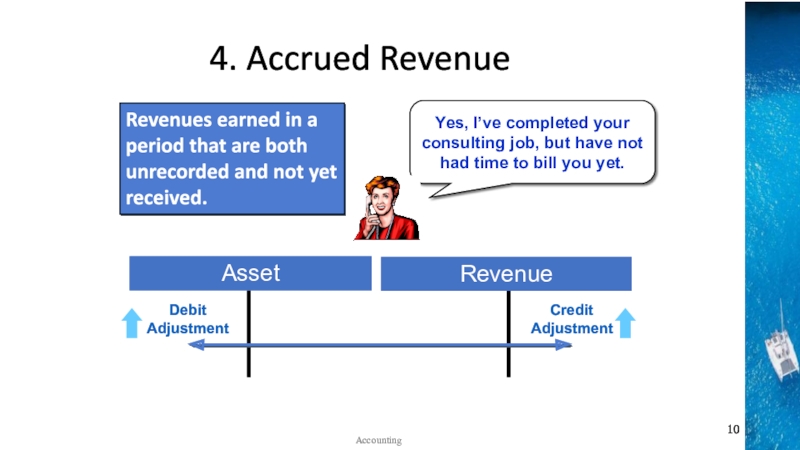

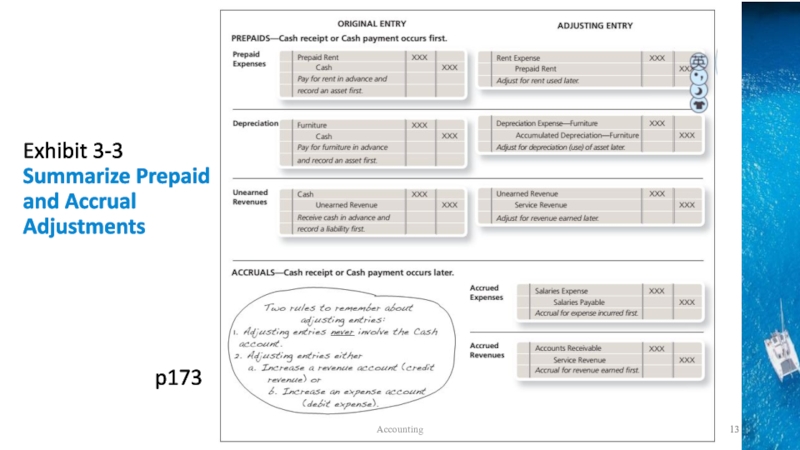

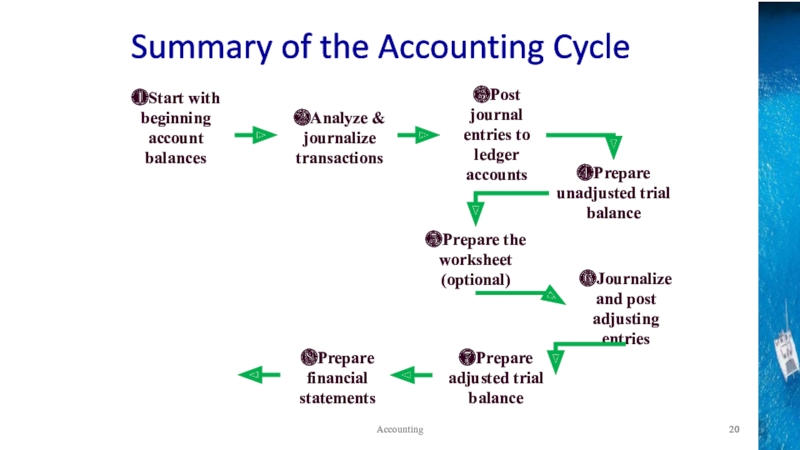

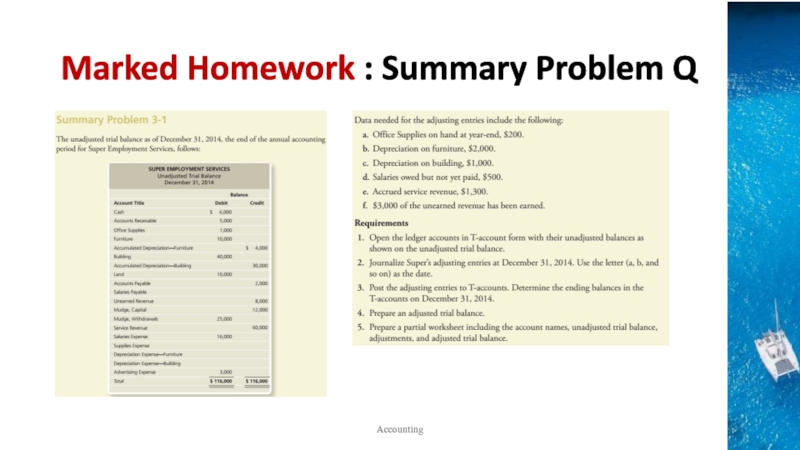

the time period concept, revenue recognition, and matching principles

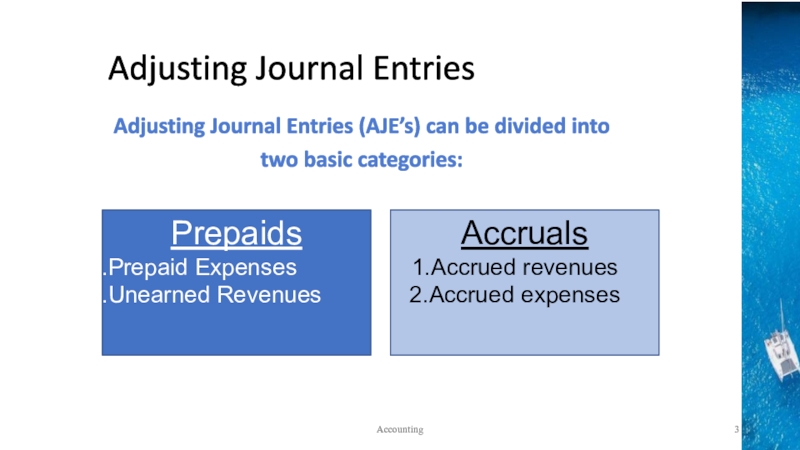

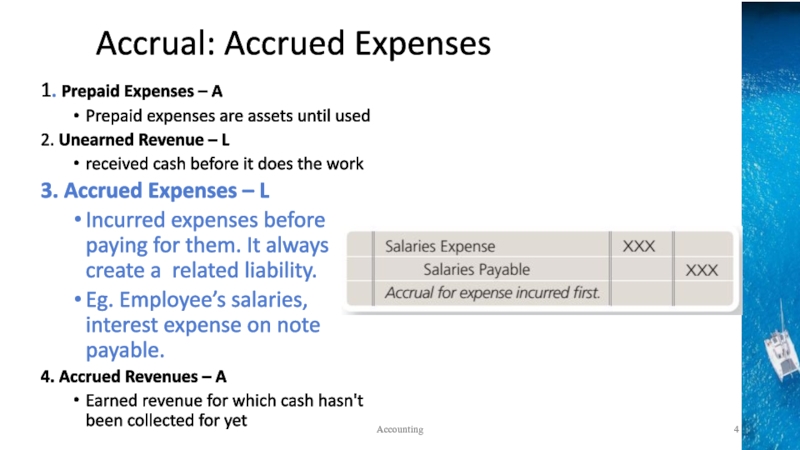

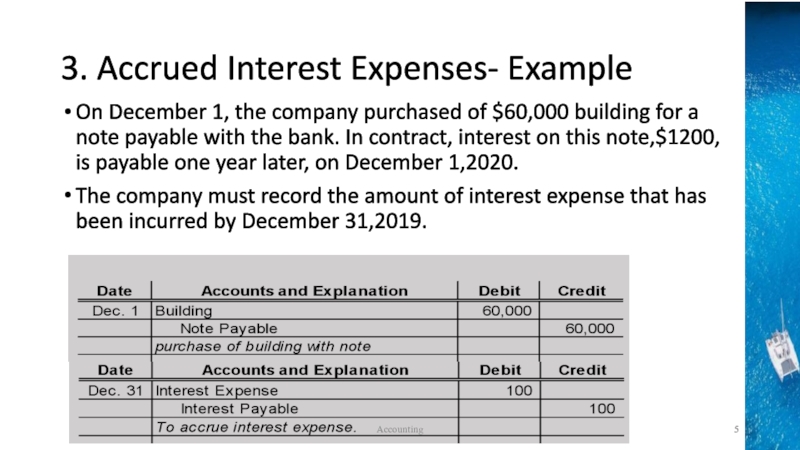

Explain the

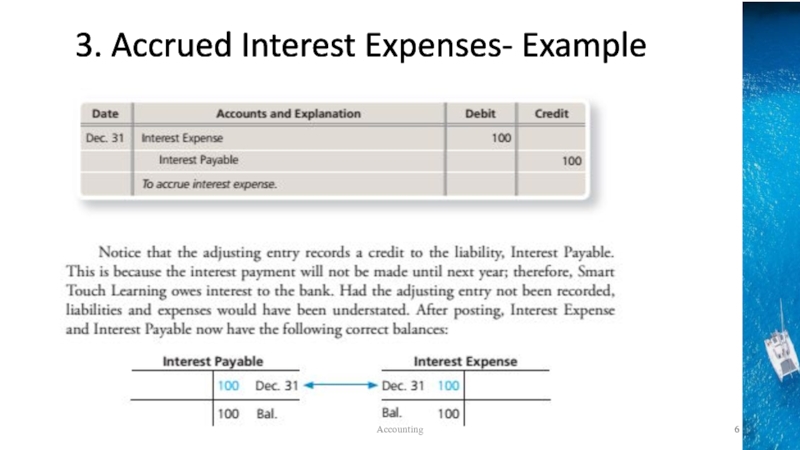

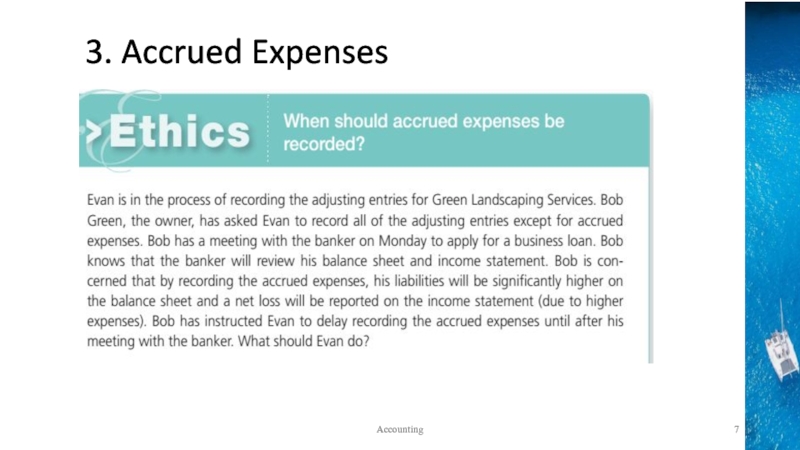

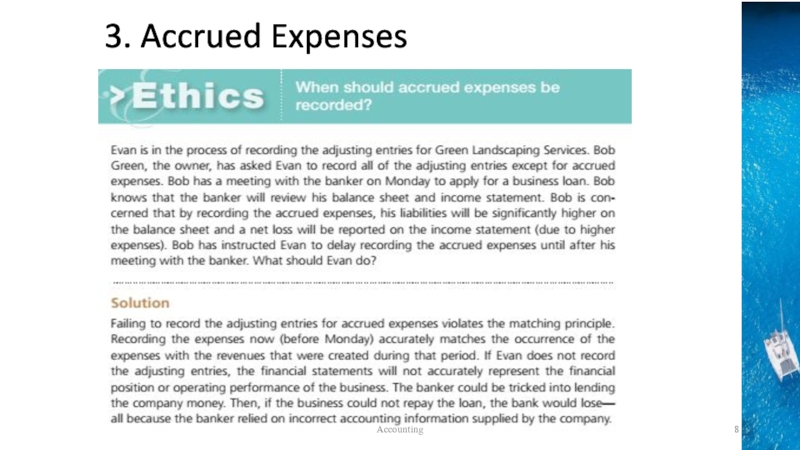

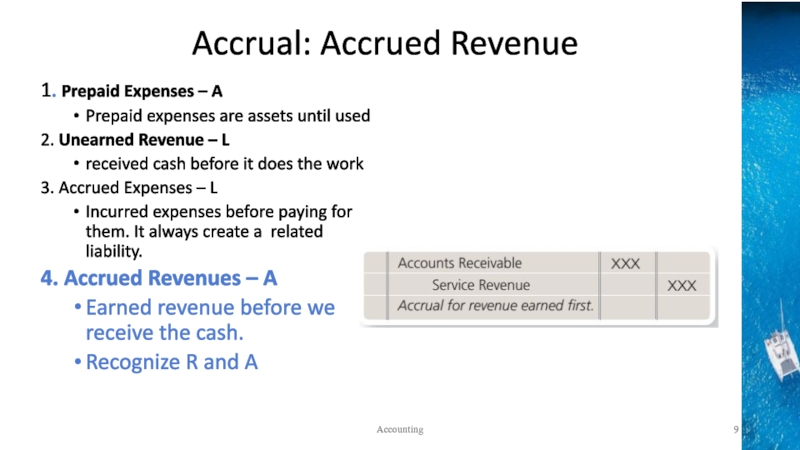

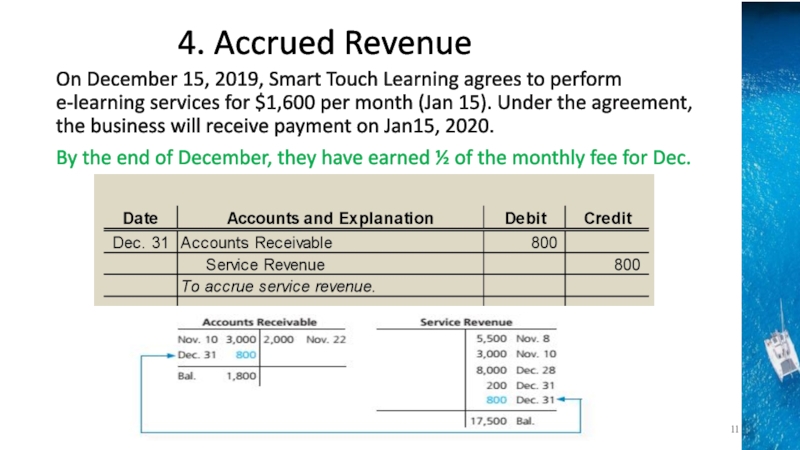

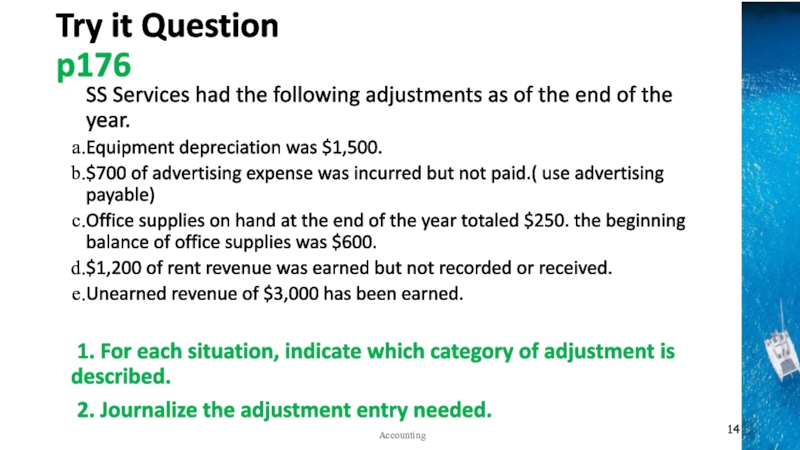

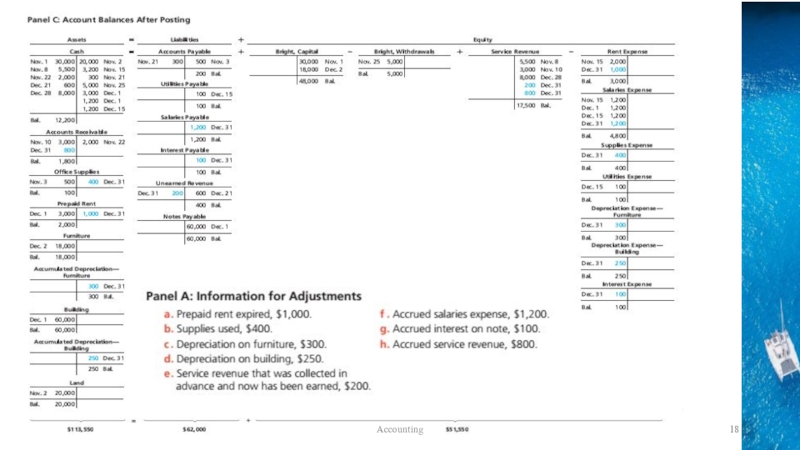

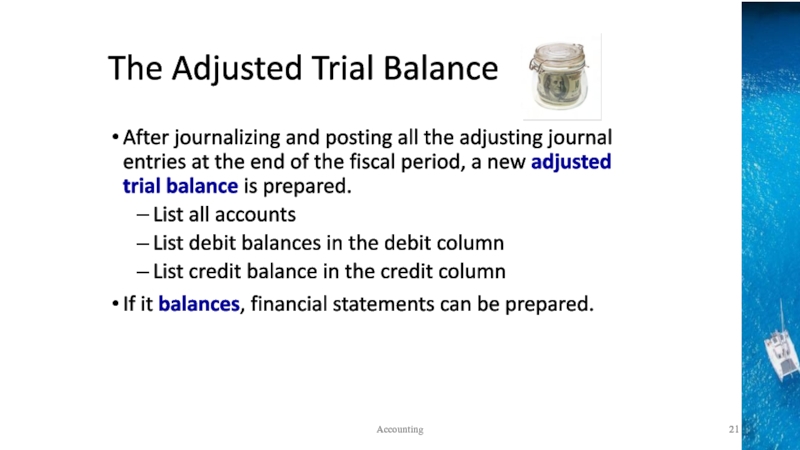

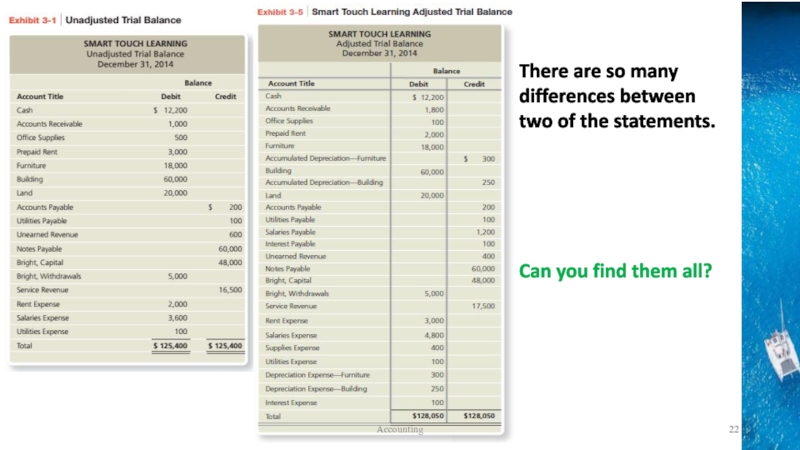

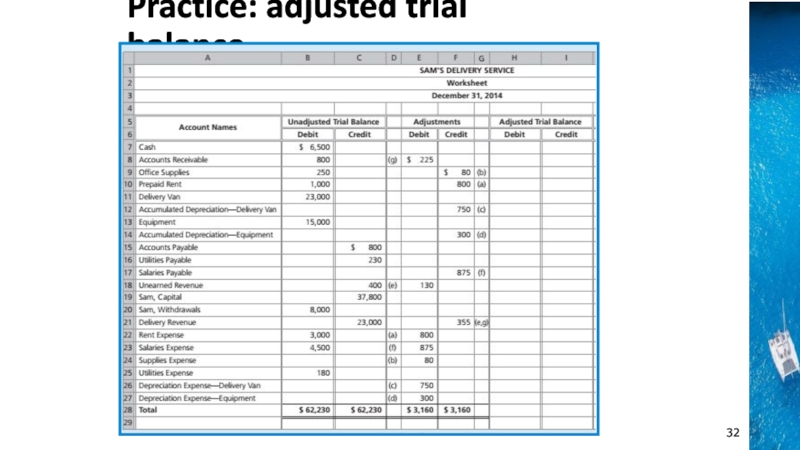

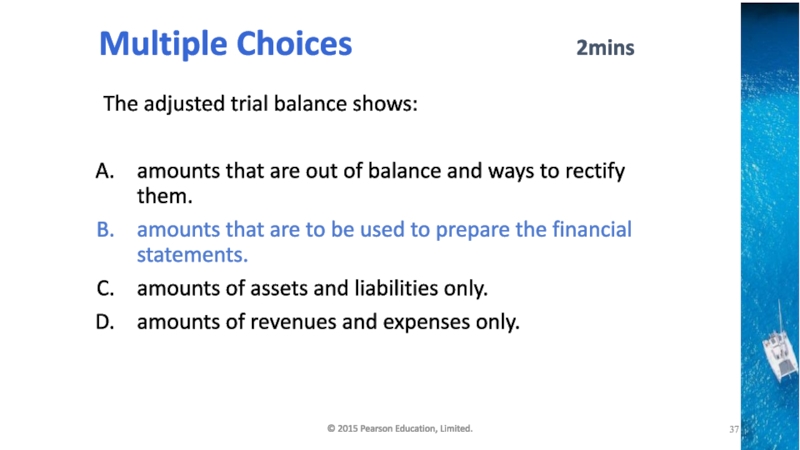

purpose of and journalize and post adjusting entriesPrepare an adjusted trial balance

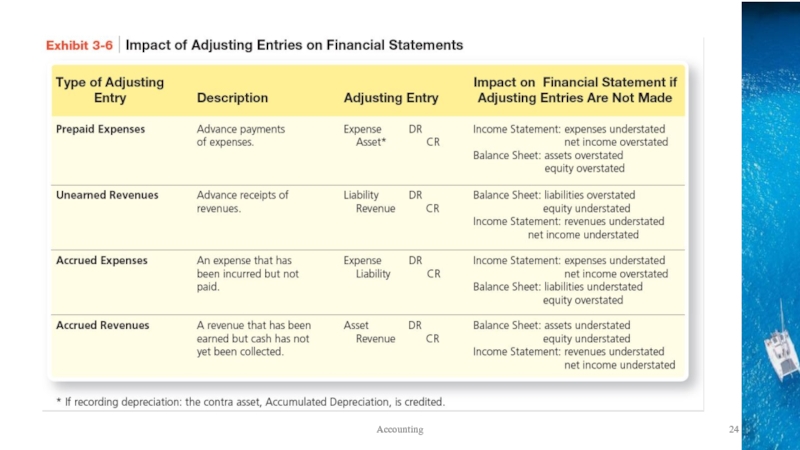

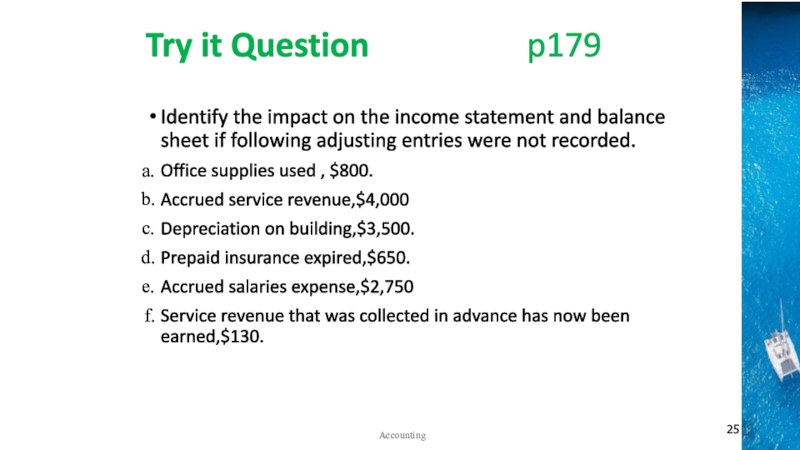

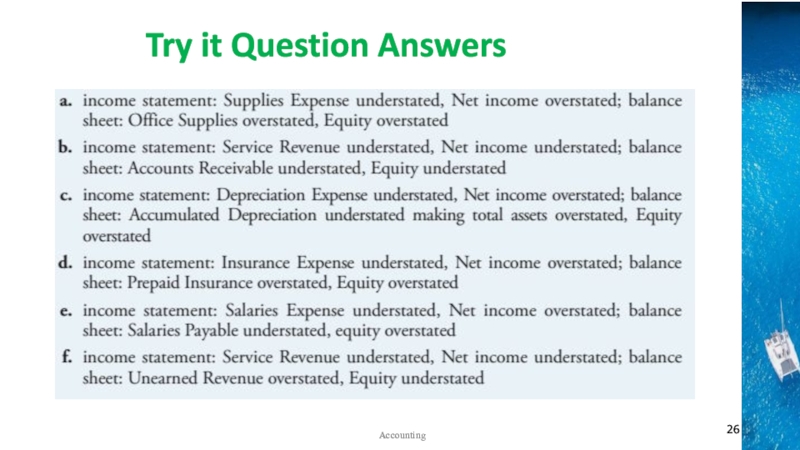

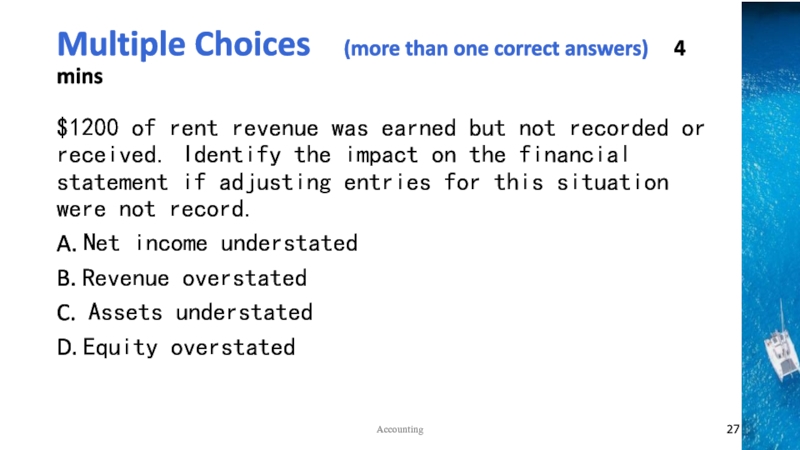

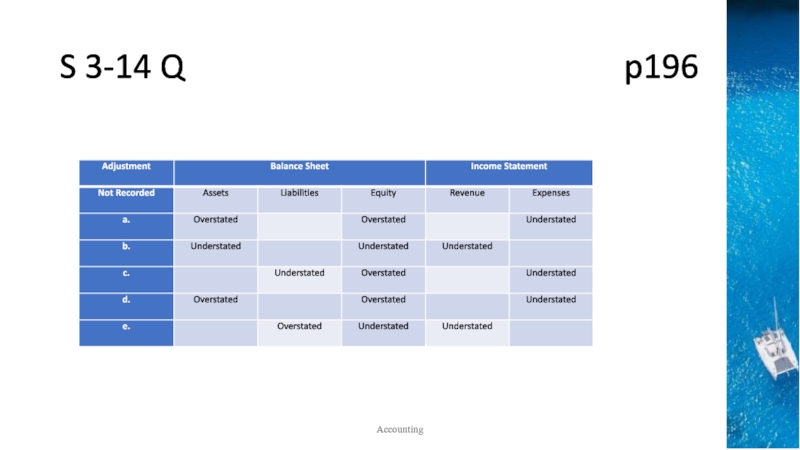

Identify the impact of adjusting entries on the financial statements

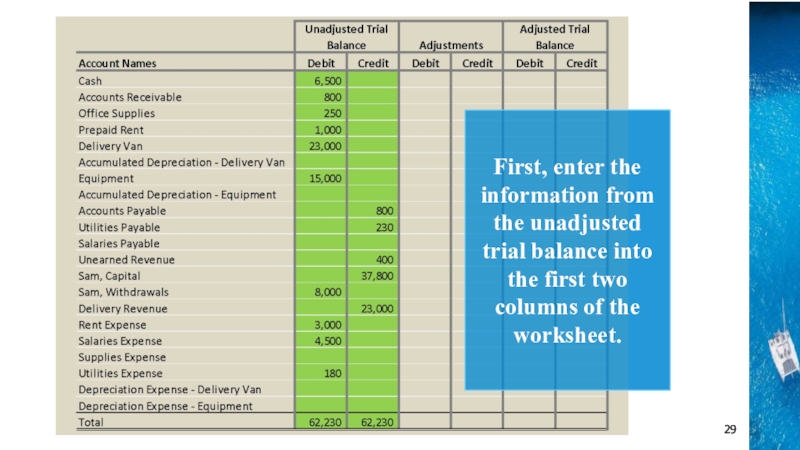

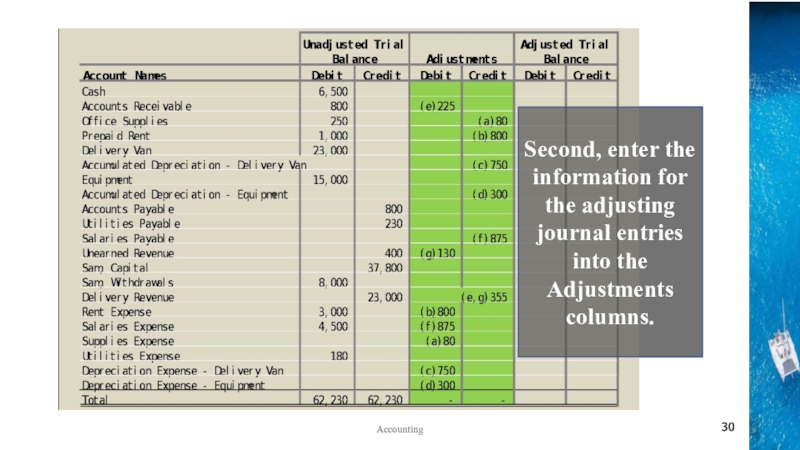

use a worksheet to prepare the adjusted trial balance

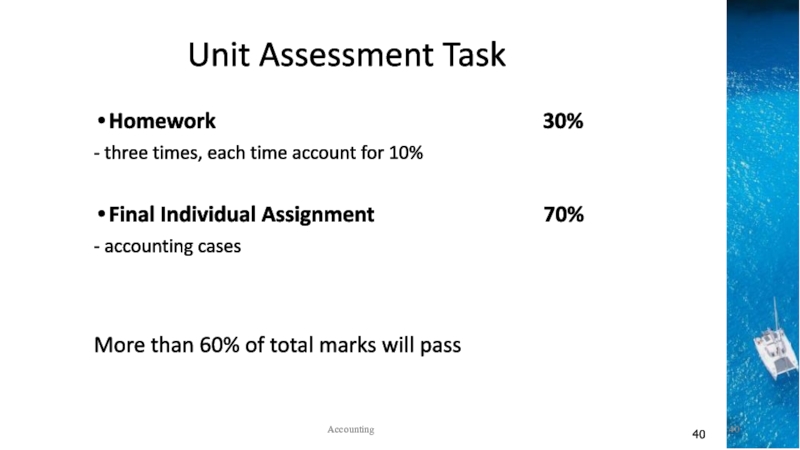

Accounting

Accounting