Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Securities in the Russian Federation

Содержание

- 1. Securities in the Russian Federation

- 2. Regulation The Civil Code of the RFFederal

- 3. Слайд 3

- 4. The types of securitiesMass-issued (those which should

- 5. Item 2 of Article 142share,bill of exchange,

- 6. Equity SecuritiesRussian joint-stock companies (“JSCs”) may issue

- 7. BondsCorporate and government Secured and unsecured bondsSecured

- 8. Exchange bonds differ from ordinary bonds in

- 9. NotesFederal Law No. 48-FZ “On Promissory Notes

- 10. Foreign securities in the RFForeign securities may

- 11. If securities have not been listed with

- 12. Russian Depositary Receipts (RDRs)An RDR is a

- 13. The financial instruments in the USAThe Securities

- 14. Financial instrumentsnegotiable instrumentsdocument of Titlequasi-negotiableseminegotiable instrumentsUncertificated securities (investment securities)equity securities (stocks)debt securitiesoptionsconvertible bondsShare certificate

- 15. Registry of the rights to the stocksMajor

- 16. Скачать презентанцию

Regulation The Civil Code of the RFFederal Law No. 39-FZ “On the Securities Market,” dated 22 April 1996 Federal Law No. 208-FZ “On Joint-Stock Companies,” dated 26 December 1995 Law No.

Слайды и текст этой презентации

Слайд 2Regulation

The Civil Code of the RF

Federal Law No. 39-FZ

“On the Securities Market,” dated 22 April 1996

Federal Law

No. 208-FZ “On Joint-Stock Companies,” dated 26 December 1995 Law No. 395-1 “On Banks and Banking Activity,” dated 2 December 1990

regulations issued by the Central Bank of the RF and the Federal Service for Financial Markets of the RF (on 1 September 2013 all the powers of the FSFM were transferred to the Central Bank of the RF)

Слайд 4The types of securities

Mass-issued (those which should be issued in

compliance with a specific issuance procedure prescribed by the Securities

Law and which require registration with the Bank of Russia (Non mass-issued (those which need not be registered)

In certain cases the Securities Law also requires a prospectus to be registered simultaneously with registration of the securities’ issue

Corporate and government securities

Documentary and non-documentary securities

Слайд 5Item 2 of Article 142

share,

bill of exchange,

mortgage deed,

an

investment unit of a unit investment trust,

bill of lading,

bond,

cheque

and the other securities named as such in a law or deemed as such in the procedure established by a law.

Слайд 6Equity Securities

Russian joint-stock companies (“JSCs”) may issue shares, options on

shares, corporate bonds, and other securities.

JSCs may raise capital

either by issuing shares to the public or by private placement. Shares in a limited liability company are not deemed to be securities and cannot be used for raising capital from the general public.

Слайд 7Bonds

Corporate and government

Secured and unsecured bonds

Secured bonds must be

fully or partly secured with:

a suretyship,

bank (independent) guarantee,

state or municipal guarantee,

or with a pledge (or a mortgage) over the issuer’s and/or third party’s property.

Слайд 8Exchange bonds differ from ordinary bonds in that they can

be issued through a simplified procedure, because the issuance, prospectus

and placement report do not need to be registered. However, the following conditions apply:(i) the placement must be made through a public offering;

(ii) exchange bonds may not be secured by pledge;

(iii) the bonds must be issued in documentary form; and

(iv) the Bank of Russia must be notified of admittance to trading and placement on the stock exchange.

Commercial bonds are also issued in documentary form through a simplified procedure. Such bonds may not be secured by pledge. However, commercial bonds can only be placed by way of private offering.

Слайд 9Notes

Federal Law No. 48-FZ “On Promissory Notes and Bills of

Exchange”, dated 11 March 1997

Uniform Law for Bills of Exchange

and Promissory Notes (Geneva, 7 June 1930)

Слайд 10Foreign securities in the RF

Foreign securities may be admitted for

placement and/or public circulation in Russia

(i) by decision of either

a Russian stock exchange (if foreign securities have been listed abroad with any of 56 stock exchanges approved by the Bank of Russia); ii) by decision of the Bank of Russia (if foreign securities are not listed with a stock exchange recognized by the Bank of Russia and are offered to the general public for the first time).

In both instances the foreign law governing the securities to be placed/offered must not restrict placement/public circulation of such securities in Russia.

Слайд 11If securities have not been listed with a stock exchange

recognized by the Bank of Russia, in order to list

them in Russia a foreign issuer has to comply with a number of requirements, the most important of which are:registration of a Russian prospectus with the Bank of Russia;

obtaining permission of the Bank of Russia for placement of

foreign securities; and

assignment of ISIN/CFI codes.

Слайд 12Russian Depositary Receipts (RDRs)

An RDR is a documented registered security

without a nominal value stored centrally by the issuer (i.e. Russian

depositary), which certifies both the right to a specified amount of shares or bonds of a foreign issuer and the provision of services in connection with the realization of rights by a Russian holder of an RDR.The first RDRs, which started trading on December 24, 2010 and listed on the MICEX SE (RUALR) trading platform and RTS (RUAL trading code) on December 16, 2010, are RDRs for common shares traded on the Hong Kong Stock Exchange The incorporated company "Rusal", which is registered on the island of Jersey (jurisdiction of Great Britain).

Слайд 13The financial instruments in the USA

The Securities Act of 1933

The

Securities Exchange Act of 1934

US Sarbanes-Oxley Act 2002

Uniform Commercial Code

Revised

Model Business Corporation ActBlue sky laws – laws of States

Acts of United States Securities and Exchange Commission (SEC)

Слайд 14Financial instruments

negotiable instruments

document of Title

quasi-negotiable

seminegotiable instruments

Uncertificated securities (investment securities)

equity securities

(stocks)

debt securities

options

convertible bonds

Share certificate

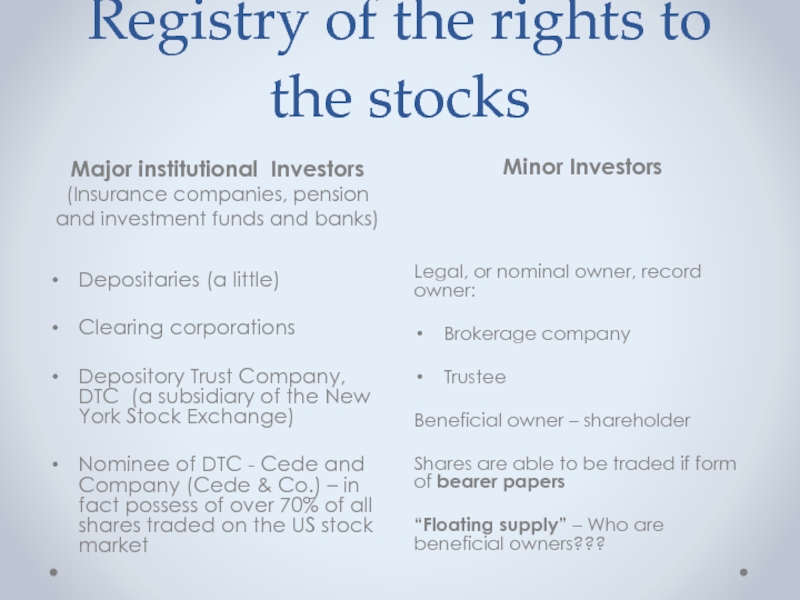

Слайд 15Registry of the rights to the stocks

Major institutional Investors

(Insurance companies,

pension and investment funds and banks)

Minor Investors

Depositaries (a little)

Clearing corporations

Depository Trust

Company, DTC (a subsidiary of the New York Stock Exchange)Nominee of DTC - Cede and Company (Cede & Co.) – in fact possess of over 70% of all shares traded on the US stock market

Legal, or nominal owner, record owner:

Brokerage company

Trustee

Beneficial owner – shareholder

Shares are able to be traded if form of bearer papers

“Floating supply” – Who are beneficial owners???