Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Accounting 1 Accounting Lecture 1: Accounting and Business Environment Lisa, Li

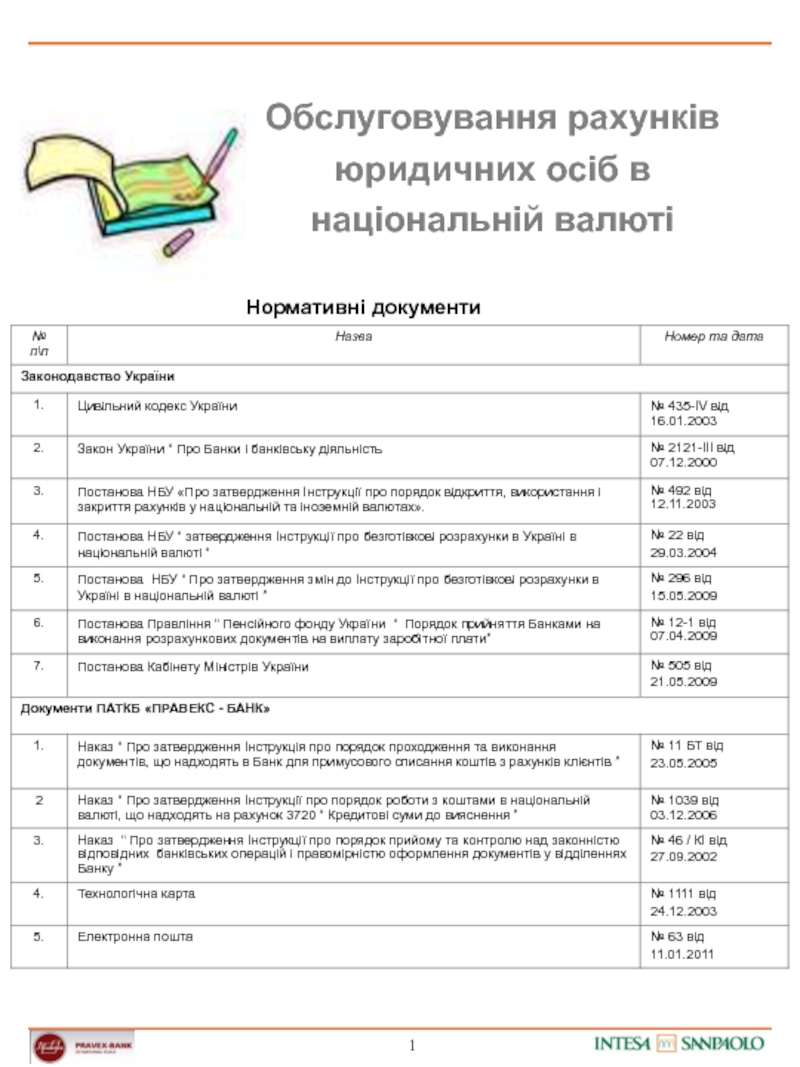

Содержание

- 1. Accounting 1 Accounting Lecture 1: Accounting and Business Environment Lisa, Li

- 2. Join the Tencent Meeting ClassPlease enter your

- 3. Materials of the CourseTextbook:Horngren’s Accounting, Pearson, 10th

- 4. Materials of the Course (cont’d)Textbook:Noble, L.Tracie; Mattison,

- 5. Materials of the Course (cont’d) Accounting

- 6. Слайд 6

- 7. Слайд 7

- 8. Unit Assessment TaskIn class

- 9. Tips for success

- 10. Chapter 1: Learning ObjectivesIntroductionImportance of AccountingGoverning

- 11. Introduction of Accounting

- 12. Users of Accounting InformationExternal UsersCreditorsShareholdersTax AuthoritiesOutside InvestorsExternal AuditorsCustomersBankersInternal UsersManagersBoard of DirectorsInternal AuditorsSales StaffBudget OfficersControllersCEO, CFO

- 13. Multiple Choices 2mins

- 14. True or False Questions 5mins Shareholders

- 15. Importance of Accounting

- 16. Importance of Accountingaccounting positions for the

- 17. BIG 4 Auditors - How Big ?leading

- 18. Importance of Accounting

- 19. How to govern accounting?I. Governing Organizations

- 20. I. Governing Organizations Governing organizations are:Securities

- 21. I. Governing OrganizationsSecurities and Exchange Commission SEC

- 22. I. Governing OrganizationsFASB in USAthe Financial Accounting

- 23. II. Guidelines for accounting information Generally Accepted

- 24. Generally Accepted Accounting Principles (GAAP)Issued by the

- 25. II. Guidelines for accounting information International Financial

- 26. Multiple ChoiceThe guidelines for accounting information are

- 27. III. Basic Accounting Assumption and Principle 1.

- 28. 1. Economic Entity AssumptionProprietorship (sole trader) means

- 29. Слайд 29

- 30. 2. Going Concern AssumptionFinancial statements are prepared

- 31. 3. Monetary Unit AssumptiomThe assumption that requires

- 32. 4. The Cost

- 33. Accounting AssumptionsAccounting Economic Entity AssumptionCost PrincipleGoing Concern AssumptionMonetary Unit Assumption

- 34. Multiple Choices 2mins The

- 35. Multiple Choices 2mins According

- 36. TRY IT!

- 37. Accounting FieldsFinancial AccountingManagerial AccountingAuditing Public Sector Accounting – governmentsAccounting

- 38. Accounting FieldsManagerial AccountingFinancial Accounting Public Sector Accounting Auditing

- 39. Two basic branches of accountingManagement accounting(MA)special requirement

- 40. Comparison of FA and MA

- 41. Comparison of FA and MA

- 42. Users of Financial Information1-©2014 Pearson Education, Inc. Publishing as Prentice Hall

- 43. Multiple Choices 2mins Managerial accounting information is used by:taxing authorities.auditors.lenders.internal decision makers.

- 44. Relationship between MA and FABoth of

- 45. 3Accounting Homework-Matching

- 46. Скачать презентанцию

Слайды и текст этой презентации

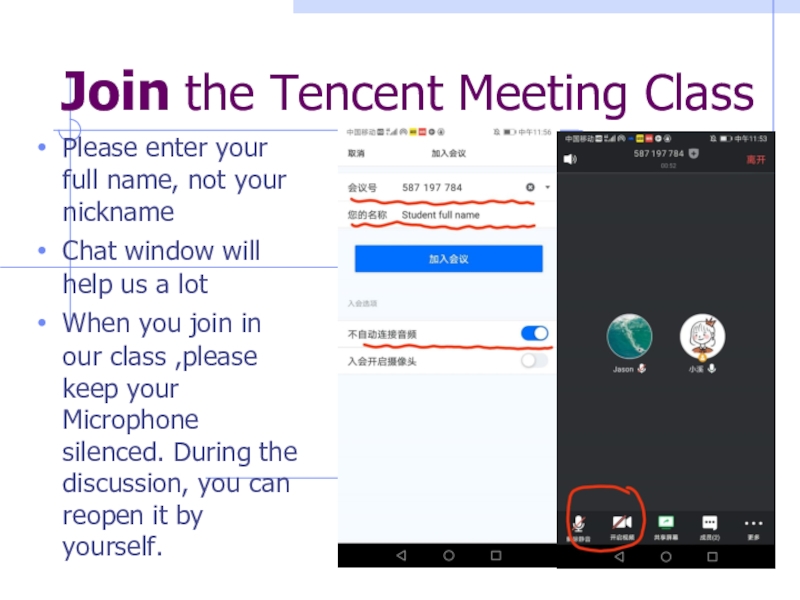

Слайд 2Join the Tencent Meeting Class

Please enter your full name, not

your nickname

Chat window will help us a lot

When you join

in our class ,please keep your Microphone silenced. During the discussion, you can reopen it by yourself.Слайд 3Materials of the Course

Textbook:

Horngren’s Accounting, Pearson, 10th Global edition

Learning Objectives,

Chapter

Summary handout (preview)

PPT slides(preview)

‘Try it’ Questions,

Chapter Overview,

10-mins quizzes

and Review Q (homework)Short Exercises, and critical thinking cases

Accounting

2

Слайд 4Materials of the Course (cont’d)

Textbook:Noble, L.Tracie; Mattison, L. Brenda &

Matsumura Mae Ella, Horngren’s Accounting, Pearson, 10th edition, Global edition

Other

Reference Books:Randall & Hopkins, Cambridge International AS and A Level Accounting

Warren,C. Reeve, J.& Fess P. Principles of Accounting(23rd ed)

by and Wild, J. Financial Accounting Fundamentals

Accounting

Слайд 6 Study Guide

Part 1:

Introduction of accounting

Accounting and Business Environment

Financial Accounting vs. Managerial

Accounting Five Groups (elements)of Accounts

Basic Accounting Principles

The Accounting Process

Mid-term exam

Accounting

Слайд 7 Study Guide

Part 2:

Prepare Financial Statement

Adjusting process

Closing process

The Accounting cycle

Common Accounting ratios

Final examination

Accounting

Слайд 8 Unit Assessment Task

In class practice

15%

multiple choices, ‘try it’

Q, practices in classMid-term Exam 15%

textbook and PowerPoint

Final Exam 70%

-textbook, PowerPoint and practices in class

-multiple choices, short answers and accounting cases

More than 60% of total marks will pass

Accounting

Слайд 9 Tips for success in the course

Experience of Learning Accounting

Spend more time on the beginning part

(Chapter 1,2)Theory → Practice → Theory

professional business language

Materials: textbook, PPTs and reference books

Download IAS,IFRS and AASB from official website

Accounting

Слайд 10 Chapter 1: Learning Objectives

Introduction

Importance of Accounting

Governing Organizations and Guidelines

Basic

Accounting assumptions

Accounting Principles

Two basic branches of accounting:

MA and FAAccounting

Слайд 11 Introduction of Accounting

What Is Accounting?

Accounting is an information

process, which is related with collecting and recording financial information from business organizations, and communicating relevant financial information to stakeholders. information process: identifying, collecting, classifying, recording and communicating

stakeholders: persons or entities have interest in the economic performance of the business. e.g. managers, creditors, bankers

Global and professional business language

Accounting

Слайд 12Users of Accounting Information

External Users

Creditors

Shareholders

Tax Authorities

Outside Investors

External Auditors

Customers

Bankers

Internal Users

Managers

Board of

Directors

Internal Auditors

Sales Staff

Budget Officers

Controllers

CEO, CFO

Слайд 13Multiple Choices 2mins

Which of

the following are external users of a business’s financial information?

A. Taxing authorities

B. Customers

C. Employees

D. Creditors

E. Board of Directors

(tip: two or more than two correct answers)

Слайд 14True or False Questions 5mins

Shareholders primarily use accounting

information for decision-making purposes.

Local, state, and federal governments use

accounting information to calculate firm’s income tax. A creditor is a person who owes money to the business.

Different users of financial statements focus on the different parts of the financial statements for the information they need.

Слайд 15 Importance of Accounting

For individual

Saving and Managing money

Statement of Financial Performance (oversea student)

Accounting

Слайд 16 Importance of Accounting

accounting positions for the careers

External auditors, BIG

4 Accounting Firms

Internal auditors,

Controllers,

finance and accounting specialists in bank,

Tax accountants(CPAs)

cost

accountants(CMAs),Business system analysts, Financial analysts

Accounting

Слайд 17BIG 4 Auditors - How Big ?

leading firms: Account for

¾ auditing markets,

Company’s Income : more than $20 billion/year

“Famous

customers”: majority customers are world's top 500 enterprises.Eg. Walmart, Albaba, Google, HSBC

Employment: 17,000-20,000

staffs in 70 countries, including

10,000 Chinese employees.

Departments: auditing, taxes, advisory

Tax

Advisory

Auditing

Слайд 18 Importance of Accounting

for Business Firms

All the businesses and organizations need accountants.

Financial

Annual Reports—public firms Budegt, project plan,Managerial report

Internal Control – accounting information system

Financial and Strategic Decisions

Accounting

Слайд 19How to govern accounting?

I. Governing Organizations

SEC

FASB in USA IASB in

UKII. Guidelines for Accounting Information

GAAP IFRS

III. Basic Accounting assumption and Principles

Accounting

Слайд 20 I. Governing Organizations

Governing organizations are:

Securities and Exchange Commission

(SEC)

Financial Accounting Standards Board (FASB)

International Accounting Standard Board (IASB), which

publish International Financial Report Standard (IFRS) the importance of the convergence of accounting standards at a global level.

Accounting

Слайд 21I. Governing Organizations

Securities and Exchange Commission

SEC is an U.S.

governmental agency that oversees the US financial markets. It also

oversees FASB.The SEC was established by the Securities Act of 1934

the SEC requires that all publicly traded companies have an annual financial statement audit that is conducted by a Certified Public Accountant.

The SEC delegated that standard-setting responsibility to the accounting profession.

Слайд 22I. Governing Organizations

FASB in USA

the Financial Accounting Standard Board (FASB)

is a private organazation.

Creates the rules and standards that

govern financial accountingIt oversees the creation and governance of U.S.GAAP (accounting standards).

IASB in UK

the International Accounting Standards Board (IASB), located in London, has established a body of International Financial Reporting Standards, IFRS, that are used by a majority of other countries.

Accounting

Слайд 23II. Guidelines for accounting information

Generally Accepted Accounting Principles (GAAP)

It

is the main US accounting rule book and is issued

by the FASB.GAAP rests on a conceptual framework that identifies the objectives, characteristics, elements and implementation of FS and create the acceptable accounting practices.

The SEC requires that American businesses follow U.S. GAAP.

Accounting

Слайд 24Generally Accepted Accounting Principles (GAAP)

Issued by the FASB.

Establishes the rules

for recording transactions and preparing financial statements.

Published online as part

of the Accounting Standards Codification.Requires that information be useful.

Relevant = The info allows users to make a decision.

Faithfully Representative = The info is complete, neutral, and free from material error.

Accounting

Слайд 25II. Guidelines for accounting information

International Financial Report Standards

(IFRS)

A set of global accounting guidelines , formulated by the

International Accounting Standard Board.IFRS is a set of global accounting standards that are used or required by more than 120 nations.

A publicly traded company in the United States come under SEC regulations as long as it follows the rules of GAAP.

Accounting

Слайд 26Multiple Choice

The guidelines for accounting information are called:

Globally Accepted and

Accurate Policies.

Global Accommodation Accounting Principles.

Generally Accredited Accounting Policies.

Generally Accepted Accounting

Principles.Слайд 27III. Basic Accounting Assumption and Principle

1. Economic Entity Assumption

2.

Goning Concern Assumption

3. Monetary Unit assumptiom

4. The Cost principle

5. The

Accounting Equation6. Profit Determination

7. Double-entry bookkeeping

8. Matching principle

9. Reporting Principle

Accounting

Слайд 281. Economic Entity Assumption

Proprietorship (sole trader) means one person or

a family owns the firm and control business,small business such

as laundries, repair shop,newsstand.Partnership multiple individuals, called general partners, manage the business and are equally liable for its debts.e.g.dentist office, law firms.

Corporation Firm that meets certain legal requirements to be recognized as having a legal existence, as an entity separate and distinct from its owners. e.g. General Motor, IBM

Limited-Liability Company (LLC) a company in which each member is only liable for his or her own actions. Indefinite life. e.g. Big 4 Auditors

Accounting

Слайд 302. Going Concern Assumption

Financial statements are prepared under the assumption

that the entity will continue to operate for the foreseeable

future.This assumption is essential if we expect businesses to engage in long term agreements. For example, a manufacturer would not likely enter into a long-term sales agreement with a customer, if it believed that that customer would soon be out of business.

Accounting

Слайд 313. Monetary Unit Assumptiom

The assumption that requires the items on

the financial statements to be measure in terms of a

monetary unit.In the United States, we record transaction in American dollars($).

In UK, we record transaction in Yuan (¥). Pound(£).

In china, we record transaction in Chinese Yuan (¥)

Albaba, big multinational Chinese company, should be record in American dollars or

Chinese Yuan? And why?

Accounting

Слайд 32 4. The Cost Principle

assets should be

recorded at their actual cost (historical cost) on the date

of acquisition.all liabilities should be recorded at their actual cost, when it happened.

We record a transaction at the amount shown on the receipt(or contracts)- actual amount paid.

Not at “expected cost” or “current relevant market value”.

Eg. the company bought the Land with building at $300,000 20 years age, now the land price increases dramatically.

Accounting

Слайд 33Accounting Assumptions

Accounting

Economic Entity Assumption

Cost Principle

Going Concern Assumption

Monetary Unit Assumption

Слайд 34Multiple Choices 2mins

The formation of

a partnership firm requires a minimum of:

A) four partners.

B) three

partners.C) one partner.

D) two partners.

Слайд 35Multiple Choices 2mins

According to which of

the following accounting concepts should the acquired assets be recorded

at the amount actually paid rather than at the estimated market value?Monetary unit assumption

Cost principle

Economic entity assumption

Going concern assumption

Слайд 37 Accounting Fields

Financial Accounting

Managerial Accounting

Auditing

Public Sector Accounting

– governments

Accounting

Слайд 38Accounting Fields

Managerial

Accounting

Financial

Accounting

Public Sector

Accounting

Auditing

Слайд 39Two basic branches of accounting

Management accounting(MA)

special requirement for the purposes

to make better decisions for the organization and improve the

efficiencyIMA: large U.S. professional organization of accountants, focus on internal accounting

Licensed as Certified Management Accountant(CMA)

Financial accounting(FA)

Stakeholders, particular external parties - comply with IASs, GAAP;external users

Licensed as Certified Public Accountant(CPA)