huge commitment for many businesses. The process for acquiring the

funds requires careful planning.Instead of paying for the asset outright using cash, it frequently makes sense for businesses to seek methods of spreading the cost of acquiring an asset, to coincide with the timing of the revenue generated by the business. The most common sources of medium-term finance for investment in capital assets are Hire Purchase and Leasing.

Leasing and hire purchase are financial facilities which allow a business to use an asset over a fixed period, in return for regular payments. The business customer selects the equipment it needs and the finance company purchases it on behalf of the business.

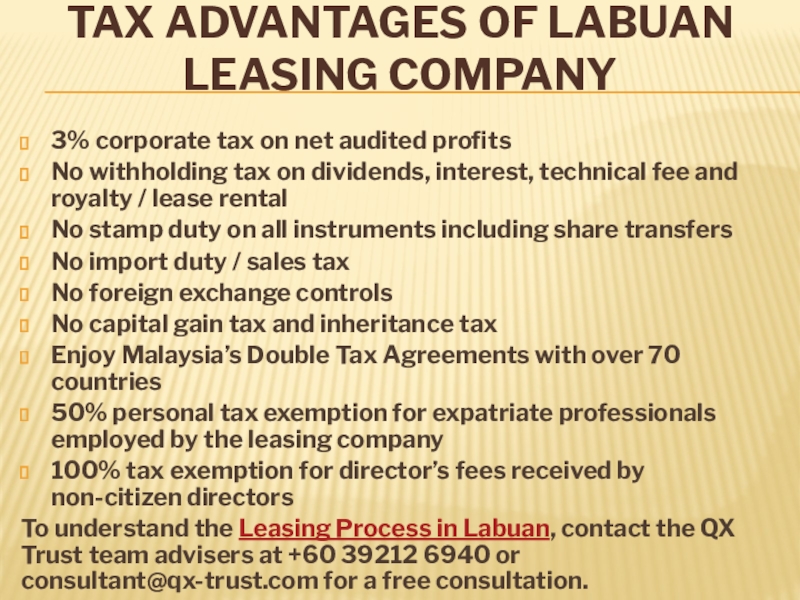

![Finance Leasing Business Typical Labuan Leasing Structures Labuan Leasing Structure: [Foreign Co-asset Owner]BenefitsLabuan Leasing Typical Labuan Leasing Structures Labuan Leasing Structure: [Foreign Co-asset Owner]BenefitsLabuan Leasing Company is taxed at 3% of](/img/tmb/7/619280/31d9f1f8f9d6101e48198fb7846cf196-800x.jpg)