Слайд 1Chapter 15

Mutual Funds: An Easy

Way to Diversify

Слайд 2Learning Objectives

Weigh the advantages and disadvantages of investing in mutual

funds.

Differentiate between types of mutual funds, ETFs, and investment trusts.

Classify

mutual funds according to objectives.

Select a mutual fund that is right for you.

Calculate mutual fund returns.

Слайд 3Mutual Funds

Pool investors’ money, investing in stocks, bonds, and various

short-term securities.

Professional managers tend to the investments.

Allow investors to diversify,

even with a small investment.

Слайд 4Why Invest in Mutual Funds?

Advantages of mutual funds:

Professional management

Access

to the best research to evaluate investment alternatives.

Minimal transaction costs

Low commissions because of volume, which may translate into higher returns.

Liquidity

Easy to buy and sell on phone or online.

Слайд 5Why Invest in Mutual Funds?

Advantages of mutual funds:

Flexibility –

over 8,000 funds to choose from, covering many objectives and

risk levels.

Service – provide bookkeeping, checking accounts, automatic additions or withdrawals.

Avoidance of bad brokers – avoid potentially bad advice, high sales commissions, and churning.

Слайд 6Why Invest in Mutual Funds?

Disadvantages of mutual funds:

Lower than

market performance – mutual funds underperform the market on average.

Costs

– sales fee or load can be as high as 8.5% in addition to annual expense ratio at 3%.

Risks – not all mutual funds are safe; specialized funds may lack diversification outside a specific industry.

Слайд 7Why Invest in Mutual Funds?

Disadvantages of mutual funds:

Systematic risk

- mutual funds do not diversify away systematic risk. Even

mutual funds will suffer in a crash.

Taxes – mutual funds trade frequently, so investors may pay taxes on capital gains. You cannot defer taxes.

Слайд 8Mutual Fund-Amentals

A mutual fund pools money from investors with similar

financial goals.

You are investing in a diversified portfolio that’s professionally

managed according to set goals.

Investment objectives are clearly stated.

Слайд 9Mutual Fund-Amentals

Make money 3 ways in a mutual fund:

As the

value of the securities in the fund increases, the value

of each mutual fund share also rises.

Most pay dividends or interest to shareholders.

Shareholders receive a capital gains distribution when the fund sells a security for more than originally paid.

Слайд 10Mutual Fund-Amentals

Organization of a mutual fund:

Fund is set up as

a corporation or trust, owned by shareholders.

Shareholders elect a board

of directors.

Fund is run by a management company.

Each individual fund hires an investment advisor to oversee the fund.

Contracts with a custodian, a transfer agent, and an underwriter.

Слайд 11Investment Companies

A firm that invests the pooled money of a

number of investors in return for

a fee.

Types of investment companies:

Open-End

Investment Companies

Closed-End Investment Companies

Unit Investment Trusts

Real Estate Investment Trusts

Слайд 12Open-End Investment Companies

These mutual funds are the most popular form

of investment companies.

Open-end means the investment company can issue an

unlimited number of ownership shares.

Shares do not trade in the secondary market, must buy or sell through the fund.

Price based on net asset value (NAV).

Слайд 13Closed-End Investment Companies

Has a fixed number of shares, cannot issue

new shares.

Shares sold initially by investment company, afterwards they trade

like a common stock.

Price based on demand, not NAV.

Слайд 14Unit Investment Trusts

A fixed pool of securities with each unit

representing a proportionate ownership in the pool.

They are not managed.

Fund

purchases a fixed amount of bonds, holds them until maturity, then the trust dissolves.

Слайд 15Real Estate Investment Trusts

Like a mutual fund specializing in real

estate.

Has a professional manager.

Uses pooled funds.

Is actively managed.

Must collect

75% of its income from real estate and distribute 95% of that income in the form of dividends.

Слайд 16Real Estate Investment Trusts

Types of REITs:

Equity – buys property directly

and manages it. Investors look for appreciation in value.

Mortgage –

investment is limited to mortgages. Investors receive interest payments only.

Hybrid – a combination of the two. Invests in both property and mortgages, receiving both interest and capital appreciation.

Слайд 17Load Versus No-Load Funds

A load mutual fund charges a sales

commission. They are sold through brokers, financial advisors and financial

planners.

Class A – front-end sales load

Class B – back-end load

Class C – pay coming and going

A no-load fund doesn’t charge a commission.

Слайд 18Management Fees and Expenses

Invest in a fund with a low

expense ratio

Ratio compares funds expenses to total assets.

Look at

the turnover rate

Measures the level of the fund’s trading activity.

12b-1 Fees

Marketing expenses for advertising and sales promotion.

Слайд 19Money Market Mutual Funds

Invest in Treasury bills, CDs, and other

short-term investments, less than 30 days.

Regarded as practically risk-free.

Carry no

loads, trade at a constant $1 NAV, and have minimal expenses.

Tax-exempt money market fund invests only in short-term municipal debt.

Слайд 20Stock Mutual Funds

Aggressive Growth Funds – maximize capital appreciation while

ignoring income. Have wider price swings than other funds.

Small-Company Growth

Funds – similar to aggressive growth funds but limited to investments in small companies. Look to uncover and invest in undiscovered companies with unlimited growth potential.

Слайд 21Stock Mutual Funds

Growth and Income Funds – provide a steady

stream of income with the potential for increasing value. Less

risky, stable dividends, less price movement.

Sector Funds – specialized mutual fund investing 65% of its assets in securities from a specific industry. Less risky than an individual stock, but more risky than a traditional mutual fund.

Слайд 22Stock Mutual Funds

Index Funds – try to track a market

index, such as the S&P 500, by buying stocks in

that index. Provide diversification at a low cost.

International Funds – concentrate on securities from other countries, may have political and currency risks.

Слайд 23Balanced Mutual Funds

Hold both common stock and bonds.

Objective is to

earn steady income and some capital gains.

Aimed at those needing

income to live on and moderate stability in their investment.

Ratio of stocks to bonds varies.

Слайд 24Asset Allocation Funds

Similar to a balanced fund, invest in stocks,

bonds, and money market securities.

Differ in that they move money

between stocks and bonds to outperform the market.

It is a balanced fund practicing market timing.

Слайд 25Life Cycle and Target

Retirement Funds

Life cycle is the newest type

of funds. An asset allocation fund that tailors holdings to

investor’s characteristics, such as age and risk tolerance.

Target retirement funds are managed based on when you plan to retire.

Слайд 26Bond Funds

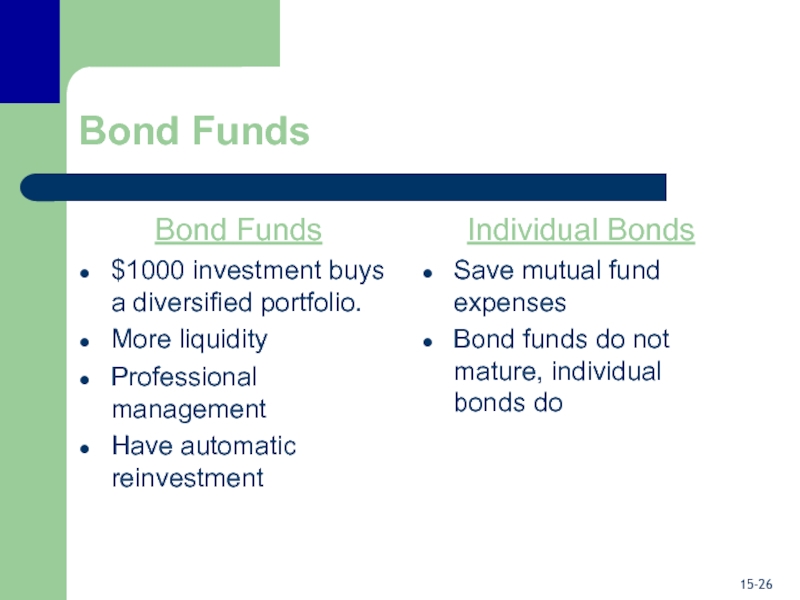

Bond Funds

$1000 investment buys a diversified portfolio.

More liquidity

Professional

management

Have automatic reinvestment

Individual Bonds

Save mutual fund expenses

Bond funds do

not mature, individual bonds do

Слайд 27

Bond Funds

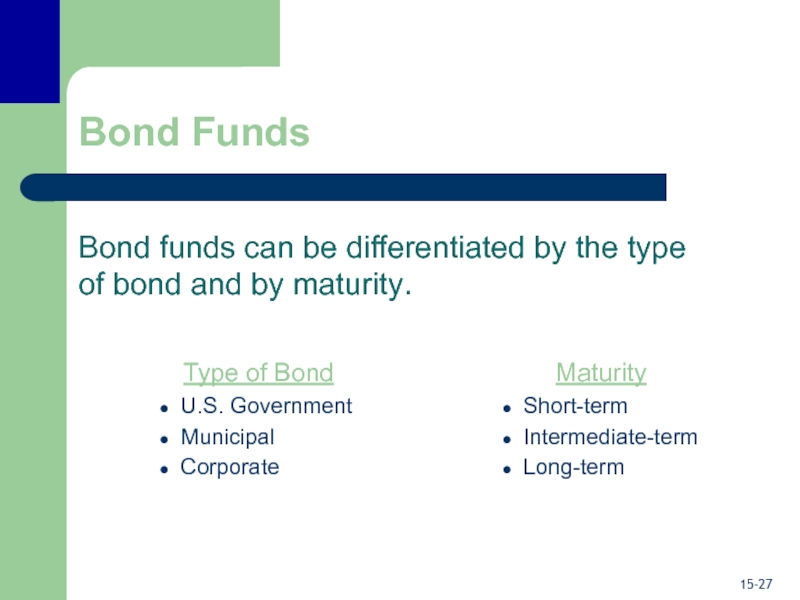

Bond funds can be differentiated by the type of

bond and by maturity.

Type of Bond

U.S. Government

Municipal

Corporate

Maturity

Short-term

Intermediate-term

Long-term

Слайд 28Bond Funds

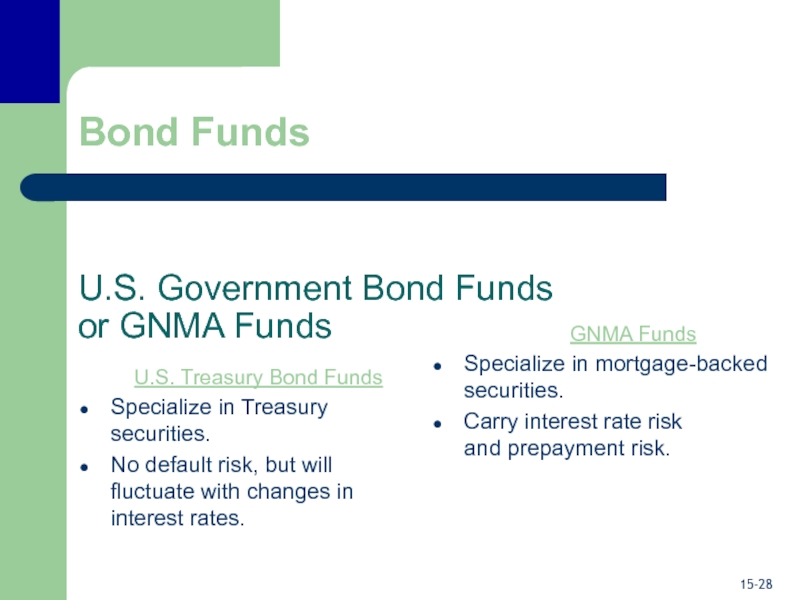

U.S. Government Bond Funds

or GNMA Funds

U.S. Treasury Bond Funds

Specialize in Treasury securities.

No default risk, but will fluctuate with

changes in interest rates.

GNMA Funds

Specialize in mortgage-backed securities.

Carry interest rate risk

and prepayment risk.

Слайд 29Bond Funds

Municipal Bond Funds – interest is generally tax-exempt from

federal taxes.

Aimed at those looking to avoid taxes.

Corporate Bond Funds

– invest in various types of corporate bonds, including high quality and junk bonds.

As interest rates rise, NAV goes down.

Слайд 30Bond Funds

Bond funds and their maturities:

Short-term – 1-5 years in

maturity

Intermediate-term – 5-10 years in maturity

Long-term – 10-30 years in

maturity

As interest rates change, long-term bonds fluctuate more than short-term.

Слайд 31ETFs or Exchange Traded Funds

First issued in 1993, these are

hybrids between a mutual fund and an individual stock or

bond.

Trade on an exchange and can be bought or sold throughout the day.

QQQ tracks the NASDAQ 100 Index.

SPDRS tracks the S&P 500.

Слайд 32ETFs or Exchange Traded Funds

Advantages of ETFs:

Trade on an exchange

and can be bought and sold throughout the day.

Can be

sold short or bought on margin.

Allow an instant position in a sector or country.

Low annual expenses.

More tax efficient than mutual funds.

Слайд 33ETFs or Exchange Traded Funds

Disadvantages of ETFs:

Pay a commission because

they trade like stocks.

Don’t necessarily trade at NAV.

Bid-ask spread because

buying from another investor.

Expensive for those who trade often, incur brokerage costs.

Слайд 34Mutual Fund Services

Automatic investment and withdrawal plans

Automatic reinvestment of

interest, dividends, and capital gains

Wiring and funds express options

Phone switching

Easy

establishment of retirement plans

Check writing

Bookkeeping and help with taxes

Слайд 35Buying a Mutual Fund

Step 1: Determining Your Goals

Buying a

mutual fund involves determining your investment goals and time horizon.

Understand

why you are investing:

To receive additional income

Supplement your retirement income

Save for a child’s education

Слайд 36Buying a Mutual Fund

Step 2: Meeting Your Objectives

Identify the

fund’s objectives by looking at objective classifications.

Don’t assume the fund’s

name reflects the strategy or objectives.

Morningstar provides an investment style box to understand the investment style.

Слайд 37Buying a Mutual Fund

Step 2: Meeting Your Objectives

Look in

the prospectus for:

Fund’s goals and investment strategy

Fund manager’s past experience

Any

investment limitations the fund may have

Tax considerations of importance to investors

Redemption and investment process

Services provided

Performance over past 10 years

Fund fees and expenses

Fund’s annual turnover rate

Слайд 38Buying a Mutual Fund

Step 3: Evaluating the Fund

Look closely

at past performance and scrutinize their costs.

Past performance does not

predict future results, but it does give insight.

Limit comparisons to funds with similar objectives.

Investigate how the fund did during upturns and downturns.

Слайд 39Buying a Mutual Fund

Step 3: Evaluating the Fund

Sources of

Information:

Wall Street Journal

Forbes – annual mutual fund survey

Kiplinger’s Personal Finance

magazine

Morningstar www.morningstar.com

Слайд 40Buying a Mutual Fund

Making the Purchase:

Buy direct – use

phone or internet.

Buy through a mutual fund supermarket – such

as Fidelity or Schwab.