by

Matthew Will

Chapter 7

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies,

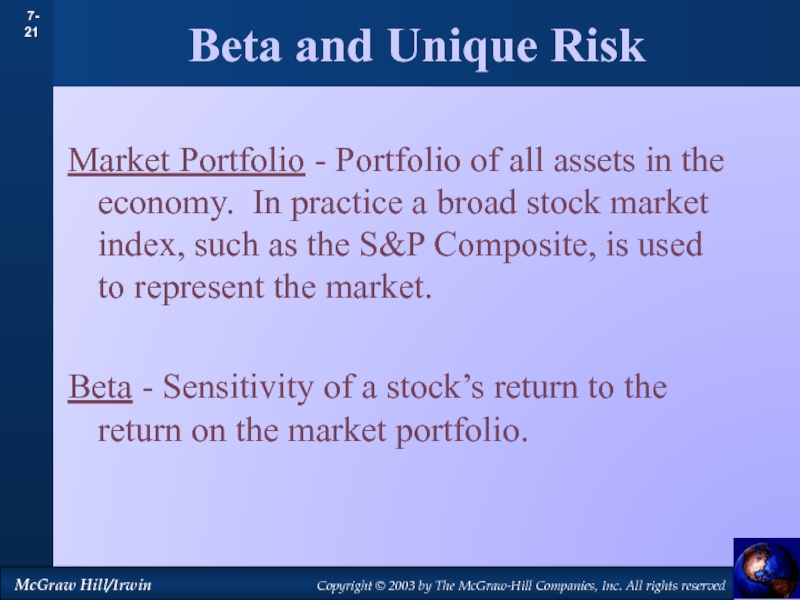

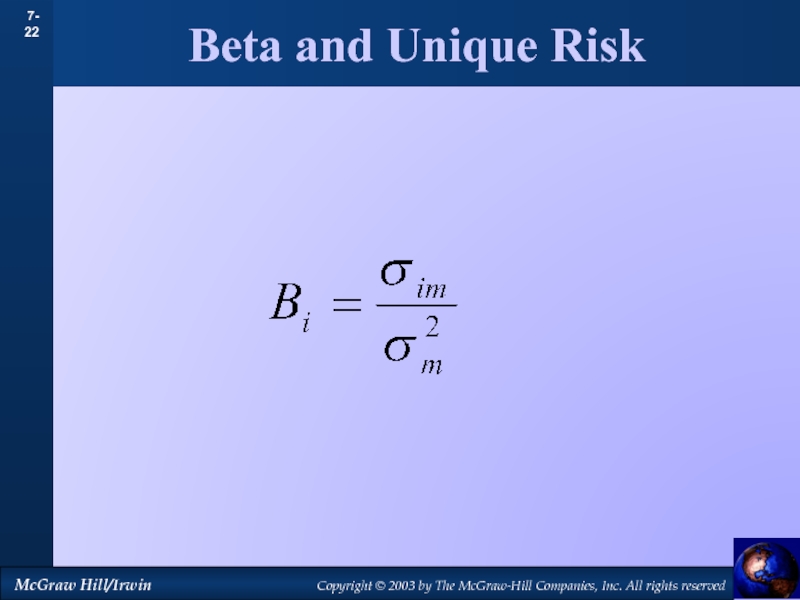

Inc. All rights reserved Introduction to Risk, Return, and the Opportunity Cost of Capital