Слайд 1

Forecasting Free Cash Flow of an Industrial Enterprise Using Fuzzy

Set Tools

Elena Tkachenko

Saint Petersburg State University of Economics

Elena Rogova

National Research

University Higher School of Economics

Daria Koval

Saint Petersburg State University of Economics

Higher School of Economics

National Research University

St Petersburg Campus

Слайд 2The problem of forecasting companies’ cash flows is important in

the growing uncertainty of the business environment

It is also discussed

in the literature (Kaplan, Ruback, 1995; Fridson, Alvarez, 2009; Cheng, Czernkowski, 2010; Pae, Yoon, 2012; Ruppert, 2017)

One of the main objectives of forecasting is to enhance the enterprise's ability to react to changes of the external environment that might affect the performance

Motivation

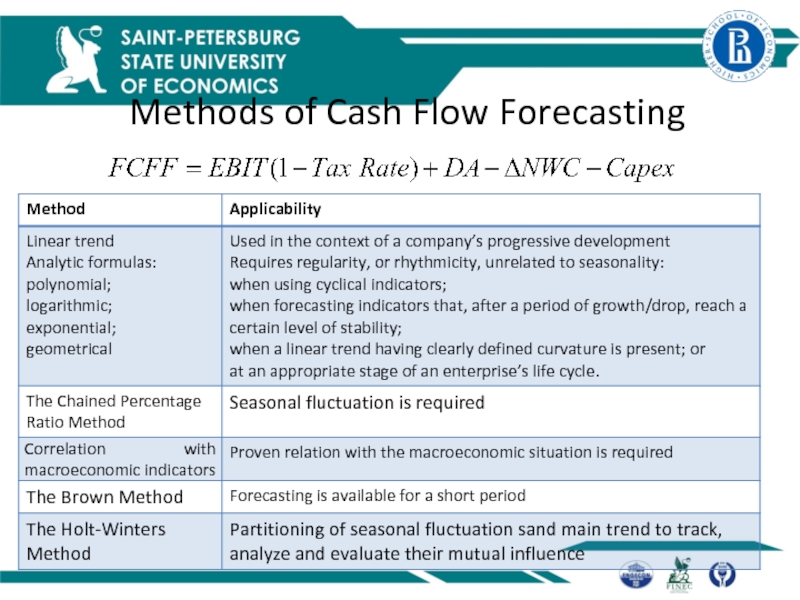

Слайд 3Methods of Cash Flow Forecasting

Слайд 4Revenues as a Key Element to be Forecasted

Revenues generated by

various centers of financial responsibilities and revenues from varying focus

areas generated under the influence of different factors may be forecasted using various methods

The resulting forecast is based on data obtained on all levels of research starting with the macroeconomic level and down to the level of enterprise. At this stage, variants of macroeconomic and microeconomic dynamics are compared, and the enterprise's response scenarios to changes of the internal and external environments are developed.

Due to the modern volatility of global and national economies, the significance of forecasting, in general, and enterprise revenue forecasting, in particular (being part of the budgeting process) is greater than ever.

The models mentioned above are limited, to some extent, and often, their use does not make it possible to obtain the desired result due to certain inherent risks and errors.

Слайд 5Fuzzy Time Series (1)

When discussing fuzzy time series {Ỹ(t)}, it

should be noted that such a series includes a number

of fuzzy sets Xt, where t = 1, 2, …

In this case, we used the assumption that the components of the series Xt have linguistic values, and Ỹ(t) is a fuzzy function with argument t which values have fuzzy verbal variables “high”, “average”, “low”, etc.

The use of logical-linguistic variables makes it possible to take into account qualitative factors that enable to recognize the uncertainty

Empirical data of the time series {Y(t)} must be designated. These are selected with account to the objective of study (revenue of the enterprise, per-capita income, GDP, etc.)

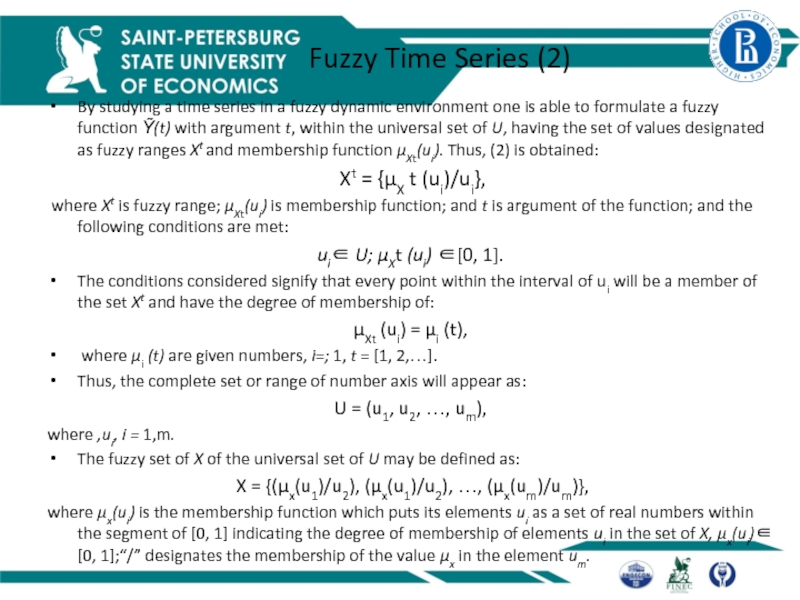

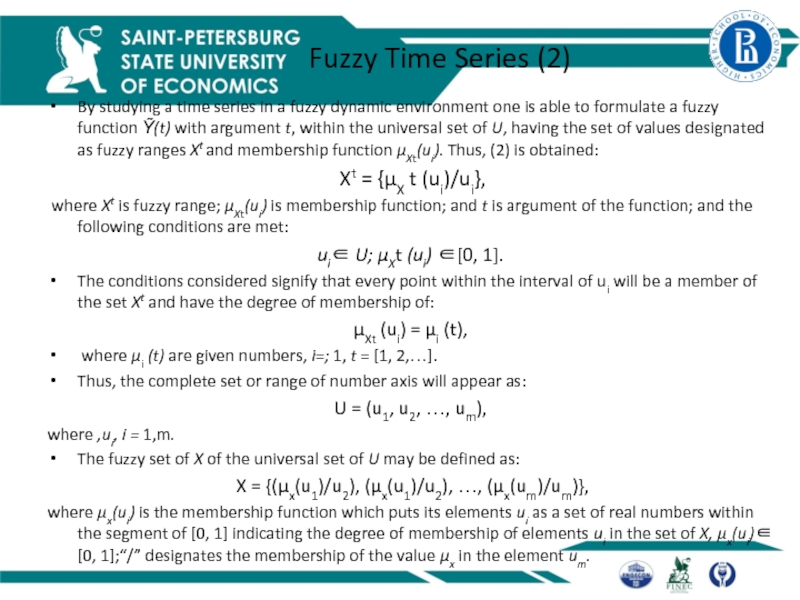

Слайд 6Fuzzy Time Series (2)

By studying a time series in a

fuzzy dynamic environment one is able to formulate a fuzzy

function Ỹ(t) with argument t, within the universal set of U, having the set of values designated as fuzzy ranges Xt and membership function µXt(ui). Thus, (2) is obtained:

Xt = {µX t (ui)/ui},

where Xt is fuzzy range; µXt(ui) is membership function; and t is argument of the function; and the following conditions are met:

ui∈ U; µXt (ui) ∈[0, 1].

The conditions considered signify that every point within the interval of ui will be a member of the set Xt and have the degree of membership of:

µXt (ui) = µi (t),

where µi (t) are given numbers, i=; 1, t = [1, 2,…].

Thus, the complete set or range of number axis will appear as:

U = (u1, u2, …, um),

where ,ui, i = 1,m.

The fuzzy set of X of the universal set of U may be defined as:

X = {(μx(u1)/u2), (μx(u1)/u2), …, (μx(um)/um)},

where μx(ui) is the membership function which puts its elements ui as a set of real numbers within the segment of [0, 1] indicating the degree of membership of elements ui in the set of X, μx(ui)∈ [0, 1];“/” designates the membership of the value μx in the element um.

Слайд 7

Stages for forecasting with Fussy Time Series (1)

Слайд 8

Stages for forecasting with Fuzzy Time Series (2)

At the first

stage, the boundaries of the time series are defined, and

the indicators necessary to solve the forecasting problem are selected. To define the universal U set, increment of the considered indicator of the time series throughout the time interval must be determined. It should be noted that boundaries of the universal set U coincide with the maximum and minimum values of the indicator increment, however, at the following stages of the forecasting process these boundaries may be expanded for the ease of calculation.

At the second stage, the defined universal U set is divided into intervals having equal length.

Слайд 9

Stages for forecasting with Fuzzy Time Series (3)

At the third

stage of the analysis, a set of fuzzy sets shall

be identified within the previously determined universal U set. For this purpose, logical-linguistic variables shall be introduced and appropriate values of these variables determined. In general terms, these variables may be as follows:

very low level of increment of the forecasted indicator (VLLIFI);

low level of increment of the forecasted indicator (LLIFI);

average level of increment of the forecasted indicator (ALIFI);

stationary level of increment of the forecasted indicator (SLIFI);

normal level of increment of the forecasted indicator (NLIFI);

high level of increment of the forecasted indicator (HLIFI); and

very high level of increment of the forecasted indicator (VHLIFI).

Слайд 10

Stages for forecasting with Fuzzy Time Series (4)

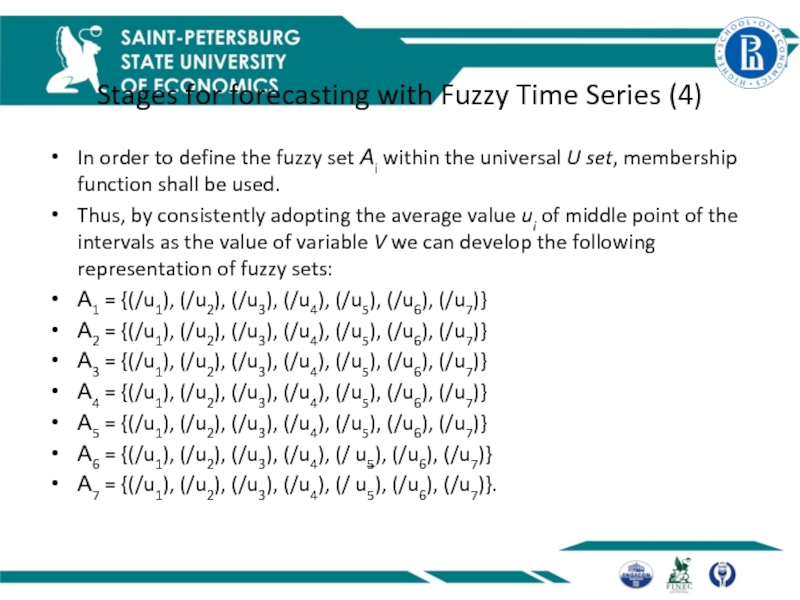

In order to

define the fuzzy set Аi within the universal U set,

membership function shall be used.

Thus, by consistently adopting the average value ui of middle point of the intervals as the value of variable V we can develop the following representation of fuzzy sets:

А1 = {(/u1), (/u2), (/u3), (/u4), (/u5), (/u6), (/u7)}

А2 = {(/u1), (/u2), (/u3), (/u4), (/u5), (/u6), (/u7)}

А3 = {(/u1), (/u2), (/u3), (/u4), (/u5), (/u6), (/u7)}

А4 = {(/u1), (/u2), (/u3), (/u4), (/u5), (/u6), (/u7)}

А5 = {(/u1), (/u2), (/u3), (/u4), (/u5), (/u6), (/u7)}

А6 = {(/u1), (/u2), (/u3), (/u4), (/ u5), (/u6), (/u7)}

А7 = {(/u1), (/u2), (/u3), (/u4), (/ u5), (/u6), (/u7)}.

Слайд 11

Stages for forecasting with Fuzzy Time Series (5)

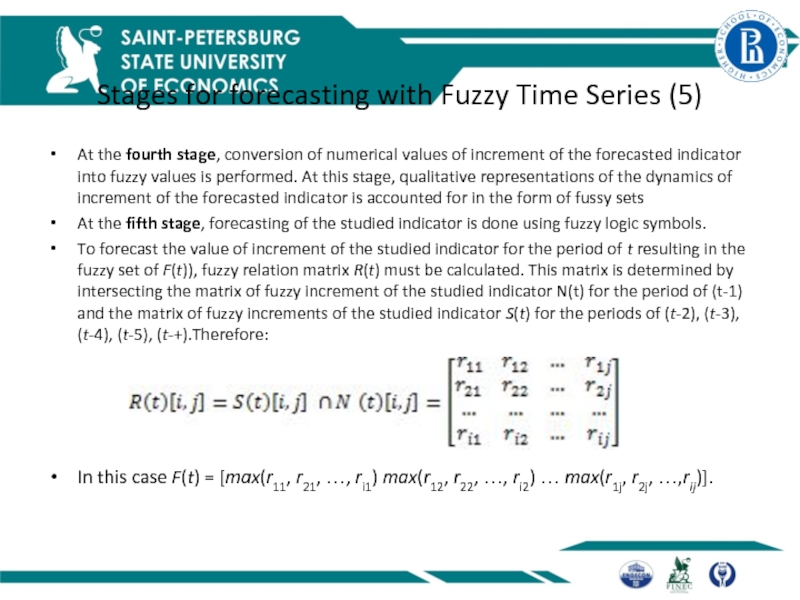

At the fourth

stage, conversion of numerical values of increment of the forecasted

indicator into fuzzy values is performed. At this stage, qualitative representations of the dynamics of increment of the forecasted indicator is accounted for in the form of fussy sets

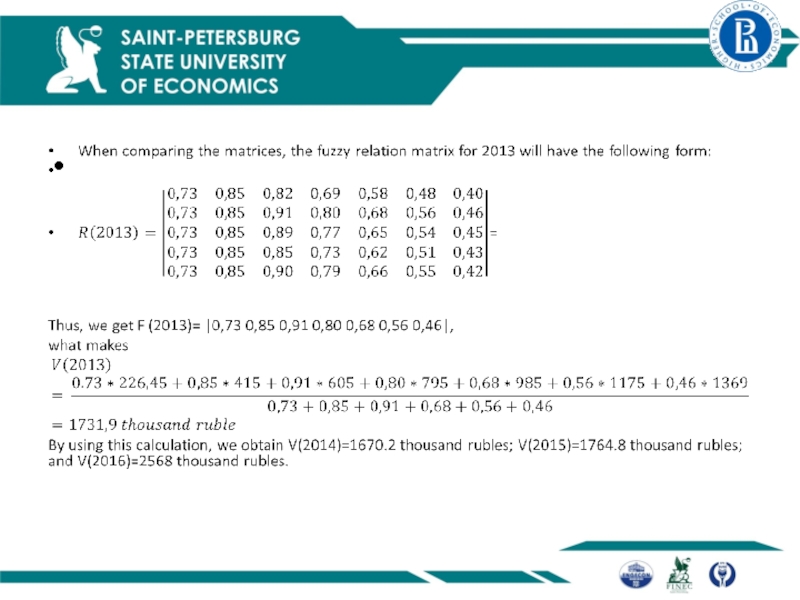

At the fifth stage, forecasting of the studied indicator is done using fuzzy logic symbols.

To forecast the value of increment of the studied indicator for the period of t resulting in the fuzzy set of F(t)), fuzzy relation matrix R(t) must be calculated. This matrix is determined by intersecting the matrix of fuzzy increment of the studied indicator N(t) for the period of (t-1) and the matrix of fuzzy increments of the studied indicator S(t) for the periods of (t-2), (t-3), (t-4), (t-5), (t-+).Therefore:

In this case F(t) = [max(r11, r21, …, ri1) max(r12, r22, …, ri2) … max(r1j, r2j, …,rij)].

Слайд 12

Stages for forecasting with Fuzzy Time Series (6)

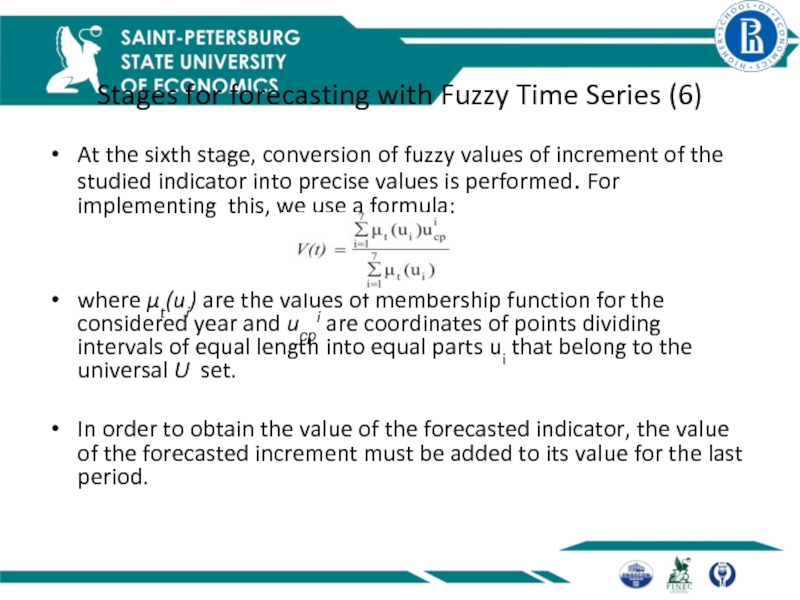

At the sixth

stage, conversion of fuzzy values of increment of the studied

indicator into precise values is performed. For implementing this, we use a formula:

where µt(ui) are the values of membership function for the considered year and uсрi are coordinates of points dividing intervals of equal length into equal parts ui that belong to the universal U set.

In order to obtain the value of the forecasted indicator, the value of the forecasted increment must be added to its value for the last period.

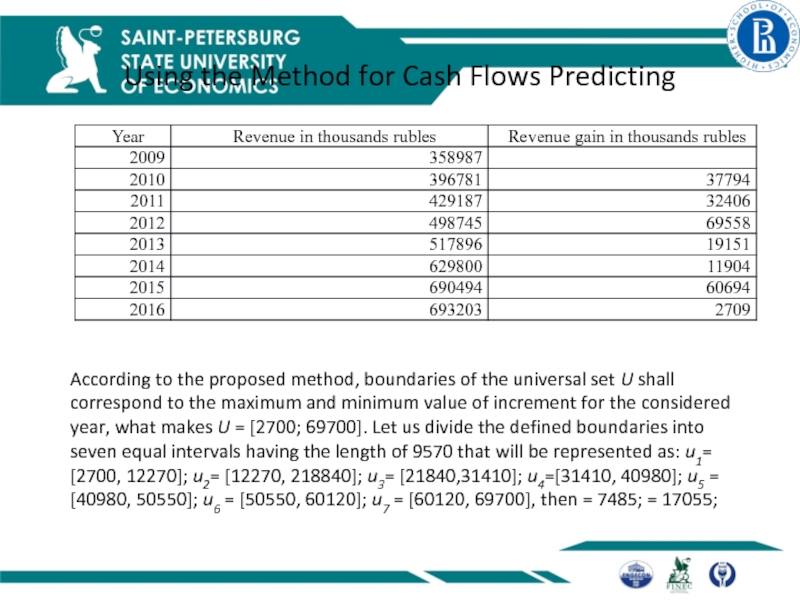

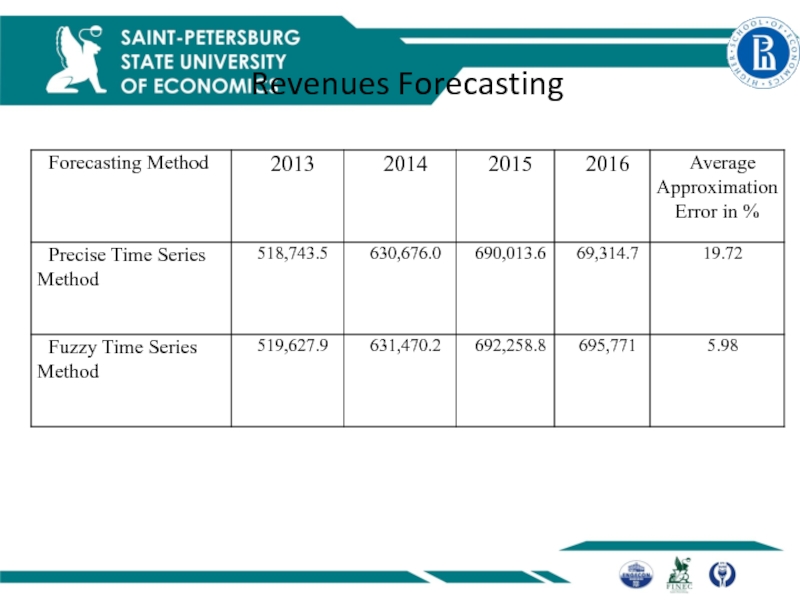

Слайд 13Using the Method for Cash Flows Predicting

According to the proposed

method, boundaries of the universal set U shall correspond to

the maximum and minimum value of increment for the considered year, what makes U = [2700; 69700]. Let us divide the defined boundaries into seven equal intervals having the length of 9570 that will be represented as: u1= [2700, 12270]; u2= [12270, 218840]; u3= [21840,31410]; u4=[31410, 40980]; u5 = [40980, 50550]; u6 = [50550, 60120]; u7 = [60120, 69700], then = 7485; = 17055;

Слайд 14Variables and Their Values

very low level of revenue gain (VLLRG);

low

level of revenue gain (LLRG);

average level of revenue gain (ALRG);

stationary

level of revenue gain (SLRG);

normal level of revenue gain (NLRG);

high level of revenue gain (HLRG); and

very high level of revenue gain (VHLRG).

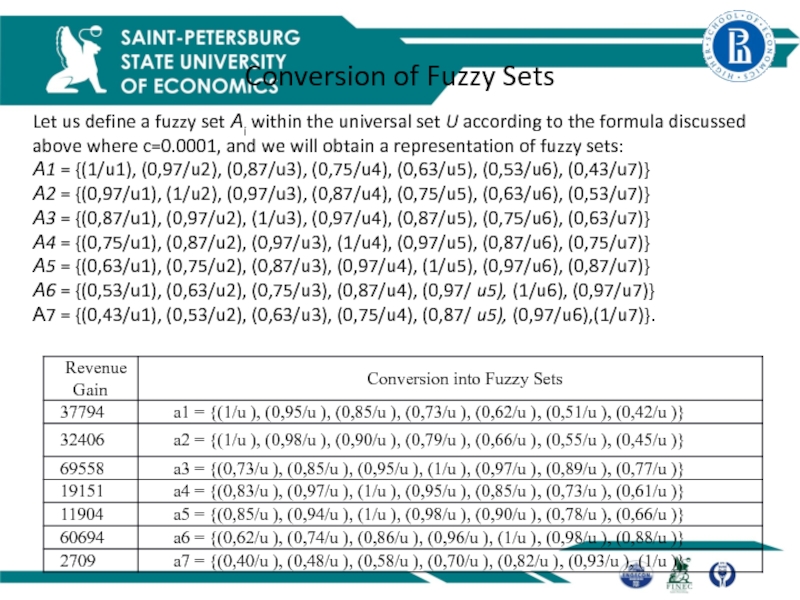

Слайд 15Conversion of Fuzzy Sets

Let us define a fuzzy set Аi

within the universal set U according to the formula discussed

above where c=0.0001, and we will obtain a representation of fuzzy sets:

А1 = {(1/u1), (0,97/u2), (0,87/u3), (0,75/u4), (0,63/u5), (0,53/u6), (0,43/u7)}

А2 = {(0,97/u1), (1/u2), (0,97/u3), (0,87/u4), (0,75/u5), (0,63/u6), (0,53/u7)}

А3 = {(0,87/u1), (0,97/u2), (1/u3), (0,97/u4), (0,87/u5), (0,75/u6), (0,63/u7)}

А4 = {(0,75/u1), (0,87/u2), (0,97/u3), (1/u4), (0,97/u5), (0,87/u6), (0,75/u7)}

А5 = {(0,63/u1), (0,75/u2), (0,87/u3), (0,97/u4), (1/u5), (0,97/u6), (0,87/u7)}

А6 = {(0,53/u1), (0,63/u2), (0,75/u3), (0,87/u4), (0,97/ u5), (1/u6), (0,97/u7)}

А7 = {(0,43/u1), (0,53/u2), (0,63/u3), (0,75/u4), (0,87/ u5), (0,97/u6),(1/u7)}.

Слайд 18Conclusion

The proposed forecasting method based on fuzzy sets is an

addition to the existing quantitative methods of forecasting. Application of

this method promotes the reduction of approximation error below the level of reduction achieved when forecasting using statistical methods. This indicates that this model has practical significance and enhances the accuracy of forecast.

Application of forecasting using the fuzzy set method and linear model demonstrated that the fuzzy set method made it possible to bring average approximation error down by 13.7%.

This allows for the conclusion that forecast accuracy is increased

Слайд 19Thank you for your attention

Your questions?