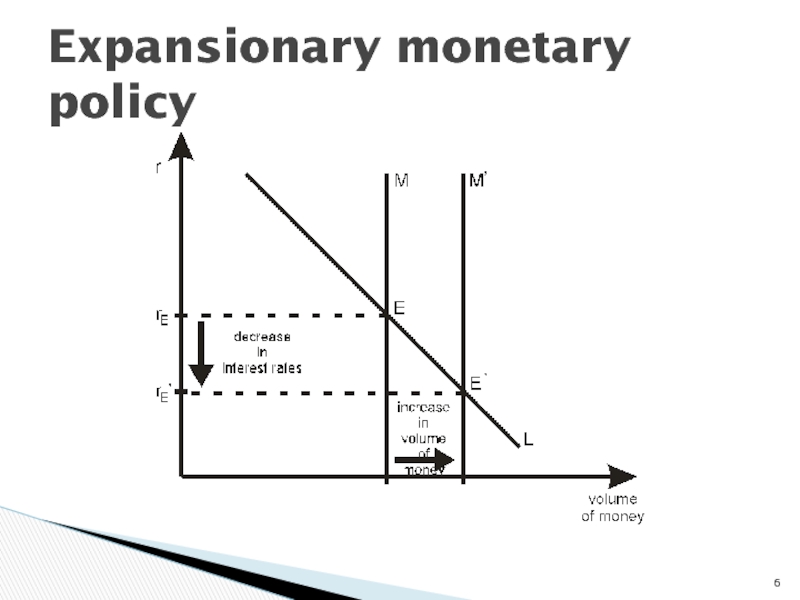

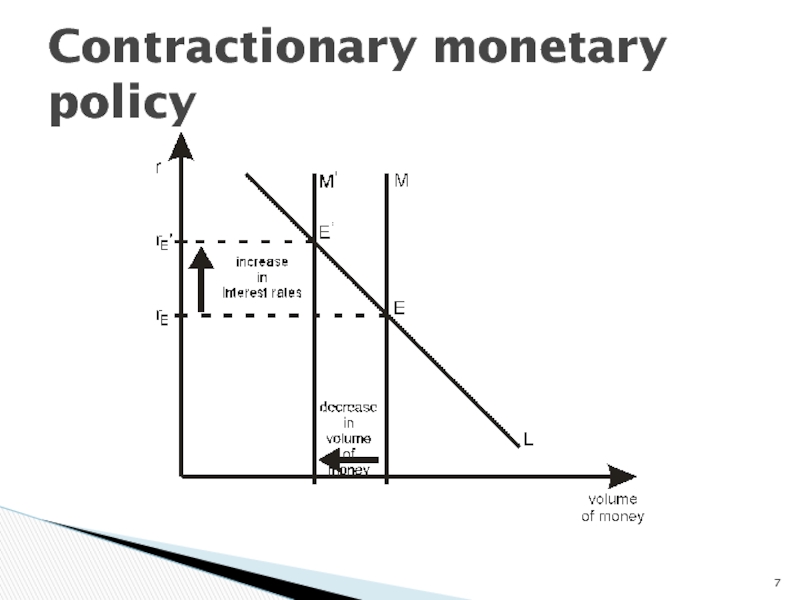

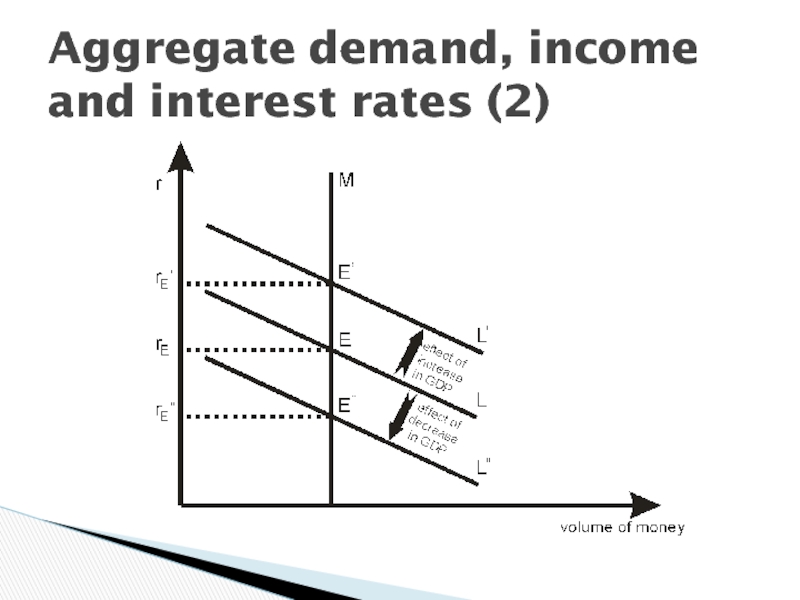

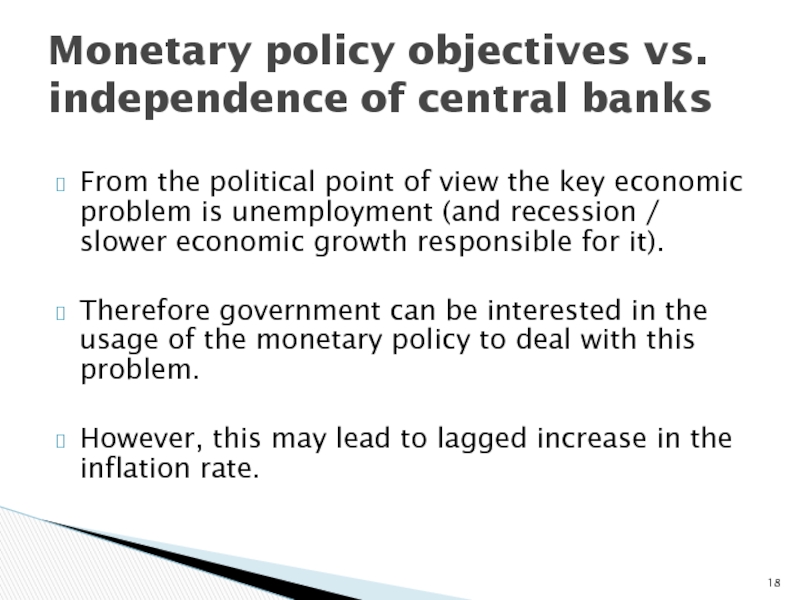

of money in the economy in order to keep inflation

under control as well as to affect production and income.„The prime aim of NBP is the preservation of stable price level. It can also support government in its economic policy on condition that such support doesn’t restrain the prime goal”. NBP Act