Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

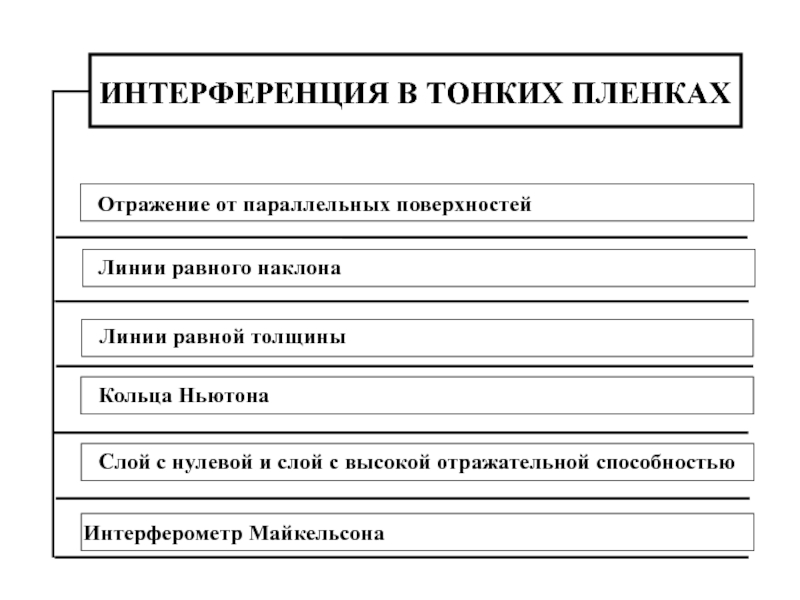

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Debt Relief, Grants and Free Riding: IDA’s proposed response Multilateral

Содержание

- 1. Debt Relief, Grants and Free Riding: IDA’s proposed response Multilateral

- 2. OverviewIDA grants are linked to a country’s

- 3. What is free riding?the indirect cross-subsidization, through

- 4. What are the Risks?Grant-recipient countries with little

- 5. The Impact of the MDRIMDRI brings debt

- 6. Debt Burden Indicators-Post MDRI

- 7. Preliminary Risk Ratings post-MDRIRwanda NigerBurkina Faso

- 8. Impact of Non-concessional borrowing

- 9. Key building blocks to an approach to

- 10. Concessionality benchmark for decisionsConcessional borrowing: multiples ways

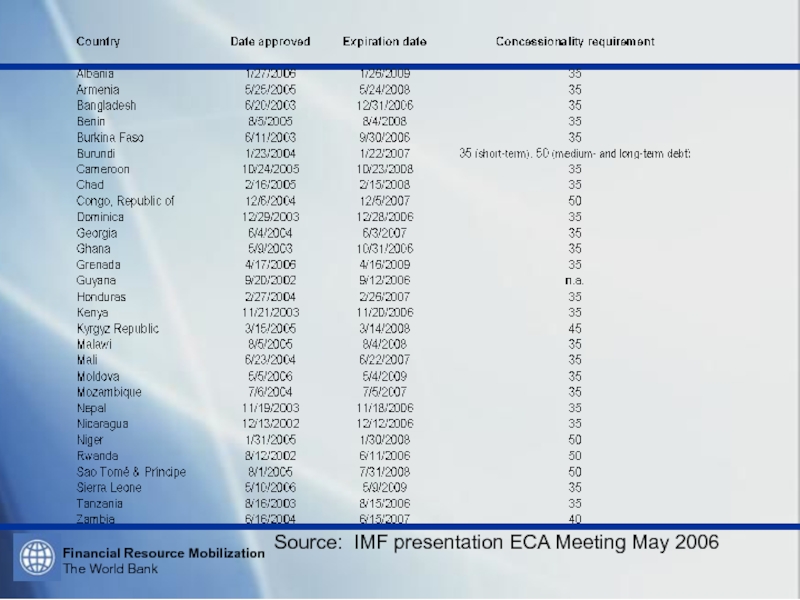

- 11. Source: IMF presentation ECA Meeting May 2006

- 12. 2. Creditor coordination Free riding is a major

- 13. Access to Information in DSFsCountry-specific DSAs are

- 14. Countries subject to IDA free-riding policy

- 15. 3. Reporting and MonitoringReporting and Monitoring of

- 16. 4. IDA disincentives at country levelUltimately Borrower

- 17. Available instruments in IDAFor unwarranted breaches options

- 18. DisincentivesGrant-eligible countries:Volume cuts would primarily be used

- 19. Risks to IDA incentive approach Approach limited effectiveness

- 20. Conclusion No magic bullet to free rider problemRequires

- 21. End

- 22. Скачать презентанцию

OverviewIDA grants are linked to a country’s risk of debt distress.MDRI debt relief and IDA grants create significant benefits for recipient countries in the form of strengthened debt sustainability prospects and

Слайды и текст этой презентации

Слайд 1Debt Relief, Grants and Free Riding: IDA’s proposed response Multilateral Development

Bank Meeting on

Debt Issues

Washington, DC, June 21-22, 2006

Слайд 2Overview

IDA grants are linked to a country’s risk of debt

distress.

MDRI debt relief and IDA grants create significant benefits for

recipient countries in the form of strengthened debt sustainability prospects and resources for the MDGs.However they also potentially add to the risk of “free riding”

This presentation will discuss the free-rider problem, and building blocks to limit the risk.

Слайд 3What is free riding?

the indirect cross-subsidization, through IDA grants and

debt relief, of other creditors offering non-concessional terms

Higher risk of

debt distressLower risk of debt distress

IDA

Grants and debt relief

Non-concessional lending

Other creditors

Слайд 4What are the Risks?

Grant-recipient countries with little access to financial

markets – risk is limited.

Higher in resource-rich grant-recipient countries that

could rely on non-concessional borrowing collateralized with future export receipts. Risks of free riding may be magnified as a result of lower debt ratios resulting from the implementation of the Multilateral Debt Relief Initiative (MDRI).

Слайд 5The Impact of the MDRI

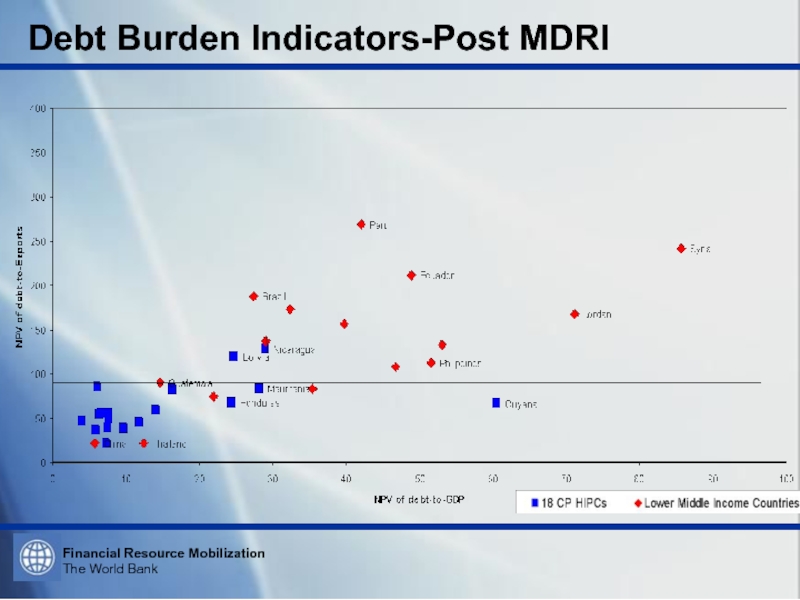

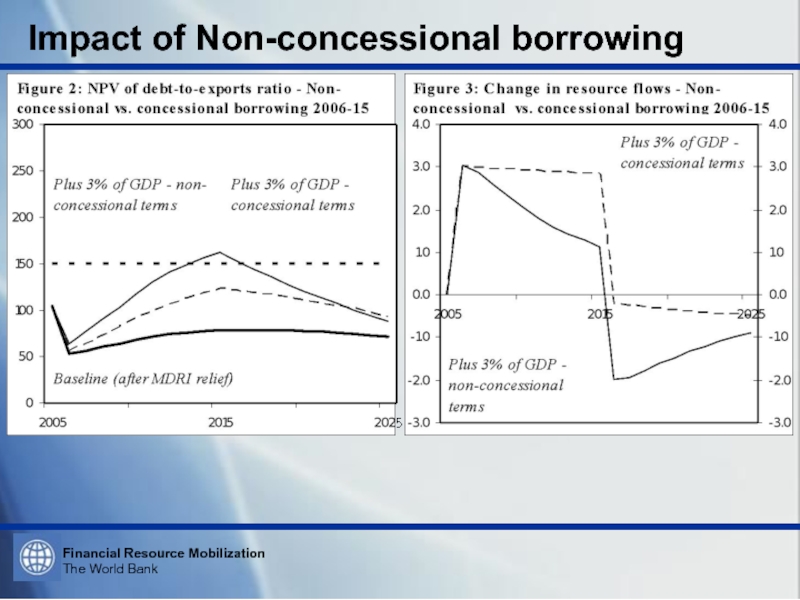

MDRI brings debt ratios for eligible

countries (at least initially) down to levels below those of

many Middle-Income Countries (see slide 9).But, static view leads to a risk that countries may accumulate excessive levels of debt that could threaten a return to unsustainability, and weaken IDA without the intended result.

However risk of debt distress post-MDRI varies by country: Forward looking DSF points out continued fragility of most countries. See diagram on slide 10.

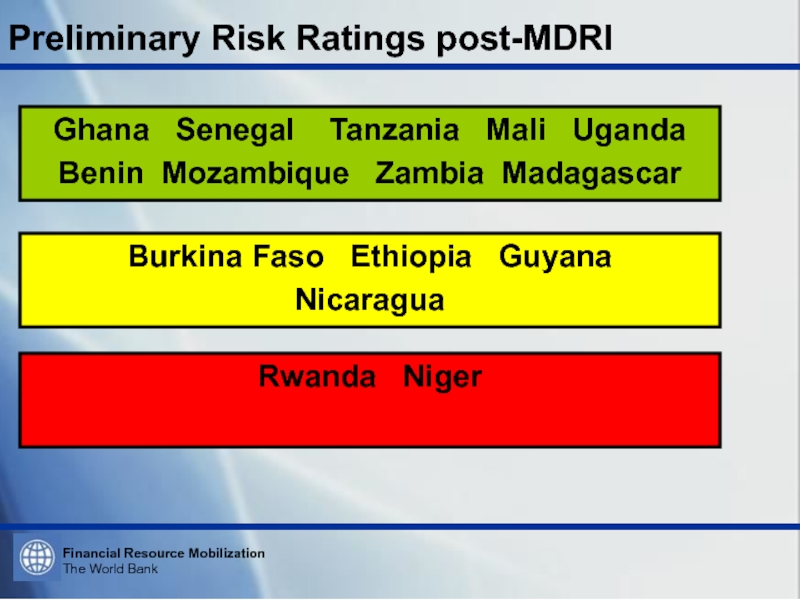

Слайд 7Preliminary Risk Ratings post-MDRI

Rwanda Niger

Burkina Faso Ethiopia

Guyana

Nicaragua

Ghana Senegal Tanzania Mali Uganda

Benin

Mozambique Zambia MadagascarСлайд 9Key building blocks to an approach to free riding

Agreement on

a concessionality benchmark

Creditor coordination

Advanced reporting, increased monitoring.

Disincentives aimed at borrower

levelСлайд 10Concessionality benchmark for decisions

Concessional borrowing: multiples ways to measure it.

DAC

ODA definition used for statistical purposes: 25% concessional using 10%

discount rate.Concessionality benchmark of at least 35% concessional using CIRR discount rates from IMF PRGF programs more realistic.

35% is a proven benchmark in IMF programs for borrowing in LICs that does not endanger sustainability

35% used by IDA in free-rider context: may be higher/lower if IMF program requires it.

Слайд 122. Creditor coordination

Free riding is a major issue for IDA

donors

Need a concerted international effort to prevent a repeat of

the pastRequires Broadening Creditor Acceptance of the DSF as useful tool – ideally to underpin an informal arrangement.

We have presented free-rider issue in number of fora as it has been developed – to MDBs early on in Tunis, to OECD creditors more recently at meetings in Paris.

Consultations will continue – including with non-OECD and commercial creditors.

Слайд 13Access to Information in DSFs

Country-specific DSAs are already available on

IMF website - by country (www.imf.org)

About 40 DSF-style DSAs available

- 23 joint DSF-style DSAs. Every month 2-3 additional DSAs are released.

A stand-alone site should be available in the next 6-8 weeks on World Bank debt website. (www.worldbank.org and type in debt).

Access to interactive DSF template also to be made more readily available.

Слайд 153. Reporting and Monitoring

Reporting and Monitoring of information flows is

a weakness that may hamper a comprehensive approach to free-riding.

Close

sharing of information and monitoring of flows will help to identify and prevent cases of unwarranted non-concessional borrowing.Monitoring is difficult – IDA is strengthening adherence to reporting requirements, working with other creditors to enhance reporting.

IDA requiring advanced reporting of planned new non-concessional borrowing.

Слайд 164. IDA disincentives at country level

Ultimately Borrower makes the final

borrowing decisions.

Pragmatic approach to determining whether a non-concessional loan is

a “breach” of the free-rider policy.accept that some potentially high return projects may warrant special exceptions

Some additional flexibility for post-MDRI countries with low risk of debt distress

Emphasizes importance of debt management

Слайд 17Available instruments in IDA

For unwarranted breaches options available:

a reduction in

volumes,

changing IDA financing terms

However, there is a tradeoff:

volume cuts reduce

resources that could be used to reach the MDGshardening of terms may exacerbate debt sustainability problems.

Слайд 18Disincentives

Grant-eligible countries:

Volume cuts would primarily be used in countries in

which debt sustainability is a major concern

Initial 20% cut to

grant allocations removes “subsidy”, but can be escalated for more serious or prolonged breaches. lf disincentives are ineffective, a strong undertaking would be sought from borrower to abide by an agreed borrowing strategy.

Last resort measure: Management could consider disengaging from future support to the country.

Слайд 19Risks to IDA incentive approach

Approach limited effectiveness if:

Countries can compensate

through additional non-concessional borrowing (risk higher for post-MDRI)

Disincentives lead to

a delay or reluctance to report, which has been particularly problematic outside of Fund arrangements.Size of available non-concessional borrowing dwarfs IDA allocations (no leverage)

Слайд 20Conclusion

No magic bullet to free rider problem

Requires concerted international effort

by all actors.

Efforts to enhance creditor coordination will continue.

Ongoing efforts

to improve debt management capacity should help.Efforts to improve information on non-concessional borrowing and adherence to reporting requirements need to continue.