Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Financial analysis of company’s activity

Содержание

- 1. Financial analysis of company’s activity

- 2. Management accountingIt measures and reports financial and

- 3. Financial AccountingIts focus is on reporting to

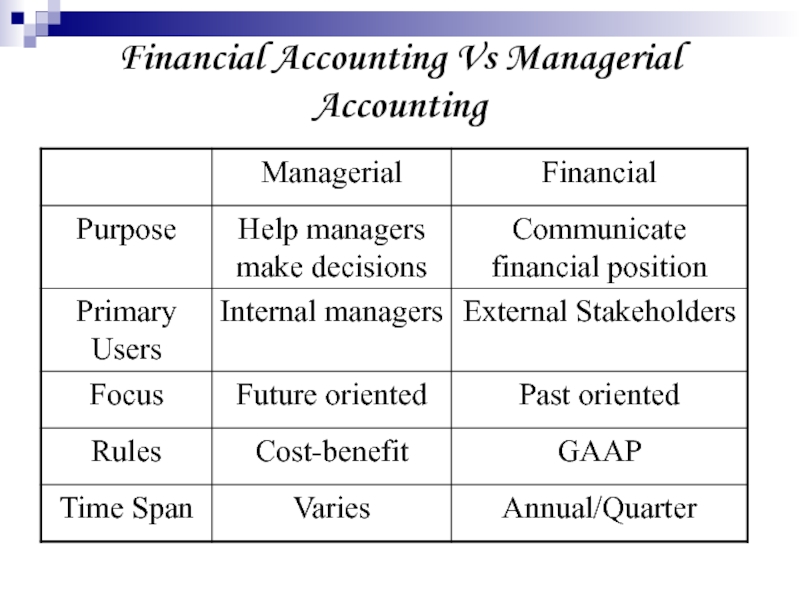

- 4. Financial Accounting Vs Managerial Accounting

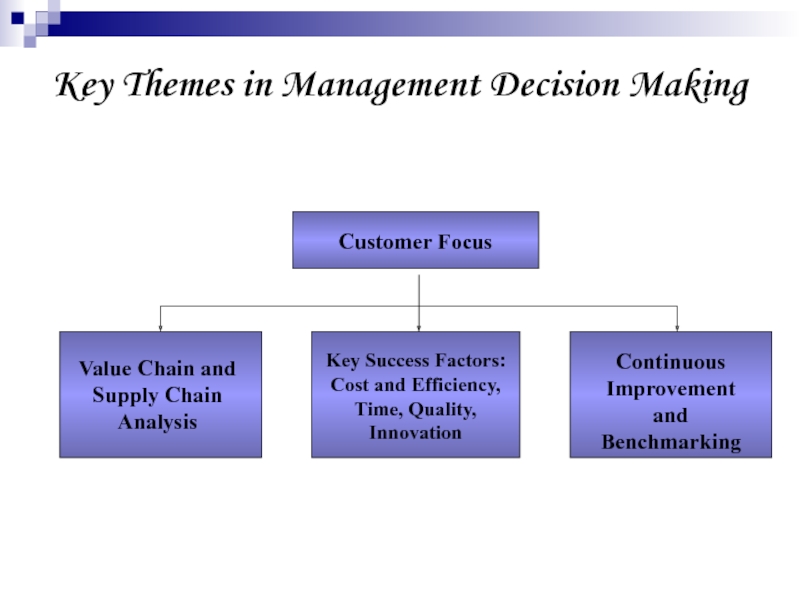

- 5. Key Themes in Management Decision MakingCustomer FocusValue

- 6. Customer Focus – continuous process of investing

- 7. Key Success Factors (operational factors that directly

- 8. Value ChainRefers to the sequence of business

- 9. Value ChainR&DDesignProductionManagement AccountingMarketingDistributionService

- 10. Learning objectivesDefinition of costCost ObjectCost Classifications:Direct/Indirect costsBusiness functionProduct/Period costsVariable/Fixed costs

- 11. Cost“Resource sacrificed or forgone to achieve a

- 12. CostCost could be computed and referred to:Total

- 13. Cost ObjectExamples of Cost Objects at Procter & Gamble

- 14. Direct and Indirect CostsDirect costs – costs

- 15. Type of cost

- 16. Business expensesStart-up expenses:business registration fees business licensing

- 17. Operating expenses:salaries (yours and staff salaries) telecommunicationsraw

- 18. Business functionR&D costsProduction costs (raw materials, direct

- 19. Manufacturing costs: ProductionNon-Manufacturing costs: R&D Marketing Customer ServiceBusiness function

- 20. Product and period costsProduct costs – all

- 21. Which costs become product costs?GAAP versionGAAP requires

- 22. Variable and Fixed costsVariable cost – cost

- 23. Cost BehaviourDo not assume that individual costs

- 24. Direct-Indirect, Fixed-Variable costsDirect CostsCost object: BMW X5s

- 25. BudgetOperating budget:Sales budgetProduction budgetDirect materials budgetDirect labor

- 26. Financial statementsBalance sheet: also referred to as

- 27. Financial ratio or accounting ratio Liquidity ratios

- 28. Profitability ratiosProfitability ratios measure the firm's use

- 29. Gross margin, Gross profit margin or

- 30. Operating margin, Operating Income Margin, Operating profit

- 31. Profit margin, Net Margin, Net profit margin

- 32. The Return on Assets (ROA) percentage shows

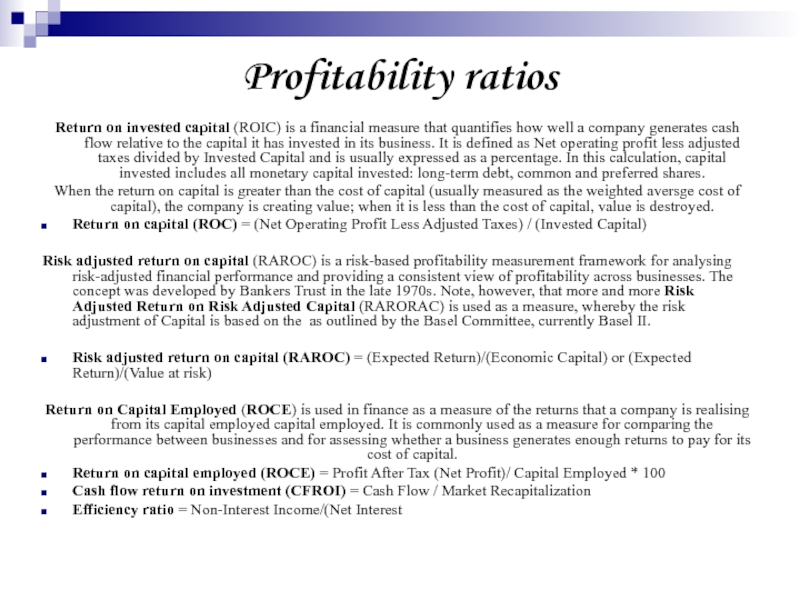

- 33. Profitability ratiosReturn on invested capital (ROIC) is

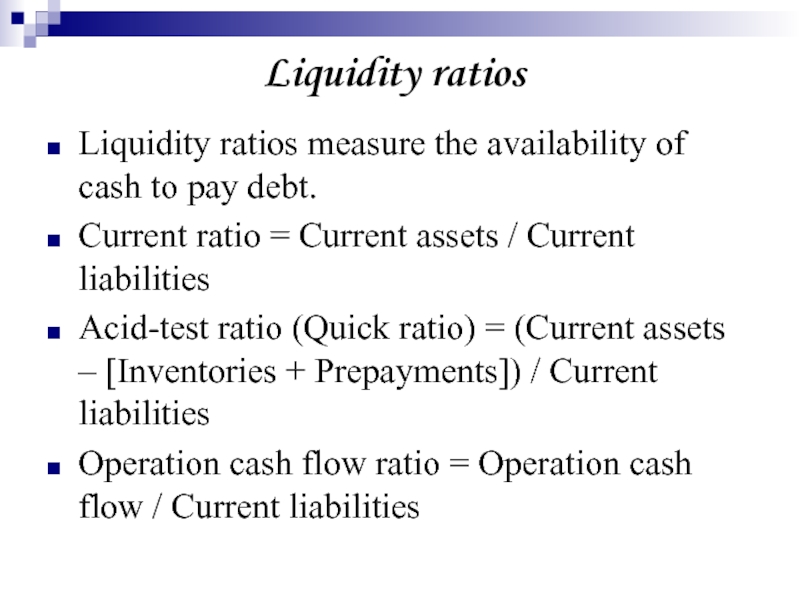

- 34. Liquidity ratiosLiquidity ratios measure the availability of

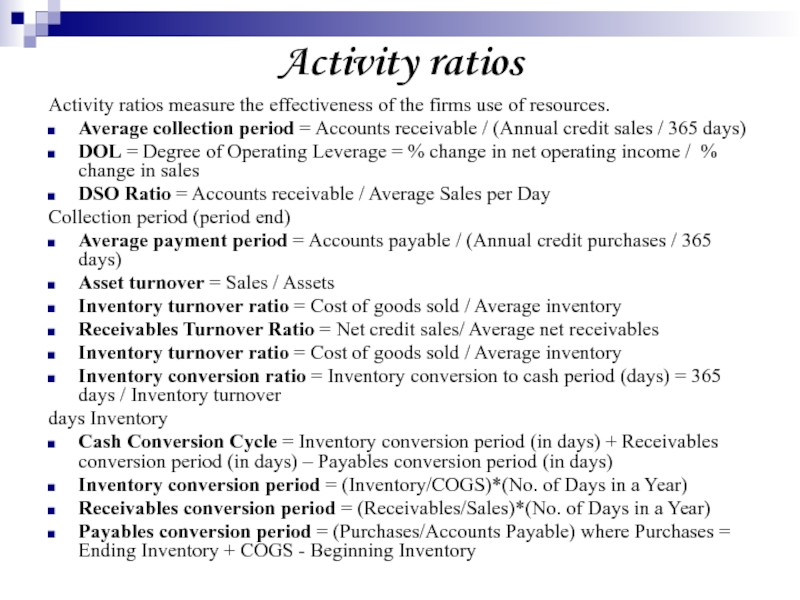

- 35. Activity ratiosActivity ratios measure the effectiveness of

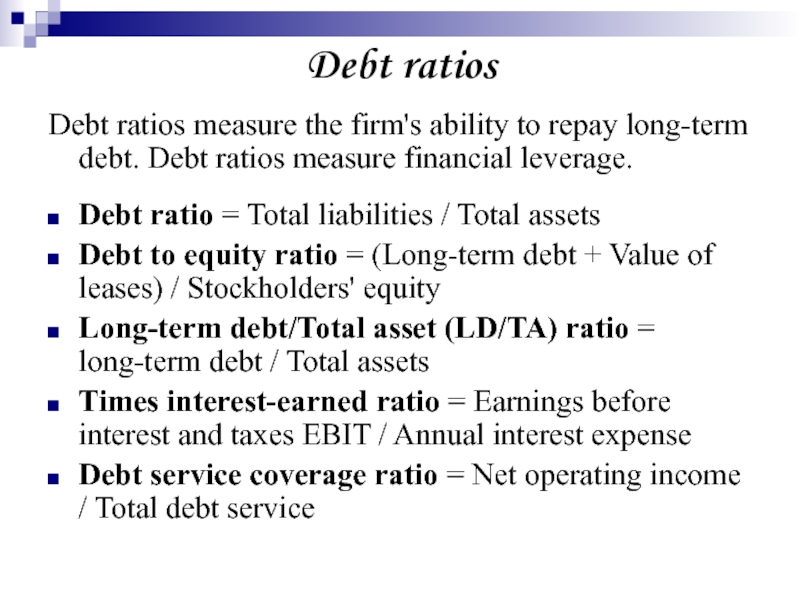

- 36. Debt ratiosDebt ratios measure the firm's ability

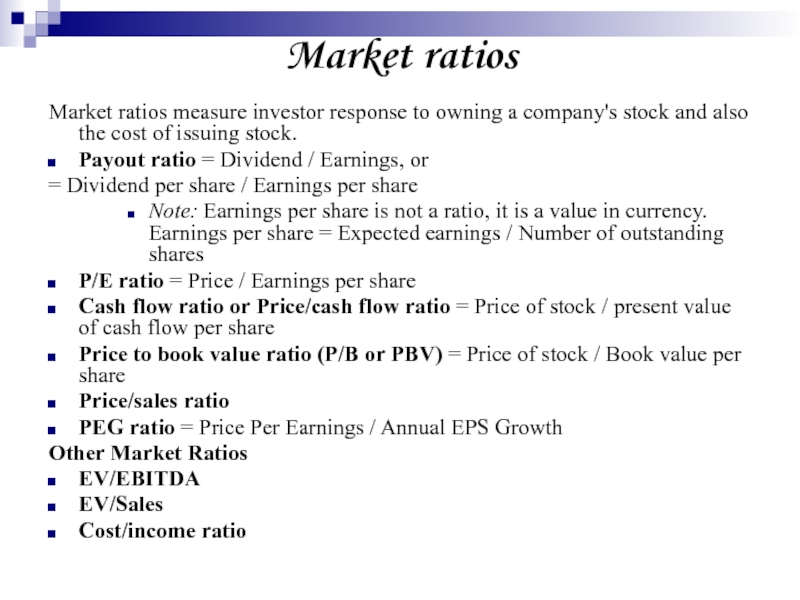

- 37. Market ratiosMarket ratios measure investor response to

- 38. Thank you for your attention!

- 39. Скачать презентанцию

Слайды и текст этой презентации

Слайд 3Financial Accounting

Its focus is on reporting to external parties.

It

measures and records business transactions.

It provides financial statements based

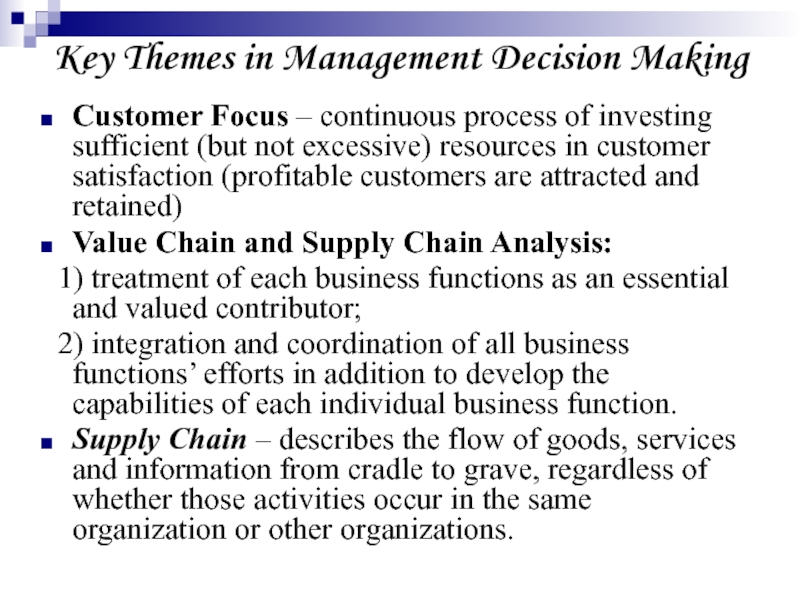

on generally accepted accounting principles. Слайд 5Key Themes in Management Decision Making

Customer Focus

Value Chain and Supply

Chain Analysis

Key Success Factors: Cost and Efficiency, Time, Quality,

InnovationContinuous Improvement and Benchmarking

Слайд 6Customer Focus – continuous process of investing sufficient (but not

excessive) resources in customer satisfaction (profitable customers are attracted and

retained)Value Chain and Supply Chain Analysis:

1) treatment of each business functions as an essential and valued contributor;

2) integration and coordination of all business functions’ efforts in addition to develop the capabilities of each individual business function.

Supply Chain – describes the flow of goods, services and information from cradle to grave, regardless of whether those activities occur in the same organization or other organizations.

Key Themes in Management Decision Making

Слайд 7Key Success Factors (operational factors that directly affect the economic

viability of the organization):

Cost – organizations are under continuous pressure

to reduce costsQuality – customers are expecting higher levels of quality

Time – organizations are under pressure to complete activities faster and to meet promised delivery dates more reliably

Innovation – nowadays is heightened recognition that a continuing flow of innovative products or services is a prerequisite to the ongoing success of most organizations

Continuous improvements by competitors creates a never-ending search for higher levels of performance within many organizations

Key Themes in Management Decision Making

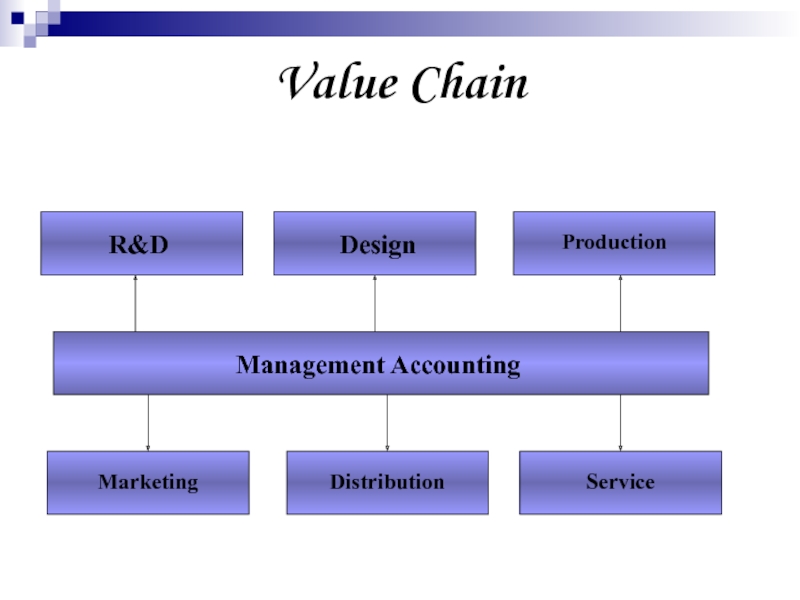

Слайд 8Value Chain

Refers to the sequence of business functions in which

usefulness is added to the products or services of an

organization (as the usefulness of the product or service is increased, so is its value to the customer)Слайд 10Learning objectives

Definition of cost

Cost Object

Cost Classifications:

Direct/Indirect costs

Business function

Product/Period costs

Variable/Fixed costs

Слайд 11Cost

“Resource sacrificed or forgone to achieve a specific objective”

“Sacrificed” refers

to a resource that is consumed

“Forgone” refers to giving up

an opportunity to use a resourceCost is usually measured as the monetary amount that must be paid to acquire goods or services

Слайд 12Cost

Cost could be computed and referred to:

Total amount (total cost

of raw material): “Total cost”

Average amount per unit (cost of

raw material per unit): “Unit cost”Unit cost: Total costs / number of units

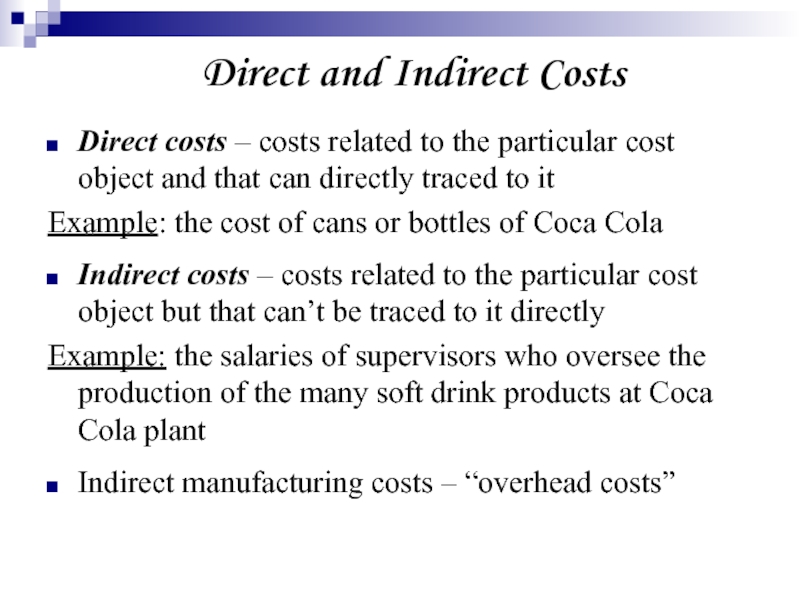

Слайд 14Direct and Indirect Costs

Direct costs – costs related to the

particular cost object and that can directly traced to it

Example:

the cost of cans or bottles of Coca ColaIndirect costs – costs related to the particular cost object but that can’t be traced to it directly

Example: the salaries of supervisors who oversee the production of the many soft drink products at Coca Cola plant

Indirect manufacturing costs – “overhead costs”

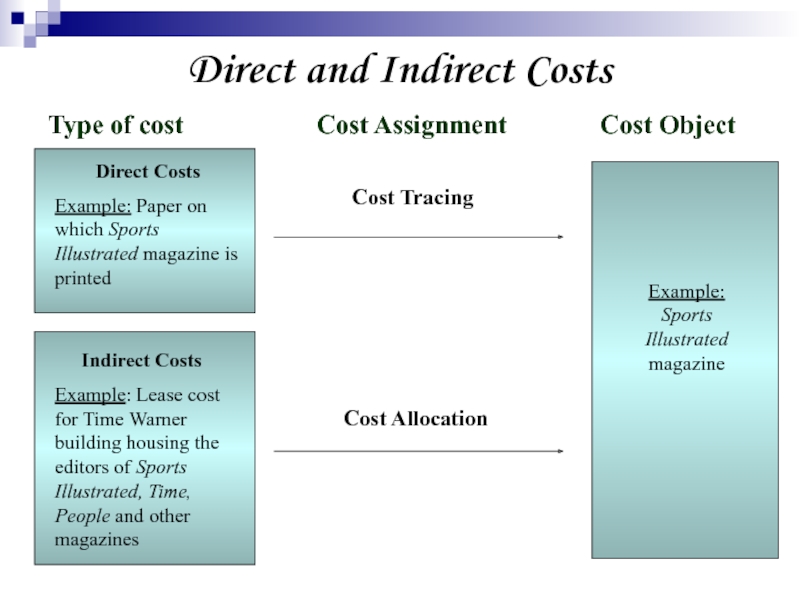

Слайд 15Type of cost

Cost Assignment

Cost ObjectDirect and Indirect Costs

Direct Costs

Example: Paper on which Sports Illustrated magazine is printed

Indirect Costs

Example: Lease cost for Time Warner building housing the editors of Sports Illustrated, Time, People and other magazines

Cost Tracing

Cost Allocation

Example: Sports Illustrated magazine

Слайд 16Business expenses

Start-up expenses:

business registration fees

business licensing and permits

starting

inventory

rent deposits

down payments on property

down payments on

equipment Слайд 17Operating expenses:

salaries (yours and staff salaries)

telecommunications

raw materials

storage

distribution

promotion

loan payments

office supplies

maintenance

Business expenses

Слайд 18Business function

R&D costs

Production costs (raw materials, direct labour)

Selling costs (provisions

to vendors, advertising, promotion …)

Distribution costs (transport, contracts with distributors

…)General and administrative costs (electricity, telephone, rents, plant’ cleaning, office’ heating …)

Слайд 19Manufacturing costs:

Production

Non-Manufacturing costs:

R&D

Marketing

Customer Service

Business function

Слайд 20Product and period costs

Product costs – all costs of a

product that are considered as assets in the balance sheet

(inventory) when they are incurred and that become cost of goods sold when the product is soldPeriod costs – all costs in the income statement other than cost of goods sold; they are treated as expenses of the accounting period whatever the volume of production/sales is

Слайд 21Which costs become product costs?

GAAP version

GAAP requires “Full costing” for

external reporting purposes. As a result indirect production costs must

be allocated to goods producedCost Behaviour version

It depends on what the company is trying to achieve by means of financial analysis (strategic analysis, operating analysis, evaluation of inventory)

Слайд 22Variable and Fixed costs

Variable cost – cost that changes the

total in proportion to changes in the related level of

total activity or volumeFixed cost – cost that remains unchanged in total for a given period despite the wide changes in the related level of total activity or volume

Total costs: variable costs + fixed costs

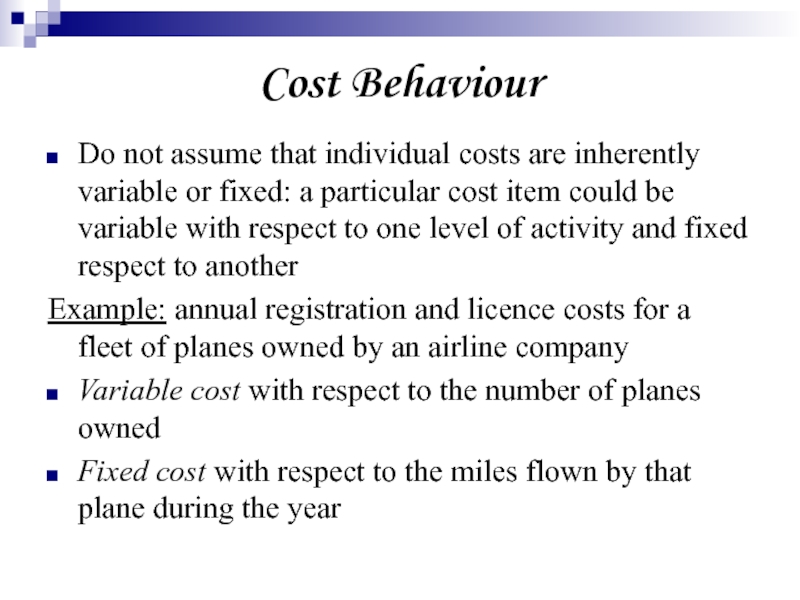

Слайд 23Cost Behaviour

Do not assume that individual costs are inherently variable

or fixed: a particular cost item could be variable with

respect to one level of activity and fixed respect to anotherExample: annual registration and licence costs for a fleet of planes owned by an airline company

Variable cost with respect to the number of planes owned

Fixed cost with respect to the miles flown by that plane during the year

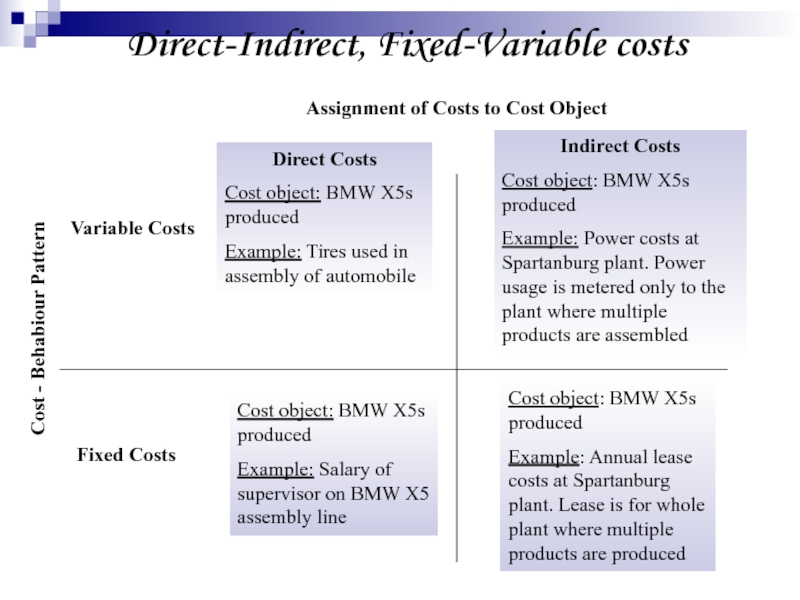

Слайд 24Direct-Indirect, Fixed-Variable costs

Direct Costs

Cost object: BMW X5s produced

Example: Tires used

in assembly of automobile

Cost object: BMW X5s produced

Example: Salary of

supervisor on BMW X5 assembly lineIndirect Costs

Cost object: BMW X5s produced

Example: Power costs at Spartanburg plant. Power usage is metered only to the plant where multiple products are assembled

Cost object: BMW X5s produced

Example: Annual lease costs at Spartanburg plant. Lease is for whole plant where multiple products are produced

Variable Costs

Fixed Costs

Assignment of Costs to Cost Object

Cost - Behabiour Pattern

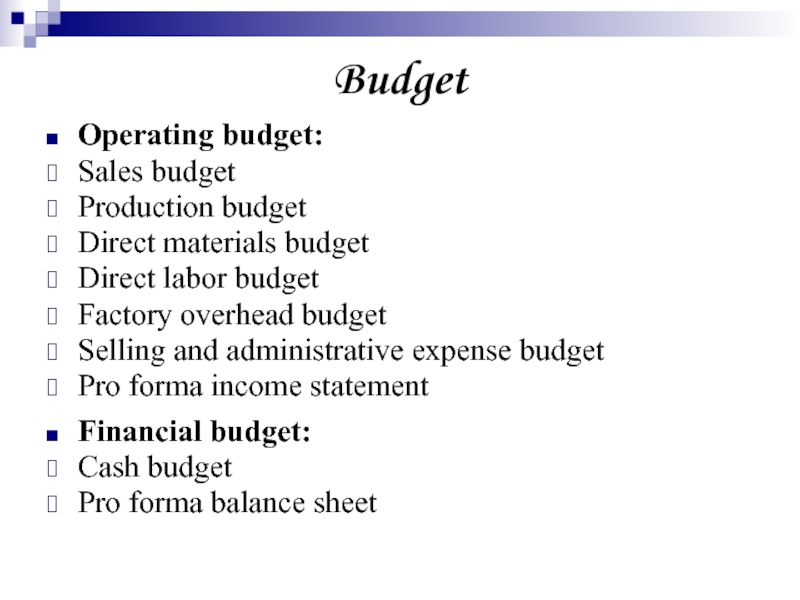

Слайд 25Budget

Operating budget:

Sales budget

Production budget

Direct materials budget

Direct labor budget

Factory overhead budget

Selling

and administrative expense budget

Pro forma income statement

Financial budget:

Cash budget

Pro forma

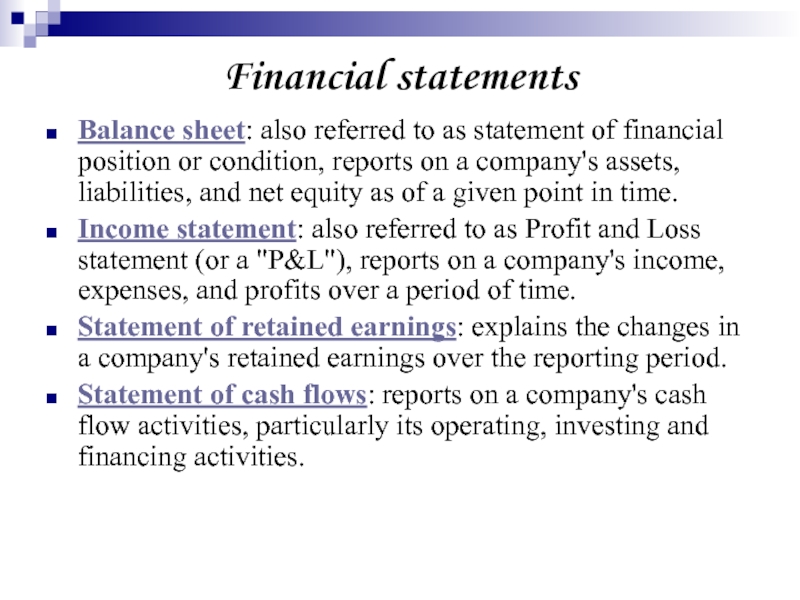

balance sheetСлайд 26Financial statements

Balance sheet: also referred to as statement of financial

position or condition, reports on a company's assets, liabilities, and

net equity as of a given point in time.Income statement: also referred to as Profit and Loss statement (or a "P&L"), reports on a company's income, expenses, and profits over a period of time.

Statement of retained earnings: explains the changes in a company's retained earnings over the reporting period.

Statement of cash flows: reports on a company's cash flow activities, particularly its operating, investing and financing activities.

Слайд 27Financial ratio or accounting ratio

Liquidity ratios measure the availability

of cash to pay debt.

Activity ratios measure how quickly a

firm converts non-cash assets to cash assets.Debt ratios measure the firm's ability to repay long-term debt.

Profitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.

Market ratios measure investor response to owning a company's stock and also the cost of issuing stock.

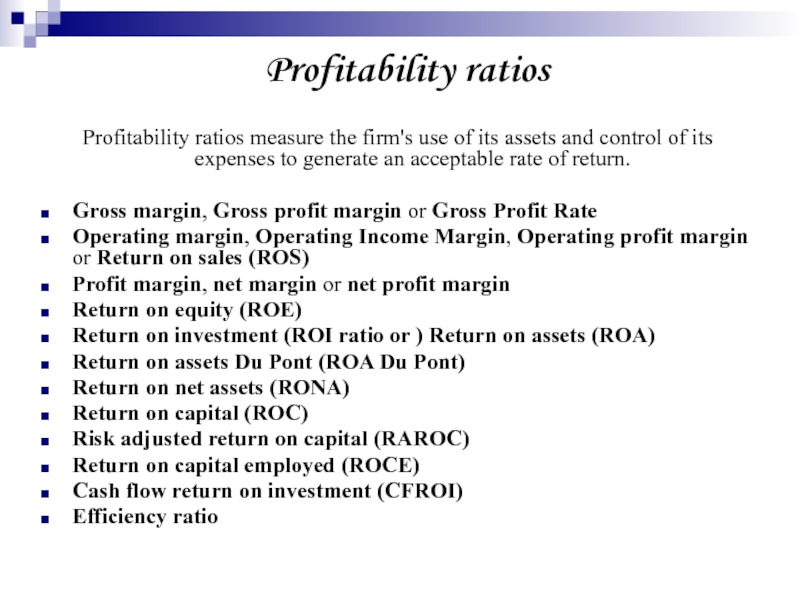

Слайд 28Profitability ratios

Profitability ratios measure the firm's use of its assets

and control of its expenses to generate an acceptable rate

of return.Gross margin, Gross profit margin or Gross Profit Rate

Operating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)

Profit margin, net margin or net profit margin

Return on equity (ROE)

Return on investment (ROI ratio or ) Return on assets (ROA)

Return on assets Du Pont (ROA Du Pont)

Return on net assets (RONA)

Return on capital (ROC)

Risk adjusted return on capital (RAROC)

Return on capital employed (ROCE)

Cash flow return on investment (CFROI)

Efficiency ratio

Слайд 29

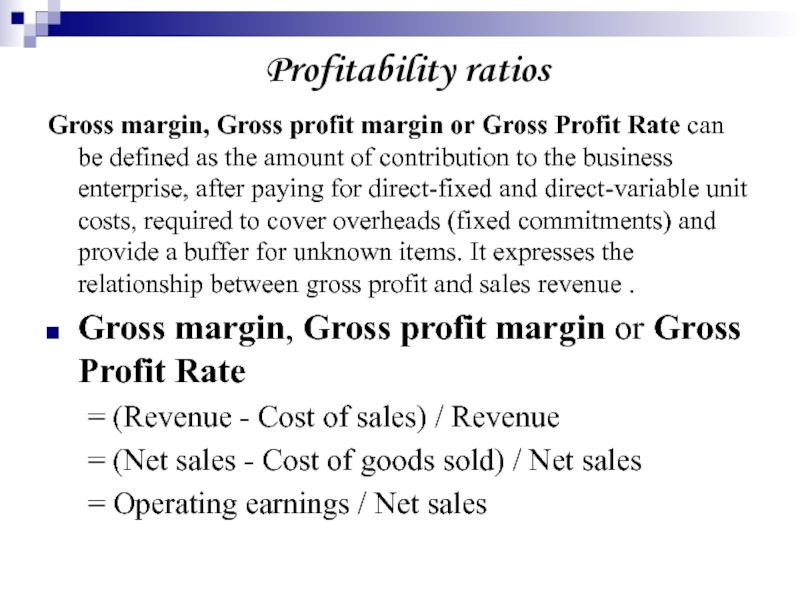

Gross margin, Gross profit margin or Gross Profit Rate can

be defined as the amount of contribution to the business

enterprise, after paying for direct-fixed and direct-variable unit costs, required to cover overheads (fixed commitments) and provide a buffer for unknown items. It expresses the relationship between gross profit and sales revenue .Gross margin, Gross profit margin or Gross Profit Rate

= (Revenue - Cost of sales) / Revenue

= (Net sales - Cost of goods sold) / Net sales

= Operating earnings / Net sales

Profitability ratios

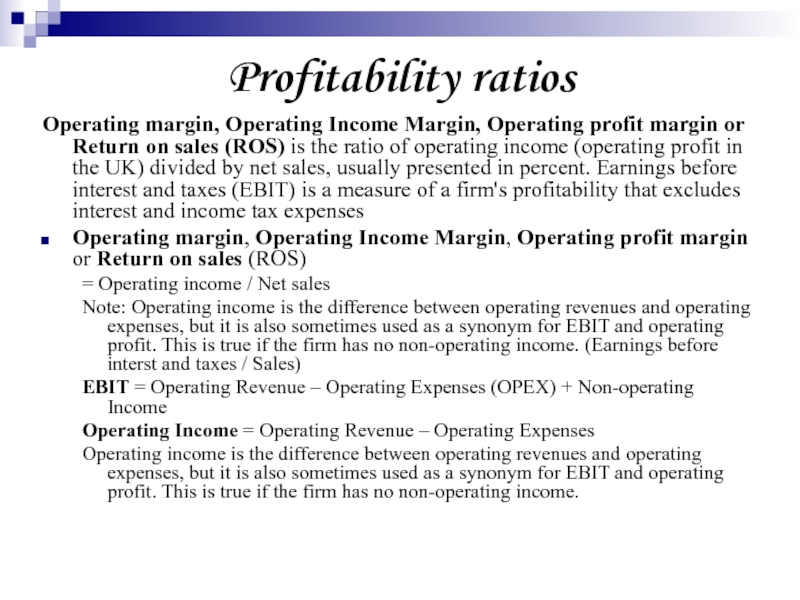

Слайд 30Operating margin, Operating Income Margin, Operating profit margin or Return

on sales (ROS) is the ratio of operating income (operating

profit in the UK) divided by net sales, usually presented in percent. Earnings before interest and taxes (EBIT) is a measure of a firm's profitability that excludes interest and income tax expensesOperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)

= Operating income / Net sales

Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit. This is true if the firm has no non-operating income. (Earnings before interst and taxes / Sales)

EBIT = Operating Revenue – Operating Expenses (OPEX) + Non-operating Income

Operating Income = Operating Revenue – Operating Expenses

Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit. This is true if the firm has no non-operating income.

Profitability ratios

Слайд 31Profit margin, Net Margin, Net profit margin or Net Profit

Ratio all refer to a measure of profitability.

Profit margin,

net margin or net profit margin = Net income / Sales

= Net profits after taxes / Sales

Net income is equal to the income that a firm has after subtracting costs and expenses from the total revenue. Net income can be distributed among holders of common stock as a dividend or held by the firm as retained earnings. Net income is an accounting term; in some countries (such as the UK) profit is the usual term. Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity.

Return on Equity (ROE, Return on average common equity, return on net worth) measures the rate of return on the ownership interest (shareholders\ equity) of the common stock owners. ROE is viewed as one of the most important financial ratios. It measures a firm's efficiency at generating profits from every dollar of net assets (assets minus liabilities), and shows how well a company uses investment dollars to generate earnings growth. ROE is equal to a fiscal year’s net income (after preferred stock dividends but before common stock dividends) divided by total equity (excluding preferred shares)

Return on equity (ROE)

= Net profits after taxes / Stockholders' equity or tangible net worth

= Net profit / Equity

Rate of return (ROR), also known as return on investment (ROI), rate of profit or sometimes just return, is the ratio of money gained or lost (realized or unrealized) on an investment relative to the amount of money invested. The amount of money gained or lost may be referred to as interst, profit / loss, gain/loss, or net income/loss. The money invested may be referred to as the asset, capital, principal or the cost basis of the investment.

Return on investment (ROI ratio or ) = Net income / Total Assets

Profitability ratios

Слайд 32

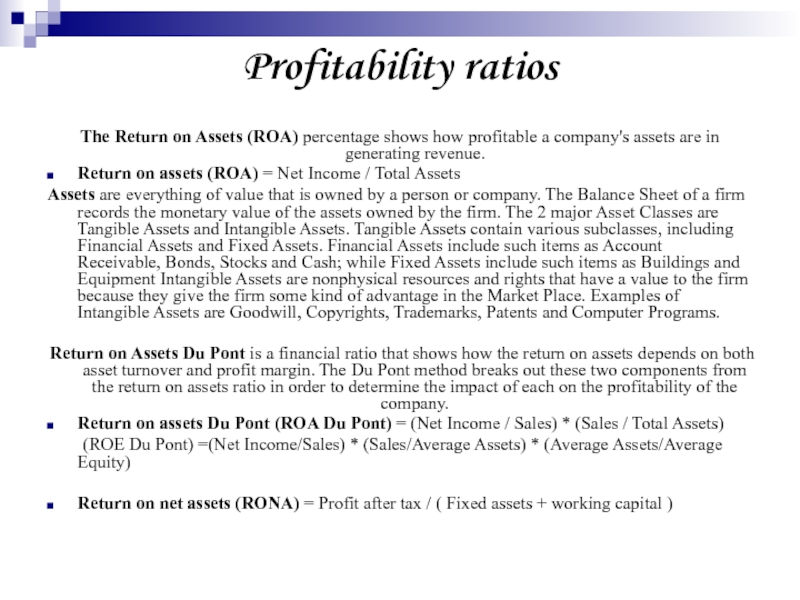

The Return on Assets (ROA) percentage shows how profitable a

company's assets are in generating revenue.

Return on assets (ROA) =

Net Income / Total AssetsAssets are everything of value that is owned by a person or company. The Balance Sheet of a firm records the monetary value of the assets owned by the firm. The 2 major Asset Classes are Tangible Assets and Intangible Assets. Tangible Assets contain various subclasses, including Financial Assets and Fixed Assets. Financial Assets include such items as Account Receivable, Bonds, Stocks and Cash; while Fixed Assets include such items as Buildings and Equipment Intangible Assets are nonphysical resources and rights that have a value to the firm because they give the firm some kind of advantage in the Market Place. Examples of Intangible Assets are Goodwill, Copyrights, Trademarks, Patents and Computer Programs.

Return on Assets Du Pont is a financial ratio that shows how the return on assets depends on both asset turnover and profit margin. The Du Pont method breaks out these two components from the return on assets ratio in order to determine the impact of each on the profitability of the company.

Return on assets Du Pont (ROA Du Pont) = (Net Income / Sales) * (Sales / Total Assets)

(ROE Du Pont) =(Net Income/Sales) * (Sales/Average Assets) * (Average Assets/Average Equity)

Return on net assets (RONA) = Profit after tax / ( Fixed assets + working capital )

Profitability ratios

Слайд 33Profitability ratios

Return on invested capital (ROIC) is a financial measure

that quantifies how well a company generates cash flow relative

to the capital it has invested in its business. It is defined as Net operating profit less adjusted taxes divided by Invested Capital and is usually expressed as a percentage. In this calculation, capital invested includes all monetary capital invested: long-term debt, common and preferred shares.When the return on capital is greater than the cost of capital (usually measured as the weighted aversge cost of capital), the company is creating value; when it is less than the cost of capital, value is destroyed.

Return on capital (ROC) = (Net Operating Profit Less Adjusted Taxes) / (Invested Capital)

Risk adjusted return on capital (RAROC) is a risk-based profitability measurement framework for analysing risk-adjusted financial performance and providing a consistent view of profitability across businesses. The concept was developed by Bankers Trust in the late 1970s. Note, however, that more and more Risk Adjusted Return on Risk Adjusted Capital (RARORAC) is used as a measure, whereby the risk adjustment of Capital is based on the as outlined by the Basel Committee, currently Basel II.

Risk adjusted return on capital (RAROC) = (Expected Return)/(Economic Capital) or (Expected Return)/(Value at risk)

Return on Capital Employed (ROCE) is used in finance as a measure of the returns that a company is realising from its capital employed capital employed. It is commonly used as a measure for comparing the performance between businesses and for assessing whether a business generates enough returns to pay for its cost of capital.

Return on capital employed (ROCE) = Profit After Tax (Net Profit)/ Capital Employed * 100

Cash flow return on investment (CFROI) = Cash Flow / Market Recapitalization

Efficiency ratio = Non-Interest Income/(Net Interest

Слайд 34Liquidity ratios

Liquidity ratios measure the availability of cash to pay

debt.

Current ratio = Current assets / Current liabilities

Acid-test ratio (Quick

ratio) = (Current assets – [Inventories + Prepayments]) / Current liabilitiesOperation cash flow ratio = Operation cash flow / Current liabilities

Слайд 35Activity ratios

Activity ratios measure the effectiveness of the firms use

of resources.

Average collection period = Accounts receivable / (Annual credit

sales / 365 days)DOL = Degree of Operating Leverage = % change in net operating income / % change in sales

DSO Ratio = Accounts receivable / Average Sales per Day

Collection period (period end)

Average payment period = Accounts payable / (Annual credit purchases / 365 days)

Asset turnover = Sales / Assets

Inventory turnover ratio = Cost of goods sold / Average inventory

Receivables Turnover Ratio = Net credit sales/ Average net receivables

Inventory turnover ratio = Cost of goods sold / Average inventory

Inventory conversion ratio = Inventory conversion to cash period (days) = 365 days / Inventory turnover

days Inventory

Cash Conversion Cycle = Inventory conversion period (in days) + Receivables conversion period (in days) – Payables conversion period (in days)

Inventory conversion period = (Inventory/COGS)*(No. of Days in a Year)

Receivables conversion period = (Receivables/Sales)*(No. of Days in a Year)

Payables conversion period = (Purchases/Accounts Payable) where Purchases = Ending Inventory + COGS - Beginning Inventory

Слайд 36Debt ratios

Debt ratios measure the firm's ability to repay long-term

debt. Debt ratios measure financial leverage.

Debt ratio = Total liabilities

/ Total assetsDebt to equity ratio = (Long-term debt + Value of leases) / Stockholders' equity

Long-term debt/Total asset (LD/TA) ratio = long-term debt / Total assets

Times interest-earned ratio = Earnings before interest and taxes EBIT / Annual interest expense

Debt service coverage ratio = Net operating income / Total debt service

Слайд 37Market ratios

Market ratios measure investor response to owning a company's

stock and also the cost of issuing stock.

Payout ratio =

Dividend / Earnings, or = Dividend per share / Earnings per share

Note: Earnings per share is not a ratio, it is a value in currency. Earnings per share = Expected earnings / Number of outstanding shares

P/E ratio = Price / Earnings per share

Cash flow ratio or Price/cash flow ratio = Price of stock / present value of cash flow per share

Price to book value ratio (P/B or PBV) = Price of stock / Book value per share

Price/sales ratio

PEG ratio = Price Per Earnings / Annual EPS Growth

Other Market Ratios

EV/EBITDA

EV/Sales

Cost/income ratio