by

Matthew Will

Chapter 9

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies,

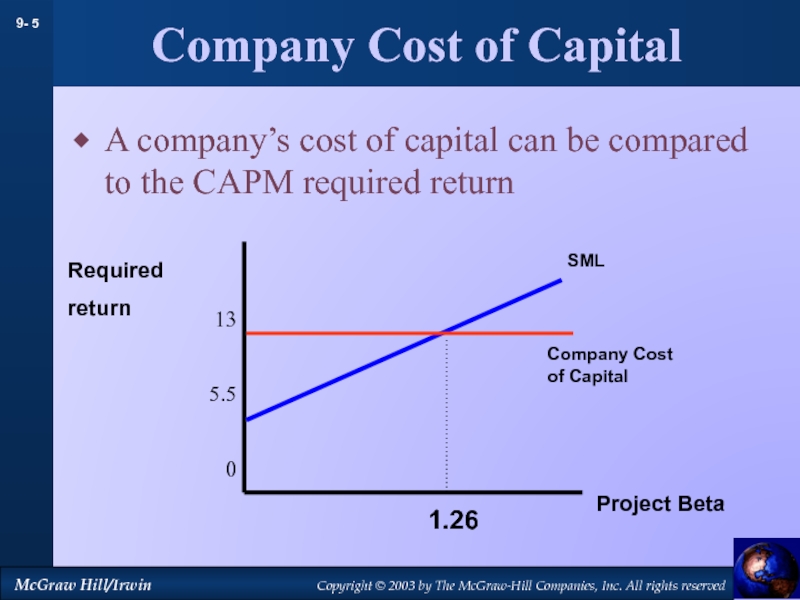

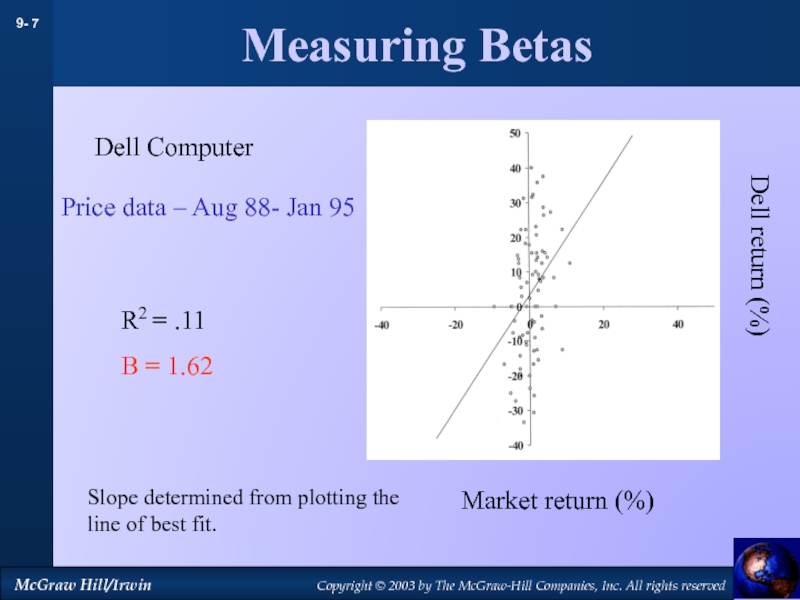

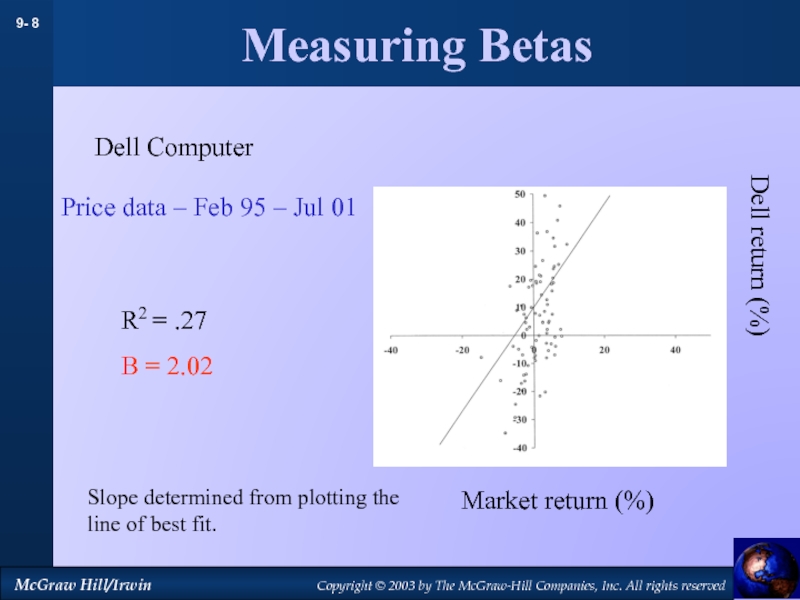

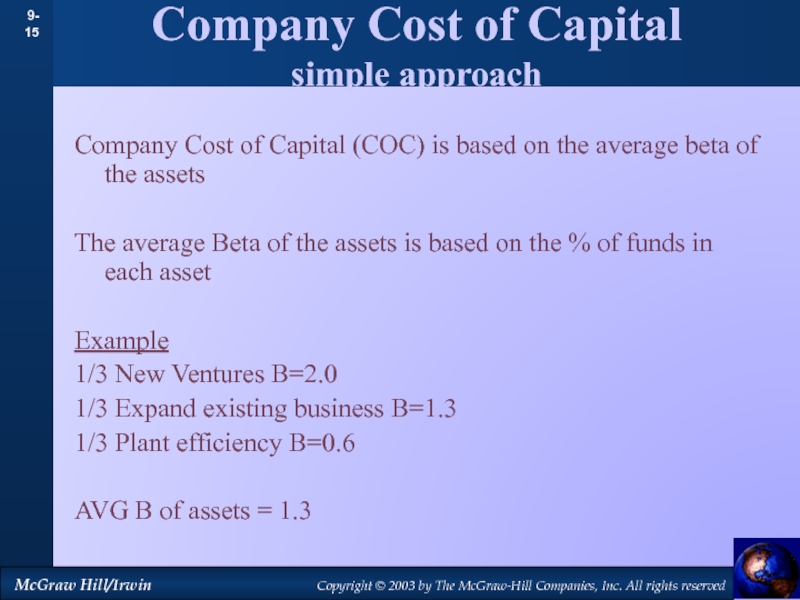

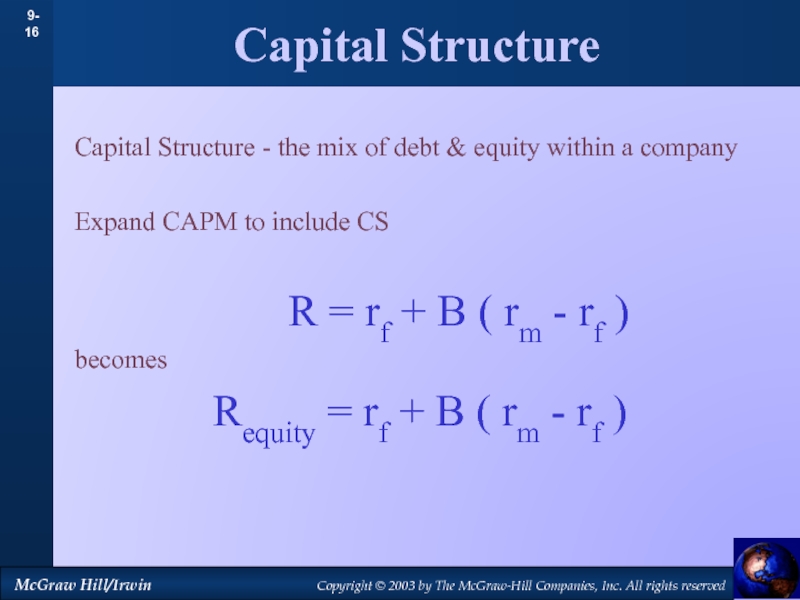

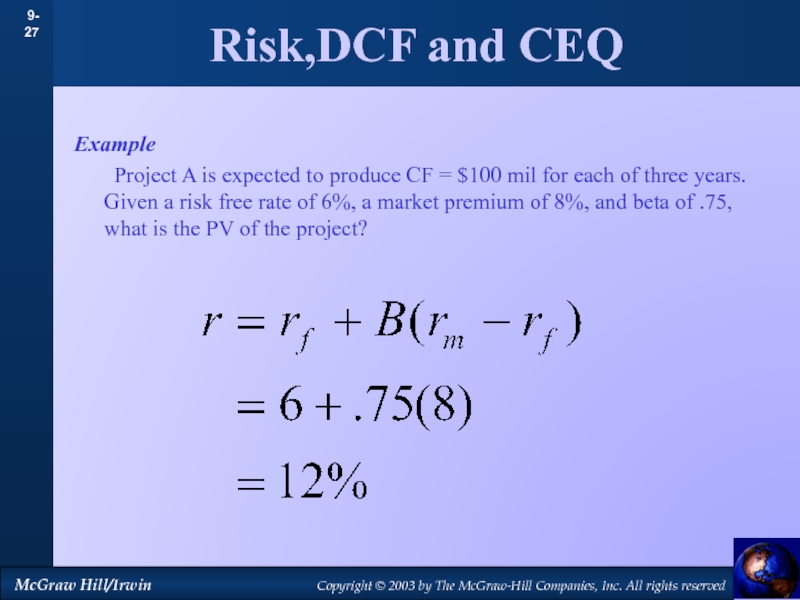

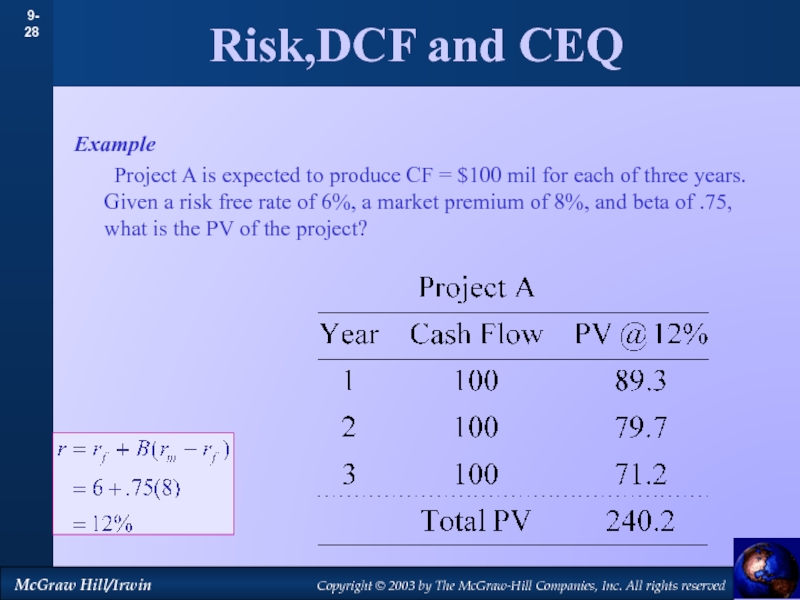

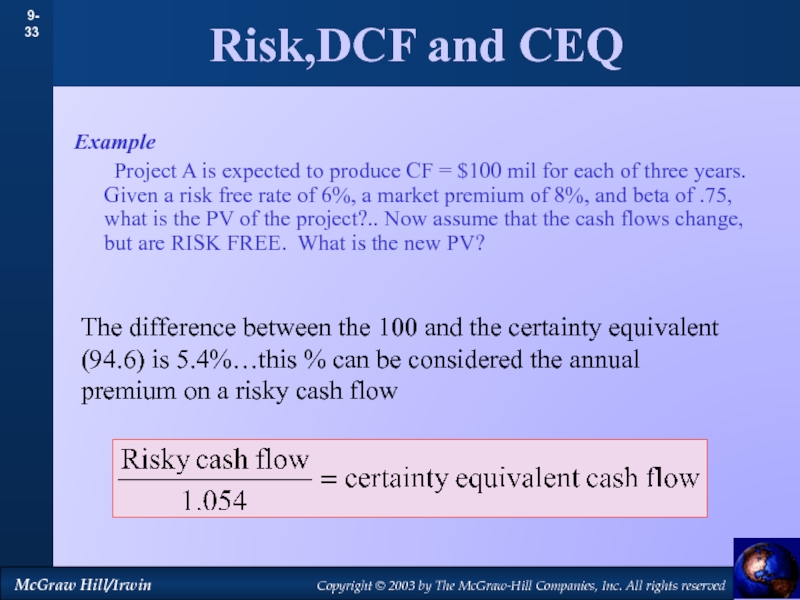

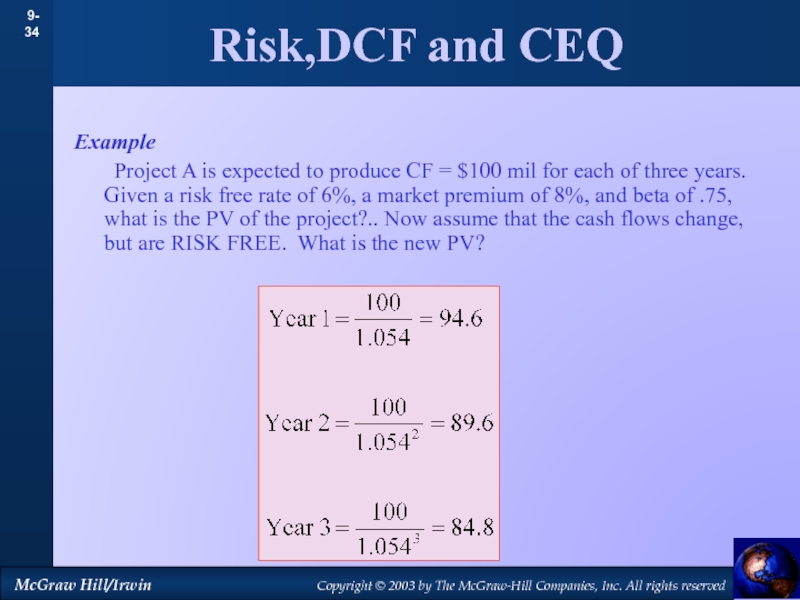

Inc. All rights reserved Capital Budgeting and Risk