the time period concept, revenue recognition, and matching principles

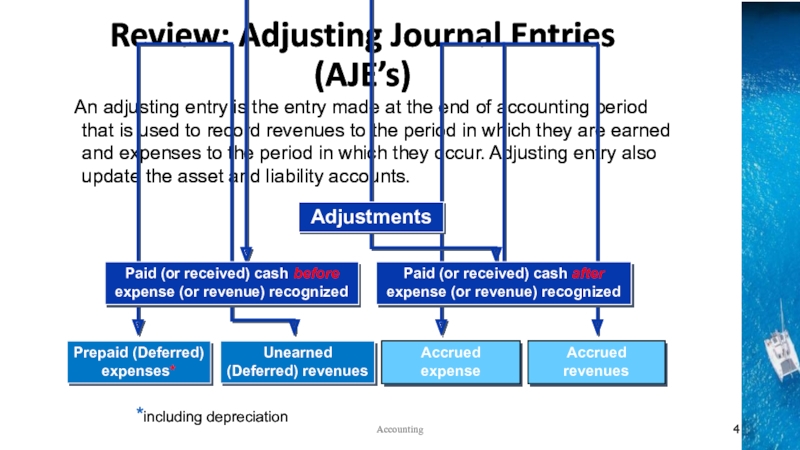

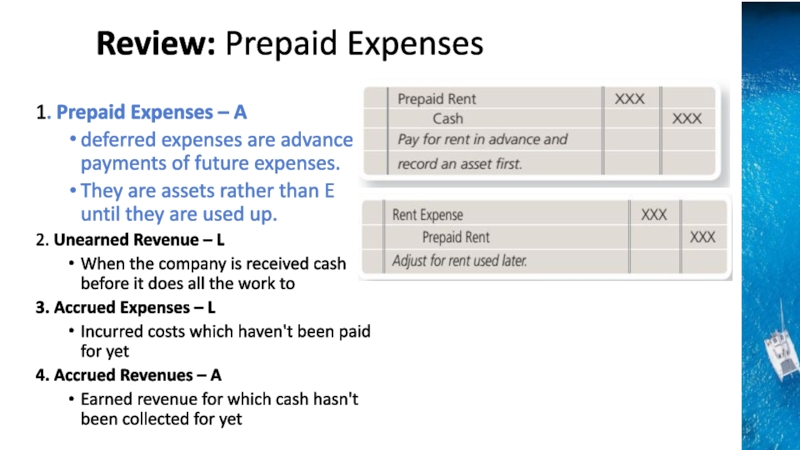

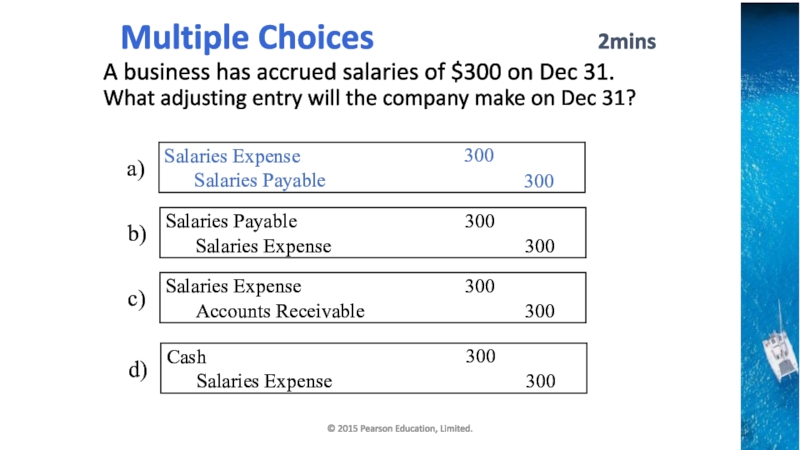

Explain the

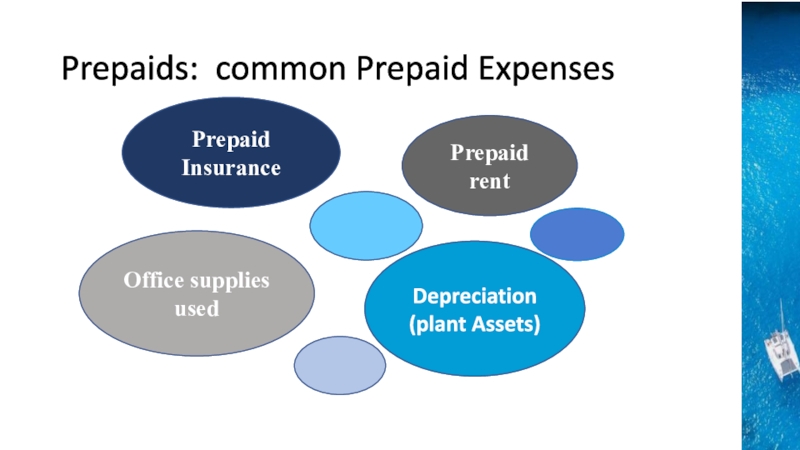

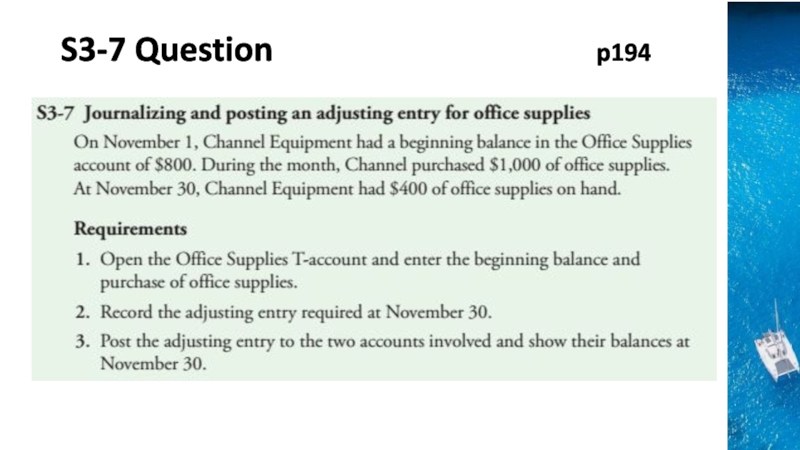

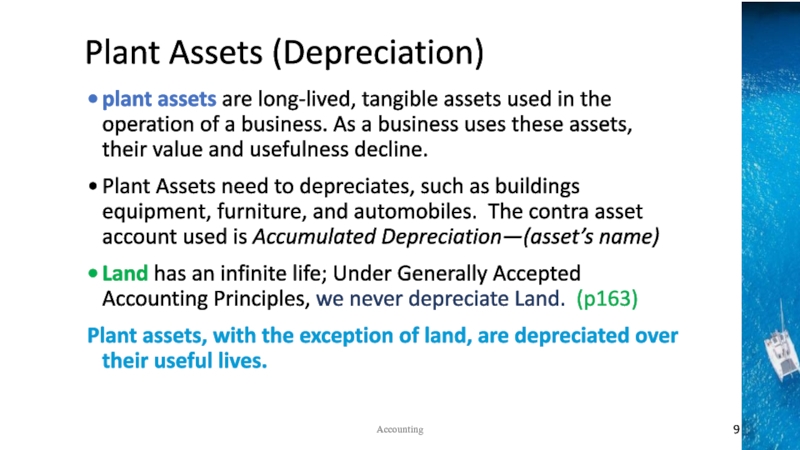

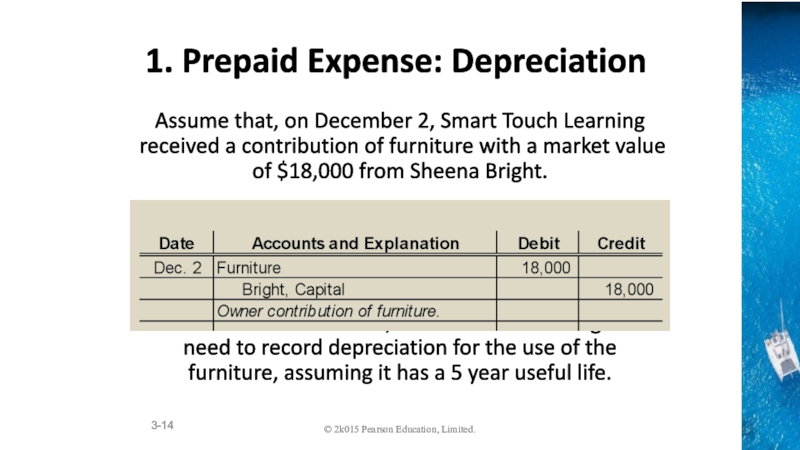

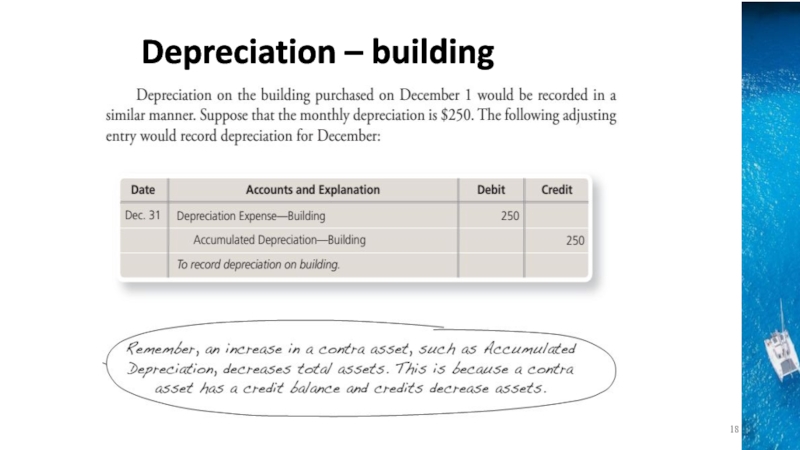

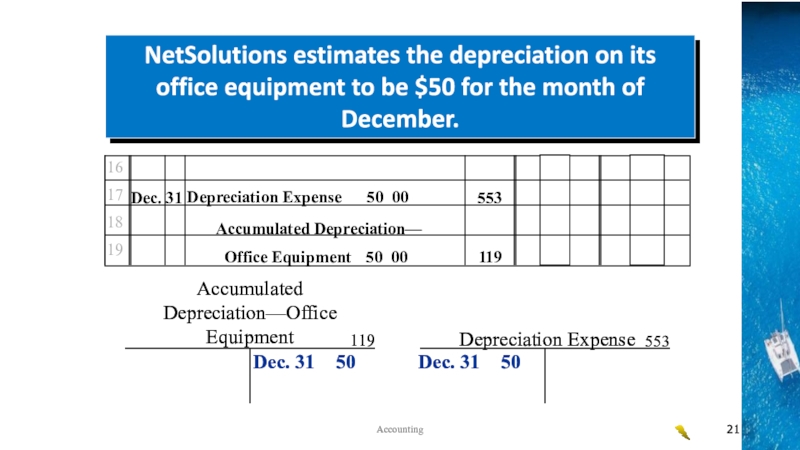

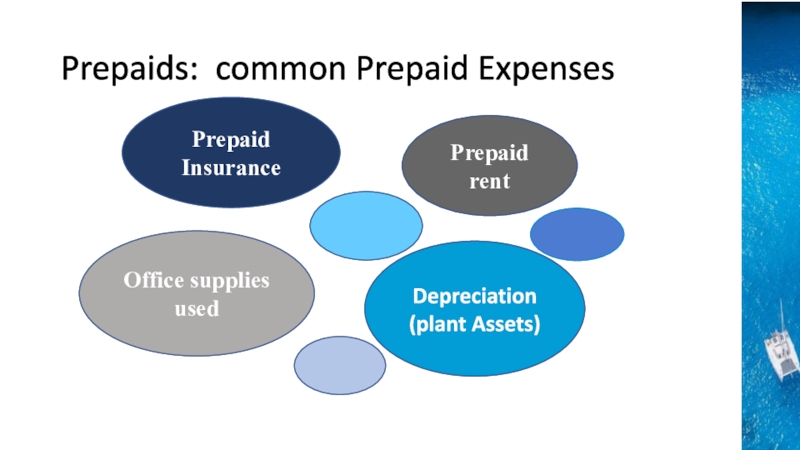

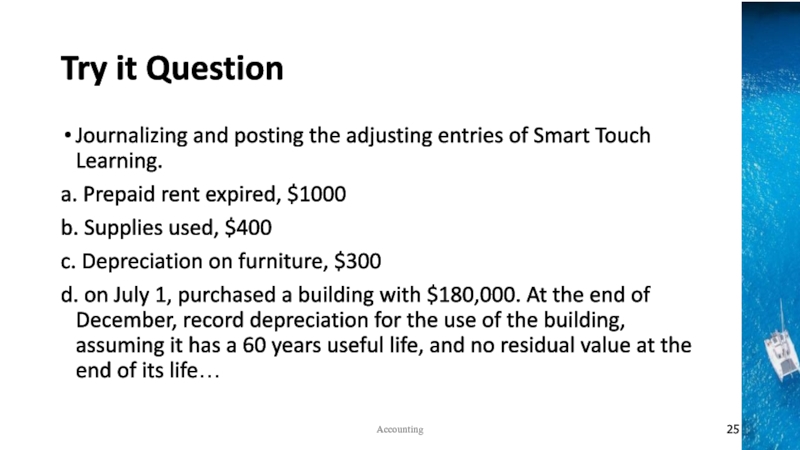

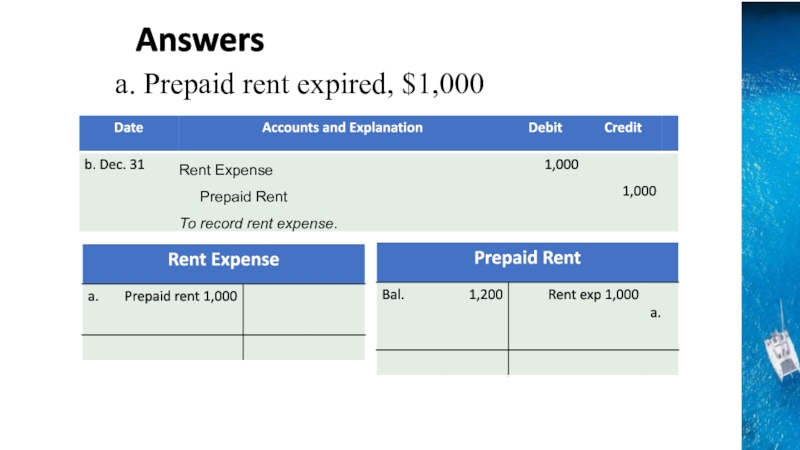

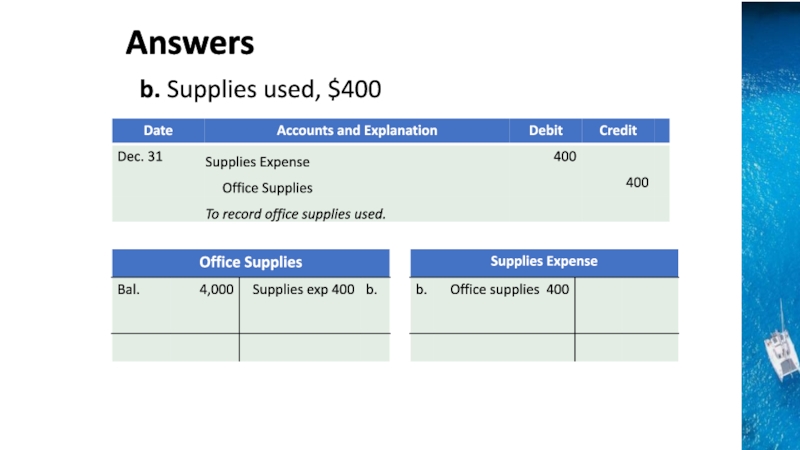

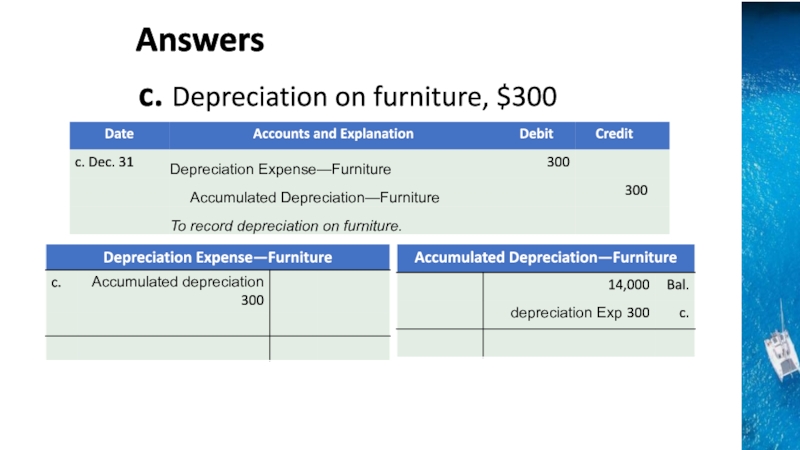

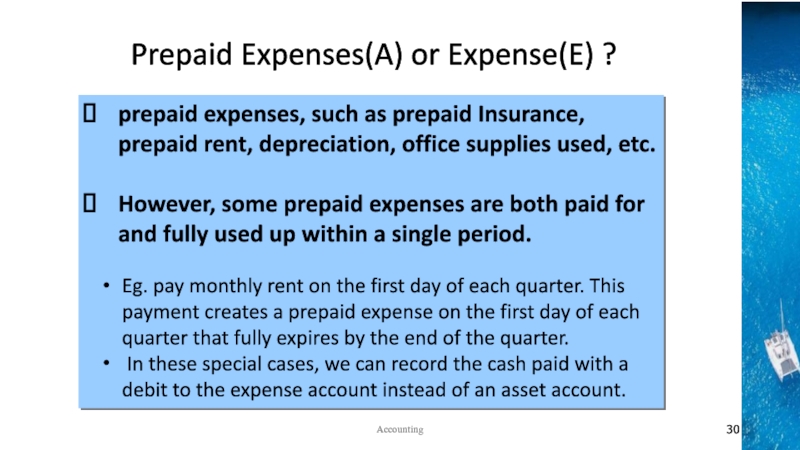

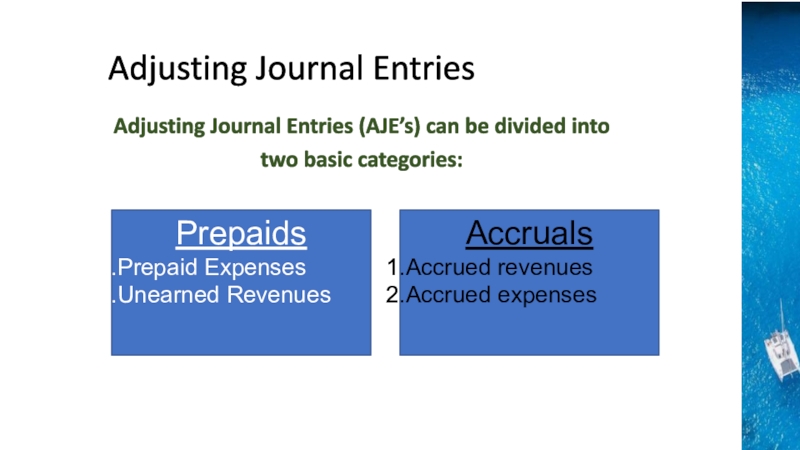

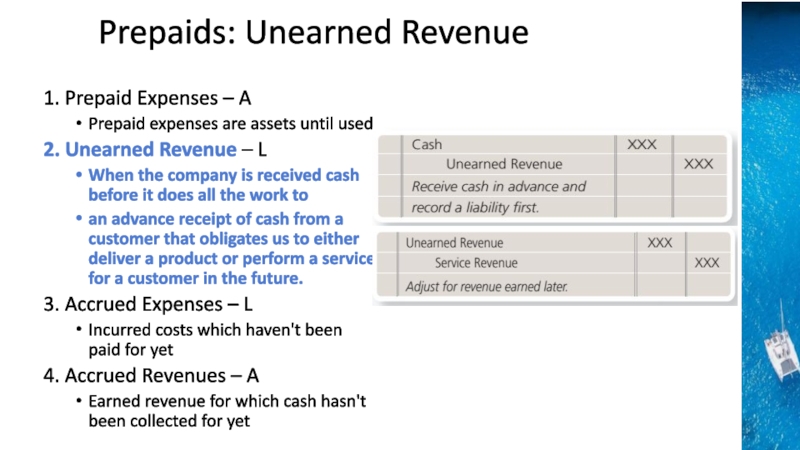

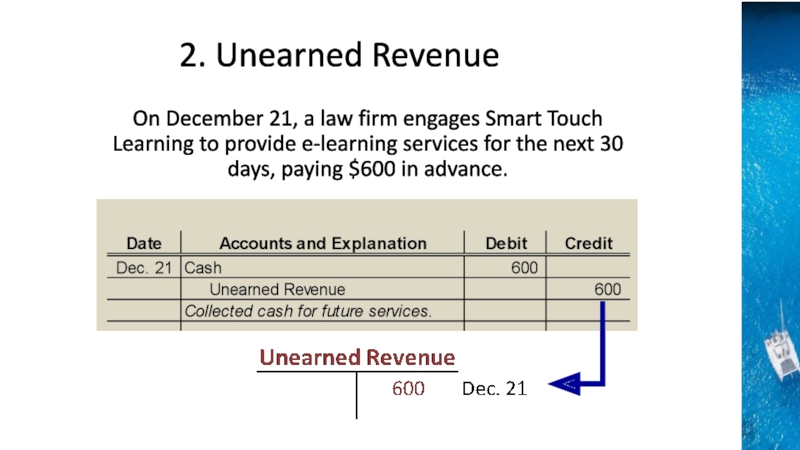

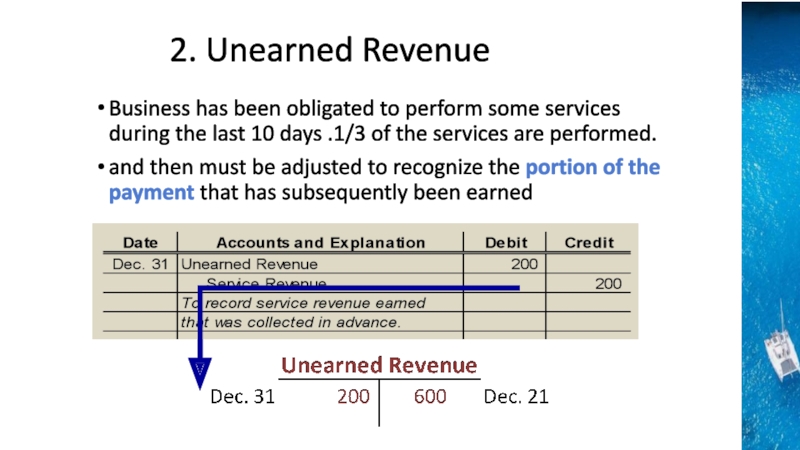

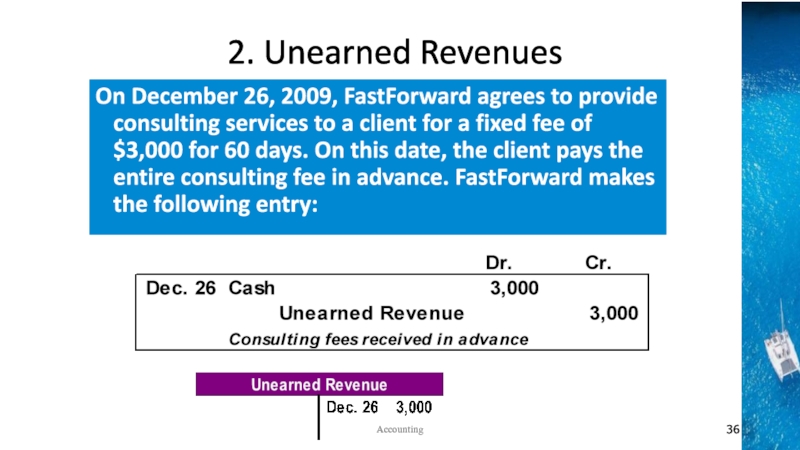

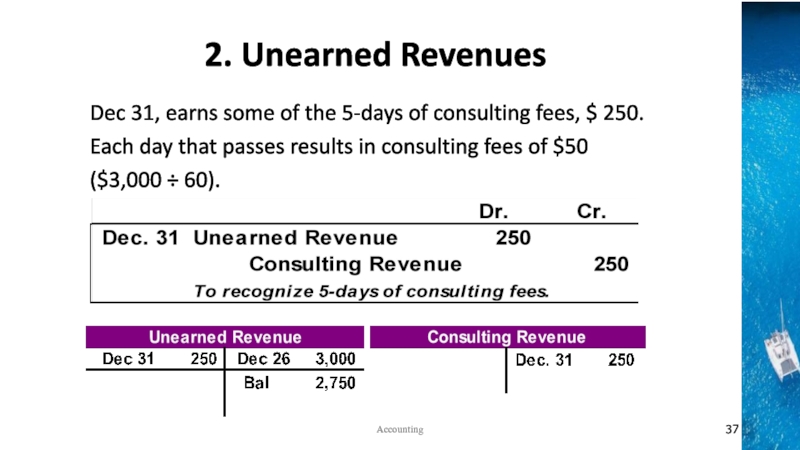

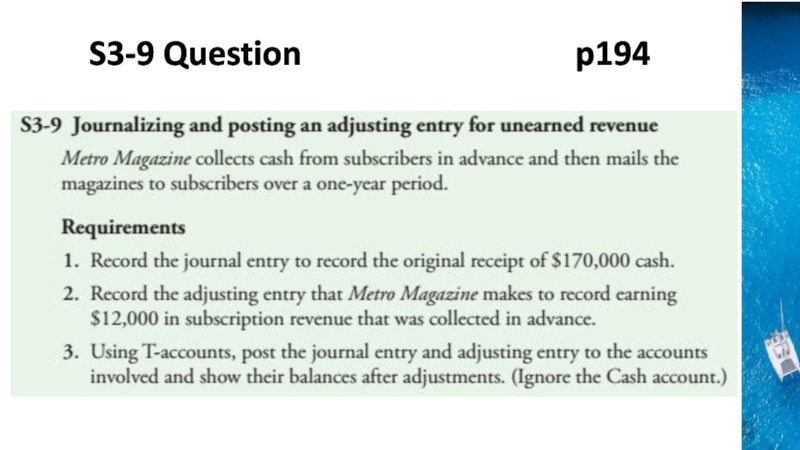

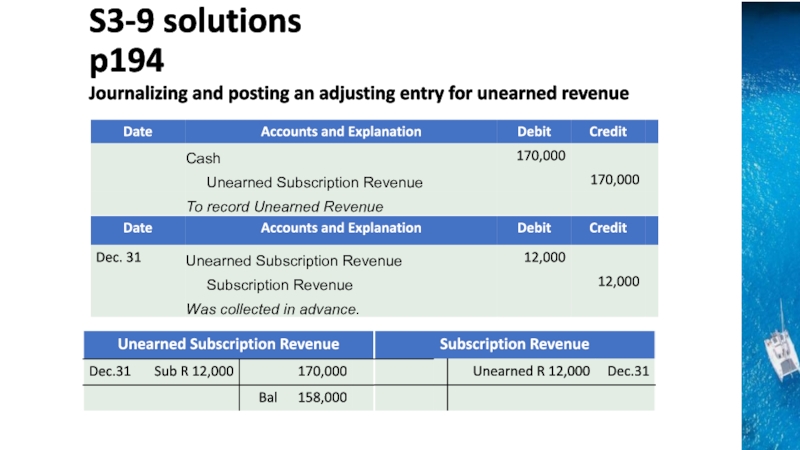

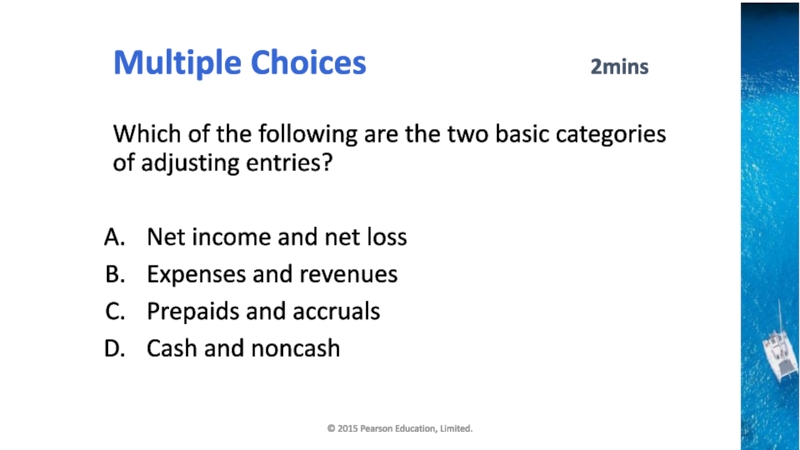

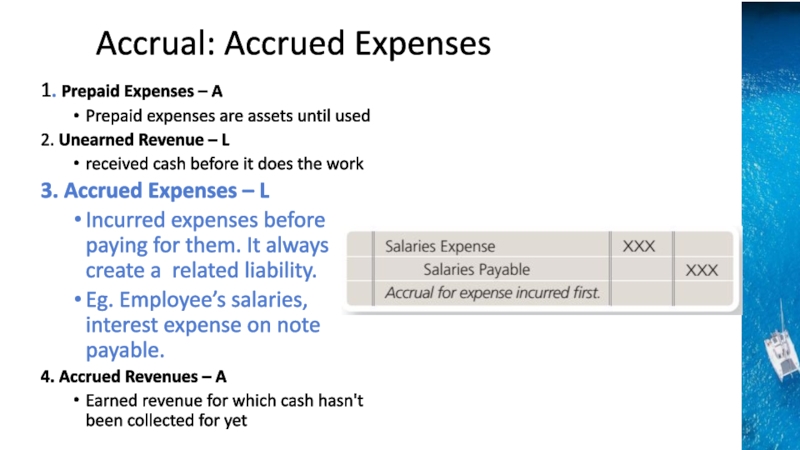

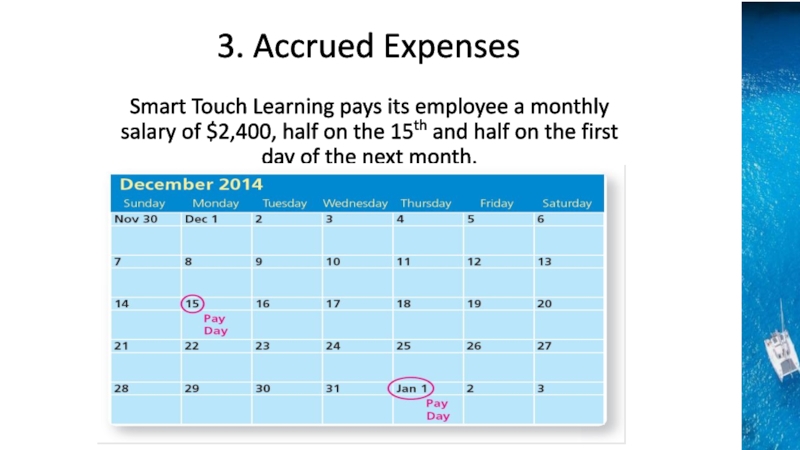

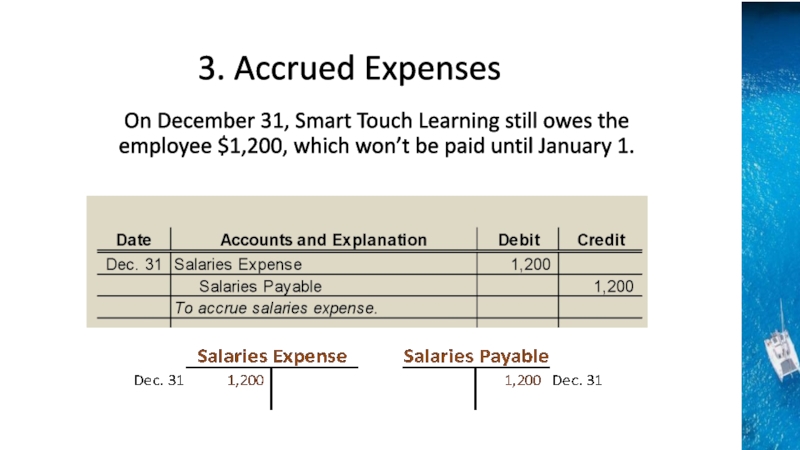

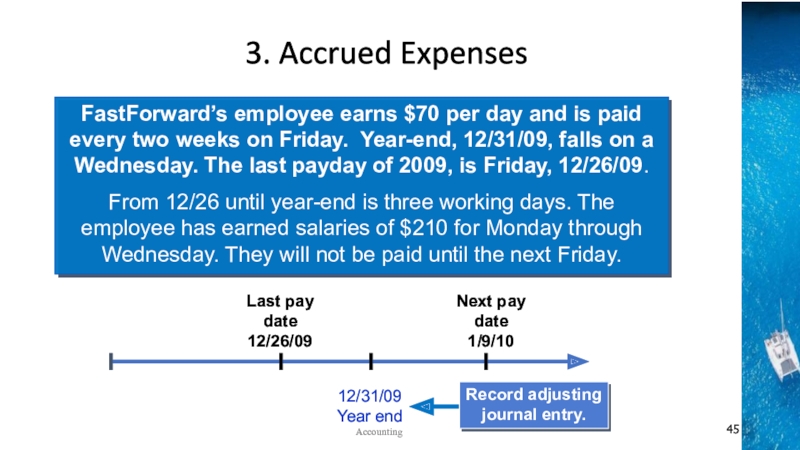

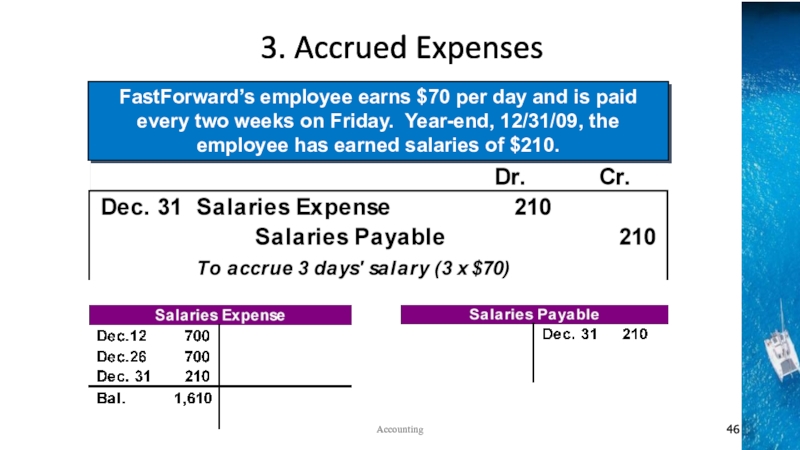

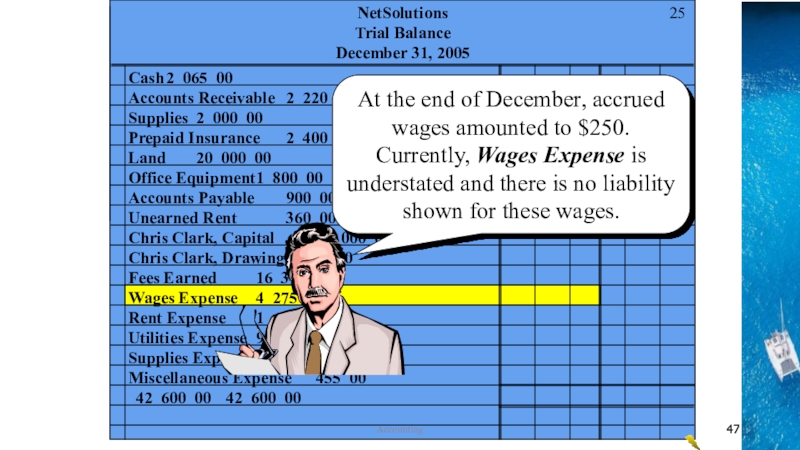

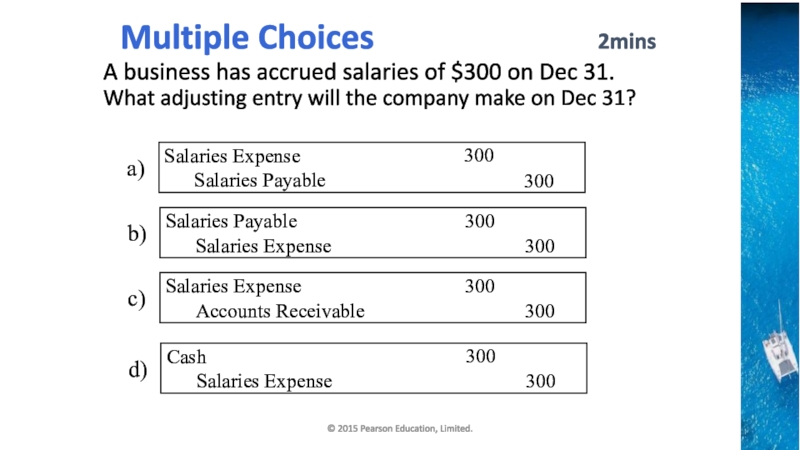

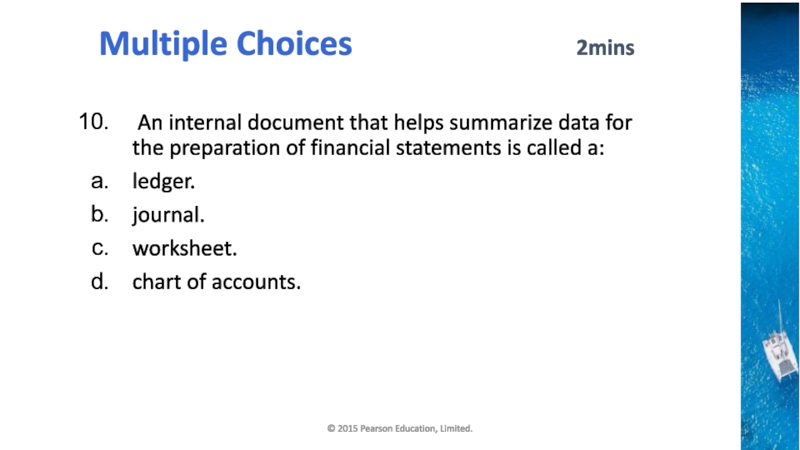

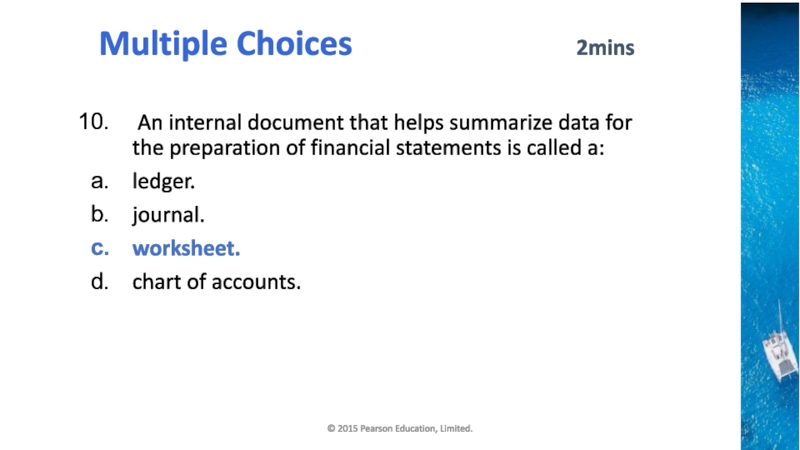

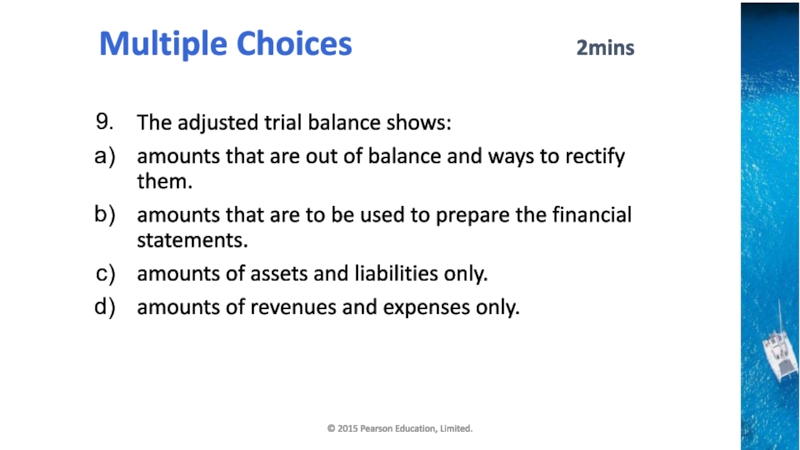

purpose of and journalize and post adjusting entriesPrepare an adjusted trial balance

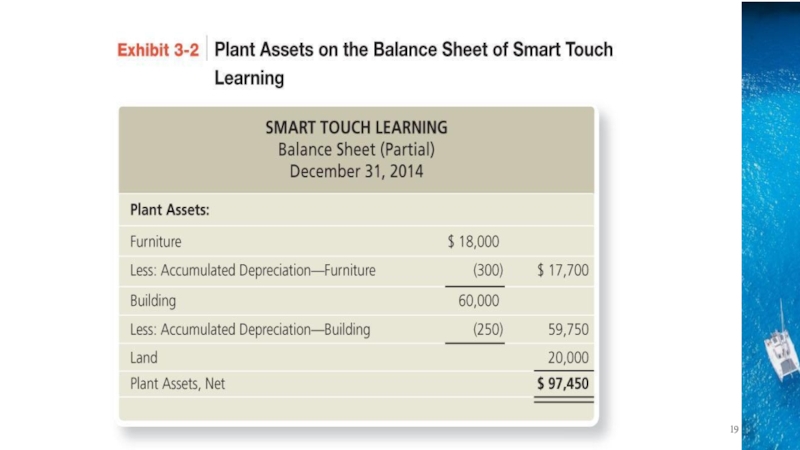

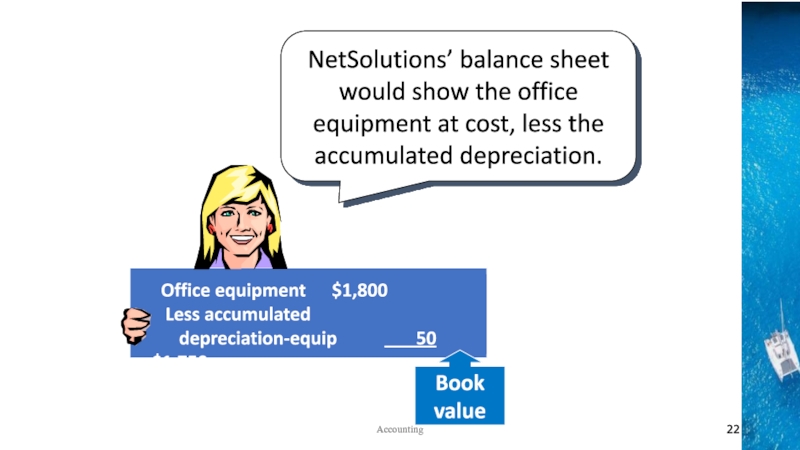

Identify the impact of adjusting entries on the financial statements

use a worksheet to prepare the adjusted trial balance

Accounting