Разделы презентаций

- Разное

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Project comments

Содержание

- 1. Project comments

- 2. ©Ella KhromovaBonds and Stocks market evaluationProjectBondsExpected returnRiskYTM

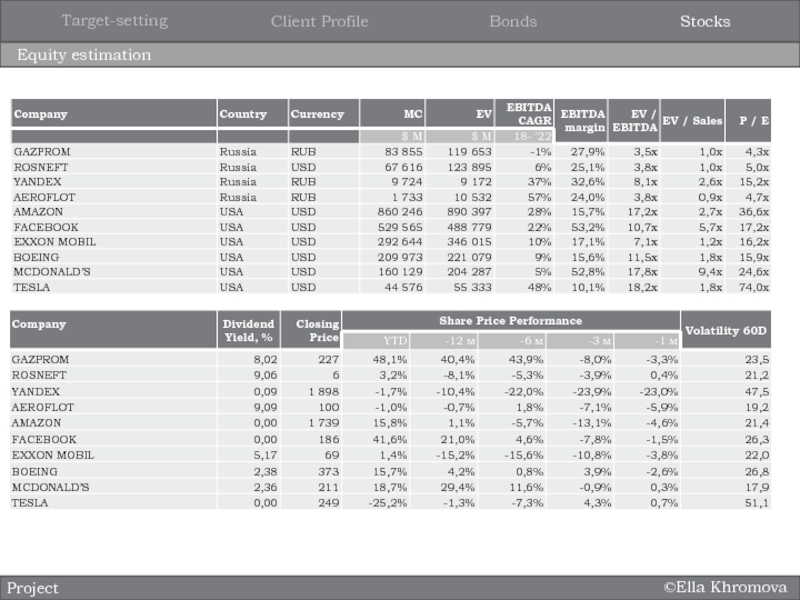

- 3. ©Ella KhromovaEquity estimationStocksBondsClient ProfileTarget-settingProject

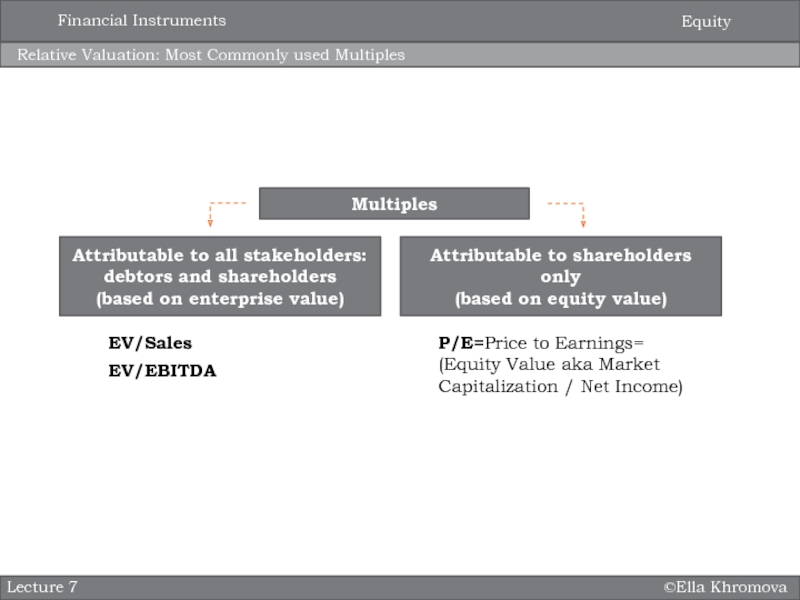

- 4. ©Ella KhromovaRelative Valuation: Most Commonly used MultiplesLecture

- 5. ©Ella KhromovaRelative Valuation: Step by step procedureLecture 7EquityFinancial Instruments

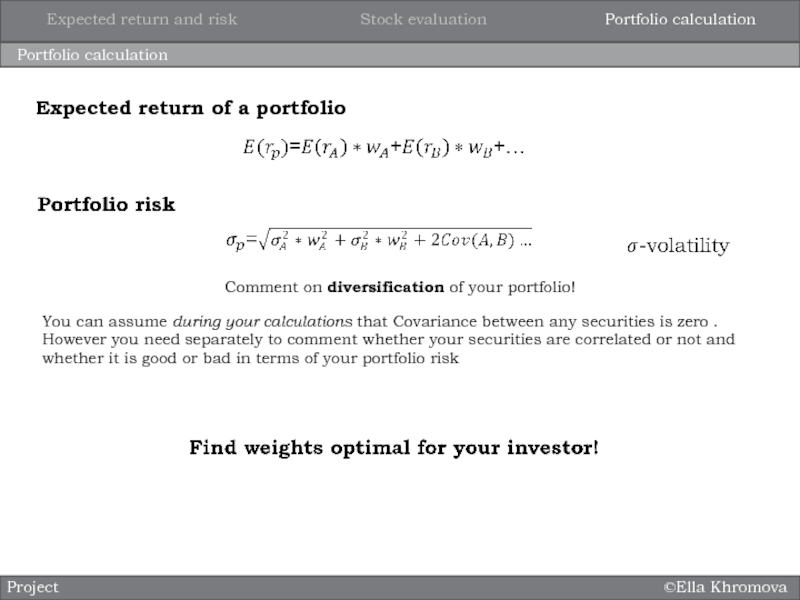

- 6. ©Ella KhromovaPortfolio calculationProjectComment on diversification of your

- 7. Lecture 9. Financial markets: Derivatives©Ella KhromovaLecture 9International finance and globalizationOptionsSecuritiesFutures and Forwards

- 8. ©Ella KhromovaWhat are Derivatives?Lecture 9Primary assetsSecurities sold

- 9. ©Ella KhromovaOptionsLecture 9Options:• Call - option to

- 10. ©Ella KhromovaLong CallLecture 9Long Call Option examplePayoff

- 11. ©Ella KhromovaShort CallLecture 9Short Call Option examplePayoff

- 12. ©Ella KhromovaLong PutLecture 9Long Put Option examplePayoff

- 13. ©Ella KhromovaShort PutLecture 9Short Put Option examplePayoff

- 14. ©Ella KhromovaOption diagramsLecture 9OptionsSecuritiesFutures and Forwards

- 15. ©Ella KhromovaMoneynessLecture 9In the Money - exercise

- 16. ©Ella KhromovaForwards and futuresLecture 9Forward ContractA forward

- 17. ©Ella KhromovaLong and Short FuturesLecture 9Long and

- 18. ©Ella KhromovaLong FuturesLecture 9OptionsSecuritiesFutures and Forwards

- 19. ©Ella KhromovaShort futuresLecture 9OptionsSecuritiesFutures and Forwards

- 20. ©Ella KhromovaHedgingLecture 9Risk Management: The Producer’s Perspective

- 21. Скачать презентанцию

Слайды и текст этой презентации

Слайд 1Project comments

©Ella Khromova

Project

International finance and globalization

Stock evaluation

Expected return and risk

Portfolio

calculation

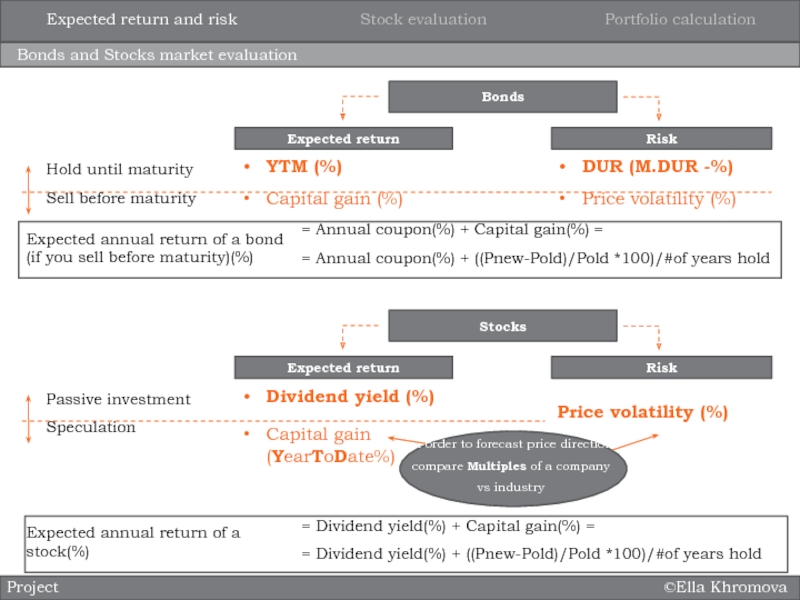

Слайд 2©Ella Khromova

Bonds and Stocks market evaluation

Project

Bonds

Expected return

Risk

YTM (%)

Capital gain (%)

DUR

(M.DUR -%)

Price volatility (%)

Hold until maturity

Sell before maturity

Stocks

Expected return

Risk

Dividend yield

(%)Capital gain (YearToDate%)

Price volatility (%)

Passive investment

Speculation

In order to forecast price direction compare Multiples of a company vs industry

Stock evaluation

Expected return and risk

Portfolio calculation

= Annual coupon(%) + Capital gain(%) =

= Annual coupon(%) + ((Pnew-Pold)/Pold *100)/#of years hold

Expected annual return of a bond (if you sell before maturity)(%)

Expected annual return of a stock(%)

= Dividend yield(%) + Capital gain(%) =

= Dividend yield(%) + ((Pnew-Pold)/Pold *100)/#of years hold

Слайд 4©Ella Khromova

Relative Valuation: Most Commonly used Multiples

Lecture 7

Multiples

Attributable to all

stakeholders: debtors and shareholders

(based on enterprise value)

Attributable to shareholders only

(based

on equity value)EV/Sales

EV/EBITDA

P/E=Price to Earnings= (Equity Value aka Market Capitalization / Net Income)

Equity

Financial Instruments

Слайд 6©Ella Khromova

Portfolio calculation

Project

Comment on diversification of your portfolio!

Expected return of

a portfolio

Stock evaluation

Expected return and risk

Portfolio calculation

You can assume

during your calculations that Covariance between any securities is zero . However you need separately to comment whether your securities are correlated or not and whether it is good or bad in terms of your portfolio riskСлайд 7Lecture 9.

Financial markets: Derivatives

©Ella Khromova

Lecture 9

International finance and globalization

Options

Securities

Futures

and Forwards

Слайд 8©Ella Khromova

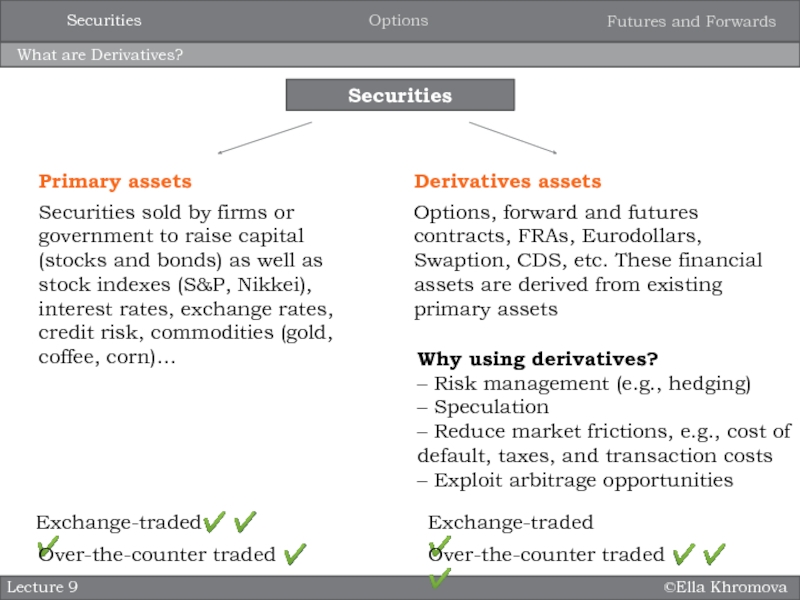

What are Derivatives?

Lecture 9

Primary assets

Securities sold by firms or

government to raise capital (stocks and bonds) as well as

stock indexes (S&P, Nikkei), interest rates, exchange rates, credit risk, commodities (gold, coffee, corn)…Derivatives assets

Options, forward and futures contracts, FRAs, Eurodollars, Swaption, CDS, etc. These financial assets are derived from existing primary assets

Securities

Exchange-traded

Over-the-counter traded

Why using derivatives?

– Risk management (e.g., hedging)

– Speculation

– Reduce market frictions, e.g., cost of default, taxes, and transaction costs

– Exploit arbitrage opportunities

Exchange-traded

Over-the-counter traded

Options

Securities

Futures and Forwards

Слайд 9©Ella Khromova

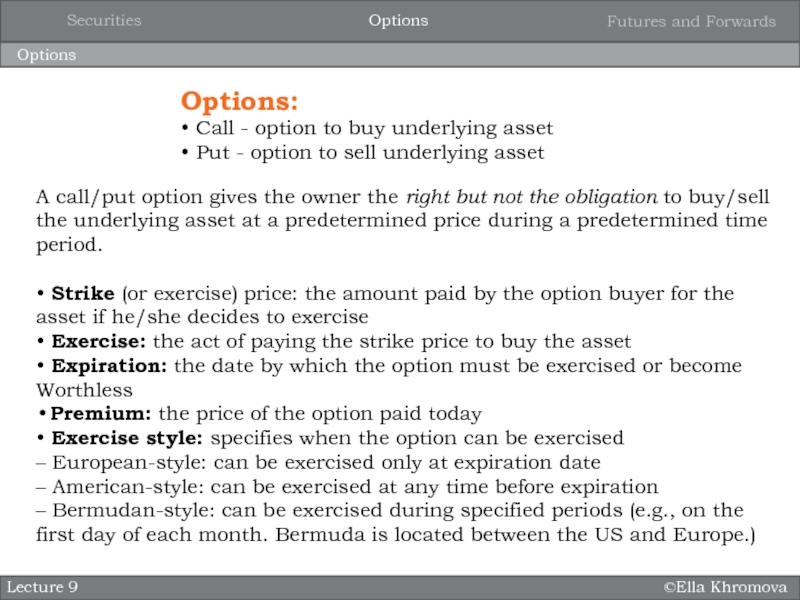

Options

Lecture 9

Options:

• Call - option to buy underlying asset

• Put - option to sell underlying asset

A call/put option

gives the owner the right but not the obligation to buy/sell the underlying asset at a predetermined price during a predetermined time period.• Strike (or exercise) price: the amount paid by the option buyer for the

asset if he/she decides to exercise

• Exercise: the act of paying the strike price to buy the asset

• Expiration: the date by which the option must be exercised or become

Worthless

Premium: the price of the option paid today

• Exercise style: specifies when the option can be exercised

– European-style: can be exercised only at expiration date

– American-style: can be exercised at any time before expiration

– Bermudan-style: can be exercised during specified periods (e.g., on the first day of each month. Bermuda is located between the US and Europe.)

Options

Securities

Futures and Forwards

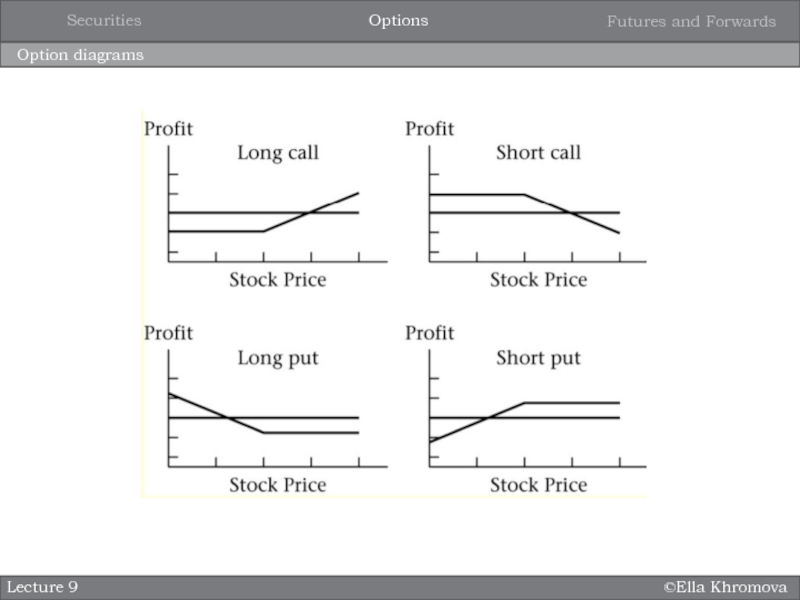

Слайд 10©Ella Khromova

Long Call

Lecture 9

Long Call Option example

Payoff = Max [0,

spot price at expiration – strike price]

Profit = Payoff –

future value of option premiumExample:

S&P Index 6-month Call Option

Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2%

– If index value in six months = $1100

– If index value in six months = $900

• Payoff = max [0, $1,100 – $1,000] = $100

• Profit = $100 – ($93.81 x 1.02) = $4.32

• Payoff = max [0, $900 – $1,000] = $0

• Profit = $0 – ($93.81 x 1.02) = – $95.68

Options

Securities

Futures and Forwards

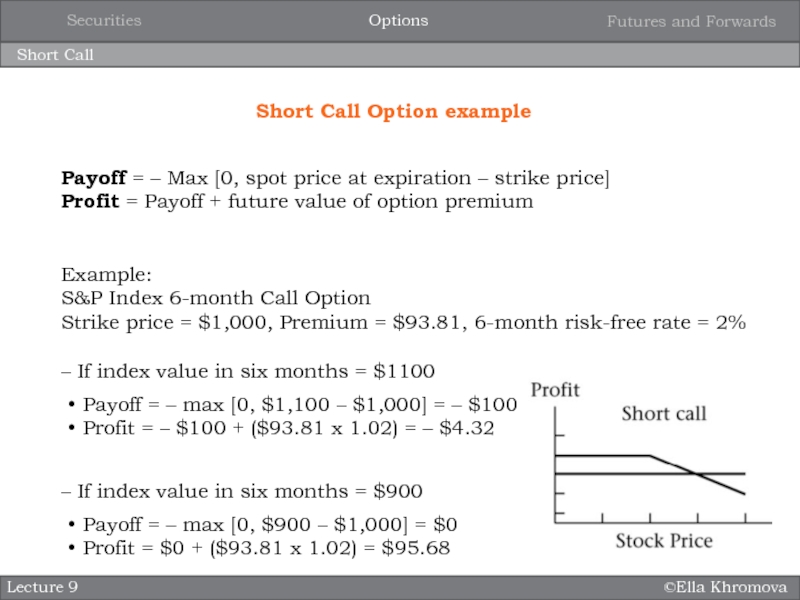

Слайд 11©Ella Khromova

Short Call

Lecture 9

Short Call Option example

Payoff = – Max

[0, spot price at expiration – strike price]

Profit = Payoff

+ future value of option premiumExample:

S&P Index 6-month Call Option

Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2%

– If index value in six months = $1100

– If index value in six months = $900

• Payoff = – max [0, $1,100 – $1,000] = – $100

• Profit = – $100 + ($93.81 x 1.02) = – $4.32

• Payoff = – max [0, $900 – $1,000] = $0

• Profit = $0 + ($93.81 x 1.02) = $95.68

Options

Securities

Futures and Forwards

Слайд 12©Ella Khromova

Long Put

Lecture 9

Long Put Option example

Payoff = Max [0,

strike price – spot price at expiration ]

Profit = Payoff

– future value of option premiumExample:

S&P Index 6-month Call Option

Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2%

– If index value in six months = $1100

– If index value in six months = $900

• Payoff = max [0, $1,000 – $1,100] = $0

• Profit = $0 – ($93.81 x 1.02) = – $95.68

• Payoff = max [0, $1000 – $900] = $100

• Profit = $100 – ($93.81 x 1.02) = $4.32

Options

Securities

Futures and Forwards

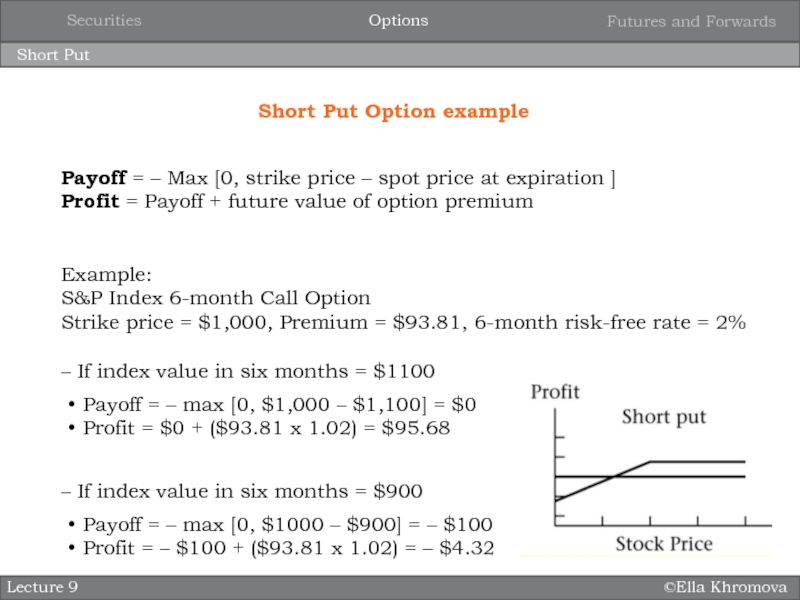

Слайд 13©Ella Khromova

Short Put

Lecture 9

Short Put Option example

Payoff = – Max

[0, strike price – spot price at expiration ]

Profit =

Payoff + future value of option premiumExample:

S&P Index 6-month Call Option

Strike price = $1,000, Premium = $93.81, 6-month risk-free rate = 2%

– If index value in six months = $1100

– If index value in six months = $900

• Payoff = – max [0, $1,000 – $1,100] = $0

• Profit = $0 + ($93.81 x 1.02) = $95.68

• Payoff = – max [0, $1000 – $900] = – $100

• Profit = – $100 + ($93.81 x 1.02) = – $4.32

Options

Securities

Futures and Forwards

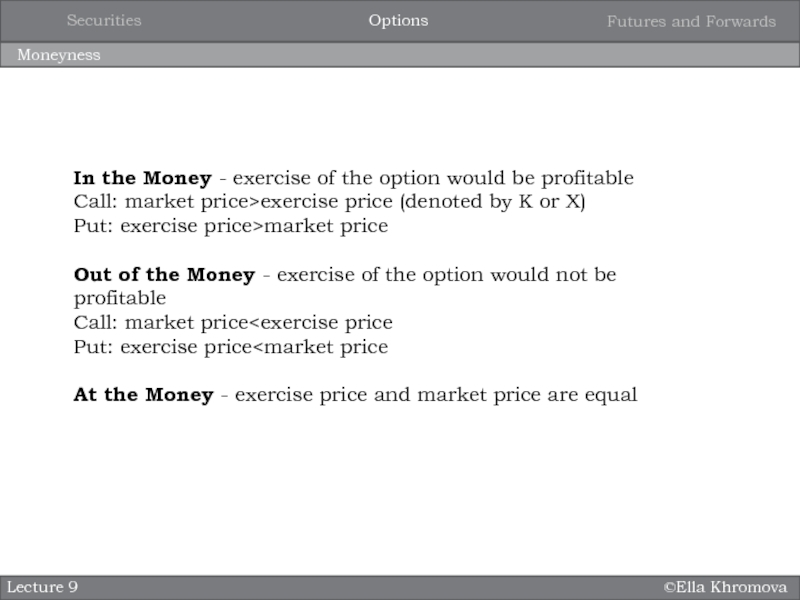

Слайд 15©Ella Khromova

Moneyness

Lecture 9

In the Money - exercise of the option

would be profitable

Call: market price>exercise price (denoted by K

or X) Put: exercise price>market price

Out of the Money - exercise of the option would not be profitable

Call: market price

At the Money - exercise price and market price are equal

Options

Securities

Futures and Forwards

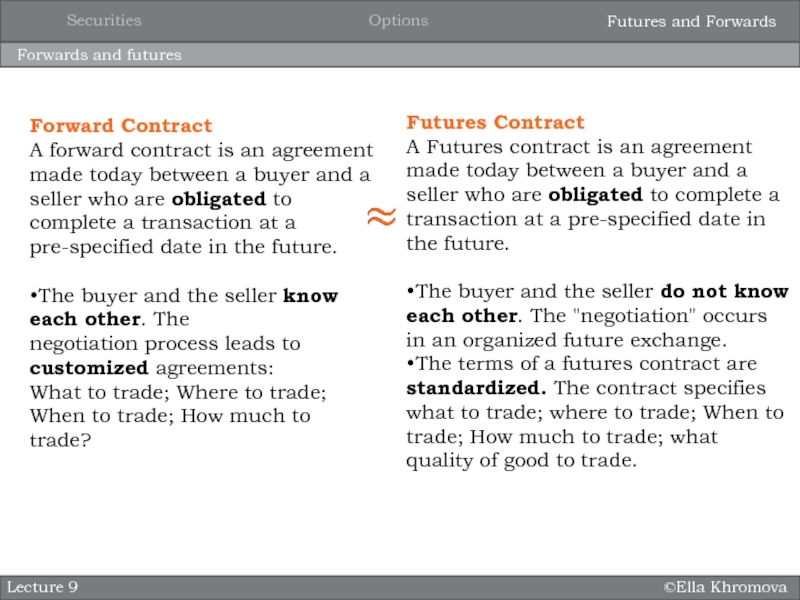

Слайд 16©Ella Khromova

Forwards and futures

Lecture 9

Forward Contract

A forward contract is an

agreement made today between a buyer and a seller who

are obligated to complete a transaction at a pre-specified date in the future.•The buyer and the seller know each other. The

negotiation process leads to customized agreements:

What to trade; Where to trade; When to trade; How much to trade?

Futures Contract

A Futures contract is an agreement made today between a buyer and a seller who are obligated to complete a

transaction at a pre-specified date in the future.

•The buyer and the seller do not know each other. The "negotiation" occurs in an organized future exchange.

•The terms of a futures contract are standardized. The contract specifies what to trade; where to trade; When to

trade; How much to trade; what quality of good to trade.

Options

Securities

Futures and Forwards

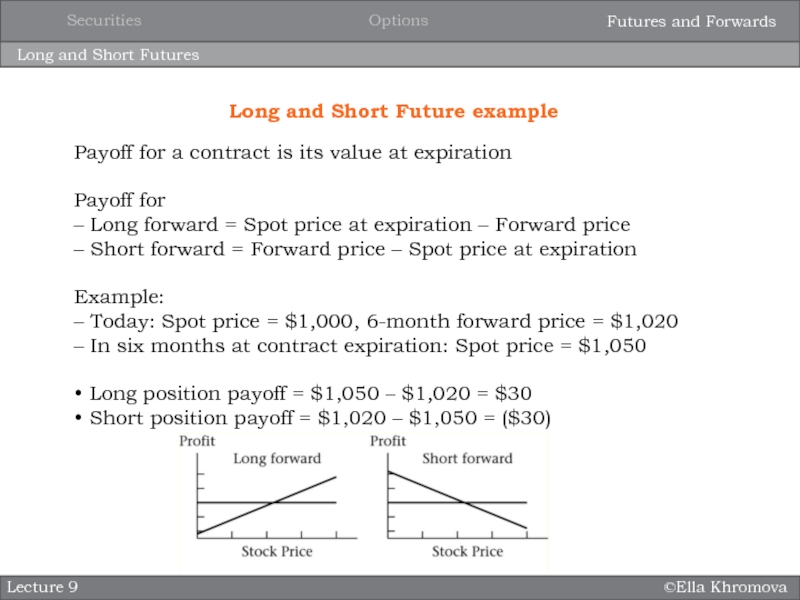

Слайд 17©Ella Khromova

Long and Short Futures

Lecture 9

Long and Short Future example

Payoff

for a contract is its value at expiration

Payoff for

– Long

forward = Spot price at expiration – Forward price– Short forward = Forward price – Spot price at expiration

Example:

– Today: Spot price = $1,000, 6-month forward price = $1,020

– In six months at contract expiration: Spot price = $1,050

• Long position payoff = $1,050 – $1,020 = $30

• Short position payoff = $1,020 – $1,050 = ($30)

Options

Securities

Futures and Forwards

Слайд 20©Ella Khromova

Hedging

Lecture 9

Risk Management: The Producer’s Perspective

A producer selling

a risky commodity has an inherent long position in this

commodityWhen the price of the commodity increases, the profit typically increases

Common strategies to hedge profit:

– Selling forward

– Buying puts

– Selling Calls

Options

Securities

Futures and Forwards

![Project comments ©Ella KhromovaLong CallLecture 9Long Call Option examplePayoff = Max [0, spot ©Ella KhromovaLong CallLecture 9Long Call Option examplePayoff = Max [0, spot price at expiration – strike price]Profit](/img/thumbs/44e84dce16123e036877ae75ac3106e0-800x.jpg)