by

Matthew Will

Chapter 8

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies,

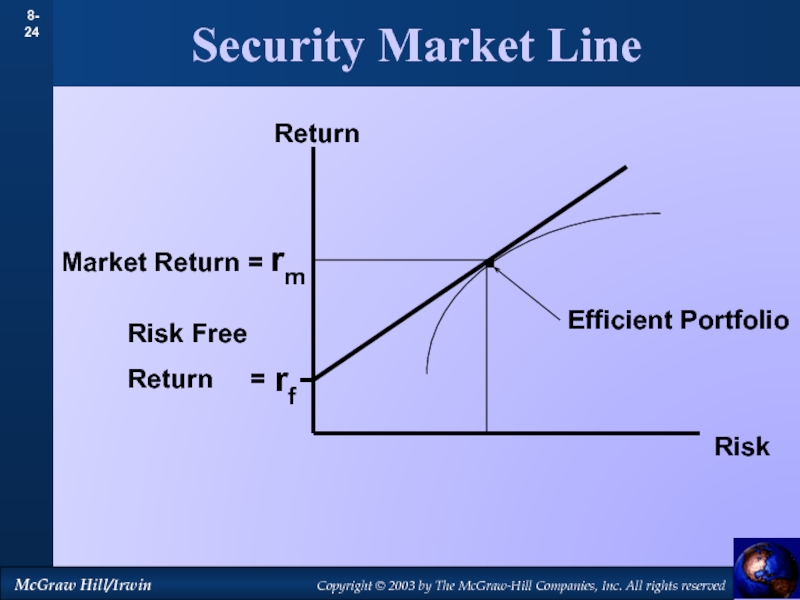

Inc. All rights reserved Risk and Return