Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Audit risks

Содержание

- 1. Audit risks

- 2. Audit riskRisk of material misstatementDetection riskInherent riskControl risk

- 3. Audit riskAudit risk is the risk that the auditor expresses an inappropriate audit opinion

- 4. RiskAuditors accept some level of risk in

- 5. Risk and EvidenceAuditors gain an understanding of

- 6. ISA 315ISA 315 (Revised) Identifying and Assessing

- 7. RoMMRisk of material misstatement is the risk

- 8. Components of RoMMRoMM = Inherent risk x Control risk

- 9. Inherent riskInherent risk is the susceptibility of

- 10. Examples?Complex accounting treatment (eg. Estimates); Nature of the company or the industry;

- 11. Examples of inherent risksExamples of inherent risks

- 12. Companies such as Zara and H&M operate

- 13. Components of RoMMRoMM = Inherent risk x Control risk

- 14. Control riskControl risk is the risk that

- 15. Audit riskRisk of material misstatementDetection riskInherent riskControl risk

- 16. Detection risk Detection risk is the risk

- 17. How to manage the risk?assigning more experienced

- 18. Managing the risk exampleSerikAga Ltd is from

- 19. As inherent risk and control risk are

- 20. As inherent and control risk are low

- 21. What is a misstatement?ISA 450: 'A difference

- 22. Risk assessment proceduresObservation and inspectionEnquiries Analytical procedures

- 23. Risk assessment proceduresUnderstanding the entity and its

- 24. Risk assessment proceduresThe information used to obtain

- 25. Risk assessment proceduresAnalytical procedures are defined in

- 26. Risk assessment proceduresKey ratios

- 27. Audit riskRisk of material misstatementDetection riskInherent riskControl risk

- 28. Слайд 28

- 29. Скачать презентанцию

Слайды и текст этой презентации

Слайд 4Risk

Auditors accept some level of risk

in performing the audit.

An

effective auditor recognizes that risks exist, are difficult to measure,

and require careful thought to respond.Responding to risks properly is critical to achieving a high-quality audit.

Слайд 5Risk and Evidence

Auditors gain an understanding of the client’s business

and industry and assess client business risk.

Auditors use the audit

risk model to further identify the potential for misstatements and where they are most likely to occur.Слайд 6ISA 315

ISA 315 (Revised) Identifying and Assessing the Risks of

Material

Misstatement Through Understanding the Entity and its Environment

states:

'The objective of

the auditor is to identify and assess the risk ofmaterial misstatement, whether due to fraud or error, at the financial

statement and assertion levels, through understanding the entity and

its environment, including the entity's internal control, thereby

providing a basis for designing and implementing responses to the

assessed risks of material misstatement.'

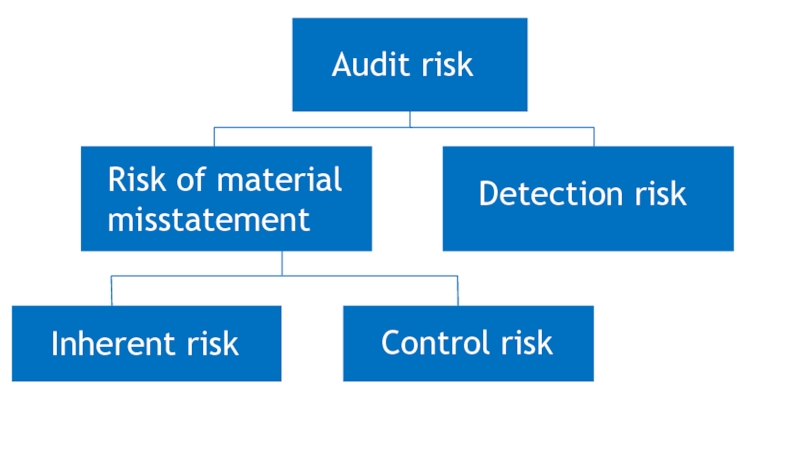

Слайд 7RoMM

Risk of material misstatement is the risk that the financial

statements are materially misstated prior to audit and consists of

two components, inherent risk and control risk.Слайд 9Inherent risk

Inherent risk is the susceptibility of an assertion about

a class of transaction, account balance or disclosure to misstatement

that could be material, before consideration of any related controls.Слайд 10Examples?

Complex accounting treatment (eg. Estimates);

Nature of the company or

the industry;

Слайд 11Examples of inherent risks

Examples of inherent risks for companies are

limitless, however, here are a few examples:

The car industry is

one of the first industries to suffer during an economic downturn due to the reluctance of the population to spend money or take out loans that they may struggle to pay back. For this reason, we could say that the car industry is inherently risky.Financial institutions deal with complex financial instruments such as derivatives. These instruments can be incredibly difficult to account for and value and so are inherently risky.

Слайд 12Companies such as Zara and H&M operate in the fashion

industry where trends and tastes change rapidly. For companies such

as these, sales and inventory balances are inherently risky.A company is heavily financed by debt. This is inherently risky as missed interest payments and repayments may lead to insolvency.

A company operates a profit related bonus scheme. Its profit figures are inherently risky as there is the incentive to management to manipulate them to achieve the bonus targets.

Examples of inherent risks

Слайд 14Control risk

Control risk is the risk that a misstatement that

could occur and that could be material will not be

prevented, or detected and corrected on a timely basis by the entity's internal controls.Could be higher or lower

Слайд 16Detection risk

Detection risk is the risk that the procedures

performed by the auditor to reduce audit risk to an

acceptably low level will not detect a misstatement that exists and that could be material.Detection risk comprises:

Sampling risk

Non-sampling risk

Слайд 17How to manage the risk?

assigning more experienced staff to risk

areas

increasing supervision levels

increasing the element of unpredictability in sample selection

changing

the nature, timing and extent of proceduresincreasing the emphasis on substantive tests of detail

emphasising the need for professional scepticism.

Слайд 18Managing the risk example

SerikAga Ltd is from an industry that

is highly exposed to the economic climate, uses lots of

complex treasuryinstruments such as interest rate swaps and futures and has a very poor system of internal controls

BakeMake Inc operates in a low risk industry, has few complex transactions and a highly sophisticated system of internal

controls.

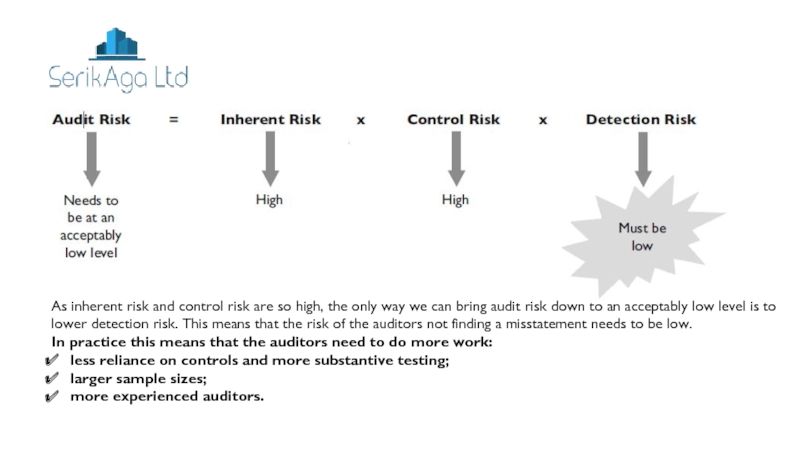

Слайд 19As inherent risk and control risk are so high, the

only way we can bring audit risk down to an

acceptably low level is to lower detection risk. This means that the risk of the auditors not finding a misstatement needs to be low.In practice this means that the auditors need to do more work:

less reliance on controls and more substantive testing;

larger sample sizes;

more experienced auditors.

Слайд 20As inherent and control risk are low then theoretically detection

risk can afford to be high. Be careful, however, as

this is a theoretical concept and under no circumstances will the auditors do no work! They can just do a different type of work:More reliance on the strong internal controls and less detailed substantive testing.

Слайд 21What is a misstatement?

ISA 450: 'A difference between the amount,

classification, presentation, or disclosure of a reported financial statement item

and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable financial reporting framework. Misstatements can arise from error or fraud.'Слайд 23Risk assessment procedures

Understanding the entity and its environment

relevant industry, regulatory

and other external factors (including the financial reporting framework)

the nature

of the entity, including:– its operations

– its ownership and governance structures

– the types of investment it makes

– the way it is structured and financed

the entity's selection and application of accounting policies

the entity's objectives, strategies and related business risks

the internal controls relevant to the audit.

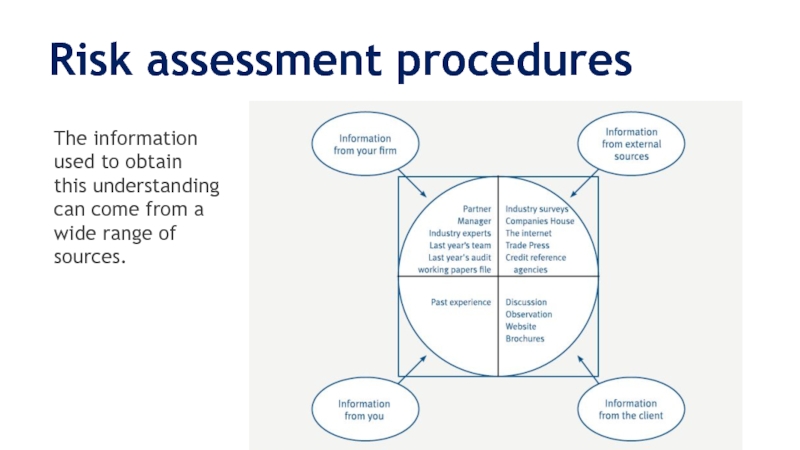

Слайд 24Risk assessment procedures

The information used to obtain this understanding can

come from a wide range of sources.

Слайд 25Risk assessment procedures

Analytical procedures are defined in ISA 520 Analytical

Procedures as:

'Evaluations of financial information through analysis of plausible relationships

among both financial and nonfinancial data' and investigation of identified fluctuations, inconsistent relationships or amounts that differ from expected values.Analytical procedures are fundamental to the auditing process.

Prior periods

Industry information

Financial ratios