Слайд 1International Economics

Topic 4: The Interwar Period (1914-1945)

Слайд 2The Interwar Period (1914-1945)

Learning Objectives

What led to the 1929 stock

market crash?

What factors contributed to the Great Depression?

What is the

Gold Standard?

What is the quantity theory of exchange?

Why were the policies to ameliorate unemployment counter-productive?

Слайд 3The Interwar Period (1914-1945)

The Roaring 1920s in the US

After WW

I, the US emerged slowly as the new economic super

power.

The Post WW I period was therefore characterized by producer and consumer self-confidence, which led to an economic boom in the US.

The 1920s are often referred to as the “roaring 1920s.”

The “roaring 1920s,” however, came to an abrupt halt with the stock market crash of 1929.

Слайд 4The Interwar Period (1914-1945)

The Situation in Germany

After WW I, Germany

was isolated and burdened by war reparation payments dictated by

the Treaty of Versailles.

Germany resorted to printing money in order to pay for its obligations.

The result, however, was inflation, more inflation, and eventually hyper inflation.

In 1923, hyper inflation was out of control, and Germany’s economy essentially collapsed.

After 1923, the world community helped Germany again to become re-integrated into the world and to ease its reparation payments (Dawes Plan, 1924)

This led to a temporary recovery, which is often referred to as Germany’s Golden 1920s.

But the Great Depression after the 1929 Stock Market Crash ended this recovery.

Слайд 5The Interwar Period (1914-1945)

The Stock Market Frenzy of the 1920s

Consumer

and producer optimism led to a stock-market frenzy.

People buy stocks,

stock prices go up, a wealth illusion develops, people borrow money to but more stocks, stock prices go up even more (it is a self-fulfilling prophecy), people borrow even more money to borrow even more stocks.

At some point in time, news spreads that the real sector’s performance falls behind the stock market’s expectations which is when the bubble bursts.

Everyone wants to sell as quickly as possible and the stock market crashes. This happened in 1929.

Bottom line: Banks should not have lent money against stocks.

Слайд 6The Interwar Period (1914-1945)

The Gold Standard and the Stock Market

Crash

While easy money was one problem, another was the Gold

Standard.

The Gold Standard meant that before the Central Bank could issue another dollar bill, it first needed to secure itself the appropriate amount of gold to back that US dollar bill.

Unfortunately, the roaring 1920s let the real sector grow faster than the money supply.

One could simply not find as much gold as would have been necessary.

Слайд 7The Interwar Period (1914-1945)

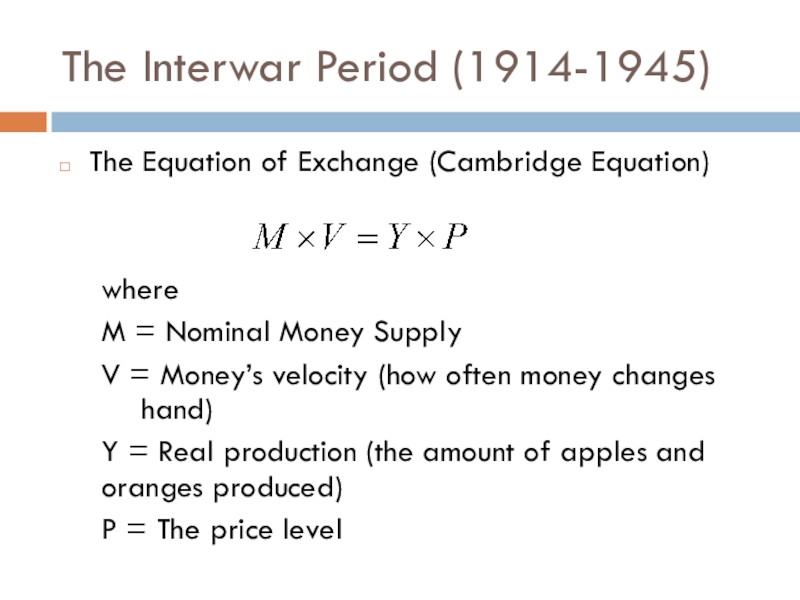

The Equation of Exchange (Cambridge Equation)

where

M

= Nominal Money Supply

V = Money’s velocity (how often money

changes hand)

Y = Real production (the amount of apples and oranges produced)

P = The price level

Слайд 8The Interwar Period (1914-1945)

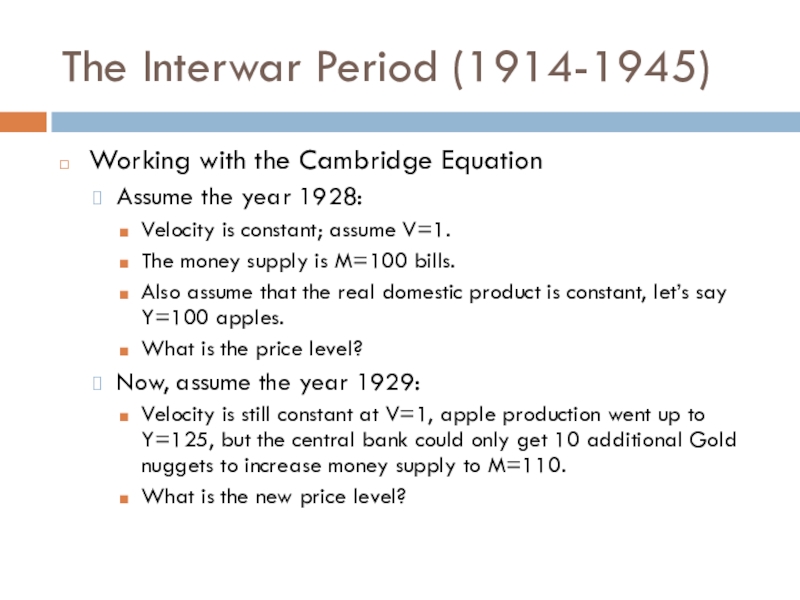

Working with the Cambridge Equation

Assume the year

1928:

Velocity is constant; assume V=1.

The money supply is M=100 bills.

Also

assume that the real domestic product is constant, let’s say Y=100 apples.

What is the price level?

Now, assume the year 1929:

Velocity is still constant at V=1, apple production went up to Y=125, but the central bank could only get 10 additional Gold nuggets to increase money supply to M=110.

What is the new price level?

Слайд 9The Interwar Period (1914-1945)

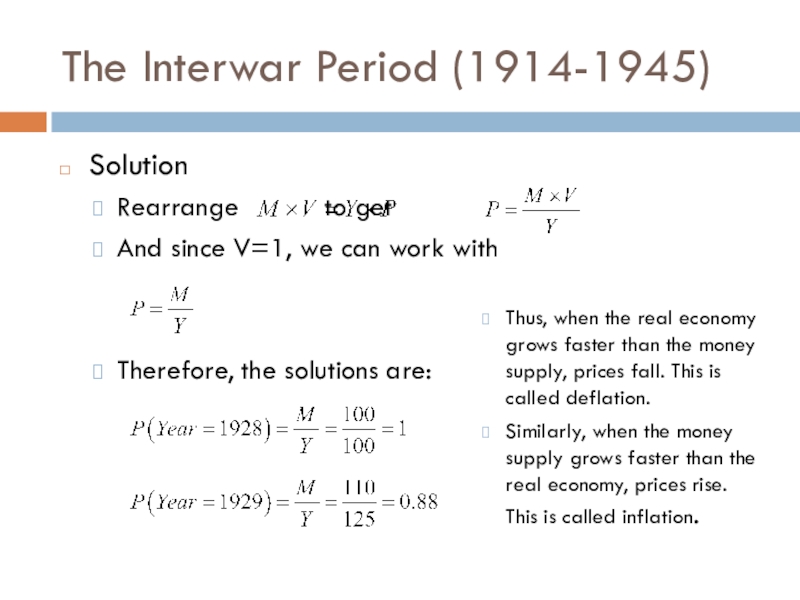

Solution

Rearrange to get

And since V=1, we

can work with

Therefore, the solutions are:

Thus, when the real economy

grows faster than the money supply, prices fall. This is called deflation.

Similarly, when the money supply grows faster than the real economy, prices rise. This is called inflation.

Слайд 10The Interwar Period (1914-1945)

Why deflation is dangerous?

If you have debt,

which many US households had in the 1920s, then the

“real debt” burden in terms of apples to be repaid will increase in light of debt.

When price levels fall, people postpone their purchases, hoping that things become even cheaper tomorrow. This becomes a self-fulfilling prophecy.

When people postpone their spending, companies try to lower the prices. This reinforces the self-fulfilling prophecy.

Eventually, companies suffer losses and when companies suffer losses, they cannot repay their loans.

And when companies cannot repay their loans, the banks are in trouble.

And when the banks are in trouble, you as a saver are in trouble, too and you try to withdraw your money as long as banks still have some. A bank run follows.

Слайд 11The Interwar Period (1914-1945)

The 1929 Stock Market Crash in a

nutshell:

The stock market crash of 1929 was a combination of

two factors:

Easy credit by private banks fueled consumer and producer confidence and a “bubble” developed.

At the same time, the Gold Standard created deflation, which eventually put a halt to credit expansion and weakened demand.

Слайд 12The Interwar Period (1914-1945)

The Great Depression

The 1929 stock market crash

was the beginning of the Great Depression of the 1930s.

Policy

makers were taken off-guard by the developments and were desperately looking for solutions for rising unemployment.

Many of those “solutions” were counterproductive, however.

Two policies in particular worsened the economic situation. They were protectionisms and currency depreciation.

Слайд 13The Interwar Period (1914-1945)

The Logic of Protectionism

The idea of protectionism

was as follows: The imposition of tariffs replaces imports by

domestic production.

The problem was that all countries imposed tariffs on each other.

Therefore, while the idea of protectionism seemed individually rational, it was a collective rationality trap.

No country gained any employment benefit because the jobs created to replace imports were lost in the export industries; all countries are now even worse off, because all countries forgo the specialization gains from trade.

Слайд 14The Interwar Period (1914-1945)

The Logic of Currency Depreciation

The idea of

currency depreciation is as follows: By making a country’s currency

cheaper (which is done by printing money), exports will be stimulated.

Again, all countries had the same idea.

All countries increased the money supply, no country depreciated in nominal terms and no country created more jobs, but all countries ended up with inflation in addition to unemployment.

Слайд 15The Interwar Period (1914-1945)

Formalizing Rationality Traps - Assumptions

Essentially, collective rationality

traps occur in the absence of cooperation.

Assume there are two

countries. Either one can either behave cooperatively or non-cooperatively.

In the case of competitive protectionism, the cooperative strategy would be not to impose tariffs, the non-cooperative strategy to impose tariffs.

Similarly, in the case of competitive currency depreciation, the cooperative strategy would be not to depreciate, the non-cooperative strategy to depreciate.

Слайд 16The Interwar Period (1914-1945)

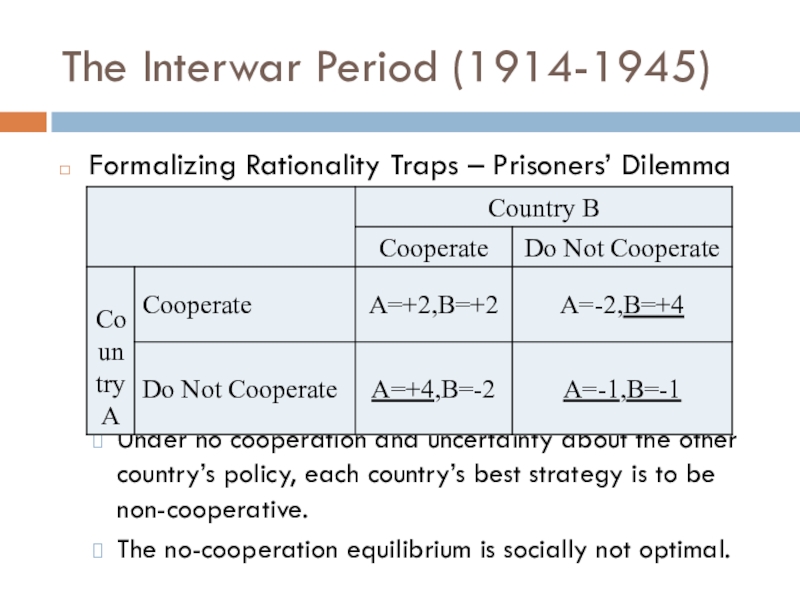

Formalizing Rationality Traps – Prisoners’ Dilemma

Under no

cooperation and uncertainty about the other country’s policy, each country’s

best strategy is to be non-cooperative.

The no-cooperation equilibrium is socially not optimal.

Слайд 17The Interwar Period (1914-1945)

The Legacy of the Great Depression

The Great

Depression led to a shift in economic thinking away from

“laissez-faire” principles to a paradigm in which the state again assumes a greater role.

This paradigm shift was brought about by John Maynard Keynes (1883-1946).

Keynesian economics influenced global economic policy since the 1930s until the end of the 1970s and then again since the 2008 global economic and financial crisis.

Слайд 18The Interwar Period (1914-1945)

Keynesian Economics

The heart of Keynesian economics is

stabilization policy.

Stabilization policy means that the state is supposed to

stabilize the economy in a downturn with expansionary fiscal and monetary policies.

Franklin D. Roosevelt’s “New Deal” policy was in the spirit of Keynesian economics, and so were the public expenditures of the Unites States’ war preparation.

In Germany, Hitler’s public expenditure program also led to economic recovery (“Nazi boom”) and helped the Nazis gain popular political support.

Слайд 19The Interwar Period (1914-1945)

Summary

The interwar period was mostly influenced by

the 1929 Stock Market Crash and the Great Depression.

The 1929

Stock Market Crash and the subsequent Great Depression provide important lessons for economic policy, most notably the dangers of easy money, deflation, and non-cooperative economic policy.

The Great Depression eventually gave birth to a new way of thinking in economics, Keynesian economics.