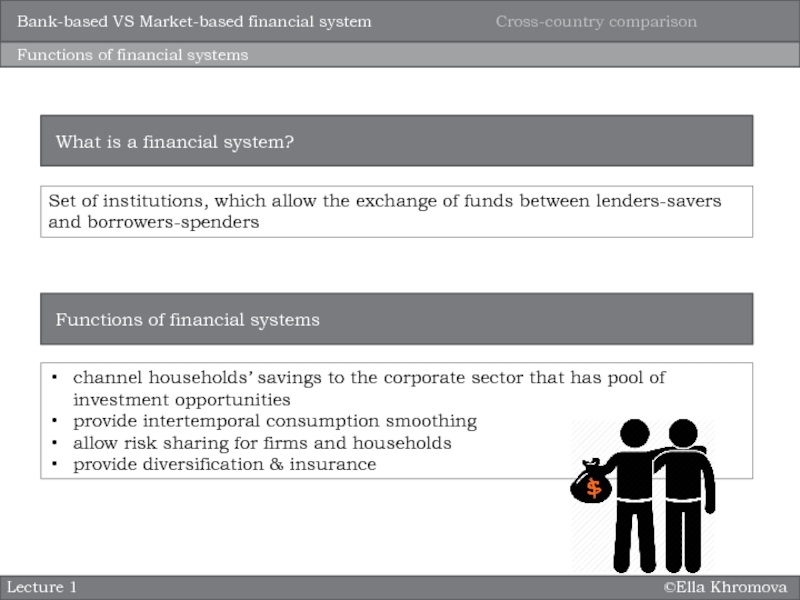

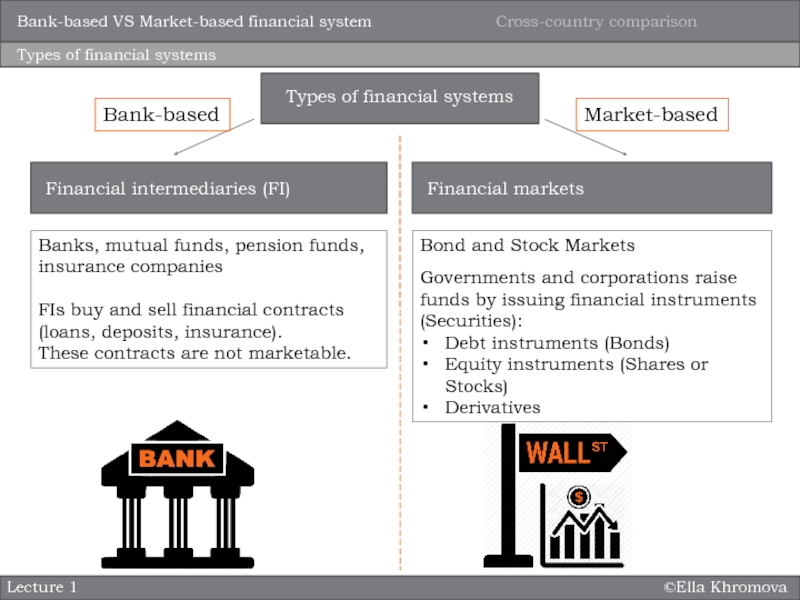

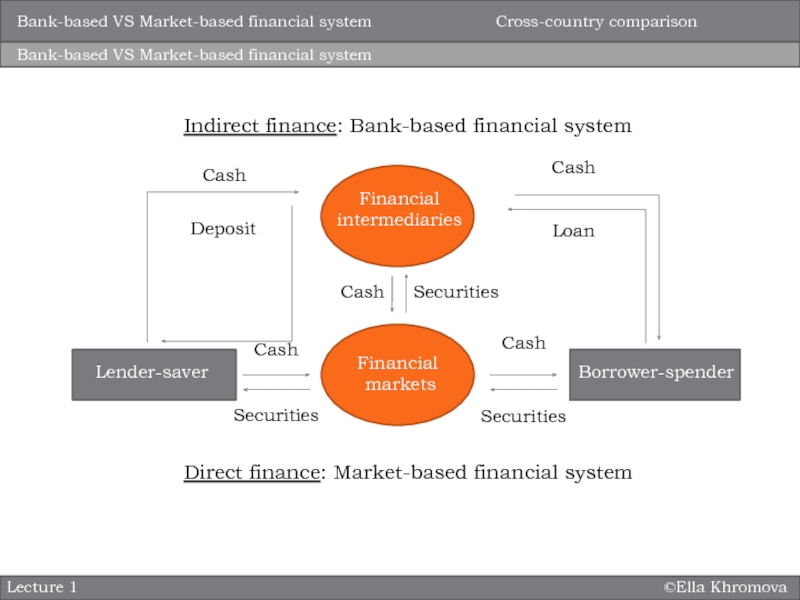

system?

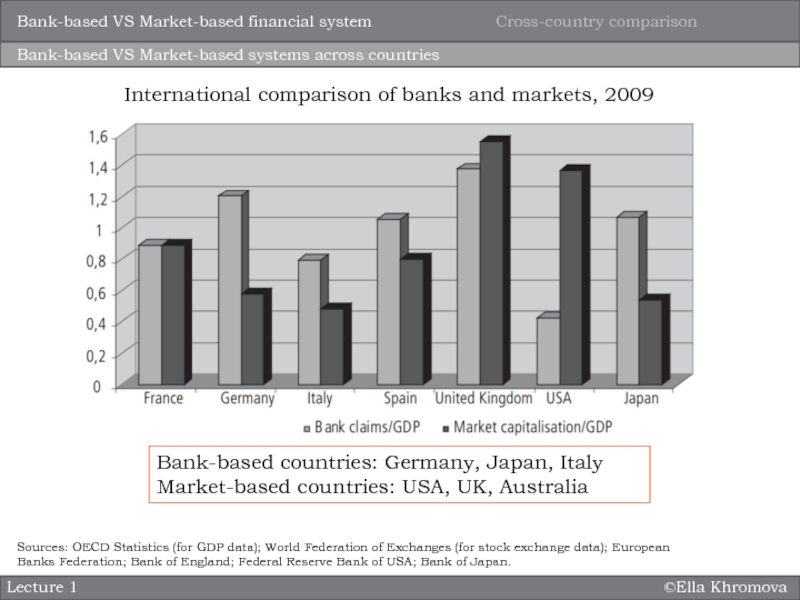

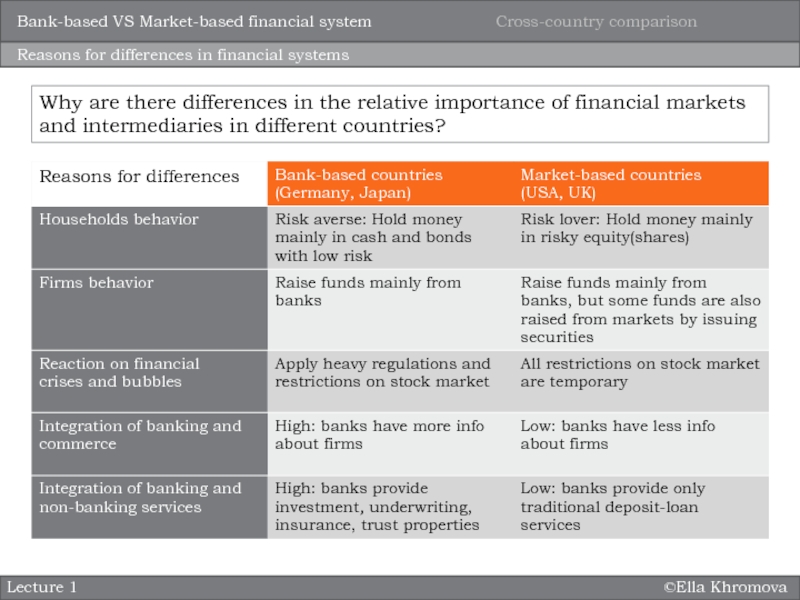

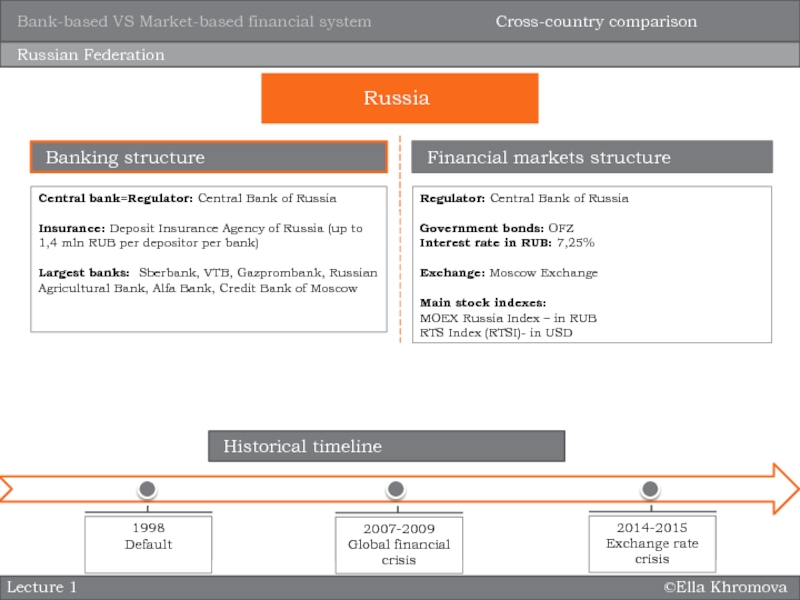

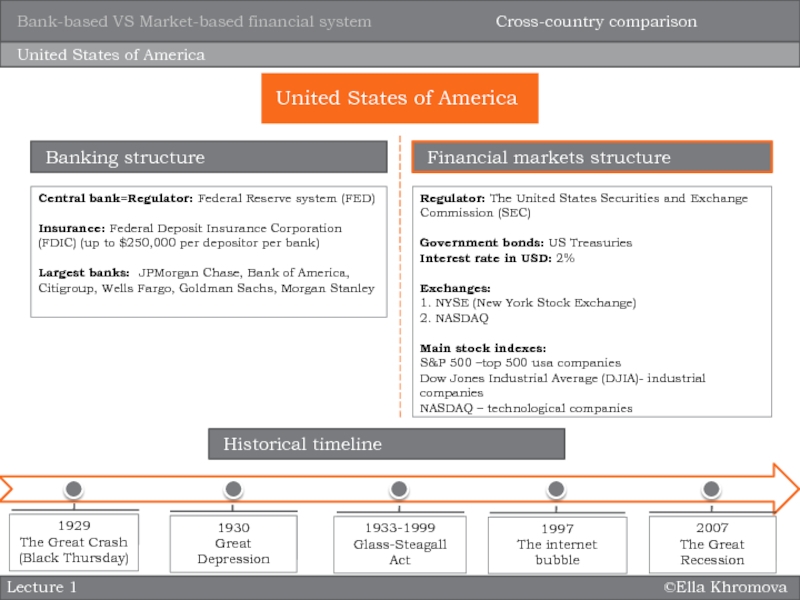

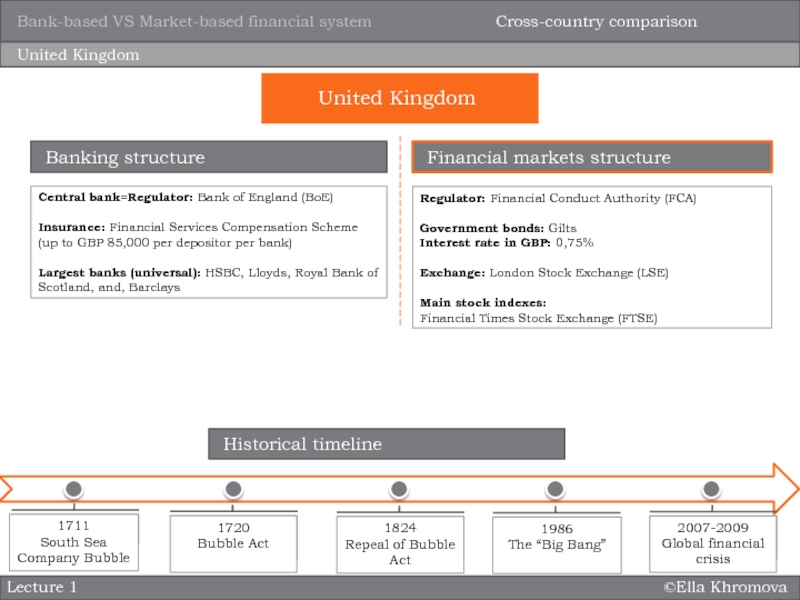

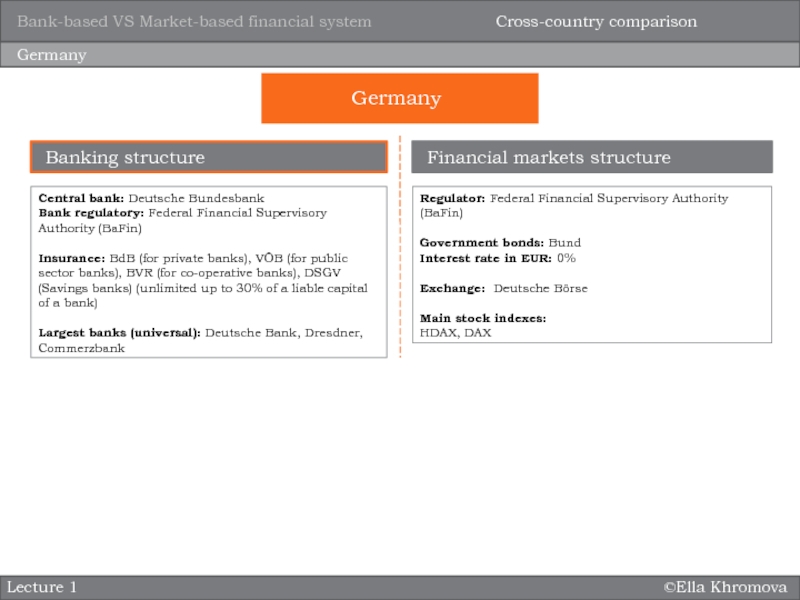

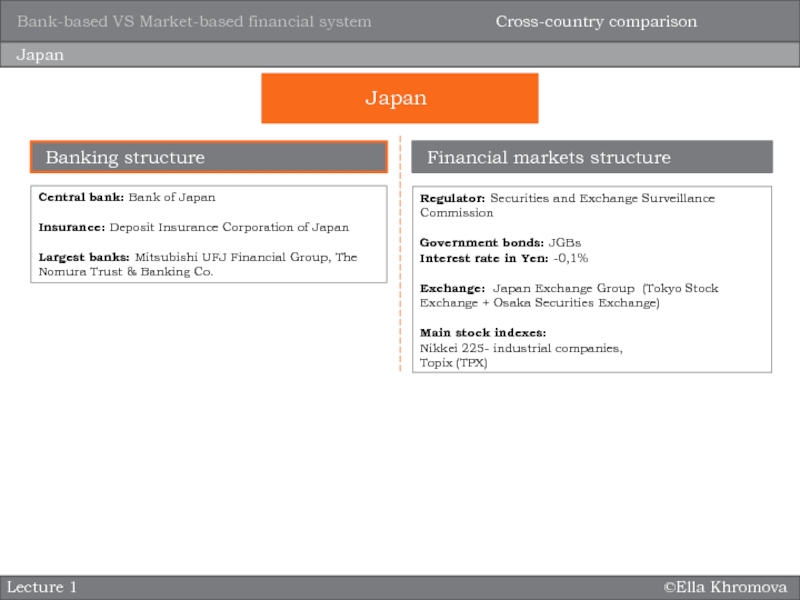

How does this structure differ across countries worldwide?

Why do financial

intermediaries exist? What are the main risks faced by banks?

How can different investment opportunities be evaluated?

How to construct a well-diversified portfolio?

Course target

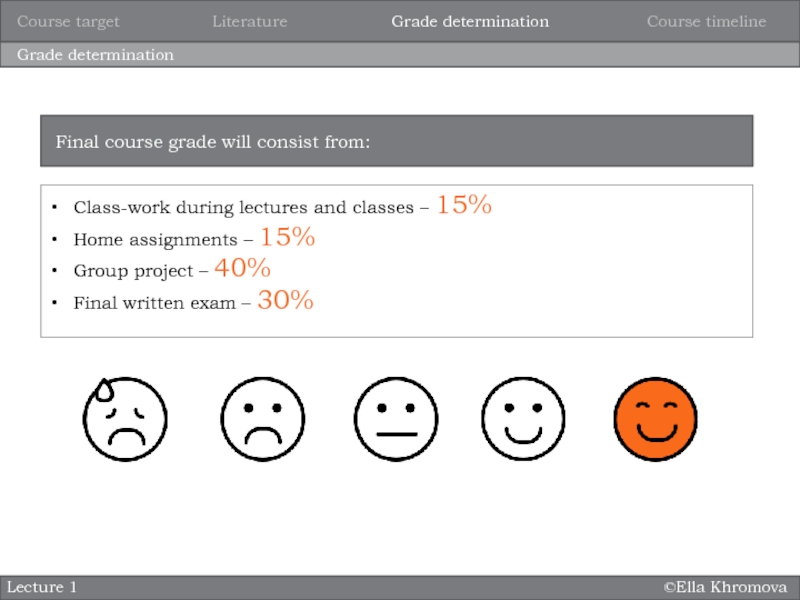

Grade determination

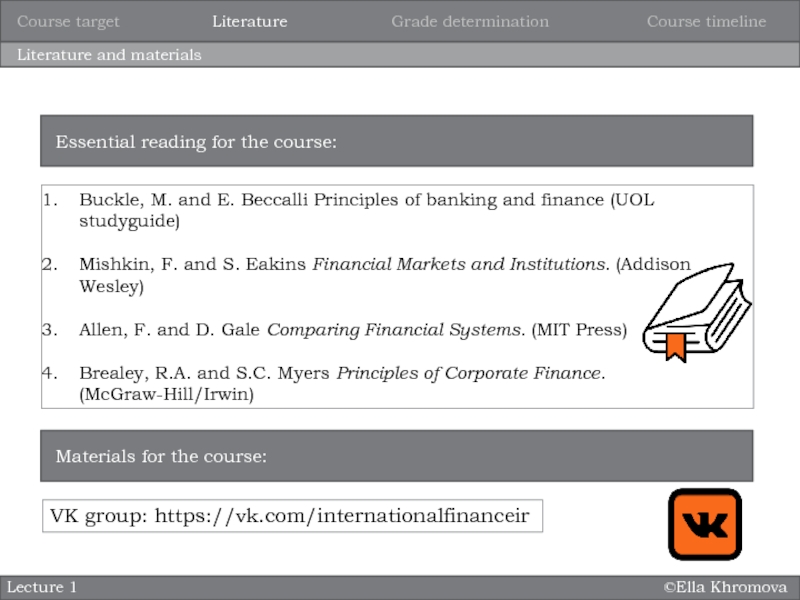

Literature

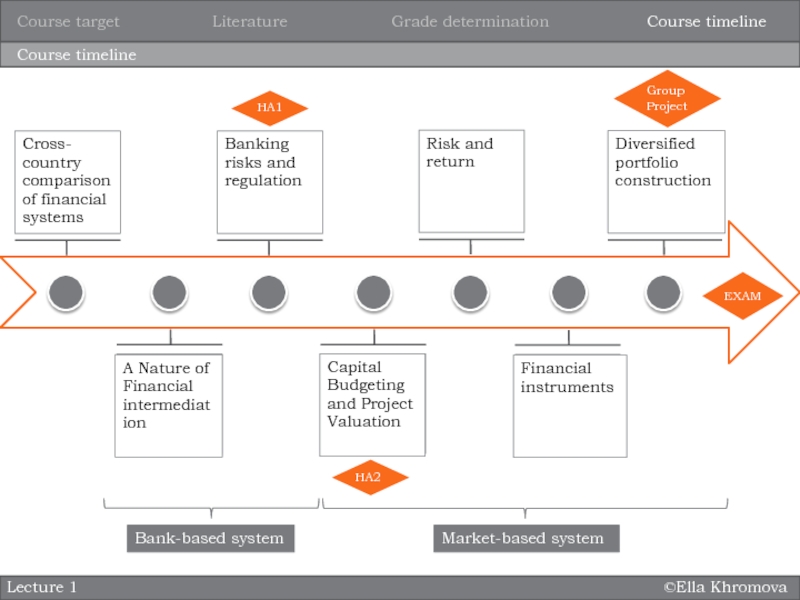

Course timeline