Слайд 1Practical risk management

Stuart Lawson

April 2013

Слайд 2Stuart Lawson, Executive Director

Tel.: +7 (495) 662-9312

E-mail: Stuart.Lawson@ru.ey.com

35 years in

banking in EM and OECD.

25 years in Citibank in 11

countries including 10 as crisis manager.

15 years in Russia as CEO/Chairman Citibank, Deltabank, Banks Soyuz, HSBC, director Trust, Menatep.

Chairman AEB Finance and Investment, Deputy Chairman TheCityUK Russia stream, Supervisory Board IDA.

Contact

Слайд 4A practitioner’s course

What is risk? A vocabulary.

Risk management, how to

maximise appropriate returns.

Black swans can get in the way.

Risk tools,

the quadrants and heat map.

Слайд 6What is risk?

Flip a coin, no financial outcome, does it

have risk? (flipped coins have no memory)

Interest in outcome creates

concept of financial risk.

Risk must deal with concept of loss but is inherent in the concept of profitability.

Слайд 7What types of risk?

Across a broad spectrum.

External, outside your control.

Within

your control.

The element of context and time.

Types of risks.

The constituents.

The

role of the board.

Слайд 8Risks you don’t control

Macroeconomic, financial markets, domestic, international.

Political, cross border.

Industrial,

cyclical, paradigm.

Technological progress

Business environment, local customs.

Legal and regulatory.

Acts of nature.

Слайд 9Risks you do control

Financial within company.

Company strategy and tactics.

Technology,

systems, IT security.

Operational, across all processes.

Management, key man and team.

Reputational

and PR.

Legal (not environmental).

Слайд 10Industrial

Innovations can create new paradigm.

Market dominance and impact on price

led or followed.

Supply chain changes and flexibility.

Cyclical or not, correlated

to what factors (input prices, within without control).

Слайд 11Political

Socio economic factors, short term elections, long term demographics.

Can

have broad repercussions across all industries and trading profiles.

Impacts demand

for foreign direct investment.

Cross border concepts and pricing. Impact of aggressive market positioning.

Слайд 12Company

Dependent on corporate organisation, might be single entity, group or

part of group.

Driven by company specific tactics or strategy.

Internal risk

management failure.

Relationships with employees.

Impact of counterparty, suppliers, tax, banks.

Risk profile of specific corporate.

Слайд 13Finance

Balance between risk and return on capital, leverage

Availability of

liquidity resources during period of risk.

Ability to extend trade creditors

etc

Crisis management and restructuring protocols.

Shareholder support.

Слайд 14Technology

Differing profiles of vulnerability to technology but always essential. Correct

infrastructure regularly reviewed, properly documented

Importance of appropriate MIS, training.

Information security,

vulnerability to internet and vendors. business continuity.

Competitive map, what developments are needed to keep up? IT implementation

Danger of the techies not understood by board, management. Competence to understand.

Слайд 15Operational risk

Holistic view of all aspects of the environment, what

could go wrong?

Protocols in place to govern intersection of entity

with external events.

A ‘what if’ set of action plans to address development of differing levels of risk.

Physical risk to plant and employees.

Intersection with technology, importance of processes.

Слайд 16Management risk

Misaligned organisational structures.

Role of KPI’s.

Key man risk, role of

succession planning.

Importance of corporate culture to bridge ‘gaps’.

Слайд 17Legal risk

Enforceability of ownership rights fundamental to entrepreneurship.

Regulation of rights

between constituents.

Trademarks, IP.

Overly strong creditor rights enabling banks to seize

assets.

Unclear legal environment with changing laws.

Corruption.

Слайд 18Reputational

Enhances or diminishes brand value and ability to super

price.

Cuts across all business lines.

Subject to event risk, importance of

tight public relations.

Requires clearly delineated ‘rules of road’ for interaction with media.

Once broken, extremely difficult, costly and time consuming to repair.

Слайд 19PR

Once out, particularly on internet, you can’t put it back

It

develops a momentum of its own

Can be controlled by competitors

Impact

on brand value

Who controls the ‘storyline’

Слайд 20Perspective, context and time

Experience is memory based and we have

selective memories.

History will influence the view of risk (eg been

lucky in the past).

Representative bias, that things should make sense.

Risk does not take place in a vacuum (competitors, macro, industry).

Слайд 21Types of risk

Market versus firm specific.

Continuous versus event risk.

Catastrophic versus

smaller risk.

Risks don’t have same rankings over time.

‘Chemistry’ of risks,

not predictable.

Слайд 22Who are the constituents?

The management

The customers

The regulators

The employees

The shareholders

Слайд 23Role of board in risk

Management board

Set up the vocabulary

of risk.

Dialogue with the supervisory board to set return parameters.

Create

and enforce control environment

Supervisory board

Represents the interests of the shareholders.

Approves the overall risk and reward appetite.

Слайд 24Risk management, a balancing act….

Слайд 25What to do with risk?

Avoid, strategic or tactical repositioning.

Transfer, economically,

to customers, banks, insurance companies.

Mitigate, operational controls, redundancy systems.

Keep.

Maximise.

An

appropriate return for risk taken

Слайд 26Dangers of risk management

Wrong risk culture means faster to wrong

conclusions, the herd mentality.

Wrong input, wrong output (credit scoring Russia).

Enables

increased risks to systemic level.

Can be used to disguise underlying risks.

By changing shape of cash flow, may benefit one constituent at expense of another (compensation and career path).

Слайд 27…if you get it right

Grow faster at more efficient rate

of capital.

Lengthens growth period.

Impacts the default rate and therefore cost

of debt.

Creates a greater upside opportunity where the firm focuses on areas where it has competitive advantage.

Allows stability of earnings that may be reflected in market valuation.

Tax impact of earnings smoothing, reduces tax on excessive profit.

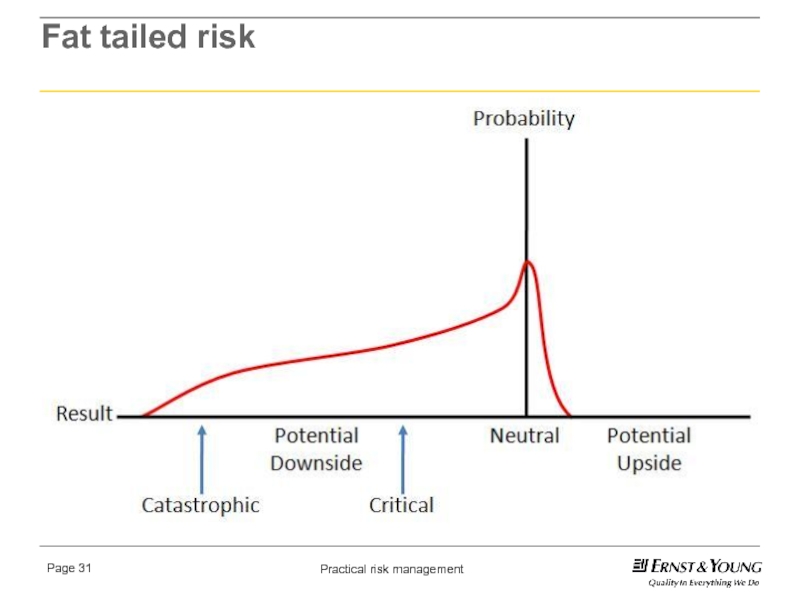

Слайд 29Black swan, what is it?

An outlier, outside normal expectations, rarity

(the fat tail).

Carries an extreme impact.

Human nature causes us to

explain why it occurred AFTER the event.

Non occurance of the probable.

Differing timeframes (earthquakes and internet).

Unknown unknowns.

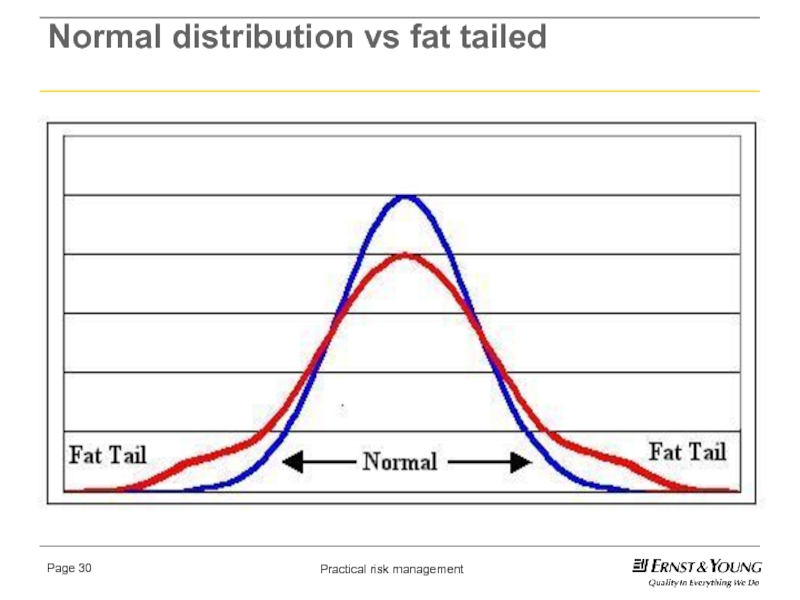

Слайд 30Normal distribution vs fat tailed

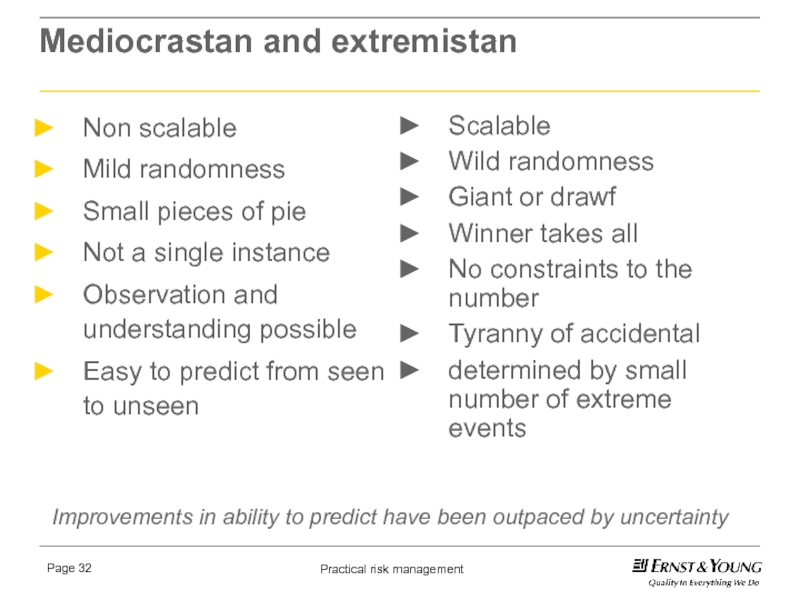

Слайд 32Mediocrastan and extremistan

Non scalable

Mild randomness

Small pieces of pie

Not a single

instance

Observation and understanding possible

Easy to predict from seen to unseen

Scalable

Wild

randomness

Giant or drawf

Winner takes all

No constraints to the number

Tyranny of accidental

determined by small number of extreme events

Improvements in ability to predict have been outpaced by uncertainty

Слайд 33And so???

Allowing unexpected to happen key to success.

Importance of trial

and error, be as exposed as possible to chance encounters.

Key

to success is not always skills doesn’t mean skills not relevant.

Can deliver black swans after thousands of white swans (the past does not predict the future, as a turkey around Thanksgiving).

BS unpredictable consequences, retrospective explainability.

Won’t know the unknown but maximise upside exposure to it.

Preparedness not prediction, chance favours the prepared.

Focus on consequences not probability

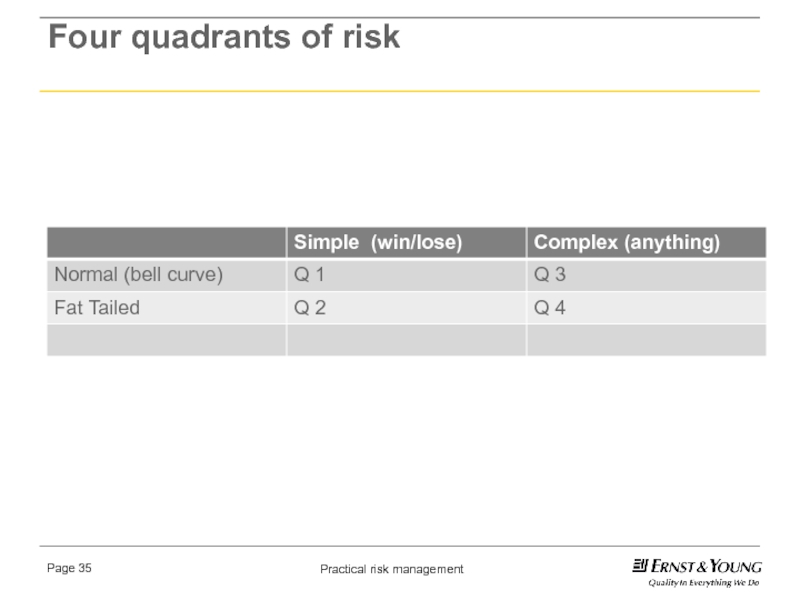

Слайд 36Quadrant 1, simple, normal

Heads or tails.

No single outcome can dramatically

change mean (height not wealth.)

Time of movie.

Elections, win or lose.

No

leverage exists..

Слайд 37Quadrant 1 tools

Probabilities from historical data work well.

No outlier, surprises.

At

risk type models work well (VAR).

Слайд 38Quadrant 2, simple, fat tailed

Payoff simple (happens or not).

Able to

understand the outcomes of events that might happen.

Manageable risks.

Apple (Q1)

coconut (Q2) trees.

Shark attack.

Oil spills.

Define risks.

Слайд 39Quadrant 2 tools

Do not understand the distribution of risks well.

Do

not know when a dramatic event may occur.

But we do

know the consequences.

Don’t know timing or how bad..

If size matters and timing everything, we have a problem.

Generally the risks can be managed, rules based, reduce, cap, mitigate.

Слайд 40Q3, complex, normal distribution

No leverage.

Outcome predictable with high level of

certainty.

Errors mostly human not physical

O rings on challenger.

Auto parts, complex

machinery.

Lunar expedition.

Are historical statistics reliable guide?

Слайд 41Quadrant 3 tools

Resilient, redundancy, fail safe systems.

Are the tails really

thin or is it a lack of historical data (ie

are we fooling ourselves).

True Quadrant 3 risks can be managed around.

Слайд 42Q4 complex, fat tailed

Black swan territory.

Infrequent but massive impact.

Leverage is

often excessive.

Risk models dont work.

Extremistan.

Social impact high (job loss, government

fail).

Dont rely on statistics or models.

Слайд 43Quadrant 4 tools

We cannot manage or model the unknown risks

of Q4.

Limit the downside risk contractually.

Reduce the impact of relationships

and complexities we do not understand.

Build in redundancies, train.

Слайд 45Over the horizon, strategic

Longer the horizon, more strategic needs more

discussion and challenge to historical bias.

Challenge the output with independent

experts.

Small cross functional risk team that collates silo’s information and looks for patterns etc.

Maps of potential risk and response.

Слайд 46External

External, uncontrollable risks (black swans excluded).

Stress testing, but watch

out for recent history (eg USA real estate) causing myopia

Scenario

planning, define time horizon, which events will have maximum impact on company (watch out for over optimism).

War gaming, teams develop what competitors (actual and potential) could do to disrupt plan.

Слайд 47Preventable, predictable risks

Compliance, rules based systems with appropriate exceptions (important

to know who can make the call).

Standard operating procedure and

clear internal culture around strong mission statement

Integrated risk management alongside line, but beware of ‘going local’

Checked with internal audit, line reviews

Слайд 48Some tools

Scenarios, separate risks, three outcomes

Decision trees, separate risks,

many outcomes

Scenario planning, continuous risk, correlated, built into each simulation

Слайд 49Practical approach to risk management

Make inventory of all risks, categorise

them

Quantify risk for entity, high, medium, low

Manage the downside whilst

maximising the upside. Decide which risks to hedge, which to pass through to investors. Cost versus impact.

What risk hedging products are available, correlation?

Which risks can be handled better than competition?

Create strategies to maximise exposure to risks which entity can better handle

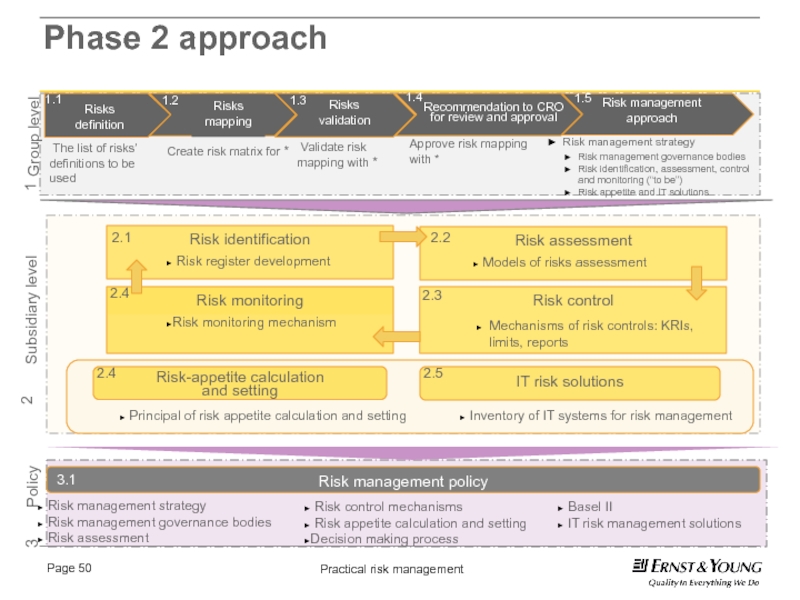

Слайд 50Phase 2 approach

The list of risks’ definitions to be

used

Create risk matrix for *

Group level

Subsidiary level

Risk management

strategy

Risk management governance bodies

Risk identification, assessment, control and monitoring (“to be”)

Risk appetite and IT solutions

Risk register development

Mechanisms of risk controls: KRIs, limits, reports

Risk management strategy

Risk management governance bodies

Risk assessment

Risk control mechanisms

Risk appetite calculation and setting

Decision making process

Risk monitoring mechanism

Models of risks assessment

Basel II

IT risk management solutions

Inventory of IT systems for risk management

Recommendation to CRO for review and approval

Validate risk mapping with *

Approve risk mapping with *

Policy

Principal of risk appetite calculation and setting

1

2

3

1.1

1.2

1.3

1.4

1.5

2.1

2.2

2.3

2.4

2.4

2.5

3.1

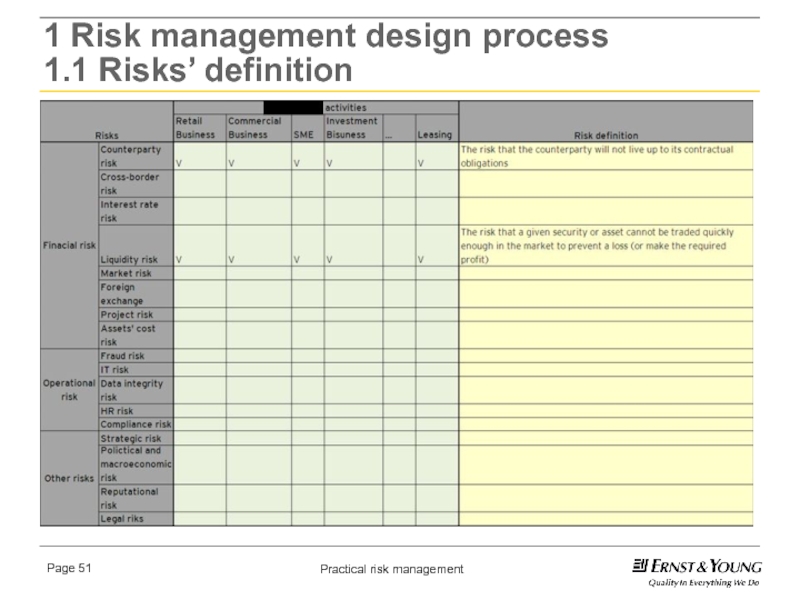

Слайд 511 Risk management design process

1.1 Risks’ definition

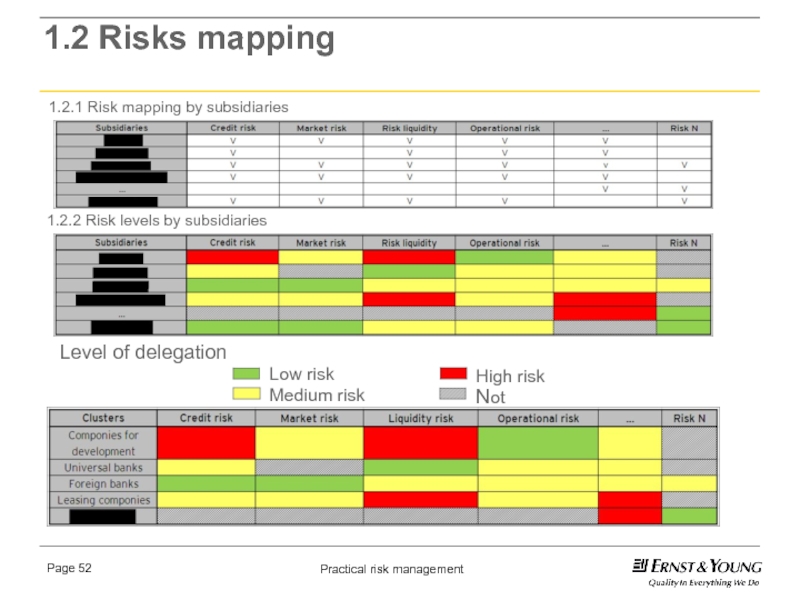

Слайд 521.2 Risks mapping

1.2.1 Risk mapping by subsidiaries

1.2.2 Risk levels by

subsidiaries

Level of delegation

Low risk

Medium risk

High risk

Not applicable

1.2.3 Risk levels by

clusters

Слайд 53Conclusion

Before you have the discussion, create the vocabulary.

Create a

broad log of all risks.

Ensure that all constituents participate.

Map risks

against quadrants.

Review appropriate actions against each set of risks.

Schedule regular reviews, risks change over time.