Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

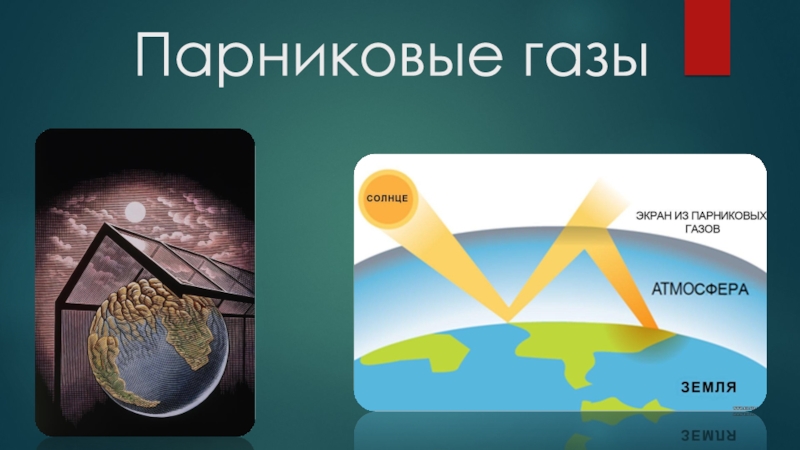

- Экология

- Экономика

- Юриспруденция

Features of the Chinese Social Security Law

Содержание

- 1. Features of the Chinese Social Security Law

- 2. Some problems with China's social security system(1)

- 3. (2) The disparity between civil servants and

- 4. (3) The number of people using the

- 5. (4) Problems with the medical insurance systemJapan:

- 6. Overview "Labor Insurance Ordinance“ for employees of

- 7. Social Insurance SystemIn urban areas, there is

- 8. Pension system Type of pensions The public

- 9. (1) The Basic Pension Insurance System for

- 10. (3) Pensions for civil servants"Provisional Method for

- 11. (4) Corporate pension planA corporate supplementary pension

- 12. (5) Expansion of social insurance coverage, especially

- 13. Medical insurance system(1) Type of systemThere is

- 14. (1) City Employees' Basic Medical Insurance System

- 15. (3) Basic medical insurance system for urban

- 16. (5) Civil servant medical assistance systemA system

- 17. Minimum Livelihood Security System for Urban ResidentsThose

- 18. Unemployment insurance systemUrban enterprises and institutions pay

- 19. In order to receive insurance benefits, the

- 20. The duration of the benefit depends on

- 21. Industrial accident insurance systemIt is necessary to

- 22. (4) If the employee suffers from an

- 23. it is deemed to be industrial accident

- 24. Thank you very much for your attention.

- 25. Скачать презентанцию

Some problems with China's social security system(1) The problem of disparity between urban and rural areasThe family register systemJust like a visa to live somewhere other than your city of origin

Слайды и текст этой презентации

Слайд 1Features of the Chinese Social Security Law

Qi Zhong

Researcher

Japan

Institute for Labor Policy and

Слайд 2Some problems with China's social security system

(1) The problem of

disparity between urban and rural areas

The family register system

Just like

a visa to live somewhere other than your city of originСлайд 3(2) The disparity between civil servants and regular workers is

large

the benefits of civil servants are much better than those

of regular workersRegular workers: pay pension insurance premiums into a fund pool, and adjust the amount received by the funds in the pool

Public servants: take money out of the state budget directly, and much higher

⇒government seeks to unify the systems

Слайд 4(3) The number of people using the unemployment insurance system

is low

new forms of work related to the platform economy

are heavily used(gig economy)not necessary to get social insurance

It is believed better not to join social insurance but to pass the money on to workers

the unemployed don't register as unemployed to get unemployment benefits unless they have unemployment insurance

More gig economy⇒ The unemployment rate seems to be lower

Слайд 5(4) Problems with the medical insurance system

Japan: the government pays

the entire amount if the cost of treatment exceeds 50,000

yen per month.China: if the cost exceeds a certain amount, the out-of-pocket expenses are proportionally larger

Слайд 6Overview

"Labor Insurance Ordinance“ for employees of government agencies and

state-owned enterprises in urban areas

mutual aid system within each group

of production organizations in rural areasOctober 2010, the Social Insurance Law

Distinction by family register and occupation has been largely maintained

Слайд 7Social Insurance System

In urban areas, there is a social insurance

system for workers in the areas of pensions, medical care,

unemployment, workers' compensation, and childbirth, but no long-term care insurance system.The expansion of the coverage of social insurance for peasant workers (migrant workers from rural areas to cities) and freelancers has become an issue, and the government is actively promoting coverage while developing related systems.

Слайд 8Pension system

Type of pensions

The public pension system includes

the Basic Pension Insurance for Urban Employees, the Basic Pension

Insurance for Urban and Rural Residents, and the Civil Service Pension, and there is a corporate pension as a supplement to the Basic Pension Insurance for Urban Employees.Слайд 9(1) The Basic Pension Insurance System for Urban EmployeesProvide stable

benefits from financial resources, including individual burdens, and guarantee old-age

income for employees of non-state-owned enterprises.The system consists of two parts: an individual account (savings method) and a fund (levy method).

(2) The Basic pension insurance system for urban and rural residents

all citizens were covered by the urban resident pension insurance and the new type of rural social pension insurance by the end of 2012

"Opinion on Building a Unified Urban and Rural Resident Basic Pension Insurance System" to integrate the previously separate "Urban Resident Pension Insurance" and "New Rural Social Pension Insurance"

Слайд 10(3) Pensions for civil servants

"Provisional Method for Processing the Retirement

of State Civil Servants" promulgated by the State Council in

1955all funding was provided by the government,

the amount of the benefit was calculated based on the salary before retirement,

the pension was provided in constant proportion

there is no individual contribution and the benefits are generous

"Decision on Reforming the Pension Insurance System of Government Offices and Government Business Organizations“(January 2015)

Each institution pays 20% of wages and individuals pay 8% of wages as premiums, with a minimum period of membership of 15 years or more

Слайд 11(4) Corporate pension plan

A corporate supplementary pension system

The number of

members is lower than that of public pensions, and the

expansion of membership is slowThe usage is limited to blue-chip companies

Слайд 12(5) Expansion of social insurance coverage, especially pensions

Pension insurance

coverage for peasant workers has not been advanced

In 2014, the

Basic Pension Insurance for Urban Employees covered 273,950,000 farmers and industrialists, but in reality, only 54,720,000 people were enrolled.It is difficult for employers using low-income peasant workers to pay the current high premiums(20% for employers and 8% for individual employees)

the amount peasant workers have accumulated is not counted when they leave their cities of work.

"Opinions on Building a Unified Urban and Rural Resident Basic Pension Insurance System"

Слайд 13Medical insurance system

(1) Type of system

There is a basic medical

insurance system for employees of urban enterprises and their retirees,

a basic medical insurance system for urban residents (non-employees), a new rural joint medical system for rural residents, and a medical assistance system for civil servants.In addition, there is a medical assistance system for the specific needy

Слайд 14(1) City Employees' Basic Medical Insurance System

an individual account

(individual savings) and a fund (social insurance system)

a) Designated hospital

systemThe co-payment rate for medical expenses is set lower for smaller hospitals, and patients are encouraged to use smaller hospitals.

b) Medical expense supplement insurance system

separate from the basic medical insurance

in order to supplement the burden of medical expenses when the insured person's out-of-pocket expenses become insufficient

Слайд 15(3) Basic medical insurance system for urban residents

Targets the elderly,

disabled people, children, university students, and non-employee residents who have

not been covered before(4) The new rural co-operative health care system

At the time of the collective economy, the People's Public Corporation and others were collectively responsible for livelihood security, including medical care.

In the wake of the SARS craze, in 2003, the existing system was reconstructed as a new type of rural cooperative medical care system

Слайд 16(5) Civil servant medical assistance system

A system of medical subsidies

provided on top of thebasic medical insurance system for city

employeesFor outpatient expenses, for the portion of outpatient expenses incurred in the same fiscal year that exceed a certain standard amount of 1,300 yuan, which is the standard amount of the basic medical insurance system for urban employees, 95 percent of the amount is subsidized.

For hospitalization costs, the city provides generous medical coverage for civil servants, such as subsidizing 90% of the cost of hospitalization if the cost is less than or equal to 50,000 yuan and 95% of the cost of hospitalization if the cost is greater than or equal to 50,000 yuan.

Слайд 17Minimum Livelihood Security System for Urban Residents

Those subject to the

system are urban residents whose income is below the minimum

livelihood security standard.The minimum livelihood security standard is set by each local government, and is generally 20-30% of the average wage in each region.

Слайд 18Unemployment insurance system

Urban enterprises and institutions pay unemployment insurance premiums

in accordance with two per cent of their gross wages.

Employees of urban enterprises and institutions pay unemployment insurance contributions at the rate of 1 per cent of their wages.

Peasant workers recruited by urban enterprises and institutions do not pay unemployment insurance premiums themselves.

Слайд 19In order to receive insurance benefits, the unemployed must meet

the following benefit requirements

(1) The company and the individual have

been paying unemployment insurance premiums for at least one year before the unemployment.(2) The resignation is involuntary and not of the individual's own volition.

(3) The unemployed person has registered for unemployment and has the intention to seek employment.

Benefit levels are determined by local governments, they shall not fall below the minimum livelihood security standards for urban residents.

Слайд 20The duration of the benefit depends on the period of

coverage prior to unemployment.

For more than one year but less

than five years: up to 12 months of benefits.For more than 5 years but less than 10 years: up to 18 months of benefits.

For more than 10 years: up to 24 months of benefits.

Слайд 21Industrial accident insurance system

It is necessary to obtain a Industrial

accident certification

Circumstances that should be certified as industrial accidents

(1) When

an employee is injured in an accident due to work-related reasons during working hours or at the working place. (2) If the employee is involved in an accident and is injured as a result of engaging in work that is in the nature of preparation or tidying up related to the job at the place of work before or after work hours.

((3) If the employee has suffered violence or other sudden injury as a result of performing his or her job duties during work hours or at the place of work.

Слайд 22(4) If the employee suffers from an occupational disease.

(5) During

a business trip, the employee is injured for business reasons

or goes missing due to an accident.(6) If, while on the way to work, he or she is injured in a traffic accident for which he or she is not primarily responsible or in an accident on a city public transportation, passenger ferry or train.

(7) In other cases where a law or administrative regulation stipulates that it must be certified as a work-related accident.

Слайд 23it is deemed to be industrial accident if

(1) When

a person dies due to a sudden illness during working

hours or in the department in which he or she works, or when a person dies even though first aid was given within 48 hours.(2) Injured in the course of activities to protect the national interest or public interest, such as disaster relief.

(3) If the employee has previously served in the military and has been wounded by combat or official duties and remains disabled, and has obtained a Revolutionary Disabled Soldier's Certificate, but the old injury recurs after he or she has worked.