Слайд 1Topic 2: Competition

and its place in

international trade

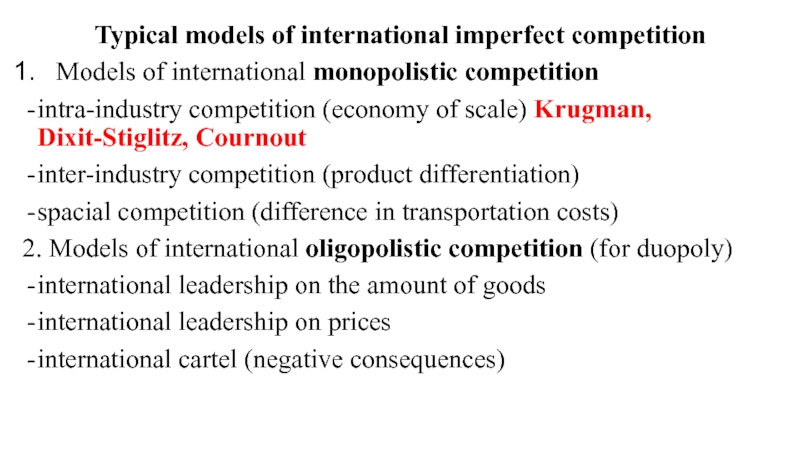

Слайд 2Typical models of international imperfect competition

Models of international monopolistic

competition

intra-industry competition (economy of scale) Krugman, Dixit-Stiglitz, Cournout

inter-industry competition

(product differentiation)

spacial competition (difference in transportation costs)

2. Models of international oligopolistic competition (for duopoly)

international leadership on the amount of goods

international leadership on prices

international cartel (negative consequences)

Слайд 33. Models of pure international monopoly

monopoly of national company on

national market

monopoly of national company on national market and in

export

monopoly of national company on internal market but competition in export

foreign company has monopoly positions on internal market

Слайд 4International trade models and imperfect competition

HO model, Leontiev paradox (competition

in result of difference between production factors)

Neotechnological models: comparative advantage

from product differentiation (rises from production factors)

“technological lag” of Pozner: comparative advantage of countries which have innovations. During time country loses such advantage.

“model of product life cycle” of Pozner: same comparative advantage which appears only on stages of technology introduction and fast growth of company

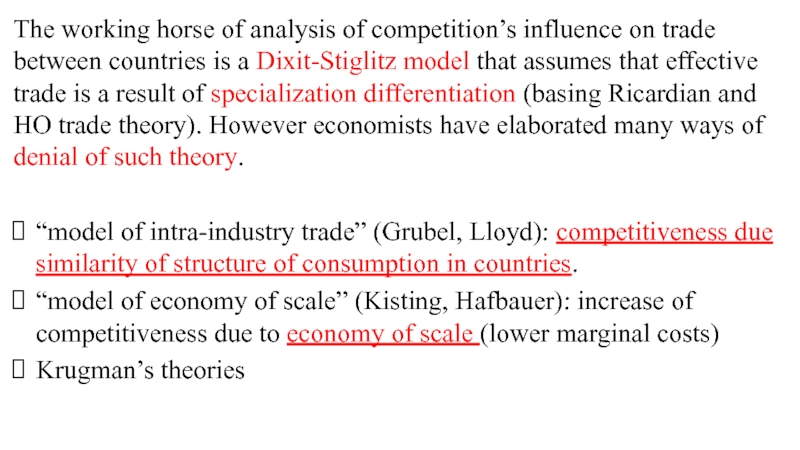

Слайд 5The working horse of analysis of competition’s influence on trade

between countries is a Dixit-Stiglitz model that assumes that effective

trade is a result of specialization differentiation (basing Ricardian and HO trade theory). However economists have elaborated many ways of denial of such theory.

“model of intra-industry trade” (Grubel, Lloyd): competitiveness due similarity of structure of consumption in countries.

“model of economy of scale” (Kisting, Hafbauer): increase of competitiveness due to economy of scale (lower marginal costs)

Krugman’s theories

Слайд 6Intra-industry imperfect competition

Intra-industry trade accounts for about ¼ of world

trade

Mostly in manufacturing goods among advanced industrial economies. Not

between developed and developing countries as Ricardian and HO models would predict.

And mostly within the same industry with no difference in their comparative advantage

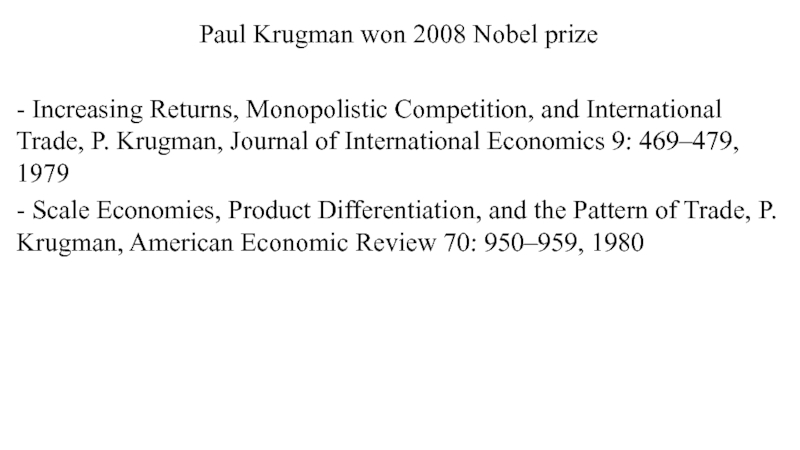

Слайд 7Paul Krugman won 2008 Nobel prize

- Increasing Returns,

Monopolistic Competition, and International Trade, P. Krugman, Journal of International

Economics 9: 469–479, 1979

- Scale Economies, Product Differentiation, and the Pattern of Trade, P. Krugman, American Economic Review 70: 950–959, 1980

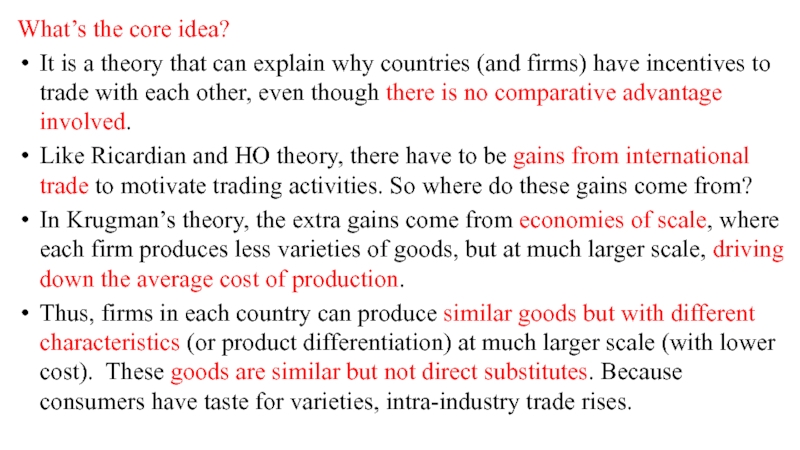

Слайд 8What’s the core idea?

It is a theory that can

explain why countries (and firms) have incentives to trade with

each other, even though there is no comparative advantage involved.

Like Ricardian and HO theory, there have to be gains from international trade to motivate trading activities. So where do these gains come from?

In Krugman’s theory, the extra gains come from economies of scale, where each firm produces less varieties of goods, but at much larger scale, driving down the average cost of production.

Thus, firms in each country can produce similar goods but with different characteristics (or product differentiation) at much larger scale (with lower cost). These goods are similar but not direct substitutes. Because consumers have taste for varieties, intra-industry trade rises.

Слайд 9Internal vs External Economies of scale

- Internal is based

upon intra-company activity that leads to increase of supplied volumes

of goods and decrease of marginal costs

- External Economies of Scale

Firms clustering together in certain location = subject of Economics of Geography

Examples: Silicon Valley as technology center

Why do firms (or individuals) behave in such way?

What are the benefits from such location choice?

Слайд 10External Economies of Scale

Sources of gains:

Specialized suppliers

Labor

market pooling

Knowledge spillovers

What are the key differences between

internal and external economies of scale?

Internal gains come from larger market scale because there is a initial fixed cost, implying that the larger the scale, the more efficient (or less costly) they can produce.

External gains are not from within the firm; rather, they are from the externalities generated from firms clustering together.

Слайд 11Impact of External Economies of Scale

It could have similar

effects as internal economies of scale:

The clustering of

firms will bring down the cost of production: easy access to suppliers and labor pool

Technology spillovers could spur innovation, another way of bringing down cost

In addition, firm clustering tends to reinforce specialization choices at the beginning, which may have some unintended consequences.

Слайд 12Switzerland watch industry

Switzerland specializes in watch making due to

mysterious unknown historical/cultural reasons. But in short, they are good

at making watches.

Over time, as income of Switzerland rises, their cost of watch making is also rising.

But because of their early specialization in watch industry and the external scale of economies generated from this long-time watch making (learning curve), it makes new competitor’s entry into the market very difficult.

And the world may face a welfare loss as a result of trade