Слайд 1Chapter 8

The Home and Automobile Decision

Слайд 2Learning Objectives

Make good buying decisions.

Choose a vehicle that suits your

needs and budget.

Choose housing that meets your needs.

Decide whether to

rent or buy housing.

Calculate the costs of buying a home.

Get the most out of your mortgage.

Слайд 3Smart Buying

Step 1: Differentiate Want From Need

Smart buying requires

separating wants from needs.

“Want” purchases require a trade-off.

Before

buying a “want,” determine whether the purchase will interfere with your ability to pay for your future needs.

Слайд 4Smart Buying

Step 2: Do Your Homework

After deciding to make

a purchase, comparison shop.

Start your research with publications that

provide unbiased ratings and recommendations such as:

Consumer Reports at www.consumerreports.org

Consumer’s Resource Handbook from the U.S. Office of Consumer Affairs at www.pueblo.gsa.gov

Слайд 5Smart Buying

Step 3: Make Your Purchase

Getting the best price might

involve negotiations.

Conduct research before haggling.

Know what the product’s mark-up is.

This

is the price dealers add on above what they paid for the product.

Consider what fits your monthly budget.

Слайд 6Smart Buying

Step 4: Maintain Your Purchase

Maintain your purchase after

the deal is complete.

Resolve complaints or issues.

First contact the seller,

then the company headquarters that made or sold the product.

Work with the Better Business Bureau and other local, state, and federal organizations.

Слайд 7Smart Buying

Checklist 8.1 Before You Buy

Decide in advance what

you need and can afford.

Take advantage of sales but compare

prices.

Be aware of extra charges that increase the total price.

Ask about refund or exchange policy.

Read and understand the contract before signing.

Learn about your cancellation rights.

Don’t succumb to high pressure tactics or do business over the phone with unknown companies.

Get everything in writing.

Слайд 8Smart Buying

Checklist 8.2 Making a Complaint

Keep a record of

your efforts to resolve the problem.

Contact the seller, then go

to the manufacturer.

Type letters, keep copies, and send letters with return receipt requested.

Allow time for the company to resolve the problem, then file a complaint with your local consumer protection office or Better Business Bureau.

Don’t give up until you are satisfied.

Слайд 9Smart Buying in Action:

Buying a Vehicle

Vehicles are your largest purchase,

next to buying a house.

Choices to consider:

Buy new

Buy used

Lease

the vehicle

Leasing is renting for an extended period with a small down payment and low monthly rates.

Слайд 10Smart Buying in Action:

Buying a Vehicle

Step 1: Differentiate Want From

Need

Determine which features you need.

Make a list of the

features you want.

Consider your employment, family, lifestyle.

Слайд 11Smart Buying in Action:

Buying a Vehicle

Step 2: Do Your Homework

How

much can you afford?

Typical family spends 4-6 months of annual

income on a new car.

Determine size of down payment.

Determine an affordable monthly payment.

Which vehicle is right for you?

Comparison shop, looking at choices and trade-offs.

Consider operating and insurance costs, and warranty.

Слайд 12Smart Buying in Action:

Buying a Vehicle

Step 3: Make Your Purchase

Be

sure to get a fair price.

Know the dealer cost or

invoice price.

Research using Edmund’s Car Buying Guide at www.edmund.com or AutoSite at their web site www.autosite.com/content/home.

Most car dealers receive a “holdback,” amounting to

2-3% of the price, when selling a car.

Слайд 13Smart Buying in Action:

Buying a Vehicle

Step 3: Make Your Purchase

Financing

Alternatives:

Cheapest way to buy a car is with cash, but

investigate all financing options before buying.

Keep financing out of the negotiations.

The shorter the term, the higher the monthly payments.

Слайд 14Smart Buying in Action:

Buying a Vehicle

Step 3: Make Your Purchase

Leasing:

Appeals

to those who are financially stable, like a new car

every few years, drive less than 15,000 miles annually, and don’t want hassle of trading in car.

Popular with those with good credit but not enough up-front money to buy.

1/3 of all new vehicles are leased.

Слайд 15Smart Buying in Action:

Buying a Vehicle

Step 4: Maintain Your Purchase

Keep

vehicle in best running condition.

Read owner’s manual and follow regular

maintenance.

Don’t ignore signs of trouble.

Listen for unusual sounds, drips, or warning lights.

Your first line of protection is the warranty.

Know your rights under the Lemon laws.

Слайд 16Smart Buying in Action: Housing

Many people equate home ownership with

financial success.

Housing costs can take up over 25% of

after-tax income.

Home ownership is also an investment – likely the biggest investment you will ever make.

Consider lifestyle, wants and needs, and budget constraints when making choices.

Слайд 17Your Housing Options

A House:

Popular choice for most individuals.

Offers space and

privacy.

Offers greater control over style decoration and home improvement.

Requires more

work than the other choices, including maintenance, repair, and renovations.

Most potential for capital appreciation.

Слайд 18Your Housing Options

A Cooperative (Co-op) is a building owned by

a corporation in which residents are stockholders.

Residents buy stock, giving

them the right to occupy a unit in the building.

The larger the space and the more desirable the location, the more shares you have to buy.

Difficult to get a mortgage.

Pay monthly homeowner’s fee for taxes and maintenance.

Слайд 19Your Housing Options

A Condominium (Condo) is an apartment complex that

allows individual ownership of the unit and joint ownership of

land, common areas, and facilities.

Allows direct ownership of the unit with a proportionate ownership in land and common areas.

Pay monthly fee for interest, taxes, utilities, and groundskeeping.

Слайд 20Your Housing Options

Apartments and other rental housing offer:

Affordability

Low maintenance situations

Little

financial commitment

Chosen by young, single people.

May be a lifestyle

decision.

Limited upkeep and no long-term commitment.

Offers lack of choice regarding pets or remodeling.

Слайд 21Smart Buying in Action: Housing

Step 1: Differentiate Want From Need

Determine

what you need versus what you want.

Decide what is important

to you:

Consider location – country, suburbs, or city

Consider the neighborhood – safety, convenience, schools

Слайд 22Smart Buying in Action: Housing

Step 2: Do Your Homework

Investigate the

potential home and all that goes along with it:

Neighborhood, community

lifestyle, satisfy needs.

www.homes.com/Content/NeighborhoodSearchMain.cfm

www.homefair.com

Understand how much you can afford to pay.

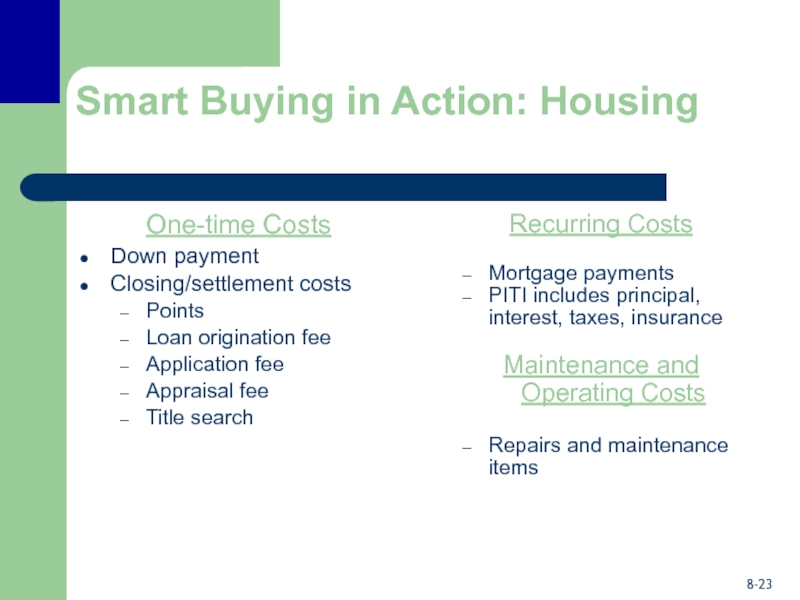

Слайд 23Smart Buying in Action: Housing

One-time Costs

Down payment

Closing/settlement costs

Points

Loan origination

fee

Application fee

Appraisal fee

Title search

Recurring Costs

Mortgage payments

PITI includes principal,

interest, taxes, insurance

Maintenance and Operating Costs

Repairs and maintenance items

Слайд 24Renting Versus Buying

Buying

Many up-front and

one-time costs

Beneficial for those who

itemize their deductions

Mortgage payments

are a form of forced savings

Renting

No large

up-front costs other than a security deposit

Beneficial if staying only for the short-term

Слайд 25Determining What You

Can Afford

Before house hunting, ask yourself:

What is the

maximum amount the bank will lend me?

Should I borrow up

to this maximum?

How big a down payment can I afford?

Слайд 26What is the Maximum Amount the Bank Will Lend Me?

Lenders look at:

Your financial history – steadiness of income,

credit report, and FICO score

Your ability to pay – lenders use ratio of a maximum 28% PITI: monthly gross income

Appraised value of home – limit mortgage loan to 80%.

Слайд 27How Much Should You Borrow?

A mortgage is a large financial

commitment of future earnings.

Look at your overall financial plan

before deciding on how much to borrow.

Prequalifying – lender confirms the loan size based on ability to pay and down payment.

Слайд 28Financing the Purchase:

The Mortgage

Sources of mortgages:

S&Ls and commercial banks are

the primary sources of mortgage loans.

Mortgage bankers originate loans, sell

them to banks or pension funds, have fixed rate mortgages.

Mortgage brokers are middlemen who place loans with lenders for a fee but do not originate those loans. They do the comparison shopping.

Слайд 29Conventional and Government-Backed Mortgages

Conventional loans - from a bank or

S&L and secured by the property.

If default - lender

seizes property, sells it to recover funds owed.

Слайд 30Conventional and Government-Backed Mortgages

Government-backed loans – lender makes loan and

government insures it. VA and FHA account for 25% of

all mortgage loans.

Advantages:

Lower interest rate

Smaller down payment

Less strict financial requirements

Disadvantages:

Increased paperwork

Higher closing costs

Limits amount borrowed

Слайд 31Fixed-Rate Mortgages

Monthly payment doesn’t change regardless of changes in market

interest rates.

If rates are low, a fixed rate mortgage

locks in the low rates for the life of the loan.

An assumable loan can be transferred to a new buyer.

Prepayment privilege allows early cash payments to be applied to principal.

Слайд 32Adjustable-Rate Mortgages

With an ARM, the interest rate fluctuates based on

current market interest rates within limits at specified intervals.

Borrowers are

better off with an ARM if interest rates drop.

Initial Rate - “teaser rate” can be deceptively low and available for only a short time period.

Слайд 33Adjustable-Rate Mortgages

Interest Rate Index – rates on ARMs are tied

to an index not controlled by the lender, such as

6- or 12-month U.S. Treasuries.

Margin – the amount over the index rate that the ARM is set.

Adjustment Interval – how frequently the rate can be reset.

Слайд 34Adjustable-Rate Mortgages

Payment Cap – sets dollar limit on how much

the monthly payment can increase during any adjustment period.

If

interest rates go up, the monthly payment may be too small to cover the interest due.

This results in negative amortization. The unpaid interest is added to the unpaid loan balance, increasing its size.

Слайд 35Adjustable-Rate Mortgages

ARM Innovations:

Convertible ARM – convert traditional ARM to a

fixed rate loan during 2nd – 5th years.

Reduction-option ARM –

one-time optional interest rate adjustment to market interest during 2nd – 6th years.

Two-step ARM – interest rate is adjusted at end of 7th year, then constant for life.

Price level adjusted mortgage – low initial rate, payments and interest change with inflation.

Слайд 36Other Mortgage Loan Options

Balloon Payment Loan – small monthly payments

for 5-7 years, then entire loan due.

Graduated Payment Mortgage –

payments set in advance, rising for 5-10 years, then level off.

Growing Equity Mortgage – designed to let homebuyer pay off mortgage early.

Слайд 37Other Mortgage Loan Options

Shared Appreciation Mortgage – borrower receives below-market

interest rate and lender receives a portion of future appreciation.

Interest

Only Mortgage – combination of interest only payment at beginning, then pay both interest and principal for remainder of loan.

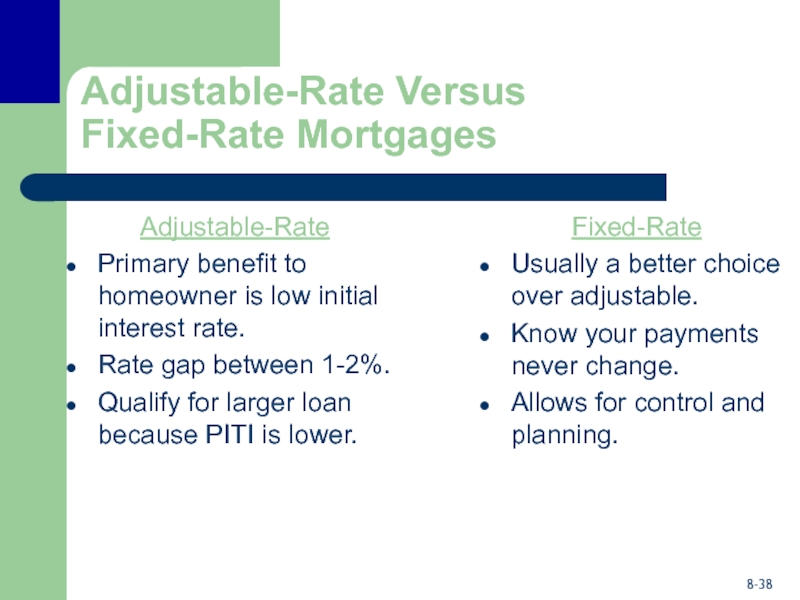

Слайд 38Adjustable-Rate Versus

Fixed-Rate Mortgages

Adjustable-Rate

Primary benefit to homeowner is low initial interest

rate.

Rate gap between 1-2%.

Qualify for larger loan because PITI is

lower.

Fixed-Rate

Usually a better choice over adjustable.

Know your payments never change.

Allows for control and planning.