Слайд 1Capital Structure and Cost of Capital

Слайд 2Capital Structure

Concerned with the effect of capital

market decisions on security prices.

Assume:

(1) investment and asset management decisions are held constant and

(2) consider only debt-versus-equity financing.

Capital Structure -- The mix (or proportion) of a firm’s permanent long-term financing represented by debt, preferred stock, and common stock equity.

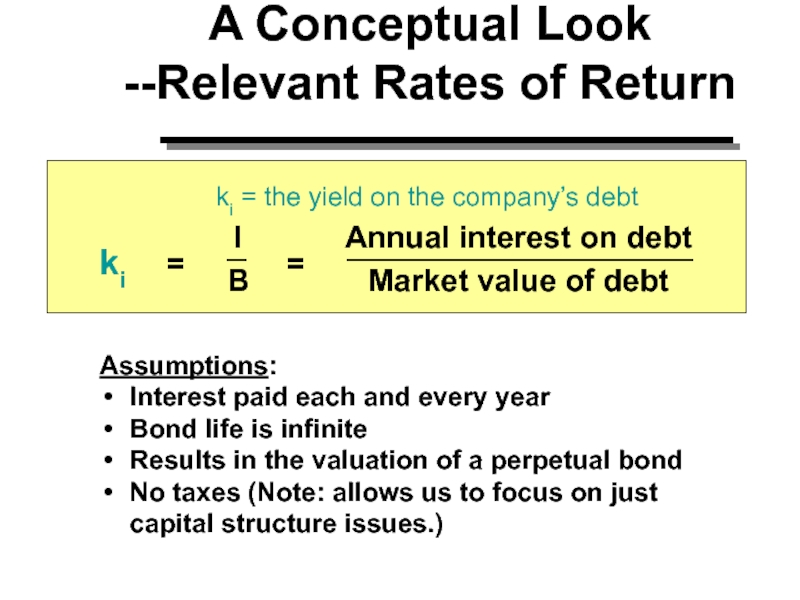

Слайд 3A Conceptual Look --Relevant Rates of Return

ki = the yield

on the company’s debt

Annual interest on debt

Market value of debt

I

B

=

=

ki

Assumptions:

Interest

paid each and every year

Bond life is infinite

Results in the valuation of a perpetual bond

No taxes (Note: allows us to focus on just capital structure issues.)

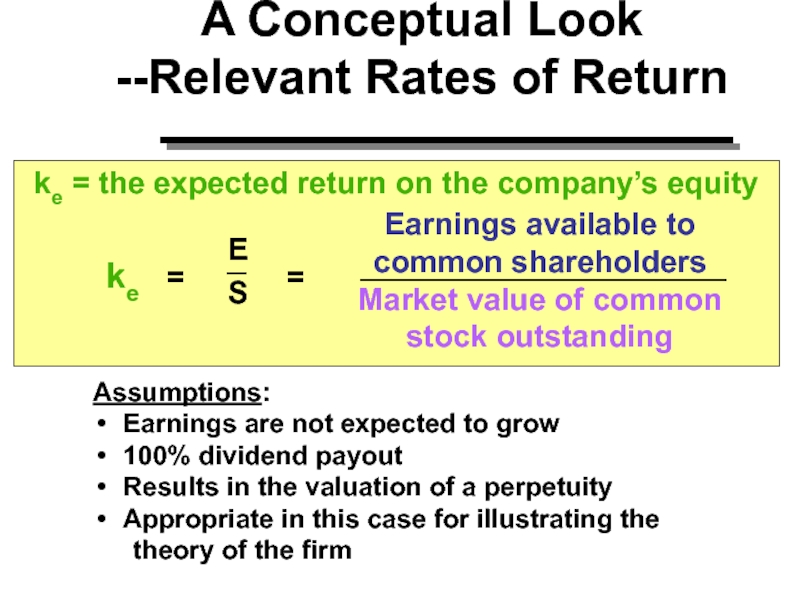

Слайд 4E

S

A Conceptual Look --Relevant Rates of Return

=

=

ke = the expected

return on the company’s equity

Earnings available to

common shareholders

Market value

of common

stock outstanding

ke

Assumptions:

Earnings are not expected to grow

100% dividend payout

Results in the valuation of a perpetuity

Appropriate in this case for illustrating the

theory of the firm

E

S

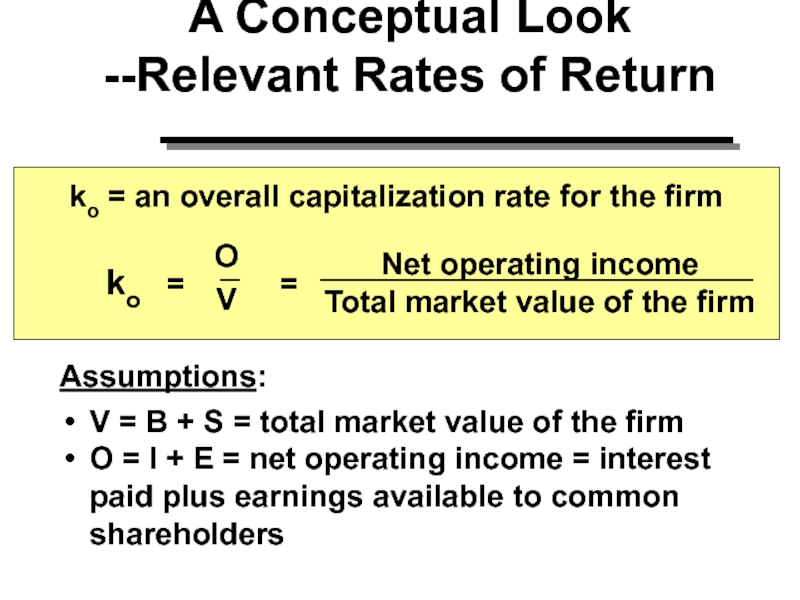

Слайд 5O

V

A Conceptual Look --Relevant Rates of Return

=

=

ko = an overall

capitalization rate for the firm

Net operating income

Total market value of

the firm

ko

Assumptions:

V = B + S = total market value of the firm

O = I + E = net operating income = interest paid plus earnings available to common shareholders

O

V

Слайд 6Capitalization Rate

Capitalization Rate, ko -- The discount rate used to

determine the present value of a stream of expected cash

flows.

ko

ke

ki

B

B + S

S

B + S

=

+

What happens to ki, ke, and ko

when leverage, B/S, increases?

Слайд 7Optimal Capital Structure

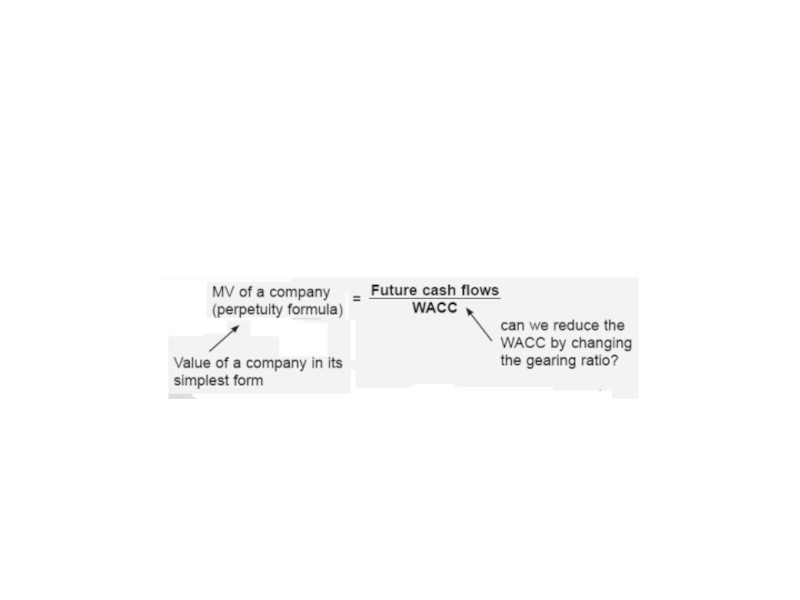

The objective of management is to maximise

shareholder wealth.

Is it possible to increase shareholder wealth by

changing the gearing ratio/level?

Слайд 9If you can reduce the WACC, this results in a

higher MV/net present value (NPV) of the company and therefore

an increase in shareholder wealth as they own the company:

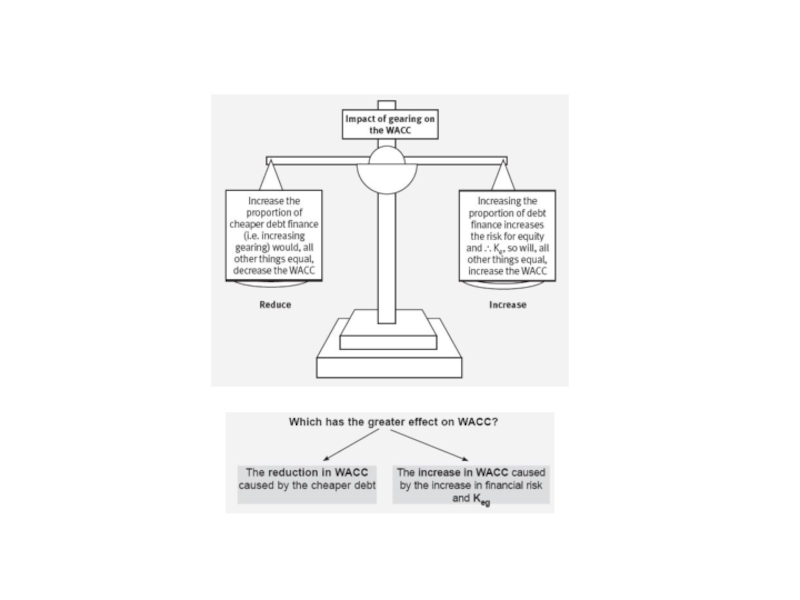

Слайд 10The WACC is a weighted average of the various sources

of finance used by the company.

Debt is cheaper than equity:

lower

risk

tax relief on interest

so you might expect that increasing the proportion of debt finance would reduce WACC.

but:

increasing levels of debt make equity more risky:

fixed commitment paid before equity – finance risk

so increasing gearing increases the cost of equity and that would increase the WACC.

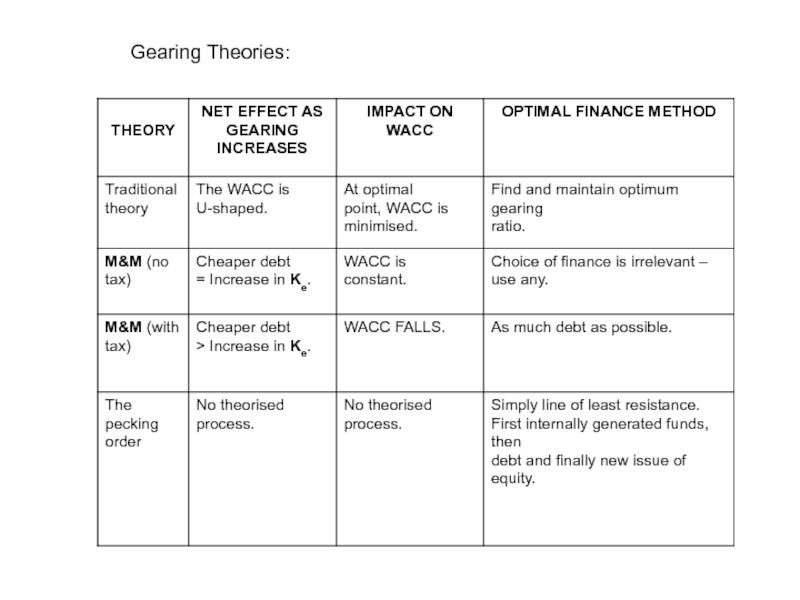

Слайд 12Summary of NOI Approach

Critical assumption is ko remains constant.

An increase

in cheaper debt funds is exactly offset by an increase

in the required rate of return on equity.

As long as ki is constant, ke is a linear function of the debt-to-equity ratio.

Thus, there is no one optimal capital structure.

Слайд 14Traditional view of capital structure (intuitive view)

The traditional view

has no theoretical basis but common sense.

Taxation

is generally ignored in this view.

At low levels of gearing:

Equity holders perceive risk as unchanged so the increase in the proportion of cheaper debt will lower the WACC

At higher levels of gearing:

Equity holders see increased volatility of returns as debt interest must be paid first

increased financial risk

increase in Ke outweighs the extra (cheap) debt being introduced

WACC starts to rise.

At very high levels of gearing:

Serious bankruptcy risk worries equity and debt holders alike

Ke and Kd rise

WACC rises further.

Слайд 16Conclusion

There is an optimal level of gearing – point X.

At point X the overall return required by investors (debt

and equity) is minimised. It follows that at this point the combined market value of the firm’s debt and equity securities will also be maximised.

Слайд 17Modigliani and Miller (M&M) – No tax

Assumptions

The theory developed by

M&M in 1958 was based on the premise of a

perfect capital market in which:

there are no transaction costs

no individual dominates the market

there is full information efficiency

all investors can borrow and lend at the risk-free rate

all investors are rational and risk averse

and crucially there are no taxes.

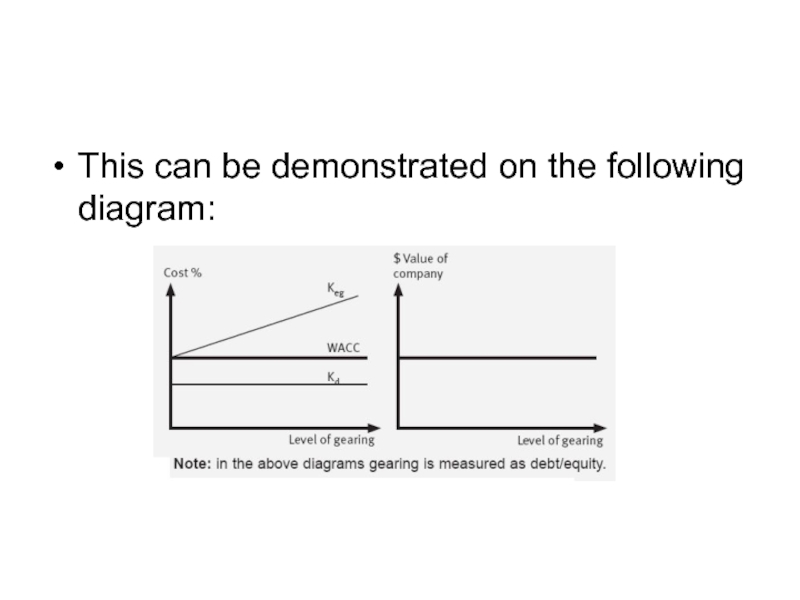

Слайд 18M&M argued that:

as investors are rational, the required return of

equity is directly proportional to the increase in gearing.

There

is thus a linear relationship between Ke and gearing (measured as D/E)

the increase in Ke exactly offsets the benefit of the cheaper debt finance and therefore the WACC remains unchanged.

Conclusion

The WACC and therefore the value of the firm are unaffected by changes in gearing levels and gearing is irrelevant.

Слайд 19This can be demonstrated on the following diagram:

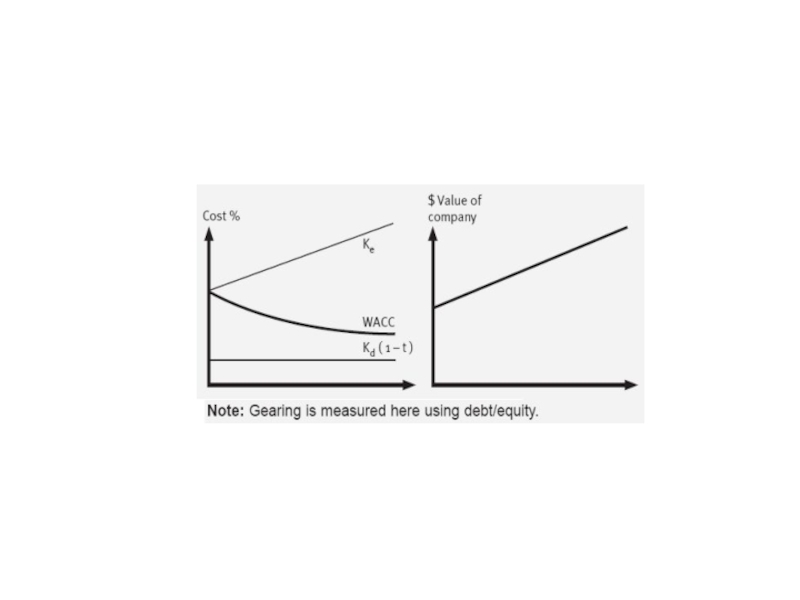

Слайд 20Modigliani and Miller (M&M) – with tax

M&M modified their model to reflect the fact that the

corporate tax system gives tax relief on interest payments.

The starting point for the theory is, as before, that:

as investors are rational, the required return of equity is directly linked to the increase in gearing – as gearing increases, Ke increases in direct proportion.

However this is adjusted to reflect the fact that:

debt interest is tax deductible so the overall cost of debt to the company is lower than in M&M – no tax

lower debt costs less volatility in returns for the same level of gearing lower increases in Ke

the increase in Ke does not offset the benefit of the cheaper debt finance and therefore the WACC falls as gearing increases.

Слайд 22The problems of high gearing

Bankruptcy risk

Agency costs

Tax exhaustion

Borrowing/debt capacity

Difference risk tolerance levels between shareholders and directors

Restrictions in the articles of association

The cost of borrowing increases as gearing increases

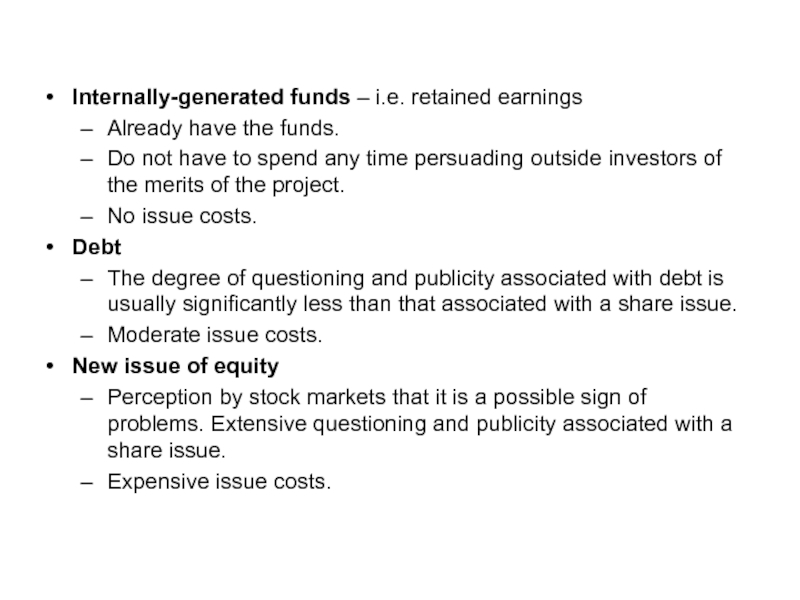

Слайд 23Pecking-order theory

In this approach, there is no

search for an optimal capital structure through a theorised process.

Instead it is argued that firms will raise new funds as follows:

internally-generated funds

debt

new issue of equity.

Слайд 24Internally-generated funds – i.e. retained earnings

Already have the funds.

Do not

have to spend any time persuading outside investors of the

merits of the project.

No issue costs.

Debt

The degree of questioning and publicity associated with debt is usually significantly less than that associated with a share issue.

Moderate issue costs.

New issue of equity

Perception by stock markets that it is a possible sign of problems. Extensive questioning and publicity associated with a share issue.

Expensive issue costs.

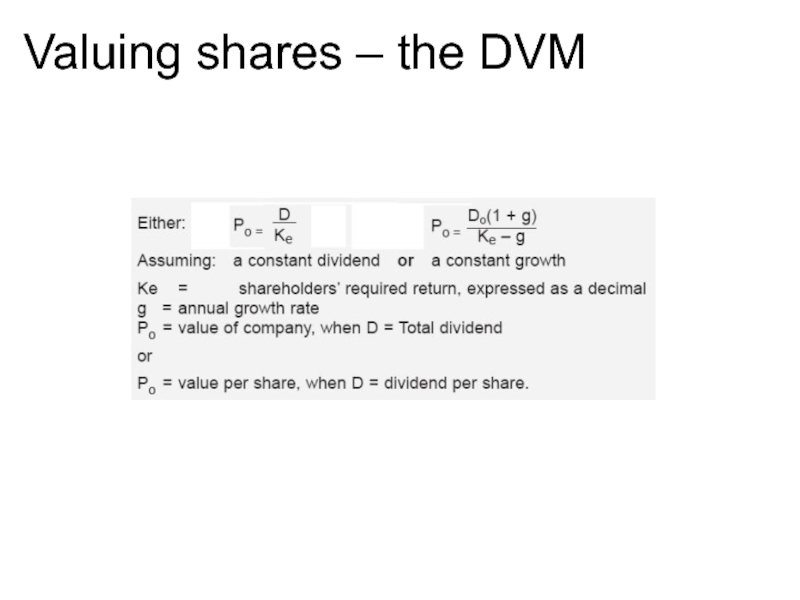

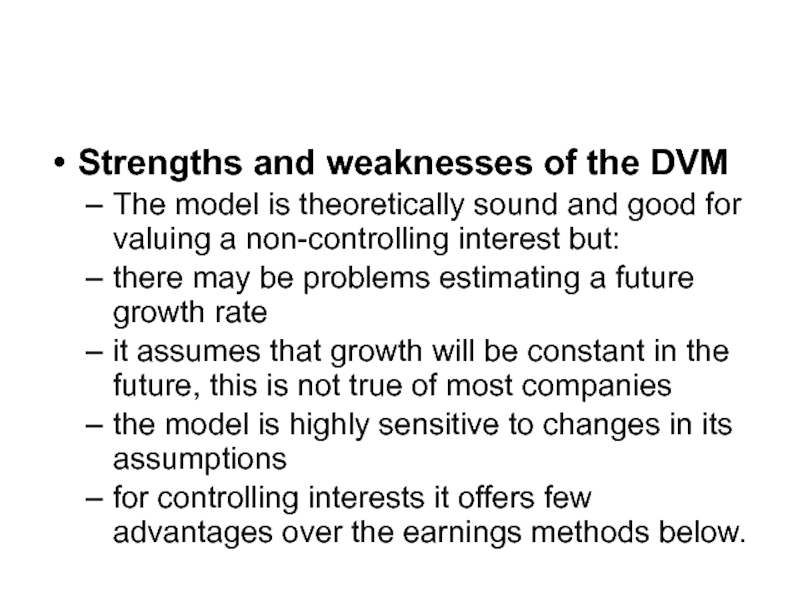

Слайд 27Strengths and weaknesses of the DVM

The model is theoretically sound

and good for valuing a non-controlling interest but:

there may be

problems estimating a future growth rate

it assumes that growth will be constant in the future, this is not true of most companies

the model is highly sensitive to changes in its assumptions

for controlling interests it offers few advantages over the earnings methods below.

Слайд 28Asset-based valuations

Problems with asset-based valuations

The fundamental weakness:

investors do not

normally buy a company for its balance sheet assets, but

for the earnings/cash flows that all of its assets can produce in the future

we should value is what is being purchased, i.e. the future income/cash flows.

Subsidiary weakness:

The asset approach also ignores non-balance sheet intangible ‘assets’, e.g.:

highly-skilled workforce

strong management team

competitive positioning of the company’s products.

Слайд 29When asset-based valuations are useful

(1) Asset stripping

(2) To set

a minimum price in a takeover bid

(3) To value

property investment companies