Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Lecture 7. Financial markets: Equity market in details

Содержание

- 1. Lecture 7. Financial markets: Equity market in details

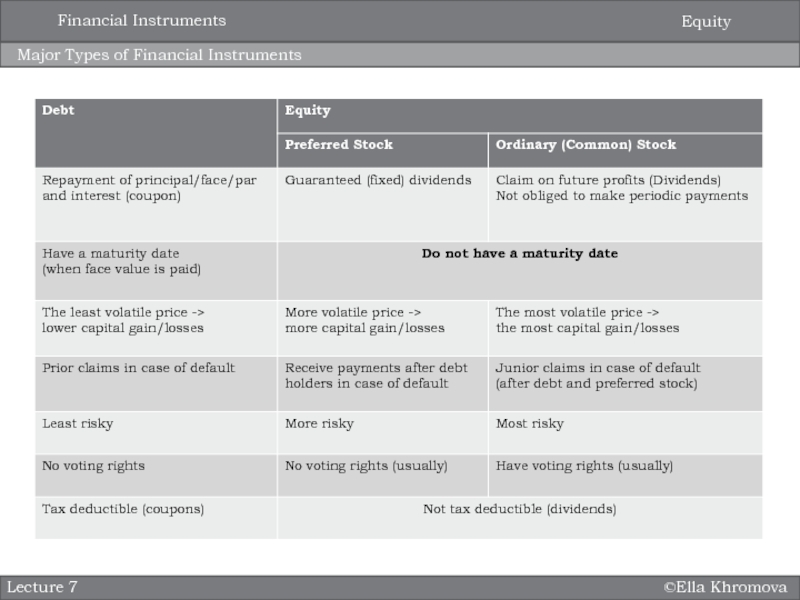

- 2. ©Ella KhromovaMajor Types of Financial InstrumentsLecture 7EquityFinancial Instruments

- 3. ©Ella KhromovaIntroduction: Methods of Equity ValuationLecture 7Intrinsic

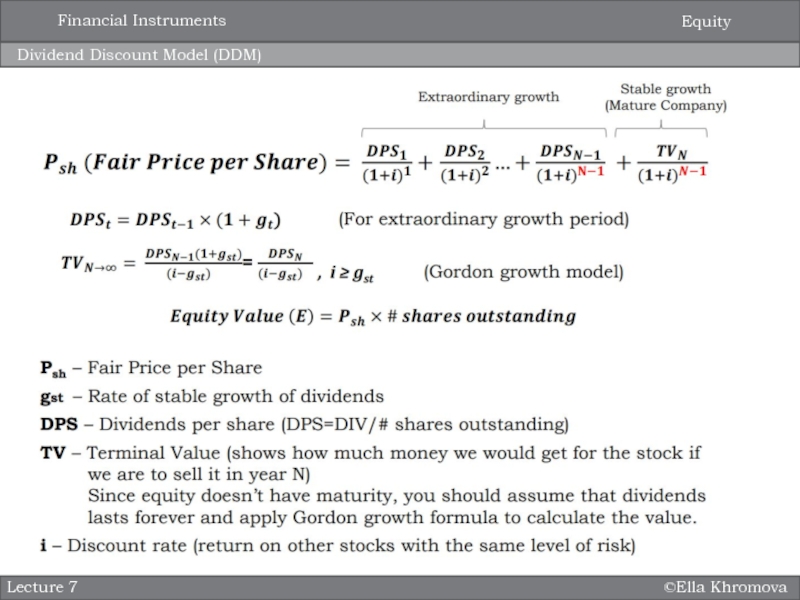

- 4. ©Ella KhromovaDividend Discount Model (DDM)Lecture 7EquityFinancial Instruments

- 5. ©Ella KhromovaDDM: Example 1Lecture 7EquityFinancial Instruments

- 6. ©Ella KhromovaDDM: Example 2Lecture 7Consider following stocks:

- 7. ©Ella KhromovaStocks market evaluationLecture 7StocksExpected returnRiskDividend yield

- 8. ©Ella KhromovaStocks market evaluationLecture 7Stock evaluation

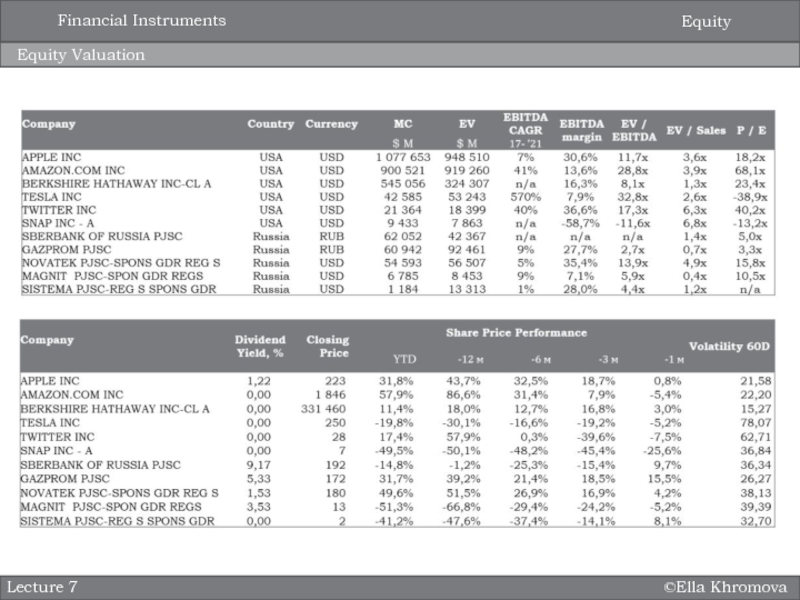

- 9. ©Ella KhromovaRelative Valuation: Most Commonly used MultiplesLecture

- 10. ©Ella KhromovaRelative Valuation: Step by step procedureLecture 7EquityFinancial Instruments

- 11. ©Ella KhromovaEquity ValuationLecture 7EquityFinancial Instruments

- 12. ©Ella KhromovaBuckle, M. and E. Beccalli Principles

- 13. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1Lecture 7.

Financial markets: Equity market in details

©Ella Khromova

Lecture 7

International

finance and globalization

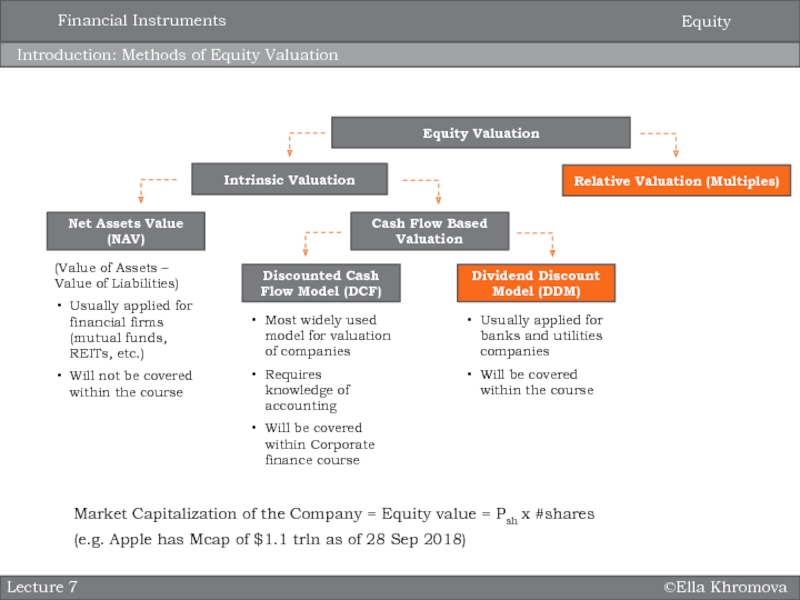

Слайд 3©Ella Khromova

Introduction: Methods of Equity Valuation

Lecture 7

Intrinsic Valuation

Relative Valuation (Multiples)

Net

Assets Value (NAV)

(Value of Assets – Value of Liabilities)

Usually applied

for financial firms (mutual funds, REITs, etc.)Will not be covered within the course

Cash Flow Based Valuation

Dividend Discount Model (DDM)

Discounted Cash Flow Model (DCF)

Usually applied for banks and utilities companies

Will be covered within the course

Most widely used model for valuation of companies

Requires knowledge of accounting

Will be covered within Corporate finance course

Equity

Financial Instruments

Market Capitalization of the Company = Equity value = Psh x #shares

(e.g. Apple has Mcap of $1.1 trln as of 28 Sep 2018)

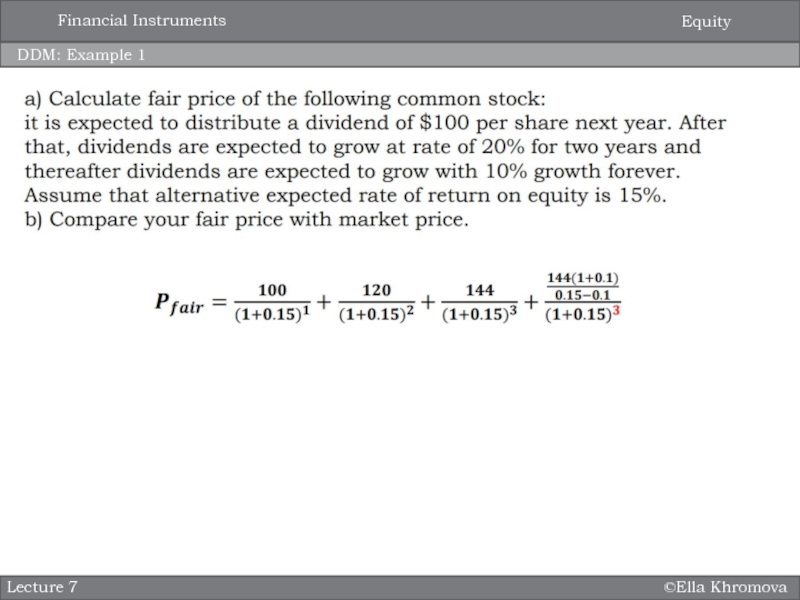

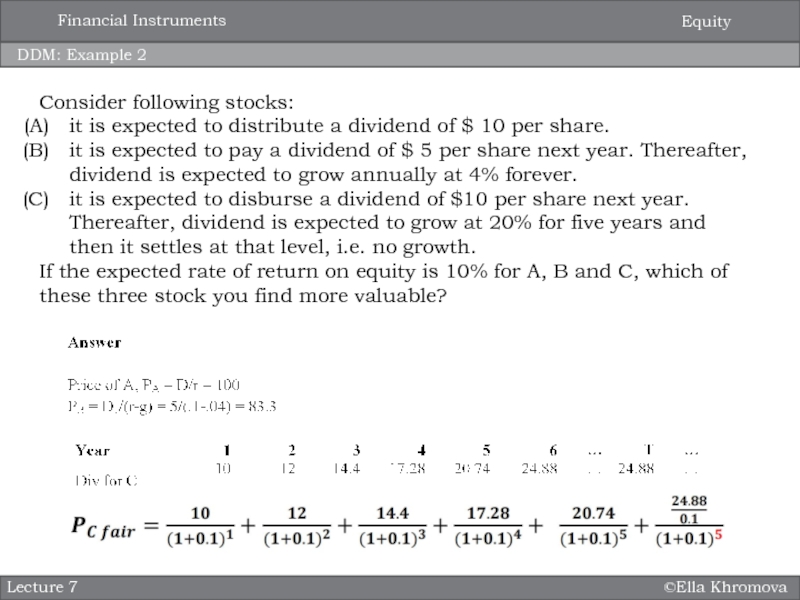

Слайд 6©Ella Khromova

DDM: Example 2

Lecture 7

Consider following stocks:

it is expected

to distribute a dividend of $ 10 per share.

it

is expected to pay a dividend of $ 5 per share next year. Thereafter, dividend is expected to grow annually at 4% forever. it is expected to disburse a dividend of $10 per share next year. Thereafter, dividend is expected to grow at 20% for five years and then it settles at that level, i.e. no growth.

If the expected rate of return on equity is 10% for A, B and C, which of these three stock you find more valuable?

Equity

Financial Instruments

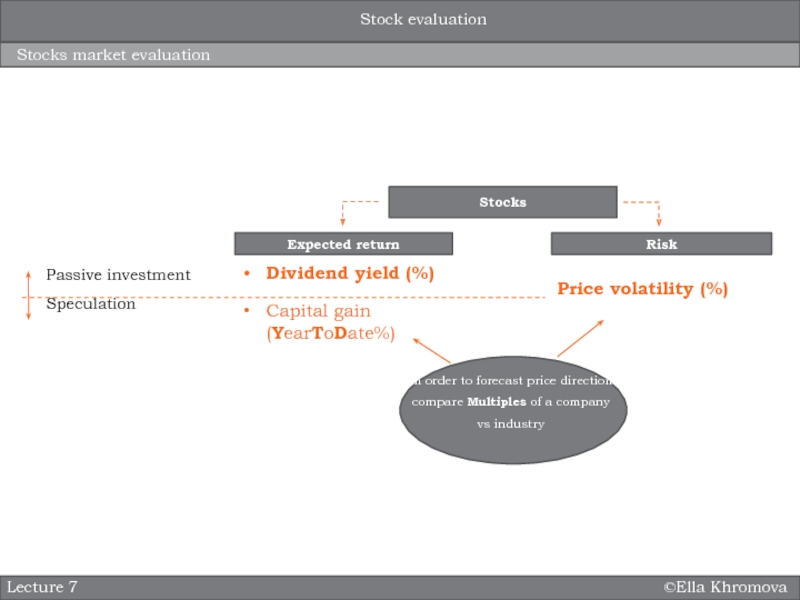

Слайд 7©Ella Khromova

Stocks market evaluation

Lecture 7

Stocks

Expected return

Risk

Dividend yield (%)

Capital gain (YearToDate%)

Price

volatility (%)

Passive investment

Speculation

In order to forecast price direction compare Multiples

of a company vs industryStock evaluation

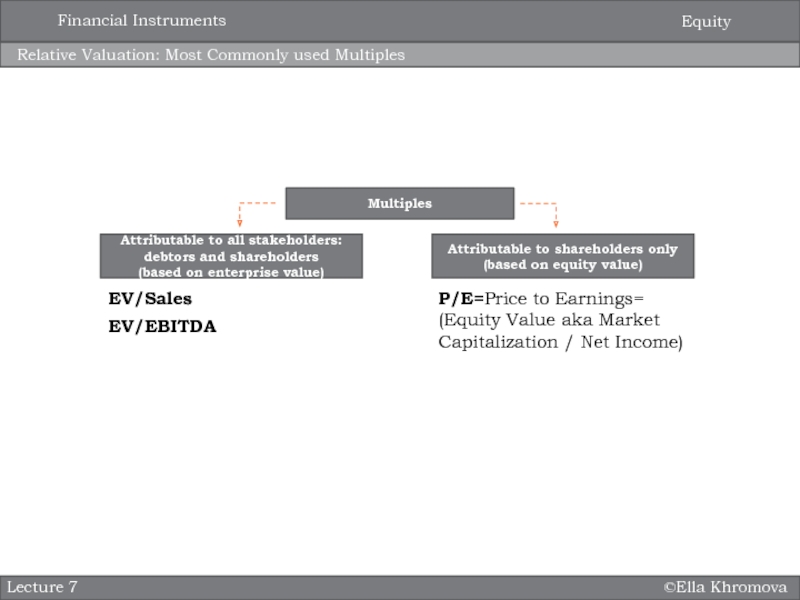

Слайд 9©Ella Khromova

Relative Valuation: Most Commonly used Multiples

Lecture 7

Multiples

Attributable to all

stakeholders: debtors and shareholders

(based on enterprise value)

Attributable to shareholders only

(based

on equity value)EV/Sales

EV/EBITDA

P/E=Price to Earnings= (Equity Value aka Market Capitalization / Net Income)

Equity

Financial Instruments

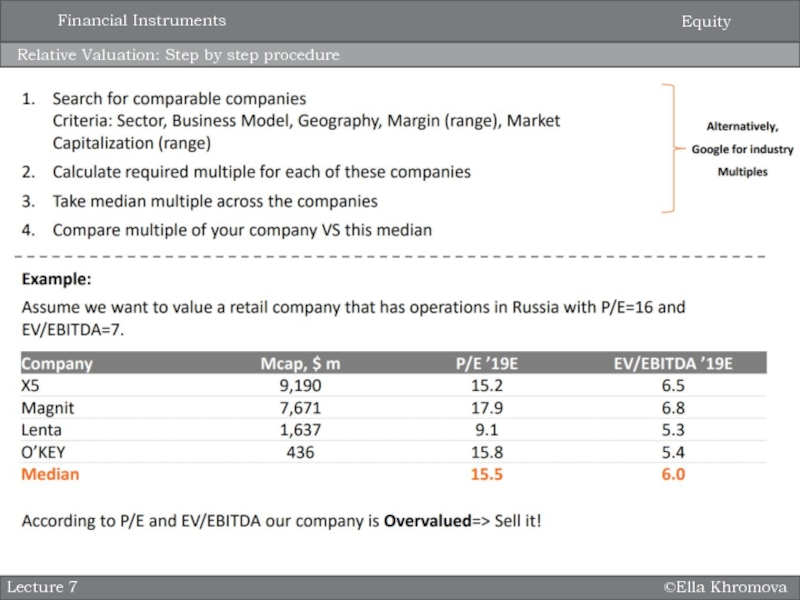

Слайд 10©Ella Khromova

Relative Valuation: Step by step procedure

Lecture 7

Equity

Financial Instruments

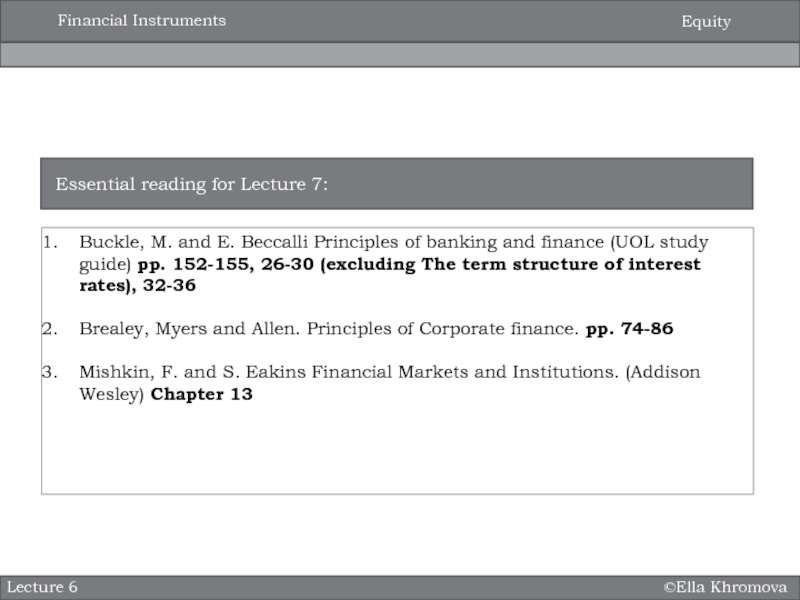

Слайд 12©Ella Khromova

Buckle, M. and E. Beccalli Principles of banking and

finance (UOL study guide) pp. 152-155, 26-30 (excluding The term

structure of interest rates), 32-36Brealey, Myers and Allen. Principles of Corporate finance. pp. 74-86

Mishkin, F. and S. Eakins Financial Markets and Institutions. (Addison Wesley) Chapter 13

Essential reading for Lecture 7:

Lecture 6

Equity

Financial Instruments