Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Structure of Balance of Payments

Содержание

- 1. The Structure of Balance of Payments

- 2. The balance of payments (BoP) is a statistical statement

- 3. The balance of payments records all economic transactions undertaken

- 4. BoP is an important macro-economic indicator used

- 5. The balance of payment record is maintained

- 6. Balance of Payment is a record pertaining

- 7. Слайд 7

- 8. 1. Trade Account Balance It is the

- 9. 2. Current Account Balance It is difference

- 10. 3. Capital Account Balance It is difference

- 11. 4. Foreign Exchange Reserves Foreign exchange reserves

- 12. Foreign exchange reserves (forex) are used to

- 13. 5. Errors and Omission The errors may

- 14. Слайд 14

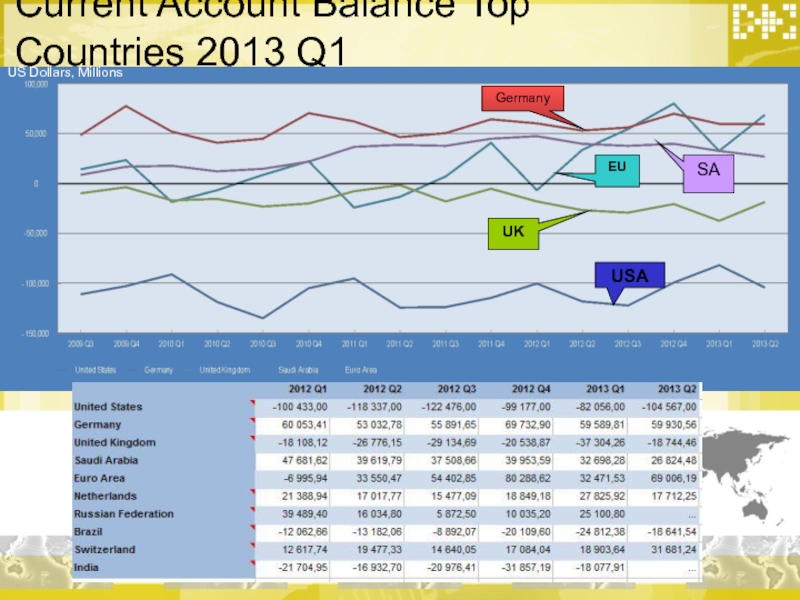

- 15. Current Account Balance Top Countries 2013 Q1US Dollars, MillionsUSAUKEUSAGermany

- 16. Слайд 16

- 17. Слайд 17

- 18. Слайд 18

- 19. Слайд 19

- 20. Thank you!

- 21. Скачать презентанцию

The balance of payments (BoP) is a statistical statement that systematically summarises, over a given period of time, all the transactions of an economy with the rest of the world.

Слайды и текст этой презентации

Слайд 3The balance of payments records all economic transactions undertaken between the residents and

non-residents of a country during a given period.

Transaction

an economic flow

that reflects the creation, transformation, exchange, transfer, or extinction of economic value and involves changes in ownership of goods and/or financial assets, the provision of services, or the provision of labour and capital Слайд 4BoP is an important macro-economic indicator used to assess the

position of an economy (of credit or debit) towards the

external world.Слайд 5The balance of payment record is maintained in a standard

double-entry book-keeping method. International transactions enter in to the record

as credit or debit. The payments received from foreign countries enter as credit and payments made to other countries as debit.Слайд 6Balance of Payment is a record pertaining to a period

of time; usually it is all annual statement. All the

transactions entering the balance of payments can be grouped under three broad accounts;Current Account,

Capital Account,

Official International Reserve Account. However, it can be vertically divided into many categories as per the requirement.

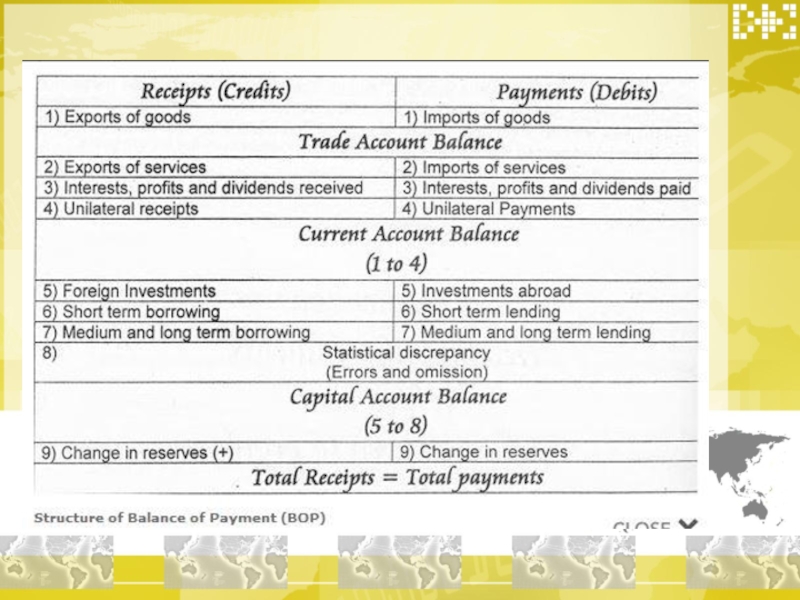

Слайд 81. Trade Account Balance

It is the difference between exports and

imports of goods, usually referred as visible or tangible items.

Till recently goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or deficit on that account. An industrial country with its industrial products comprising consumer and capital goods always had an advantageous position. Developing countries with its export of primary goods had most of the time suffered from a deficit in their balance of payments. Most of the OPEC countries are in better position on trade account balance.The Balance of Trade is also referred as the 'Balance of Visible Trade' or 'Balance of Merchandise Trade'.

Слайд 92. Current Account Balance

It is difference between the receipts and

payments on account of current account which includes trade balance.

The current account includes export of services, interests, profits, dividends and unilateral receipts from abroad, and the import of services, interests, profits, dividends and unilateral Payments to abroad.There can be either surplus or deficit in current account. The deficit will take place when the debits are more than credits or when payments are more than receipts and the current account surplus will take place when the credits are more than debits.

Слайд 103. Capital Account Balance

It is difference between the receipts and

payments on account of capital account. The capital account involves

inflows and outflows relating to investments, short tern borrowings/lending, and medium term to long term borrowing/lending.There can be surplus or deficit in capital account.

The surplus will take place when the credits are more than debits and the deficit will take place when the debits are more than credits.

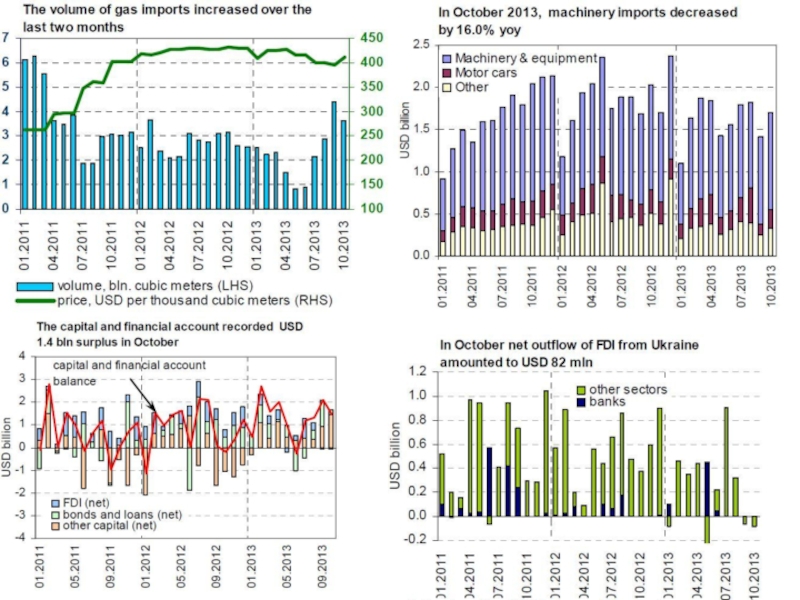

Слайд 114. Foreign Exchange Reserves

Foreign exchange reserves shows the reserves which

are held in the form of foreign currencies usually in

hard currencies like dollar, pound etc., gold and Special Drawing Rights (SDRs).Foreign exchange reserves are analogous to an individual's holding of cash. They increase when the individual has a surplus in his transactions and decrease when he has a deficit.

When a country enjoys a net surplus both in current account & capital account, it increases foreign exchange reserves. Whenever current account deficit exceeds the inflow in capital account, foreign exchange from the reserve accounts is used to meet the deficit. If a country's foreign exchange reserves rise, that transaction is shown as minus in that country's balance of payments accounts because money is been transferred to the foreign exchange reserves.