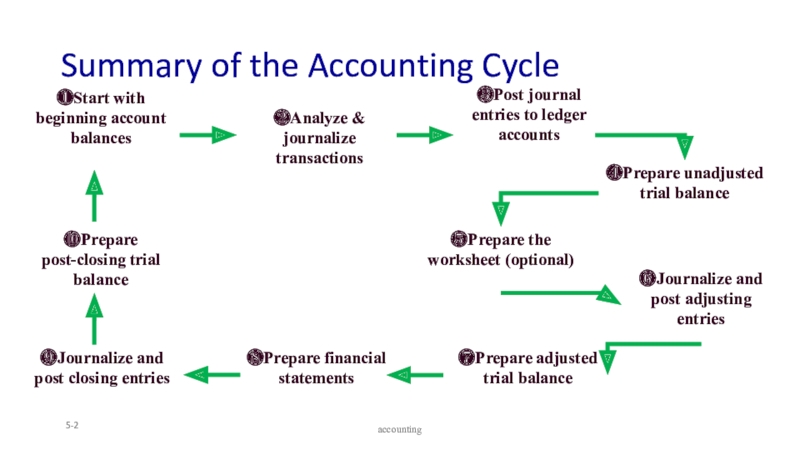

to ledger accounts

Prepare unadjusted trial balance

Journalize and post adjusting entries

Prepare

adjusted trial balancePrepare financial statements

Prepare post-closing trial balance

Journalize and post closing entries

Start with beginning account balances

Prepare the worksheet (optional)

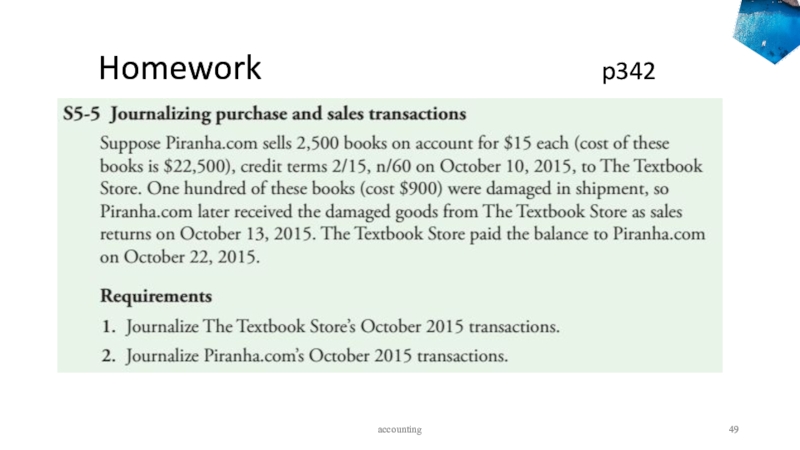

accounting