Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Finance

Содержание

- 1. Finance

- 2. ContentConcept of taxes.Tax system.Organization of levying the taxes.

- 3. Taxes- are obligatory payments established by

- 4. Functions of taxes: Fiscal functions- ensuring receipt

- 5. 2. Tax system Tax system of

- 6. 1. From object of taxation both mutual

- 7. 2. On use On use the

- 8. 3. From a body imposing the tax

- 9. 4.On an economic signTo economic attributes of

- 10. The ways of collection of taxes depending

- 11. Cadastral The account and collection of the

- 12. Under the declaration of the tax bearerThe

- 13. At a source of reception of income

- 14. Under the patent The tax is paid

- 15. The tax system of RK- includes kinds

- 16. 3.Organization of levying the taxesThe organization of

- 17. Organization of levying the taxesSource of tax-

- 18. Organization of levying the taxesTax salary- sum

- 19. Скачать презентанцию

ContentConcept of taxes.Tax system.Organization of levying the taxes.

Слайды и текст этой презентации

Слайд 3 Taxes- are obligatory payments established by the state and

raised in the certain sizes and in established terms.

Principles

of taxes:The principle of fairness (equity) in taxation.

Principle of simplicity.

Definiteness of the taxes.

Minimum of tax privileges.

An economic acceptability.

Comparability of tax rates on the basic kinds of the taxes with other countries- partners.

Слайд 4Functions of taxes:

Fiscal functions- ensuring receipt of means in the

state budget.

The redistributive functions- consists of redistribution of a part

of the incomes of the various companies for the benefit of the state.Regulating- arises with expansion of economic activity of the state.

Control functions.

Слайд 52. Tax system

Tax system of the state- set of

kinds of the taxes raised in the state, forms and

methods of their construction, bodies of a tax service.Taxes can be classified by different principles:

1. From object of taxation both mutual relation of the payer and state

2. On use

3. From a body imposing the tax

4. On an economic sign

Слайд 61. From object of taxation both mutual relation of the

payer and state

1. The taxes are subdivided into: direct and

indirectDirect taxes are established directly on the income or property (tax to profit, on property, ground).

The direct taxes are subdivided into: real and personal.

Real the property to external sign is taxed, that is at the taxation the object of the tax, instead of efficiency of its use is considered.

In the personal taxes not only income is taken into account, but also financial position of the payer, for example, the marital status.

The indirect taxes are levied indirectly- through the prices of the goods, services

(VAT, excises, custom duties).

Слайд 72. On use

On use the taxes are subdivided into:

common and special.

The common taxes go to the state and

use they depersonalized. The special taxes have strictly certain purpose.

Слайд 83. From a body imposing the tax

Depending on a body

the taxes are subdivided into: central (nation-wide) and local taxes

differ.Слайд 94.On an economic sign

To economic attributes of object the taxes

on incomes and taxes on consumption differ.

Слайд 10The ways of collection of taxes depending on ways of

the account and estimation of objects of taxation:

Cadastral

Under the declaration

of the tax bearerAt a source of reception of income

Under the patent

Слайд 11Cadastral

The account and collection of the tax on the basis

of the inventory of objects of taxation with the instruction

of norm their profitableness (ground, property) without account of actual profitableness.Слайд 12Under the declaration of the tax bearer

The tax bearer specifies

the size of income necessary privileges, deductions, estimates the sum

of the tax.Слайд 13At a source of reception of income

The tax is estimated

and paid on a place of reception of income by

accounting department of the where the payer works.Слайд 14Under the patent

The tax is paid for reception of incomes

from various kinds of activity, on which it is difficult

to define and to take into account their volumes.Слайд 15The tax system of RK- includes kinds of taxes, duties,

rules of law regulating tax relations and bodies of a

tax service.The tax law of RK is based on the Code of RK “About taxes and other obligatory payments in the budget” (the Tax Code).

Слайд 163.Organization of levying the taxes

The organization of taxation is construction

and functioning of the tax mechanism.

The elements of the taxation

are:The subject (tax bearer) - is a physical or legal person to which the law assigns a duty to pay the tax.

Object of the taxation- income, property, kind of activity, which are the basis of taxation.

Carrier- physical persons, final tax bearers- citizens of the state.

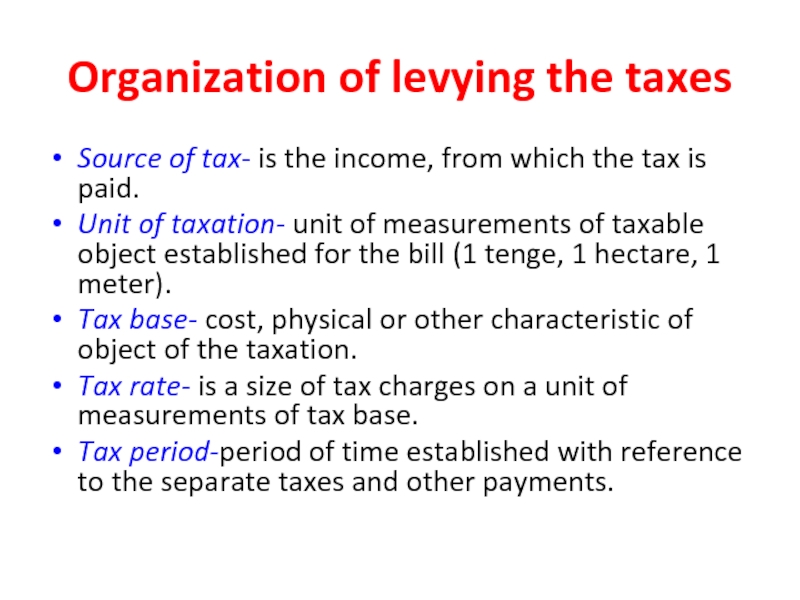

Слайд 17Organization of levying the taxes

Source of tax- is the income,

from which the tax is paid.

Unit of taxation- unit

of measurements of taxable object established for the bill (1 tenge, 1 hectare, 1 meter).Tax base- cost, physical or other characteristic of object of the taxation.

Tax rate- is a size of tax charges on a unit of measurements of tax base.

Tax period-period of time established with reference to the separate taxes and other payments.

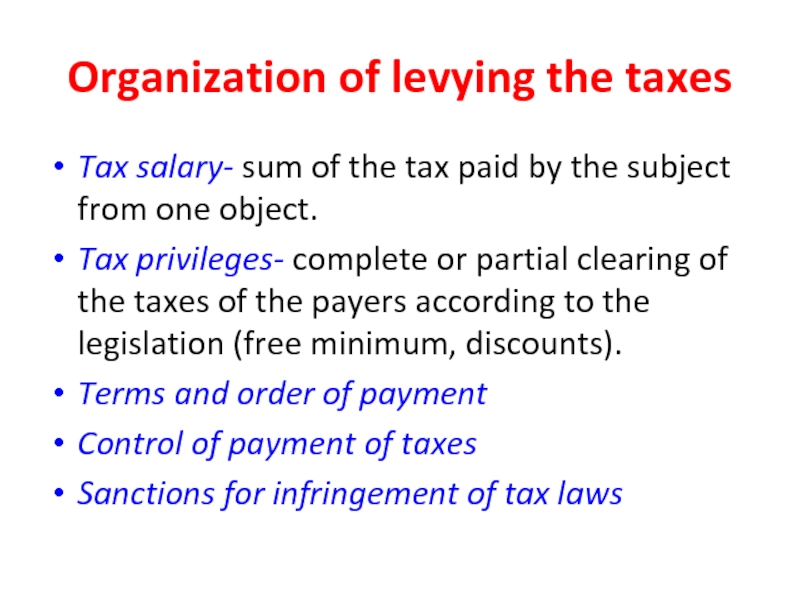

Слайд 18Organization of levying the taxes

Tax salary- sum of the tax

paid by the subject from one object.

Tax privileges- complete or

partial clearing of the taxes of the payers according to the legislation (free minimum, discounts).Terms and order of payment

Control of payment of taxes

Sanctions for infringement of tax laws