the citizens whose income exceeds 120 thousand marks . At the present time the non-taxable minimum income tax for the year 5616 amounts to Euro for single and 11232 Euro for couples. For incomes that do not exceed 8153 Euro for single and 16307 Euros for the spouses , there is a proportional tax at the rate of 22.9 %.Income tax (Einkommensteuer)

Слайд 4Next, the tax is levied on a progressive scale up

revenues in the 120041 Euros for single and 240083 euros

for those who are married . Revenues that exceed this level are taxed at a maximum rate of 51 %. There are tax benefits for children , age benefits , benefits in extraordinary circumstances (illness, accident) . For example, individuals who have reached the age of 64, the non-taxable minimum is increased to Euro 3700 . Individuals who have a plot of land , income tax will be charged with Euro 4750 .Income tax for individuals

Слайд 5Thank you for attention.

If you want to live in a

prosperous European country where higher education is free, even for

international students, while the German pay taxes, and sleep well.Thank you for attention.