Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Lecture 6. Financial markets: Debt market in details

Содержание

- 1. Lecture 6. Financial markets: Debt market in details

- 2. ©Ella KhromovaFinancial marketsBondsFinancial InstrumentsFinancial marketsLecture 6Primary marketsSecondary

- 3. ©Ella KhromovaMajor Types of Financial InstrumentsBondsFinancial InstrumentsFinancial marketsLecture 6

- 4. ©Ella KhromovaKey terminologies of debt/bonds (fixed income

- 5. ©Ella KhromovaDebt ValuationLecture 6N – Years to

- 6. ©Ella KhromovaDebt Valuation: ExampleLecture 6French government bonds,

- 7. ©Ella KhromovaClassification of bonds based on cash-flowLecture

- 8. ©Ella KhromovaYTMLecture 6N – Years to maturityC

- 9. ©Ella KhromovaYTM: ExampleLecture 6French government bonds, known

- 10. ©Ella KhromovaYTM: Quick calculationLecture 6French government bonds,

- 11. ©Ella KhromovaExercise 2Practice 4What is the intrinsic

- 12. ©Ella KhromovaInvestment strategyLecture 6How to compare bonds?

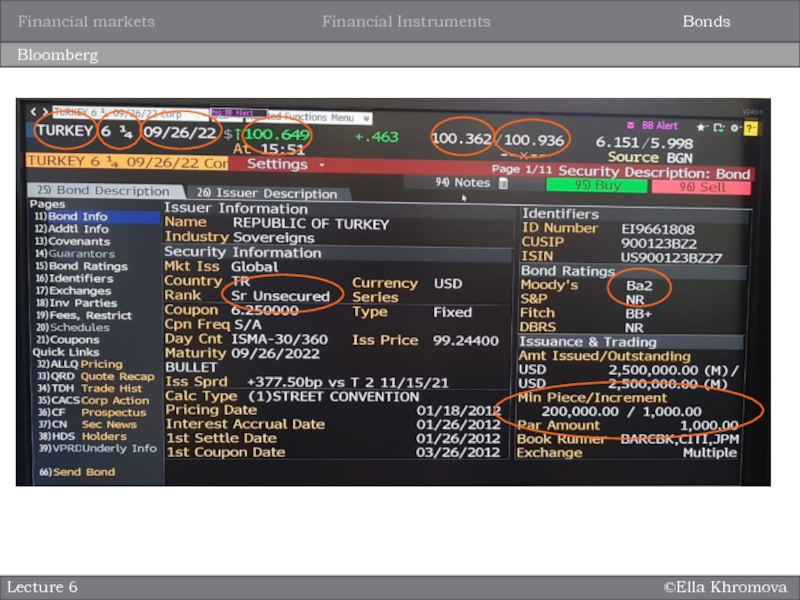

- 13. ©Ella KhromovaBloombergLecture 6BondsFinancial InstrumentsFinancial markets

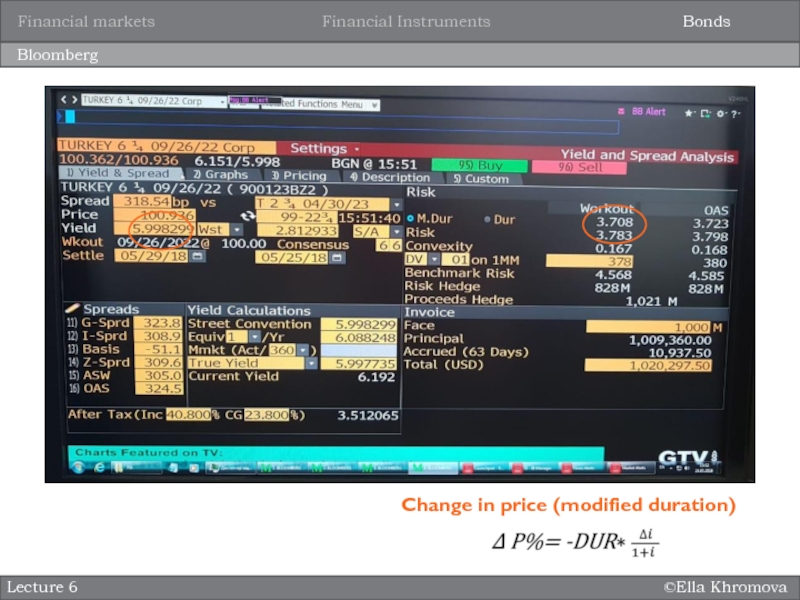

- 14. ©Ella KhromovaBloombergLecture 6BondsFinancial InstrumentsFinancial marketsChange in price (modified duration)

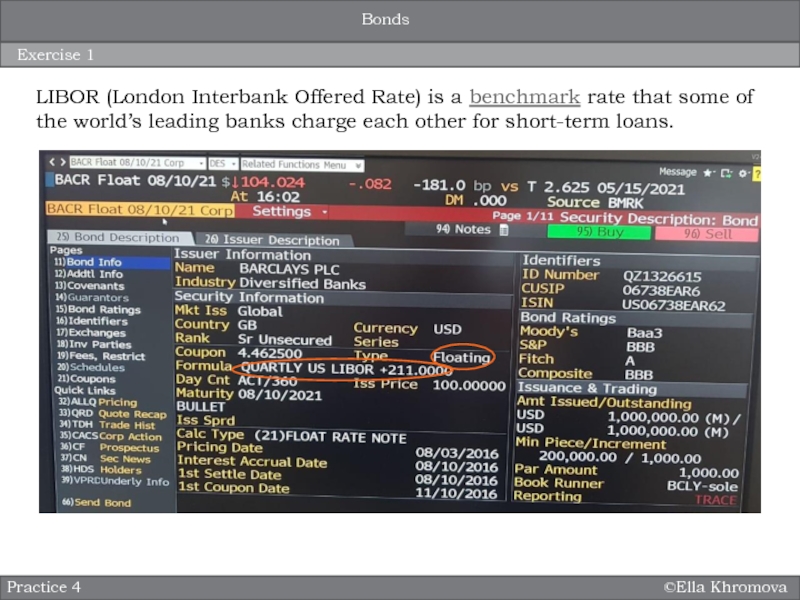

- 15. ©Ella KhromovaExercise 1Practice 4BondsLIBOR (London Interbank Offered

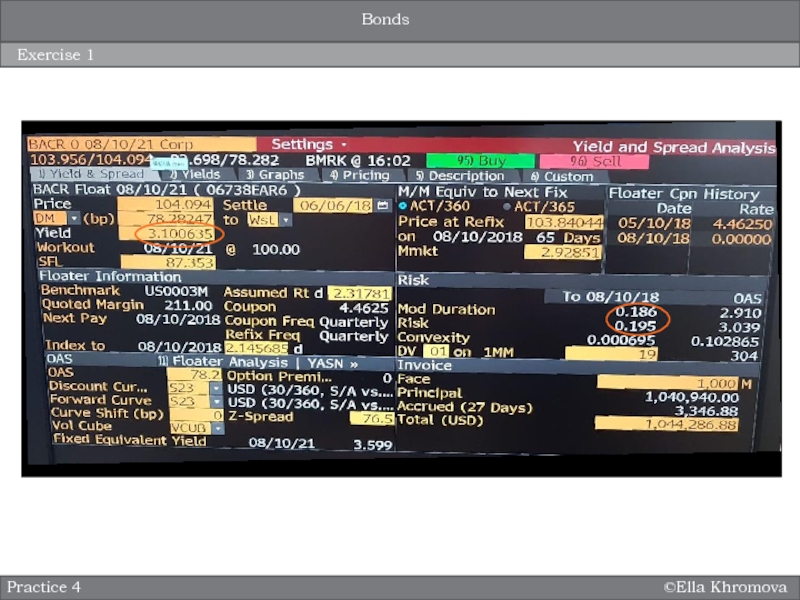

- 16. ©Ella KhromovaPractice 4Exercise 1Bonds

- 17. ©Ella KhromovaPractice 4Exercise 1Bonds

- 18. ©Ella KhromovaBuckle, M. and E. Beccalli Principles

- 19. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1Lecture 6.

Financial markets: Debt market in details

©Ella Khromova

Lecture 6

International

finance and globalization

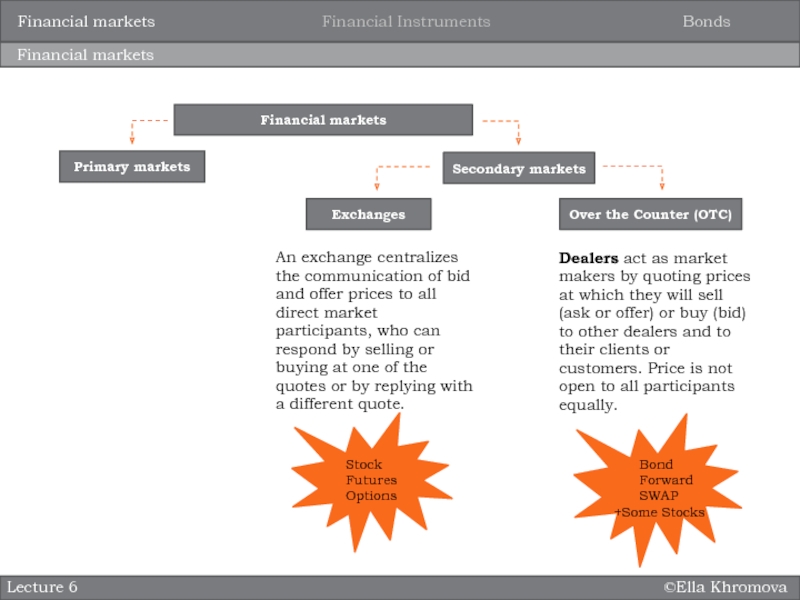

Слайд 2©Ella Khromova

Financial markets

Bonds

Financial Instruments

Financial markets

Lecture 6

Primary markets

Secondary markets

Over the Counter

(OTC)

An exchange centralizes the communication of bid and offer prices

to all direct market participants, who can respond by selling or buying at one of the quotes or by replying with a different quote.Exchanges

Dealers act as market makers by quoting prices at which they will sell (ask or offer) or buy (bid) to other dealers and to their clients or customers. Price is not open to all participants equally.

Stock

Futures

Options

Bond

Forward

SWAP

+Some Stocks

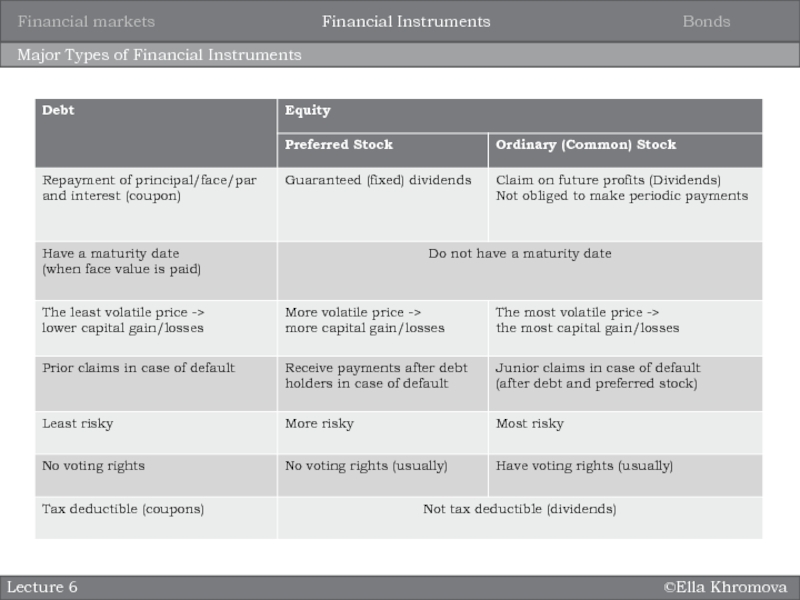

Слайд 3©Ella Khromova

Major Types of Financial Instruments

Bonds

Financial Instruments

Financial markets

Lecture 6

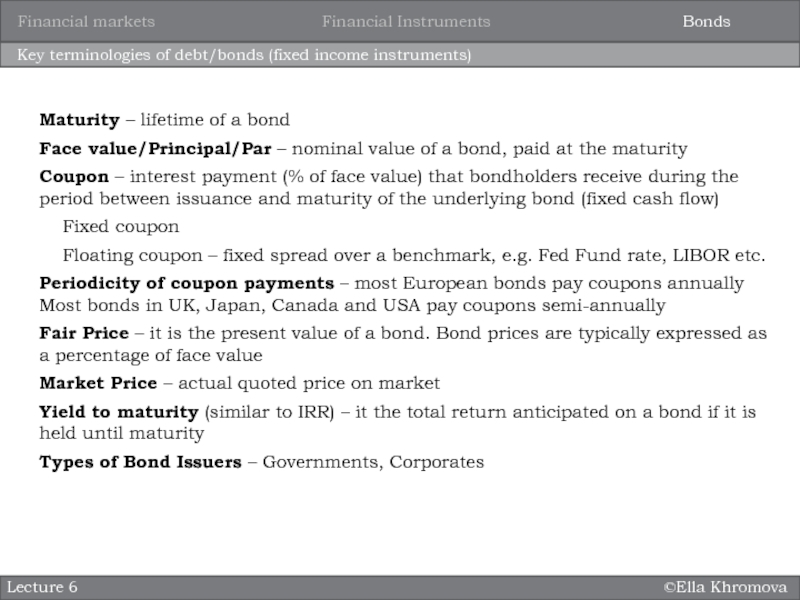

Слайд 4©Ella Khromova

Key terminologies of debt/bonds (fixed income instruments)

Lecture 6

Maturity –

lifetime of a bond

Face value/Principal/Par – nominal value of a

bond, paid at the maturityCoupon – interest payment (% of face value) that bondholders receive during the period between issuance and maturity of the underlying bond (fixed cash flow)

Fixed coupon

Floating coupon – fixed spread over a benchmark, e.g. Fed Fund rate, LIBOR etc.

Periodicity of coupon payments – most European bonds pay coupons annually Most bonds in UK, Japan, Canada and USA pay coupons semi-annually

Fair Price – it is the present value of a bond. Bond prices are typically expressed as a percentage of face value

Market Price – actual quoted price on market

Yield to maturity (similar to IRR) – it the total return anticipated on a bond if it is held until maturity

Types of Bond Issuers – Governments, Corporates

Bonds

Financial Instruments

Financial markets

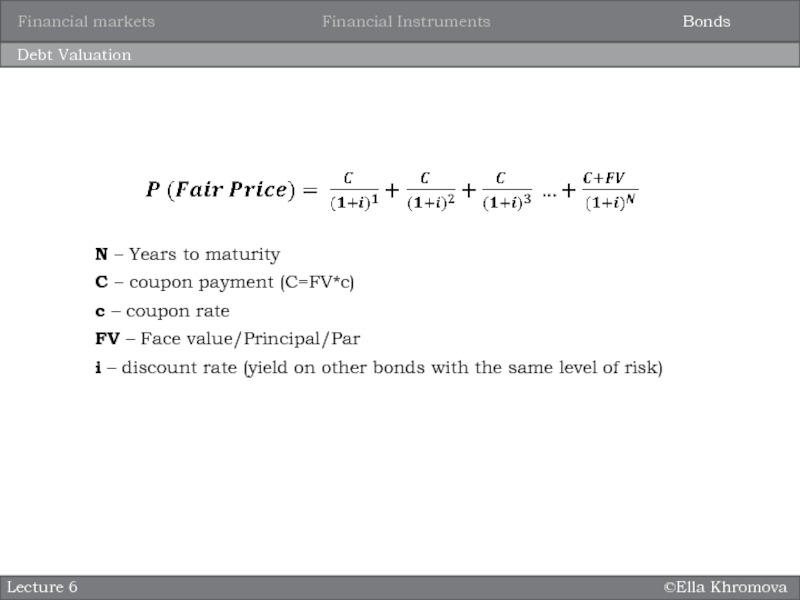

Слайд 5©Ella Khromova

Debt Valuation

Lecture 6

N – Years to maturity

C – coupon

payment (C=FV*c)

c – coupon rate

FV – Face value/Principal/Par

i –

discount rate (yield on other bonds with the same level of risk)Bonds

Financial Instruments

Financial markets

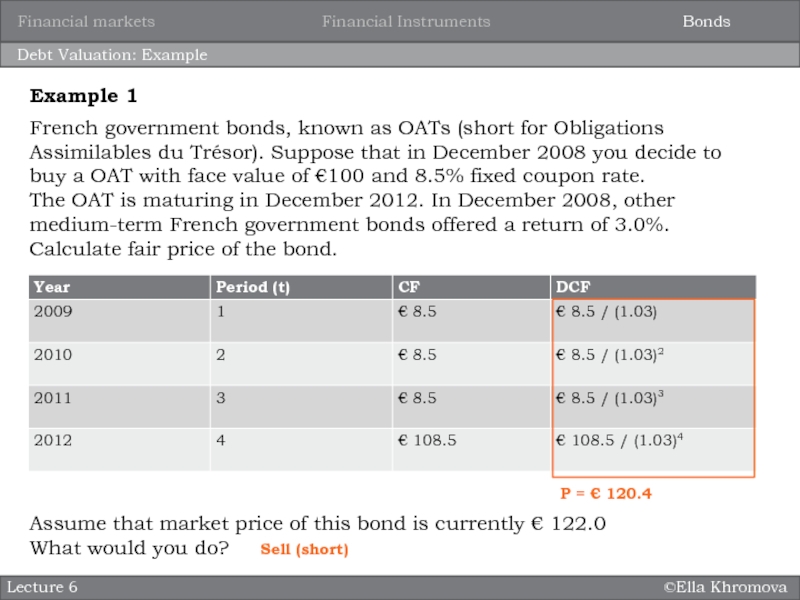

Слайд 6©Ella Khromova

Debt Valuation: Example

Lecture 6

French government bonds, known as OATs

(short for Obligations Assimilables du Trésor). Suppose that in December

2008 you decide to buy a OAT with face value of €100 and 8.5% fixed coupon rate.The OAT is maturing in December 2012. In December 2008, other medium-term French government bonds offered a return of 3.0%.

Calculate fair price of the bond.

Example 1

P = € 120.4

Assume that market price of this bond is currently € 122.0

What would you do?

Sell (short)

Bonds

Financial Instruments

Financial markets

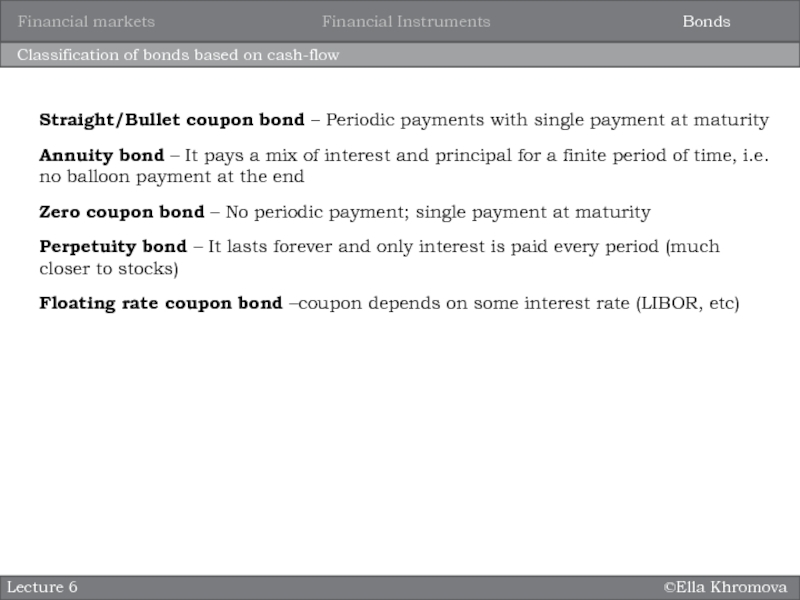

Слайд 7©Ella Khromova

Classification of bonds based on cash-flow

Lecture 6

Straight/Bullet coupon bond

– Periodic payments with single payment at maturity

Annuity bond –

It pays a mix of interest and principal for a finite period of time, i.e. no balloon payment at the endZero coupon bond – No periodic payment; single payment at maturity

Perpetuity bond – It lasts forever and only interest is paid every period (much closer to stocks)

Floating rate coupon bond –coupon depends on some interest rate (LIBOR, etc)

Bonds

Financial Instruments

Financial markets

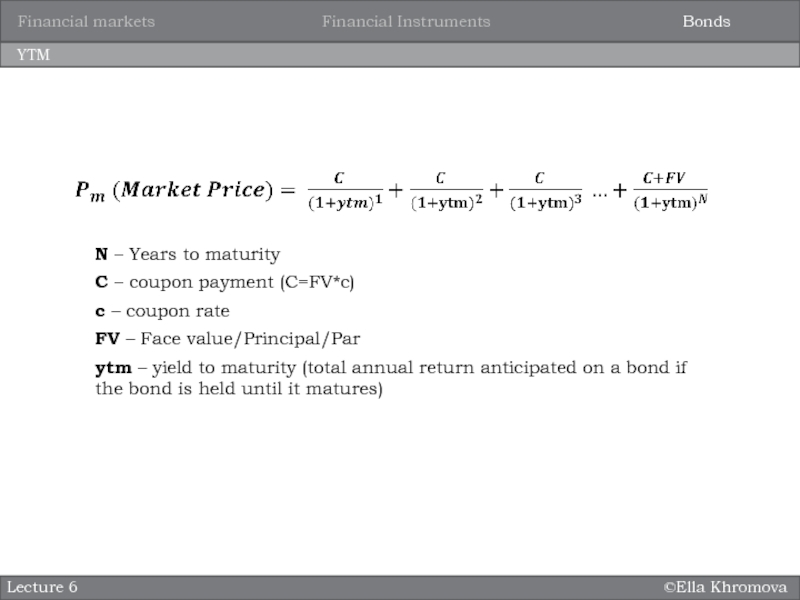

Слайд 8©Ella Khromova

YTM

Lecture 6

N – Years to maturity

C – coupon payment

(C=FV*c)

c – coupon rate

FV – Face value/Principal/Par

ytm – yield

to maturity (total annual return anticipated on a bond if the bond is held until it matures)Bonds

Financial Instruments

Financial markets

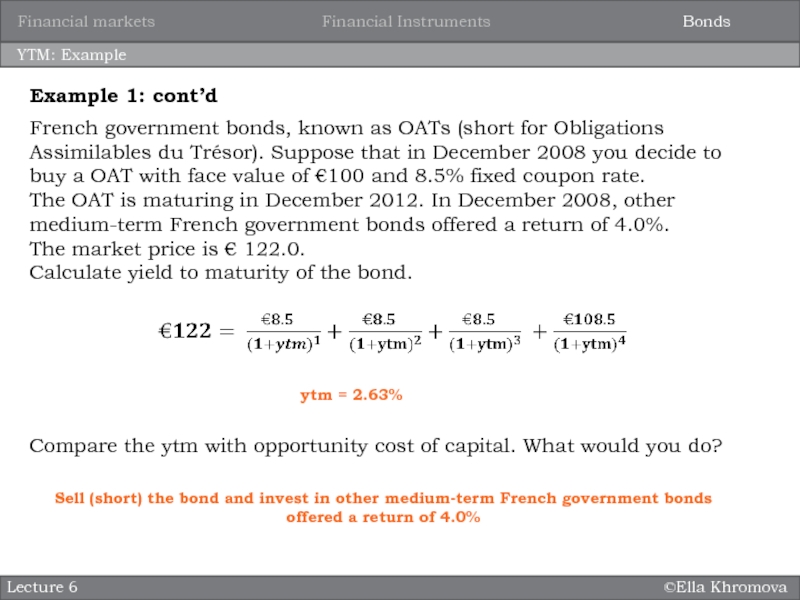

Слайд 9©Ella Khromova

YTM: Example

Lecture 6

French government bonds, known as OATs (short

for Obligations Assimilables du Trésor). Suppose that in December 2008

you decide to buy a OAT with face value of €100 and 8.5% fixed coupon rate.The OAT is maturing in December 2012. In December 2008, other medium-term French government bonds offered a return of 4.0%.

The market price is € 122.0.

Calculate yield to maturity of the bond.

Example 1: cont’d

ytm = 2.63%

Compare the ytm with opportunity cost of capital. What would you do?

Sell (short) the bond and invest in other medium-term French government bonds offered a return of 4.0%

Bonds

Financial Instruments

Financial markets

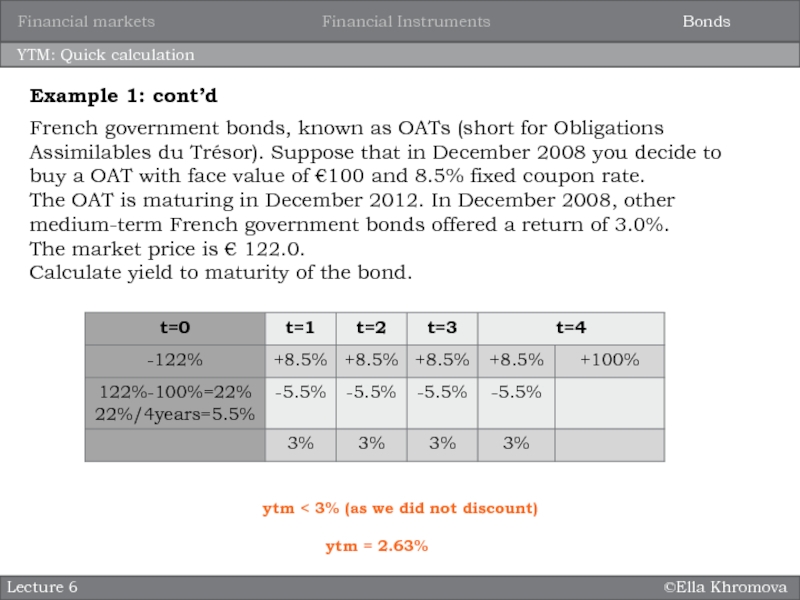

Слайд 10©Ella Khromova

YTM: Quick calculation

Lecture 6

French government bonds, known as OATs

(short for Obligations Assimilables du Trésor). Suppose that in December

2008 you decide to buy a OAT with face value of €100 and 8.5% fixed coupon rate.The OAT is maturing in December 2012. In December 2008, other medium-term French government bonds offered a return of 3.0%.

The market price is € 122.0.

Calculate yield to maturity of the bond.

Example 1: cont’d

ytm < 3% (as we did not discount)

Bonds

Financial Instruments

Financial markets

ytm = 2.63%

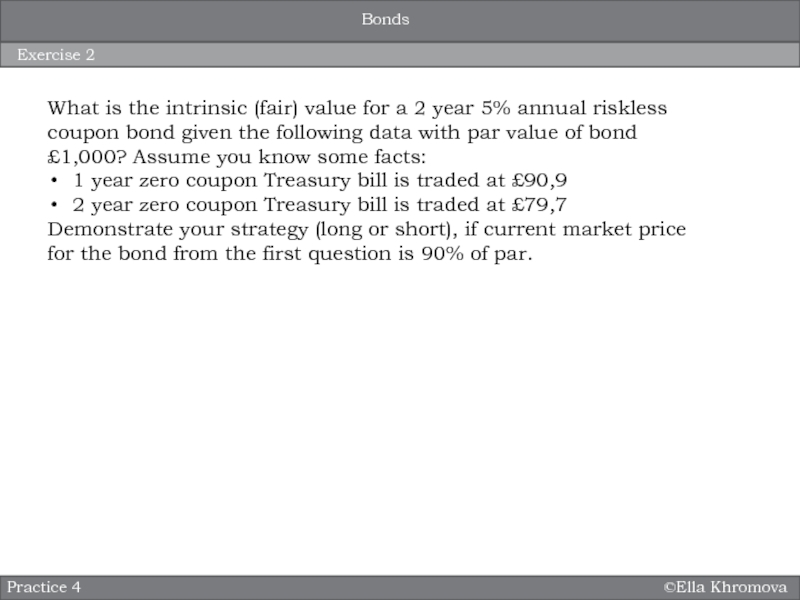

Слайд 11©Ella Khromova

Exercise 2

Practice 4

What is the intrinsic (fair) value for

a 2 year 5% annual riskless coupon bond given the

following data with par value of bond £1,000? Assume you know some facts:1 year zero coupon Treasury bill is traded at £90,9

2 year zero coupon Treasury bill is traded at £79,7

Demonstrate your strategy (long or short), if current market price for the bond from the first question is 90% of par.

Bonds

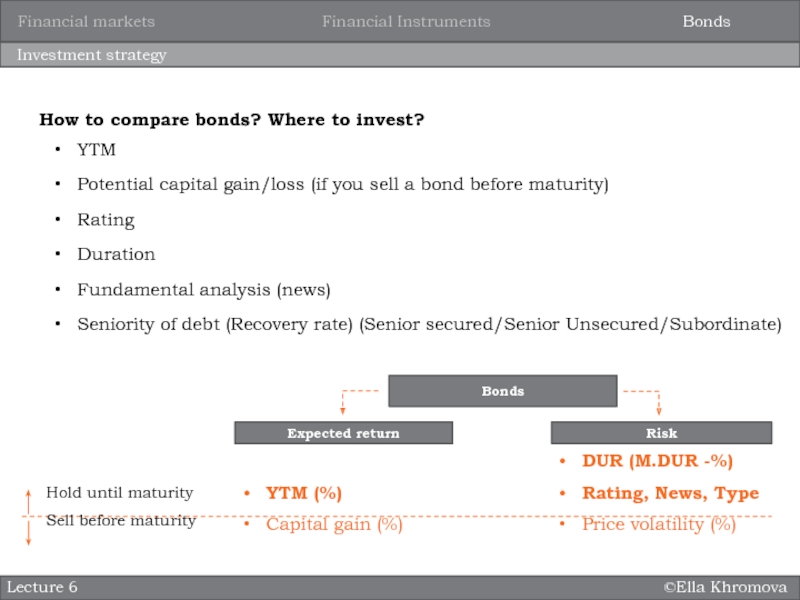

Слайд 12©Ella Khromova

Investment strategy

Lecture 6

How to compare bonds? Where to invest?

YTM

Potential

capital gain/loss (if you sell a bond before maturity)

Rating

Duration

Fundamental analysis

(news)Seniority of debt (Recovery rate) (Senior secured/Senior Unsecured/Subordinate)

Bonds

Financial Instruments

Financial markets

Bonds

Expected return

Risk

YTM (%)

Capital gain (%)

DUR (M.DUR -%)

Rating, News, Type

Price volatility (%)

Hold until maturity

Sell before maturity

Слайд 14©Ella Khromova

Bloomberg

Lecture 6

Bonds

Financial Instruments

Financial markets

Change in price (modified duration)

Слайд 15©Ella Khromova

Exercise 1

Practice 4

Bonds

LIBOR (London Interbank Offered Rate) is a benchmark rate

that some of the world’s leading banks charge each other

for short-term loans.Слайд 18©Ella Khromova

Buckle, M. and E. Beccalli Principles of banking and

finance (UOL study guide) pp. 26-30 (excluding The term structure

of interest rates), 32-36, 150-151Brealey, Myers and Allen. Principles of Corporate finance. Chapter 3

Mishkin, F. and S. Eakins Financial Markets and Institutions. (Addison Wesley) Chapter 12

Essential reading for Lecture 6:

Lecture 6