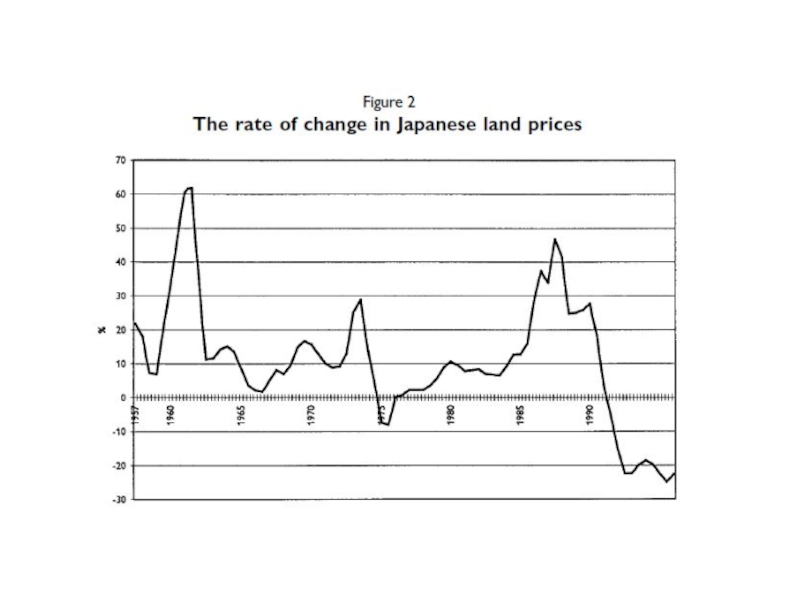

was the bursting of the asset proce bubble in the

period of late 1980s to early 1990s.Bank loans were overextended particularly in risky areas with inadequate supervision and regulation over banks during bubble period. (loan portfolios were concentrated in property related business)