Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

INTRODUCTION TO INTERNATIONAL TAX LAW

Содержание

- 1. INTRODUCTION TO INTERNATIONAL TAX LAW

- 2. R&C BERNALES ABOGADOSIntroduction to International Tax Law

- 3. R&C BERNALES ABOGADOSIntroduction to International Tax LawCONCEPT AND GOALS

- 4. R&C BERNALES ABOGADOSCONCEPT AND GOALS“International Tax Law”

- 5. R&C BERNALES ABOGADOSCONCEPT & GOALSInternational (Income) tax

- 6. R&C BERNALES ABOGADOSCONCEPT & GOALSIssues under income

- 7. R&C BERNALES ABOGADOSCONCEPT & GOALSInternational tax law.

- 8. R&C BERNALES ABOGADOSCONCEPT & GOALSGOALS:Inter-nation equityPromoting fairnessEnhancing

- 9. R&C BERNALES ABOGADOSCONCEPT & GOALSPractical issues faced

- 10. R&C BERNALES ABOGADOSIntroduction to International Tax LawJURISDICTION TO TAX

- 11. R&C BERNALES ABOGADOSJURISDICTION TO TAXResidence – SourceResidenceIndividualsLegal entitiesTreaty issuesSourceEmployment and Personal ServicesBusiness incomeInvestment incomeCapital gains

- 12. R&C BERNALES ABOGADOSJURISDICTION TO TAXNexus country -

- 13. R&C BERNALES ABOGADOSJURISDICTION TO TAX - ResidenceResidence

- 14. JURISDICTION TO TAXResidence of Individuals (II)Facts and

- 15. JURISDICTION TO TAXResidence of Individuals (III)Presumptions: Individuals

- 16. JURISDICTION TO TAXResidence of legal entitiesCorporations:Place of

- 17. JURISDICTION TO TAXTreaty issuesArt. 4(1) OECD MC:(…)

- 18. JURISDICTION TO TAXTreaty issuesArt. 4(2) OECD MC

- 19. JURISDICTION TO TAXResidence of legal entitiesArt. 4(3)

- 20. JURISDICTION TO TAX – SourceInternational custom: A

- 21. JURISDICTION TO TAX – Source What is

- 22. JURISDICTION TO TAX – SourceEmployment and Personal

- 23. JURISDICTION TO TAX - SourceEmployment and Personal

- 24. JURISDICTION TO TAX – Source Business IncomeOECD

- 25. JURISDICTION TO TAX - SourceInvestment IncomeInvestment income

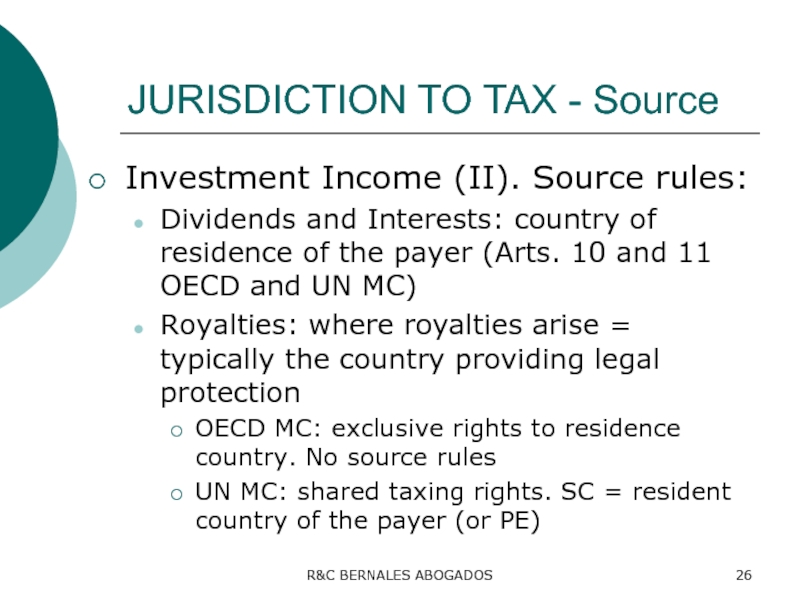

- 26. JURISDICTION TO TAX - SourceInvestment Income (II).

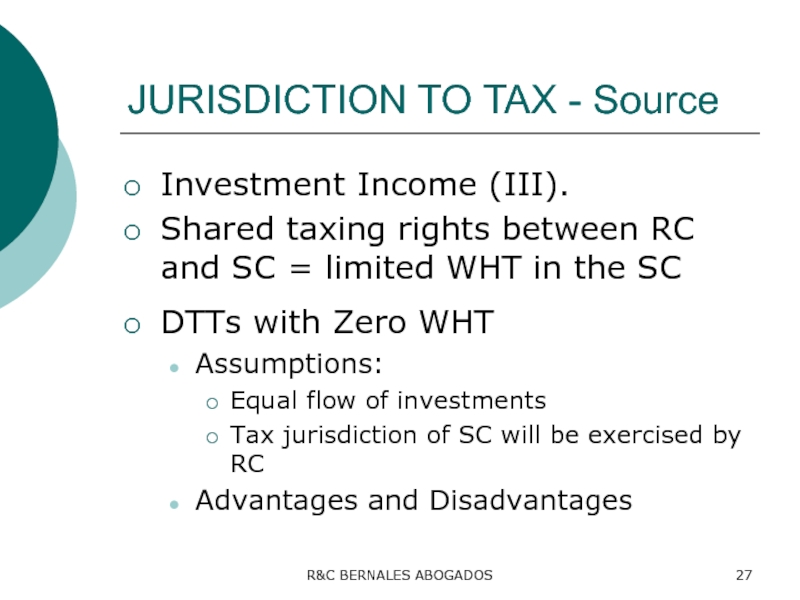

- 27. JURISDICTION TO TAX - SourceInvestment Income (III).

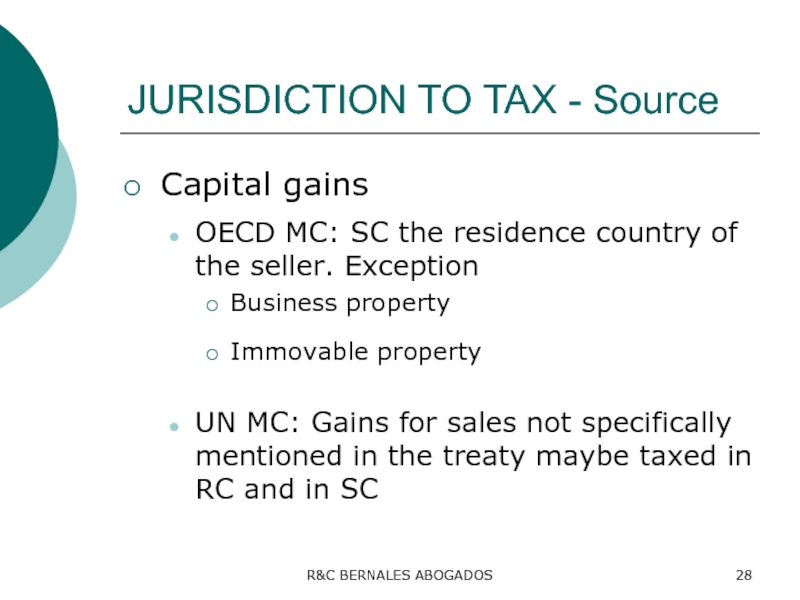

- 28. JURISDICTION TO TAX - SourceCapital gainsOECD MC:

- 29. Introduction to International Tax LawDOUBLE TAXATION RELIEFR&C BERNALES ABOGADOS

- 30. DOUBLE TAXATION RELIEF – Concept & TypesInternational

- 31. DOUBLE TAXATION RELIEF(International) Economic Double Taxation:Multiple taxation

- 32. DOUBLE TAXATION RELIEFThree types of double taxation

- 33. DOUBLE TAXATION RELIEFOther types of conflicts:Definitions of

- 34. DOUBLE TAXATION RELIEFRemedies to prevent double taxation:UnilateralBilateralMultilateralThe

- 35. DOUBLE TAXATION RELIEF - METHODSRelief mechanisms (Methods):Deduction ExemptionCredit (Imputation)R&C BERNALES ABOGADOS

- 36. DOUBLE TAXATION RELIEFDEDUCTION MethodTaxation on the worldwide

- 37. DOUBLE TAXATION RELIEFDEDUCTION Method (II)Effect: Residents earning

- 38. DOUBLE TAXATION RELIEFEXEMPTION MethodTaxation of residents on

- 39. DOUBLE TAXATION RELIEFEXEMPTION Method (II). Effects:Elimination of

- 40. DOUBLE TAXATION RELIEFEXEMPTION Method (III). Types:Ordinary Exemption Exemption with progressionFull ExemptionPartial ExemptionParticipation exemptionR&C BERNALES ABOGADOS

- 41. DOUBLE TAXATION RELIEFEXEMPTION Method (IV):Ordinary Exemption Exemption

- 42. DOUBLE TAXATION RELIEFEXEMPTION Method (V):Full ExemptionPartial Exemption:

- 43. DOUBLE TAXATION RELIEFEXEMPTION Method (VI)Partial exemption. Requirements

- 44. DOUBLE TAXATION RELIEFEXEMPTION Method (VII)Participation exemption Exemption of

- 45. DOUBLE TAXATION RELIEFEXEMPTION Method (VIII). DrawbackShifting of

- 46. DOUBLE TAXATION RELIEFCREDIT MethodForeign taxes paid by

- 47. DOUBLE TAXATION RELIEFCREDIT Method (II). Effects. Eliminate

- 48. DOUBLE TAXATION RELIEFCREDIT Method (III). Effects (II)Resident

- 49. DOUBLE TAXATION RELIEFCREDIT Method (IV). LimitationsOverall (worldwide) Country-by-country Item-by-itemR&C BERNALES ABOGADOS

- 50. DOUBLE TAXATION RELIEFCREDIT Method (V). Indirect (foreign)

- 51. DOUBLE TAXATION RELIEFCREDIT Method (VI). Possible effect:

- 52. DOUBLE TAXATION RELIEFEXEMPTION vs CREDIT MethodsBoth authorized

- 53. DOUBLE TAXATION RELIEFEXEMPTION vs CREDIT Methods (II)Both

- 54. DOUBLE TAXATION RELIEFEXEMPTION vs CREDIT Methods (III)Most

- 55. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1R&C BERNALES ABOGADOS

INTRODUCTION TO INTERNATIONAL TAX LAW

Dr Roberto Bernales

University of

Deusto (Bilbao, Spain)

Слайд 2R&C BERNALES ABOGADOS

Introduction to International Tax Law - Agenda

Concept and

goals

Jurisdiction

Double taxation relief

See “International Tax Primer”, B.J. Arnold and M.J.

McIntyreСлайд 4R&C BERNALES ABOGADOS

CONCEPT AND GOALS

“International Tax Law” = misnomer

Scope

All tax

issues arising under a country's tax laws that include a

foreign elementMainly income tax laws

Other taxes

Слайд 5R&C BERNALES ABOGADOS

CONCEPT & GOALS

International (Income) tax law: two dimensions:

Taxation

of Resident individuals and corporations on income in foreign countries

(taxation of foreign income)Taxation of Nonresidents on income arising domestically (taxation of nonresidents)

Слайд 6R&C BERNALES ABOGADOS

CONCEPT & GOALS

Issues under income tax laws:

Cross-border trade

in goods and services

Cross-border manufacturing by MNE

Cross-border investment by individuals

or investment fundsTaxation of individuals who work or do business in a country other than their residence country

Слайд 7R&C BERNALES ABOGADOS

CONCEPT & GOALS

International tax law. Scope beyond income

tax:

Estate taxes/ Inheritance taxes

Gift taxes

Wealth taxes

Sales taxes

Customs taxes

Слайд 8R&C BERNALES ABOGADOS

CONCEPT & GOALS

GOALS:

Inter-nation equity

Promoting fairness

Enhancing the position of

the country in the world economy

Capital-export and capital-import neutrality

Слайд 9R&C BERNALES ABOGADOS

CONCEPT & GOALS

Practical issues faced by the professional:

Intersection

domestic-foreign tax law

Differences in the legal systems: concepts, institutions, legal

traditions, accounting principles, etc.Слайд 11R&C BERNALES ABOGADOS

JURISDICTION TO TAX

Residence – Source

Residence

Individuals

Legal entities

Treaty issues

Source

Employment and

Personal Services

Business income

Investment income

Capital gains

Слайд 12R&C BERNALES ABOGADOS

JURISDICTION TO TAX

Nexus country - person obtaining the

income: residence jurisdiction

Nexus country – activities generating the income: source

jurisdictionСлайд 13R&C BERNALES ABOGADOS

JURISDICTION TO TAX - Residence

Residence of Individuals

Facts and

circumstances. Objective manifestations of joining the economic and social life

of a country:Dwelling

Income producing activities

Family

Social ties

Arbitrary test: number of days of presence, e.g. 183-day test

Слайд 14JURISDICTION TO TAX

Residence of Individuals (II)

Facts and circumstances + objective

tests = presumptions to establish residence = certainty and fairness

R&C

BERNALES ABOGADOSСлайд 15JURISDICTION TO TAX

Residence of Individuals (III)

Presumptions:

Individuals present in a

country for 183 days in a taxable year unless they

do not have a dwelling and are not citizensIndividuals having a dwelling unless they also have a dwelling in another country

Citizens unless they have a dwelling abroad and are outside more than 183 days

Individuals cannot relinquish residence until residence in another country

R&C BERNALES ABOGADOS

Слайд 16JURISDICTION TO TAX

Residence of legal entities

Corporations:

Place of Incorporation

Place of (Effective)

Management

Residence of the shareholders

Other legal entities:

Place of organization

Place of management

R&C

BERNALES ABOGADOSСлайд 17JURISDICTION TO TAX

Treaty issues

Art. 4(1) OECD MC:

(…) the term resident

of a Contracting state means any person who, under the

laws of that State, is liable to tax therein by reasons of his domicile, residence, place of management or any other criterion of a similar nature (…)R&C BERNALES ABOGADOS

Слайд 18JURISDICTION TO TAX

Treaty issues

Art. 4(2) OECD MC Tie-breaker rules:

Place of

permanent home

Centre of the vital interests

Habitual abode

Citizenship

MAP

R&C BERNALES ABOGADOS

Слайд 19JURISDICTION TO TAX

Residence of legal entities

Art. 4(3) OECD MC: Legal

entities residence: POEM.

Other tie-breaker rules:

Place of Incorporation

Dual resident =

not resident in either countryR&C BERNALES ABOGADOS

Слайд 20JURISDICTION TO TAX – Source

International custom:

A country has the

primary right to tax income that has its source in

that countryCountry of residence expected to provide relief from double taxation if its residence jurisdiction overlaps the source jurisdiction of another country

R&C BERNALES ABOGADOS

Слайд 21JURISDICTION TO TAX – Source

What is “source”?

Most countries: vague

rules (especially for business income)

Most tax treaties do not include

explicit source rules for business incomeOECD MC vs UN MC: limitation of source jurisdiction

R&C BERNALES ABOGADOS

Слайд 22JURISDICTION TO TAX – Source

Employment and Personal Services

Source country

= where services are performed

If several countries = allocation based

on the time performing in each countryR&C BERNALES ABOGADOS

Слайд 23JURISDICTION TO TAX - Source

Employment and Personal Services (II)

Limit of

source jurisdiction on dependent personal services income if (all requirements

met):Employee present in SC ≤ 183 days

Payment by a non-resident

Payment not allocated to a PE in SC

R&C BERNALES ABOGADOS

Слайд 24JURISDICTION TO TAX – Source

Business Income

OECD and UN MC:

taxable only if attributable to a PE

US MC: Source rule

approachR&C BERNALES ABOGADOS

Слайд 25JURISDICTION TO TAX - Source

Investment Income

Investment income (dividends, interest, royalties)

derived by non-residents usually taxable through WHT

Capital gains are not

usually subject to WHTR&C BERNALES ABOGADOS

Слайд 26JURISDICTION TO TAX - Source

Investment Income (II). Source rules:

Dividends and

Interests: country of residence of the payer (Arts. 10 and

11 OECD and UN MC)Royalties: where royalties arise = typically the country providing legal protection

OECD MC: exclusive rights to residence country. No source rules

UN MC: shared taxing rights. SC = resident country of the payer (or PE)

R&C BERNALES ABOGADOS

Слайд 27JURISDICTION TO TAX - Source

Investment Income (III).

Shared taxing rights

between RC and SC = limited WHT in the SC

DTTs

with Zero WHT Assumptions:

Equal flow of investments

Tax jurisdiction of SC will be exercised by RC

Advantages and Disadvantages

R&C BERNALES ABOGADOS

Слайд 28JURISDICTION TO TAX - Source

Capital gains

OECD MC: SC the residence

country of the seller. Exception

Business property

Immovable property

UN MC: Gains for

sales not specifically mentioned in the treaty maybe taxed in RC and in SCR&C BERNALES ABOGADOS

Слайд 30DOUBLE TAXATION RELIEF – Concept & Types

International (Juridical) Double Taxation:

The

imposition of comparable direct taxes (income-wealth-inheritance) taxes

by two or

more sovereign countries on the same item (income-assets)

of the same taxable person

for the same taxable period

R&C BERNALES ABOGADOS

Слайд 31DOUBLE TAXATION RELIEF

(International) Economic Double Taxation:

Multiple taxation of the same

items of economic income in different taxpayers, e.g.

Company –

Shareholder:Parent company

Individual shareholder

Partnership – Partner

Trust - Beneficiary

R&C BERNALES ABOGADOS

Слайд 32DOUBLE TAXATION RELIEF

Three types of double taxation in relation to

3 types of conflicts:

Source – Source

Residence – Residence

Residence – Source

R&C

BERNALES ABOGADOSСлайд 33DOUBLE TAXATION RELIEF

Other types of conflicts:

Definitions of Income

Timing and tax

accounting rules

Arm´s Length Prices

Rules to prevent tax avoidance

R&C BERNALES ABOGADOS

Слайд 34DOUBLE TAXATION RELIEF

Remedies to prevent double taxation:

Unilateral

Bilateral

Multilateral

The methods for relieving

international taxation refer both to juridical and economic double taxation

R&C

BERNALES ABOGADOSСлайд 35DOUBLE TAXATION RELIEF - METHODS

Relief mechanisms (Methods):

Deduction

Exemption

Credit (Imputation)

R&C BERNALES

ABOGADOS

Слайд 36DOUBLE TAXATION RELIEF

DEDUCTION Method

Taxation on the worldwide income of residents

and deduction of the foreign taxes paid from the taxable

incomeR&C BERNALES ABOGADOS

Слайд 37DOUBLE TAXATION RELIEF

DEDUCTION Method (II)

Effect: Residents earning foreign income and

paying foreign income taxes are taxed at a higher combined

tax rate than the rate applied to domestic-source incomeFavourable for domestic investment

R&C BERNALES ABOGADOS

Слайд 38DOUBLE TAXATION RELIEF

EXEMPTION Method

Taxation of residents on their domestic income

and exemption of their foreign-source income

R&C BERNALES ABOGADOS

Слайд 39DOUBLE TAXATION RELIEF

EXEMPTION Method (II). Effects:

Elimination of Residence – Source

DT

Exemption of all foreign-source income = Taxation on territorial basis

Exemption

of certain kinds of income (e.g. business income, investment income)R&C BERNALES ABOGADOS

Слайд 40DOUBLE TAXATION RELIEF

EXEMPTION Method (III). Types:

Ordinary Exemption

Exemption with progression

Full

Exemption

Partial Exemption

Participation exemption

R&C BERNALES ABOGADOS

Слайд 41DOUBLE TAXATION RELIEF

EXEMPTION Method (IV):

Ordinary Exemption

Exemption with progression

Foreign source

income included to determine average tax rate on taxable (domestic)

incomeR&C BERNALES ABOGADOS

Слайд 42DOUBLE TAXATION RELIEF

EXEMPTION Method (V):

Full Exemption

Partial Exemption: exemption of foreign-source

income taxed at rates comparable to the country of residence

rateR&C BERNALES ABOGADOS

Слайд 43DOUBLE TAXATION RELIEF

EXEMPTION Method (VI)

Partial exemption. Requirements of the method:

Source

income and expenses rules

Anti-avoidance rules

Expense allocation rules

R&C BERNALES ABOGADOS

Слайд 44DOUBLE TAXATION RELIEF

EXEMPTION Method (VII)

Participation exemption

Exemption of dividends derived from

foreign companies in which the resident shareholder have a minimum

ownership interestR&C BERNALES ABOGADOS

Слайд 45DOUBLE TAXATION RELIEF

EXEMPTION Method (VIII). Drawback

Shifting of tax burden from

the income earner to the income payer in some circumstances

R&C

BERNALES ABOGADOSСлайд 46DOUBLE TAXATION RELIEF

CREDIT Method

Foreign taxes paid by residents on foreign

source income reduce the domestic taxes payable on the same

incomeR&C BERNALES ABOGADOS

Слайд 47DOUBLE TAXATION RELIEF

CREDIT Method (II). Effects.

Eliminate residence – source

double taxation

Usually limited to the amount of the domestic tax

payable on the foreign source income (ordinary tax credit)R&C BERNALES ABOGADOS

Слайд 48DOUBLE TAXATION RELIEF

CREDIT Method (III). Effects (II)

Resident taxpayers are treated

equally from the perspective of the total (domestic and foreign)

tax burden, except if foreign tax > domestic taxNeutral respect to place of investment (domestic – abroad)

R&C BERNALES ABOGADOS

Слайд 49DOUBLE TAXATION RELIEF

CREDIT Method (IV). Limitations

Overall (worldwide)

Country-by-country

Item-by-item

R&C BERNALES

ABOGADOS

Слайд 50DOUBLE TAXATION RELIEF

CREDIT Method (V). Indirect (foreign) tax credit =

Credit granted

To a domestic corporation for the foreign income taxes

paid by a foreign affiliated companyWhen the domestic corporation receives the dividend distributed by its foreign affiliate

Equal to the underlying foreign tax paid by the foreign affiliate on the income out of which the dividend was paid

R&C BERNALES ABOGADOS

Слайд 51DOUBLE TAXATION RELIEF

CREDIT Method (VI).

Possible effect: discouraging repatriate benefits.

Solution?:

Taxation on accrual basis:

CFC rules

Offshore investment fund rules

R&C BERNALES ABOGADOS

Слайд 52DOUBLE TAXATION RELIEF

EXEMPTION vs CREDIT Methods

Both authorized by OECD and

UN MC

Equal results if the foreign taxes paid by the

foreign company (plus WHT) are at least equal to domestic taxes.Even if foreign taxes < domestic tax, deferment until dividends are paid

R&C BERNALES ABOGADOS

Слайд 53DOUBLE TAXATION RELIEF

EXEMPTION vs CREDIT Methods (II)

Both systems require rules:

Resident

qualified taxpayers

Type of qualified income

Source of income

Allocation of expenses

CFC

(current or accrual taxation)Foreign losses

Computation of foreign Co income

R&C BERNALES ABOGADOS

Слайд 54DOUBLE TAXATION RELIEF

EXEMPTION vs CREDIT Methods (III)

Most important difference: requirement

of different rules

Credit: definition of creditable foreign taxes

Exemption: determination when

foreign source income is subject to a level of foreign tax comparable to domestic tax R&C BERNALES ABOGADOS